Professional Documents

Culture Documents

The Accounting Information System: Kimmel Weygandt Kieso Trenholm Irvine Burnley

Uploaded by

andrea ortega0 ratings0% found this document useful (0 votes)

6 views23 pagesOriginal Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views23 pagesThe Accounting Information System: Kimmel Weygandt Kieso Trenholm Irvine Burnley

Uploaded by

andrea ortegaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 23

Financial Accounting: Tools for

Business Decision-Making

Kimmel Weygandt Kieso Trenholm Irvine Burnley

Eighth Canadian Edition

Chapter 3

The Accounting Information System

Copyright ©2020 John Wiley & Sons, Inc.

Learning Objectives

LO 1: Analyze the effect of transactions on the accounting

equation.

LO 2: Explain how accounts, debits, and credits are used

to record transactions.

LO 3: Journalize transactions in the general journal.

LO 4: Post transactions to the general ledger.

LO 5: Prepare a trial balance.

Copyright ©2020 John Wiley & Sons, Inc. 2

Accounting Information System

• The system used to collect and process transaction data

and communicate financial information

• Can vary widely based on factors such as:

o Type of business and its transactions

o Size of company

o Amount of data

o Information needed by management and others

Copyright ©2020 John Wiley & Sons, Inc. 3

Steps in the Recording Process

• Step 1: Analyze each transaction to determine its effect

on accounts (if any)

o Evidence comes from a source document

• Step 2: Record transaction as a journal entry in the

general journal

• Step 3: Transfer journal entries recorded to appropriate

accounts in the general ledger

• Step 4: Prepare a trial balance

Copyright ©2020 John Wiley & Sons, Inc. 4

Accounting Transactions

• Transactions are economic events that must be

recorded in the financial statements

• Not all events are recorded and reported as accounting

transactions:

o Only those that effect or change assets, liabilities, or

shareholders’ equity accounts

Copyright ©2020 John Wiley & Sons, Inc. 5

Transaction Identification Process

Copyright ©2020 John Wiley & Sons, Inc. 6

Step 1 of Accounting Cycle: Analyzing

Transactions

• Transaction analysis determines impact on the

accounting equation

Assets = Liabilities + Shareholders’ Equity

• The accounting equation must always balance

o Therefore, each transaction has a dual (double-sided)

effect on the equation

Copyright ©2020 John Wiley & Sons, Inc. 7

Analyzing Transactions

Copyright ©2020 John Wiley & Sons, Inc. 8

Discussion Question 1

Identify an economic event that:

a. is recorded in the accounting system.

b. that is not recorded in the accounting system.

Copyright ©2020 John Wiley & Sons, Inc. 9

Account

• An individual accounting record of increases and decreases

in a specific asset, liability, or shareholders’ equity item,

along with opening and closing balances

• T Account—three parts:

1) Title of the account

2) A left or debit side

3) A right or credit side

• In its simplest form, these parts are positioned like the

letter T; therefore, called a T account

Copyright ©2020 John Wiley & Sons, Inc. 10

Debits and Credits

• Describe where entries are made in the T accounts:

Debiting: entering an amount on the left side

Crediting: entering an amount on the right side

• If debit amounts exceed credit amounts, account has a

debit balance

• If credit amounts exceed debit amounts, account has a

credit balance

Copyright ©2020 John Wiley & Sons, Inc. 11

The T Account – Debit Balance

Copyright ©2020 John Wiley & Sons, Inc. 12

The T Account – Credit Balance

Copyright ©2020 John Wiley & Sons, Inc. 13

Normal Balances (1 of 2)

Copyright ©2020 John Wiley & Sons, Inc. 14

Normal Balances (2 of 2)

• Increases in shareholders’ equity:

• Decreases in shareholders’ equity:

Copyright ©2020 John Wiley & Sons, Inc. 15

Expanded Accounting Equation

Copyright ©2020 John Wiley & Sons, Inc. 16

Step 2 of Accounting Cycle: Journalize

Transactions

• An accounting record is where the transactions are

recorded in chronological order

• General journal is most common

• Other journals can include:

o Cash receipts

o Cash disbursements

o Sales

o Purchases

• Entering transaction data is known as journalizing

Copyright ©2020 John Wiley & Sons, Inc. 17

Step 3 of Accounting Cycle: Post to Ledger

Accounts

• The general ledger contains all the asset, liability, and

shareholders’ equity, dividends declared, revenue and

expense accounts

• Each account has a number so it is easier to identify

• Posting is the process of transferring journal entries

from the general journal to the general ledger accounts

• List of all accounts maintained by a company is called

a chart of accounts

Copyright ©2020 John Wiley & Sons, Inc. 18

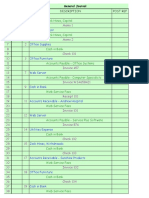

Step 4 of Accounting Cycle: Trial Balance

• List of the general ledger accounts and their balances at a

specific time – usually the end of an accounting period

• Serves to prove that debits equal credits after posting:

o Sum of debits = sum of credits

• Aids in the preparation of financial statements

• Subject to limitations

o Does not prove that the general ledger is correct

o Examples: missing transactions, incorrect account(s),

duplicate postings

Copyright ©2020 John Wiley & Sons, Inc. 19

Trial Balance - Example

Copyright ©2020 John Wiley & Sons, Inc. 20

Discussion Question 2

Provide examples of:

a. errors where the trial balance still balances

b. errors where the trial balance does not balance

Copyright ©2020 John Wiley & Sons, Inc. 21

Summary of the Accounting Cycle

Chapter 3

1. Analyze transactions

2. Journalize the transactions

3. Post to the ledger accounts

4. Prepare a trial balance

Chapter 4 (next chapter)

5. Journalize and post adjusting entries

6. Prepare an adjusted trial balance

7. Prepare financial statements

8. Journalize and post closing entries

9. Prepare a post-closing trial balance

Copyright ©2020 John Wiley & Sons, Inc. 22

Copyright

Copyright © 2020 John Wiley & Sons, Inc.

All rights reserved. Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Act without the express written permission of the

copyright owner is unlawful. Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up

copies for his/her own use only and not for distribution or resale. The Publisher assumes

no responsibility for errors, omissions, or damages, caused by the use of these programs or

from the use of the information contained herein.

Copyright ©2020 John Wiley & Sons, Inc. 23

You might also like

- FAR-1 Complete PP With SolutionsDocument86 pagesFAR-1 Complete PP With SolutionsS Usama S75% (8)

- Cash in Bank: Description Post RefDocument25 pagesCash in Bank: Description Post RefJayMoralesNo ratings yet

- Survey of Accounting: Introduction To Financial StatementsDocument33 pagesSurvey of Accounting: Introduction To Financial StatementsTiaraNo ratings yet

- ch03 Kieso IFRS4 PPT SentDocument121 pagesch03 Kieso IFRS4 PPT SentPhee SiwakornNo ratings yet

- CH 03Document34 pagesCH 03Nirupa DudhatraNo ratings yet

- CH 02Document57 pagesCH 02Fd AhNo ratings yet

- Financial Accounting: Analyzing Transactions and Their Effects On Financial StatementsDocument52 pagesFinancial Accounting: Analyzing Transactions and Their Effects On Financial StatementsSebastián GómezNo ratings yet

- Chapter 3Document90 pagesChapter 3임재영100% (1)

- Ch2 4e - Recording ProcessDocument59 pagesCh2 4e - Recording ProcessChâu HàNo ratings yet

- Financial Accounting: Weygandt KimmelDocument59 pagesFinancial Accounting: Weygandt KimmelAnh LýNo ratings yet

- Topic 2 (A) - The Recording ProcessDocument53 pagesTopic 2 (A) - The Recording ProcessNabilah NajwaNo ratings yet

- Accounting Principles: The Recording ProcessDocument57 pagesAccounting Principles: The Recording ProcessTrần Minh HuyềnNo ratings yet

- Ch2 4e - Recording Process 2021Document51 pagesCh2 4e - Recording Process 2021Nhung CaoNo ratings yet

- CH 02Document59 pagesCH 02Linda Anadya TastyaNo ratings yet

- CH 02Document59 pagesCH 02thucnhi.2003hnntNo ratings yet

- CH 03Document34 pagesCH 03Ethan Gio CordañoNo ratings yet

- Chapter 1 - Accounting in ActionDocument68 pagesChapter 1 - Accounting in ActionNgân TrươngNo ratings yet

- Financial AccountingDocument46 pagesFinancial Accountingkajol.leoNo ratings yet

- Chapter 1 Acct 2121Document39 pagesChapter 1 Acct 2121kirbydegay1028No ratings yet

- CH 07Document52 pagesCH 07Rabie HarounNo ratings yet

- Chap 2 SlideDocument30 pagesChap 2 Slidehainguyen.31231022080No ratings yet

- Chapter 2Document25 pagesChapter 2Jose Carlos SouzaNo ratings yet

- Preview of Chapter 23: ACCT2110 Intermediate Accounting II Week 11Document60 pagesPreview of Chapter 23: ACCT2110 Intermediate Accounting II Week 11Chi IuvianamoNo ratings yet

- Ch. 6 - Wiley PowerPointDocument60 pagesCh. 6 - Wiley PowerPointazargalaxykustagiNo ratings yet

- Intermediate Accounting: Eleventh Canadian EditionDocument62 pagesIntermediate Accounting: Eleventh Canadian EditionthisisfakedNo ratings yet

- CH 10Document94 pagesCH 10Ashish YadavNo ratings yet

- CH 02Document53 pagesCH 02Hoàng Lâm NguyễnNo ratings yet

- Akt Keu Menengah Minggu Ke 1 CHP 4Document75 pagesAkt Keu Menengah Minggu Ke 1 CHP 4Deo GultomNo ratings yet

- Internal Control and Cash: Accounting PrinciplesDocument34 pagesInternal Control and Cash: Accounting PrinciplesChelsea AdontengNo ratings yet

- ch23 Kieso IFRS4 PPTDocument74 pagesch23 Kieso IFRS4 PPTAnis RahmawatiNo ratings yet

- ch07 STDocument31 pagesch07 STquangle.31221025758No ratings yet

- Intermediate: AccountingDocument115 pagesIntermediate: AccountingDieu NguyenNo ratings yet

- Accounting Concepts & PrinciplesDocument26 pagesAccounting Concepts & PrinciplesThy Ngoc100% (1)

- Ch04 Kieso IFRS PPTDocument73 pagesCh04 Kieso IFRS PPTDiva ShafiaNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument36 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, Warfielddystopian au.100% (1)

- Chapter 4Document67 pagesChapter 4Ibrahim ManshaNo ratings yet

- Ch07 Kieso Ifrs4 PPT HNDocument62 pagesCh07 Kieso Ifrs4 PPT HNEsra GuzelelNo ratings yet

- Ch07 Kieso Ifrs4Document92 pagesCh07 Kieso Ifrs4Owen Kurnia100% (2)

- CH01 Savage AIS PPTDocument49 pagesCH01 Savage AIS PPTAbdulelah AlgufariNo ratings yet

- Survey of Accounting: A Further Look at The Balance SheetDocument28 pagesSurvey of Accounting: A Further Look at The Balance SheetTiaraNo ratings yet

- PPT1-Accounting in Action and The Recording ProcessDocument35 pagesPPT1-Accounting in Action and The Recording ProcessMartinusNo ratings yet

- CH 02Document59 pagesCH 0263D-026-Md Golam Muktadir AsifNo ratings yet

- Financial AccountingDocument43 pagesFinancial AccountingazargalaxykustagiNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument29 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, Warfielddystopian au.No ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument76 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldĐức Huy100% (1)

- CH 13Document77 pagesCH 13Mohammed SamyNo ratings yet

- Chapter 18Document71 pagesChapter 18m.garagan16No ratings yet

- Economics and Financial Accounting Module: By: Mrs. Shubhangi DixitDocument68 pagesEconomics and Financial Accounting Module: By: Mrs. Shubhangi DixitGladwin JosephNo ratings yet

- ppt04 LO1Document12 pagesppt04 LO1gnmuzariri20No ratings yet

- ch02 The Recording ProcessDocument12 pagesch02 The Recording ProcessMạnh Hoàng Phi ĐứcNo ratings yet

- CH 03Document114 pagesCH 03Sabbir ahmedNo ratings yet

- Lecture 3 DoubleentrysystemDocument47 pagesLecture 3 Doubleentrysystem叶祖儿No ratings yet

- Accounting Principles 2: Mr. Mohammed AliDocument43 pagesAccounting Principles 2: Mr. Mohammed AliramiNo ratings yet

- ACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionDocument24 pagesACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionFatimatuz ZahroNo ratings yet

- Chapter 1Document54 pagesChapter 1Phước Hà NgôNo ratings yet

- Chapter 3 WileyDocument20 pagesChapter 3 Wileyp876468No ratings yet

- Statement of Cash Flows: Tenth Canadian EditionDocument39 pagesStatement of Cash Flows: Tenth Canadian EditionEli SaNo ratings yet

- CH 01Document54 pagesCH 01Ngân Hà ĐỗNo ratings yet

- Week 1 OneslideperpageDocument73 pagesWeek 1 OneslideperpageBarry AuNo ratings yet

- CH 02Document36 pagesCH 02Nirupa DudhatraNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- AE13 MidtermDocument10 pagesAE13 MidtermWenjunNo ratings yet

- ch08 Accounting For Receivables - StudentDocument16 pagesch08 Accounting For Receivables - StudentNhật TâmNo ratings yet

- Lecture Notes: National University Ellery de Leon Advac 1-Partnerships 1 Semester SY 2016-2017Document10 pagesLecture Notes: National University Ellery de Leon Advac 1-Partnerships 1 Semester SY 2016-2017sunflowerNo ratings yet

- Accounting12 3ed Ch09Document19 pagesAccounting12 3ed Ch09jhsNo ratings yet

- Ca Foundation: Introducing Best Faculties Together at One Platform (COC Education) ForDocument43 pagesCa Foundation: Introducing Best Faculties Together at One Platform (COC Education) ForTarunNo ratings yet

- Audit - Sales and ReceivablesDocument6 pagesAudit - Sales and ReceivablesValentina Tan DuNo ratings yet

- Tally Exercise 1Document1 pageTally Exercise 1Arun91% (11)

- Alba Generators W.L.L. Desert Diamond Co.: Particulars Credit DebitDocument1 pageAlba Generators W.L.L. Desert Diamond Co.: Particulars Credit Debitwagih83115No ratings yet

- 6801 - Accounting Process PDFDocument5 pages6801 - Accounting Process PDFSheila Mae PioquintoNo ratings yet

- Financial Accounting N5: National CertificateDocument9 pagesFinancial Accounting N5: National CertificateHonorine Ngum NibaNo ratings yet

- SET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirDocument5 pagesSET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirnisharvishwaNo ratings yet

- Swift Iso20022 Pacs Camt Message Mapping 2020 Slides En03Document45 pagesSwift Iso20022 Pacs Camt Message Mapping 2020 Slides En03wafa hedhliNo ratings yet

- CH 10Document39 pagesCH 10anjo hosmerNo ratings yet

- Draft Accounting Manual For Panchayati RajDocument71 pagesDraft Accounting Manual For Panchayati RajRavinder KhullarNo ratings yet

- Chapter 17 - Cost Accounting - JKBakerDocument69 pagesChapter 17 - Cost Accounting - JKBakerlizNo ratings yet

- Accounts Receivable: Notwithstanding, Are Classified As Current AssetsDocument13 pagesAccounts Receivable: Notwithstanding, Are Classified As Current AssetsAdyangNo ratings yet

- Personal Financing TNCDocument2 pagesPersonal Financing TNCnick4nameNo ratings yet

- Subidha Chhatrabas 070-071Document5 pagesSubidha Chhatrabas 070-071Junu MainaliNo ratings yet

- 04 Activity 1Document1 page04 Activity 1rencemesias05No ratings yet

- Central Excise Notification No. 3/2011Document8 pagesCentral Excise Notification No. 3/2011sonia87No ratings yet

- 11th Annual Benedict's PDFDocument15 pages11th Annual Benedict's PDFYugam RathiNo ratings yet

- Audit Manual CSDDocument74 pagesAudit Manual CSDdotpolkaNo ratings yet

- FIN611 Quiz No 2 Mega File Attempted and Solved by Ulfat Abbas Jafery, Abdul Saboor & Sweet PoisonsDocument33 pagesFIN611 Quiz No 2 Mega File Attempted and Solved by Ulfat Abbas Jafery, Abdul Saboor & Sweet PoisonsShahid Saeed100% (1)

- Manual On The New Government Accounting System For National Government Agencies Accounting Policies Chapter 2. Basic Features and PoliciesDocument4 pagesManual On The New Government Accounting System For National Government Agencies Accounting Policies Chapter 2. Basic Features and PoliciesJustine Mae MoranoNo ratings yet

- Supreme Ledger 19-20 FinalDocument1 pageSupreme Ledger 19-20 FinalKripa Shankar MishraNo ratings yet

- Bank Reconciliation-1Document5 pagesBank Reconciliation-1Chin DyNo ratings yet

- Correction of Errors IllustrationsDocument3 pagesCorrection of Errors IllustrationsBrian NaderaNo ratings yet

- 12 Half Yearly Accounts PaperDocument4 pages12 Half Yearly Accounts PaperAditya ShrivastavaNo ratings yet