Professional Documents

Culture Documents

Chapter 01

Uploaded by

Gadisa Benti Muleta0 ratings0% found this document useful (0 votes)

3 views43 pagesThis module provides an introduction to public finance and taxation. It aims to give students additional knowledge about public finance systems, including taxation, public expenditures, deficit financing, and regulations. Key topics that will be covered include the theory and practice of public finance, various tax laws, the Ethiopian tax structure, and the economic effects of taxation. Assessment will include tests, assignments, and a final exam.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis module provides an introduction to public finance and taxation. It aims to give students additional knowledge about public finance systems, including taxation, public expenditures, deficit financing, and regulations. Key topics that will be covered include the theory and practice of public finance, various tax laws, the Ethiopian tax structure, and the economic effects of taxation. Assessment will include tests, assignments, and a final exam.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views43 pagesChapter 01

Uploaded by

Gadisa Benti MuletaThis module provides an introduction to public finance and taxation. It aims to give students additional knowledge about public finance systems, including taxation, public expenditures, deficit financing, and regulations. Key topics that will be covered include the theory and practice of public finance, various tax laws, the Ethiopian tax structure, and the economic effects of taxation. Assessment will include tests, assignments, and a final exam.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 43

Ethiopian Civil Service University

College of Finance, Management and Development

Advanced Public finance & Taxation

Thursday, November 23, 2023 1

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

MODULE DESCRIPTION

This module intends to provide the students with concepts and

practices of public finance and taxation.

It offers students with additional knowledge on matters dealing with

public finance and taxation in both the local and the international

sectors.

The module describes public financial systems that comprise taxation,

public expenditure, deficit financing and public financial regulations.

Thursday, November 23, 2023 Dr.Messele Getachew 2

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Learning Outcomes

After completion of the module students will be able to:

Understand the thoery and practice of public finance with especial reference

to Ethiopia

Understand various tax laws applicable in general and with special

reference to Ethiopia as well as to other countries.

identify the characteristics of taxes and taxation in general;

understand the objectives and principles of a tax policy and conflicts among

some of them;

explain the problems in the application of the principles of a tax policy like

equity principle;

comprehend the types of taxes and tax system and practical problems in

deciding on tax bases (income, value added and other tax bases);

Thursday, November 23, 2023 3

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Learning Outcomes

After completion of the module students will be able to:

explain the various issues in international taxation regime

including issues of taxation of foreign source incomes,

international double taxation and international tax avoidance

through subsidiaries and transfer prices;

comprehend on the role of taxation in financial decision

makings such as investment, dividend and finance decisions;

Distinguish between tax avoidance and evasion; and

Examine the Ethiopian tax system in the context of the

theoretical underpinnings of taxation.

Thursday, November 23, 2023 Dr.Messele Getachew 4

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

MODULE CONTENTS

1. Public Finance – General Introduction

2. Fiscal Federalism and Power of Taxation

3. General Overview of Taxation

4. Ethiopian Tax Structure

5. International Trade Taxes

6. Economic Impact of Taxation

7. Fiscal Administration and Tax Administration Reform .

Thursday, November 23, 2023 Dr.Messele Getachew 5

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

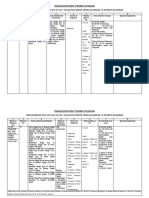

ASSESSMENT

As part of assessment on the course students will

Test (20%), (Ch 1 and 2)

Nov 15,2023

Article review report (20%)

Submission Deadline: Dec 15,2023

Group Assignment 20%(Ch 4)

Submission Deadline: Dec 31,2023

Final examination (40%)

Thursday, November 23, 2023 Dr.Messele Getachew 6

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

CHAPTER ONE

PUBLIC FINANCE – GENERAL INTRODUCTION

Thursday, November 23, 2023 Dr.Messele Getachew 7

Learning Objectives

• Identify the problems and issues addressed in the discipline

of public finance

• Discuss ways to think about the role of the public sector in

an economy

Thursday, November 23, 2023 Dr.Messele Getachew 8

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

The Field of Public Finance

Public finance is field of study in economics that is concerned with

the financial activities of the public sector—that part of the economy

controlled by governments

Richard Musgrave definition: The complex of problems that center

around the revenue-expenditure process of government is referred to

traditionally as public finance

Thursday, November 23, 2023 Dr.Messele Getachew 9

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

What is Public Finance?

• Very few areas of our lives are untouched by the public sector.

• All policies of the public sector confer benefits upon and exact costs from

members of the society

Thursday, November 23, 2023 Dr.Messele Getachew 10

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

What is Public Finance?

• Public finance is the study of how spending and tax policies influence our

economic lives.

• In examining how governments influence our lives, public finance

addresses one fundamental issue: why do we want the public sector to exert

such powerful influences over our lives & public finance, a sub discipline of

economics ( also known as public sector economics or just public

economics), provides us with a framework for understanding changing and

improving the ways in which the public sector influences our lives

Thursday, November 23, 2023 Dr.Messele Getachew 11

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

The Field of Public Finance

• We want to know:

– Which activities it is sensible for governments to perform

– The right quantities of public goods and services that should be

provided

– And the best method of paying for those services

Thursday, November 23, 2023 Dr.Messele Getachew 12

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

The Field of Public Finance

• We care about public sector activity at all levels:

– Federal

– State

– Local

Thursday, November 23, 2023 Dr.Messele Getachew 13

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Explanation of Public Economics From the Handbook of Public

Economics

• We attempt to explain why government behaves as it does,

how its behavior influences the behavior of private firms

and households, and what the welfare effects of such

changes in behavior are

• Notice the why, how, and what aspects of this statement

Thursday, November 23, 2023 Dr.Messele Getachew 14

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Private and Public Interests

• Individual rights versus social responsibility

• Adam Smith’s roles of government

• Musgrave’s economic roles of government

• Public and private aspects of the economy:

Allocation of Resources

• Institutional limitations on market allocation of

resources

Thursday, November 23, 2023 Dr.Messele Getachew 15

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

J. M. Keynes on the Problems to be Solved

“The political problem of mankind is to combine three things:

economic efficiency, social justice, individual liberty”

Thursday, November 23, 2023 Dr.Messele Getachew 16

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public and Private Aspects of the Economy: Allocation of

Resources

• Market and non-market allocation of resources

• Factors of production like land, labor, and capital are all

allocated by market mechanisms

Thursday, November 23, 2023 Dr.Messele Getachew 17

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Institutional limitations on market allocation of

resources

• Institutions have been crafted at all levels of government to

provide boundaries within which the market mechanism

may operate

• For example, the Federal Aviation Administration (FAA)

regulates the behavior of airlines and operates to assure air

travel safety

Thursday, November 23, 2023 Dr.Messele Getachew 18

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Adam Smith’s Roles of Government

(1776)

• The first duty of the sovereign [is] that of protecting the society from

the violence and invasion of other independent societies

• The second duty of the sovereign [is] that of protecting, as far as

possible, every member of the society from the injustice or

oppression of every other member of it, or the duty of establishing

an exact administration of justice

Thursday, November 23, 2023 Dr.Messele Getachew 19

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Adam Smith’s Roles of Government

• The third and last duty of the sovereign or commonwealth is that of

erecting and maintaining those public institutions and those public

works, which, though they may be in the highest degree advantageous

to a great society, are, however, of such a nature, that the profit could

never repay the expense to any individual or small number of

individuals, and which it therefore cannot be expected that any

individual or small number of individuals should erect or maintain

Thursday, November 23, 2023 Dr.Messele Getachew 20

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Musgrave’s Economic Roles of Government

• Allocation

• Distribution

• Stabilization

Thursday, November 23, 2023 Dr.Messele Getachew 21

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Allocation Role of Government

• Allocate resources in public sector Involves making

decisions on public expenditure programs to provide the

public goods and services citizens desire at tax/fee rates

they are willing to pay

Thursday, November 23, 2023 Dr.Messele Getachew 22

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Distribution Role of Government

• Given output of economy (measured in GDP or other

terms), the question is who receives the benefit of that

production?

• If the distribution provided by the market mechanism is

unacceptable, there is a role for government to redistribute

income or wealth

Thursday, November 23, 2023 Dr.Messele Getachew 23

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Stabilization Role of Government

• Stabilize output, employment, and prices

Thursday, November 23, 2023 Dr.Messele Getachew 24

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public and Private Aspects of the Economy

• Market and non-market allocation of resources

• Institutional limits on the market allocation of resources

Thursday, November 23, 2023 Dr.Messele Getachew 25

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Scope of Public Finance:

• The Subject matter of the public finance is classifies under five

broad categories. They are:

1. Public revenue

2. Public Expenditure

3. Public debt

4. Financial administration

5. Economic stabilization

Thursday, November 23, 2023 Dr.Messele Getachew 26

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Revenue Source

• Public revenue is the means for public expenditure. Various

sources of public revenue are:

a. Tax revenue

b. Non-tax revenue

Thursday, November 23, 2023 Dr.Messele Getachew 27

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Revenue Source…

A)Tax revenue: - Taxes are compulsory payments to government

without expectation of direct return or benefit to tax payers.

It imposes a personal obligation on the taxpayer.

Taxes received from the taxpayers, may not be incurred for their benefit

alone.

Taxation is the powerful instrument in the hands of the government for

transferring purchasing power from individuals to government.

The objectives of taxation are to reduce inequalities of income and

wealth; to provide incentives for capital formation in the private

sector, and to restrain consumption so as to keep in check domestic

inflationary pressures.

Thursday, November 23, 2023 Dr.Messele Getachew 28

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Revenue Source…

B)Non-tax revenue:- This includes the revenue from government

or public undertakings, revenue from social services like

education and hospitals, and revenue from loans or debt service.

To sum up, non-tax revenue consists of:

Interest receipts

Dividends and profits

Fiscal services and others.

Thursday, November 23, 2023 Dr.Messele Getachew 29

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Expenditure theories

• Government of a country has to use its expenditure and revenue

programs to produce desirable effects on national income,

production, and employment.

• The role of public expenditure in the determination and

distribution of national income was emphasized by Keynes.

• Public expenditure plays the dual role of administration and

economic achievement of a nation.

Thursday, November 23, 2023 Dr.Messele Getachew 30

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Expenditure theories…

• Hence planned expenditure and accurate foresight of earnings

are the important aspects of sound government finance.

• Public expenditure is done under two broad heads viz.,

developmental expenditure and non-developmental expenditure.

• developmental expenditure includes social and community

services, economic services, and grants in aid.

• non-developmental expenditure mainly consists of interest

payments, administrative services, and defense expenses.

• Expenditure can also be classified into revenue and capital

expenditure.

Thursday, November 23, 2023 Dr.Messele Getachew 31

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Debt/ Deficit Financing

• This category deals with the causes, methods and problems of

public borrowings and its management.

• This includes both internal debt and external debt.

• Debt raised for productive purpose will not be a burden on the

economy.

• There are many objectives of creation of public debt. Debt may

be raised to meet the normal current expenditure, exigencies

like war, finance productive government enterprise, finance

public social welfare and economic development.

Thursday, November 23, 2023 Dr.Messele Getachew 32

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Debt/ Deficit Financing

• Measures of debts and deficits are widely used to estimate the

risks of fiscal crises.

• They also enter into assessments of the sustainability of the

government’s tax and spending policies and thus judgments

about intergenerational equity.

• Deficits are used to estimate whether the government’s fiscal

policy is stimulating or constraining the rest of the economy.

• Debt must be measured to determine whether high levels

inhibit economic growth. And estimates of spending and

revenue must be made to assess the impact of the size of

government on economic growth and other variables.

Thursday, November 23, 2023 Dr.Messele Getachew 33

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Debt/ Deficit Financing

• Although the budget deficit and the public debt feature prominently

in political debate and economic research, there is no agreement

about how they should be measured.

• They can be defined for different sets of public institutions,

including the nested sets corresponding to central government,

general government, and the public sector, and, for any definition of

government, there are many measures of the debt and deficit,

including those generated by four kinds of accounts (cash, financial,

full accrual, and comprehensive), which can be derived from four

nested sets of assets and liabilities.

• Each debt and deficit measure says something about public

finances, but none tells the whole story. Each is also vulnerable to

manipulation, and is likely to be manipulated if it is subject to a

binding fiscal rule or target.

Thursday, November 23, 2023 Dr.Messele Getachew 34

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Financial Management

• Public financial management entails the development of laws,

organizations and systems to enable sustainable, efficient,

effective and transparent management of public finance.

• Public financial management (PFM) is an essential part of the

development process.

• Sound PFM supports aggregate control, prioritization,

accountability and efficiency in the management of public

resources and delivery of services, which are critical to the

achievement of public policy objectives, including achievement

of the Millennium Development Goals (MDGs).

Thursday, November 23, 2023 Dr.Messele Getachew 35

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Financial Management

• In addition, sound public financial management

systems are fundamental to the appropriate use

and effectiveness of donor assistance since aid is

increasingly provided through modalities that rely

on well-functioning systems for budget

development, execution and control.

Thursday, November 23, 2023 Dr.Messele Getachew 36

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Financial Management

• Strong public financial management (PFM) systems are

essential for effective and sustainable economic

management and public service delivery.

• States are effective and accountable when they are

underpinned by good PFM institutions and systems. Good

PFM systems are also indispensable in ensuring that aid is

being used to achieve development goals.

Thursday, November 23, 2023 Dr.Messele Getachew 37

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

PFM: Why does it matter and how best to improve it?

Thursday, November 23, 2023 Dr.Messele Getachew 38

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Thursday, November 23, 2023 Dr.Messele Getachew 39

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public and Private Aspects of the Economy…

• In economics, nonmarket forces are those acting on economic

factors from outside the market system.

• They include organizing and correcting factors that provide

order to market and other societal institutions and

organizations economic, political, social and cultural – so that

they may function efficiently and effectively as well as repair

their failures.

Thursday, November 23, 2023 Dr.Messele Getachew 40

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Public Goods and the Need for Government

• A game theoretic motivation for government

• Market failure and potential roles for government

• Constitutional definition of scope and limitations of

government

• State and local governments and their powers

Thursday, November 23, 2023 Dr.Messele Getachew 41

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

Market Failure and Potential Roles for Government

• Public goods

• Externalities

• Lack of competition

• Imperfect information

• Distribution of income

Thursday, November 23, 2023 Dr.Messele Getachew 42

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

END

Thursday, November 23, 2023 Dr.Messele Getachew 43

©2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publically accessible website, in whole or in part.

You might also like

- FGT-V0 24Document63 pagesFGT-V0 24FoliaNLNo ratings yet

- Principles of Economics, 10e: Chapter 10: ExternalitiesDocument39 pagesPrinciples of Economics, 10e: Chapter 10: ExternalitiesQuỳnh HươngNo ratings yet

- About Public Private PartnershipsDocument25 pagesAbout Public Private Partnershipsbaloch75No ratings yet

- QVC - Qatar Visa Center PDFDocument2 pagesQVC - Qatar Visa Center PDFMuhammad Bilal Ahmed75% (16)

- Principles of Corporate Finance PrinciplDocument2 pagesPrinciples of Corporate Finance Principl03- Vũ Thị Lan AnhNo ratings yet

- P.E.T. Case No. 005 (Resolution) - Marcos, Jr. v. RobredoDocument57 pagesP.E.T. Case No. 005 (Resolution) - Marcos, Jr. v. RobredoAj SobrevegaNo ratings yet

- Chapter Six: Social Cost Benefit Analysis (Scba)Document47 pagesChapter Six: Social Cost Benefit Analysis (Scba)yimer100% (1)

- Interactive CH 36 Six Debates Over Macroeconomic Policy 9eDocument33 pagesInteractive CH 36 Six Debates Over Macroeconomic Policy 9eMohammad NurzamanNo ratings yet

- Summer Internship Project Report On Recruitment and Selection Process in NISGDocument60 pagesSummer Internship Project Report On Recruitment and Selection Process in NISGAngie AngelNo ratings yet

- Lesson 1 - UCSP 2021Document39 pagesLesson 1 - UCSP 2021Lance Andre SamozaNo ratings yet

- Advanced Public Finance & Taxation: Ethiopian Civil Service University College of Finance, Management and DevelopmentDocument28 pagesAdvanced Public Finance & Taxation: Ethiopian Civil Service University College of Finance, Management and DevelopmentWagner Adugna100% (4)

- Chapter One Basics of Public FinanceDocument17 pagesChapter One Basics of Public FinanceYitera SisayNo ratings yet

- WDR2013 BP Social Cohesion and Public Works (2016!12!11 23-51-45 UTC)Document21 pagesWDR2013 BP Social Cohesion and Public Works (2016!12!11 23-51-45 UTC)michelmboueNo ratings yet

- Public Private 1Document10 pagesPublic Private 1Abiri KelvinNo ratings yet

- 2 The Service Sector Supersectors and Ethical ConsiderationsDocument36 pages2 The Service Sector Supersectors and Ethical ConsiderationsGrace Marasigan0% (1)

- CH 1 - Principles of EconomicsDocument13 pagesCH 1 - Principles of EconomicsCheyenne Megan Kohchet-ChuaNo ratings yet

- Why Public Policies Fail: Policymaking Under Complexity: Article in PressDocument13 pagesWhy Public Policies Fail: Policymaking Under Complexity: Article in PressAlan Rod CybulaNo ratings yet

- Financial Markets and Institutions: Abridged 10 EditionDocument31 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Nile University of Nigeria: Faculty of Management Sciences Department of AccountingDocument16 pagesNile University of Nigeria: Faculty of Management Sciences Department of AccountingObayemi AyomideNo ratings yet

- 076 Mscom 017Document25 pages076 Mscom 017Rukesh GhimireNo ratings yet

- Lect Topic 3.1 PrivatizationDocument22 pagesLect Topic 3.1 PrivatizationKertik SinghNo ratings yet

- Why Public Policies Fail: Policymaking Under Complexity: SciencedirectDocument13 pagesWhy Public Policies Fail: Policymaking Under Complexity: SciencedirectAnnisa Fitri FebriantiNo ratings yet

- Lecture 3A - CH03 - The Environment and Corporate Culture Student VersionDocument26 pagesLecture 3A - CH03 - The Environment and Corporate Culture Student VersionAaliyah SameerNo ratings yet

- Blindness, Poverty, and DevelopmentDocument10 pagesBlindness, Poverty, and DevelopmentAsad KhanNo ratings yet

- ლექცია 1 - Analyzing Economic Problems and MicroeconomicsDocument17 pagesლექცია 1 - Analyzing Economic Problems and MicroeconomicsJUST LETNo ratings yet

- ECO 304 Lecture 1 2023Document31 pagesECO 304 Lecture 1 2023lubisithembinkosi4No ratings yet

- Principles For Action: Centre For Entrepreneurship, Smes, Local Development and TourismDocument39 pagesPrinciples For Action: Centre For Entrepreneurship, Smes, Local Development and TourismMLGNo ratings yet

- The Environment and Corporate CultureDocument30 pagesThe Environment and Corporate CultureHeba ElzeerNo ratings yet

- Impact of Subsidy Removal On Nigerian Educational SystemDocument12 pagesImpact of Subsidy Removal On Nigerian Educational SystemAcademic JournalNo ratings yet

- A9716128 E-Learning Social Health Protection Addressing Inequities ENDocument4 pagesA9716128 E-Learning Social Health Protection Addressing Inequities ENAmr El SheikhNo ratings yet

- Chapter 24 - 25 - National Income AccountingDocument26 pagesChapter 24 - 25 - National Income AccountingBasma EissaNo ratings yet

- Public Finance - Unit 1 - Lecture 5Document3 pagesPublic Finance - Unit 1 - Lecture 5Dyuti SinhaNo ratings yet

- J26. PPP Sustainibility - ResManageriaDocument11 pagesJ26. PPP Sustainibility - ResManageriaAza ARNo ratings yet

- Mgmt6202 Graded Assignment 1Document9 pagesMgmt6202 Graded Assignment 1terry berryNo ratings yet

- Investment For African Development: Making It Happen: Nepad/Oecd Investment InitiativeDocument37 pagesInvestment For African Development: Making It Happen: Nepad/Oecd Investment InitiativeAngie_Monteagu_6929No ratings yet

- Determinants of Mfis Group Loan Repayment Performance: A Case of Dedebit Credit and Saving Institution, Mekelle, EthiopiaDocument22 pagesDeterminants of Mfis Group Loan Repayment Performance: A Case of Dedebit Credit and Saving Institution, Mekelle, EthiopiaAmeliaNo ratings yet

- Introduction To Global Business 2nd Edition Gaspar Solutions ManualDocument14 pagesIntroduction To Global Business 2nd Edition Gaspar Solutions ManualJenniferMartinezxtafr100% (11)

- Applied Economics Worksheet Week 11Document27 pagesApplied Economics Worksheet Week 11Moon LightNo ratings yet

- QuickGuide LED Pre-Field Testing DraftDocument21 pagesQuickGuide LED Pre-Field Testing DraftRoxana ConstantinescuNo ratings yet

- Public FinanceDocument163 pagesPublic FinancerodyaromanoNo ratings yet

- TGI Good PlanningDocument5 pagesTGI Good Planningasdf789456123No ratings yet

- Term Paper: Bangladesh University of Professionals (BUP)Document26 pagesTerm Paper: Bangladesh University of Professionals (BUP)Jahidur Rahman DipuNo ratings yet

- Education Planning: Education Learning and Development ModuleDocument25 pagesEducation Planning: Education Learning and Development ModuleIvy Christine OrquillasNo ratings yet

- Benefit Cost Analysis and Public Sector EconomicsDocument52 pagesBenefit Cost Analysis and Public Sector EconomicsHaery SihombingNo ratings yet

- Public Project Success Measuring The Nuances o - 2022 - International Journal oDocument12 pagesPublic Project Success Measuring The Nuances o - 2022 - International Journal oPavlo Andre AbiyNo ratings yet

- Mercy, Public FinanceDocument4 pagesMercy, Public FinancePatrick ChibabulaNo ratings yet

- Background Information On OECD Principles On Effective Public Investment Across Levels of Government - OECDDocument4 pagesBackground Information On OECD Principles On Effective Public Investment Across Levels of Government - OECDRomy Marlehn Schneider GutierrezNo ratings yet

- Agricultural Project Planning & AnalysisDocument66 pagesAgricultural Project Planning & AnalysisMilkessa SeyoumNo ratings yet

- Chapter 1Document65 pagesChapter 1Wonde GebeyehuNo ratings yet

- Mabini Development Policymaking and StateDocument8 pagesMabini Development Policymaking and StatePran piyaNo ratings yet

- Reflection Paper On NEDA 2023 Report by Rodan FabroDocument9 pagesReflection Paper On NEDA 2023 Report by Rodan FabroRodan FabroNo ratings yet

- Topic 10 CSRDocument66 pagesTopic 10 CSRDiana Vergara MacalindongNo ratings yet

- BSBA Module3-ELECT1 AudijeDocument10 pagesBSBA Module3-ELECT1 AudijeLagran, Micah AndreaNo ratings yet

- ECN297 Jul 19 DNDocument3 pagesECN297 Jul 19 DNivan demichevNo ratings yet

- Privatation in MalaysiaDocument14 pagesPrivatation in MalaysiaPokong Potok100% (1)

- BBB Program and Its Economic ConcernsDocument18 pagesBBB Program and Its Economic ConcernsKatherine DahangNo ratings yet

- Chapter 30 Money Growth and InflationDocument24 pagesChapter 30 Money Growth and InflationHIỀN HOÀNG BẢO MỸNo ratings yet

- أثر تطبيق التسويق الاجتماعي لمتعاملي الإتصالات في الجزائر - موبيليس- أوريدو - على اتجاهات المستهلك الجزائري -دراسة ميدانية مقارنةDocument16 pagesأثر تطبيق التسويق الاجتماعي لمتعاملي الإتصالات في الجزائر - موبيليس- أوريدو - على اتجاهات المستهلك الجزائري -دراسة ميدانية مقارنةRiadh CheblaouiNo ratings yet

- Assignment No. 2Document18 pagesAssignment No. 2muhammadwaris111333No ratings yet

- Learning Journal 0Document32 pagesLearning Journal 0Arquitetogeek PontocomNo ratings yet

- DILG ProgramsnProjects 201357 775ba2bbc5 PDFDocument8 pagesDILG ProgramsnProjects 201357 775ba2bbc5 PDFRhizzalyn Bautista100% (1)

- Assignment No. 2Document20 pagesAssignment No. 2muhammadwaris111333No ratings yet

- Relevant Vocational Trainings For Persons With Disabilities in Nepal PDFDocument7 pagesRelevant Vocational Trainings For Persons With Disabilities in Nepal PDFAlyssa DuranoNo ratings yet

- Introduction To Public FinanceDocument14 pagesIntroduction To Public FinanceMey MeyNo ratings yet

- A Radical Solution for the Problems of Bankruptcy and Financial Bottlenecks for Individuals and CompaniesFrom EverandA Radical Solution for the Problems of Bankruptcy and Financial Bottlenecks for Individuals and CompaniesNo ratings yet

- ARIAS17 Fall OnsiteProgram Web ReadyDocument184 pagesARIAS17 Fall OnsiteProgram Web Readyelassaadkhalil_80479No ratings yet

- The Preamble of The ConstitutionDocument2 pagesThe Preamble of The ConstitutionadityaNo ratings yet

- Zoning Aff PDFDocument1 pageZoning Aff PDFRoque M. RiveralNo ratings yet

- Civ No 39 of 2000 PDFDocument10 pagesCiv No 39 of 2000 PDFherman gervasNo ratings yet

- OBJ2015Feb14 SMDocument100 pagesOBJ2015Feb14 SMAlef CeroNo ratings yet

- What Is FeminismDocument5 pagesWhat Is Feminismdanifemarsil30No ratings yet

- Basic GAD ConceptsDocument26 pagesBasic GAD ConceptsCarl Laura ClimacoNo ratings yet

- Ar 414 Professional Practice 3Document14 pagesAr 414 Professional Practice 3JAMES LLOYD ANTHONY CONCHANo ratings yet

- 16.02.2024 Translation Fard of Village Kultarpur and GakhalDocument8 pages16.02.2024 Translation Fard of Village Kultarpur and GakhalAdv Gagandeep BabraNo ratings yet

- 2010 Jan 2 Llbdegreesemester 1 Paper 2 Lawofcontract 1 AssignmentDocument16 pages2010 Jan 2 Llbdegreesemester 1 Paper 2 Lawofcontract 1 AssignmentSreegopal SreekumaranNo ratings yet

- Income Exempt From TaxDocument4 pagesIncome Exempt From TaxKartikNo ratings yet

- Pagaling Homer ETHICSDocument78 pagesPagaling Homer ETHICSPagaling, Homer L.No ratings yet

- World War II Causes Events and ConsequencesDocument1 pageWorld War II Causes Events and ConsequenceskrishnaNo ratings yet

- Agregat Plan Tugas PDFDocument11 pagesAgregat Plan Tugas PDFNur Rahma Laila Rizki FauziahNo ratings yet

- PLD 2013 SC 401Document2 pagesPLD 2013 SC 401otho saeedNo ratings yet

- Civics Form Two Full NotesDocument30 pagesCivics Form Two Full NotesKazi ImeliNo ratings yet

- Accountancy (Far Eastern University) Accountancy (Far Eastern University)Document21 pagesAccountancy (Far Eastern University) Accountancy (Far Eastern University)Shiela DanoNo ratings yet

- Brief History of Mindanao IslandDocument26 pagesBrief History of Mindanao IslandChenchen AlamanNo ratings yet

- CcvoDocument1 pageCcvoronniedsNo ratings yet

- Salters v. North Carolina Prisoners Legal Services Et Al - Document No. 4Document2 pagesSalters v. North Carolina Prisoners Legal Services Et Al - Document No. 4Justia.comNo ratings yet

- IYCN Agents of Change - 2009 ReportDocument27 pagesIYCN Agents of Change - 2009 ReportChaitanya KumarNo ratings yet

- Jurisdiction of The Labor Arbiter (Cases)Document66 pagesJurisdiction of The Labor Arbiter (Cases)MargeNo ratings yet

- The Law of Equivalent ExchangeDocument2 pagesThe Law of Equivalent ExchangeSphelele MaphumuloNo ratings yet

- Tendeciarz Silvia - Citizens of Memory, Refiguring The Past Postdictatorship ArgentinaDocument20 pagesTendeciarz Silvia - Citizens of Memory, Refiguring The Past Postdictatorship ArgentinaBelen FernandezNo ratings yet

- Ebook Project Management PDF Full Chapter PDFDocument67 pagesEbook Project Management PDF Full Chapter PDFmelvin.smith746100% (23)