Professional Documents

Culture Documents

Business Finance Lessons, 2,3,7,8,9, and 10

Uploaded by

dollizonmishaeliezer0 ratings0% found this document useful (0 votes)

6 views56 pagesThis file contains lessons for Business Finances for the GRADE 12 ABM STUDENTS.

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis file contains lessons for Business Finances for the GRADE 12 ABM STUDENTS.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views56 pagesBusiness Finance Lessons, 2,3,7,8,9, and 10

Uploaded by

dollizonmishaeliezerThis file contains lessons for Business Finances for the GRADE 12 ABM STUDENTS.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 56

Financial Planning

Tools and Concepts

Parts1&2

Week 10

Introduction

Every business unit whether it is an industrial

establishment, a trading concern or a construction

company needs funds for carrying on its activities

successfully.

It requires funds to acquire fixed assets like machines, equipment,

furniture etc. and to purchase raw materials or finished goods, to pay

its creditors, to meet its day-to-day expenses, and so on. In fact,

availability of adequate finance is one of the most important factors

for success in any business.

However, the requirement of finance, nowadays, is so

large that no individual is in a position to provide the

whole amount from his personal sources.

So the businessman has to depend on other sources

and use various ways to raise the necessary amount of

funds.

Every businessman has to be very careful not only in

assessing the firm’s requirement of finance but also in

deciding on the forms in which funds are raised and

utilized.

Planning

Planning is an important aspect of the firm’s

operations because it provides road maps for

guiding, coordinating, and controlling the

firm’s actions to achieve its objectives

(Gitman & Zutter, 2012).

Planning is a systematic way of deciding

about and doing things in a purposeful

manner. When this approach is applied

exclusively for financial matter, it is termed

as financial planning.

In simple words Financial Planning can be

defined as:

“the process of estimating the capital required

and determining it’s composition. It is the

process of framing financial policies in relation

to procurement, investment and administration

of funds of an enterprise.”

-Management planning is about setting

the goals of the organization and identifying

ways on how to achieve them (Borja&

Cayanan, 2015).

There are two phases of financial

planning:

Financial planning starts with long

term plans which would then

translate to short term plans.

Importance of Financial Planning

To ensure adequate funds

Help in making growth and expansion program

which will aid the long-run survival of the company.

Assures the suppliers of funds that their

investments are well managed.

Maintain a secure balance between outflow and

inflow of funds for stability.

Strategic financial

management

Strategic financial management

focuses on developing long-term

goals through forecasting market

changes.

Strategic financial

management is about

creating profits for the

business over the long

run.

It seeks to maximize

return on investment

for stakeholders.

Tactical financial

management

Tactical financial management focuses on more

short-term goals by making decisions and creating

an action plan based on current market conditions.

which relate to short-term positioning.

Long-term financial plans

-These are a set of goals that lay out the overall

direction of the company.

-A long-term financial plan is an integrated

strategy that takes into account various

departments such as sales, production, marketing,

and operations for the purpose of guiding these

departments towards strategic goals.

-Those long-term plans consider proposed outlays for

fixed assets, research and development activities,

marketing and product development actions, capital

structure, and major sources of financing.

-Also included would be termination of existing

projects, product lines, or lines of business; repayment

or retirement of outstanding debts; and any planned

acquisitions (Gitman & Zutter, 2012)

Short-term financial plans

-Specify short-term financial actions and the anticipated

impact of those actions. Part of short term financial

plans include setting the sales forecast and other forms

of operating and financial data. This would then

translate into operating budgets, the cash budget, and

pro forma financial statements (Gitman & Zutter, 2012).

-For the purpose of this topic, emphasis will be made on

short-term financial planning

Comparison of Short-Term and Long-Term Planning

the planning process as follows:

1)Set goals or objectives.

•For corporations, long term and short term

objectives are usually identified. These can be

seen in the company’s vision and mission

statements. The vision statement states where the

company wants to be while the mission statement

states the plans on how to achieve the vision.

Goal setting is a process that starts with

careful consideration of what you want to

achieve and ends with a lot of hard work to

accomplish it. In setting goals, you have to

identify the long-term and short-term plans

in order to achieve your mission and vision.

Examples of a company’s Vision-Mission

statements are as follows:

Jollibee Foods Corporation (JFC)

Vision: To excel in providing great tasting food that

meets local preferences better than anyone; To

become one of the three largest and most profitable

restaurant companies in the world by 2020.

Mission: To serve great tasting food, bringing the

joy of eating to everyone.

McDonalds Philippines

Vision: First to respond to the fast changing needs of the

Filipino family; First choice when it comes to food and dining

experience; First mention as the ideal employer and socially

responsible company; First to respond to the changing lifestyle

of the Filipino family

Mission: To serve the Filipino community by providing great-

tasting food and the most relevant customer delight experience.

2)Identify Resources

Resources include production capacity,

human resources who will man the

operations and financial resources (Borja

& Cayanan, 2015).

3)Identify goal-related tasks

In this step, management should focus

on completing a task in order to achieved

planned objectives. Task-driven or

results-driven uses targets to stay

motivated in their work.

• the goal-related task is to

prepare an event to increase

awareness of (whatever issue

you want)

4)Establish responsibility centers for

accountability and timeline

If the task is already identified, the next step is to identify

which department should be held accountable. For

example, if your goal is to achieve 30% in sales, this

should be the responsibility of the head of sales and

marketing department and there should also be another

departments who take the responsibility in achieving the

goal.

there must be a timeline for the

planned activities, especially

activities which are not normally

done.

5)Establish the evaluation system for

monitoring and controlling

In financial planning, the management must establish

a monitoring and controlling evaluation system so that

there is a clear plan for the program or activity. It will

help the staffs decide how they are going to track and

analyze data. Quantified plans for budget and

projected financial statements should also be done.

For corporations, the management must establish

a mechanism which will allow plans to be

monitored. This can be done through quantified

plans such as budgets and projected financial

statements. The management will then compare

the actual results to the planned budgets and

projected financial statements. Any deviations

from the budgets should be investigated.

6)Determine contingency plans

A contingency plan is often referred to as

PLAN B because it can be used as an

assumption for an unexpected result.

Determining a contingency plan helps an

organization respond effectively to a future

event or situation that may or may not occur.

•In planning, contingencies must be considered as

well.

•Budgets and projected financial statements are

anchored on assumptions. If these assumptions

do not become realities, management must have

alternative plans to minimize the adverse effects

on the company (Borja & Cayanan, 2015)

Financial Planning Tools

and Concepts Part 2

Characteristics of an Effective Plan

• In planning, the goal of maximizing shareholders’

wealth must always be put in mind. The following

criteria may be used for effective planning:

• •Specific – target a specific area for improvement.

• •Measurable – quantify or at least suggest an

indicator of progress.

• •Assignable – specify who will do it.

• •Realistic – state what results can

realistically be achieved, given available

resources.

• •Time-related – specify when the result(s)

can be achieved.

1. Sales Budget

• The most important account in the financial

statement in making a forecast is sales since most of

the expenses are correlated with sales.

• Given the importance of the sales forecast, the

financial manager must be able to support this

figure with reasonable assumptions. The following

external and internal factors should be considered in

forecasting sales:

Factors that Influence Sales

the following external and internal factors

influencing sale, among others:

-Macroeconomic Variables (external)

Macroeconomic variables such as the GDP rate,

inflation rate, and interest rates, among others

play an important role in forecasting sales

because it tells us how much the consumers are

willing to spend.

• A low GDP rate coupled by a high inflation

rate means that consumers are spending

less on their purchases of goods and

services. This means that we should not

forecast high sales of the periods of low

GDP.

-Developments in the Industry (external)

Products and services which have more

developments in its industry would likely have a

higher sales forecast than a product or service in

slow moving industry. Consumer trends are always

changing, thus the industry should be competitive

to be able to appeal to more customers and stay in

the market.

-Competition (external)

Suppose you are selling bread and you know that

each person in your community eats an average of

one loaf of bread a day. The population of your

community is 500 people. If you are the only person

selling bread in your town, then your sales forecast is

500 units of bread. However, you also have to take

account your competition.

What if there are 4 other sellers of bread? You will

need to have to divide the sales between the 5 of

you. Does this mean your new forecast should be

100 units of bread? Not necessary. You should also

know the preference of your consumers. If more of

them would prefer to buy more bread from you,

then you should increase your sales forecast

-Production Capacity and man power

(internal)

Suppose that you have already evaluated the

macroeconomic factors and identified that there is a

very strong market for your product and consumers

are very likely to buy from you. You forecasted that

you will be able to sell 1,000 units of your product.

However, you only have 20 employees who are

able to produce 20 units each. Your capacity

cannot cover your expected demand hence, you

are limited by it. To be able to increase

capacity, you should be able to expand your

operations.

What are the implications if the sales budget

is not correct? If understated, there can be

lost opportunities in the form of forgone

sales. If it is too optimistic, the management

may decide to unnecessarily increase

capacity or hire more employees and end up

with more inventories.

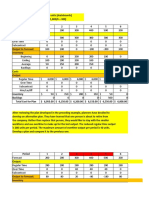

2. Production Budget

-A production budget provides

information regarding the number of

units that should be produced over a

given accounting period based on

expected sales and targeted level of

ending inventories.

It is computed as follows:

Example:

-[A] Company forecasts sales in units for

January to May as follows:

-Moreover, [A] Company would like to maintain

100 units in its ending inventory at the end of

each month.

-Beginning inventory at the start of January

amounts to 50 units.

-How many units should [A] Company produce in

order to fulfill the expected sales of the company?

Answer:

Example of a Production Budget

As an example of a production budget, ABC

Company plans to produce an array of plastic

pails during the upcoming budget year, all of

which fall into the general Product A category.

Its production needs are outlined as follows:

Calculation of the Production Budget

The production budget is typically presented in either a monthly

or quarterly format. The basic calculation used by the production

budget is:

+ Forecasted unit sales

+ Planned finished goods ending inventory balance

= Total production required

- Beginning finished goods inventory

= Products to be manufactured

The planned ending finished goods inventory at the end of

each quarter declines from an initial 1,000 units to 500

units, since the materials manager believes that the

company is keeping too many finished goods in stock.

Consequently, the plan calls for a decline from 1,000 units

of ending finished goods inventory at the end of the first

quarter to 500 units by the end of the second quarter,

despite a projection for rising sales. This may be a risky

forecast, since the amount of safety stock on hand is being

cut while production volume increases by over 30 percent.

Given the size of the projected inventory decline, there is a

fair chance that ABC will be forced to increase the amount

of ending finished goods inventory later in the year.

3. Budgeting Cash

Operating Budget An operating budget is a

forecast of the revenues and expenses

expected for one or more future periods.

An operating budget is typically formulated by

the management team just prior to the

beginning of the year and shows expected

activity levels for the entire year.

This budget may be supported by a

number of subsidiary schedules that contain

information at a more detailed level.

For example, there may be separate

supporting budgets that address payroll, the

cost of goods sold, and inventory. Actual results

are then compared to the operating budget to

determine the extent of any variances from

expectations. Management may alter its actions

during the year to bring actual results into line

with the operating budget.

-Operations budget refers to the variable

and fixed costs needed to run the

operations of the company but are not

directly attributable to the generation of

sales.

-Examples of this are the following:

•Rent payments •Wages and Salaries of selling

and administrative personnel •Administrative

Costs •Travel and representation expenses

•Professional fees •Interest Payment

Activity 10 (30 pts.) to be presented in

class

• Suppose you are planning an event

(birthday, debut, wedding, etc.)

prepare a step-by-step activity

following the financial process.

You might also like

- Business Forecasting 9th Edition Hanke Solution ManualDocument9 pagesBusiness Forecasting 9th Edition Hanke Solution ManualMisha Lezhava67% (6)

- Assignment 2 IndividualDocument10 pagesAssignment 2 IndividualShahrul AzrinNo ratings yet

- Financial Planning Tools and ConceptsDocument30 pagesFinancial Planning Tools and ConceptsEarl Concepcion89% (9)

- The Importance of Accurate Sales ForecastingDocument8 pagesThe Importance of Accurate Sales ForecastingVipul KothariNo ratings yet

- Operations Management: Contemporary Concepts and Cases Fifth EditionDocument6 pagesOperations Management: Contemporary Concepts and Cases Fifth EditionShahriar Alam100% (1)

- Bagong Patype EditedDocument21 pagesBagong Patype EditedJoyluxxi100% (1)

- Sample Questions of MSCDocument6 pagesSample Questions of MSCJacob hauhengNo ratings yet

- SOAL DAN JAWABAN: MANAJEMEN OPERASIONALDocument106 pagesSOAL DAN JAWABAN: MANAJEMEN OPERASIONALrenyzahridar63% (8)

- OPIM5671 Case Study ReportDocument76 pagesOPIM5671 Case Study ReportJobin GeorgeNo ratings yet

- Case #1 Farmers RestaurantDocument63 pagesCase #1 Farmers RestaurantPaulina Naranjo83% (6)

- Converging Factor Racing FormulasDocument53 pagesConverging Factor Racing Formulashomomysticus67% (3)

- Financial Planning Tools and Concepts - and andDocument25 pagesFinancial Planning Tools and Concepts - and andChristian ZebuaNo ratings yet

- Financial PlanningDocument48 pagesFinancial PlanningKeanna Ashley Grace GutingNo ratings yet

- Business Finance: 1 Quarter Lesson 3: Financial Planning ProcessDocument6 pagesBusiness Finance: 1 Quarter Lesson 3: Financial Planning ProcessReshaNo ratings yet

- Local Media6428844306473856818Document38 pagesLocal Media6428844306473856818Maura Lizabeth Gawili BalunggayNo ratings yet

- Financial MGMT MODULE 2Document7 pagesFinancial MGMT MODULE 2Isabelle MariaNo ratings yet

- Financial Planning: WK04-LAS1-BF-II-12Document19 pagesFinancial Planning: WK04-LAS1-BF-II-12Benj Jamieson DuagNo ratings yet

- Financial Planning and ToolsDocument41 pagesFinancial Planning and ToolsShalom BuenafeNo ratings yet

- BUDGETING PresentationDocument6 pagesBUDGETING PresentationJandJ's Art BoxNo ratings yet

- Page 1 of 9Document9 pagesPage 1 of 9Gemechis LemaNo ratings yet

- Budgets and Their Ability To Support Organisational ObjectivesDocument38 pagesBudgets and Their Ability To Support Organisational ObjectivesranjithNo ratings yet

- What Is Budgeting?: Strategy Into Targets and BudgetsDocument11 pagesWhat Is Budgeting?: Strategy Into Targets and BudgetsAriela DavisNo ratings yet

- Group 1 Financial Forecasting For Strategic GrowthDocument17 pagesGroup 1 Financial Forecasting For Strategic GrowthZirah Mae NiepesNo ratings yet

- Financial Forecasting for Strategic GrowthDocument17 pagesFinancial Forecasting for Strategic GrowthArmand RoblesNo ratings yet

- FM II - Chapter 03, Financial Planning & ForecastingDocument14 pagesFM II - Chapter 03, Financial Planning & ForecastingHace AdisNo ratings yet

- Finance Module 03 - Week 3Document16 pagesFinance Module 03 - Week 3Christian ZebuaNo ratings yet

- Understanding the Importance of Financial Planning for BusinessesDocument98 pagesUnderstanding the Importance of Financial Planning for Businessesrey mark hamacNo ratings yet

- Topic 5 Financial Forecasting For Strategic GrowthDocument20 pagesTopic 5 Financial Forecasting For Strategic GrowthIrene KimNo ratings yet

- Financial Planning: Prepared By: Luigi Miguel B. Antonio, MBADocument20 pagesFinancial Planning: Prepared By: Luigi Miguel B. Antonio, MBAThriztan Andrei BaluyutNo ratings yet

- Importance of Financial PlanningDocument18 pagesImportance of Financial PlanningSyam LaNo ratings yet

- Fiscal Management WF Dr. Emerita R. Alias Edgar Roy M. Curammeng Financial Forecasting, Corporate Planning and BudgetingDocument10 pagesFiscal Management WF Dr. Emerita R. Alias Edgar Roy M. Curammeng Financial Forecasting, Corporate Planning and BudgetingJeannelyn CondeNo ratings yet

- Sterling Institute of Management StudiesDocument29 pagesSterling Institute of Management StudiesPraNita AmbavaneNo ratings yet

- Business Finance For Video Module 2Document16 pagesBusiness Finance For Video Module 2Bai NiloNo ratings yet

- Introduction to Accounting Lesson 14 Operational BudgetingDocument36 pagesIntroduction to Accounting Lesson 14 Operational Budgetingluo jamesNo ratings yet

- Fin Assignment1 CunananDocument4 pagesFin Assignment1 CunananJowen Para CruzNo ratings yet

- Financial Planning and ForecastingDocument15 pagesFinancial Planning and Forecastingalkanm750100% (1)

- Cost II Chapter Two by SisayDocument20 pagesCost II Chapter Two by SisaySisay Belong To JesusNo ratings yet

- Chapter 5 SummaryDocument6 pagesChapter 5 SummaryDiana Mark AndrewNo ratings yet

- Chapter Two-SalesDocument9 pagesChapter Two-SalesBelay AdamuNo ratings yet

- Costing FinalfffDocument39 pagesCosting FinalfffSaloni Aman SanghviNo ratings yet

- Corporate PlanningDocument22 pagesCorporate PlanningYumna HashmiNo ratings yet

- Assignment SMDocument3 pagesAssignment SMshahrukhakhterNo ratings yet

- Master Budget Framework for Planning and ControlDocument5 pagesMaster Budget Framework for Planning and ControlJeson MalinaoNo ratings yet

- Budgets and Managing MoneyDocument51 pagesBudgets and Managing MoneyIrtiza Shahriar ChowdhuryNo ratings yet

- CMI ManagementDirect - BudgetsDocument34 pagesCMI ManagementDirect - BudgetsAnonymous 2AK0KTNo ratings yet

- Chapter 9 Financial Forecasting For Strategic GrowthDocument18 pagesChapter 9 Financial Forecasting For Strategic GrowthMa. Jhoan DailyNo ratings yet

- Financial Planning and BudgetingDocument45 pagesFinancial Planning and BudgetingRafael BensigNo ratings yet

- Financial Performance ToolsDocument30 pagesFinancial Performance ToolsJason RecanaNo ratings yet

- Master Budget Strategy GuideDocument20 pagesMaster Budget Strategy Guideitsdaloveshot naNANAnanaNo ratings yet

- H9 Master Budget and ForecastingDocument17 pagesH9 Master Budget and ForecastingGodwin Jil CabotajeNo ratings yet

- Budget and BudgetryDocument6 pagesBudget and Budgetryram sagar100% (1)

- Financial Strategizing Contributes To ProfitsDocument3 pagesFinancial Strategizing Contributes To ProfitsSaleeth Muhammed SaleethNo ratings yet

- Financial Forecasting For Strategic GrowthDocument3 pagesFinancial Forecasting For Strategic GrowthVergel MartinezNo ratings yet

- MB 0045Document32 pagesMB 0045Kawal Preet Singh OberoiNo ratings yet

- Role of Financial Management WorkbookDocument15 pagesRole of Financial Management WorkbookAditri MahajanNo ratings yet

- Cost Ii CH 2Document23 pagesCost Ii CH 2TESFAY GEBRECHERKOSNo ratings yet

- Financial Planning and Forecasting StudyDocument16 pagesFinancial Planning and Forecasting Studyprince yadavNo ratings yet

- CHAPTER FOUR Financial Forcasting and PlanningDocument15 pagesCHAPTER FOUR Financial Forcasting and PlanningSoftware Lab MISKERNo ratings yet

- Accounting and Finance for Managers: Budgeting and Budgetary ControlDocument12 pagesAccounting and Finance for Managers: Budgeting and Budgetary ControlSiraj MohammedNo ratings yet

- Chapter 4 PptsDocument111 pagesChapter 4 PptsKimberly Quin Cañas100% (1)

- Abm 4 Module 6Document6 pagesAbm 4 Module 6Argene AbellanosaNo ratings yet

- Plan Your EnterpriseDocument9 pagesPlan Your EnterpriseJerwin SamsonNo ratings yet

- Financial Planning and Control ProcessDocument3 pagesFinancial Planning and Control ProcessPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Unit 7Document11 pagesUnit 7Shaik UsmanNo ratings yet

- CHAPTER 3 Financial PlanningDocument7 pagesCHAPTER 3 Financial Planningflorabel parana0% (1)

- Chapter 3Document14 pagesChapter 3Tariku KolchaNo ratings yet

- Financial Planning and Budgeting GuideDocument29 pagesFinancial Planning and Budgeting GuidejsemlpzNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- Management AccountingDocument3 pagesManagement AccountingRobert HensonNo ratings yet

- Qualitative Forecasting relies on opinionsDocument10 pagesQualitative Forecasting relies on opinionsLiezel Panganiban TaralaNo ratings yet

- The Role of Planning and Forecasting in Business OrganizationDocument43 pagesThe Role of Planning and Forecasting in Business OrganizationAyalsew MekonnenNo ratings yet

- Forecasting Seasonal Time SeriesDocument11 pagesForecasting Seasonal Time SeriesManuel Alejandro Sanabria AmayaNo ratings yet

- The ROI Fieldbook - Strategies For Implementing ROI in HR and Training (PDFDrive) PDFDocument412 pagesThe ROI Fieldbook - Strategies For Implementing ROI in HR and Training (PDFDrive) PDFBe DawsonNo ratings yet

- CH 7. Demend Estimation and ForecastingDocument27 pagesCH 7. Demend Estimation and ForecastingdanarNo ratings yet

- Holt WinterDocument5 pagesHolt Winterjohanna silabanNo ratings yet

- 1 s2.0 S0301479723016791 MainDocument8 pages1 s2.0 S0301479723016791 MainAmal AouadiNo ratings yet

- CounselLink - Law Department Budgeting and ForecastingDocument12 pagesCounselLink - Law Department Budgeting and ForecastingBuddhika PereraNo ratings yet

- Aggregate Planning Example SolvedDocument16 pagesAggregate Planning Example SolvedAbdullah ShahidNo ratings yet

- Chapter 1 - Introduction To Quantitative AnalysisDocument35 pagesChapter 1 - Introduction To Quantitative AnalysisAbo FawazNo ratings yet

- Forecast Time Series With R LanguageDocument98 pagesForecast Time Series With R Languageec04017No ratings yet

- Overview BPC 11.00 For Sapbw4hanaDocument56 pagesOverview BPC 11.00 For Sapbw4hanaAriel Linetzky0% (1)

- Practice NumericalsDocument12 pagesPractice NumericalsAvinash SubramanianNo ratings yet

- PM Unit IiiDocument106 pagesPM Unit IiiAnonymous kwi5IqtWJNo ratings yet

- Energies 14 06336 v2Document23 pagesEnergies 14 06336 v2Ashar AwanNo ratings yet

- Insights into forecasting models for PET bottle stock ordersDocument8 pagesInsights into forecasting models for PET bottle stock ordersTwinkle ChoudharyNo ratings yet

- Flowcasting The Retail Supply Chain PDFDocument115 pagesFlowcasting The Retail Supply Chain PDFCésar Zapata R100% (2)

- Traffic Growth Rate EstimationDocument6 pagesTraffic Growth Rate Estimationmanu1357No ratings yet

- 5 MPC-Aggregate PlanningDocument16 pages5 MPC-Aggregate Planningpkj009No ratings yet

- Elliott 2007Document30 pagesElliott 2007Eko AdhityoNo ratings yet