Professional Documents

Culture Documents

Microeconomics

Uploaded by

selomonbrhane17171Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microeconomics

Uploaded by

selomonbrhane17171Copyright:

Available Formats

Chapter Two

Price and Output Determination Under Monopolistic Competition

Chapter Outline :

1. Introduction

2. Assumptions

3. Product Differentiation

4. Demand and Revenue functions

5. Cost of monopolistic competition

6. The concept of product group and industry

7. Equilibrium Under Monopolistic Competition

1. Short-run Equilibrium

2. Long Run Equilibrium

8. Comparison with perfect competition: the excess capacity

02/21/2024 Micro II Slides Monopolistic Competition 1

2.1. Introduction

• Both monopoly and perfect competition are rare to find

• They don’t reflect the true behavior of the majority of the firms

• Very few commodities are entirely homogeneous (identical) to

make perfect competition assumption realistic.

• Monopolistic competition was developed by Edward

Chamberlin and Joan Robinson in early 1930s

• They were dissatisfied with the existing two markets

• This market structure lies between the two extreme market

structures of PC and Monopoly.

02/21/2024 Micro II Slides Monopolistic Competition 2

Definition and Features

• Monopolistic competition is a market structure in

which many firms sell differentiated products.

– Examples: furniture, jewelry, leather goods,

barber shops, restaurants, books, magazines,

films and movies, bottled water, etc.

• Characteristics:

– Many sellers

– Product differentiation

– Free entry and exit

02/21/2024 Micro II Slides Monopolistic Competition 3

2.2. Assumptions

a. There are large numbers of sellers (but not as large as PC)

in the product group

b. Differentiated product and yet close substitutes: firms

get certain monopoly power to set price of their product

* no identical or standardized product

c. Ease of entry and exit: long run normal profit

d. Objective of the firms is profit maximization

e. Firms are assumed to behave as if they knew their

demand and cost curves with certainty

f. Both demand and cost curves for all products are uniform

through the output group

02/21/2024 Micro II Slides Monopolistic Competition 4

2.3. Product Differentiation

• Product differentiation:.

process of making a product appear different from other

products

It is accomplished by producing products that have distinct

positive identities in consumers’ minds

• The goal of PD is to achieve market power.

• It changes the demand curve from horizontal to

downward demand curve

02/21/2024 Micro II Slides Monopolistic Competition 5

Two types of product differentiations

• Real product differentiation: products differ in terms

of their inherent characteristics such as inputs used,

location, services etc.

E.g. Shampoo with and without conditioner

• Fancied (spurious) product differentiation: products

are the same but producers convince customers that

their product is different

E.g. Differences which are created due to advertisement,

in packing, design, brand name and other sales promotion

activities

E.g. Spring water( Yes Vs Abyssinia), Beer,

02/21/2024 Micro II Slides Monopolistic Competition 6

2.4. Demand and Revenue functions

• A firm gains certain monopoly power through product

differentiation. This results in downward sloping demand curve.

• Marginal revenue is also downward sloping but is less than the

demand curve .

• The firm did not loss its entire customer through price rise even

though some of them may switch to its competitors product.

• Small rise in price results in large fall in quantity demanded

• The demand curve is highly elastic, but not perfectly elastic,

because of the existence of large number of firms producing

closely substitute products

• Flatter demand curve compared to pure monopolist and

steeper compared to perfect competitive firm.

02/21/2024 Micro II Slides Monopolistic Competition 7

The actual sales and the perceived demand curve

• Chamberlin also introduced a new demand

curve

• The demand curve we know till now is

called perceived/ predicted/ demand curve

• It is drawn based on ceteris paribus assumption

• When other things do not remain the same,

the firm faces a new type of demand curve

called actual sales/market share/ demand

curve

02/21/2024 Micro II Slides Monopolistic Competition 8

Graphically,

P D

d

P0

P1

P2

d

D

Q 0 Q 1* Q1 Q

•There is difference between expected and actual sales

•The perceived demand curve is flat compared to the market share

demand curve

02/21/2024 Micro II Slides Monopolistic Competition 9

2.5. Cost of monopolistic competition

• Firms often devote considerable resources to

differentiate their product from their competitors

through devices such as quality and style variations,

warranty, special services features, and product

advertisement.

• The firm faces a new type of cost called selling cost or

cost of product differentiation

• Average and marginal selling costs curve of monopolistically

competitive firm have U-shaped.

– Reason: economies and diseconomies of scale of selling activities.

• TC= Production Cost + Selling cost

• The average and marginal selling cost of monopolistically competitive firm is

generally greater than that of perfect competitive and monopolist firm

02/21/2024 Micro II Slides Monopolistic Competition 10

2.6. The concept of product group and industry

• Industry: is collection of firms with identical product

• Product group: formed by lumping together firms producing similar products (but

not identical) which are close substitutes.

– They are group of products with higher price and cross elasticity of demand.

• Close substitution can be two types:

– Technological substitute: products which satisfy the same demand.

e.g. all motor cars i.e. they provide transport, TV, Computers

– Economic substitute: products which have similar price and satisfy the

same demand.

• We do not have a single equilibrium price for differentiated product, but a

cluster of prices.

• Chamberlin assumed that every firm in the product group

faces the same demand curve with identical cost.

02/21/2024 Micro II Slides Monopolistic Competition 11

2.7. Equilibrium Under Monopolistic Competition

2.7.1. Short-run Equilibrium

• At equilibrium, a firm should produce at a point where:

– MR = MC and

– Slope of MC is greater than that of MR

• The firm charges the corresponding price (P) based

on its demand curve.

• The nature of profit earned at equilibrium depends on

the relationship between P and AC. More specifically,

– When P > AC, the firm earns an economic profit. (AR>AC)

– When P < AC, the firm incurs a loss.(AR<AC)

– When P = AC, the firm earns normal profit (AR=AC) i.e.

profit=0

02/21/2024 Micro II Slides Monopolistic Competition 12

Case A: Monopolistically Competitive Firm with positive Profit

Fig. Above normal profit

02/21/2024 Micro II Slides Monopolistic Competition 13

A Monopolistically

Competitive Firm: Normal Profit

Fig. Normal profit

02/21/2024 Micro II Slides Monopolistic Competition 14

Case C: Monopolistically

Competitive Firm with Economic loss or -ve profit

Fig. Economic Loss

02/21/2024 Micro II Slides Monopolistic Competition 15

1.7.2 The Long Run: Only a Normal Profit

• Chamberlin made two heroic assumptions

a. Firms have identical cost

b. Consumer preferences are evenly distributed among

different product (firms have the same demand curve)

• The adjustments to equilibrium point takes place through

change in the position of demand curve resulted from:

– entry and exit of firms or

– price adjustment by the existing firm or a combination of the two.

• Chamberlin developed three distinct model of long run

equilibrium.

02/21/2024 Micro II Slides Monopolistic Competition 16

Three distinct model of long run equilibrium.

A. Long run equilibrium with free entry of new

firms ( there is no price competition among

the existing firms)

B. Long run equilibrium with price competition

among the existing firms ( there is optimal

number of firms)

C. Long run equilibrium with price competition

among the existing firms and free entry of

new firms( the ultimate solution)

02/21/2024 Micro II Slides Monopolistic Competition 17

Long run equilibrium: graphical presentation

e

D

d

02/21/2024 Micro II Slides Monopolistic Competition 18

A equilibrium point

• MR=LMC

• LAC= P

• Demand curve becomes tangent to the LAC

curve

• DD=dd=LAC

• The market share demand curve passes through

the tangency point between perceived demand

curve and LAC.

• Profit =0

02/21/2024 Micro II Slides Monopolistic Competition 19

2.8. Identifying Monopolistic Competition

• Two indexes:

– The four-firm concentration ratio (CR)

– The Herfindahl-Hirschman Index(HHI)

02/21/2024 Micro II Slides Monopolistic Competition 20

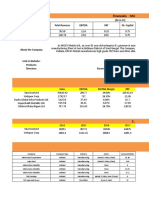

The Four-Firm Concentration Ratio

• The four-firm concentration ratio is the

percentage of the value of sales accounted for by

the four largest firms in the industry.

• The range of concentration ratio is from almost

zero for perfect competition to 100 percent for

monopoly.

• A ratio that exceeds 60 percent is an indication of

oligopoly.

• A ratio of less than 40 percent is an indication of a

competitive market—monopolistic competition.

02/21/2024 Micro II Slides Monopolistic Competition 21

The Herfindahl-Hirschman Index

• The Herfindahl-Hirschman Index (HHI) is the square

of the percentage market share of each firm

summed over the largest 50 firms in a market.

• Example, four firms with market shares as 50

percent, 25 percent, 15 percent, and 10 percent.

– HHI = 502 + 252 + 152 + 102 = 3,450

• A market with an HHI less than 1,000 is

regarded as competitive and between 1,000

and 1,800 is moderately competitive.

02/21/2024 Micro II Slides Monopolistic Competition 22

2.9. Monopolistic Competition and Efficiency

• In monopolistic competition, neither productive nor allocative efficiency

occurs in long-run equilibrium.

• Productive Efficiency: is achieved when the output is produced at minimum

average total cost (ATC).

Condition: P=min ATC

• Allocative Efficiency: is achieved when the value consumers place on a good

or service (reflected in the price they are willing to pay) equals the cost of

the resources used up in production.

Condition: P=MC

• Since the firm’s profit-maximizing price (and average total cost)

slightly exceed the lowest average total cost, productive efficiency is

not achieved.

• Since the profit-maximizing price exceeds marginal cost, monopolistic

competition causes an under allocation of resources.

• Monopolistic competition decision did not maximize social welfare

since equilibrium price is higher than MC and output is below social

desired level

02/21/2024 Micro II Slides Monopolistic Competition 23

2.10. Excess Capacity and Comparison with PC and Monopoly

• Long run equilibrium of the firm under monopolistic

competition is attained at a point where the

perceived demand curve is tangent to LAC curve

• Compared to the LR equilibrium of perfectly

competitive firm, a monopolistically competitive

firm:

– Produces smaller units of output

– Charges higher price

– Price is above marginal cost of production

– Operates on the falling part of the LAC curve( it is at the

min point of the LAC curve of PC)

02/21/2024 Micro II Slides Monopolistic Competition 24

Regarding similarity,

• For both economic profit in the long run is zero .

02/21/2024 Micro II Slides Monopolistic Competition 25

Monopolistic Competition vs. Monopoly

• It is possible for the monopolist to make economic

profit in the long run because of the existence of

barriers to entry

• No long-run economic profit is possible in

monopolistic competition because there are no

significant barriers to entry

• Flatter demand for monopolistically competitive firm,

while pure monopolist steeper demand

02/21/2024 Micro II Slides Monopolistic Competition 26

Excess capacity

• A firm has excess capacity if the quantity it produces

is less that the quantity at which average total cost is

a minimum.

• A firm’s efficient scale is the quantity of production

at which average total cost is a minimum.

• The gap between the minimum LAC output and the profit-

maximizing output of a monopolistically competitive firm

shows excess capacity that exists in the later market

• It is unused capacity that exists in this market structure

• Monopolistically competitive industries are overcrowded

with firms each operating below its optimal capacity.

• Higher cost due to Selling cost

02/21/2024 Micro II Slides Monopolistic Competition 27

Graphically

02/21/2024 Micro II Slides Monopolistic Competition 28

Chamberlin’s excess capacity

• Chamberlin believes that as far as there is new entry

and price competition among existing firms, there is no

excess capacity in MC

• MC firms can not produce output indicated for

competitive firms owing to their downward sloping

demand curve

• The deviation in output is a measure of cost of product

differentiation according to him

• People like to consume varieties of a good and this has

a cost

• For Chamberlin, excess capacity exists only when firms

are not engaging in price competition.

02/21/2024 Micro II Slides Monopolistic Competition 29

Advertising and Monopolistic Competition

• Advertising is one of competition mechanism in MCM.

• Firms that sell highly differentiated consumer goods typically spend

between 10-20% of revenue on advertising.

• Overall, about 2 percent of total revenue, or over $200 billion a

year, is spent on advertising.

• Perfectly competitive firms have no incentive to advertise, but

monopolistic competitors do

• The increase in cost of a monopolistically competitive product is the

cost of “differentness”: Advertising increases ATC

• Differentiation exists so long as advertising convinces buyers that it

exists.

• Firms will continue to advertise as long as the marginal benefits of

advertising exceed its marginal costs.

02/21/2024 Micro II Slides Monopolistic Competition 30

Arguments for advertising

– Provide information to customers

• Customers - make better choices

• Enhances the ability of markets to allocate resources

efficiently

– Fosters competition

• Customers - take advantage of price differences

– Allows new firms to enter more easily

02/21/2024 Micro II Slides Monopolistic Competition 31

Arguments against Advertising

• The critique of advertising

– Firms advertise to manipulate people’s tastes

• Psychological rather than informational

• Creates a desire that otherwise might not exist

– Impedes competition

– Increase perception of product differentiation

• Foster brand loyalty

– Makes buyers less concerned with price

differences among similar goods

02/21/2024 Micro II Slides Monopolistic Competition 32

Summary of the relationships among the three

Market structure

Perfect Monopolistic

competition competition Monopoly

Features that all three market structures share

Goal of firms ………………………………………… Maximize Maximize profits Maximize profits

Rule for maximizing ……………………………… profits MR = MC MR = MC

Can earn economic profits in the short run? MR = MC Yes Yes

the products firms sell………………………………… Identical Differentiated Unique

Features that monop. competition shares with

monopoly

Price taker? …………………………………….. Yes No No

Price…………………………………………………. P = MC P > MC P > MC

Produces welfare-maximizing level of output? Yes No No

DD curve facing firm………………………….. Horizontal Downward sloping Downward sloping

Features that monopolistic competition shares

with competition

Number of firms …………………………………… Many Many One

Entry in long run? ………………………………….. Yes Yes No

Can earn economic profits in long run?..... No No Yes

Free entry/exit……………………………………… Yes Yes No

02/21/2024 Micro II Slides Monopolistic Competition 33

Critics of Chamberlin model

• Critics

– The assumptions of product differentiation and independent actions of

competitors are inconsistent: firms closely follow the actions of others.

– The absence of taking past experience into future decision is not valid.

– Product differentiation and “free entry”. Product differentiation and brand

loyalty create a significant barrier to entry for new firms

– ‘Large number of firms’….does not define the actual number

• Contribution of the model

– Introducing the concept of product differentiation and selling strategy as two

additional policy variables in optimal decision-making process of the firm.

– It introduces the concept of share of the market demand curve as a tool of

analysis.

02/21/2024 Micro II Slides Monopolistic Competition 34

You might also like

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterFrom EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNo ratings yet

- The Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesFrom EverandThe Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesNo ratings yet

- Module 2 External AnalysisDocument33 pagesModule 2 External AnalysisAlberto LiNo ratings yet

- Micro Economics II Monopolistic CompetitionDocument11 pagesMicro Economics II Monopolistic Competitiontegegn mogessieNo ratings yet

- Week 5 Competitors and Competition IIDocument42 pagesWeek 5 Competitors and Competition IIyenNo ratings yet

- Industry Analysis 4Document48 pagesIndustry Analysis 4ZainNo ratings yet

- Pricing Under Various Forms of Market by Super Crash Course MALIkDocument7 pagesPricing Under Various Forms of Market by Super Crash Course MALIkasimrashid05950No ratings yet

- Session 16 - Price Discrimination-2020 New 2Document75 pagesSession 16 - Price Discrimination-2020 New 2Abhishek HandaNo ratings yet

- Consumer Chapter 3Document33 pagesConsumer Chapter 3undertheshadowofjesuschristNo ratings yet

- IO Lecture5Document37 pagesIO Lecture5Ismaîl TemsamaniNo ratings yet

- Indian Television Industry: in Indian Industry The Korean Companies Are Clearly Dominating The MarketDocument14 pagesIndian Television Industry: in Indian Industry The Korean Companies Are Clearly Dominating The MarketManu AgarwalNo ratings yet

- PIPFA Solutions W15Document71 pagesPIPFA Solutions W15Mudassar PatelNo ratings yet

- Profit Maximising Under Imperfect CompetitionDocument18 pagesProfit Maximising Under Imperfect CompetitionHuten VasellNo ratings yet

- ECON 350 - October 20th 2022 (F22)Document15 pagesECON 350 - October 20th 2022 (F22)Dat NguyenNo ratings yet

- ECON254 Lecture5 StrategicCompetitionDocument37 pagesECON254 Lecture5 StrategicCompetitionKhalid JassimNo ratings yet

- OligopolyDocument53 pagesOligopolyjohn100% (1)

- Ch11 - Price and Output Under Monopolistic Competition and OligopolyDocument5 pagesCh11 - Price and Output Under Monopolistic Competition and OligopolyNabh GargNo ratings yet

- Economics 3150b - Lecture 11 f08Document16 pagesEconomics 3150b - Lecture 11 f08ramushindeNo ratings yet

- Chapter Twenty-Three Monopolistic Competition and Oligopoly: Instructional ObjectivesDocument9 pagesChapter Twenty-Three Monopolistic Competition and Oligopoly: Instructional Objectivespalak32No ratings yet

- Economics PDFDocument28 pagesEconomics PDFAnit LuckyNo ratings yet

- 12 MC and OligopolyDocument33 pages12 MC and OligopolyAMBWANI NAREN MAHESHNo ratings yet

- Monopoly Aug29Document21 pagesMonopoly Aug29Devam DixitNo ratings yet

- PBM Category AnalysisDocument26 pagesPBM Category AnalysisAbhi KumarNo ratings yet

- Eco Ch-5 ExamClassDocument6 pagesEco Ch-5 ExamClassHaylemeskel HaylemariamNo ratings yet

- LESSON 22-Perfect Competition and Monopolies: Main LectureDocument4 pagesLESSON 22-Perfect Competition and Monopolies: Main LecturefarahNo ratings yet

- (Why Don't You R& D Top 2 ??) Supply Chain of Motor Company. Critical Success Factors. What Is Your MarketDocument4 pages(Why Don't You R& D Top 2 ??) Supply Chain of Motor Company. Critical Success Factors. What Is Your MarketJHASDFIJKSDFNo ratings yet

- 08 - OligopolyDocument19 pages08 - OligopolyManisha GoraiNo ratings yet

- Principles of Microeconomics 2E: Chapter 10 Monopolistic Competition and OligopolyDocument18 pagesPrinciples of Microeconomics 2E: Chapter 10 Monopolistic Competition and OligopolyAhmed KhanNo ratings yet

- Oligopoly Competition: Names of Sub-UnitsDocument11 pagesOligopoly Competition: Names of Sub-UnitssarthaksenNo ratings yet

- CH 13Document47 pagesCH 13anshbavishi17No ratings yet

- Icm#InsightsDocument143 pagesIcm#InsightsJad FagoulNo ratings yet

- Monopolistic Competition: I. Between Monopoly & Perfect CompetitionDocument8 pagesMonopolistic Competition: I. Between Monopoly & Perfect CompetitionHà PhạmNo ratings yet

- Group 2 Oligopoly Market StructureDocument35 pagesGroup 2 Oligopoly Market StructureNorsyuhada Binti JohanNo ratings yet

- Monopolistic Competition 1Document3 pagesMonopolistic Competition 1prudenceNo ratings yet

- Imperfect 3Document17 pagesImperfect 3Surya PanwarNo ratings yet

- Monopolistic Competition and Product DifferentiationDocument18 pagesMonopolistic Competition and Product DifferentiationSurya PanwarNo ratings yet

- Strategic Marketing: 2. Markets and Competitive SpaceDocument48 pagesStrategic Marketing: 2. Markets and Competitive SpaceAnil Kumar KashyapNo ratings yet

- Monopolistic CompetitionDocument9 pagesMonopolistic Competitionpriyanka2303100% (2)

- ACFrOgD8mx1aj1NlKb5479so 1JW7zuyY rDfTA-F1b4xL-ijXcw9dz lrQ45xO6Z9867rqhFFkFtiBxdv9rd PnG4aFz7wpQ6TjpRyMGjnRDuIxt-gI avIe41pTKXKe-AYLrs Kx4fnBvLKc2SDocument41 pagesACFrOgD8mx1aj1NlKb5479so 1JW7zuyY rDfTA-F1b4xL-ijXcw9dz lrQ45xO6Z9867rqhFFkFtiBxdv9rd PnG4aFz7wpQ6TjpRyMGjnRDuIxt-gI avIe41pTKXKe-AYLrs Kx4fnBvLKc2SErsin TukenmezNo ratings yet

- Master of Business Administration 2020-22: Group Assignment 2 XiameterDocument3 pagesMaster of Business Administration 2020-22: Group Assignment 2 Xiameterkusumit1011No ratings yet

- Topic 1 - Business Strategy AnalysisDocument30 pagesTopic 1 - Business Strategy AnalysisOng Zi JiunNo ratings yet

- Abrenilla Na Bahala Ani, Kapoy Nako. Mwa: Excess Capacity Theorem: "A Monopolistic Competitor Will Produce An OutputDocument2 pagesAbrenilla Na Bahala Ani, Kapoy Nako. Mwa: Excess Capacity Theorem: "A Monopolistic Competitor Will Produce An OutputBrendan PG Arcenal AmbayanNo ratings yet

- The Strategy Accelerator - New Business Models Based On Competitive AdvantageDocument16 pagesThe Strategy Accelerator - New Business Models Based On Competitive AdvantageAlfredGriffioen100% (4)

- Monopolistic CompetitionnDocument26 pagesMonopolistic CompetitionnMohit MalhotraNo ratings yet

- Price and Output Determination Under Imperfect CompetitionDocument19 pagesPrice and Output Determination Under Imperfect CompetitionAshish PareekNo ratings yet

- Wharton Casebook 2010 For Case Interview Practice - MasterTheCaseDocument81 pagesWharton Casebook 2010 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (25)

- Chap4 DiffVerticaleEmpirics EtuDocument23 pagesChap4 DiffVerticaleEmpirics EtuThy HuỳnhNo ratings yet

- Micro CH 12 Ragan With Ians AnnotationsDocument35 pagesMicro CH 12 Ragan With Ians AnnotationsRyan BolkiniNo ratings yet

- 11 Mill Micro1ce PPT ch11Document52 pages11 Mill Micro1ce PPT ch11prabhjot kaurNo ratings yet

- Oligopoly Market StructureDocument31 pagesOligopoly Market StructureMulugeta tequarNo ratings yet

- Topic 20: Monopolistic CompetitionDocument17 pagesTopic 20: Monopolistic CompetitionAnnie DarkNo ratings yet

- PPM SessionDocument269 pagesPPM SessionMonis KhanNo ratings yet

- OligoDocument13 pagesOligoSona VermaNo ratings yet

- Economics 2nd Edition Hubbard Test BankDocument48 pagesEconomics 2nd Edition Hubbard Test Bankmarthalouisaq6x100% (24)

- Lecture 7 - 2022 - SYNCDocument35 pagesLecture 7 - 2022 - SYNCJiayu HeNo ratings yet

- The Boston Beer Company, Inc.: Final Report For Financial Analysis ClassDocument7 pagesThe Boston Beer Company, Inc.: Final Report For Financial Analysis ClassHA CskNo ratings yet

- Fin Analysis Chap 2 PreciseDocument20 pagesFin Analysis Chap 2 PreciseHasanNo ratings yet

- Market Structure Chapter 2 Lynne PepallDocument18 pagesMarket Structure Chapter 2 Lynne PepallFawwaz ReyNo ratings yet

- 1.3.industrial SectorsDocument25 pages1.3.industrial SectorsGabrieleNo ratings yet

- Final PPT 2Document46 pagesFinal PPT 2Dhani AlhamidiNo ratings yet

- Income and Substitution EffectDocument44 pagesIncome and Substitution EffectAndane TaylorNo ratings yet

- CH 4Document74 pagesCH 4Nathalie FytrouNo ratings yet

- Microeconomics IDocument160 pagesMicroeconomics Iselomonbrhane17171No ratings yet

- MicroeconomicsDocument54 pagesMicroeconomicsselomonbrhane17171No ratings yet

- Chapter II Choice Involving RiskDocument29 pagesChapter II Choice Involving Riskselomonbrhane17171No ratings yet

- Microeconomics MonopolyDocument109 pagesMicroeconomics Monopolyselomonbrhane17171No ratings yet

- Chapter III-IIDocument36 pagesChapter III-IIselomonbrhane17171No ratings yet

- Chapter 2 Questions and AnswersDocument11 pagesChapter 2 Questions and AnswersNoor TaherNo ratings yet

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisRAKESH SINGHNo ratings yet

- Investment Management CaseDocument7 pagesInvestment Management CaseHarmanjit DhillonNo ratings yet

- Overview of Financial System of BangladeshDocument13 pagesOverview of Financial System of BangladeshMonjurul Hassan50% (2)

- Practice Problems On Yield To MaturityDocument2 pagesPractice Problems On Yield To MaturityCharl PontillaNo ratings yet

- The Stock Exchange of Hong Kong Limited New Listing Application (Equity) - Main Board Summary of Key Financial Ratios During The Track Record Period With Explanation For FluctuationDocument2 pagesThe Stock Exchange of Hong Kong Limited New Listing Application (Equity) - Main Board Summary of Key Financial Ratios During The Track Record Period With Explanation For FluctuationAlex YiuNo ratings yet

- Mickey Metals LTDDocument13 pagesMickey Metals LTDBhavin SagarNo ratings yet

- Shapiro Chapter 14 Solutions PDFDocument11 pagesShapiro Chapter 14 Solutions PDFyuliNo ratings yet

- NIFTY100 ESG Index FactsheetDocument2 pagesNIFTY100 ESG Index FactsheetSanket SharmaNo ratings yet

- JSC Liberty Finance Factsheet - April 2014Document2 pagesJSC Liberty Finance Factsheet - April 2014LibertySecuritiesNo ratings yet

- Management Accounts For The Year 2022Document6 pagesManagement Accounts For The Year 2022Clyton MusipaNo ratings yet

- Interbank Market - What Is It, History, Examples, Vs Open MarketDocument13 pagesInterbank Market - What Is It, History, Examples, Vs Open MarketRahul chaurasiyaNo ratings yet

- Weighted Average Cost of Capital ReportDocument9 pagesWeighted Average Cost of Capital ReportDavid OwitiNo ratings yet

- What Is A DepositoryDocument10 pagesWhat Is A DepositoryKrishna Gopal MazumdarNo ratings yet

- Banking and Finance Week 1Document7 pagesBanking and Finance Week 1Sheena Mae Castillo GallerosNo ratings yet

- Types of Decisions Made by A Finance ManagerDocument3 pagesTypes of Decisions Made by A Finance ManagerAadil HanifNo ratings yet

- Learning Objective 13-1: Chapter 13 CorporationsDocument51 pagesLearning Objective 13-1: Chapter 13 CorporationsMarqaz MarqazNo ratings yet

- BOND VALUATION With SolutionsDocument30 pagesBOND VALUATION With Solutionschiaraferragni75% (8)

- R60 Introduction To Alternative Investments Q BankDocument26 pagesR60 Introduction To Alternative Investments Q BankAhmedNo ratings yet

- Session 5 Part 3 Case Study Questions Warburg PincusDocument1 pageSession 5 Part 3 Case Study Questions Warburg Pincuseruditeaviator0% (1)

- Problems: Set B: InstructionsDocument2 pagesProblems: Set B: InstructionsflrnciairnNo ratings yet

- Thesis On Nepal Stock ExchangeDocument7 pagesThesis On Nepal Stock Exchangetmexyhikd100% (2)

- Bitcoin Trading Terminology: Crypto VIP SignalDocument9 pagesBitcoin Trading Terminology: Crypto VIP SignalBen AdamteyNo ratings yet

- PDF Audit 1Document18 pagesPDF Audit 1Kali NazriNo ratings yet

- Financial Institution and MarketDocument52 pagesFinancial Institution and Marketsabit hussenNo ratings yet

- Disciplined Trader Trade Journal (Lots)Document873 pagesDisciplined Trader Trade Journal (Lots)JasonNo ratings yet

- ND10X ManualDocument79 pagesND10X ManualAlex Alex Alex100% (7)

- CS Executive EBCL Notes Part 1Document71 pagesCS Executive EBCL Notes Part 1CA Himanshu AroraNo ratings yet

- IAS 33 Earnings Per ShareDocument9 pagesIAS 33 Earnings Per ShareangaNo ratings yet

- Foreign Exchange RiskDocument16 pagesForeign Exchange RiskPraneela100% (1)