Professional Documents

Culture Documents

J.P PPTC

J.P PPTC

Uploaded by

kaddeabhijitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

J.P PPTC

J.P PPTC

Uploaded by

kaddeabhijitCopyright:

Available Formats

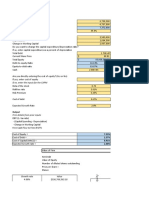

Provide an investment recommendation

Dear Management Team,

Financial Impact of supply chain interruptions

• Minimal financial impact in the short term given it has had minimal effect on the financial projections in the years following FY 21.Therefore, we do not use this as a strong reason to

significantly lower your bid nor it is an indication of future financial distress

• Given the long term nature of this investment and the intangible (synergy value) value of this investment , we do not see this fire as a material issue either.

Bidding Dynamics

The information regarding bidding on HappyHour CO. from the NY/HK Times to be credible. Due to several large strategic firms searching for opportunities to expand we can expect a highly

competitive bidding environment

If worldwide Brewing is expecting to extract higher value from synergies than some of the bidding competition , this leaves an opportunity to pay a higher price.

Valuation Adjustment

FY 21 Revenue of $1,100mm (down-4.5)

50% Gross margin

Management expects to revert to orginally forecasted sales in FY 22 and thereafter

This has resulted in a revised NPV of $803mm , an equity value of #654 from $718mm and offer share price of 329 cents from 361 cents,.

Net present value based on perpetuity growth method

Preliminary valuation Revised Valuation (post fire)

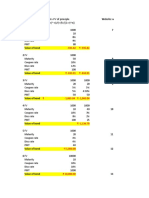

Value Based on 8.5%WACC & 0.5% TGR. Amount($m) %ofNPV Value Based on 8.5%WACC & 0.5% TGR. Amount($m) %ofNPV

Present Value of Cash Flows 409 50.90%

PV of Terminal Value 394 49.10% Present Value of Cash Flows 345 46.70%

PV of Terminal Value 394 53.30%

Implied Firm NPV 803 100.00% Implied Firm NPV 739 100.00%

Net debt as of Mar -20E -85 Net debt as of Mar -20E -85

Implied equity value 718 Implied equity value 654

Implied offer share price © 361 Implied offer share price © 329

%premium to current 118.80% %premium to current 99.30%

J.P.Morgan

You might also like

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedMathieu KasprzakNo ratings yet

- Compound InterestDocument14 pagesCompound InterestIan Butera Lopez100% (2)

- DCF and Terminal Values The Footnotes AnalystDocument17 pagesDCF and Terminal Values The Footnotes Analystgesona4324No ratings yet

- Winding UpDocument9 pagesWinding UpJedaiah CruzNo ratings yet

- Chapter # 3 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument11 pagesChapter # 3 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b84% (19)

- Sworn Statement For Tax Clearance SampleDocument1 pageSworn Statement For Tax Clearance SampleRachel ChanNo ratings yet

- Charles ChristmasDocument55 pagesCharles ChristmasJORISSEN1No ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedNaturallyNo ratings yet

- BB Dashboard Template SolutionDocument4 pagesBB Dashboard Template SolutionMavin JeraldNo ratings yet

- MT 799 VerbiageDocument1 pageMT 799 VerbiageAdaikalam Alexander Rayappa100% (2)

- Task 4 - Model Answer - RevisedDocument1 pageTask 4 - Model Answer - RevisedRoshan GaikwadNo ratings yet

- DCF Valuation-BDocument11 pagesDCF Valuation-BElsaNo ratings yet

- Provide An Investment Recommendation: Email To ManagementDocument1 pageProvide An Investment Recommendation: Email To Managementdavin nathanNo ratings yet

- Foreign Investment ActDocument4 pagesForeign Investment ActPBWGNo ratings yet

- Task 4 DavinDocument2 pagesTask 4 DavinKarpaga E SriramNo ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedIshitaNo ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - Revisedyot7patelNo ratings yet

- Model Formule - ExerciseDocument8 pagesModel Formule - Exercisemaxball53000No ratings yet

- Inventory and Recievables FormulasDocument7 pagesInventory and Recievables FormulasJoshua CabinasNo ratings yet

- React JsDocument4 pagesReact Jsdevawer547No ratings yet

- MBA 670 Quiz 1 SolutionsDocument2 pagesMBA 670 Quiz 1 SolutionsLauren LoshNo ratings yet

- Stuti Mehta pgmb2149 FinanceDocument12 pagesStuti Mehta pgmb2149 FinanceStutiNo ratings yet

- Prataap Snacks Limited: DCF Analysis Valuation Date: 07 March, 2019Document41 pagesPrataap Snacks Limited: DCF Analysis Valuation Date: 07 March, 2019CharanjitNo ratings yet

- Allied Foods Integrated CaseDocument32 pagesAllied Foods Integrated Casehijab zaidiNo ratings yet

- VALUING SYNERGIES IN M&A-Data Revised Jan 2020Document7 pagesVALUING SYNERGIES IN M&A-Data Revised Jan 2020Aninda Dutta100% (1)

- Illustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowDocument1 pageIllustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash Flowvikas100% (1)

- Equal Cash Flows Unequal Cash Flows: Discount Rate 10% Discount Rate 10%Document7 pagesEqual Cash Flows Unequal Cash Flows: Discount Rate 10% Discount Rate 10%Mahmood AhmadNo ratings yet

- Gulf Takeover ExcelDocument7 pagesGulf Takeover ExcelNarinderNo ratings yet

- Sbma Marc-1 2016Document1 pageSbma Marc-1 2016mysubicbayNo ratings yet

- 2010 Proposed KRA - BESC EstateDocument8 pages2010 Proposed KRA - BESC EstateJoseph SaltingNo ratings yet

- Long Term Debt: New Common Stock New DebtDocument4 pagesLong Term Debt: New Common Stock New DebtPutri AndiniNo ratings yet

- Model Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue CalculationDocument41 pagesModel Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue Calculationavinash singhNo ratings yet

- Pembahasan Exercise CH 9 Cost of CapitalDocument4 pagesPembahasan Exercise CH 9 Cost of CapitalGhina NabilaNo ratings yet

- Qatar National Bank April 2011Document6 pagesQatar National Bank April 2011Michael KiddNo ratings yet

- 31 May 20Document1 page31 May 20tonderainderereNo ratings yet

- (A) Calculation of WACC V R VR $ $ $: Dinla CoDocument8 pages(A) Calculation of WACC V R VR $ $ $: Dinla CoWan NubliNo ratings yet

- Introduction To Financial ModellingDocument9 pagesIntroduction To Financial ModellingHabib AhmadNo ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- CH 12 Muhtar Rasyid 42P20019Document6 pagesCH 12 Muhtar Rasyid 42P20019Muhtar RasyidNo ratings yet

- FINAL EXAMS PREPARATION (Version 1) .XLSBDocument94 pagesFINAL EXAMS PREPARATION (Version 1) .XLSBmishal zikriaNo ratings yet

- Bond ValuationDocument4 pagesBond ValuationPragathi SundarNo ratings yet

- Draft KPI Dan DB FinanceDocument61 pagesDraft KPI Dan DB FinancebagirNo ratings yet

- Incensive Scheme WorkingsDocument5 pagesIncensive Scheme WorkingsvivekNo ratings yet

- Finance Simulation: M&A in Wine Country Valuation ExerciseDocument7 pagesFinance Simulation: M&A in Wine Country Valuation ExerciseAdemola Adeola0% (2)

- Vaibhav - Mojidra - Tanla Platforms DCF ValuationDocument93 pagesVaibhav - Mojidra - Tanla Platforms DCF Valuation71 Vaibhav MojidraNo ratings yet

- Ceigall Bhatinda Mandi v2 03.08.2023Document109 pagesCeigall Bhatinda Mandi v2 03.08.2023baljeet singhNo ratings yet

- FCFFSTDocument10 pagesFCFFSTapi-3701114No ratings yet

- SCM 2nd RecitDocument5 pagesSCM 2nd RecitMaxine ConstantinoNo ratings yet

- WHT Rate Card 2018-19Document2 pagesWHT Rate Card 2018-19taqi1122No ratings yet

- Eicher Motors LTD: DCF Analysis Valuation Date: 13 March, 2019Document60 pagesEicher Motors LTD: DCF Analysis Valuation Date: 13 March, 2019CharanjitNo ratings yet

- Inputs: If No, Enter The Inputs For The CAPMDocument7 pagesInputs: If No, Enter The Inputs For The CAPMTheris FlorenciaNo ratings yet

- Present Value (P.V.) Calculator: (Pvif) (Pvifa) 1,000 1,000 1,000 1,000Document1 pagePresent Value (P.V.) Calculator: (Pvif) (Pvifa) 1,000 1,000 1,000 1,000Viswanathan SrkNo ratings yet

- Prior Year Item Current Period Cumulative % Change Vs Py % of Sales % of Sales % Change Vs Budget % of Sale % of Sales % Change Vs BudgetDocument23 pagesPrior Year Item Current Period Cumulative % Change Vs Py % of Sales % of Sales % Change Vs Budget % of Sale % of Sales % Change Vs Budgetraghavofficial9677No ratings yet

- Mudarabah Model Family Takaful: CompanyDocument3 pagesMudarabah Model Family Takaful: CompanyfariaNo ratings yet

- Allen Lane Case Write UpDocument2 pagesAllen Lane Case Write UpAndrew Choi100% (1)

- Firmoverview: Marianne Lake, Chief Financial Officer Marianne Lake, Chief Financial OfficerDocument61 pagesFirmoverview: Marianne Lake, Chief Financial Officer Marianne Lake, Chief Financial OfficerAbhishek SinghNo ratings yet

- A PDF Companion To The AudiobookDocument11 pagesA PDF Companion To The AudiobookTim JoyceNo ratings yet

- The Boston Beer CompanyDocument52 pagesThe Boston Beer CompanyLarsNo ratings yet

- CERC Draft Regulations 11.02.2019-PMIDocument22 pagesCERC Draft Regulations 11.02.2019-PMISuresh Babu ANo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Assignment Capital BudgetingDocument7 pagesAssignment Capital BudgetingSufyan AshrafNo ratings yet

- Semas Handout 5Document6 pagesSemas Handout 5GONZALES, MICA ANGEL A.No ratings yet

- No Quick Turnaround Seen For The San Gabriel: First Gen CorporationDocument2 pagesNo Quick Turnaround Seen For The San Gabriel: First Gen CorporationJohn Kyle LluzNo ratings yet

- Hul Wacc PDFDocument1 pageHul Wacc PDFutkNo ratings yet

- Independent University, Bangladesh: School of BusinessDocument9 pagesIndependent University, Bangladesh: School of BusinessRahi MunNo ratings yet

- Government of Andhra Pradesh: Finance (Fmu-Welfare-Ii) DepartmentDocument1 pageGovernment of Andhra Pradesh: Finance (Fmu-Welfare-Ii) DepartmentsivachennareddyNo ratings yet

- Question Bank For MfsDocument4 pagesQuestion Bank For MfsBALPREET_SVIETNo ratings yet

- Insider Trading (HLL-BBLIL Case)Document14 pagesInsider Trading (HLL-BBLIL Case)Vrinda NarulaNo ratings yet

- What Is Financing?: The Account. Bank Overdraft Is Made For Convenience in Order To PurchaseDocument3 pagesWhat Is Financing?: The Account. Bank Overdraft Is Made For Convenience in Order To PurchaseKim GuibaoNo ratings yet

- Effect of Earnings Per Share and Reference Coal Price On The Stock Price of PT Indotambang Raya Megah, TBK During Period 2010 - 2020Document6 pagesEffect of Earnings Per Share and Reference Coal Price On The Stock Price of PT Indotambang Raya Megah, TBK During Period 2010 - 2020International Journal of Innovative Science and Research TechnologyNo ratings yet

- A Brief History of Money - 22sept2021Document44 pagesA Brief History of Money - 22sept2021Mj RodriguesNo ratings yet

- 7 MFQR II Chapter FiveDocument25 pages7 MFQR II Chapter Fivemarini ulfaNo ratings yet

- Spouses Charito M. Reyes and Roberto Reyes vs. Heirs of Benjamin Malance GR No. 219071 August 24, 2016 FactsDocument4 pagesSpouses Charito M. Reyes and Roberto Reyes vs. Heirs of Benjamin Malance GR No. 219071 August 24, 2016 FactsdenNo ratings yet

- 1h Bingham CH 8 Prof Chauvins Instructions Student VersionDocument9 pages1h Bingham CH 8 Prof Chauvins Instructions Student VersionAstha GoplaniNo ratings yet

- 08 Konys IncDocument44 pages08 Konys IncAshish Kumar0% (1)

- Crown Board MeetingDocument2 pagesCrown Board Meetingmary antonette manaloNo ratings yet

- CASE 5-33 Solution: Nabeeda ShaheenDocument4 pagesCASE 5-33 Solution: Nabeeda ShaheenhadiNo ratings yet

- Jurnal Eliminasi - Inter Company ProfitDocument14 pagesJurnal Eliminasi - Inter Company ProfitIrfan JayaNo ratings yet

- Audit Report 2014 15 PDFDocument566 pagesAudit Report 2014 15 PDFfayazNo ratings yet

- FcraDocument2 pagesFcraHLM ORGNo ratings yet

- Bajaj Finance LTD: A Presentation by Rohan Sharma (16105056), Pritesh (16105065), Ashwanpreet Singh (16105070)Document8 pagesBajaj Finance LTD: A Presentation by Rohan Sharma (16105056), Pritesh (16105065), Ashwanpreet Singh (16105070)ashwanpreet singh100% (1)

- Registrar S CaveatDocument24 pagesRegistrar S CaveatasadsfdgNo ratings yet

- E-Maths Genie: Course Fee ofDocument1 pageE-Maths Genie: Course Fee ofRaja kumarNo ratings yet

- Costas Milas CVDocument9 pagesCostas Milas CVSami IslamNo ratings yet

- Report On Interest Rates in NepalDocument12 pagesReport On Interest Rates in NepalRupesh Shah100% (2)

- Dubai IslamicDocument8 pagesDubai IslamicAsif JavaidNo ratings yet

- Rich Dad Vs Poor Dad Book SummaryDocument4 pagesRich Dad Vs Poor Dad Book SummaryOnlyfreeNo ratings yet

- Assignment 2 DR ShantalDocument4 pagesAssignment 2 DR ShantalBishoy EmileNo ratings yet