Professional Documents

Culture Documents

Task 4 Davin

Task 4 Davin

Uploaded by

Karpaga E SriramOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task 4 Davin

Task 4 Davin

Uploaded by

Karpaga E SriramCopyright:

Available Formats

Provide an investment recommendation

Email to management

Good morning Anna, I have updated the valuation of Brewing Co., with the expected

financial impact of facility fire in FY21. With

that, the supply chain can be assumed to be interrupted for a whole year as the

facility is long to rebuild, with that assumption our

implied equity value goes down from 718 $m to 654$m. minus 20% from our margin of

safety , and now the margin is 99,1%. As

from the report of another bidding, they valued the Brewing Co., to be 650$m , as

expected with our calculation. This is still a

bargain and a good M&A transaction if looking from the MOS.

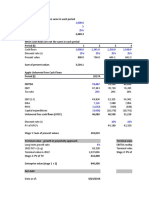

Net present value based on perpetuity growth method

Preliminary valuation

Revised valuation (post-fire)

Amount % of

Value Based on 8.5% WACC & 0.5% TGR Amount ($m)

% of NPV Value Based on 09% WACC & 01%

Present Value of Cash flows 409

50.9% TGR ($m) NPV

PV of Terminal Value 394

49.1%

Present Value of Cashflows 345 46,7%

Implied Firm NPV 803

100.0%

PV of Terminal Value 394 53,3%

Net debt as of Mar-20E (85)

Implied Firm NPV 738 100,0%

Implied equity value 718

Net debt & adjustments (85)

Implied offer share price (c) 361

Implied equity value 654

% premium to current 118.8%

Implied share price ($c) 329

% premium to current 99,1%

Source: Company Business Plan (January 2020); Equity research; J.P. Morgan analysis

WORLDWIDE BREWING

1

You might also like

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedIshitaNo ratings yet

- Seminar 3 N1591 - MCK Chap 8 QuestionsDocument4 pagesSeminar 3 N1591 - MCK Chap 8 QuestionsMandeep SNo ratings yet

- Solution For Case 10 Valuation of Common StockDocument8 pagesSolution For Case 10 Valuation of Common StockHello100% (1)

- Zycus CalculationsDocument3 pagesZycus CalculationsDarshan ShethNo ratings yet

- Finance Simulation: M&A in Wine Country Valuation ExerciseDocument7 pagesFinance Simulation: M&A in Wine Country Valuation ExerciseAdemola Adeola0% (2)

- Case 9-2 Innovative Engineering CoDocument4 pagesCase 9-2 Innovative Engineering CoFaizal PradhanaNo ratings yet

- Provide An Investment Recommendation: Email To ManagementDocument1 pageProvide An Investment Recommendation: Email To Managementdavin nathanNo ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedNaturallyNo ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - Revisedyot7patelNo ratings yet

- Task 4 - Model Answer - RevisedDocument1 pageTask 4 - Model Answer - RevisedRoshan GaikwadNo ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedMathieu KasprzakNo ratings yet

- J.P PPTCDocument1 pageJ.P PPTCkaddeabhijitNo ratings yet

- Illustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowDocument1 pageIllustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash Flowvikas100% (1)

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- Solution To Case 12: What Are We Really Worth?Document4 pagesSolution To Case 12: What Are We Really Worth?khalil rebato100% (1)

- VALUING SYNERGIES IN M&A-Data Revised Jan 2020Document7 pagesVALUING SYNERGIES IN M&A-Data Revised Jan 2020Aninda Dutta100% (1)

- DCF ModellDocument7 pagesDCF Modellsandeep0604No ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- DCF Guide Example2020Document6 pagesDCF Guide Example2020jam manNo ratings yet

- Saudi Telecom RatioDocument11 pagesSaudi Telecom RatioAgung Prasetyo BudiNo ratings yet

- HSBC Holdings PLC 3Q21 Results: Presentation To Investors and AnalystsDocument34 pagesHSBC Holdings PLC 3Q21 Results: Presentation To Investors and Analystsnoorth 010No ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- ACC314 Practise Paper SolutionsDocument7 pagesACC314 Practise Paper SolutionsRukshani RefaiNo ratings yet

- Revision Excel SheetsDocument9 pagesRevision Excel SheetsPhan Phúc NguyênNo ratings yet

- DCF ModellDocument7 pagesDCF ModellVishal BhanushaliNo ratings yet

- Investor Conference 2023Q2 en - tcm33 86078Document27 pagesInvestor Conference 2023Q2 en - tcm33 86078潘祈睿No ratings yet

- Valuation of Tata Power, Based On Prof. Aswath Damodaran: DCF Base Year 1 2 3 AssumptionsDocument6 pagesValuation of Tata Power, Based On Prof. Aswath Damodaran: DCF Base Year 1 2 3 Assumptionspriyal batraNo ratings yet

- ACC314 Business Finance Management Resit Answers (SEPT) R 19-20Document8 pagesACC314 Business Finance Management Resit Answers (SEPT) R 19-20Rukshani RefaiNo ratings yet

- Feb 22Document2 pagesFeb 22naxahejNo ratings yet

- Stuti Mehta pgmb2149 FinanceDocument12 pagesStuti Mehta pgmb2149 FinanceStutiNo ratings yet

- Synergy Benefits - Mathematical Problem For Valuation ExerciseDocument2 pagesSynergy Benefits - Mathematical Problem For Valuation ExerciseJayash KaushalNo ratings yet

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiNo ratings yet

- All-Chapter-FM (1) (1) - 230602 - 235400Document19 pagesAll-Chapter-FM (1) (1) - 230602 - 235400alomgirhussan740No ratings yet

- Assignment Capital BudgetingDocument7 pagesAssignment Capital BudgetingSufyan AshrafNo ratings yet

- ABG+Shipyard 11-6-08 PLDocument3 pagesABG+Shipyard 11-6-08 PLapi-3862995No ratings yet

- Cougar EnergyDocument6 pagesCougar EnergysamaussieNo ratings yet

- Model PAPER-Analysis of Financial Statement - MBA-BBADocument5 pagesModel PAPER-Analysis of Financial Statement - MBA-BBAvelas4100% (1)

- Real Estate Development ProformaDocument3 pagesReal Estate Development Proformaartsan3No ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Valuation of Asian PaintsDocument18 pagesValuation of Asian Paintsaravindmenonm0% (3)

- No Quick Turnaround Seen For The San Gabriel: First Gen CorporationDocument2 pagesNo Quick Turnaround Seen For The San Gabriel: First Gen CorporationJohn Kyle LluzNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Paper 8Document60 pagesPaper 8rababkr23No ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- What Is More Valuable - (A) Taka 1,50,000 Per Year For Ever or (B) An Annuity of Taka 2,80,000 For 4 Years? Annual Rate Is 20 PercentDocument24 pagesWhat Is More Valuable - (A) Taka 1,50,000 Per Year For Ever or (B) An Annuity of Taka 2,80,000 For 4 Years? Annual Rate Is 20 Percentafsana zoyaNo ratings yet

- Solution CF and Price of EquityDocument2 pagesSolution CF and Price of EquitySnigdha IndurtiNo ratings yet

- Model Formule - ExerciseDocument8 pagesModel Formule - Exercisemaxball53000No ratings yet

- Requirement 1 This Year Last Year: Case 3 (Comprehensive Ratio Analysis)Document6 pagesRequirement 1 This Year Last Year: Case 3 (Comprehensive Ratio Analysis)Mark Jayson Gonzaga CerezoNo ratings yet

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNo ratings yet

- FY2024AnalystPresL&T Q1FY24 Analyst PresentationDocument32 pagesFY2024AnalystPresL&T Q1FY24 Analyst PresentationSHREYA NAIRNo ratings yet

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- In Line Performance... : (Natmin) HoldDocument10 pagesIn Line Performance... : (Natmin) HoldMani SeshadrinathanNo ratings yet

- Group 10Document12 pagesGroup 10Vaibhav AroraNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementVaibhav AroraNo ratings yet

- Group 10 FMDocument12 pagesGroup 10 FMVaibhav AroraNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet