Professional Documents

Culture Documents

DCF analysis for Happy Hour Co

Uploaded by

vikasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCF analysis for Happy Hour Co

Uploaded by

vikasCopyright:

Available Formats

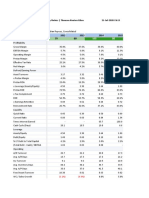

Illustrative DCF analysis for Happy Hour Co

Summary financials and cash flow

Management estimates J.P. Morgan outside-in extrapolation

Net present value based on perpetuity growth method

Amount % of Sensitising firm value ($m) and implied offer price to WACC and TGR

Value Based on 8.5% WACC &

0.5% TGR Perpetuity Growth Rate (%)

($m) NPV

0.00% 0.25% 0.50% 0.75% 1.00%

WACC (%)

Present Value of 7.5% 874 / 396c 890 / 405c 908 / 414c 927 / 424c 948 / 434c

403 51.0%

Cashflows 8.0% 816 / 368c 830 / 375c 845 / 382c 861 / 390c 878 / 399c

PV of Terminal Value 387 49.0%

8.5% 766 / 342c 777 / 348c 790 / 355c 804 / 361c 818 / 369c

Implied Firm NPV 790 100.0%

9.0% 721 / 320c 731 / 325c 742 / 330c 753 / 336c 765 / 342c

Net debt & adjustments (85)

9.5% 680 / 299c 689 / 304c 698 / 308c 708 / 313c 719 / 319c

Implied equity value 706 Morgan analysis

Source: Company Business Plan (January 2020); Equity research; J.P.

Implied share price ($c) 355 1

WORLDWIDE BREWING

% premium to current 114.9%

You might also like

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedNaturallyNo ratings yet

- Task 4 - Model Answer - RevisedDocument1 pageTask 4 - Model Answer - RevisedRoshan GaikwadNo ratings yet

- Provide An Investment Recommendation: Email To ManagementDocument1 pageProvide An Investment Recommendation: Email To Managementdavin nathanNo ratings yet

- Illustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowDocument1 pageIllustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash Flowdavin nathan100% (2)

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v2Siddhant AggarwalNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- Strictly Confidential ModelDocument10 pagesStrictly Confidential Modelww weNo ratings yet

- Task 2 - Company Overview Model Answer v2Document2 pagesTask 2 - Company Overview Model Answer v2Pruthvi Shetty ShettyNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v221BAM045 Sandhiya SNo ratings yet

- Task 2 TemplateDocument2 pagesTask 2 TemplateMUHAMMED FARSIN ENo ratings yet

- NBA ADVANCED - Happy Hour Co - DCF COMPLETEDDocument10 pagesNBA ADVANCED - Happy Hour Co - DCF COMPLETEDViinnii Kumar100% (1)

- JP Morgan Task 2 ForagerDocument3 pagesJP Morgan Task 2 ForagerVilhelm CarlssonNo ratings yet

- Illustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowDocument1 pageIllustrative DCF Analysis For Happy Hour Co: Summary Financials and Cash FlowSiddhant AggarwalNo ratings yet

- Task 2 TemplateDocument2 pagesTask 2 TemplateAmardeep Tayade100% (2)

- Task 3Document2 pagesTask 3Rohit SanghviNo ratings yet

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedMathieu KasprzakNo ratings yet

- Task 3 - DCF ModelDocument10 pagesTask 3 - DCF Modeldavin nathanNo ratings yet

- Task 2 - Company Overview Template v2Document2 pagesTask 2 - Company Overview Template v2Louis P100% (2)

- HappyHour Co. Company Profile and Auction Process OverviewDocument2 pagesHappyHour Co. Company Profile and Auction Process Overviewrevanth t100% (1)

- Forage JP Morgan Ib Task 2 SolutionDocument2 pagesForage JP Morgan Ib Task 2 SolutionRohit Vasave100% (1)

- NBA Happy Hour Co - DCF Model v2Document10 pagesNBA Happy Hour Co - DCF Model v2Siddhant Aggarwal50% (2)

- Task 1 - Email Model Answer v2Document2 pagesTask 1 - Email Model Answer v2Siddhant Aggarwal100% (1)

- Task 2 - Company Overview - DavinDocument2 pagesTask 2 - Company Overview - Davindavin nathan100% (1)

- Task 2 - Company Overview (Aman Upadhyay)Document2 pagesTask 2 - Company Overview (Aman Upadhyay)Aman UpadhyayNo ratings yet

- Task 3 - Model Answer - NewDocument2 pagesTask 3 - Model Answer - NewNidhi Khandelwal100% (2)

- Task 1 - Email JP MorganDocument2 pagesTask 1 - Email JP MorganWilliam100% (1)

- Task 2 - Process Letter Summary Model Answer v2Document1 pageTask 2 - Process Letter Summary Model Answer v2Siddhant AggarwalNo ratings yet

- HappyHour Co. Company Profile & ValuationDocument2 pagesHappyHour Co. Company Profile & ValuationGrace StylesNo ratings yet

- To: From: SubjectDocument3 pagesTo: From: SubjectHephzibah LeannaNo ratings yet

- Task 2 - Company Overview Model Answer v2Document2 pagesTask 2 - Company Overview Model Answer v2Siddhant Aggarwal100% (3)

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2AKANSHA100% (1)

- Task 2 - Second SlideDocument1 pageTask 2 - Second SlideLouis P50% (2)

- Task 4 - Template - RevisedDocument1 pageTask 4 - Template - RevisedIshitaNo ratings yet

- Overview of Auction Process and Key WorkstreamsDocument1 pageOverview of Auction Process and Key Workstreams055Nitish BhatiaNo ratings yet

- Institutional Clients Group | General Industrials & Financial SponsorsDocument2 pagesInstitutional Clients Group | General Industrials & Financial SponsorsVidehi Bajaj0% (1)

- Task 1 - EmailDocument2 pagesTask 1 - EmailLouis P0% (1)

- Task 1 Solution JP Morgan Investment Banking Virtual ExperienceDocument3 pagesTask 1 Solution JP Morgan Investment Banking Virtual ExperiencePiyush KumarNo ratings yet

- Task 2 - Resource - NewDocument2 pagesTask 2 - Resource - NewShilpi KumariNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2deepika0% (1)

- Task 3 - Model Answer EmailDocument1 pageTask 3 - Model Answer EmailPruthvi Shetty ShettyNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art EuphoriaNo ratings yet

- Nintendo Profile Model TemplateDocument2 pagesNintendo Profile Model TemplateHunter Hearst LevesqueNo ratings yet

- Task 3 - DCF Advanced Model OutlineDocument6 pagesTask 3 - DCF Advanced Model OutlinesamNo ratings yet

- Task 2 - Notes On HappyHour Co v3Document3 pagesTask 2 - Notes On HappyHour Co v3Siddhant AggarwalNo ratings yet

- Task 2 - AnswerDocument2 pagesTask 2 - Answersamueloyekoya445No ratings yet

- Task 2 - Company Overview - DavinDocument2 pagesTask 2 - Company Overview - DavinDAVIN NATHANNo ratings yet

- Vodafone Bid HBS Case - ExhibitsDocument13 pagesVodafone Bid HBS Case - ExhibitsNaman PorwalNo ratings yet

- Task 2 - Notes On HappyHour Co v3Document3 pagesTask 2 - Notes On HappyHour Co v3Ayman FatimaNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- DCF Model Forecast Sales Growth ProfitsDocument7 pagesDCF Model Forecast Sales Growth Profitssandeep0604No ratings yet

- DCF ModellDocument7 pagesDCF ModellVishal BhanushaliNo ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- Tata Power DCF valuationDocument6 pagesTata Power DCF valuationpriyal batraNo ratings yet

- Corporate Valuation ConceptsDocument810 pagesCorporate Valuation ConceptsSupplies DepotNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- FIN4040 Rosetta Stone Valuation SheetDocument6 pagesFIN4040 Rosetta Stone Valuation SheetMaira Ahmad0% (1)

- Total Income - Annual: Sales Sales YoyDocument16 pagesTotal Income - Annual: Sales Sales YoyKshatrapati SinghNo ratings yet

- Gef DisbursementDocument1 pageGef Disbursementapi-372973428No ratings yet

- Glaxosmithkline Consumer Healthcare: Group MembersDocument19 pagesGlaxosmithkline Consumer Healthcare: Group MembersBilal AfzalNo ratings yet

- Lecture 7 - 9th Feb 2022 - Finance Current Affairs Part 1Document85 pagesLecture 7 - 9th Feb 2022 - Finance Current Affairs Part 1vikasNo ratings yet

- Task 2 - Company Overview Template v2Document2 pagesTask 2 - Company Overview Template v2vikasNo ratings yet

- NBA Happy Hour Co - DCF Model v2Document10 pagesNBA Happy Hour Co - DCF Model v2Siddhant Aggarwal50% (2)

- NBA Happy Hour Co - DCF Model v2Document10 pagesNBA Happy Hour Co - DCF Model v2Siddhant Aggarwal50% (2)

- Sample Substantive Procedures AllDocument13 pagesSample Substantive Procedures AllCris LuNo ratings yet

- Difference Between Mark Up and MarginDocument2 pagesDifference Between Mark Up and MarginIan VinoyaNo ratings yet

- Aafr Ifrs 5 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 5 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- Company AuditDocument15 pagesCompany AuditNimesh JobanputraNo ratings yet

- KPIs Bharti Airtel 04022020Document13 pagesKPIs Bharti Airtel 04022020laksikaNo ratings yet

- PAS 1 With Notes - Pres of FS PDFDocument75 pagesPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraNo ratings yet

- 41 Job Costing NotesDocument2 pages41 Job Costing Notesgetcultured69No ratings yet

- 2nd Year QuestionnairesDocument7 pages2nd Year QuestionnaireswivadaNo ratings yet

- Tugas Akuntansi ManajemenDocument3 pagesTugas Akuntansi ManajemenThera MonicaNo ratings yet

- Acfrogcfcx4kjjyhjgu0jsfpnrcnh-E0fwie6-D5j4cypp6gus1tao NJV M Gwjzqots3yelvgahf1oohibwbkkpvlw41z M75aryunad7r My8f-Ddncyo1mur4rs9cayo6pzxlkxxgpu4bxutDocument34 pagesAcfrogcfcx4kjjyhjgu0jsfpnrcnh-E0fwie6-D5j4cypp6gus1tao NJV M Gwjzqots3yelvgahf1oohibwbkkpvlw41z M75aryunad7r My8f-Ddncyo1mur4rs9cayo6pzxlkxxgpu4bxutNur슈하다No ratings yet

- Four financial statements in annual reportsDocument2 pagesFour financial statements in annual reportsbrnycNo ratings yet

- Chapter 2 Audit of Receivables and SalesDocument19 pagesChapter 2 Audit of Receivables and SalesKez MaxNo ratings yet

- MGT-214 Assignment on Factors Determining Dividend PolicyDocument20 pagesMGT-214 Assignment on Factors Determining Dividend PolicyNayem Islam75% (4)

- HKICPA QP Exam (Module A) May2005 AnswerDocument12 pagesHKICPA QP Exam (Module A) May2005 Answercynthia tsuiNo ratings yet

- ACCT6174 - Introduction To Financial Accounting: Week 7 LiabilitiesDocument28 pagesACCT6174 - Introduction To Financial Accounting: Week 7 LiabilitiesLim MaedaNo ratings yet

- Unit IV - Hospitality Management Planning and Managing Inventories in A Supply ChainDocument32 pagesUnit IV - Hospitality Management Planning and Managing Inventories in A Supply ChainAngel Fe BedoyNo ratings yet

- Managerial Accounting, Also Known As Management Accounting, Is The Process of Identifying, MeasuringDocument11 pagesManagerial Accounting, Also Known As Management Accounting, Is The Process of Identifying, MeasuringJeffrey De LeonNo ratings yet

- CH01 Introduction To Accounting PDFDocument40 pagesCH01 Introduction To Accounting PDFindra6rusadie100% (1)

- Budgeting Quiz Answer KeyDocument5 pagesBudgeting Quiz Answer KeyDeniseNo ratings yet

- What Is Accrual Accounting ?Document1 pageWhat Is Accrual Accounting ?Manar ZahraniNo ratings yet

- Columbus Annual - Report - 2015Document87 pagesColumbus Annual - Report - 2015anshuNo ratings yet

- Chapter One: Challenge Exercise 1Document3 pagesChapter One: Challenge Exercise 1Jean Korsini Angeline Klau0% (1)

- Axial DCF Business Valuation Calculator GuideDocument4 pagesAxial DCF Business Valuation Calculator GuideUdit AgrawalNo ratings yet

- 2.1 Components and General Features of Financial Statements (3114AFE)Document19 pages2.1 Components and General Features of Financial Statements (3114AFE)WilsonNo ratings yet

- Ragan 15e PPT ch07Document30 pagesRagan 15e PPT ch07enigmauNo ratings yet

- RTP Nov. 2019 PDFDocument211 pagesRTP Nov. 2019 PDFAbhinab DasNo ratings yet

- Fabm2 6a1 Books of AccountsDocument3 pagesFabm2 6a1 Books of AccountsRenz AbadNo ratings yet

- The current ratio informs you about a company's liquidityDocument3 pagesThe current ratio informs you about a company's liquidityCarlo ParasNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaan50% (2)

- Finance 5Document3 pagesFinance 5Jheannie Jenly Mia SabulberoNo ratings yet