Professional Documents

Culture Documents

SP500 Update 30 Jan 11

Uploaded by

AndysTechnicalsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SP500 Update 30 Jan 11

Uploaded by

AndysTechnicalsCopyright:

Available Formats

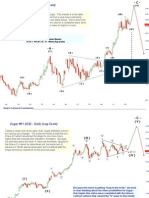

Dow Jones Industrial Average (Monthly Log Scale)

The Dow Jones Industrial Average has become flawed (for wave counting purposes)

over the years as it is an “average,” and not a true index of stocks. It is for this

reason that we don’t model the DJIA. However, the DJIA has a much longer history

than the S&P 500 and is useful in getting our “bearings” on the longer term wave

model. 2000

< III > -B-

-V- -D-

REPRINTED from 9/7/2010

-A-

-C- -E-

< IV >

- III - - IV - 2018-2030

1966

<I> -I- This period looks congestive/correcitve.

-V- -X- The Wave -V- did not start until the

- II - beginning of 1995.

(X)

- III - -Y-

1929

(Y) -W- < II >

<X> (W) - IV - 1982

-I-

-D-

-B-

- II -

-E-

<Y>

-C-

II

The Supercyle Wave II, which began in 1860,

concluded in 1949.

-A-

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Monthly Log Scale The (A) Wave down that began late 2007/early 2008 appears to be an “elongated flat,”

which is an “abc” pattern with a HUGE c-wave. These ONLY appear within triangles. If

that’s correct, then this Primary -C- wave stands a good chance of becoming a triangle.

9/1/2000 -B-

(Z)

< III >

(Y)

“b”

-D-

(B)

(X)

(W)

“a”

(D)

(X)

(X)

(W)

(X)

-E-

(E) < IV >

-C- 2018-2030

(Z)

(Y) (C)

-A-

Baby Boomers will have fully exited the

Stock Market by this point

“c”

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

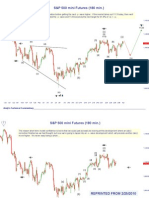

S&P 500 ~ Weekly Non-Log Scale REPRINTED from 1/2/2011

One of the axioms of wave counting is this: “If there is way for a wave to take longer to complete,

assume it will.” This has been especially true of this current (B) Wave. Notice how long it has taken

the S&P 500 to take back the 1255 level from its lows. It took only 24 weeks to drop 590 S&P points

while it has taken 95 weeks to take it back. The point is that both the structure of the move off the

lows and the time it has taken to rally, relative to the previous drop, are all strong clues that this rally

is a corrective (B) wave.

(B)

“y”

c

1313

-5-

Critical Inflection Zone

1255 a

-3-

-1-

-4-

“w”

“x”

-2-

b

alt: (A)

“c”

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Weekly Log Scale

This “Critical Inflection Zone” was highlighted early this month and it’s worth reviewing. Markets have

memories of the past. There were plenty of investors who were long and/or “buying the dip” in 2008

around this zone. They eventually saw one of the most devastating moves in the history of the stock

market. There are plenty of longs who are now relieved to see much of the loss recouped--continued

sell pressure in this zone would not surprise.

1313

Critical Inflection Zone

1255

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily Log Scale

“y”

c

-5-

a

-3-

d

-1- -4-

“w” b

g

e

e -2-

c “x”

a

b

c f

d This has been our count for over five months now! It’s been noted in the last few weeks that the last

leg up, the wave -5-, was beginning to resemble a “correction” more than an “impulse.” That

b development is making it a little more difficult to call this a c-wave with a “y.” It’s possible that the

Wave -5- is a terminal type of configuration which might explain the “corrective look.”

Bottom Line: The Wave -5- here has reached it’s wave target objective. According to this

count, the S&P must see a good correction lower now.

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily Log Scale

The alternative count would be that the “x” wave concluded later in what would be

described as a textbook “expanding triangle.” From the “x” lows, we might be witnessing a

“y”

type a “diametric” pattern that would take the “bow-tie” shape--just the opposite of the

“diamond” shaped diametric that began the entire advance. g

e

d

c

b

“w” a f

g d

e

f

c b

a

e

c

“x”

a d

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily (Log) with Weekly Support and Resistance

c

-5-

Mr. Market is struggling to

remain within this channel

(b)

REPRINTED from 1/23/2011 (d)

-3-

(5)

(3)

(e)

(c)

-4-

(1) (a)

(4)

-1-

(5)

(3) (2)

(1)

Time is out for this particular wave count. The theory here would be that we

just witnessed the conclusion of a “terminal” Wave -5- and, so, the c-wave has

(4)

concluded. I am adjusting “Sell Stop” levels in accordance with this concept. I

will sell, to initiate shorts, on a break of 1271, risking only 20% of Max. Short.

(2)

-2-

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily (Log) with Weekly Support and Resistance

c

-5-

This might be one way to count

(5)

out an “impulsive wave -5-.

(3)

(1)

[3] (4)

[1]

(2)

[4]

[2]

-3-

1173

-4-

No matter what the precise wave count might be, “something” concluded on

Thursday. Friday’s decline was the sharpest and largest of the advance from

1,173. This is normally a signal that a correction, of some kind, is underway.

Our “sell stop” for this week is the same as last week--a break below 1271 will

force us to initiate shorts (20% of a Max Short Position). Resistance this week

should be 1,295. If the market doesn’t trigger our sells stop below 1271, then

we will short the market at 1,290, just below the weekly resistance.

-2-

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- Gold Report 30 May 2010Document7 pagesGold Report 30 May 2010AndysTechnicalsNo ratings yet

- Crude Oil 31 October 2010Document8 pagesCrude Oil 31 October 2010AndysTechnicalsNo ratings yet

- Market Commentary 1may11Document12 pagesMarket Commentary 1may11AndysTechnicalsNo ratings yet

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- SP500 Update 24 Oct 09Document7 pagesSP500 Update 24 Oct 09AndysTechnicalsNo ratings yet

- SP500 Update 24apr11Document7 pagesSP500 Update 24apr11AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- R-22 Weight and BalanceDocument1 pageR-22 Weight and BalanceleeNo ratings yet

- Sugar Jan 1 2010Document9 pagesSugar Jan 1 2010AndysTechnicalsNo ratings yet

- 011 ChapterDocument4 pages011 ChapterFayaz MohammedNo ratings yet

- Tutorial Sheet (2) : Kingdom of Saudi Arabia Ministry of Education - Higher Education Computer Sciences DepartmentDocument5 pagesTutorial Sheet (2) : Kingdom of Saudi Arabia Ministry of Education - Higher Education Computer Sciences DepartmentFatimah TurkiNo ratings yet

- UntitledDocument6 pagesUntitledskchkch faillkerteNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- Parade State of 15 NovemberDocument1 pageParade State of 15 NovemberNoor E ElahiNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- TV Tritono (V) Dominante Secondario TVV Tritono Del Dominante (TVV) Tritono Del Dominante SecondarioDocument1 pageTV Tritono (V) Dominante Secondario TVV Tritono Del Dominante (TVV) Tritono Del Dominante SecondarioGiovanni ZiparoNo ratings yet

- 02 Turnaround C PDFDocument1 page02 Turnaround C PDFGiovanni ZiparoNo ratings yet

- Qaradag Ambar Binasi 08.02.2023Document1 pageQaradag Ambar Binasi 08.02.2023Murat TopbaştekinNo ratings yet

- Parade State of 06 December, 2021..Document2 pagesParade State of 06 December, 2021..Noor E ElahiNo ratings yet

- Ladder With Cage (If Required)Document15 pagesLadder With Cage (If Required)Zan PerzadaNo ratings yet

- TV Tritono (V) Dominante Secondario TVV Tritono Del Dominante (TVV) Tritono Del Dominante SecondarioDocument1 pageTV Tritono (V) Dominante Secondario TVV Tritono Del Dominante (TVV) Tritono Del Dominante SecondarioGiovanni ZiparoNo ratings yet

- Sunday Night Views 28 Feb 10Document5 pagesSunday Night Views 28 Feb 10AndysTechnicalsNo ratings yet

- Gold Report 16 May 2010Document11 pagesGold Report 16 May 2010AndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- Blue en Co 1ºDocument1 pageBlue en Co 1ºmozart24111No ratings yet

- Beat 2024 Minor Test 01 Handwritten SolutionsDocument32 pagesBeat 2024 Minor Test 01 Handwritten SolutionsPAVEENA KNo ratings yet

- 2 Le Corps Comme Lieu Pour Etre PresentDocument8 pages2 Le Corps Comme Lieu Pour Etre PresentGioveNo ratings yet

- Chapter/Section Number Title Number Number: HT-206A/B-SERIES-IDocument6 pagesChapter/Section Number Title Number Number: HT-206A/B-SERIES-Iedward alba torresNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- 012 ChapterDocument4 pages012 ChapterFayaz MohammedNo ratings yet

- Mist Mess HM W/R Out-Living: 1. EeceDocument1 pageMist Mess HM W/R Out-Living: 1. EeceNoor E ElahiNo ratings yet

- FD DrawingDocument1 pageFD DrawingthermaxciplaNo ratings yet

- Virgo Actuator CatalogueDocument6 pagesVirgo Actuator CatalogueProcess Controls & ServicesNo ratings yet

- Mist Mess HM W/R Living - OUT: Ser - Dept - Level Total Level Tota L Level TotalDocument1 pageMist Mess HM W/R Living - OUT: Ser - Dept - Level Total Level Tota L Level TotalNoor E ElahiNo ratings yet

- Wheeled Excavator - Js160W: Static DimensionsDocument16 pagesWheeled Excavator - Js160W: Static DimensionsHire-minibus Lithuania Buso-nuomaNo ratings yet

- Gold Report 7 Nov 2010Document8 pagesGold Report 7 Nov 2010AndysTechnicalsNo ratings yet

- Down Whit It EbDocument1 pageDown Whit It EbwilliamNo ratings yet

- Ga & RCC Drawing of Boundary Wall-Sht-3Document1 pageGa & RCC Drawing of Boundary Wall-Sht-3Dipanjan SomeNo ratings yet

- B-3b Engine Control SystemDocument1 pageB-3b Engine Control SystemAUTOSCOPE DIAGNOSIS PERUNo ratings yet

- VmwareDocument1 pageVmwarehabibtigalbyNo ratings yet

- PSC Bridges (Accessory)Document14 pagesPSC Bridges (Accessory)ASHISH SRIVASTAVANo ratings yet

- FactoringDocument1 pageFactoringesmeraldajordan2198No ratings yet

- Mynetworkdiagram PDFDocument1 pageMynetworkdiagram PDFIrene B. QuiñonesNo ratings yet

- MAZAKManuals1071 PDFDocument15 pagesMAZAKManuals1071 PDFFernando SabogalNo ratings yet

- 10x12-S1 Studio Shed Plans v2Document17 pages10x12-S1 Studio Shed Plans v2manoj mannaiNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- KEYConics Rots Ws 2Document2 pagesKEYConics Rots Ws 2abc123asdNo ratings yet

- Comau NJ4Document2 pagesComau NJ4Hakan BayrakNo ratings yet

- JS130W Spec Issue 4Document16 pagesJS130W Spec Issue 4CALVINNo ratings yet

- Morning View 23 Feb 10Document6 pagesMorning View 23 Feb 10AndysTechnicalsNo ratings yet

- The Delvers Guide Wagon Sheet Form Fillable PDFDocument2 pagesThe Delvers Guide Wagon Sheet Form Fillable PDFJhon Jairo ReveloNo ratings yet

- Đề 2 MI1124 20222Document9 pagesĐề 2 MI1124 20222tan12t1lhpNo ratings yet

- I I I-I I I I I I I I I I: Plate Multi PlateDocument1 pageI I I-I I I I I I I I I I: Plate Multi PlatejosNo ratings yet

- Img 20220125 0001Document1 pageImg 20220125 0001Aron TaypeNo ratings yet

- Foundation - 3-Storey With Roof Deck-Model PDFDocument1 pageFoundation - 3-Storey With Roof Deck-Model PDFAnjo BalucasNo ratings yet

- 3DRAWING Layout1Document1 page3DRAWING Layout1divya brahmaNo ratings yet

- Section A-A Section A-ADocument1 pageSection A-A Section A-AMATHANNo ratings yet

- Friday Update 12 March 2010Document9 pagesFriday Update 12 March 2010AndysTechnicalsNo ratings yet

- Growing Up in the Valley: Pioneer Childhood in the Lower Fraser ValleyFrom EverandGrowing Up in the Valley: Pioneer Childhood in the Lower Fraser ValleyNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Pasahol-Bsa1-Rizal AssignmentDocument4 pagesPasahol-Bsa1-Rizal AssignmentAngel PasaholNo ratings yet

- Precertification Worksheet: LEED v4.1 BD+C - PrecertificationDocument62 pagesPrecertification Worksheet: LEED v4.1 BD+C - PrecertificationLipi AgarwalNo ratings yet

- Community Service Learning IdeasDocument4 pagesCommunity Service Learning IdeasMuneeb ZafarNo ratings yet

- Walt Whitman Video Worksheet. CompletedDocument1 pageWalt Whitman Video Worksheet. CompletedelizabethannelangehennigNo ratings yet

- Cat Hydo 10wDocument4 pagesCat Hydo 10wWilbort Encomenderos RuizNo ratings yet

- Imc Case - Group 3Document5 pagesImc Case - Group 3Shubham Jakhmola100% (3)

- Karnataka BankDocument6 pagesKarnataka BankS Vivek BhatNo ratings yet

- Notice: Constable (Driver) - Male in Delhi Police Examination, 2022Document50 pagesNotice: Constable (Driver) - Male in Delhi Police Examination, 2022intzar aliNo ratings yet

- 978-1119504306 Financial Accounting - 4thDocument4 pages978-1119504306 Financial Accounting - 4thtaupaypayNo ratings yet

- Economics and Agricultural EconomicsDocument28 pagesEconomics and Agricultural EconomicsM Hossain AliNo ratings yet

- Haloperidol PDFDocument4 pagesHaloperidol PDFfatimahNo ratings yet

- LEWANDOWSKI-olso 8.11.2015 OfficialDocument24 pagesLEWANDOWSKI-olso 8.11.2015 Officialmorpheus23No ratings yet

- MagmatismDocument12 pagesMagmatismVea Patricia Angelo100% (1)

- 059 Night of The Werewolf PDFDocument172 pages059 Night of The Werewolf PDFomar omar100% (1)

- The Nature of Mathematics: "Nature's Great Books Is Written in Mathematics" Galileo GalileiDocument9 pagesThe Nature of Mathematics: "Nature's Great Books Is Written in Mathematics" Galileo GalileiLei-Angelika TungpalanNo ratings yet

- School Games Calendar Part-1Document5 pagesSchool Games Calendar Part-1Ranadhir Singh100% (2)

- A - Persuasive TextDocument15 pagesA - Persuasive TextMA. MERCELITA LABUYONo ratings yet

- English 10-Dll-Week 3Document5 pagesEnglish 10-Dll-Week 3Alyssa Grace Dela TorreNo ratings yet

- The Leaders of The NationDocument3 pagesThe Leaders of The NationMark Dave RodriguezNo ratings yet

- Concordia: The Lutheran Confessions - ExcerptsDocument39 pagesConcordia: The Lutheran Confessions - ExcerptsConcordia Publishing House28% (25)

- Foundations For Assisting in Home Care 1520419723Document349 pagesFoundations For Assisting in Home Care 1520419723amasrurNo ratings yet

- Elements of PoetryDocument5 pagesElements of PoetryChristian ParkNo ratings yet

- 4Q 4 Embedded SystemsDocument3 pages4Q 4 Embedded SystemsJoyce HechanovaNo ratings yet

- Specification - Pump StationDocument59 pagesSpecification - Pump StationchialunNo ratings yet

- PsychometricsDocument4 pagesPsychometricsCor Villanueva33% (3)

- Damodaram Sanjivayya National Law University VisakhapatnamDocument6 pagesDamodaram Sanjivayya National Law University VisakhapatnamSuvedhya ReddyNo ratings yet

- 19-Microendoscopic Lumbar DiscectomyDocument8 pages19-Microendoscopic Lumbar DiscectomyNewton IssacNo ratings yet

- Military - British Army - Clothing & Badges of RankDocument47 pagesMilitary - British Army - Clothing & Badges of RankThe 18th Century Material Culture Resource Center94% (16)

- Newspaper OrganisationDocument20 pagesNewspaper OrganisationKcite91100% (5)

- Taxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghDocument32 pagesTaxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghjurdaNo ratings yet