Professional Documents

Culture Documents

Dolly M Gee Financial Disclosure Report For Gee, Dolly M

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dolly M Gee Financial Disclosure Report For Gee, Dolly M

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

Rev.

1/2011

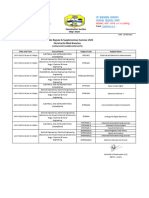

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization United States District Court, Central District of California

5a. Report T)pe (check appropriate ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Government Act ofl978 (5 U.S.C. app. ~.,~ 101-111)

I. Person Reporting (last name, first, middle initial)

3. Date of Report

Gee, Dolly M.

4. Title (Article III judges indicate active or senior status; magistrate judges indicate full- or part-time)

08/13/2011

6. Reporting Period 01/01/2010 to 12/31/2010

United States District Judge (active)

5b. [] Amended Report

7. Chambers or Office Address U.S. District Court, Central District of CA 312 N. Spring Street, Room 218P Los Angeles, CA 90012

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance v, ith applicable laws and regulations.

Revie,ving Officer

Date

IMPORTANT NOTES: The instructions accompanying this form must be followed Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. (Reporting individual only; see pp. 9-13 of filing instructions.)

D NONE (No reportablepositions.) POSITION

!. 2. 3. 4. 5. Executive Committee Executive Board

NAME OF ORGANIZATION/ENTITY

Litigation Section, Los Angeles County Bar Association Federal Bar Association, Central District of California

II. AGREEMENTS. (Reporting individual only; see pp. 14-16 of filing instructions.)

D NONE (No reportable agreements.) DATE

1.2010

PARTIES AND TERMS

Former Law Firm Partnership Agreement: capital account, contingency case recovery, and withdrawing partner payments are paid within 72 months after withdrawal Former Law Firm 401(k) through ABA Retirement Funds Program

2.2010 3.

Gee, Dolly M.

FINANCIAL DISCLOSURE REPORT Page 2 of 9

Name of Person Reporting Gee, Dolly M.

Dale of Report 08/13/201 I

III. NON-INVESTMENT INCOME. (nepo.i.g indiridualandspouse; seepp. 17-24 of filing instructions.)

A. Filers Non-Investment Income ~ NONE (No reportable non-investment income.) DATE

1.2010

SOURCE AND TYPE

Schwartz, Steinsapir, Dohrmann & Sommers LLP capital account and pannership withdrawal payments

INCOME (yours, not spouses)

$92,796.00

B. S p o u s e s N o n - l n v e s t m e n t I n c o m e - If yo u were ma tried during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

OneWest Bank - salary

1.2010

2. 3. 4.

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE

I. 2. 3. 4.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

5.

FINANCIAL DISCLOSURE REPORT Page 3 of 9

Name of Person Reporting Gee, Dolly M.

Date of I~eport

08/I 3/2011

V. GIFTS. (Includes those to spouse and dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.)

SOURCE

I. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIAB ILITIES. andude~ those oy~po.~e und dependent children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.) CRED1TOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUECODE

FINANCIAL DISCLOSURE REPORT Page 4 of 9

Name of Person Reporting Gee, Dolly M.

Date of Report 08/I 3/201 I

VII. INVESTMENTS and TRUSTS -inc~me~~alue~transacti~nsanc~udesth~se~fsp~us~anddependentchi~drn;seepp~34-6~f~inginstructi~ns~)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period Amount Code I (A-H) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period Value Code 2 (J-P) Value Method Code 3 (Q-W) Type (e.g., buy, sell, redemption) Date Value [ Gain mnffdd/yy Code 2 Code 1 (J-P) (A-H) Identity of buyer/seller (if private transaction) D. Transactions during reporting period

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16.

17.

Bank of America accounts Citibank (IRA) (CD) Citibank accounts ETrade Financial accounts OneWest Bank accounts U.S. Bank (formerly Downey Savings) (Y) Wachovia Bank account Ally Bank account ING Direct Accounts (X) Brokerage Account #1 -Citibank Market-Linked Account Brokerage Account #2 -AAPL Common Stock (Y) -StatOilHydro ASA Common Stock -Vanguared High Yield Municipal Bond Fund Citigroup Common Stock

Brokerage Account #3 (Y)

A A A B C

Interest Interest Interest Interest Interest

J J M L N

T T T T T

A B B

Interest Interest Interest M L T T

Closed

06/05/10 K

Interest

A B A

Dividend Dividend Dividend

J L J

T T T

1. Income Gain Codes: (See Columns BI and IM) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes tSee Column C2)

A =$ 1,000 or less F -$50,001 - $ I00.000 J = $15.000 or less N =$250,091 - $500.000 P3 =$25.000.001 - $50.000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1,090,0~9~ K - $15,001 - $50,000 O =$500.001 - $1,000,000 R =Cost {Real Eslale Only) V -Other

C =$2,501 - $5,000 HI =$l,0O~,001 - $5.000,000 L -$50,001 - $100.000 PI =$1,000.001 - $5,000.0~0 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5.000,000 M =$ 100.001 - $250,000 P2 =$5,000,001 - $25,000.000 T =Cash Market

E =$15.001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 9

Name of Person Reporting Gee, Dolly M.

Date of Report 08/13/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructionsO

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period Gross value at end of reporting period (1) (2) Value Value Method Code 2 (J-P) Code 3 Transactions during reporting period

(I)

Amount Code I (A-H)

(2)

Type (.g., div., rent, or int.)

(l)

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code2 Code I (J-P) (A-H)

(Q-W)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. Brokerage Account #4 (Y) Brokerage Account #5 (401(k)) -ABA Retirement Stable Asset Return Fund -ABA Retirement Balanced Fund -ABA Retirement Intermediate Bond Fund -ABA Retirement Large Cap Equity Fund -ABA Retirement All Cap Index Equity Fund -ABA Retirement Small-Mid Cap Equity Fund -ABA Retirement Small Cap Index Equity Fund -ABA Retirement International All Cap Equity Fund -State Street Global Mkt Money Mkt Fund -Ariel Appreciation Mid-Cap Blend Mutual Fund -Bridgeway Ultra Small Co. Mkt Fund -Dodge & Cox Intl Stock Fund -Fairholme Mutual Fund -Federated Prudent Bear Fund -Forester Value Mutual Fund A A A A A A A Interest

None J

(5) Identity of buyer/seller (if private transaction)

T

T

None None None None None None Interest Dividend Dividend Dividend Dividend None Dividend

J K K J J J J

T T T T T T T

J J J J J

I. Income Gain Codes: ISee Columns B I and IM) 2. Value Codes (See Columns C1 and D3) 3. Value Method Codes [Sec Column C2)

A =$1,000 or less F =$50,0~1 - $100,00~ J =$15.0~O or less N -$250.001 - $500,000 P3 =$25,000.001 - $50.000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100.001 - $1.0(~.000 K =$15,001 - $50,000 O -$500.001 = $1,000.000 R =Cost (Real Eslate Only) V -Other

C =$2,501 - $5,000 HI =$1,0OO.001 - $5.00~.000 L =$50.001 - $1 PI =$1.000,001 - $5.000.000 P4 =More than $50,000.000 S =As:,.essment W =Eslimated

D =$5.0OI - $15,000 H2 =More than $5.0~0.0OO P2 =$5.000,001 - $25.1)00.000 T =Cash Market

E =$15,1~1 - $50,0OO

FINANCIAL DISCLOSURE REPORT Page 6 of 9

Name of Person Reporting Gee, Doll) 51.

Date of Report 08/I 3/201 I

VII. INVESTMENTS and TRUSTS - income, ,alue, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period C. Gross value at end of reporting period Transactions during reporting period

0)

Amount Code I (A-H)

(2)

Type (e.g., div., rent, or int.)

(l)

Value Code 2 (J-P)

(2)

Value Method Code 3 (Q-W)

(1)

Type (e.g. buy, sell, redemption)

(2) (3) (4) Date Value Gain mrrddd/yy Code 2 Code 1 (J-P) (A-H)

(5)

Identity of buyer/seller (if private transaction)

35. 36.

-ING Corporate Leaders Trust Series B Mutual Fund -Meridian Growth Fund

Dividend None

J J

T T

37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51.

-Tamarack Enterprise Small Blend Mutual Fund -US World Precious Minerals Fund -Vanguard Star Mutual Fund -Vanguard High Yield Municipal Bond Fund -San Juan Basin Royalty Trust -AAPLCommon Stock(Y) -Bank ofAmerica common stock -Baytex Energy Trust Common Stock -GE Common Stock -HomeDepot Common Stock -IntelCorp. Common Stock -Ishares Inc. MSCI Japan Index Fund -MSFT Common Stock -StatOil Hydro ASA Common Stock -JAVA Common Stock (Y) A A A A A A A A A A A

None Dividend Dividend Dividend Dividend J

J J J

T

T T T

Dividend Dividend Dividend Dividend Dividend Dividend Dividend Dividend K J J J J J T T

T T T T

Sold

03/23/10 J

I. Income Gain Codes: (See Columns B I and IM) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes {See Column C2)

A =$ 1,000 or less F =$50,001 - $100,000 J =$15,000 or less N =$250.001 - $509,000 P3 =$25,000,001 - $50.0<)0.000 Q =Apprai~l U =Book Value

B =$1.001 - $2,500 G =$100.001 - $1,000.000 K -$15,001 - $50,000 O =$500.001 - $ I,!)00,009 R =Cost {Real Estate Only) V =Other

C =$2,501 - $5,000 HI =$ I,~O,001 - $5,000.000 L =$ 50,001 - $1130,000 PI =$1,000.001 - $5,000,000 P4 =More than $50,000.000 S =Asscs:,mcnt W =Esltmatcd

D =$5,001 - $15,000 H2 More than $5,000,000 M =$ 100,001 - $250,000 P2 =$5.000,001 * $25.000.000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 9

Name of Person Reporting Gee, Dolly M.

Date of Report 08/I 3/201 I

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during repotting period (i) (2) Amount Type (e.g., Code I div., rent, (A-H) or int.)

Gross value at end of reporting period Transactions during reporting period

(l)

Value Code 2 (J-P)

(2)

Value Method Code 3 (Q-W)

O)

Type (.g., buy, sell, redemption)

(2) (3} (4) Value Gain Date mm/dd/yy Code 2 Code 1 (J-P) (A-H)

(5)

Identity of buyer/seller (if private transaclion)

52. 53. 54. 55. 56. 57. 58.

-Ridgeworth U.S. Govt Securities Bond Fund IX)

Brokerage Account #6 (401 (k))

Dividend

-Janus Growth & Income Fund -Fidelity Income Fund Brokerage Account #7 (401(k)) -PIMCO Total Return Bond Fund IX) -Principal Financial Group Life Cycle Retirement Fund (Y) A B

Dividend Int./Div. N

Sold

08~0/10 L

Dividend

I. Income Gain Codes: (See Columns B I and IM ) 2. Value Codes (See Columns C I and D3) 3. Value Method Codc~ ISee Column C2)

A =$1,000 or less F =$ 50.001 - $ 100.000 J =$15.0~O or less N = $250.1901 - $500.000 P3 -$25,000.001 o $50.000.000 Q =Appraisal U =Book Value

B =$1,001 - $2.500 G = $100.001 - $1.000.000 K = $15.001 - $50.000 O -$500.001 - $ 1,000.000 R =Cosl (Real Eslale Onl)) V Other

C =$2,501 - $5,000 H I =$ 1.000.001 - $5.000.000 L =$ 50,001 - $ 100,000 P I =$1.000,001 - $5,000.000 P4 -More than $50.000.000 S =Assessment W =Eslimated

D =$5,0~1 - $15,000 H2 =More than $5.000.000 M =$ 100,001 - $250,000 P2 =$5,000.001 - $25.000.000 T =Cash Market

E =$15.0~1 - $50,00~

FINANCIAL DISCLOSURE REPORT Page 8 of 9

Name of Person Reporting Gee, Dolly 51.

Date of Report 08/13/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (Indlcate part of report.)

In Part VII of my Nomination Report, dated August 10, 2009, I misidentified a mutual fund at line 73 as the Fidelity Money Market Fund. The correct name is Fidelity Income Fund and that is reflected in the current report at line 55.

FINANCIAL DISCLOSURE REPORT Page 9 of 9

IX. CERTIFICATION.

Name of Person Reporting Gee, Doily M.

Date of Report 08/13/201 I

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my kno~vledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure.

I further certify that earned income from outside employment and honoraria and the acceptance of gifts ~vhich have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Dolly M. Gee

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- A320 TakeoffDocument17 pagesA320 Takeoffpp100% (1)

- TAB Procedures From An Engineering FirmDocument18 pagesTAB Procedures From An Engineering Firmtestuser180No ratings yet

- Basic Vibration Analysis Training-1Document193 pagesBasic Vibration Analysis Training-1Sanjeevi Kumar SpNo ratings yet

- GL 186400 Case DigestDocument2 pagesGL 186400 Case DigestRuss TuazonNo ratings yet

- D - MMDA vs. Concerned Residents of Manila BayDocument13 pagesD - MMDA vs. Concerned Residents of Manila BayMia VinuyaNo ratings yet

- James Knoll Gardner Financial Disclosure Report For 2010Document11 pagesJames Knoll Gardner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Raymond W Gruender Financial Disclosure Report For 2010Document8 pagesRaymond W Gruender Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gerard E Lynch Financial Disclosure Report For 2010Document9 pagesGerard E Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert S Lasnik Financial Disclosure Report For 2010Document7 pagesRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Leslie E Kobayashi Financial Disclosure Report For Kobayashi, Leslie EDocument12 pagesLeslie E Kobayashi Financial Disclosure Report For Kobayashi, Leslie EJudicial Watch, Inc.No ratings yet

- Richard M Gergel Financial Disclosure Report For Gergel, Richard MDocument16 pagesRichard M Gergel Financial Disclosure Report For Gergel, Richard MJudicial Watch, Inc.No ratings yet

- Richard L Voorhees Financial Disclosure Report For 2010Document8 pagesRichard L Voorhees Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James E Gritzner Financial Disclosure Report For 2010Document10 pagesJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Loretta A Preska Financial Disclosure Report For 2010Document14 pagesLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William T Moore JR Financial Disclosure Report For 2010Document20 pagesWilliam T Moore JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Daniel L Hovland Financial Disclosure Report For 2010Document7 pagesDaniel L Hovland Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Brian M Cogan Financial Disclosure Report For 2010Document15 pagesBrian M Cogan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roger J Miner Financial Disclosure Report For 2010Document8 pagesRoger J Miner Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Merrick B Garland Financial Disclosure Report For 2010Document10 pagesMerrick B Garland Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William H Stafford JR Financial Disclosure Report For 2010Document8 pagesWilliam H Stafford JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joan B Gottschall Financial Disclosure Report For 2010Document10 pagesJoan B Gottschall Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2010Document9 pagesSimeon T Lake Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Daniel A Manion Financial Disclosure Report For 2010Document13 pagesDaniel A Manion Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Howard A Matz Financial Disclosure Report For 2010Document12 pagesHoward A Matz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Steven J McAuliffe Financial Disclosure Report For 2010Document15 pagesSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Thad Heartfield Financial Disclosure Report For 2010Document18 pagesThad Heartfield Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Patrick J Schiltz Financial Disclosure Report For 2010Document9 pagesPatrick J Schiltz Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Procter R Hug JR Financial Disclosure Report For 2010Document8 pagesProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William Keith Watkins Financial Disclosure Report For 2010Document8 pagesWilliam Keith Watkins Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Marilyn L Huff Financial Disclosure Report For 2010Document14 pagesMarilyn L Huff Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Martha C Daughtrey Financial Disclosure Report For 2010Document8 pagesMartha C Daughtrey Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David G Campbell Financial Disclosure Report For 2010Document11 pagesDavid G Campbell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William L Garwood Financial Disclosure Report For 2010Document15 pagesWilliam L Garwood Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gregory L Frost Financial Disclosure Report For 2010Document8 pagesGregory L Frost Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Russel H Holland Financial Disclosure Report For 2010Document20 pagesRussel H Holland Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Charles J Siragusa Financial Disclosure Report For 2010Document27 pagesCharles J Siragusa Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James L Dennis Financial Disclosure Report For 2010Document8 pagesJames L Dennis Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Paul L Maloney Financial Disclosure Report For 2010Document18 pagesPaul L Maloney Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold R DeMoss JR Financial Disclosure Report For 2010Document9 pagesHarold R DeMoss JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Walter T McGovern Financial Disclosure Report For 2010Document7 pagesWalter T McGovern Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen F Williams Financial Disclosure Report For 2010Document9 pagesStephen F Williams Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Irma E Gonzalez Financial Disclosure Report For 2010Document8 pagesIrma E Gonzalez Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William Eugene Davis Financial Disclosure Report For 2010Document8 pagesWilliam Eugene Davis Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Peter J Messitte Financial Disclosure Report For 2010Document9 pagesPeter J Messitte Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harry Lee Hudspeth Financial Disclosure Report For 2010Document7 pagesHarry Lee Hudspeth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Alan D Lourie Financial Disclosure Report For 2010Document7 pagesAlan D Lourie Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert L Jordan Financial Disclosure Report For 2010Document11 pagesRobert L Jordan Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- George S Agee Financial Disclosure Report For 2010Document12 pagesGeorge S Agee Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Roger Vinson Financial Disclosure Report For 2010Document20 pagesRoger Vinson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William D Stiehl Financial Disclosure Report For 2010Document16 pagesWilliam D Stiehl Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert R Beezer Financial Disclosure Report For 2010Document9 pagesRobert R Beezer Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Susan O Mollway Financial Disclosure Report For 2010Document7 pagesSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sharon Prost Financial Disclosure Report For 2010Document9 pagesSharon Prost Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Brock D Hornby Financial Disclosure Report For 2010Document13 pagesBrock D Hornby Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sandra L Lynch Financial Disclosure Report For 2010Document15 pagesSandra L Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen M McNamee Financial Disclosure Report For 2010Document12 pagesStephen M McNamee Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David J Folsom Financial Disclosure Report For 2009Document10 pagesDavid J Folsom Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William M Hoeveler Financial Disclosure Report For 2010Document10 pagesWilliam M Hoeveler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Mark A Goldsmith Financial Disclosure Report For Goldsmith, Mark ADocument7 pagesMark A Goldsmith Financial Disclosure Report For Goldsmith, Mark AJudicial Watch, Inc.No ratings yet

- James A Beaty JR Financial Disclosure Report For 2010Document8 pagesJames A Beaty JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Abdul K Kallon Financial Disclosure Report For Kallon, Abdul KDocument15 pagesAbdul K Kallon Financial Disclosure Report For Kallon, Abdul KJudicial Watch, Inc.No ratings yet

- Ruggero J Aldisert Financial Disclosure Report For 2010Document12 pagesRuggero J Aldisert Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Terrence L OBrien Financial Disclosure Report For 2010Document8 pagesTerrence L OBrien Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Dean D Pregerson Financial Disclosure Report For 2010Document8 pagesDean D Pregerson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- TEVTA Fin Pay 1 107Document3 pagesTEVTA Fin Pay 1 107Abdul BasitNo ratings yet

- Year 9 - Justrice System Civil LawDocument12 pagesYear 9 - Justrice System Civil Lawapi-301001591No ratings yet

- Doas - MotorcycleDocument2 pagesDoas - MotorcycleNaojNo ratings yet

- RevisionHistory APFIFF33 To V219Document12 pagesRevisionHistory APFIFF33 To V219younesNo ratings yet

- 23 Things You Should Know About Excel Pivot Tables - Exceljet PDFDocument21 pages23 Things You Should Know About Excel Pivot Tables - Exceljet PDFRishavKrishna0% (1)

- Epidemiologi DialipidemiaDocument5 pagesEpidemiologi DialipidemianurfitrizuhurhurNo ratings yet

- Portrait of An INTJDocument2 pagesPortrait of An INTJDelia VlasceanuNo ratings yet

- Powerpoint Presentation: Calcium Sulphate in Cement ManufactureDocument7 pagesPowerpoint Presentation: Calcium Sulphate in Cement ManufactureDhruv PrajapatiNo ratings yet

- 3125 Vitalogic 4000 PDFDocument444 pages3125 Vitalogic 4000 PDFvlaimirNo ratings yet

- WEEK6 BAU COOP DM NextGen CRMDocument29 pagesWEEK6 BAU COOP DM NextGen CRMOnur MutluayNo ratings yet

- 4th Sem Electrical AliiedDocument1 page4th Sem Electrical AliiedSam ChavanNo ratings yet

- Audit On ERP Implementation UN PWCDocument28 pagesAudit On ERP Implementation UN PWCSamina InkandellaNo ratings yet

- Blade Torrent 110 FPV BNF Basic Sales TrainingDocument4 pagesBlade Torrent 110 FPV BNF Basic Sales TrainingMarcio PisiNo ratings yet

- Social Media Marketing Advice To Get You StartedmhogmDocument2 pagesSocial Media Marketing Advice To Get You StartedmhogmSanchezCowan8No ratings yet

- Business Environment Analysis - Saudi ArabiaDocument24 pagesBusiness Environment Analysis - Saudi ArabiaAmlan JenaNo ratings yet

- Appendix - 5 (Under The Bye-Law No. 19 (B) )Document3 pagesAppendix - 5 (Under The Bye-Law No. 19 (B) )jytj1No ratings yet

- QUIZ Group 1 Answer KeyDocument3 pagesQUIZ Group 1 Answer KeyJames MercadoNo ratings yet

- The Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and CountriesDocument13 pagesThe Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and Countriesluisbmwm6No ratings yet

- ARUP Project UpdateDocument5 pagesARUP Project UpdateMark Erwin SalduaNo ratings yet

- Topic 4: Mental AccountingDocument13 pagesTopic 4: Mental AccountingHimanshi AryaNo ratings yet

- Selvan CVDocument4 pagesSelvan CVsuman_civilNo ratings yet

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADocument10 pagesResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXNo ratings yet

- Ces Presentation 08 23 23Document13 pagesCes Presentation 08 23 23api-317062486No ratings yet

- Low Cost Building ConstructionDocument15 pagesLow Cost Building ConstructionAtta RehmanNo ratings yet

- Convention On The Rights of Persons With Disabilities: United NationsDocument13 pagesConvention On The Rights of Persons With Disabilities: United NationssofiabloemNo ratings yet