Professional Documents

Culture Documents

The Fiscal Predicament of Local Governments

Uploaded by

bobo9876543210 ratings0% found this document useful (0 votes)

5 views6 pagesThe Fiscal Predicament of Local Governments

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Fiscal Predicament of Local Governments

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views6 pagesThe Fiscal Predicament of Local Governments

Uploaded by

bobo987654321The Fiscal Predicament of Local Governments

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 6

The Fiscal Predicament of Local Governments

November 2, 2011

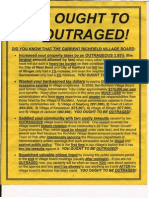

Rural Tax Revolts in 1990s

1980s: decollectivization means rapid rise in rural incomes 1990s: Local fees and charges burden farmers particularly in central China Rural urban income gap widens: 1:2.57 in 1978; 1: 1.86 in 1985; 1: 3.11 in 2002 Petitioning and violent protest

Describe the Process of Making the Tax for Fee Policy

Describe the Process of Making the Tax for Fee Policy

Sense of urgency Top town (Agriculture and Finance) Cut size, waste, corruption of local govts (scapegoating) Make cuts a veto target in cadre assessment Abolish ALL fees, ALL taxes Monitoring problems requires blanket abolition, no fine tuning (all thumbs, no fingers) Locals reduce taxes and center approves Transfers compensated provinces but not counties and townships which simply cut services

Fiscal Pressures on Local Governments

Transfers inadequate to cover mandates Cant tax or use fees Land sales and development are the solution Underfunded public goods Starving the township

Land Requisitions Have Become Main Complaint of Protestors

Where are protests concentrated?

You might also like

- Taxes Have Consequences: An Income Tax History of the United StatesFrom EverandTaxes Have Consequences: An Income Tax History of the United StatesRating: 5 out of 5 stars5/5 (1)

- Mike Shea FrontDocument1 pageMike Shea Frontapi-211030562No ratings yet

- Kenya Presentation-Peter KavithiDocument12 pagesKenya Presentation-Peter KavithiPrince AliNo ratings yet

- City and County Budget Crises: When in A Hole, First Stop DiggingDocument27 pagesCity and County Budget Crises: When in A Hole, First Stop DiggingJohn Locke FoundationNo ratings yet

- Prospectus ContribuableDocument1 pageProspectus Contribuableawong_jack2532No ratings yet

- Chapter 3 - EMDocument47 pagesChapter 3 - EMphươngNo ratings yet

- Understanding and Measuring Macroeconomic PerformanceDocument19 pagesUnderstanding and Measuring Macroeconomic PerformanceinfamisbooNo ratings yet

- Chapter 1Document102 pagesChapter 1Chelsi XiaoNo ratings yet

- 2023ECO152 - Chapter 3Document26 pages2023ECO152 - Chapter 3aphoraserviceNo ratings yet

- Urban and Regional Economy Gees 516: Chapter OneDocument142 pagesUrban and Regional Economy Gees 516: Chapter OneGetuNo ratings yet

- Fiscal Policy DefinedDocument25 pagesFiscal Policy DefinedShoaib RehmanNo ratings yet

- North IV Annexation Fiscal Plan Presentation: Fort Wayne City CouncilDocument43 pagesNorth IV Annexation Fiscal Plan Presentation: Fort Wayne City CouncilSaige DriverNo ratings yet

- Econ. Reforms - LGP in NepalDocument39 pagesEcon. Reforms - LGP in NepalFTQCDO DamauliNo ratings yet

- Unit IVDocument26 pagesUnit IVDevilzzzzNo ratings yet

- The Tiebout Model: CompetitionDocument14 pagesThe Tiebout Model: CompetitionUmerSaeedNo ratings yet

- Tobin Tax: English Applied Language SkillsDocument14 pagesTobin Tax: English Applied Language SkillsSofiane MouelhiNo ratings yet

- India: Policies To Reduce Poverty and Accelerate Sustainable Development Through GlobalizationDocument20 pagesIndia: Policies To Reduce Poverty and Accelerate Sustainable Development Through GlobalizationSafal AcharyaNo ratings yet

- Econ 100.2 Discussion Class 7: 3/1/18 JC PunongbayanDocument15 pagesEcon 100.2 Discussion Class 7: 3/1/18 JC PunongbayanPauline EviotaNo ratings yet

- Rural Taxation and Government Regulation in ChinaDocument8 pagesRural Taxation and Government Regulation in ChinaAntonio MarroccoNo ratings yet

- Community Presentation 8 2013 V2Lakeside - CityDocument27 pagesCommunity Presentation 8 2013 V2Lakeside - CityGet the Cell Out - Atlanta ChapterNo ratings yet

- India's Economic Growth and Structural Change: From Independence To The PresentDocument26 pagesIndia's Economic Growth and Structural Change: From Independence To The PresentNavin KiradooNo ratings yet

- Town of Galway: Financial OperationsDocument17 pagesTown of Galway: Financial OperationsdayuskoNo ratings yet

- C2 Central-Local Government Relations - Oct28Document53 pagesC2 Central-Local Government Relations - Oct28chanchunsumbrianNo ratings yet

- ME - Case Discussion - China Rural LeapDocument24 pagesME - Case Discussion - China Rural LeapRaghvendra KumarNo ratings yet

- Local Government Finance NotesDocument23 pagesLocal Government Finance NotesBa NyaNo ratings yet

- Urban Growth and SprawlDocument7 pagesUrban Growth and SprawlAnnaNo ratings yet

- Chapter Six: Local and Regional Development Planning: 11/11/2022 Eng. Sakariye Abdihakim MohamedDocument13 pagesChapter Six: Local and Regional Development Planning: 11/11/2022 Eng. Sakariye Abdihakim MohamedAbwaan maakhiriNo ratings yet

- State of The City and FY2011 Draft Budget Review: Welcom EDocument43 pagesState of The City and FY2011 Draft Budget Review: Welcom EiBerkshires.comNo ratings yet

- Tax Increment Finance District #2 - Irving Boulevard: Council Audit and Finance CommitteeDocument13 pagesTax Increment Finance District #2 - Irving Boulevard: Council Audit and Finance CommitteeIrving BlogNo ratings yet

- Urban Development and GrowthDocument19 pagesUrban Development and Growthkaiser2cuNo ratings yet

- Local Government Finance in The Philippines: Milwida M. Guevara SynergeiaDocument8 pagesLocal Government Finance in The Philippines: Milwida M. Guevara SynergeiaKheii VitugNo ratings yet

- Understanding Tax Increment Financing (TIF)Document30 pagesUnderstanding Tax Increment Financing (TIF)David DillnerNo ratings yet

- Part II. Chapter 2 Imposition of Real Property TaxDocument30 pagesPart II. Chapter 2 Imposition of Real Property TaxRuiz, CherryjaneNo ratings yet

- Urban Issues in Afghanistan: Regeneration and Inclusive GrowthDocument15 pagesUrban Issues in Afghanistan: Regeneration and Inclusive GrowthUrbanKnowledgeNo ratings yet

- My Region, My Europe, Our Future The 7 Cohesion ReportDocument16 pagesMy Region, My Europe, Our Future The 7 Cohesion Reportto PhoNo ratings yet

- Greater Downtown Dayton FactsDocument38 pagesGreater Downtown Dayton Factsfortheloveofdayton100% (1)

- Revenue Sharing ReportDocument12 pagesRevenue Sharing ReportMaine Policy InstituteNo ratings yet

- Advanced Taxation (ACFN 614) : Zeyad AhmedDocument199 pagesAdvanced Taxation (ACFN 614) : Zeyad AhmedKetema AsfawNo ratings yet

- Economic Development in Asia Chapter 11 - Globalization and The New EconomyDocument54 pagesEconomic Development in Asia Chapter 11 - Globalization and The New EconomyNeilLaurrenceDimalNo ratings yet

- Presentation6 PGEco2 2022Document21 pagesPresentation6 PGEco2 2022Arka DasNo ratings yet

- A Revenue Guide For Local Government: Robert L. Bland University of North TexasDocument124 pagesA Revenue Guide For Local Government: Robert L. Bland University of North TexasSiddharth BakhaiNo ratings yet

- Property Tax Reform DOF SlidesDocument25 pagesProperty Tax Reform DOF SlidesClarissa DegamoNo ratings yet

- 9 Internal MigrationDocument3 pages9 Internal MigrationConrad SawyersNo ratings yet

- Process of Becoming Urban - Population - Structural Transformation - Socio-PsychologicalDocument44 pagesProcess of Becoming Urban - Population - Structural Transformation - Socio-PsychologicalKishan KumarNo ratings yet

- 07-Measures of Success 20210227Document81 pages07-Measures of Success 20210227Ali SaleemNo ratings yet

- Designing Comprehensive Privatization Programs For Cities: ExecutiveDocument26 pagesDesigning Comprehensive Privatization Programs For Cities: ExecutivereasonorgNo ratings yet

- The Data of MacroeconomicsDocument43 pagesThe Data of MacroeconomicsAlex DraganNo ratings yet

- Dallas Mayor's Poverty Task Force Issues RecommendationsDocument20 pagesDallas Mayor's Poverty Task Force Issues RecommendationsKERANewsNo ratings yet

- North Green BushDocument23 pagesNorth Green BushjfrancorecordNo ratings yet

- 2012 City of Lawrence Tax ClassificationDocument27 pages2012 City of Lawrence Tax ClassificationDan RiveraNo ratings yet

- Household Contracted Responsibility SystemDocument4 pagesHousehold Contracted Responsibility SystemSantania syebaNo ratings yet

- Counter UrbanisationDocument7 pagesCounter UrbanisationSonal SinghNo ratings yet

- Delhi Master Plan 2021Document33 pagesDelhi Master Plan 2021Ankit Kumar ShahNo ratings yet

- FINAL Greater Minnesota Advocate 102511Document2 pagesFINAL Greater Minnesota Advocate 102511Bill SpitzerNo ratings yet

- Detroit Faces The Largest Tax Foreclosure Crisis in HistoryDocument2 pagesDetroit Faces The Largest Tax Foreclosure Crisis in HistoryRich SamartinoNo ratings yet

- Pertemuan 9 (User Charge)Document54 pagesPertemuan 9 (User Charge)Wahyu Nur IsnainiNo ratings yet

- Lesson OneDocument28 pagesLesson Oneveeveepatrick1No ratings yet

- BGE Case Study: Degree of Capitalism in ChinaDocument27 pagesBGE Case Study: Degree of Capitalism in ChinaraviNo ratings yet

- Cooperation Spillovers in Coordination Games: Timothy N. Cason, Anya Savikhin, and Roman M. SheremetaDocument31 pagesCooperation Spillovers in Coordination Games: Timothy N. Cason, Anya Savikhin, and Roman M. Sheremetabobo987654321No ratings yet

- Pit Market and Double Auction InstructionsDocument5 pagesPit Market and Double Auction Instructionsbobo987654321No ratings yet

- Cournot and tCOURNOT AND THE OLIGOPOLY PROBLEMhe Oligopoly ProblemDocument12 pagesCournot and tCOURNOT AND THE OLIGOPOLY PROBLEMhe Oligopoly Problembobo987654321No ratings yet

- Cournot and Bertrand GamesDocument15 pagesCournot and Bertrand Gamesbobo987654321No ratings yet

- Lect04 SlidesDocument30 pagesLect04 Slidesbobo987654321No ratings yet

- Minxin Pei Is SBDocument45 pagesMinxin Pei Is SBbobo987654321No ratings yet

- The Business of Governing BusinessDocument28 pagesThe Business of Governing Businessbobo987654321No ratings yet

- Style: Citations Are Required For All Print and Electronic Sources. These Are Examples of The Most CommonDocument4 pagesStyle: Citations Are Required For All Print and Electronic Sources. These Are Examples of The Most Commonbobo987654321No ratings yet

- State Capacity On The ReboundDocument9 pagesState Capacity On The Reboundbobo987654321No ratings yet

- Political Machinations in A Rural CountyDocument32 pagesPolitical Machinations in A Rural Countybobo987654321No ratings yet

- Policy ImplementationDocument16 pagesPolicy Implementationbobo987654321No ratings yet

- State Capacity and Local Agent Control in ChinaDocument19 pagesState Capacity and Local Agent Control in Chinabobo987654321No ratings yet