Professional Documents

Culture Documents

Edmonds School District Revenue

Edmonds School District Revenue

Uploaded by

Debra KolrudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Edmonds School District Revenue

Edmonds School District Revenue

Uploaded by

Debra KolrudCopyright:

Available Formats

WA State Budgets

District

3/6/13 4:45 PM

Edmonds

View Report

of 1

Find | Next

Workload/Staffing/Finance

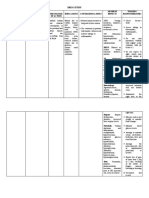

Edmonds School District

District

Budgeted

SY2006-07

SY2007-08

SY2008-09

SY2009-10

SY2010-11

SY2011-12

19,935

19,651

19,509

19,523

19,570

19,404

Special Education Percentage (2)

13.14 %

11.97 %

12.15 %

12.16 %

12.18 %

12.23 %

Free and Reduced Lunch Percentage (9)

29.55 %

29.38 %

30.40 %

26.63 %

33.58 %

36.56 %

69.3

67.0

65.9

59.6

58.4

58.2

1,251.2

1,204.0

1,187.5

1,132.1

1,123.3

1,109.6

Total FTE Enrollment (1)

Certificated Administrative Staff (03)

Certificated Instructional Staff (03)

Classified Staff (03)

Total Staff

780.0

787.0

761.3

732.1

700.2

686.1

2,100.5

2,058.0

2,014.7

1,923.8

1,881.9

1,853.9

FTE Enrollment per Staff

Certificated Administrative Staff (03)

287.6

293.3

296.0

327.3

335.1

333.2

Certificated Instructional Staff (03)

15.9

16.3

16.4

17.2

17.4

17.5

Total Certificated Staff (3)

15.1

15.5

15.6

16.4

16.6

16.6

Classified Staff (03)

25.6

25.0

25.6

26.7

28.0

28.3

Staff per Thousand FTE Enrollment

Certificated Administrative Staff

Certificated Instructional Staff

Classified Staff

3.5

3.4

3.4

3.1

3.0

3.0

62.8

61.3

60.9

58.0

57.4

57.2

39.1

40.0

39.0

37.5

35.8

35.4

105.2

104.6

103.1

98.4

96.0

95.5

Total General Fund Revenues

170,411,475

178,835,242

187,005,070

182,207,127

188,195,355

193,450,276

Total State General Fund Revenues (4)

117,767,598

125,539,752

124,286,511

123,062,285

117,867,469

122,978,190

11,001,585

12,293,680

13,745,560

13,041,811

13,170,252

12,976,878

State Student Achievment Revenues (5)

7,548,686

8,975,844

7,042,071

511,910

Total Federal General Fund Revenues (6)

11,542,571

11,827,636

20,166,384

15,691,489

20,973,906

16,707,242

Local Taxes (7)

32,640,508

33,476,646

34,379,433

35,277,596

40,830,572

45,729,143

8,460,797

7,991,208

8,172,743

8,175,756

8,523,407

8,035,701

173,713,392

182,352,132

185,730,351

179,397,811

181,942,595

193,089,234

Total Staff

State Special Education Revenues (5)

Other Revenues (10)

Total General Fund Expenditures (8)

Total Fund Balance

9,686,038

6,169,147

7,443,866

10,225,620

15,860,038

10,944,080

% of Total Revenues

5.68 %

3.45 %

3.98 %

5.61 %

8.43 %

5.66 %

% of Total Exenditures

5.58 %

3.38 %

4.01 %

5.70 %

8.72 %

5.67 %

1,136,208

347,178

199,927

1,029,527

2,615,945

900,014

% of Total Revenues

0.67 %

0.19 %

0.11 %

0.57 %

1.39 %

0.47 %

% of Total Expenditures

0.65 %

0.19 %

0.11 %

0.57 %

1.44 %

0.47 %

Total General Fund Revenues

8,548

9,100

9,586

9,333

9,616

9,970

Total State General Fund Revenues (4)

5,908

6,388

6,371

6,304

6,023

6,338

579

602

1,034

804

1,072

861

1,637

1,704

1,762

1,807

2,086

2,357

Unreserved, Undesignated Fund Balance

Dollars per FTE Enrollment

Total Federal General Fund Revenues (6)

Local Taxes (7)

Other Revenues (10)

Total Expenditures

424

407

419

419

436

414

8,714

9,279

9,520

9,189

9,297

9,951

Sources: OSPI F195/F196 School Financial Services reports, unless noted:

(1) Enrollment from OSPI Apportionment, exclude Summer Skills Centers, Institutions, and pre-K Special Ed; SY 2010-11 are year-to-date data through January

2011.

(2) Special Education percentages from OSPI Report 1220.

(3) FTE Staff from OSPI S275 reports; "Total Staff" displayed excludes extracurricular, substitutes, and on-leave staff (which average 4.0 FTEs in Bethel in recent

years).

(4) Total State General Fund Revenues includes both State General Purpose (codes 3000s, excl. Timber Excise Tax) and State Special Purpose Revenues (codes

4000s).

(5) Special Education Revenues (revenue code 4121) and Student Achievement Revenues (revenue code 4166) are part of Total State General Fund Revenues.

(6) Total Federal General Fund Revenues includes both Federal General Purpose (codes 5000s) and Federal Special Purpose Revenues (codes 6000s).

(7) Includes: Local Property Tax, Sale of Tax Title Property, Local In-Lieu-of Taxes, County Administered Forests, Other Local Taxes, and Timber Excise Tax.

(8) Includes only K-12 General Fund; excludes Capital Projects, Debt Service, Transportation Vehicle, Associated Student Body, Bond, and Trust funds.

(9) Free and Reduced Lunch Percentage from OSPI Apportionment; data correspond to reports on web site

http://www.k12.wa.us/ChildNutrition/FreeReducedDistrict.aspx

(10) Other Revenues include Local Nontax, Other Financing Sources, and Revenues from other school districts, agencies, and associations.

Data for SY 2011-12 exclude budget extensions.

http://fiscal.wa.gov/FRViewer.aspx?Rpt=K12WSFDistrict

Page 1 of 2

WA State Budgets

3/6/13 4:45 PM

Data for SY 2011-12 exclude budget extensions.

Source: fiscal.wa.gov - K12WSFDistrict

http://fiscal.wa.gov/FRViewer.aspx?Rpt=K12WSFDistrict

3/6/2013 4:32:07 PM

Page 2 of 2

You might also like

- Monroe School District FundingDocument2 pagesMonroe School District FundingDebra KolrudNo ratings yet

- General Fund Expenditures by Object and StaffingDocument15 pagesGeneral Fund Expenditures by Object and StaffingStatesman JournalNo ratings yet

- ITAC Annual Summary of DWV Budget 2005-2010Document6 pagesITAC Annual Summary of DWV Budget 2005-2010Carolanne ReynoldsNo ratings yet

- Final Budget Edition: Estimated Impacts of 2009-11 Proposed Budget(s) On State RevenuesDocument4 pagesFinal Budget Edition: Estimated Impacts of 2009-11 Proposed Budget(s) On State RevenuesJay WebsterNo ratings yet

- GPPSS 2012-13 Financial State of The District - FINALDocument18 pagesGPPSS 2012-13 Financial State of The District - FINALBrendan WalshNo ratings yet

- Kasich Budget On EducationDocument14 pagesKasich Budget On EducationmodernesquireNo ratings yet

- Budget PresentationDocument30 pagesBudget PresentationHarsh ChauhanNo ratings yet

- MSME Statistics - Department of Trade and Industry PhilippinesDocument8 pagesMSME Statistics - Department of Trade and Industry PhilippinesthisisrhealynNo ratings yet

- FY16 Working Budget Summary 7-21-15Document2 pagesFY16 Working Budget Summary 7-21-15DPMartinNo ratings yet

- Seminole County Public Schools Budget Work SessionDocument9 pagesSeminole County Public Schools Budget Work SessionWekivaPTANo ratings yet

- LAUSDFirstInterimFinancial2011 12 OcrDocument77 pagesLAUSDFirstInterimFinancial2011 12 OcrSaveAdultEdNo ratings yet

- WBC 5yr SummaryDocument2 pagesWBC 5yr SummaryPaskalis GlabadanidisNo ratings yet

- 16 Mindef Ee2011Document5 pages16 Mindef Ee2011ambivalenteNo ratings yet

- WATER (41) : Agency Plan: Mission, Goals and Budget SummaryDocument61 pagesWATER (41) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNo ratings yet

- Arkansas Bill HB1085Document6 pagesArkansas Bill HB1085capsearchNo ratings yet

- FY 2014 Budget Status Final CorrectedDocument74 pagesFY 2014 Budget Status Final Correctedted_nesiNo ratings yet

- Local Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Document19 pagesLocal Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Rushbh PatilNo ratings yet

- Candor Central School District: 2010 - 2011 Budget PresentationDocument27 pagesCandor Central School District: 2010 - 2011 Budget PresentationPulukuri JyothiNo ratings yet

- 2021 IMPD Budget Presentation - FINAL PDFDocument30 pages2021 IMPD Budget Presentation - FINAL PDFWTHRNo ratings yet

- May 2014 Rev-E NewsDocument4 pagesMay 2014 Rev-E NewsRob PortNo ratings yet

- Sewerage (42) : Agency Plan: Mission, Goals and Budget SummaryDocument50 pagesSewerage (42) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNo ratings yet

- NASA 171651main fs-2007-02-00041-sscDocument2 pagesNASA 171651main fs-2007-02-00041-sscNASAdocumentsNo ratings yet

- 2011 Budget Overview - DHW - 01 19 2010 - Final JFACDocument21 pages2011 Budget Overview - DHW - 01 19 2010 - Final JFACMark ReinhardtNo ratings yet

- AgriEng BOAE-PRCDocument38 pagesAgriEng BOAE-PRCMaribel Bonite PeneyraNo ratings yet

- Foreign Workers in SingaporeDocument46 pagesForeign Workers in SingaporesnguidemynahNo ratings yet

- HISD Board Meeting Budget Presentation 030311Document17 pagesHISD Board Meeting Budget Presentation 030311enm077486No ratings yet

- Detroit Workforce Development Department (21) : Agency Plan: Mission, Goals and Budget SummaryDocument26 pagesDetroit Workforce Development Department (21) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNo ratings yet

- August 2011.webDocument2 pagesAugust 2011.webNavarro CollegeNo ratings yet

- 2012-13 Budget Presentation As of 1-4-12Document38 pages2012-13 Budget Presentation As of 1-4-12Hemanta BaishyaNo ratings yet

- Arkansas Bill HB1069Document8 pagesArkansas Bill HB1069capsearchNo ratings yet

- MSD 2011/12 Preliminary BudgetDocument123 pagesMSD 2011/12 Preliminary BudgetDebra KolrudNo ratings yet

- Functions of Local Government Education FundsDocument34 pagesFunctions of Local Government Education FundsNerie Joy Faltado BalmesNo ratings yet

- Union Budget 2013 14 FinalDocument32 pagesUnion Budget 2013 14 FinalAdarsh KambojNo ratings yet

- 2011 Results Presentation SlidesDocument56 pages2011 Results Presentation SlidesTarun GuptaNo ratings yet

- Malaysia at A Glance: (Average Annual Growth)Document2 pagesMalaysia at A Glance: (Average Annual Growth)volatilevortecsNo ratings yet

- Data Extract From World Development IndicatorsDocument15 pagesData Extract From World Development IndicatorsAmandine GbayeNo ratings yet

- Salem-Keizer Public Schools 2012-13 Budget Message (Draft)Document23 pagesSalem-Keizer Public Schools 2012-13 Budget Message (Draft)Statesman JournalNo ratings yet

- ENCSD, NCSD Closing in HOUSE BILL 200 RATIFIED BILL Section 7.25. (A)Document343 pagesENCSD, NCSD Closing in HOUSE BILL 200 RATIFIED BILL Section 7.25. (A)Brance-Rhonda LongNo ratings yet

- 2011-12 Financial State of The District - FinalDocument19 pages2011-12 Financial State of The District - FinalBrendan WalshNo ratings yet

- Arkansas Bill HB1073Document7 pagesArkansas Bill HB1073capsearchNo ratings yet

- Employment and Skill DevelopmentDocument15 pagesEmployment and Skill DevelopmentShilpa Born To LoveNo ratings yet

- SB51: 2012 Education AppropriationDocument18 pagesSB51: 2012 Education AppropriationFactBasedNo ratings yet

- Performance Highlights: CMP '46 Target Price '60Document14 pagesPerformance Highlights: CMP '46 Target Price '60Angel BrokingNo ratings yet

- Fnsinc602 - Assessment 1Document14 pagesFnsinc602 - Assessment 1Daranee TrakanchanNo ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- Arkansas Bill HB1129Document12 pagesArkansas Bill HB1129capsearchNo ratings yet

- Arkansas Bill HB1135Document10 pagesArkansas Bill HB1135capsearchNo ratings yet

- Missouri Dept Social Services Support Divisions Appropriation Summaries, August 15, 2008.Document14 pagesMissouri Dept Social Services Support Divisions Appropriation Summaries, August 15, 2008.Rick ThomaNo ratings yet

- 2012/13: $73.7b (33.8% of GDP) : $7.3b $3.8b $23.2b $6.5bDocument2 pages2012/13: $73.7b (33.8% of GDP) : $7.3b $3.8b $23.2b $6.5briz2010No ratings yet

- Ohio SequestrationDocument1 pageOhio SequestrationjointhefutureNo ratings yet

- Maybank Nestle ResearchDocument7 pagesMaybank Nestle ResearchCindy SimNo ratings yet

- Department of Health and Wellness Promotion (25) : Agency Plan: Mission, Goals and Budget SummaryDocument63 pagesDepartment of Health and Wellness Promotion (25) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNo ratings yet

- Arkansas Bill HB1087Document7 pagesArkansas Bill HB1087capsearchNo ratings yet

- LFB State Aid and Levy Information For Technical College DistrictsDocument4 pagesLFB State Aid and Levy Information For Technical College Districtskfoody5436No ratings yet

- Paradise Community Collegefy2014budgetDocument11 pagesParadise Community Collegefy2014budgetapi-222496408No ratings yet

- Budget Charts & GraphsDocument10 pagesBudget Charts & GraphsPeter SchorschNo ratings yet

- Brs-Ipo Document Peoples Leasing Company LimitedDocument13 pagesBrs-Ipo Document Peoples Leasing Company LimitedLBTodayNo ratings yet

- Exam Preparation & Tutoring Revenues World Summary: Market Values & Financials by CountryFrom EverandExam Preparation & Tutoring Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryFrom EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miller V Monroe School District Federal ComplaintDocument46 pagesMiller V Monroe School District Federal ComplaintDebra KolrudNo ratings yet

- Seattle Police Report During BLM RiotDocument5 pagesSeattle Police Report During BLM RiotDebra KolrudNo ratings yet

- Special Education Citizen Complaint (Secc) No. 13-72 Procedural HistoryDocument21 pagesSpecial Education Citizen Complaint (Secc) No. 13-72 Procedural HistoryDebra KolrudNo ratings yet

- Washington State Report CardDocument1 pageWashington State Report CardDebra KolrudNo ratings yet

- Neighborhood Watch From Snohomish County SheriffDocument24 pagesNeighborhood Watch From Snohomish County SheriffDebra Kolrud100% (1)

- It's Perfectly NormalDocument2 pagesIt's Perfectly NormalDebra KolrudNo ratings yet

- Monroe School District Facebook GroupDocument22 pagesMonroe School District Facebook GroupDebra KolrudNo ratings yet

- Public School Directors Denied The Ability To Communicate With Their Own District Attorney!!Document4 pagesPublic School Directors Denied The Ability To Communicate With Their Own District Attorney!!Debra KolrudNo ratings yet

- It's Perfectly NormalDocument1 pageIt's Perfectly NormalDebra KolrudNo ratings yet

- 2013 Snohomish County School District Levy TaxDocument2 pages2013 Snohomish County School District Levy TaxDebra KolrudNo ratings yet

- Washington Risk PoolDocument87 pagesWashington Risk PoolDebra KolrudNo ratings yet

- Monroe School District Superintendent ContractDocument5 pagesMonroe School District Superintendent ContractDebra KolrudNo ratings yet

- Monroe School District End of Course Washington State Report Card For Algebra 1 2012:13Document2 pagesMonroe School District End of Course Washington State Report Card For Algebra 1 2012:13Debra KolrudNo ratings yet

- Monroe School District Capital Facilities Plan 2010Document1 pageMonroe School District Capital Facilities Plan 2010Debra KolrudNo ratings yet

- Office of Superintendent of Public Instruction 2012-13 Table15 Personnel Report On Superintendent SalariesDocument6 pagesOffice of Superintendent of Public Instruction 2012-13 Table15 Personnel Report On Superintendent SalariesDebra KolrudNo ratings yet

- Snohomish County Superform Carlos MartinezDocument3 pagesSnohomish County Superform Carlos MartinezDebra KolrudNo ratings yet

- Zombie Lending and Depressed Restructuring in JapanDocument25 pagesZombie Lending and Depressed Restructuring in JapanYassine MerizakNo ratings yet

- Analy Food Colour Uv-VisDocument13 pagesAnaly Food Colour Uv-VisNoor Zarif100% (1)

- An Opinion Essay About Fast Food - ExercisesDocument5 pagesAn Opinion Essay About Fast Food - ExercisesalinaNo ratings yet

- Class 9 Science TamilMediumDocument312 pagesClass 9 Science TamilMediumsimpletontsNo ratings yet

- RASHMi JuvenileDocument6 pagesRASHMi Juvenilerashmi gargNo ratings yet

- Melt Polymerization ReactorDocument9 pagesMelt Polymerization ReactornichkhunieNo ratings yet

- Drug StudyDocument8 pagesDrug StudyStephanie Zafico PalalayNo ratings yet

- Refractory Brick Data SheetsDocument5 pagesRefractory Brick Data SheetsSaragadam DilsriNo ratings yet

- BIO103L, Expt 3 & 4Document13 pagesBIO103L, Expt 3 & 4shayamNo ratings yet

- Neet Mds 2019 Result For Web 17012019Document119 pagesNeet Mds 2019 Result For Web 17012019Pavan KallempudiNo ratings yet

- Outline ICON JournalDocument2 pagesOutline ICON JournalNurhaya NurdinNo ratings yet

- OCHEM Practice FinalDocument24 pagesOCHEM Practice FinalNoleNo ratings yet

- Prevalence and Underlying Factors of MobileDocument10 pagesPrevalence and Underlying Factors of MobileJoan CedyNo ratings yet

- CC2413 Fundamental Psychology For Health Studies: Lesson PlanDocument10 pagesCC2413 Fundamental Psychology For Health Studies: Lesson Plantwy113No ratings yet

- CDA PC PeriflexVN 21 EN 0714 1Document36 pagesCDA PC PeriflexVN 21 EN 0714 1RonaldNo ratings yet

- Waterproofing Catalogue: Parchem Construction SuppliesDocument20 pagesWaterproofing Catalogue: Parchem Construction SuppliesJet ToledoNo ratings yet

- 21T3A-T Haier Hyundai PDFDocument52 pages21T3A-T Haier Hyundai PDFAdithyanVs100% (2)

- This Study Resource Was: Ak - Ic - Mock Exam Set ADocument9 pagesThis Study Resource Was: Ak - Ic - Mock Exam Set AArvinALNo ratings yet

- Specification For Carbon Structural Steel: SA-36 /SA-36MDocument7 pagesSpecification For Carbon Structural Steel: SA-36 /SA-36MBowo Edhi Wibowo100% (2)

- GEN6001A GDC KLIA Inspection Report Generator - DraftDocument20 pagesGEN6001A GDC KLIA Inspection Report Generator - DraftRashid Al JaowadNo ratings yet

- Lecture 10: Enzyme Kinetics: Reading: Chapter 6 Pp. 202-213Document21 pagesLecture 10: Enzyme Kinetics: Reading: Chapter 6 Pp. 202-213SriArthiNo ratings yet

- Ger 4610Document39 pagesGer 4610esutjiadiNo ratings yet

- Dirty Texting Lenguage of LustDocument19 pagesDirty Texting Lenguage of LustValpo ValparaisoNo ratings yet

- Nutrition and Diet Therapy - LEC (5,6,7)Document9 pagesNutrition and Diet Therapy - LEC (5,6,7)Anntwilight MontesNo ratings yet

- Rosenflex FIBC TypeGuideDocument2 pagesRosenflex FIBC TypeGuideZahir KhiraNo ratings yet

- Ingles UPCDocument5 pagesIngles UPCHector TineoNo ratings yet

- Lightnin Plenty BrochureDocument28 pagesLightnin Plenty BrochureHenry Garavito RamirezNo ratings yet

- Operation & Maintenance Guideline For Bio-Digesters: 6 Economics 11Document13 pagesOperation & Maintenance Guideline For Bio-Digesters: 6 Economics 11myco samNo ratings yet

- JGCapitinBSABE1 - Language Register ActivityDocument2 pagesJGCapitinBSABE1 - Language Register ActivityJuan CapitinNo ratings yet

- Colles FractureDocument20 pagesColles FracturedhinahafizNo ratings yet