Professional Documents

Culture Documents

Wennis Math Final Project Feb 2013

Wennis Math Final Project Feb 2013

Uploaded by

api-215482820Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wennis Math Final Project Feb 2013

Wennis Math Final Project Feb 2013

Uploaded by

api-215482820Copyright:

Available Formats

Wenni Iben NA Topics 6 February 24, 13 Wenni Sophie

The Final Report

By, Wenni Iben Partnered with Sophie Licostie Group name: Wenni Sophie Our Final Value: $99,914.96

Companies and Stock Ticker Symbols: AAPL- Apple Inc. AMZN- Amazon.com, Inc. BK- The Bank of New York Mellon Corporation BKS- Barnes & Noble, Inc. BLK- Blackrock Inc. CENX- Century Aluminum Co. DGAS- Delta Natural Gas Company, Inc. DIS- The Walt Disney Company DOW- Dow Chemical Co. EXPR- Express, Inc. FARO- FARO Technologies Inc. HPQ- Hewlett-Packard Co. M- Macys, Inc. NEO- NeoGenomics Inc. YHOO- Yahoo! Inc.

Introduction: Sophie and I learned a lot about the stock market and how

it works through this stock market project. At first we just bought stocks that we thought would do well, but were already doing well, like Apple. Unfortunately that didnt work out, so we started googling the stocks. That seemed to go well until we realized that wed been reading it wrong. Although Sophie and my stocks didnt do very well in the end, for a while, we were actually making some money. Our rankings overall never got above 4th but never below 8th, which was the place wed ended with, so Sophie and I had consistent rankings throughout the entire game. The stock market game was a fun experience, and although it got pretty competitive, it was always interesting to see who was on top.

Description of Stocks: AAPL: Apple was doing very well in the beginning, which is why I originally didnt want to buy it. We bought it on the second day however, a little after it started going down, and then it crashed since after the iPhone 5 came out, people bought fewer Apple products. We short sold each stock for $457.35 and bought each share for $521.00. AMZN: Amazon, like Apple, didnt do so well, it went down a little over the time we had it, but not as much as Apple. BK: One of Sophie and my first stocks, the Bank of New York Mellon Company was at is peak when Sophie and I bought it and then in started to go up and down. Believe it or not we sold it for a price very close to the amount wed bought it for only one dollar more. BKS: Sophie and I bought Barnes and Nobles hoping it could only go up from where it was, and it turns out we were wrong. By looking at Figure 4 you can see how this stock went up and down. You can also see how we made money, although for a while it didnt seem like we would. We bought it at a low point, and sold it on January 23rd for $13.00 about 24 more then wed bought it for. BLK: When we bought Blackrock, it seemed very stable. It seemed like it wasnt increasing or decreasing, which is why we eventually sold this stock for the same price wed bought it for. CENX: Sophie and I never sold Century Aluminum Co. but if we had, we wouldve made money since it increased after we bought it. DGAS: The first stock wed decided to buy, DIS: Although we sold Disney before it started to go up, I learned the most from this stock. I found out how to read Google and DOW: Dow Chemical Co. was another company that didnt seem to increase or decrease. When we sold it, we only made about 18. Wed bought it for $32.25 and sold it for $32.43. EXPR: Since the day we first bought it Express Inc. increased. In the second week, its price increased by one dollar each day for two days and then stayed at that price. We made money from this stock and sold it for $18.50 while we bought it for $6.31. FARO: Sophie and I bought FARO for $32.15 and sold it $31.70. as soon as we bought it went down and then started to increase. Right before we sold it, its price became $33.33 and that was the highest it got. We lost money on this stock because we didnt have good timing. HPQ: Hewlett-Packard Company, like many of our other stocks, went down from when we first bought it but not by that much. At first it went from $16.67 to $16.01, but then it increased to $17.01. in the end, we never sold it, and it ended at $16.64. M: Yet another stock we never sold, we bought Macys the day the stock market game ended at $40.51. Since we didnt sell this stock, we didnt lose money, but it went down to $40.39 when the game ended. NEO: We bought NeoGenomics for $2.89 and sold it for $2.91. Over the four days we had it, the most NEO changed was only about 5 cents.

YHOO: You can tell by Figure 7 that although Sophie and I made money from Yahoo, had we had better timing, we wouldve made more money than we did. We bought Yahoo for $19.33 and sold it for $19.76. Overall Changes: In my stock market project, our stocks at first went down and then up and then down again. We ended up losing $985.04 mainly because we read Google wrong, but also because we werent as careful with the stocks we picked like how we were with Apple. Progress of all Stocks: This graph shows how the price of each stock progressed: increasing or decreasing. Some of our stocks did well, and some others (as you can see in Figure 1) didnt.

Percent of Change Per Share: APPL: Week 1 to Week 2: -13.4% Week 2 to Week 3: -1.79% Week 3 to Week 4: -.6% Start to End: -12.3% AMZN: Week 1 to Week 2: 1.5% Week 2 to Week 3: -2.5% Week 3 to Week 4: -2.7% Start to End: -1.3% BK: Week 1 to Week 2: 1.5% Week 2 to Week 3: 1.8% Start to End: 1.6% BKS: Week 1 to Week 2: -1.8% Week 2 to Week 3: 3% Start to End: 0% BLK: Week 3 to Week 4: .3% Start to End: -2.3% CENX: Week 3 to Week 4: 2.4% Start to End: 6% DGAS: Week 1 to Week 2: -32% Week 2 to Week 3: 50% Week 3 to Week 4: Start to End: 0.6% DIS: Week 1 to Week 2: 2.9% Week 2 to Week 3: 0.9% Start to End: 6.7% DOW: Week 3 to Week 4: .55% Start to End: .55% EXPR: Week 1 to Week 2: 4.4% Week 2 to Week 3: 0.8% Start to End: 13.4% FARO: Week 1 to Week 2: -1.3% Start to End: -1.3% HPQ: Week 3 to Week 4: .2% Start to End: -0.1% M: Start to End: -.3% NEO: Start to End: 0% YHOO: Week 1 to Week 2: 1.7% Week 2 to Week 3: 3.2% Week 3 to Week 4: 10.05% Start to End: -1.5

You might also like

- Anthony Robbins - The Power of Momentum 2006Document18 pagesAnthony Robbins - The Power of Momentum 2006chandanbabu95% (21)

- Learning CAN SLIM Education Resources: Lee TannerDocument43 pagesLearning CAN SLIM Education Resources: Lee Tannerneagucosmin67% (3)

- Flipping For ProfitDocument18 pagesFlipping For ProfitThe ProfitabullNo ratings yet

- 01-Issue 1 - The Order Form BumpDocument8 pages01-Issue 1 - The Order Form BumpMazaroto SantosNo ratings yet

- Never Before Revealed Secrets FreeDocument35 pagesNever Before Revealed Secrets FreesethNo ratings yet

- Coaching Business FoundationsDocument96 pagesCoaching Business FoundationsmariaNo ratings yet

- Good to Great: Why Some Companies Make the Leap...And Others Don'tFrom EverandGood to Great: Why Some Companies Make the Leap...And Others Don'tRating: 4.5 out of 5 stars4.5/5 (152)

- Beginner’s Guide To Starting a YouTube Channel 2024-2025 EditionFrom EverandBeginner’s Guide To Starting a YouTube Channel 2024-2025 EditionNo ratings yet

- Penny Stock Players: Penetrating the minds of underground penny stock traders as they strive to beat the pink sheet and over the counter market: Penny Stock PlayersFrom EverandPenny Stock Players: Penetrating the minds of underground penny stock traders as they strive to beat the pink sheet and over the counter market: Penny Stock PlayersRating: 4.5 out of 5 stars4.5/5 (2)

- Valuation Method ExamsDocument75 pagesValuation Method ExamsRhejean Lozano100% (2)

- Coaching Business Foundations PDFDocument96 pagesCoaching Business Foundations PDFcrownshiv100% (3)

- Terms & ConditionsDocument2 pagesTerms & ConditionsES YanNo ratings yet

- Summary of The Hard Thing About Hard Things: by Ben Horowitz - Building a Business When There Are No Easy Answers - A Comprehensive SummaryFrom EverandSummary of The Hard Thing About Hard Things: by Ben Horowitz - Building a Business When There Are No Easy Answers - A Comprehensive SummaryNo ratings yet

- Ellen's PPT BFDPDocument19 pagesEllen's PPT BFDParaceli aure-naciongayoNo ratings yet

- Business Plan of A FruitsDocument11 pagesBusiness Plan of A FruitsVikram ReddyNo ratings yet

- All Banks Preview by MOSLDocument268 pagesAll Banks Preview by MOSLdollyparmarNo ratings yet

- Three Weeks to eBay® Profits, Revised Edition: Go from Beginner to Successful Seller in Less than a MonthFrom EverandThree Weeks to eBay® Profits, Revised Edition: Go from Beginner to Successful Seller in Less than a MonthNo ratings yet

- Our Best Stock Trading Analyses and StrategiesFrom EverandOur Best Stock Trading Analyses and StrategiesRating: 5 out of 5 stars5/5 (1)

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Variations in Construction ContractsDocument4 pagesVariations in Construction ContractslaikienfuiNo ratings yet

- Chapter 13 Investment Centre and Transfer PricingDocument8 pagesChapter 13 Investment Centre and Transfer PricingRobyn TlsNo ratings yet

- Kim KiyosakiDocument4 pagesKim KiyosakiAlice Azucena FerreiraNo ratings yet

- Buy Shoes on Wednesday and Tweet at 4:00: More of the Best Times to Buy This, Do That, and Go ThereFrom EverandBuy Shoes on Wednesday and Tweet at 4:00: More of the Best Times to Buy This, Do That, and Go ThereNo ratings yet

- The Contemporary World Module (Ge 3)Document42 pagesThe Contemporary World Module (Ge 3)Kirstine Valerie MandalonesNo ratings yet

- Feel Good Club: A guide to feeling good and being okay with it when you’re notFrom EverandFeel Good Club: A guide to feeling good and being okay with it when you’re notNo ratings yet

- Funding Freedom: From Corporate Life to a Life of TravelFrom EverandFunding Freedom: From Corporate Life to a Life of TravelRating: 1 out of 5 stars1/5 (1)

- FIN203 Essay 6Document7 pagesFIN203 Essay 6ANo ratings yet

- FILM229 Test 8Document6 pagesFILM229 Test 8Sekar Devi ArnatiNo ratings yet

- Grow More Marketwatch Stock Trading ReportDocument2 pagesGrow More Marketwatch Stock Trading ReportSaiful ShihabNo ratings yet

- Economics Stock Market ProjectDocument8 pagesEconomics Stock Market ProjectStephanie RamirezNo ratings yet

- Class 03-10-29Document6 pagesClass 03-10-29DULCE PAZNo ratings yet

- Kennell Stephen StocksDocument11 pagesKennell Stephen Stocksapi-320545633No ratings yet

- Corporate Financial Policy: Trading Games: Forward PricingDocument13 pagesCorporate Financial Policy: Trading Games: Forward PricingLouis Giacomo Pranlas DescoursNo ratings yet

- UntitleddocumentDocument3 pagesUntitleddocumentapi-359132751No ratings yet

- BMED225 Homework Help 2Document9 pagesBMED225 Homework Help 2RamosNo ratings yet

- Name: Enrollment: Date: Name of Evidence of Learning: Module NameDocument2 pagesName: Enrollment: Date: Name of Evidence of Learning: Module NameManito ESTRADA SNo ratings yet

- 29 Jan To 2 Feb 24Document10 pages29 Jan To 2 Feb 24Akash NawinNo ratings yet

- Business Expo 2-WPS OfficeDocument1 pageBusiness Expo 2-WPS OfficeClarissa Ann BorboNo ratings yet

- Entrepreneurship Final Project Conclusion PDFDocument2 pagesEntrepreneurship Final Project Conclusion PDFJohn WarwickNo ratings yet

- Market Leader - ActivitiesDocument7 pagesMarket Leader - ActivitiesBondfriendsNo ratings yet

- MATH323 Extra Credit 10Document4 pagesMATH323 Extra Credit 10Uvuvwe VweNo ratings yet

- CNBC Transcript: Warren Buffett On 'Squawk Box' - March 4, 2013Document79 pagesCNBC Transcript: Warren Buffett On 'Squawk Box' - March 4, 2013CNBCNo ratings yet

- ART243 Questions 3Document4 pagesART243 Questions 3HamzaNo ratings yet

- Workshop 7. My Favorite CharacterDocument9 pagesWorkshop 7. My Favorite CharacterAlejandra CerqueraNo ratings yet

- Sargun Gill - Aylesbury PS (1425) - Final Business ReportDocument10 pagesSargun Gill - Aylesbury PS (1425) - Final Business ReportSargun GillNo ratings yet

- Project NameDocument2 pagesProject NameuahproductionsNo ratings yet

- TradersWorld Nov 06Document3 pagesTradersWorld Nov 06jekhadeesanNo ratings yet

- Stock Market Project: United Parcel Service (SUMMARY)Document3 pagesStock Market Project: United Parcel Service (SUMMARY)Sakshi RangrooNo ratings yet

- Options Aa ReportDocument10 pagesOptions Aa ReportDavid GarciaNo ratings yet

- ANT237 Cheat Sheet 1Document5 pagesANT237 Cheat Sheet 1jkNo ratings yet

- EXE11Document3 pagesEXE11moekhinmar layNo ratings yet

- BIO192 Pre Lab 5Document5 pagesBIO192 Pre Lab 5RICHARD FERNANDEZNo ratings yet

- Student: No One Ever Taught MeDocument12 pagesStudent: No One Ever Taught MecmlqndNo ratings yet

- The Pink Lily Story - Showit BlogDocument16 pagesThe Pink Lily Story - Showit BlogGoKi VoregisNo ratings yet

- Activity 5 SymbolsDocument2 pagesActivity 5 SymbolsAfrozNo ratings yet

- Three Weeks to eBay® Profits, Third Edition: Go From Beginner to Successful Seller in Less than a MonthFrom EverandThree Weeks to eBay® Profits, Third Edition: Go From Beginner to Successful Seller in Less than a MonthNo ratings yet

- Pres NotesDocument3 pagesPres NotesTyler WilliamsNo ratings yet

- Greg Lippman FCIC TestimonyDocument20 pagesGreg Lippman FCIC TestimonyLuke ConstableNo ratings yet

- Boyd Street Magazine May 23, 2012 Issue 10 Volume 9Document32 pagesBoyd Street Magazine May 23, 2012 Issue 10 Volume 9BoydStreetMagazineNo ratings yet

- Bui Truong Thinh-2Document9 pagesBui Truong Thinh-2buitruongthinh2004No ratings yet

- QA June 4 2022Document4 pagesQA June 4 2022Vincent T.No ratings yet

- Production Diary: Up725313 - Animation Group ProjectDocument54 pagesProduction Diary: Up725313 - Animation Group ProjectAndreaTzontchevaNo ratings yet

- ECO261 Practice 7Document6 pagesECO261 Practice 7Hugo CopperfieldNo ratings yet

- make money from A. IDocument30 pagesmake money from A. IFatima zahra SabbarNo ratings yet

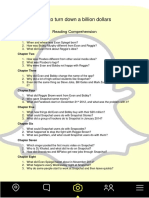

- How To Turn Down 1 Billion DollarsDocument5 pagesHow To Turn Down 1 Billion DollarsAndy SherwinNo ratings yet

- Accounting Theory & Practice Fall 2011 - Ch4Document26 pagesAccounting Theory & Practice Fall 2011 - Ch4eileen_floodxoxoNo ratings yet

- Financial Statement Analysis - Chashma Sugar Mills Limited.: Inventory Turnover (Ito)Document10 pagesFinancial Statement Analysis - Chashma Sugar Mills Limited.: Inventory Turnover (Ito)Areebah MateenNo ratings yet

- Digital India in Agriculture SiddhanthMurdeshwar NMIMS MumbaiDocument4 pagesDigital India in Agriculture SiddhanthMurdeshwar NMIMS MumbaisiddhanthNo ratings yet

- Kanniyakumari 2022 PDFDocument265 pagesKanniyakumari 2022 PDFஅபினேஷ்குமார்No ratings yet

- STATISTA - Study - Id48427 - Costa-RicaDocument108 pagesSTATISTA - Study - Id48427 - Costa-Ricabeellyejean8No ratings yet

- Assignment 8 Business Mail 2016 1Document5 pagesAssignment 8 Business Mail 2016 1api-339690724No ratings yet

- Space Star CaseDocument8 pagesSpace Star CasePaul GhanimehNo ratings yet

- PWC Hospitality Directions Lodging OutlookDocument4 pagesPWC Hospitality Directions Lodging Outlookmotherfucker111No ratings yet

- Financial Management (FM) Solution Pack: S. No ACCA Exam Paper Topics CoveredDocument64 pagesFinancial Management (FM) Solution Pack: S. No ACCA Exam Paper Topics CoveredKoketso MogweNo ratings yet

- 10 - ECON 3023 - Class On December 7th, CH 14 - Phillips CurveDocument22 pages10 - ECON 3023 - Class On December 7th, CH 14 - Phillips CurveRafina AzizNo ratings yet

- Nit Gps Based Oitds 83 051109 - NRDocument139 pagesNit Gps Based Oitds 83 051109 - NRMadhusudhanaBandapalli0% (1)

- Grade 11 Unit 7Document3 pagesGrade 11 Unit 7Nipuni PereraNo ratings yet

- $6,975.36 Total Assets: Balances and HoldingsDocument2 pages$6,975.36 Total Assets: Balances and Holdingsnnenna26No ratings yet

- Sales Promotions: Sales Promotion Spurs Action andDocument32 pagesSales Promotions: Sales Promotion Spurs Action andMehak SinghNo ratings yet

- Port Pricing PDFDocument86 pagesPort Pricing PDFMw. MustolihNo ratings yet

- Order FL0200682072: Mode of Payment: NONCODDocument1 pageOrder FL0200682072: Mode of Payment: NONCODShubham NamdevNo ratings yet

- 1.PPT Cost AccountingDocument14 pages1.PPT Cost AccountingShruti GargNo ratings yet

- Module 17 Practice Set 1Document5 pagesModule 17 Practice Set 1Ian LuNo ratings yet

- Question Sheet - Non Profit OrganisationDocument7 pagesQuestion Sheet - Non Profit OrganisationShivangi JhawarNo ratings yet

- Chapter 21 Inventory ManagementDocument31 pagesChapter 21 Inventory ManagementVertueVolcanoNo ratings yet

- Operation BudgetDocument2 pagesOperation BudgetMuhammad RidhwanNo ratings yet