Professional Documents

Culture Documents

Break Even Analysis

Uploaded by

Hamid Hameed SheikhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Break Even Analysis

Uploaded by

Hamid Hameed SheikhCopyright:

Available Formats

Financial Management

BreakEven Analysis

Particulars F.E V.E Raw Material 37,390,082.00 Salaries 11,355,687.00 Repair & Maintaines 570,495.00 Fuel & Power 172,620.00 978,177.00 Insurance 571,263.00 Rent, Rates 37,136.00 Depriciation 891,260.00 Administrative, selling, General Salaries 5,289,409.00 Trevelling 1,552,107.00 Vechile runing 800,975.00 Postage & Telephone 836,070.00 Leagal & Professional 455,250.00 Audit fee 50,000.00 printing & Stationary 319,210.00 Boarding,Loadging 206,521.00 fee & Subscription 414,202.00 Books & Periodicals 31,073.00 Repair & Maintaines 93,851.00 Free samples 175,008.00 Export Tax 255,735.00 Advertisment 1,200,828.00 publicity -------cleaning & forwarding 2,376,925.00 Bad debts written miscelleneous 24,966.00 Depriciation 1,184,562.00 Financial & other Charges Markup 2,143,844.00 Bank charges 383,912.00 Zakat 9,975.00 Capital Loss 3,464.00 Worker participation fund 4,469,580.00 Donations 1,168,213.00 Taxation 7,667,150.00 Total 34,957,698.00 48,121,852.00 Debt Repayment 3250000

COMMERCIAL BREAKEVEN

Sales

160777089

B.E C.B.E

F.c / S - V.C * P.C 31.03

it represent that level of sales after which company's inc showing profit. It includes all expenses wether cash or non Debt Repay Capital Exp debt payment should b

C.B.E = commercial break even, F.c = Fix cost, V.c= Variable c = Production Capacity

Ca.B.E Ca.B.E

CASH BREAKEVEN

it represent that level of sales after which company's income s surplus cash. In Ca.B.E non- cash exp are replaced by repayme debt(capital Expenditure). If D.ReP is > Non-cash Exp, cash B Commercial B,E a nd vice versa. I requires value of depriciation to be equal to non-ca

Ca.B.E= Cash BreakEven, D,ReP = Debt Rep

gement

F.c / S - V.C * P.C 31.03

sent that level of sales after which company's income statement start profit. It includes all expenses wether cash or non- cash e.g Interest epay Revenue Exp p debt payment should be equal to depriciation

mmercial break even, F.c = Fix cost, V.c= Variable cost, S = Sales, = Production Capacity

P.C

F.c - non-cash exp+ D.ReP / S - V.C 32.07

nt that level of sales after which company's income statement start showing h. In Ca.B.E non- cash exp are replaced by repayment of principal amount of ital Expenditure). If D.ReP is > Non-cash Exp, cash B.E will be higher then al B,E a nd vice versa. Ideal Debt Management quires value of depriciation to be equal to non-cash expenditure

Ca.B.E= Cash BreakEven, D,ReP = Debt Repayment

You might also like

- Steps in Financial Planning ProcessDocument9 pagesSteps in Financial Planning ProcessMylene SalvadorNo ratings yet

- 109Document34 pages109danara1991No ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- 14 Jan 13Document4 pages14 Jan 13Sneh Toshniwal MaheswariNo ratings yet

- Sanchez Daisy A1Document12 pagesSanchez Daisy A1api-300102702No ratings yet

- CH 4 Solutions To Questions and ProblemsDocument24 pagesCH 4 Solutions To Questions and ProblemsJane Ming0% (1)

- Chap4 (1-15)Document8 pagesChap4 (1-15)Jahanzaib JavaidNo ratings yet

- Chapter 2 Abm 3Document9 pagesChapter 2 Abm 3Joan Mae Angot - Villegas50% (2)

- Chapter 4 SolutionsDocument12 pagesChapter 4 SolutionsSoshiNo ratings yet

- Chipmunk Company FULLDocument9 pagesChipmunk Company FULLJi YuNo ratings yet

- Mini Case - Chapter 3Document5 pagesMini Case - Chapter 3shivam1992No ratings yet

- 333893Document12 pages333893Char MonNo ratings yet

- Solutions To Exam Financial Statement Analysis June 23, 2011Document8 pagesSolutions To Exam Financial Statement Analysis June 23, 2011BuketNo ratings yet

- VebitdaDocument24 pagesVebitdaAndr EiNo ratings yet

- Chapter VDocument7 pagesChapter VJanella LorineNo ratings yet

- Pro Forma Models - StudentsDocument9 pagesPro Forma Models - Studentsshanker23scribd100% (1)

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Bookkeeping Quiz PDFDocument5 pagesBookkeeping Quiz PDFEllie Cerino100% (1)

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDocument46 pages1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaNo ratings yet

- Hi GrowthDocument24 pagesHi Growthminhthuc203No ratings yet

- Final AccountDocument47 pagesFinal Accountsakshi tomarNo ratings yet

- Chapter 6 (Accounting)Document36 pagesChapter 6 (Accounting)yvonneberdosNo ratings yet

- SEx 7Document16 pagesSEx 7Amir Madani100% (1)

- Assignment 3 SolutionsDocument2 pagesAssignment 3 SolutionsHennrocksNo ratings yet

- ForecastingDocument2 pagesForecastinghasnaNo ratings yet

- Acctg Chap 2Document23 pagesAcctg Chap 2Mateo RjNo ratings yet

- CFASDocument3 pagesCFASJerome BaluseroNo ratings yet

- IMT PatanjaliDocument4 pagesIMT PatanjalisquyenNo ratings yet

- Cash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationDocument32 pagesCash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationHanh Mai TranNo ratings yet

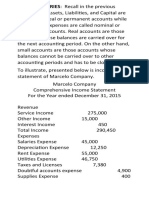

- CLOSING ENTRIES: Recall in The PreviousDocument4 pagesCLOSING ENTRIES: Recall in The PreviousPark ChimmyNo ratings yet

- Chapter 13 SolutionsDocument5 pagesChapter 13 SolutionsStephen Ayala100% (1)

- 4052 Xls Eng Prof BLAINE KITCHENWAREDocument11 pages4052 Xls Eng Prof BLAINE KITCHENWAREMafernanda GR67% (6)

- What Is The Income Statement?Document5 pagesWhat Is The Income Statement?MA ValdezNo ratings yet

- Breakeven Analysis and Payback PeriodDocument6 pagesBreakeven Analysis and Payback PeriodErvin Cajes DetallaNo ratings yet

- Pro Forma Profit and LossDocument2 pagesPro Forma Profit and LossIrem AàmarNo ratings yet

- Final Accounting With AdjustmentDocument20 pagesFinal Accounting With AdjustmentChitranjan Sharma100% (1)

- MBA641 Managerial Accounting Case Study #3Document3 pagesMBA641 Managerial Accounting Case Study #3risvana rahimNo ratings yet

- Responsibility Accounting AssignmentDocument5 pagesResponsibility Accounting AssignmentMikah LabacoNo ratings yet

- SEx 4Document24 pagesSEx 4Amir Madani100% (3)

- CCP102Document22 pagesCCP102api-3849444No ratings yet

- P and L - ReportDocument9 pagesP and L - Reportr.thogitiNo ratings yet

- ENTREP2112 Second Quarter ExamDocument19 pagesENTREP2112 Second Quarter ExamPallas AthenaNo ratings yet

- FABM2 Chapter2Document7 pagesFABM2 Chapter2Archie CampomanesNo ratings yet

- Fm-Answer-Key 2Document5 pagesFm-Answer-Key 2Kitheia Ostrava Reisenchauer100% (3)

- Planning For Growth - Minicase Auto Saved)Document5 pagesPlanning For Growth - Minicase Auto Saved)Ahmed Salim100% (2)

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocument25 pagesPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- Finance 2Document7 pagesFinance 2Vũ Hải YếnNo ratings yet

- Financial ReportingDocument19 pagesFinancial ReportingMd Mehrab HossainNo ratings yet

- Interest Income, Non-BankDocument206 pagesInterest Income, Non-BankArturo RiveroNo ratings yet

- Solution For The Analysis and Use of Financial Statements White G Ch03Document50 pagesSolution For The Analysis and Use of Financial Statements White G Ch03Tamim Rahman0% (1)

- Profit and Loss Statement TemplateDocument8 pagesProfit and Loss Statement TemplateJerarudo BoknoyNo ratings yet

- Chapter 6Document26 pagesChapter 6dshilkarNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- The Comprehensive Guide on How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandThe Comprehensive Guide on How to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 2 out of 5 stars2/5 (1)

- What Is OBDocument5 pagesWhat Is OBHamid Hameed SheikhNo ratings yet

- Invoice: Thank You For Being Our Valued CustomerDocument1 pageInvoice: Thank You For Being Our Valued CustomerHamid Hameed SheikhNo ratings yet

- Fazli Anwar e ElahiDocument95 pagesFazli Anwar e ElahiSHAHID FAROOQNo ratings yet

- Break Even AnalysisDocument11 pagesBreak Even AnalysisHamid Hameed SheikhNo ratings yet

- Sales Force StrategyDocument2 pagesSales Force Strategydeepu0787No ratings yet

- Sales Plan PresentationDocument11 pagesSales Plan PresentationHamid Hameed Sheikh100% (1)

- Haan Main Baghi Hoon by Javed HashmiDocument409 pagesHaan Main Baghi Hoon by Javed HashmiNaeem Ahmed100% (1)

- Quality 5SDocument10 pagesQuality 5SHamid Hameed SheikhNo ratings yet

- Shahadat-e-Imam Hussain (As) by Syed Abul Ala MaudoodiDocument13 pagesShahadat-e-Imam Hussain (As) by Syed Abul Ala MaudoodiSyed Naqvi100% (13)

- Appointment LetterDocument2 pagesAppointment LetterHamid Hameed SheikhNo ratings yet

- Electrical Cables Refrence GuideDocument4 pagesElectrical Cables Refrence GuideHamid Hameed SheikhNo ratings yet