Professional Documents

Culture Documents

Macro Revision Notes Nice and Simple

Macro Revision Notes Nice and Simple

Uploaded by

NahidaAlamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macro Revision Notes Nice and Simple

Macro Revision Notes Nice and Simple

Uploaded by

NahidaAlamCopyright:

Available Formats

1.

Indicators of economic performance

a. Inflation a sustained rise in the general level of prices. i. RPI Retail Price Index. A sample of the population records their expenditure. An index of weighted goods is based upon their spending. The changes in the price of the bas et of goods! show how the price levels are changing over time. ii. RPI" # RPI mortgage repa$ments% because mortgage repa$ments can have distorting effects on the RPI. iii. &PI # RPI" with less weight on housing costs. Is therefore less than RPI". &omplies with '( guidelines so the best 'uropean measure. b. Unemployment the macroeconomic problem of wasted scarce resources labour i. &laimant count all those out of wor and able to claim benefits ii. I)* International )abour *rganisation% based on the )+, -)abour +orce ,urve$.. (nemplo$ed are those who are available for wor and have loo ed for wor in the last month. I)* is better for international comparisons but is costl$. Also is an underestimation because is doesn!t includes part/time wor ers c. Balance of payments record of financial transactions between (0 and other countries. ,plit into different components1 i. &urrent account This is an indication of competitiveness of (0 goods and services. Trade in goods balance -exported goods imported goods. 2 Trade in services balance -exported services imported services. 2Net income flows -interest% profits 3 dividends earned abroad interest% profits 3 dividends paid to foreign holders of (0 assets. 2 Net current transfers -(0 contribution to '( budget. ii. &apital and financial account. 4oth show long term capital flows. Includes1 foreign direct investment% short term capital flows -hot mone$. investments in shares and changes in gold 3 foreign currenc$ reserves. d. Economic Growth measured b$ changes in R'A) 56P per head e. Gross Domestic roduct! Gross National roduct " National Income 56P% 57P and 7I refer to the value of goods and services produced b$ an econom$. 56P can also be viewed as the total income of ever$one in the econom$ or as the total expenditure on the econom$!s output of goods and services. i. 56P at mar et prices # #onsumers$ e%penditure &#' ( ublic authorities$ e%penditure &G' ( )alue of physical increase in stoc*s! gross domestic fi%ed capital formulation &I' ( E%ports &+' Imports &,' ii. 56P at mar et prices # GD at mar*et prices ( -ubsidies Indirect ta%es iii. 57P # GD at mar*et prices ( net property income from abroad iv. 7ational income # GN depreciation. 56P statistics are used to compare standards of living between countries% to build models of the econom$ and to forecast changes in the econom$ /eal GD is better than Nominal GD services at constant prices because real 56P is the value of goods and

Polic$ instruments

-upply2side olicies A range of policies aimed at enhancing the performance of an econom$ b$ strengthening mar et forces and increasing economic incentives -upply2side olicies in 6abour ,ar*ets ma e labour mar et more competitive Education and training increase the number of those able to do wor and improve the s ills of those currentl$ in wor . 6ower income ta% Increase the incentive to wor % more net/income. 6owering benefits gives those on benefits a higher incentive to wor /educing trade union power ma es the labour force more competitive -upply2side olicies in the roduct ,ar*et increase competition and efficienc$ in the mar et rivatisation this will increase or create competition within industries Deregulation this involves opening mar ets to greater competition. It invites more competitors which in turn drives down prices 3ree trade this will increase efficienc$ through the increase in competition and will eep costs low. roblems of -upply2side olicies &Evaluation points' The$ can be effective in the long run but ta e a long time to implement% with no immediate benefits -especiall$ education/ can be decades. Policies might also be morall$ incorrect and lead to a more une8ual distribution of income -cutting benefits is harsh on those who are oliciesdisabled. a range of policies designed to influence the level of aggregate *nl$ wor in the opinion of ,uppl$/side economists i.e. a cut in income 3iscal policy &hanges in wor public expenditure to influence level of A6. tax might not lead some to more.

Demand2side demand.

#hanging ta% levels increasing tax # lower disposable income less A6% decreasing tax # more disposable income more A6 #hanging Government spending higher 5ov. spending # more A6 -b$ multiplier.% lower 5ov. spending # less A6 - b$ negative multiplier. roblems of 3iscal policy +iscal polic$ ta es a long time to implement -taxes have to wait until the annual budget% building a new hospital for example ma$ ta e $ears.. Also% the effect of fiscal polic$ is entirel$ dependant upon the multiplier effect% and also consumer and business confidence. ,onetary policy &ontrolling mone$ variables such as the rate of interest and the mone$ suppl$% to influence Aggregate 6emand. The rate of interest is inversel$ proportional to Aggregate demand -ceteris paribus. as interest rates go up% aggregate demand goes down. This is for a number of reasons. #onsumer Durables ;an$ consumers bu$ these on credit. <hen interest rates are high% repa$ments will be higher so less are purchased. 4ousing ,ar*et =ouses are bought on a mortgage so when interest rates are high% repa$ments are also. -avings rates =igh interest rates increase the ;P, it is more attractive to save% less attractive to

(sing 56P statistics to compare standards of living and national income have serious limitations such as1 population si0e and age distribution -therefore 56P per head is better. Income distribution -56P would onl$ wor if income distributions were e8ual in all countries% because if 9apan!s and 4ra:il!s 56P were the same% then $ou would assume that the standards of living are e8ual% even though 4ra:il!s income distribution is much more uneven than 9apan!s.. E%ternalities -these ma$ affect standards of living. 1uality of life 3 E%change rates

You might also like

- Manual de Reparacion Motor Nissan Td27Document4 pagesManual de Reparacion Motor Nissan Td27Patricio Parada31% (29)

- Engineer's Quick Reference Guide - For Ground InvestigationDocument56 pagesEngineer's Quick Reference Guide - For Ground InvestigationЮлия ДамNo ratings yet

- Embracing The Whole Individual: Advantages of A Dual-Centric Perspective of Work and LifeDocument12 pagesEmbracing The Whole Individual: Advantages of A Dual-Centric Perspective of Work and LifeUMAMA UZAIR MIRZA100% (1)

- Economic For StatisticsDocument4 pagesEconomic For StatisticsJainNo ratings yet

- Unit 2 Economics ProperDocument17 pagesUnit 2 Economics ProperkirstinroseNo ratings yet

- Shwe Htun AssignmentDocument8 pagesShwe Htun AssignmentDrEi Shwesin HtunNo ratings yet

- Econ1102 Macroecnomics 1 Mid-Semester Exam 2013 S2 Question Bank Solutions by Zhi Ying FengDocument17 pagesEcon1102 Macroecnomics 1 Mid-Semester Exam 2013 S2 Question Bank Solutions by Zhi Ying FengJakeRohaldNo ratings yet

- 011 - Measuring The Cost of LivingDocument24 pages011 - Measuring The Cost of LivingRanjitNo ratings yet

- G 12 Economcs 15Document12 pagesG 12 Economcs 15Abdallah HassanNo ratings yet

- Canadian Securities: Overview of EconomicsDocument81 pagesCanadian Securities: Overview of EconomicsNikku SinghNo ratings yet

- The Fundamental Concepts of Macroeconomics: Erandathie PathirajaDocument69 pagesThe Fundamental Concepts of Macroeconomics: Erandathie PathirajaDK White LionNo ratings yet

- Section C:-Essay Questions: Q. Differentiate Between Economies of Scale and Diseconomies of ScaleDocument6 pagesSection C:-Essay Questions: Q. Differentiate Between Economies of Scale and Diseconomies of ScaleIqa IsyiqaNo ratings yet

- 1.1 When Is The Economy Performing Well?: Macroeconomics - Chapter 1Document6 pages1.1 When Is The Economy Performing Well?: Macroeconomics - Chapter 1Kevin D'LimaNo ratings yet

- Macroeconomics Notes!: 5 Macroeconomic ObjectivesDocument7 pagesMacroeconomics Notes!: 5 Macroeconomic ObjectivesHarry JobanputraNo ratings yet

- Business Economic: Dr. Dina YousriDocument24 pagesBusiness Economic: Dr. Dina YousriLilian MichelNo ratings yet

- Macro Session 15 - 16 InflationDocument37 pagesMacro Session 15 - 16 InflationSHRESTI ANDENo ratings yet

- MacroeconomicsDocument8 pagesMacroeconomicscamellNo ratings yet

- BUS 404 Chapter 3Document17 pagesBUS 404 Chapter 3R-540 Mahmud Hasan Batch-105-CNo ratings yet

- ECONOMICS ASSIGNMENT-national Income StatisticsDocument6 pagesECONOMICS ASSIGNMENT-national Income StatisticsTarusengaNo ratings yet

- Unit 5me (New)Document6 pagesUnit 5me (New)Anuj YadavNo ratings yet

- Econ2 NotesDocument8 pagesEcon2 NoteshuuihsduidhuiNo ratings yet

- A2 Economics Chapter 9Document200 pagesA2 Economics Chapter 9Wu JingbiaoNo ratings yet

- Impt TopicDocument7 pagesImpt TopicAcceleration ExNo ratings yet

- Towards Relevant Education For All: National Income AccountingDocument7 pagesTowards Relevant Education For All: National Income AccountingJun Mark Balasico YaboNo ratings yet

- Introduction To MacroeconomicsDocument8 pagesIntroduction To Macroeconomicsksylviakinyanjui2No ratings yet

- Macroeconomics Microeconomics Definition: Measurement of GDPDocument22 pagesMacroeconomics Microeconomics Definition: Measurement of GDPKavya ShahNo ratings yet

- Apuntes Macroeconomía PDFDocument52 pagesApuntes Macroeconomía PDFIsidro Suarez GarciaNo ratings yet

- The International Economic Environment: Chapter - 3Document29 pagesThe International Economic Environment: Chapter - 3Tasnim IslamNo ratings yet

- Unit V National IncomeDocument21 pagesUnit V National IncomemohsinNo ratings yet

- Econ - )Document9 pagesEcon - )Praween BimsaraNo ratings yet

- MacroeceonomicsDocument70 pagesMacroeceonomicsHundeNo ratings yet

- Fiscal PolicyDocument18 pagesFiscal PolicyNathhhNo ratings yet

- Chapter 7 - External Economic Influences On Business ActivityDocument10 pagesChapter 7 - External Economic Influences On Business ActivityJamie HillNo ratings yet

- MN 304 - National Accounting and Macro Economics - 7Document34 pagesMN 304 - National Accounting and Macro Economics - 7Nipuna Thushara WijesekaraNo ratings yet

- AP MacroEconomics Study GuideDocument14 pagesAP MacroEconomics Study GuideRon GorodetskyNo ratings yet

- Economics AssignmentDocument10 pagesEconomics AssignmentRama ChandranNo ratings yet

- Economics Notes - 2Document17 pagesEconomics Notes - 2sindhu pNo ratings yet

- Economics A Level NotesDocument29 pagesEconomics A Level NotesDavid HolmesNo ratings yet

- Comprehensive Outline For Economic Concepts and TheoryDocument9 pagesComprehensive Outline For Economic Concepts and TheorycerapyaNo ratings yet

- Document 17 PDFDocument2 pagesDocument 17 PDFGweyneth DadorNo ratings yet

- PBD Module 1 NotesDocument13 pagesPBD Module 1 Notesafshots422No ratings yet

- PMG Unit 1 Extra Qs 1Document19 pagesPMG Unit 1 Extra Qs 1Loveesh SinglaNo ratings yet

- National IncomeDocument129 pagesNational IncomeBabli PattanaikNo ratings yet

- Summarised Economics NotesDocument52 pagesSummarised Economics Notessashawoody167No ratings yet

- Chapter 9BDocument30 pagesChapter 9BMandarin English CentreNo ratings yet

- Government As ProducerDocument56 pagesGovernment As ProducerrowobelangNo ratings yet

- Trade & DevelopmentDocument4 pagesTrade & DevelopmentAli HasnainNo ratings yet

- National Income AccountingDocument25 pagesNational Income Accountingmba23subhasishchakrabortyNo ratings yet

- макра теорияDocument38 pagesмакра теорияVictoriaNo ratings yet

- ECONTWO Reviewer - National Income Determination (Answers)Document7 pagesECONTWO Reviewer - National Income Determination (Answers)Richmond Esperidion (Sperrydion)No ratings yet

- Measuring The Cost of LivingDocument27 pagesMeasuring The Cost of LivingAnikNo ratings yet

- Aggregate Demand and Aggregate SupplyDocument4 pagesAggregate Demand and Aggregate SupplyAMMAR AZAMNo ratings yet

- Science of Wealth Laws Which Govern Wealth Mankind Allocation of Scarce Optimizing or Maximizing ObjectivesDocument6 pagesScience of Wealth Laws Which Govern Wealth Mankind Allocation of Scarce Optimizing or Maximizing ObjectivesJudy Annbel Regalia CañeteNo ratings yet

- Inflation: Group 9Document19 pagesInflation: Group 9Zusane Dian TabladaNo ratings yet

- Eco TutorialDocument4 pagesEco TutorialKimLee97No ratings yet

- Quiz 1 - MacroeconomyDocument33 pagesQuiz 1 - Macroeconomysantiago.paredes.molinaNo ratings yet

- GDP ProjectDocument11 pagesGDP ProjectNikhil Goyal 141No ratings yet

- Introduction VT2024Document39 pagesIntroduction VT2024aleema anjumNo ratings yet

- Macroeconomic Data (CH 20) PDFDocument11 pagesMacroeconomic Data (CH 20) PDFAlicia CataláNo ratings yet

- ch4 Government and The MacroeconomyDocument21 pagesch4 Government and The MacroeconomyNeeha KaziNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- Spreading: Knitwear Production PlanningDocument3 pagesSpreading: Knitwear Production PlanningAbhinav VermaNo ratings yet

- Psalm 110 The King and The PriestDocument19 pagesPsalm 110 The King and The Priestanibal_santelizNo ratings yet

- Voluntary Actions and Social MovementsDocument20 pagesVoluntary Actions and Social MovementsgmNo ratings yet

- Contemporary Philippine Arts From The RegionsDocument22 pagesContemporary Philippine Arts From The RegionsCherry ChanelNo ratings yet

- Case DigestsDocument209 pagesCase DigestsEloisa Katrina MadambaNo ratings yet

- Ehsaas Payment Centers List 2021Document34 pagesEhsaas Payment Centers List 2021incpak80% (10)

- Shoring, Underpinning and ScaffoldingDocument50 pagesShoring, Underpinning and ScaffoldingTanvir ShovonNo ratings yet

- Safe Back Exercises: The Extensors. Craig LiebensonDocument1 pageSafe Back Exercises: The Extensors. Craig LiebensonrojexeNo ratings yet

- Routine Stool ExaminationDocument2 pagesRoutine Stool ExaminationarvenemartinNo ratings yet

- Dell EMC Unity: Unisphere OverviewDocument41 pagesDell EMC Unity: Unisphere OverviewJim SmithNo ratings yet

- Younity - in New Year Jamboree Sale 2022Document1 pageYounity - in New Year Jamboree Sale 2022Aryan RanaNo ratings yet

- Hybrid Electric VDocument23 pagesHybrid Electric VDeepesh HingoraniNo ratings yet

- Export SunnyDocument12 pagesExport SunnySunny RajputNo ratings yet

- Literary Appreciation SkillsDocument69 pagesLiterary Appreciation SkillsAlmarez BastyNo ratings yet

- Analele Stiintifice Ale Universitatii A. I. Cuza, Iasi, Nr.1, 2008Document337 pagesAnalele Stiintifice Ale Universitatii A. I. Cuza, Iasi, Nr.1, 2008emilmanea100% (1)

- 10 - The Farm Business SurveyDocument48 pages10 - The Farm Business SurveySeyha L. AgriFoodNo ratings yet

- Ict ModuleDocument26 pagesIct ModuleSai GuyoNo ratings yet

- CH 14 A New Spirit of ChangeDocument38 pagesCH 14 A New Spirit of Changeapi-134134588No ratings yet

- 2101 Study QuestionsDocument13 pages2101 Study QuestionsMarcusKlahnTokoeJr.No ratings yet

- Liquidity Provision and Market Making by HftsDocument49 pagesLiquidity Provision and Market Making by HftsLuca PilottiNo ratings yet

- Effects of Earthquakes On Dams and Embankments By: Fifth RankineDocument22 pagesEffects of Earthquakes On Dams and Embankments By: Fifth RankineΚική ΚωστοπούλουNo ratings yet

- Smyth, Herbert Weir: Greek GrammarDocument798 pagesSmyth, Herbert Weir: Greek GrammarDavid-Artur Daix86% (7)

- Tuna BurgersDocument1 pageTuna BurgersmirnafkhouryNo ratings yet

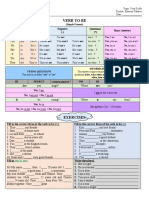

- Verb To Be: Positive (+) Negative (-) Questions (?) Short AnswersDocument2 pagesVerb To Be: Positive (+) Negative (-) Questions (?) Short AnswersSalazar marceNo ratings yet

- Practical 1b - TESTING OF AGGREGATES PDFDocument8 pagesPractical 1b - TESTING OF AGGREGATES PDFAisyah NadhirahNo ratings yet

- AP6171 - 1.2 - 2020APM008 - Siddharth Soumya Roy Report PDFDocument9 pagesAP6171 - 1.2 - 2020APM008 - Siddharth Soumya Roy Report PDFsiddharthasoumyaroyNo ratings yet

- 3 Different Ways To Display Progress in An ASP - Net AJAXDocument7 pages3 Different Ways To Display Progress in An ASP - Net AJAXNehaNo ratings yet