Professional Documents

Culture Documents

Dividend Decisions: Ans: (A) Rs 112 (B) Rs 102 (C) 5883 Shares

Dividend Decisions: Ans: (A) Rs 112 (B) Rs 102 (C) 5883 Shares

Uploaded by

Vincent ClementOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dividend Decisions: Ans: (A) Rs 112 (B) Rs 102 (C) 5883 Shares

Dividend Decisions: Ans: (A) Rs 112 (B) Rs 102 (C) 5883 Shares

Uploaded by

Vincent ClementCopyright:

Available Formats

Dividend Decisions

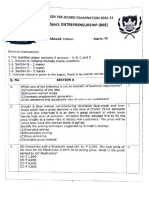

1. RST Ltd has a capital of Rs 10,00,000 in equity shares of Rs 100 each. The shares

are currently quoted at par. The company proposes to declare a dividend of Rs 10 per

share at the end of the current financial year. The capitalization rate for the risk class of

which the company elon!s is 1"#. $hat will e the market price of the share at the end

of the year, if

%a& a dividend is not cleared'

%& a dividend is declared'

%c& assumin! that the company pays the dividend and has net profits of Rs (,00,000

and makes new investments of Rs 10,00,000 durin! the period, how many new

shares must e issued' )se the ** model.

[CA Final, Nov. 2008]

Ans: (a) Rs 112; (b) Rs 102; (c) 5883 shares

2. + company has a ook value per share of Rs 1,-..0. /ts return on equity is 1(# and

it follows a policy of retainin! 00# of its earnin!s. /f the 1pportunity 2ost of 2apital is

1.#, what is the price of the share today'

[CA Final, a! 2002]

Ans: Rs 103.35

3. Sahu 3 2o. earns Rs 0 per share havin! capitalization rate of 10 per cent and has a

return on investment at the rate of "0 per cent. +ccordin! to $alter4s model, what should

e the price per share at ,0 per cent dividend payout ratio' /s this the optimum payout

ratio as per $alter'

[CA Final, Nov. 2002]

Ans: "rice #er share Rs 102;

"a!o$% ra%io is no% o#%i&$&.

4. 5 Ltd has . lakh equity shares outstandin! at the e!innin! of the year "00,. The

current market price per share is Rs 1"0. The 6oard of 7irectors of the company is

contemplatin! Rs 0.8 per share as dividend. The rate of capitalization, appropriate to the

risk9class to which the company elon!s, is :.0#.

%i& 6ased on ** +pproach, calculate the market price of the share of the company,

when the dividend is;%a& declared< and %& not declared.

%ii& =ow many new shares are to e issued y the company, if the company desires to

fund an investment ud!et of Rs ,."0 crores y the end of the year assumin! net

income for the year will e Rs 1.00 crores'

[CA Final, a! 2003]

Ans: 'ivi(en( (eclare( 'ivi(en( no% (eclare(

(i) 125.12 131.52

(ii)1,)8,*+8 1,21,)55.

5. The followin! fi!ures are collected from the annual report of 5>? Ltd@

Rs lakh

Aet Brofit ,0

1utstandin! 1"# preference shares 100

Ao. of equity shares ,

Return on /nvestment "0#

$hat should e the approCimate dividend payout ratio so as to keep the share price at

Rs 8" y usin! $alter model'

[CA Final, a! 2005]

Ans: 'ivi(en( #a!o$% ra%io 52,, cos% o- ca#i%al 1),.

6. The followin! information pertains to *Ds 5> Ltd@

Earnin!s of the 2ompany Rs (,00,000

7ividend Bayout ratio 00#

Ao. of shares outstandin! 1,00,000

Equity capitalization rate 1"#

Rate of return on investment 1(#

%i& $hat would e the market value per share as per $alter4s model'

%ii& $hat is the optimum dividend payout ratio accordin! to $alter4s model and the

market value of 2ompany4s share at that payout ratio'

[CA Final, a! 200)]

Ans: (i) Rs. .5.83, (ii) /#%i&$& (ivi(en( #a!o$%

ra%io N01, ar2e% val$e o- co&#an!3s share Rs 52.08.

7. A62 Ltd has (0,000 outstandin! shares. The current market price per share is Rs

100 each. /t hopes to make a net income of Rs (,00,000 at the end of current year. The

company4s 6oard is considerin! a dividend of Rs ( per share at the end of current

financial year. The company needs to raise Rs 10,00,000 for an approved investment

eCpenditure. The company elon!s to a risk class for which the capitalization rate is

10#. Show how does the ** approach affect the value of firm if the dividends are paid

or not paid.

[CA Final, Nov. 200)]

Ans: 4al$e i- -ir& re&ains share a% Rs 50,00,000.

5he%her %he (ivi(en(s one #ai( o- no%

8. The followin! information is supplied to you@

Rs

Total Earnin!s ",00,000

Ao. of equity shares %of Rs 100 each& "0,000

7ividend paid 1,(0,000

BriceDEarnin! ratio 1".(

%a& +scertain whether the company is the followin! an optimal dividend policy.

%& Find out what should e the BDE ratio at which the dividend policy will have no

effect on the value of the share.

%c& $ill your decision chan!e, if the BDE ratio is . instead of 1".('

[CA Final, a! 200*]

Ans: (i) Co&#an! is no% -ollo6in7 or o#%i&al (ivi(en( #olic! &ar2e% #rice

o- %he share can be increase( b! a(o#%in7 a 8ero #a!o$%.

(ii) "9: ; 10, %he (ivi(en( #olic! 6o$l( have no

e--ec% on %he val$e o- %he shares.

9. * Ltd elon!s to a risk class for which the capitalization rate is 10#. /t has "(,000

outstandin! shares and the current market price is Rs 100. /t eCpects a net profit of Rs

",(0,000 for the year and the 6oard is considerin! dividend of Rs ( per share.

* Ltd requires to raise Rs (,00,000 for an approved investment eCpenditure. Show,

how does the ** approach affect the value of * Ltd, if dividends are paid or not paid.

[CA Final, a! 2008]

Ans: 4al$e o- 1%( in bo%h cases Rs 30,00,0)0.

You might also like

- Revenue (Sales) XXX (-) Variable Costs XXXDocument10 pagesRevenue (Sales) XXX (-) Variable Costs XXXNageshwar SinghNo ratings yet

- Capital Budgeting Sums-Doc For PDF (Encrypted)Document7 pagesCapital Budgeting Sums-Doc For PDF (Encrypted)Prasad GharatNo ratings yet

- Sample PaperDocument8 pagesSample Paperneilpatrel31No ratings yet

- Arabtec FSDocument46 pagesArabtec FSShakib ApNo ratings yet

- Dividend DecisionsDocument3 pagesDividend Decisionsjdon50% (2)

- Analysis of Fund Flow StatementDocument5 pagesAnalysis of Fund Flow Statements_ripunjay100% (2)

- Financial Forecasting Planning 1226943025978198 9Document20 pagesFinancial Forecasting Planning 1226943025978198 9Surya PratapNo ratings yet

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDocument39 pagesFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNo ratings yet

- Aggregate Planning in A Supply ChainDocument9 pagesAggregate Planning in A Supply ChainThiru VenkatNo ratings yet

- Research ProposalDocument7 pagesResearch Proposalpachpind jayeshNo ratings yet

- Dividend Policy": Term Paper - I On Corporate Financial ManagementDocument10 pagesDividend Policy": Term Paper - I On Corporate Financial ManagementbodhikolNo ratings yet

- Working CapitalDocument66 pagesWorking CapitalAamit KumarNo ratings yet

- FM Class Notes Day1Document5 pagesFM Class Notes Day1febycvNo ratings yet

- Dividend Policy: Dividend Decision and Valuation of FirmsDocument14 pagesDividend Policy: Dividend Decision and Valuation of Firmsvarsha raichalNo ratings yet

- Biniyam Yitbarek Article Review On Financial AnalysisDocument6 pagesBiniyam Yitbarek Article Review On Financial AnalysisBiniyam Yitbarek100% (1)

- Project On Inventory ManagementDocument40 pagesProject On Inventory ManagementsarvajithNo ratings yet

- Marginal and Profit Planning - Unit IV CH 4Document22 pagesMarginal and Profit Planning - Unit IV CH 4devika125790% (1)

- Analysis of Financial StatementDocument23 pagesAnalysis of Financial StatementMohammad Tariq AnsariNo ratings yet

- Unit 2 Capital StructureDocument27 pagesUnit 2 Capital StructureNeha RastogiNo ratings yet

- The Cost of CapitalDocument18 pagesThe Cost of CapitalzewdieNo ratings yet

- MCQ of Corporate Valuation Mergers AcquisitionsDocument19 pagesMCQ of Corporate Valuation Mergers AcquisitionsNuman AliNo ratings yet

- Invt FM 1 Chapter-3Document56 pagesInvt FM 1 Chapter-3Khalid Muhammad100% (1)

- LPP FormulationDocument15 pagesLPP FormulationGaurav Somani0% (2)

- International Cash ManagementDocument52 pagesInternational Cash ManagementPanashe MachekepfuNo ratings yet

- Financial ManagementDocument89 pagesFinancial ManagementDHARANI PRIYANo ratings yet

- Afm AssignmentDocument17 pagesAfm AssignmentHabtamuNo ratings yet

- Sharpe Treynor N JensenDocument4 pagesSharpe Treynor N JensenjustsatyaNo ratings yet

- Chapter 3 Valuation and Cost of CapitalDocument92 pagesChapter 3 Valuation and Cost of Capitalyemisrach fikiruNo ratings yet

- Banking CompaniesDocument68 pagesBanking CompaniesKiran100% (2)

- Chapter (4) : Fund Flow Statements: Saoud Chayed MashkourDocument18 pagesChapter (4) : Fund Flow Statements: Saoud Chayed MashkourParamesh Miracle100% (1)

- Ilide - Info Review Qs PRDocument93 pagesIlide - Info Review Qs PRMobashir KabirNo ratings yet

- CH 6 Cost Volume Profit Revised Mar 18Document84 pagesCH 6 Cost Volume Profit Revised Mar 18beccafabbriNo ratings yet

- Chapter01 2Document10 pagesChapter01 2Subhankar PatraNo ratings yet

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Case 1-4 Boeing's E-Enabled AdvantageDocument12 pagesCase 1-4 Boeing's E-Enabled AdvantageanjiroNo ratings yet

- Final Internship Report On ASSET FINAnING 2 by Sachin GautamDocument97 pagesFinal Internship Report On ASSET FINAnING 2 by Sachin GautamSachin GautamNo ratings yet

- TYBFM Sem 6 Mutual Fund ManagementDocument53 pagesTYBFM Sem 6 Mutual Fund ManagementHitesh BaneNo ratings yet

- 13 08 20 Final Capital Market ADDIS ABABA UNIVERSITYDocument2 pages13 08 20 Final Capital Market ADDIS ABABA UNIVERSITYchere100% (2)

- AssignmentDocument1 pageAssignmentOumer ShaffiNo ratings yet

- Working Capital ManagementDocument44 pagesWorking Capital ManagementPhaniraj Lenkalapally100% (1)

- Cash ManagementDocument9 pagesCash ManagementMeenakshi SundaramNo ratings yet

- Amalgamation of Firms ProjectDocument5 pagesAmalgamation of Firms ProjectkalaswamiNo ratings yet

- CS Executive MCQ and Risk AnalysisDocument17 pagesCS Executive MCQ and Risk Analysis19101977No ratings yet

- 11 - Funds Flow AnalysisDocument6 pages11 - Funds Flow AnalysisMantu KumarNo ratings yet

- File 3Document77 pagesFile 3Othow Cham AballaNo ratings yet

- 7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFDocument32 pages7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFPrasanna SharmaNo ratings yet

- Learning Curves and ApplicationsDocument10 pagesLearning Curves and ApplicationsDarshan N GangolliNo ratings yet

- Hypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDDocument25 pagesHypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDlovels_agrawal6313No ratings yet

- 06 Financial Estimates and ProjectionsDocument19 pages06 Financial Estimates and ProjectionsSri RanjaniNo ratings yet

- B. Ed. Prospectus 2011Document16 pagesB. Ed. Prospectus 2011deepak4uNo ratings yet

- Issue ManagementDocument194 pagesIssue ManagementBubune KofiNo ratings yet

- FINANCIAL MANAGEMENT Assignment 2Document14 pagesFINANCIAL MANAGEMENT Assignment 2dangerous saifNo ratings yet

- Marginal Costing - Brief Cases and Solutions PDFDocument7 pagesMarginal Costing - Brief Cases and Solutions PDFKaranSinghNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- True OR False Type Questions: 3:-Change IN Profit Sharing Ratio Among Existing PartnersDocument2 pagesTrue OR False Type Questions: 3:-Change IN Profit Sharing Ratio Among Existing PartnersabiNo ratings yet

- Chapter 10 Management of Translation Exposure Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument18 pagesChapter 10 Management of Translation Exposure Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsOyeleye TofunmiNo ratings yet

- Capital Structure TheoriesDocument47 pagesCapital Structure Theoriesamol_more37No ratings yet

- Business Accounting Course Outline 2021Document7 pagesBusiness Accounting Course Outline 2021Everjoice Chatora100% (1)

- 1.3 M1 - Dividends Question SetDocument3 pages1.3 M1 - Dividends Question Setshyla negiNo ratings yet

- A) Walter's Model:: Advanced Financial Management Examples On Unit No - 5 Dividend Policy and Firm ValueDocument6 pagesA) Walter's Model:: Advanced Financial Management Examples On Unit No - 5 Dividend Policy and Firm Valuesakshisharma17164No ratings yet

- OICL Assistant 2012 Paper SolvedDocument10 pagesOICL Assistant 2012 Paper SolvedRatnadeep MitraNo ratings yet

- KYC - Know Your CustomerDocument2 pagesKYC - Know Your CustomerRatnadeep Mitra0% (1)

- HSBC Question PaperDocument5 pagesHSBC Question PaperRatnadeep Mitra100% (2)

- HSBC Placement Paper Aptitude ReasoningDocument6 pagesHSBC Placement Paper Aptitude ReasoningRatnadeep Mitra67% (3)

- PMLADocument28 pagesPMLARatnadeep MitraNo ratings yet

- Cover Letter EmailDocument1 pageCover Letter EmailRatnadeep MitraNo ratings yet

- HSBC Placement Paper English LanguageDocument4 pagesHSBC Placement Paper English LanguageRatnadeep Mitra100% (1)

- Subsidized Credit To MicroreditDocument14 pagesSubsidized Credit To MicroreditRatnadeep MitraNo ratings yet

- Credit Research: Corporate BondsDocument43 pagesCredit Research: Corporate BondsRatnadeep MitraNo ratings yet

- MIFDocument5 pagesMIFRatnadeep MitraNo ratings yet

- Problems of Rural LendingDocument6 pagesProblems of Rural LendingRatnadeep MitraNo ratings yet

- Magnitude of Poverty in IndiaDocument9 pagesMagnitude of Poverty in IndiaRatnadeep MitraNo ratings yet

- Credit Rating of NgosDocument10 pagesCredit Rating of NgosRatnadeep MitraNo ratings yet

- Role of NabardDocument1 pageRole of NabardRatnadeep MitraNo ratings yet

- Functions of SIDBIDocument2 pagesFunctions of SIDBIRatnadeep MitraNo ratings yet

- Financial InclusionDocument2 pagesFinancial InclusionRatnadeep MitraNo ratings yet

- Date Price Return Mean of Return Var: Frequency DistributionDocument3 pagesDate Price Return Mean of Return Var: Frequency DistributionRatnadeep MitraNo ratings yet

- Allahabad Bank, Indian Overseas Bank & Sompo Japan Insurance To Infuse Rs 200 CR in Universal SompoDocument3 pagesAllahabad Bank, Indian Overseas Bank & Sompo Japan Insurance To Infuse Rs 200 CR in Universal SompoRatnadeep MitraNo ratings yet

- Fixed Income Market Assignment: "Calculation of Clean Price of A Bond & Var"Document2 pagesFixed Income Market Assignment: "Calculation of Clean Price of A Bond & Var"Ratnadeep MitraNo ratings yet

- Indian Insurance Market: Life Insurance Business PerformanceDocument2 pagesIndian Insurance Market: Life Insurance Business PerformanceRatnadeep MitraNo ratings yet

- Case Study On Infrastructure FinanceDocument10 pagesCase Study On Infrastructure FinanceRatnadeep MitraNo ratings yet

- 1 Pivots-1 PDFDocument5 pages1 Pivots-1 PDFKalpesh Shah100% (1)

- Airline Jet Fuel Hedging Theory and PracticeDocument19 pagesAirline Jet Fuel Hedging Theory and PracticeKo KoNo ratings yet

- Chapter 3Document16 pagesChapter 3mark sanadNo ratings yet

- Manju Honda Finance ProjectDocument101 pagesManju Honda Finance Projectpriyanka repalle100% (2)

- RM Music Worksheet For The Ended Period July, 31 2016Document25 pagesRM Music Worksheet For The Ended Period July, 31 2016AmandaNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V04 Fillable FinalDocument2 pagesSLF065 MultiPurposeLoanApplicationForm V04 Fillable FinalKristyl AmbitaNo ratings yet

- Canada Post ReportDocument202 pagesCanada Post ReportrgranatsteinNo ratings yet

- Receivables Discussion QuestionDocument17 pagesReceivables Discussion QuestionAngelica TalledoNo ratings yet

- Daftar AkunDocument2 pagesDaftar Akunike sinagaNo ratings yet

- MAS CompiledDocument5 pagesMAS CompiledadorableperezNo ratings yet

- Topic 5 - Evaluating Business OpportunitiesDocument32 pagesTopic 5 - Evaluating Business OpportunitiesAisyNo ratings yet

- CPSPM 66257312 1702746681Document28 pagesCPSPM 66257312 1702746681BidhinNo ratings yet

- Goldman Sachs Growth Equity: Themes, Insights, and Investment Opportunities in Global GrowthDocument49 pagesGoldman Sachs Growth Equity: Themes, Insights, and Investment Opportunities in Global GrowthSaad AliNo ratings yet

- DOP WhitepaperDocument23 pagesDOP Whitepaperarjunkushwaha750No ratings yet

- HTFDRecent SalesDocument11 pagesHTFDRecent Salespostbox7310% (1)

- AmcDocument9 pagesAmcerode els erodeNo ratings yet

- Security Interest in Movable Property Act 2019Document24 pagesSecurity Interest in Movable Property Act 2019Babirye ShamirahNo ratings yet

- Alliance Trust Full Sipp Handbook 2011Document14 pagesAlliance Trust Full Sipp Handbook 2011rohit1000No ratings yet

- Adrian, T. & Brunnermeier, M. (2008) CoVaRDocument53 pagesAdrian, T. & Brunnermeier, M. (2008) CoVaRMateo ReinosoNo ratings yet

- MAE - P4 Chapter 5Document2 pagesMAE - P4 Chapter 5Leah Mae NolascoNo ratings yet

- Process Econ S1 2021 Evaluation of Alternatives Wk14Document16 pagesProcess Econ S1 2021 Evaluation of Alternatives Wk14Farhan MuhamadNo ratings yet

- Ratio Analysis Case Study SolutionDocument7 pagesRatio Analysis Case Study SolutionRanjuNo ratings yet

- International-Expansion Entry Modes by AcquisitionDocument14 pagesInternational-Expansion Entry Modes by AcquisitionWm NajmuddinNo ratings yet

- Final Report MBA501Document23 pagesFinal Report MBA501Palash AGSNo ratings yet

- EPS Common QP PDFDocument9 pagesEPS Common QP PDFAdrian D'souzaNo ratings yet

- Q1 2023 PitchBook Private Capital IndexesDocument24 pagesQ1 2023 PitchBook Private Capital IndexesmarianoveNo ratings yet

- A Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Document36 pagesA Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Kshitij ThakurNo ratings yet

- University Entrepreneurship Report - CB InsightsDocument60 pagesUniversity Entrepreneurship Report - CB InsightsAlex LuceNo ratings yet

- Post Employment BenefitsDocument31 pagesPost Employment BenefitsSky SoronoiNo ratings yet