Professional Documents

Culture Documents

Questions Ibanks

Questions Ibanks

Uploaded by

Sandeep ChowdhuryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions Ibanks

Questions Ibanks

Uploaded by

Sandeep ChowdhuryCopyright:

Available Formats

General Questions for INVESTMENT BANKING

1. What is the mobility across industry groups and product groups within the firm?

For instance, can I after some time (say 1 or 2 years) moe from an !"# role to a

corporate finance role or from the healthcare sector to the $!$ sector?

2. In all inestment ban%s there is a &china wall' between the inestment ban%ing side

and research and trading. What is the interaction of the Inestment ban%ing team

with the research and other departments and how does %nowledge sharing ta%e

place between them?

(. #fter a while in any inestment ban%, an employee gets assigned to an industry

coerage group. Industry groups are formed based on the mar%et perception of &hot'

areas. What happens to an aerage employee if he)she*

+ets assigned to an area in which there is relatiely less business at the

moment. For e,ample telecom in India became hot a couple of years bac%,

before that there was hardly any actiity. In such a case does this person get an

opportunity to get inoled with deals in some other industry group?

$!$ is one of the primary thrust areas of most Inestment ban%s. What if I get

assigned to the $!$ sector now, deelop s%ills in this sector and the sector goes

out of the mar%et-s faour after (./ years? 0ow do I then moe to another sector

and deelop s%ills in a new industry from scratch?

/. $raders are %nown for haing a typical life of 1.12 years before they moe out. Is

there any such burn.out time for inestment ban%ers too? If yes, what are the %ind of

e,it options that ban%ers typically hae?

3. #re moements to ban%ing from sales)research)trading possible and ice.ersa?

Why?

4. Inestment ban%ing is generally belieed to be the most ulnerable to mar%et ups

and downs. What has been your e,perience)obseration regarding this?

Questions for J.P. Morgan Chase & Co.

For how long does a new recruit wor% in a generalist role before being assigned to

an industry team?

0ow is the organi5ation structured within Inestment 6an%ing? 7pecifically, are !"#

and 8apital raising the two product groups, or are there separate teams for

7yndicated Finance, 9ebt 8apital !ar%ets and :;uity 8apital !ar%ets within capital

raising?

What is the hierarchy within the Inestment ban%ing group? 0ow do teams typically

get formed for a deal?

$eam si5e, no. of people from different leels, role of the senior analyst

8ould you tell me about the training program for new hires in Inestment ban%ing? It

was mentioned during the <<$ that the program is spread oer a period of time.

0ow does this wor% and what are the s%ill sets that one is trained to deelop at each

stage?

What is the geographical mobility within the firm? 0ow often does one get to wor% on

a deal which is being e,ecuted by another office?

I beliee that that there is a (42 degree ealuation program in the organi5ation.

+ien the strong team culture in the firm, how is indiidual performance ealuated? I

thin%, based on the <<$ and some articles that I hae read about the firm, that =<!

has an entrepreneurial culture. 0ow does this culture permeate the inestment

ban%ing business gien the heay emphasis on team wor%, is the accountability also

team specific rather than indiidual specific?

=<! has singled out $!$ as the thrust area for the future. What will the thrust

regions for the Inestment ban%ing team going ahead? What is the commitment to

#sia <acific and India?

=<! has been oted >o. 1 in #sian !"# e,. =apan by $hompson Financial 7urey.

What steps are being ta%en)will be ta%en to accomplish similar a similar feat in

capital raising also? =< !organ would be haing uni;ue strengths in this area gien

its balance sheet strength, long.standing relationships, innoation and global

distribution capabilities. What is the e,tra effort re;uired to become >o. 1 or >o. 2 in

capital raising too both in e;uities and debt?

You might also like

- CIO Interview QuestionsDocument7 pagesCIO Interview QuestionsViju NeduvathoorNo ratings yet

- Business Plan ChecklistDocument7 pagesBusiness Plan ChecklistBruna JunckesNo ratings yet

- 49 Interview Questions For The CIODocument4 pages49 Interview Questions For The CIOyagayNo ratings yet

- Special Considerations of High Yield Credit AnalysisDocument30 pagesSpecial Considerations of High Yield Credit AnalysisTaanNo ratings yet

- Summit Point FaqDocument3 pagesSummit Point Faqapi-255112852No ratings yet

- BIR Form No. 0608 PDFDocument2 pagesBIR Form No. 0608 PDFPaolo MartinNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Hire Purchase IDocument3 pagesHire Purchase IJelena CientaNo ratings yet

- 23 Bulaong vs. Gonzales (Digest)Document4 pages23 Bulaong vs. Gonzales (Digest)Monchi de Lumen100% (1)

- Organizational Case StudyDocument39 pagesOrganizational Case StudyHelen Grace Avila0% (1)

- Accenture Outlook Change Capable OrganizationDocument11 pagesAccenture Outlook Change Capable OrganizationjibranqqNo ratings yet

- Farm Mech in WBDocument8 pagesFarm Mech in WBSubhasis MishraNo ratings yet

- Civil Law Review 2 Case DigestDocument65 pagesCivil Law Review 2 Case DigestyanieggNo ratings yet

- Circular No 905Document55 pagesCircular No 905chrisNo ratings yet

- Understanding BPODocument40 pagesUnderstanding BPOHarihar PratihariNo ratings yet

- Part 4 Case 2 Digest Torres vs. LimjapDocument1 pagePart 4 Case 2 Digest Torres vs. Limjapemmaniago08100% (1)

- Talent - Building A New Talent Management ModelDocument13 pagesTalent - Building A New Talent Management ModelAstri PratiwiNo ratings yet

- Gowtham Yadav BBA3CDocument3 pagesGowtham Yadav BBA3CGowtham yadav YadavNo ratings yet

- BSBMGT616: Develop and Implement Strategic PlansDocument31 pagesBSBMGT616: Develop and Implement Strategic PlansChunhui Lo100% (1)

- Siddharth VivaDocument49 pagesSiddharth Vivamerugu manojNo ratings yet

- Diversity in RecruitmentDocument19 pagesDiversity in RecruitmentumangNo ratings yet

- Literature Review For Impact of Mergers & Acquisitions On: Human Resource Practices in IT IndustryDocument15 pagesLiterature Review For Impact of Mergers & Acquisitions On: Human Resource Practices in IT Industryasmita_matrix1983No ratings yet

- Possible Detailed Questions For The Internship Report 2021Document5 pagesPossible Detailed Questions For The Internship Report 2021Quentin CheretNo ratings yet

- Mba Dissertation Reports in FinanceDocument4 pagesMba Dissertation Reports in FinancePapersWritingHelpSingapore100% (1)

- Firm Analysis - OUTLINEDocument4 pagesFirm Analysis - OUTLINEMylyn DabuNo ratings yet

- Review of Research Paper On Relationship Between Size Complexity and Organizational StructrureDocument5 pagesReview of Research Paper On Relationship Between Size Complexity and Organizational StructrureGourav BaidNo ratings yet

- Strategic Management and Business PolicyDocument6 pagesStrategic Management and Business PolicyBrandon WarrenNo ratings yet

- Solution To Assign2Document1 pageSolution To Assign2Mahlab RajpootNo ratings yet

- PG 2nd PageDocument31 pagesPG 2nd PageThilak.TNo ratings yet

- Literature Review On Attrition and RetentionDocument8 pagesLiterature Review On Attrition and Retentionafdtuwxrb100% (1)

- Accounting Textbook Solutions - 46Document19 pagesAccounting Textbook Solutions - 46acc-expertNo ratings yet

- Initial Application: "Am I A Good Fit For The Global Innovation Fund?"Document2 pagesInitial Application: "Am I A Good Fit For The Global Innovation Fund?"Priscila FerreiraNo ratings yet

- Question 1Document3 pagesQuestion 1blablablaNo ratings yet

- Questions For HRM and Change ManagementDocument4 pagesQuestions For HRM and Change ManagementShilpika ShettyNo ratings yet

- Us7222 Pengantar Kepada Keusahawanan BI07160108Document5 pagesUs7222 Pengantar Kepada Keusahawanan BI07160108RadenSue Raden Abd MuinNo ratings yet

- Priyadarsini GDocument78 pagesPriyadarsini GPRIYADARSINI GNo ratings yet

- Chapter 1Document22 pagesChapter 1Yvonne BerdosNo ratings yet

- ExportDocument9 pagesExportayan khanNo ratings yet

- Ascent 19 JanDocument5 pagesAscent 19 Jansyedfarhan11No ratings yet

- Organizational Theory, Structure and PracticeDocument10 pagesOrganizational Theory, Structure and PracticeAkshatNo ratings yet

- Unit 1: Alliances: 1. What Types of Corporate Alliances Are There?Document36 pagesUnit 1: Alliances: 1. What Types of Corporate Alliances Are There?nguyễn thắngNo ratings yet

- 1.3.2 Organizational ObjectivesDocument2 pages1.3.2 Organizational Objectivesa01178999No ratings yet

- Dissertation GovernanceDocument4 pagesDissertation GovernancePayingSomeoneToWriteAPaperSingapore100% (1)

- Account and Finance DissertationDocument6 pagesAccount and Finance DissertationCustomPaperServicesCanada100% (1)

- Dissertation Report On FinanceDocument8 pagesDissertation Report On FinanceBuyingPapersOnlineCollegeRochester100% (1)

- Masters Dissertation Topics in FinanceDocument4 pagesMasters Dissertation Topics in FinanceCustomPapersOnlineBatonRouge100% (1)

- PortfolioDocument4 pagesPortfolioDeliya GurungNo ratings yet

- Tutorial PackDocument6 pagesTutorial PackSamiul KhanNo ratings yet

- Wahaj - Group - Project (1-3) RevisedDocument21 pagesWahaj - Group - Project (1-3) RevisedNandhiniNo ratings yet

- Research Paper On Manpower Planning PDFDocument8 pagesResearch Paper On Manpower Planning PDFafnhdcebalreda100% (1)

- Industrial RelationsDocument4 pagesIndustrial RelationsViraja GuruNo ratings yet

- Competing For The Future - Hamel&prahaladDocument15 pagesCompeting For The Future - Hamel&prahaladgendut_novriNo ratings yet

- Return On TalentDocument4 pagesReturn On TalentdugdugdugdugiNo ratings yet

- International HR AssignmentDocument7 pagesInternational HR AssignmentISHAN JHA PGP 2020 BatchNo ratings yet

- Multinational Company 5Document4 pagesMultinational Company 5Imran maqboolNo ratings yet

- Research Methodology - NiteshDocument9 pagesResearch Methodology - NiteshNitesh AgrawalNo ratings yet

- Revised Chapter 1 - BPODocument11 pagesRevised Chapter 1 - BPOJP Ramos DatinguinooNo ratings yet

- Soft Skills + Hard Skills Which One Is Important?: It Depends Highly On The Career You ChooseDocument6 pagesSoft Skills + Hard Skills Which One Is Important?: It Depends Highly On The Career You ChoosedhruvNo ratings yet

- Lesson 2 Organization PDFDocument20 pagesLesson 2 Organization PDFAngelita Dela cruzNo ratings yet

- Assignment No.7Document2 pagesAssignment No.7Romeo ChuaNo ratings yet

- Contract Management Languishes inDocument4 pagesContract Management Languishes inGregg BarrettNo ratings yet

- SPE 93680 Career Development System: A Giant Nascent: WWW - Petroman.irDocument27 pagesSPE 93680 Career Development System: A Giant Nascent: WWW - Petroman.irmsmsoft90No ratings yet

- Assessment 2Document14 pagesAssessment 2andrew etheredgeNo ratings yet

- Strategic Management Term Paper TopicsDocument6 pagesStrategic Management Term Paper Topicsc5h71zzc100% (1)

- Multinational Company Paper 2Document4 pagesMultinational Company Paper 2Imran maqboolNo ratings yet

- Employment / Recruitment Agencies: Recruitment - External Recruitment What Is External Recruitment?Document6 pagesEmployment / Recruitment Agencies: Recruitment - External Recruitment What Is External Recruitment?Daouda ThiamNo ratings yet

- CS AssignmentDocument14 pagesCS AssignmentSamrin KhanNo ratings yet

- Mba Master Thesis PDFDocument4 pagesMba Master Thesis PDFsarareedannarbor100% (2)

- Mejik Pengganti QuizDocument3 pagesMejik Pengganti Quizshierley rosalinaNo ratings yet

- Strategic Consulting: Tools and methods for successful strategy missionsFrom EverandStrategic Consulting: Tools and methods for successful strategy missionsNo ratings yet

- Which Model Is "Linear" in Case of Linear Regression?Document1 pageWhich Model Is "Linear" in Case of Linear Regression?spaw1108No ratings yet

- World's Leader Gigawatts: PaymentsDocument1 pageWorld's Leader Gigawatts: Paymentsspaw1108No ratings yet

- ExhibitDocument1 pageExhibitspaw1108No ratings yet

- Investment in Technology To Increase Yield of The SeedsDocument2 pagesInvestment in Technology To Increase Yield of The Seedsspaw1108No ratings yet

- Research Looks The Most Apt. It Is An Exhaustive Form of Research Which Clearly Defines The WhoDocument1 pageResearch Looks The Most Apt. It Is An Exhaustive Form of Research Which Clearly Defines The Whospaw1108No ratings yet

- Parameters Wtg. Ipts Brts LRT: Total 100% 3.06 2.69 2.1Document2 pagesParameters Wtg. Ipts Brts LRT: Total 100% 3.06 2.69 2.1spaw1108100% (1)

- Introduction ESHDocument2 pagesIntroduction ESHspaw1108No ratings yet

- Selected Eco IndicatorsDocument6 pagesSelected Eco Indicatorsspaw1108No ratings yet

- Wipro Paper (System Software) July-1997Document1 pageWipro Paper (System Software) July-1997spaw1108No ratings yet

- APMC FinalDocument43 pagesAPMC Finalsweetesha78% (9)

- Budget PreparationDocument3 pagesBudget Preparationspaw1108No ratings yet

- California-Based Restaurant Chain Offering Made-To-Order Sandwich Wraps Using Fresh, Healthy IngredientsDocument2 pagesCalifornia-Based Restaurant Chain Offering Made-To-Order Sandwich Wraps Using Fresh, Healthy Ingredientsspaw1108No ratings yet

- Does Mcdonald HV Anytg To Offer To BusinessesDocument7 pagesDoes Mcdonald HV Anytg To Offer To Businessesspaw1108No ratings yet

- The Questions Typically Asked in The Application Forms of Various Companies Last Year WereDocument2 pagesThe Questions Typically Asked in The Application Forms of Various Companies Last Year Werespaw1108No ratings yet

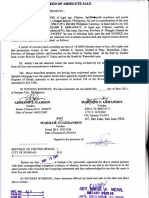

- Deed of Absolute SaleDocument1 pageDeed of Absolute SaleMariano GerandoyNo ratings yet

- Soc LegDocument144 pagesSoc LegHaru RodriguezNo ratings yet

- Kishan BF PresantationDocument3 pagesKishan BF PresantationKishan RajaniNo ratings yet

- MBOF912D-Financial Management-Assignment-1Document15 pagesMBOF912D-Financial Management-Assignment-1Utkarsh Singh0% (1)

- The Benefits of Postgraduate StudyDocument3 pagesThe Benefits of Postgraduate StudyRatnam SankarNo ratings yet

- 4.04 Interest Rates - Monthly (2003-Sep. 2017)Document1 page4.04 Interest Rates - Monthly (2003-Sep. 2017)jeevanNo ratings yet

- Simple Interest Principal × Rate × Time: ExamplesDocument17 pagesSimple Interest Principal × Rate × Time: ExamplesAliya IqbalNo ratings yet

- ISDA Standard CDS Contract Converter Specification - Sept 4, 2009Document4 pagesISDA Standard CDS Contract Converter Specification - Sept 4, 2009Ymae AlmonteNo ratings yet

- Loan Agreement Document of $100,000.00 USDDocument3 pagesLoan Agreement Document of $100,000.00 USDUniverse Loan Company LimtedNo ratings yet

- Lipat Vs Pacific Banking Corp - 142435 - April 30, 2003 - JDocument8 pagesLipat Vs Pacific Banking Corp - 142435 - April 30, 2003 - JQueenie SabladaNo ratings yet

- Promissory NoteDocument30 pagesPromissory NoteSabyasachi GhoshNo ratings yet

- Arithmetic and Geometric GradientDocument14 pagesArithmetic and Geometric GradientKloyd EurolfanNo ratings yet

- MK84F763C3ID49548209 KeyFactStatementDocument3 pagesMK84F763C3ID49548209 KeyFactStatementMita BanerjeeNo ratings yet

- GST Express SchemeDocument1 pageGST Express SchemeMahadev MahataNo ratings yet

- IRCTC E Wallet User GuideDocument8 pagesIRCTC E Wallet User GuideVikas PatelNo ratings yet

- Simple IntetestDocument4 pagesSimple IntetestThennarasu JayaramanNo ratings yet

- Bretton Woods TwinsDocument8 pagesBretton Woods TwinsBala SubramanianNo ratings yet

- Exercise 1 - Decision Theory PDFDocument5 pagesExercise 1 - Decision Theory PDFKaran Kakkar0% (1)

- Republic Act No. 3765Document1 pageRepublic Act No. 3765Josef PeñasNo ratings yet

- Fins 2624 Quiz 1Document3 pagesFins 2624 Quiz 1sagarox7No ratings yet

- Private BanksDocument3 pagesPrivate BanksJasmeet KaurNo ratings yet