Professional Documents

Culture Documents

Future Pharma

Future Pharma

Uploaded by

Cesar Rodolfo Angulo DelgadoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Future Pharma

Future Pharma

Uploaded by

Cesar Rodolfo Angulo DelgadoCopyright:

Available Formats

PHARMACEUTICALS

FuturePharma

FiveStrategiestoAccelerate

theTransformationofthe

PharmaceuticalIndustryby2020

kpmg.co.uk

Future

Pharma

FiveStrategiestoAcceleratetheTransformation

ofthePharmaceuticalIndustryby2020

Contents

ExecutiveSummary

KeyChallengesFacingthePharmaceuticalIndustry 1

1.Deliveringshareholder/stakeholdervalue 2-6

2.Lowgrowthbusinessenvironment 7-10

3.R&Dproductivity 11-15

4.Risingrisksandlossoftrust 16-18

AVisionofthePharmaceuticalIndustryin2020andBeyond 19-24

FiveStrategiestoAccelerateIndustryTransformation 25

1.Reassessproductstrategy 26

2.Investinthemarketingandsalesinfrastructureof2015andbeyond 27-29

3.Acquiremoretalentandexperiencefromotherindustries 30

4.UseinternalrateofreturntoprioritiseandrationalisetheR&Dportfolio 31-32

5.Reviewandrevisegovernancestandards 33-34

Ifyouwouldliketodiscussanyoftheideasinthisreportorhowthey

canbeimplemented,pleasecontactanyofourpharmaceuticalteam.

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

Executive

Summary

Thispaperexploressomeofthemajor

challengesfacingthepharmaceutical

industrytoday.

FourMajorChallengesFacing

thePharmaceuticalIndustry:

1.Deliveringshareholder/stakeholdervalue

2.Lowgrowthbusinessenvironment

3.R&Dproductivity

4.Risingrisksandlossoftrust

Webelievethatthereisareal

opportunityfortheindustrytoredene

itselfinthemindsofshareholders,

stakeholders,consumersand

governments,followingthe

disappointingbusinessandshare

priceperformanceofrecentyears.

StagnationinmatureWesternMarkets

(WM)combinedwithrapidgrowthof

EmergingMarketswillchangethe

shapeandneedsoftheindustry.

Operatingmarginsarepeakingandthe

impactofEmergingMarketgrowthon

thecurrentcostbasewillbringmargins

down.Businessesneedtoensure

investmentingrowthmarketsreects

thenewindustryandnotatemplate

fromthepast.Socialmediaand

informationtechnologyofferpotentially

signicantnewwaystocontact

prescribersandconsumers

moreefciently.

R&Dproductivityhasbeensub-optimal

andpoorlymeasured.Weassessthat

returnsoncapitalisedR&Dspending

havebeensteadilyfalling.Ashiftto

aninternalrateofreturnmeasureof

developmentspendingisneeded,

togetherwithsomeinformationabout

whythecompaniesbelievethat

spendingondevelopmentprojectswill

giveshareholdersareturngreaterthan

thecostofcapitalforthecompany.

Scientic,political,legalandpersonnel

risksareallrising.Weseeaneedfora

reviewofgovernancestandardsfrom

Boardleveldownwards,togetherwitha

freshlookatinternalappraisalsystems

toensurethebestqualiedemployees

areinthekeyrolesandgetthebest

trainingforthechangingmarketplace.

Pharmaceuticalcompaniesmustwin

backtrust;theyhavecreatedthe

perceptionthattheyputtheir

commercialgoalsabovetheinterests

ofgovernments,payors,prescribers

andpatients.

Thissituationcanbechangedaspartofa

seriesoftransformationalstepsinboth

theoperationsandcultureincludingbetter

internalandexternalcommunicationof

risksandmoreconsistentcompliance

withregulatorystandards.

Therearemanynewrelationshipsto

developwithgovernmentagenciesin

thegrowthmarkets,inadditionto

increasingcomplexityinrelationswith

governmentsandpayorsinestablished

markets.Improvingtheserelationships

canbestbeachievedbyadoptingbetter

standardsofgovernanceatalllevelsof

theindustry.

Inourvisionfor2020weseeanindustry

thatwillbesimplerforinvestorsto

understandnotbecauseitwillbe

structurallysimpler:developingnew

medicineswillbeanevermore

complexprocess.

Butbecausethegeographicallydiverse

natureofitsbusinesswillincrease

withthegrowthofEmergingMarket

inuence,thepharmaceuticalindustry

couldtakeontheappearanceofahigh

valueconsumerproductsindustrytoits

shareholders.Whetheradiversiedor

specialistbusinessmodelisbetterto

meetthe2020challengesisamuch

morecompanyspecicanalysisthat

wehavenotattemptedtocoverhere.

Wehaveidentiedvestrategiesto

acceleratethetransformationofthe

industrytomeetthem.

FiveStrategiestoAccelerate

IndustryTransformation:

1.Reassessproductstrategy

2.Investinthemarketingandsales

infrastructureof2015andbeyond

3.Acquiremoretalentandexperience

fromotherindustries

4.Useinternalrateofreturntoprioritise

andrationalisetheR&Dportfolio

5.Reviewandrevisegovernance

standards

Theindustryisrespondingpositively

toanumberofotherimportantissues,

suchasworkingwithgovernmentsand

providerstoaddresstherisingcost

ofhealthcare.

Theselectiveandfocusedapproach

thatwehavechosenmeansthatthis

paperdoesnotcovertheseother

challengesinanydetail.

With well chosen

strategies combined

with disciplined

implementation, I believe

the pharmaceutical

industry has the platform

from which to prosper

over the next 10 years.

ChrisStirling,EuropeanSectorLeader

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

1|FuturePharma

KeyChallenges

FacingthePharmaceuticalIndustry

1.Deliveringshareholder/stakeholdervalue

2.Lowgrowthbusinessenvironment

3.R&Dproductivity

4.Risingrisksandlossoftrust

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

Tobacco

Food & Beverages

Personal & Household Goods

U8li8es

STOXX Europe 600 Index

Europe Pharma

US Pharma

FuturePharma|2

Challenge1

DeliveringShareholder/

StakeholderValue

Thepharmaceuticalindustryhas

performeddisappointinglyoverthelast

tenyearsrelativetootherindustries

(Figure1).Thisistheresultofa

complexebbandowofpositiveand

negativefactorsonbothrevenues

andprotsthathasmarginallyfavoured

thenegatives.

Factorsinuencingrevenuesinclude:

Positives:

-StronggrowthinEmergingMarkets

(Figure2)

-Agingpopulations

- PriceincreasesintheUS

(Figure3)

-Inuenzapandemics

-Enduringwillingnessofpayorsto

supportdemonstrably

innovativetherapies

Negatives:

-Increasingspeedandintensityof

productcompetition(Figure4)

-Increasingrebatestogovernment

andthirdpartyprovidersintheUS

-Budgetdecitdrivenpricereductions

inEurope

Exposuretolossofrevenues

followingpatentexpiration(Figure2)

-Ferocityofearlygenericcompetition

-Higherregulatoryhurdles,leading

togreateruncertaintyandfewer

productapprovals

-Greaterrestrictions

onreimbursement

-DecliningR&Dproductivity

Figure1

RelativeSharePricePerformance

from2005

Source:Bloomberg

250

200

150

100

50

0

0

7

/

0

1

/

2

0

0

5

0

7

/

0

1

/

2

0

0

6

0

7

/

0

1

/

2

0

0

7

0

7

/

0

1

/

2

0

0

8

0

7

/

0

1

/

2

0

0

9

0

7

/

0

1

/

2

0

1

0

0

7

/

0

1

/

2

0

1

1

Key

STOXXEurope600Index

HealthCare

Utilities

FoodandBeverages

Tobacco

Personal&HouseholdGoods

EuropePharma

USPharma

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

3|FuturePharma

Challenge1

DeliveringShareholder/

StakeholderValue

Thebalanceoffactors

inuencingprotshas

contributedtomakingthe

consistentdeliveryof

shareholder/stakeholder

valuemoredifcultand

thiscontinuestobe

thecase.

Factorsinuencingprotsandearnings

Positives:

- Anindustry-widedrivetoreducecosts

andimproveefciency

- Improvedoperatingmargins

(Figure5)and

- Strongcashowgrowthfuelling

increasedcashreturnsto

shareholdersthroughincreased

dividendpay-outratiosandshare

repurchaseprogrammes(Figure6)

Negatives:

- Royaltypaymentsincreasingdueto

greatercollaborationandrisksharing

- Increasedlegalsettlementswith

plaintiffsandgovernments

- Increasedclinicaltrialdemands

- Increasedregulatory

lingrequirements

- M&Aactivitythathasadded

complexity,whilstrarelygenerating

obviouslybetterreturns

- Growingsafetyrequirements

post-approval

Figure2

EmergingMarketsaretheKey

DriversofTotalSpending

Source:IMSMarket

Prognosis;KPMG

1150

1100

1050

700

2010 Brand Patent Generic Emerging Other 2015E

750

800

850

900

950

1100

$856bn

$1081bn

119 -120

47

150

29

T

o

t

a

l

S

p

e

n

d

i

n

g

$

b

n

growth expirations Markets

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|4

Figure3

AverageAnnualPercentChangeinUSRetailPrices

forWidelyUsedBrandNamePrescriptionDrugs

Source:AARPRxWatchdogReport,August2010

9%

8%

7%

0%

1%

2%

3%

4%

5%

6%

2005 2006 2007 2008 2009

6%

6.1%

7%

7.9%

8.3%

Figure4

SpeedandIntensityofCompetition

Source:DiMasiandFaden;TuftsCenterfortheStudyofDrug

Development,Workingpaper2009;PhRMA

Percentofrst-in-classmedicineswith

acompetitorinphaseIItestingatthe

timeofapproval.

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

23%

50%

71%

77%

90%

1970s 1980-1984 1985-1989 1990-1994 1995-1999

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

5|FuturePharma

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|6

Figure5

IndustryPharmaceuticalDivisionOperatingMargins

Source:KPMGestimates

AggregatepharmaceuticalindustryoperatingmarginsinUSD

33%

2005

2010

32%

29%

O

p

e

r

a

t

i

n

g

M

a

r

g

i

n

32%

32%

31%

31%

30%

30%

29%

29%

28%

28%

Figure6

PharmaceuticalIndustryPostTaxCashFlows

Source:KPMGestimates

2008 2009 2010

6

8

,

4

6

5

8

7

,

6

1

2

9

8

,

2

3

3

1

1

8

,

3

2

7

1

2

3

,

1

0

4

1

2

2

,

8

9

3

1

4

4

,

7

9

7

1

3

4

,

9

5

5

I

n

d

u

s

t

r

y

P

o

s

t

T

a

x

C

a

s

h

F

l

o

w

s

$

b

n

160,000

140,000

120,000

100,000

80,000

60,000

40,000

20,000

0

2003 2004 2005 2006 2007

Webelievethatoverthenexttenyears

thepharmaceuticalindustrycould

delivergrowthinlinewithrealGDP

(3-5%),whichisrespectableandmerits

ahighermarketvaluethanthatoftoday.

Weseearealopportunityfor

theindustrytoredeneitselfinthe

mindsofshareholders,stakeholders,

consumersandgovernments.

Thiswillrequireashiftinhowthe

industryoperates,particularlyregarding

howitspendsitsshareholdersfunds

andhowitcommunicatesthevalueof

itsproductanddeliversitsservices.

Theindustryhastodemonstrate

thatitcandeliverbetterreturnson

investmentthaninthepastbychanging

manyaspectsofhowitoperates.

Thisislikelytobeuncomfortablebutwill

be,wesuspect,acontinuationofa

processwhichhasalreadystarted.

Novartismanagementhasmadeastep

intherightdirectionbydiscussingcash

owreturnoninvestedcapital,andhow

itplannedtoimproveitforeachdivision,

atitsNovember2010Strategy&

InnovationForum

1

.

1

http://www.novartis.com/downloads/investors/presentations-events/pipeline-update/2010/2010-11-17-

generating-nancial-returns-from-the-portfolio.pdf

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

7|FuturePharma

Challenge2

LowGrowthBusiness

Environment

Revenuegrowthmodestly

slowingin2010-2015

Thepharmaceuticalindustryisfacinga

futurewithlowergrowthprospectsthan

inthepast.IMSforecastsglobalspending

onmedicineswillreach$1.1trillionby

2015buttherevenuegrowthratewill

slowfrom6%between2005and2010

to3-6%between2010and2015.

Theimpactof$120bnofproduct

revenueslosingpatentprotectionin

majorWesternMarketsfrom2010-2015

willbelargelymatchedbyon-patent

brandgrowth,leavingEmergingMarket

growthandgenericspendingasthe

maindriversofglobalspending.PerIMS

thecombinedUSandEURshareof

spendingwillshrinkfrom61%in2005to

44%by2015andEmergingMarketswill

growfrom12%in2005to28%by2015.

Policychangesseenin2010intheUS,

Japan,EuropeandChinaareunlikelyto

bethelastmadeasgovernments

strugglewithgrowingbudgetdecits

andlookforwaystospendmore

effectivelyonhealthcare,further

pressurisinggrowth.

Majortherapeuticclassesdriving

brandgrowthbetween2010and

2015areexpectedtobeOncology

(+5-8%annuallyto$75-80bn),diabetes

(+4-7%annuallyto$43-48bn)and

autoimmunediseases(+6%tocirca

$30bn),withcontinuingifslowergrowth

forasthma/COPD(+2-5%to$41-46bn),

angiotensininhibitors(+1-4%to

$28-33bn)andplateletaggregation

inhibitors(+4-7%to$18-22bn),both

forcardiovasculardisease(Figure 7).

Biologictherapiesasaclassareamajor

growthcontributor,forecasttogrow

from$138bnin2010to$190-200bnby

2015,oranincreasefrom16%ofglobal

drugspendingto18%.

Theimpactof$120bnof

productrevenueslosing

patentprotectioninmajor

WesternMarketsfrom2011-

2015willbelargelymatched

byon-patentbrandgrowth,

leavingEmergingMarket

growthandgeneric

spendingasthemain

driversofglobalspending.

Figure7

ForecastTherapeuticClass

Growth2010-2015

Source:IMSHealth

$

b

n

50

90

70

20

30

Oncology

Asthma/COPD

Lipidlowering

Diabetes

Angiotensininhibitors

forCVdisease

60

40

80

2010 2015

2

TheGlobalUseofMedicines:OutlookThrough2015.IMSInstituteforHealthcareInformaticsMay2011

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|8

AggregateEmergingMarket

revenuesareforecasttogrow

atacompound14%between

2010and2015.

IfWesternMarketstagnation/decline

continuesandEmergingMarketgrowth

slowstoaround10%perannumthen

globalrevenueswouldgrowonaverage

4%perannumbetween2015-2020

(Figure 8).

IfthepressureonUSandEUmarket

lessenspostthepatentexpirationcliff

andlowlevelsofgrowthreturn(say

3%)thenglobalgrowthwouldbe4%

between2015and2020.

Figure8

PharmaceuticalIndustry2010to

2020byMajorGeographicMarket

Source:2010,2015IMSHealth;2020KPMGestimates

1400

1200

1000

800

600

400

200

0

2010E 2015E

$856bn

188

238

300

154

303

487

205

205

195

308 335 335

$1,081bn

C

A

G

R

5

%

C

A

G

R

4

%

$1,318bn

2020E

$

b

n

US EU EM Other

Figure9

EstimatedIndustryCostand

Marginbreakdown

Source:KPMGestimates

OperatingMarginsPeaking

andSettoDecline

Webelievethatthepharmaceutical

industrycurrentlyachievescloseto

50%pre-R&Doperatingmargins,

onaverage.

2010E

Revenues 100%

Costofsales -25%

Generalandadministrativecosts -7%

Marketing&sales -20%

R&D -16%

Operatingprot 32%

PreR&Doperatingprot 48%

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

9|FuturePharma

Challenge2

LowGrowthBusiness

Environment

Figure10

Estimated2010GeographicContributionto

GlobalPharmaceuticalSalesandProts

Source:IMSHealth;

KPMGestimates

Basedondatafromvariousindustry

sources,wehaveestimatedthe

contributionbymajorgeographic

regiontoindustrypre-R&D

operatingprot(Figure10).

Thistablehighlightsthe

lowermarginsavailable

inEmergingMarkets.

Region %2010global

revenues

Revenues

$bn

EstPre-R&D

margin

Pre-R&D

op.prot$bn

US 36% 308 65% 200

EU 24% 205 43% 88

EM 18% 154 33% 51

Other 22% 188 40% 75

Total 856 48% 415

Figure11

ChangingGeographicContribution

toGlobalPre-R&DOperatingProt

Source:2010,2015IMSHealth;

2020KPMGestimates

GrowthofEmergingMarketscould

resultinthesecountriestogether

contributingasmuchtoglobalprots

astheUSby2020(Figure11).

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

18%

12%

21%

48%

20%

21%

16%

42%

21%

30%

13%

36%

2010 2015E 2020E

US EU EM Other

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|10

Usingtheassumptionsshownin

(Figure12)weconcludethatglobal

marginswillinevitablycomeunder

pressureasthecontributionfromlower

marginEmergingMarketscontinuesto

growrapidlyrelativetothemature

WesternMarkets.Wendthatthe

pre-R&Dindustryoperatingmargin

coulddeclinefromanestimated48%

in2010to43%by2020(Figure13).

TheimportanceofEmergingMarkets

andthepressureonmarginswebelieve

meritsawholesalereviewofthe

marketingandsalesinvestmentinboth

growthmarketsandthoseindecline,

thepersonneltalentrequiredtomanage

thesebusinessesandabovealltheR&D

portfoliobeingdevelopedtosupply

appropriateproductsthatpayorswill

fundinthesedifferentmarketsover

thenext10years.

Wendthatthepre-R&D

industryoperatingmargin

coulddeclinefroman

estimated48%in2010

to43%by2020.

Figure12

AssumptionsofCompoundAnnualRevenue

GrowthandGeographicMargin2010-2020 Source:IMSHealth;KPMGestimates

2010-15

RevenueCAGR

2015Pre-R&D

op.margin

2015-20Revenue

CAGR

2020Pre-R&D

op.margin

Assumptions

US 2% 60% 0% 60%

EU 0% 38% -1% 38%

EM 14% 33% 10% 35%

Other 5% 40% 5% 40%

Global 5% 45% 4% 43%

Figure13

Pre-R&DProtMarginsPressured

duetoEmergingMarkets Source:2010,2015IMSHealth;2020KPMGestimates

Thisgureillustratestheprot

marginimpactofthegrowthof

theindustryinEmergingMarkets.

2010E 2015E

856

1081

1318

415

474

566

2020E

Pre-R&D

margin48%

Pre-R&D

margin44%

Pre-R&D

margin43%

Revenues$bn PreR&Dopprot$bn

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

11|FuturePharma

Challenge3

R&DProductivity

Overthepastdecadethe

numberofapplicationsfor

approvalofnewmedical

entitiesbeingmadeto

FDAhasaveraged30per

year.However,in2010only

23applicationswereled,

thesecondlowestnumber

inadecade(Figure14).

PoorR&Dproductivity

Thenumberofnewmedicalentities

(excludinglineextensions)being

approvedintheUShasnotshown

anytrendchange(Figure15)over

thepastdecade.Itishardtocorrelate

applicationnumberswithapprovals

becauseofthedifferenceinapproval

times.FDAdataindicatesthatbetween

January2006andOctober200961%

ofnewmedicalentityapplications

wereapproved.Comparativedatafor

theequivalentEuropeanauthority,

theEMEA,indicates68%were

approvedinthesameperiod

3

.

2011islookingalotbetterthan2010

andcouldbeanaboveaverageyear.

Sofarthisyear(through7

th

July)20

newmedicineshavebeenapproved

comparedwith21inthewholeof2010

4

.

Thislookslikethepatternof2005and

2009beingrepeated.Thereisnobasis

toassumetheoverallnumberof

approvalsisonalongtermuptrend.

Figure14

NumberofApplicationsfor

NewMedicalEntitiestoFDA

Source:FDA

40

35

30

25

20

15

10

5

0

N

u

m

b

e

r

o

f

a

p

p

l

i

c

a

t

i

o

n

s

f

o

r

n

e

w

m

e

d

i

c

a

l

e

n

t

i

t

i

e

s

t

o

F

D

A

b

y

y

e

a

r

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

3

http://www.fda.gov/downloads/AboutFDA/CentersOfces/CDER/UCM192786.pdf

4

http://www.rstwordpharma.com/node/886309

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|12

R&Dproductivitybasedon

numbersofapprovalsrelative

toR&Dspendingisworsening.

R&Dspendinghas,however,been

climbinginexorably,runningata

compoundannualgrowthrateof10%

1999-2007,althoughtherehasbeena

signicantslowdownsince2007(CAGR

1%).Thesecalculationsarebasedon

dataformembercompaniesofthe

PharmaceuticalManufacturers

AssociationofAmericaandtherefore

understateglobalR&Dspending.

R&Dproductivitybasedonnumbers

ofapprovalsrelativetoR&Dspending

isworsening.

LookingatR&Dproductivityanotherway,

theindustrysuccessrateinbringinga

drugfromresearchtomarketwasjust

4%between2005and2009

5

.Thisis

clearlyanunsustainablylowrate.

Figure15

NewMedicalEntityApprovalsand

AnnualR&DSpending1999-2010

Source:PhRMAandFDA

40

N

u

m

b

e

r

o

f

n

e

w

U

S

d

r

u

g

a

p

p

r

o

v

a

l

35

30

25

20

15

10

5

0

55,000

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Newdrugapprovals R&Dspent

50,000

45,000

40,000

35,000

30,000

25,000

20,000

A

n

n

u

a

l

U

S

I

n

d

u

s

t

r

y

s

p

e

n

t

5

LindaMartinKMR,BernsteinR&DConference2011,citedinRoche1H2011resultspresentation

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

13|FuturePharma

Challenge3

R&DProductivity

R&Dreturnshave

nearlyhalvedover

thelast10years.

ReturnonR&Dfalling

Wehavemadeanillustrativecalculation

ofthepost-taxreturnonR&Dspending

over15years(Figure16).

Thesteadydeclineoverthepast20years

isnosurprise,butitillustratestheneedto

addresstheexpectationsoffuturereturns

fromcurrentspendingbothfromapeak

salesperspectiveandfromacostof

marketingandsalessupportpointofview.

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|14

Figure16

IllustrativePostTaxReturn

onR&DExpenditure

Source:PhRMAdata;KPMGestimates

20%

18%

P

o

s

t

T

a

x

r

e

t

u

r

n

o

n

R

&

D

e

x

p

e

n

d

i

t

u

r

e

16%

14%

12%

10%

8%

6%

4%

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

15|FuturePharma

Challenge3

R&DProductivity

Apredictabledeliveryof

newdrugsoveramulti-year

periodisthemostlikely

meansforcompaniesto

captureanelementoftheir

pipelinevalueintheir

marketcapitalisation.

R&DProductivity

IneffectivelyAssessed

Industryfocusesonnumbersofprojects

inR&D,notreturns,norforecasts

Corporatepresentationofthevalueof

R&Dtendstofocusonnumbersof

productcandidatesindevelopment.

Mentionofhowmuchwasspentrarely

featuresprominentlyintheannualreport

toshareholdersandwecouldndonly

onecompany,GlaxoSmithKline,among

theindustrymajorsthathighlightsits

targetreturnonR&Dspending.

Phrasesthatindustryparticipantsuseto

describetheirR&Dpipelinesinclude:

strongest

one of the best

one of the most innovative

strongest and most productive

uniquely broad

peer-leading

Thesubjectivenatureofthese

descriptionsisnotunreasonable.Thereis

littlenumericalbasisforcomparisonwith

othercompanieswhoseneedsforfuture

growthmaybesmallerorgreater.The

recenthistoryoftheindustrywould

suggestthathubrisistobeavoidedatall

costs.Thepointisthatthesecomments

andthedetailedexplanationsofthe

individualdevelopmentprojectsgiveno

informationaboutwhythecompanies

believethatspendingontheseprojects

willgiveshareholdersareturngreater

thanthecostofcapitalforthecompany.

Orputanotherway,whytheseprojects

willresultinareversalofthelong-term

trendillustratedinFigure16.

Webelievethatthereislittleornovalue

beingascribedtopipelines,basedon

currentmarketcapitalisationsandthe

cashowvalueofonmarketdrugs.

Somevalueshouldbeallocated,

althoughnottoomuchgiventhe

inherentunpredictabilityofmedical

research.Apredictabledeliveryofnew

drugsoveramulti-yearperiodisthemost

likelymeansforcompaniestocapture

anelementoftheirpipelinevaluein

theirmarketcapitalisation.However,

intheshorterterm,expositionofan

understandableassessmentofthe

returnsthathavebeenachievedand

indicationsofwhythefuturereturns

willbebetterwouldalsohelp.

Asystematicexplanationofwhyproduct

candidatesfailedorwhyproductshadto

bewithdrawnfromthemarketandwhat

waslearntfromthesefailureswouldhelp

showthattheR&Dprocessismore

consideredthaninthepastandthatpast

mistakesarenotbeingrepeated.

Somemeasureofscienticqualityis

alsoneeded.Thebestscienceisnot

alwaysconductedinlarge-capitalisation

pharmaceuticalcompaniesasillustrated

bytheindustryseekingnewwaysto

partnerwithacademia

6

.

6

2March2011|Nature471,17-18(2011

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|16

Challenge4

RisingRisksand

LossofTrust

Stayingclosetogovernment

thinkingwillbecriticalto

securingacontinuingstrong

positionintheindustry.

Risingscienticrisk

Intheinformationageitisreasonableto

assumethateveryoneknowseverything,

andthereforethatcompetitorsmaybe

workingonsimilarbiologicaltargetswith

similarchemicalorbiologicalentities.In

therecentpastthespeedwithwhich

severalcompanieshavesimultaneously

developednewchemicalentitiesis

testamenttothis.Weseeitaskeyto

understandtheendgameatthestart:

integrateinformationonwhatvaluea

newdrugornewdrugclasscouldbring

andtheattitudeofthosethatwillpayfor

themedicineasearlyaspossibleintothe

developmentprocess.

Wewereverysurprisedtondthatonly

5/13(38%)ofmajorcompaniesincludea

Boardcommitteewithanexplicitmandate

toprovideassurancetotheBoardabout

thequality,competitivenessandintegrity

of the Companys R&D/scientifc

activities.Thiswouldseemanessential

checkandbalanceonthepathtogreater

rigouronagreeingR&Dexpendituregiven

theimportanceofinnovation.

Risingpoliticalrisk

PoliticalriskintheUSandtheEuropean

Communityiswellunderstoodandwill

be part of all companies planning

process.Thereareprobablyno

expectationsthatpressurefrom

governmentstoreducethecostof

medicinesandoftreatingchronic

diseaseisgoingtoreduce.Theindustry

iscashgenerativeandrelativelycash

rich.Workingwithgovernmentsto

promoteinnovation,whileachieving

adequatecommercialreturns,will

beimportant.

Wethinkthatasystematicapproach

tothechangingnatureofgovernment

policyinEmergingMarketsiskeyto

reducinglong-termpoliticalrisk.Ina

majorityofEmergingMarkets,the

consumerpaysforprescription

medicines,butgovernmentsinuence

thepricepaidtovaryingdegrees.

Stayingclosetogovernmentthinking

willbecriticaltosecuringacontinuing

strongpositioninthesemarkets.

Risinglegalrisk

Inspiteofextensiveriskmanagement

inputtoBoardauditcommittees,there

hasbeenariseinthenumberof

settlementsforviolationsofavarietyof

lawsasexempliedbydatafromtheUS

overthepasttwentyyearswithavery

rapidrisesince2003(Figure17,Figure18).

Theindustryneedsto

reversethesetrendstobegin

towinbackcondenceand

trustfromconsumersand

governmentsalike.

Thisisnosmalltask.

Wesupposethattherateofincreasein

thesesettlementscouldbeviewedby

someasapositive,becausethedecks

arebeingclearedandhistoriclong

runninglitigationriskisbeingreduced.

Weseethisasstretchingthepoint.

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

17|FuturePharma

Challenge4

RisingRisksand

LossofTrust

Figure17

NumberofPharmaceuticalIndustrySettlements

withUSStateandFederalGovernment1991-2010

Source:PublicCitizen

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

40

35

30

25

20

15

10

5

0

Thevalueofthesesettlementshasalsorisendramaticallyoverthepastdecade.

Figure18

ValueofPharmaceuticalSettlementswith

USStateandFederalGovernment1991-2010

Source:PublicCitizen

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

4000

4500

$

b

n

5000

3500

3000

2500

2000

1500

1000

10 22 1 0 10 7 4 3 100

500

0

404

889

549

967

999

1067

3976

1441 1445

4405

3517

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|18

Risingpersonnelrisk

Thechangingnatureofthegrowthdrivers

withinthepharmaceuticalindustryand

theculturalshiftinhowtheindustry

spendsmoneysuggesttousthatthere

isrisingpersonnelrisk.Riskbecause

thebestqualiedstaffmaybetempted

bycompetitors,orbyopportunities

forcareerdevelopment.Riskbecause

thewrongstaffmayberetainingkey

managementpositionsfortoolong.

Riskbecauseseniormanagementhas

notaskedthehardquestionsofits

employeesfrequentlyenough.Itcould

bearguedthatBoardsofDirectorsand

executivemanagementshouldputin

placeplanstoincreasethediversity

ofseniortalenttomatchtheevolving

needsoftheglobalhealthcaremarket.

Inadditionareviewofmanagement

structureswouldalsoseemessential

tothegrowingimportanceofEmerging

Marketsnotonlyasgrowthdrivers,but

alsoasimportantsourcesofscientic

andmedicalresearchtalent.

LossofTrust

Pharmaceuticalcompanieshave

createdtheperceptionthattheyput

theircommercialgoalsabovethe

interestsofgovernments,payors,

prescribersandpatientsandlostthetrust

ofthesestakeholders.Investorstoo

remainscepticalofthelongerterm

outlookinthewakeofserialR&Dpipeline

disappointments.Justiedornot,the

pharmaceuticalindustryfacesasceptical

audienceregardingtheintegrityof

itscommercialoperations.Golden

parachutesthatrewardexecutivesin

spiteofpoorperformanceexacerbatethe

situation.Fines,courtcasesandproduct

withdrawalsareallprevalentandserve

to draw attention to the industrys

weaknesses.Thissituationcanbe

changedaspartofaseriesof

transformationalstepsinboththe

operationsandcultureincludingbetter

internalandexternalcommunicationof

corporatepriorities,corporate

responsibilitiesandoftherisksthatthe

companyispreparedtotakeandwhy.

Stakeholdersneeda

clearunderstandingof

theriskproletowhich

theyareexposedeitheras

employees,shareholders

orboth.

Therearemanynewrelationshipsto

developwithgovernmentagenciesinthe

growthmarkets,inadditiontoincreasing

complexityinrelationswithgovernments

andpayorsinestablishedmarkets.

Improvingtheserelationshipsand

avoidingthecreationofnewriskscan

bestbeachievedbyadoptingbetter

standardsofgovernanceatalllevels

oftheindustry.

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

119| 9|FFut utur urePhar ePharma ma

AVisionofthe

Pharmaceutical

Industryin

2020and

Beyond

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|20

AVisionofthePharmaceutical

Industryin2020andBeyond

Companiesthatcan

demonstratethevaluetheir

products(andservices)

bringtopatientswillbe

abletoaccessbroadpatient

populationsinbothWestern

andEmergingMarkets.

Havinglaidoutsomeofthekey

challengesthatwebelievetheindustry

isfacing,weoutlineavisionofhowthe

industrymightlookin2020andbeyond.

Webelievethattobesuccessfulinten

years time, companies will need to be

differentfromtodayinthewaythatthey

areorganisedandoperate.(Fig.19)

Companiesthatcandemonstratethe

valuetheirproducts(andservices)bring

topatientswillbeabletoaccessbroad

patientpopulationsinbothWesternand

EmergingMarkets.Scalewillstillbe

importantbutmarketingmusclealone

willnotbesufcient.

Companieswiththecouragetoprice

accordingtoabilitytopayandnotsolely

weddedtoaglobalhighWesternbased

pricewillreapthevolumebenets,asfor

exampleGlaxoSmithKlinehasreported

followinganEmergingMarketpricecut

foranti-allergymedicationAvamys.

7

Inaddition,thepharmaceuticalindustry

hasasignicantopportunitytoplayan

importantroleinthebroaderhealthcare

ecosystemasthepressuresto

reducecost,improvequality,and

increaseaccesstocareimpactnearlyall

countries healthcare systems. Payment

forhealthcareproductsandservices,

whichhashistoricallybeenbasedon

unitorepisode,isexpectedtomoveto

aneweconomicsystemthatrewards

demonstrablybetterhealthoutcomes

andlowercosts.Inthisscenario,the

interestsofthepharmaceuticalindustry

wouldconvergewiththoseofhealthcare

providersandpayersinincreasingly

integrateddeliveryandnancing

models.Givenpharmaceutical

companies deep knowledge of testing

andmeasuringqualityoutcomesand

relatedcosts,theindustrycanplaya

signicantroleintheevolving,broader

healthcareenterprise.

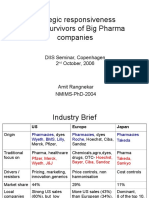

Figure19

FutureIndustrialSuccessFactors Source:KPMGestimate

Basesofcompetitiveadvantagetoday Basesofcompetitiveadvantagein2020

Development resources, sales and marketing scale Valueofproductsandservices,distributionstrength

Global high prices, restricting access Pricingbasedonabilitytopaydrivingvolumeuplift

Multiple competitors in major therapeutic areas,

scale permitting success

Fewercompetitorsinabroaderrangeofdiseases

Multi-billion dollar drug revenues covering high xed costs Moreproductswithlowerrevenuesandlowercosts

End to end operational capabilities for self-sufciency strategy

Signicantoutsourcingofoperationssuchasmanufacturing

andsupportfunctions

Acquisitions of technologies and products to augment

product pipeline

Greatercollaborationwithacademia,biotechandpeers

Focus on mature Western Markets FocusonEmergingMarkets

7

http://www.gsk.com/investors/presentations/2011/Abbas-Hussain-10March2011.pdf

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

21|FuturePharma

AVisionofthePharmaceutical

Industryin2020andBeyond

Historically,companieshavefaced

competitionataneverincreasingpace

becausemarketshavesustained

multipleproductswithlittleor

nodifferentiation(Figure20).

Weseethistrendslowlyreversingbecause

oftheneedtofocusR&Dspendingonthe

mostdifferentiatedproducts.Thegrowth

ofbiopharmaceuticalsisalsolikelytohave

animpactonthenumberofcompetitors

perdisease.Newbiologicaltargetsare

beingidentiedforlesscommonbut

debilitatingorlifethreateningdiseasefor

whichnotreatmentsexist,includingrare

diseases.Intheseareasweexpect

fewercompetitors.

Figure20

CompetingMedicines

RaceforApproval Source:TuftsCenterfortheStudyofDrugDevelopment;PhRMA

M

e

d

i

a

n

n

u

m

b

e

r

o

f

y

e

a

r

s

12

10

8

6

4

2

0

1970s 1980s

1990s

Theaveragetimeamedicineistheonlydrugavailableinits

therapeuticclasshasdeclineddramaticallyfrommorethan

10yearsinthe1970stolessthan2yearsby1998

Wethinkthatby2020therewillbemore

productssellinglessonaveragethan

todayasaresultofmoretargeted

therapiesandthegenericisationofmany

ofthemajorprimarycaretherapeutic

areas.Butnewproductsshouldhave

betterreturnsoncapitalthankstomore

efcientdevelopmentspending,fewer

failuresandmuchlowerlevelsof

marketingandsalesinvestment.

Thescarcityofnewproductopportunities

hasdrivenupthepricetoin-license

developmentstagecompounds.Butthe

problemisthatthefailurerateshavebeen

risingforalllatestagecompoundsand

arehigherforin-licensedcompounds

thanforin-houseprojects.

Accordingtoarecentreportfromthe

CentreforMedicinesResearchthere

were55phaseIIIdrugterminations

during2008-2010,morethandoublethe

numberofterminationsduring2005

2007;andinadditionthenumberofdrugs

enteringphaseIIIclinicaltrialsfellby55

percentin2010

8

.Weseeagrowingtrend

forlargepharmaceuticalcompaniesto

bypassthesmallbiotechsandforge

collaborationsdirectlywithacademia.We

seeleanerorganisationswithnetworks

ofacademiccollaborationsandsmall

companypartnershipsfuellingthe

researchprocessandmorefocused

developmentorganisationsusing

genomicprolingallowingsmallerclinical

trialstobeconductedwithmorepower

andatlowercost.Companiondiagnostic

testswillbemuchmorecommonand

willbeintegraltodevelopment,market

accessandpenetration.Morerisk

sharingwithotherindustryparticipants

shouldhelpimproveresearch

productivity.ThecreationofViiV

HealthcarebyGlaxoSmithKlineandPzer

shouldprovidebothcompanieswitha

betteroutcomefortheirHIVtherapies

thaneithergoingitaloneandisagood

exampleofhowtoretainintellectual

capitalontheonehandandaccessa

commercialplatformfordevelopment

assetsontheother.Companieswillneed

tomaximisethereturnondifferentiated

researchskillsandavoidlosing

intellectualcapital.

8

CMR2011PharmaceuticalR&DFactbook

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|22

Apredictabledeliveryof

newdrugsoveramulti-year

periodisthemostlikely

meansforcompaniesto

captureanelementoftheir

pipelinevalueintheir

marketcapitalisation.

Companiesintheindustryhavealready

startedunpicking,tovariousdegrees,

theirlong-establishednetworkofinternal

capabilitiesthatwasbuiltupduring

theheadydaysoffreepricingand

lesscompetition.Weseethistrend

accelerating,withthepotentialfor

signicantportionsofnotjustprimary

manufacturingbeingoutsourced.Itis

ofnotethatthemarketstowhichmany

capabilitiesarebeingoutsourcedarethe

verysameEmergingMarketsthatare

drivingindustrygrowth.

EmergingMarketswillbethedrivers

ofindustrygrowthandsuccessful

companiesbeyond2020willhavedeep

localrelationshipsincludingsignicant

investmentsinR&Dfacilities,aswellas

thealreadygrowingmanufacturing

investmentsinthesekeymarkets.

Webelievethatthereisasignicant

opportunityforcreatingshareholdervalue

byrebalancingtheriskthatshareholders

perceivetheyaretakingwithmore

predictablerewardsfrombetter

organisedandgovernedcompanies.

Returnsneedtobemorepredictable,

andwiththeoptionalupsidefrom

serendipitousdiscoveriesnotbased

ontheneedtobecreativetoorder.

Shareholdersneedtoseeanexplanation

ofthereturnsonhistoricR&Dspending

andthecriteriaforfuturereturnsto

believethatR&Dspendingisworthwhile.

Boardsofdirectorsneedtobelievethis

evenmoreandsooner.

Successfulcompaniesin2020could

pursueeitheradiversiedoraspecialist

businessmodel;thekeywillbeto

maximise the individual companys

strengths,toimproveinternalprocesses

and to understand if the companys

productofferingandfutureproduct

offeringdeliversustainablevalueto

itscustomers.

Cleararticulationofthestrategybothto

accessEmergingMarketgrowthwhile

notmissingopportunitiesinmature

marketswillbeneededtopersuade

shareholdersthatcompanieshave

movedonfromtheoldpharmamodel.

Trustneedstoberestored.Visibility

andhonestywillbekeytoachieve

this.Simpler,lesscomplexbusinesses

willmakethiseasier.

Figure21

PotentialSuccessFactorsin

CreatingShareholderValue

Source:KPMGestimates

Basesofcompetitiveadvantageinthepast/today Basesofcompetitiveadvantagein2020

SerendipityandscaledrivereturnsfromR&D Morepredictabilityandefciencydrivereturns

NumberofR&Dprojectsthebasisforastrongpipeline

PortfoliowithrangeofIRRforecastsbasedon

historictrackrecord

Emphasisonearningspersharegrowth Emphasisonvolume/revenuegrowth

Inadequatearticulationofsystemicrisk Riskbettergovernedandmanaged

Unintendedcomplexity Transparentandsimplerbusinessmodeleasiertounderstand

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

23|FuturePharma

AVisionofthePharmaceutical

Industryin2020andBeyond

Scienticandmedicalresearchis

unpredictableandserendipitous

discoverywillcontinuetooccur.

However,thecompetitivenatureofthe

businessnow(likelytobeevenmore

soby2020)meansthatinourviewa

greaterelementofpredictabilityneeds

to be introduced to regain investors

condenceinthevaluethesectorcan

deliver.Showregularandsteady

growth.Minimisebusinesssurprises.

R&Din2020willbeamuchmore

numericallydrivenprocessthantoday.

Wecannotseeanywaytojustifythe

spendingneededwithoutbetter

measuresofthehistoricreturnon

capitalbasedonIRR.Theseedsofa

newapproacharebeingsown,for

exampleatPzer

9

andNovartis

10

.

ThedominanceofEmergingMarket

economiesby2020couldresultina

shiftbacktovolumegrowthasakey

measureofperformance,withearnings

growthfollowing.Improvingefciency

istherightstrategybutuntilitis

accompaniedbysustainablerevenue

growth,itisnotlikelytoseethe

industrys valuation expand, all other

factorsinthestockmarketbeingequal.

Whilereturningcashtoshareholders

throughsharerepurchaseorenhanced

dividendsisapositiveuseofexcess

freecashow,itisnotlikelytobe

rewardedbyahighvaluation.

Wethinksuccessful

companiesin2020willhave

amoredynamicapproachto

riskreporting,withgreater

disclosureofpotentialand

actualrisk.Theindustrywill

beperceivedtobebetter

governedasaconsequence.

Lastly,weseeanindustryin2020

thatwillbesimplerforinvestorsto

understandnotbecauseitwillbe

structurallysimpler;developingnew

medicineswillbeanevermorecomplex

process.Butbecausethegeographically

diversenatureofitsbusinesswill

increasewiththegrowthofEmerging

Marketinuence,thepharmaceutical

industrycouldtakeontheappearance

ofahighvalueconsumerproducts

industrytoitsshareholders.

9

http://www.pzer.com/les/investors/presentations/barclays_capital_031711.pdf

10

http://www.novartis.com/downloads/investors/presentations-events/pipeline-update/2010/2010-11-17-changing-

the-practice-of-medicine.pdf

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FFut utur urePhar ePharma ma|24 |24

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

25|FuturePharma

5

Strategiesto

Acceleratethe

Transformationof

thePharmaceutical

Industryby2020

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|26

Strategy1

ReassessProductStrategy

Thedriverofindustrygrowthis

EmergingMarkets.Whilethese

marketsarecurrentlybeingdrivenby

thegrowthofclassicprimarycare

productsformajordiseasesthevery

therapeuticcategoriesthatarebeing

genericisedinWesternMarkets,this

situationisunlikelytopersist.Thereis

thereforeastrategicdilemmabecause

mostcompaniesdonotpossessan

idealEmergingMarketsportfolio.

Towhatextentshouldinvestmentin

todays needs be made versus the longer

term?Becauseinthelongerterm,the

keyEmergingMarketconsumersand

governmentswillwantaccessto

theverybestmedicines,butitisalmost

inconceivablethattheywillbeprepared

orabletopaythepricescurrentlypaidin

theUSoreveninEurope.Thevolumes

andthereforethecostswouldsimplybe

toohigh.Therecouldbetwiceasmany

peoplewithincomeabove$10,000in

thetop13EmergingMarketscompared

withtheUSandEUcombined

11

.

Therecentvolumeincreasesreportedby

somecompaniesforproductsforwhich

priceshavebeensubstantiallyreduced

indicateinourviewthepaththeindustry

mustpursueinthelongtermalthough

balancingtheneedforaffordableprices

withtheriskofcommoditisation.Value

deliverymustbedemonstrable.

Productsmusttake

intoaccounttheneeds

ofconsumersin

EmergingMarkets.

EmergingMarketsofferlargelyblank

slates;thecontinuingapplicationofan

adaptedoldWesternmodelofthedrug

industry,whichiscurrentlyongoing,will

missasignicantopportunitytoredraw

howtheindustryinteractswithpatients

andgovernments.

Thereisanargumentforfocusing

businessstrategyondeliveringhigh

valuemodernmedicinestoEmerging

Marketsatmuchlowerpricesthanhave

beenacceptedinWesternMarkets.

Thiswouldunderpinarootandbranch

reassessmentofthecostsofbringing

thesemedicinestomarket,themarketing

andsalessupportrequiredandtherisk

ofcounterfeitingandparalleltrade.

Thisshoulddrivestrategyinclinical

development,locationoftrials,

marketingplans,salesinfrastructure

andmanufacturinginvestment.The

opportunityforbiologictherapies

forcancerforinstanceisverylarge,

providingtherightpricingstrategy

canbedeveloped

12

.

EmergingMarketgovernmentsare

movingrapidlytoincreasemedical

consumerspending.Theestablished

brandedgenericEmergingMarkets

growthroutecouldrunoutofsteamas

genericsbecomecommoditised.This

suggeststhateverypossibleopportunity

todriveconsumer/OTCbusinessin

EmergingMarketsshouldbeexploredin

additiontoafocusonspeedtomarket,

loweringthecostsofdevelopment

andefcientdeliveryofappropriate,

differentiatedqualityprescriptionproducts.

11

http://www.gsk.com/investors/presentations/2011/Abbas-Hussain-10March2011.pdf

12

http://www.roche.com/investors/ir_agenda.htm?tab=2SanfordBernsteinConference1stJune2011,p10

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

27|FuturePharma

Strategy2

InvestintheMarketingand

SalesInfrastructureof2015

andBeyond

Acceleratethemodernisationofselling

andmarketinginmaturemarkets

Newtechnologyhascomerelatively

slowlytothepharmaceuticalindustry.

Nowthechallengeforthepharmaceutical

industryistobalanceinnovationand

creativityinitsuseofnewtechnology

againstperceivedvalueandthecostof

creation.Thekeyismappingthenew

technologyopportunitywiththebusiness

inasustainableandupdatableway.

Integratingexibletechnologiessuchas

QRbarcodesasameansfordoctorsto

communicatewiththeindustryusing

smartphonesisoneexampleofhowa

technologyinvestmentcouldmakea

salesforcemoreefcient.Itprovides

amorerapidandexibleresponse

mechanismforaphysiciantocontact

thepharmaceuticalcompanythan

simplytickingaboxorevenllingin

anonlineform.

Partnershipwithtechnologycompanies

couldbearoutetomorerapid

integrationofmoderntechnology

platforms.Potentiallypartnershipwith

consumercompaniesmightalsoreveal

opportunitiesforgreaterefciency.

Manycompanieshavestartedtoaddress

theneedtoreducemarketingandsales

infrastructureinmaturemarketsoftheUS

andWesternEurope.However,wethink

thepaceofchangecouldbeaccelerated

andmaybeakeycomponentof

preservingmarginsinthefaceof

increasingpressureonprice.New

technology,suchastheiPad,isenabling

greaterefciencyaccordingtoseveral

companiesincludingNovartis

13

and

Otsuka

14

.PzerlaunchedaniPhoneapp

toencouragedoctorstosendquestions

directlytothecompany

15

andAstraZeneca

hasaniPhone,iTouchandiPadappto

helpeducatehealthcareprofessionals

withgenetictestingforlungcancer

16

.

AstraZenecaalsorecentlylaunchedalive

click-to-chatfunctiononitsUSCrestor

andNexiumconsumerwebsites

17

.

Thebasisforassessingmarketing

andsaleseffectivenessneedsto

beaddressed.

Weseecommunicationofevolving

corporatestrategyinthefaceofthe

rapidlychangingindustryasessential.

Thisisnostraightforwardorsimpletask

andmeritsamajorcommitmentfrom

executivemanagement.

Focusonthelongerterm

inEmergingMarkets

EmergingMarketsarenotgoingto

replicatethedevelopmentofthe

westernpharmaceuticalmarketsofthe

last25yearsbutwilltakenewpaths

denedbythepressuresfromlarge

populations,rapidgrowthofboth

personalandnationalwealthand

alsotheclearneedforindividualsand

governmentstobalancespendingon

healthcarewithmultipleotherdemands.

Businessleadershipinkeygrowth

EmergingMarketsneedstodevelopaplan

forinvestmentinthemarketsthatthese

keycountrieswillbecome,notthosethat

theyaretoday.Merelyaddingmoreand

moresalesrepsonthegroundina

traditionalmodeldoesnotseeman

appropriatestrategyforthefuture.Itcould

bevalidtobuildapresencebutthepace

ofchangeissuchthatplansshouldbe

regularlyreviewedandrealigned.

13

http://www.pharmalot.com/2011/03/novartis-the-ipad-35000-more-visits-to-docs/

14

http://www.bloomberg.com/news/2010-06-08/ipads-to-help-otsuka-pharmaceutical-sales-force-market-drugs-

to-doctors.html

15

http://www.pharmalot.com/2010/06/one-more-way-to-minimize-the-sales-rep/

16

http://www.astrazeneca.co.uk/Media/latest-press-releases/2010/FIRST_IAPP_TO_HELP_EDUCATE_HPa_ON_

EGFR_GENETIC_TESTING?itemId=12167029

17

http://astrazeneca-us.com/about-astrazeneca-us/newsroom/all/12379170?itemId=12379170

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|28

ThediversenatureofEmergingMarkets

meritsacarefulrenementofinvestment

strategy;whileBrazil,Russia,India,

China,MexicoandTurkeymaycontribute

halfofEmergingMarketsales,dozens

ofothersmallermarketsmakeupthe

otherhalf.

Onerecentexampleoftheneedtoplan

forchangecanbefoundinChina.An

importantelementofthehistoricgrowth

experiencedbymostinternational

companieshascomefrombranded

generics, where the manufacturers

nameisaproxyforhighquality.Branded

genericshaveenjoyedhigherprices

(referredtoasseparatepricing)thanlocal

equivalentsthatarelimitedtoalower

maximumprice(knownasgeneral

pricing).Anewpricelistissuedin

November2010reducedseparatepricing

onnearly50drugsoutof200onthe

EssentialDrugList.Itisbelievedthat

separatepricingcouldbereducedor

eliminatedacrosstheboardoverthe

next4years.

Atthesametimethereislikelytobea

governmentpushtoincreaseuseof

OTCdrugssoldatretailpharmacies.

Thesemovesbygovernmentwillvery

likelyresultinmaterialchangesinthe

Chinesemarketandwillneeddifferent

infrastructurefrom2011tomaximise

longtermreturns.

Acceleratedevelopmentand

integrationofsocialmedia

andmobile-healthpolicy

Thepharmaceuticalindustryhaslagged

othermajorindustriesinitsuseofsocial

media.Atfacevaluethisisunderstandable

giventhehighlevelsofregulatory

scrutinyimposedonallaspectsofthe

industrys interaction with patients,

prescribersandpayors.

Since2009therehasbeenasignicant

investmentinsocialmedia.

Fromasurveyofthewebsitesofthe13

companiesthatwedeneasthelarge

capitalisationpharmaceuticalindustry,

15%haveablog,54%areonFacebook

and77%arenowonTwitter.

Howeveritisclearthatthereisan

opportunitynotonlytoleadthe

regulatorsandhelpdevelopregulatory

policybut,forinternalplanningpurposes,

beingpreparedtousesocialmedia

mightbeakeycompetitiveadvantage

inmanymarkets.

ForinstanceEmergingMarket

penetrationofsocialmediauseishigher

thaninWesternmarkets,withover

70%ofthepopulationofthePhilippines

andMalaysiaforexampleasactive

onlineusers.

Figure22

SocialmediausebyFortune

100Companiesin2009

Source:Burson-Marsteller:SocialMediaUseby

Fortune100Companies29thJuly2009

Industry

Percentagewith

ablog

Percentageon

Facebook

Percentageon

Twitter

Telecommunications 75% 100% 100%

Computer,ofce

equipment

67% 100% 67%

Specialtyretailer 50% 50% 100%

Foodanddrugstores 17% 33% 50%

Pharmaceuticals 33% 0% 33%

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

29|FuturePharma

Strategy2 Strategy2

InvestintheMarketingand

SalesInfrastructurefor2015

andBeyond

Figure23

GlobalSocialNetworkPenetration

SourceGlobalWebIndex

P

h

i

l

i

p

p

i

n

e

s

I

n

d

o

n

e

s

i

a

M

a

l

a

y

s

i

a

B

r

a

z

i

l

R

u

s

s

i

a

I

n

d

i

a

S

i

n

g

a

p

o

r

e

P

o

l

a

n

d

M

e

x

i

c

o

H

o

n

g

K

o

n

g

U

S

C

a

n

a

d

a

C

h

i

n

a

A

u

s

t

r

a

l

i

a

N

e

t

h

e

r

l

a

n

d

s

U

K

I

t

a

l

y

S

p

a

i

n

F

r

a

n

c

e

G

e

r

m

a

n

y

S

o

u

t

h

K

o

r

e

a

J

a

p

a

n

G

l

o

b

a

l

A

v

e

r

a

g

e

80%

70%

60%

50%

40%

30%

20%

10%

0%

%

A

c

t

i

v

e

o

n

l

i

n

e

u

s

e

r

s

Therisingpowerofpatientgroupsin

thedataagewillcontinueatpace.If

thepastveyearshasseentheindustry

focusonregulatoryandreimbursement

outcomesthenthenextveyearsshould

seeagreateremphasisonhowto

improvetheoutcomeforpatients. The

spreadofsocialmediauseseems

certaintobegivingpatientgroupsa

greatervoiceandempowering

individuals,withapotentialimpactat

alllevelsofhealthcareprovisionand

delivery. Theuseofsocialmediaoffers

theindustryaroutetorestoringtrust

withpatientsfromitscurrentlowebb

18

.

Theindustryneedsonlytolookback

inhistoryatthepowerexertedby

organisedpatientgroups(e.g.inthe

fast-trackingoftherstAIDSdrugs).

Patientgroupsarebecomingmore

organised,betterinformed,and

connectingacrossbordersusingsocial

media.Greaterinteractionwithsuch

groupsinastructuredwayshould

benetallaspectsofthepharmaceutical

developmentprocessandthesafeand

appropriateuseofmedicines

oncemarketed.

18

Financial Times 12th March 2010, Patients groups distrust big pharma

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

Strategy3

FuturePharma|30

AcquiremoreTalentand

ExperiencefromotherIndustries

Thegrowthmarketsofthefuturelook

morelikeconsumerbranddrivenmarkets

thanthetraditionalpharmaceutical

marketsofthe20thcentury.Thisbegs

thequestionofwhatleadershiptalentwill

berequiredtocapturetheopportunities

presentedbythesenewmarketswhile

maximisingthemostefcientreturns

frommatureWesternMarkets.

Ourresearchindicatesthatinaggregate

lessthan20%ofexecutiveteam

memberswithintheindustryhave

comefromoutsidethepharmaceutical

industrywithinthelast5years,withina

rangeof0%-50%.Themostcommon

rolenowlledbyindividualswith

industrialexperiencefromoutsidethe

pharmaceuticalsectoristhatofchief

nancialofcer.Theimpactofthe

attendantfreshthinkinghasbeenvisible

onhowindividualcompaniesspend

shareholderfundsandthescaleand

speedofefciencyprogrammes.

Morediversityoftalent

throughoutanygiven

organisationshouldenhance

andstrengthenthebusiness.

Thiscouldcoverallmajorbusinessareas.

Manufacturingandadministrationare

areasinwhichnewtalenthasbeen

recruitedbysomecompaniesbutthe

needforgreaterurgencyispressing.

EveninR&Dtherehavebeensomevery

successfulhiresofhighlyskilledacademic

researcherstoleaddrugdiscovery.

Webelievethatsenior

managementintheindustry

shouldactivelyseektalent

andexperiencefromoutside

thetraditionalgroupof

pharmaceuticalcompetitors.

However,itcouldbearguedthatlooking

forfreshapproachestokeyaccount

managementinthechangingworldof

marketingandsalesisthebusiness

activitywiththegreatestneed,giventhe

shiftingnatureofbothtraditionalWestern

andEmergingMarkets.Inparticular

regionalandcountrymanagementwould

benetfromhavingexperiencefrom

othersectors,asopposedtojustfrom

thepharmaceuticalindustry.Withtheold

salesrepcallingondoctormodelnow

beinggraduallyconsignedtohistory,we

believethattheindustryshouldlookto

importkeyaccountmanagement

techniquesfromothersectors,

notablyintheconsumerspace.

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

31|FuturePharma

Strategy4

UseInternalRateofReturnto

PrioritiseandRationalisethe

R&DPortfolio

Researchspendingistheminorpartof

industryR&Dinvestment(circa30%).

Itshouldbereviewedforhowandwhy

spendingistakingplacebutalso

scrutinisedastowhoisdoingthe

spendingi.e.thequalityoftheindividuals

leadingtheprojects.

Thisscrutiny,whichcouldbealongthelines

ofisthisbestbiology/bestmolecule/best

targetandarethesethebestpeople,begs

thequestionofhowdoyouknowthatyou

havethebestofanything?

Patentapplicationsled,scienticpapers

published(andtheproportioninthe

prestigiousjournals,suchasNatureand

Science),andthenumberoftimes

scientistsworkinginresearchhavebeen

citedbytheirpeersallspringtomindas

potentialmeasuresofquality.Assessment

byanindependentpanelofexpertsisa

furtherpossibility.

Developmentspendingandthepost

launchinvestmentneededtodeliver

acceptablereturnsisthebigissue.

Webelieveallcompaniesshouldhavea

standardisedapproachtobeabletoshow

onanongoingbasiswhatinternalrateof

return(IRR)hasbeenachievedonpast

investmentandaninternalperspective

onwhatrangeofreturnsisforecastfrom

thecurrentinvestments,andwhat

assumptionsareusedintheseprojections.

Suchanalysesshouldalsoincludeoff

balancesheetfundingthroughpartnerships

andminorityinvestmentinthirdparty

companies(typicallydevelopment

stagebiotechnologycompanies).

WebelievethistypeofIRRbased

informationcouldtransformthe

investmentdecisionsrecommendedby

seniormanagementintheindustryand

signedoffbyBoardsofDirectors.

Ifmoreefcientdevelopmentcanbe

achieved,andmarketingandsales

practicesaremodernised,lowerpeak

revenuenumberswillstillpermitinternal

rates of return well above the industrys

costofcapital.

Thereisalsoaneedtobeclear

aboutthetruecostofcapital

foranyindividualcompany.

Itishardtobelievethateverylatestage

portfoliointheindustryisoptimalandthat

noneoftheprojectscarriesapotentially

marginalornegativereturn.We

recommendre-evaluationofthevalue

propositionofallphaseII,phaseIIIand

registrationassetsonanIRRbasis.

Thisreviewshouldincludeadetailed

reviewoftheassumptionsthat

supporteddevelopmentofthese

assets.Considerationcouldbegiven

towhethertheforecastreturnscould

beimprovedbypartnershipsor

co-marketingarrangements.

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|32

Wethinkthatthemostsuccessful

companieshavecomplemented

theirscienticagendawithbusiness

performancemanagementgoals

andanintegratedapproachtoR&D

Finance.R&DFinanceiskeytoreducing

operationalobstaclesthatslowthe

progressofproductcandidatesto

marketbytimelyanalysisandnancial

reviewthroughtheintroductionofearly

warningindicatorsandgo/nogo

checkpointsbasedonnancial

analysisandevaluation.

WealsorecommendthefollowingactionsaspartoftheR&Dreview:

Set up an R&D team with the express role of working out how to beat

the companys key innovative compounds - an internal fast follower team

Assess whether the compounds with the highest potential return are

optimallyfundedtobringthemtomarketasrapidlyaspossiblewiththe

bestpossiblelabel

Consider introducing an external perspective to this process

Host an internal R&D day for all R&D employees worldwide to showcase

theirresearchtoeachotheranddrivehigherlevelsofcollaboration

Clearly articulate policy on collaborations with academia, biotechnology

companiesandsmallerpharmaceuticalcompaniesaswellaswithpeers

Look for ways to maintain a return on the intellectual capital built up during

periodsofsuccessinanygiventherapeuticarea.Toooftencompanies

discardthisintellectualcapitaloncepatentshaveexpired

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

33|FuturePharma

Strategy5

ReviewandRevise

GovernanceStandards

Changeshouldstartatthetop.Itcould

bearguedthattheindustryisstill

perceivedpoorlybyconsumersand

somepartsofgovernment.Theaim

shouldbetoreviseandimproveBoard

governancestandardstonotonly

ahigherlevelthananyindustry

competitor,buttothebestpractice

levelsseeninanyindustry.

Companiesneedtoconductaroot

andbranchreviewofgovernanceand

enterpriseriskmanagementacrossthe

entirevaluechaintounderstandbetter

theactivities,appreciatetheimpact

fromspeedofchangeandthe

increasingpressuresoneachlinkof

thechainfromearlyresearchand

development,throughlatestage

development,manufacturingtosales

andmarketing.

Weseeusingaspecialistapproachas

thebestwaytodealwiththesenew

risks,wherebypersonnelareemployed

inspecialistrisk/governanceroles,

togetherwithathree-stepapproach:

1.Internalindependentchecksand

balanceswherepeoplerevieweach

stageandhaveareportingline

outside of that areas particular

verticalwithdirectaccessto

C-Suiteexecutives.

2.Givepowerandcredenceto

internalauditgroupsandfocus

ontheiroutputs.

3.Usecompletelyindependentand

externalexpertswhoarealliedwith

ethics,riskandgovernanceasanal

checkandbalanceforeachelement

ofthevaluechain.

Weexpectallcompanies

inthesectorwillhavein

placerobustandmodern

employeeappraisal

systems.Wethinka

thoroughreviewofall

seniormanagementjob

descriptionsshouldbea

componentofthereview

oftheproductportfolio

andtheinvestmentin

marketingandsales

supportdescribedearlier.

Changingelementsofthevaluechainwhereweseethesenew

pressuresinclude:

Increased (volume and value of) research collaborations to source innovation

New social media use leading to exponential growth in data collection

andstorage

Changing IT landscapes (e.g. cloud computing)

Doing business in Emerging Markets (e.g. competitive landscape, the way

thingsaredonearoundhere,anti-briberyandcorruption,intermediaryrisk)

Regulators all gaining teeth regulators tend to regulate rules are not going to

getanyeasiergoingforward

Increasing use of third parties (e.g. CROs in late stage development, CMOs

inmanufacturing,ITorganisations)

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

FuturePharma|34

Change

shouldstart

atthetop.

2011 KPMG LLP, a UK limited liability partnership, is a subsidiary of KPMG Europe LLP and a member rm of the KPMG network

of independent member rms afliated with KPMG International Cooperative, a Swiss entity. All rights reserved.

PHARMACEUTICALS

FuturePharma

FiveStrategiestoAccelerate

theTransformationofthe

PharmaceuticalIndustryby2020

kpmg.co.uk

Contactus

EuropeanSectorLeader

ChrisStirling

KPMGintheUK

T:+442073118512

E:chris.stirling@kpmg.co.uk

Belgium

LudoRuysen

KPMGinBelgium

T:+3238211837

E:lruysen@kpmg.com

Denmark

LauBentBaun

KPMGinDenmark

T:+4538183530

E:lbaun@kpmg.dk

France

WilfridLaurianodoRego

KPMGinFrance

T:+33155686872

E:wlaurianodorego@kpmg.com

Germany

VirLakshman

KPMGinGermany

Wirtschaftsprufungsgesellschaft