Professional Documents

Culture Documents

Honda Motor Company: Presented By: Zach Bodine March 9, 2006

Honda Motor Company: Presented By: Zach Bodine March 9, 2006

Uploaded by

dilip5040 ratings0% found this document useful (0 votes)

4 views25 pagesOriginal Title

234646850-Honda

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views25 pagesHonda Motor Company: Presented By: Zach Bodine March 9, 2006

Honda Motor Company: Presented By: Zach Bodine March 9, 2006

Uploaded by

dilip504Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 25

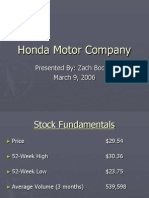

Honda Motor Company

Presented By: Zach Bodine

March 9, 2006

Stock Fundamentals

Price

52-Week High

52-Week Low

Average Volume (3 months)

Market Capitalization

$29.54

$30.36

$23.75

539,598

$55.55 Bil

Investment Recommendation

Buy/Hold

Key Ratios

Ratios (all per share)

P/E Ratio

Earnings

Dividend and Yield

Financial Strength Ratios

Quick

Current

Long-Term D/E

Total Debt to Equity

Return on Equity (per share)

Return on Assets

13.46

$2.19

0.34 (1.10%)

0.84

1.13

0.839

13.52%

5.03%

Growth Percentages

Over the past 5 Years

Revenue

Dividend Per Share

Earnings Per Share

Operating Income

7.2%

19.42%

14.1%

8.2%

Company Description

Automotive Manufacturers

Major

1. Automobiles

2. Motorcycles

3. Power Products

4. Financial Services

HMC Sales Allocation Over the Past 9 Months

12%

81%

3%

4%

Motorcycles

Automobiles

Financial Services

Power Products

Honda is the Worlds Largest motorcycle manufacturer

but is most known for its automotive industry

Global Position

Over 9 month span

Honda generated 59% of its automobile

profit from the North America alone,

which was an increase of 2.5% from a

year ago.

However, Asia led in Motorcycle sales

with 27.5%, while N.A. had 25.5%. This

was opposite of a year ago.

HMC Sales Allocation Across Countries (last

reported 9 mo.)

18%

54%

10%

11%

7%

Japan

North America

Europe

Asia

Other Regions

Sales for the last 9 months

ended Dec 30, 2005 totaled

$60.9B, and Sales for all of 2005

totaled $80.5B.

Automobile Business

9 months ended

Dec. 30, 2005

Sales Make

up

% change from

previous year

Japan 18.50% -2.70%

North America 58.90% 2.40%

Europe 8.40% 0.30%

Asia 9.30% -0.30%

Other Regions 4.60% 0.30%

Hondas Automobile Brands

Hondas principal

automobile products

include passenger cars

under:

Legend, Accord, Civic,

City, Fit Saloon, Acura

RL, Acura TL, and

Acura TSX brands

Multiwagons, Minivans,

Sport utility vehicle, and

Sports coupe under:

Elysion, Odyssey, Step

Wagon, Edix, FR-V,

Stream, Fit, Jazz, Pilot,

Element, CR-V, Acura

MDX, and Acura RSX

brands

Consumer Reports Top Automobile picks for 2006

Top Small Sedan (less than $20gs)

Top Family Sedan ($20-$30gs)

Top Upscale Sedan ($30-40gs)

Luxury Sedan

SUV ($30gs and more)

Small SUV (less than $30gs)

Top Minivan

Top Pick-up Truck

Green Car

Fun to drive

Honda Civic

Honda Accord

Acura TL (Honda)

Infiniti M35 (Nissan)

Toyota Highlander Hybrid

Subaru Forester

Honda Odyssey

Honda Ridgeline

Toyota Prius

Subaru Imprezza

Additionally, Honda was 2

nd

overall in vehicle reliability right behind Lexus

Marketing/Technology

The new ACE System

(Advanced Compatibility

Engineering)

5 star rating

Hybrid Engines

ASIMO

Jet Engines Manufacturing

Nattokinase

Research and Development

Honda currently has individualized R&D facilities in Japan

for motorcycles, automobiles, and power products, and a

motorcycle R&D center in China for its increasing market

demand.

HRI (the Honda Research Institute) is located in Japan,

U.S., and Germany.

- Research focus on: robotics technology, automotive

safety, ultra lightweight products, and fuel cell technology

- Deriving automotive fuel from plants.

Honda also has networked facilities in the UK, Germany

and Italy (to help focus on the European market more

independently)

Management Structure

President and

Representative Director

Takeo Fukui

Age: 62

Executive Vice-President and

Representative Director

Satoshi Aoki

Age: 60

Promotion of Objective Management:

Staff composed of 22 personnel. Two director positions and one

auditor assigned annually outside the company.

Temporary directors are paid according to how well the Company

performs during their tenor.

Image

New Jersey Supreme Court: Honda sued for

engine failure by a leasee.

Magnussen Warranty Act

Engine failure occurred @ 22,000 miles

Losing company must cover all legal fees

AAM supports Honda

Clean- Fuel tax deduction (2005)

Tax breaks under new energy bill (2006)

Competitive Analysis

HMC F GM TM Industry

Market Cap: 53.25B 14.06B 10.86B 171.94B 53.25B

Employees: 137,827 300,000 327,000 265,753 300.00K

Qtrly Rev Growth (yoy): 15.80% 3.60% -1.20% 14.80% 5.60%

5 year Sales Growth 9.74% 1.06% 1.34% 11.12% N/A

Revenue (ttm): 81.00B 177.09B 192.60B 173.35B 177.09B

Gross Margin (ttm): 29.58% 8.21% 1.53% 18.27% 18.27%

EBITDA (ttm): 8.64B 16.10B 5.82B 24.35B 16.10B

Oper Margins (ttm): 7.09% 1.00% -5.34% 8.30% 7.89%

Net Income (ttm): 4.05B 2.23B -8.45B 10.82B 3.37B

EPS (ttm): 2.19 1.048 -15.14 6.61 2.19

P/E (ttm): 13.22 7.22 N/A 15.99 15.99

PEG (5 yr expected): 2.06 2.07 N/A 2.9 2.07

P/S (ttm): 0.67 0.08 0.06 1 0.66

ROE 14.10% 15.70% -13.00% 12.70% N/A

ROA 5.10% 0.80% -0.70% 4.70% N/A

Dividend Yield 1.12% 5.23% 11.09% 1.20% N/A

Industry Trends

Trend of Companies performing well in foreign markets, but not

domestically.

GM: Dealing with Health care problems ($100B annually)

Sold GMAC Subsid.

Possibility of bankruptcy in the future

Ford: $1.6B decline in car sales from years ending 04 05

Sold Hertz rentl car business

Chrysler: Changes management around

Only U.S. manufacturer not in the red

Volkswagen: high prices, low quality, plus labor force issues

Toyota and Honda are prospering well in U.S. market

Everyone looks to China for expansion

Market Performance

One Year Price Performance Compared to the S&P 500

Market Performance

5 year Price Performance Compared to the S&P 500

Common Size Financials

Income Statement

Revenue (ttm): 81.00B

Revenue Per Share (ttm): 43.86

Qtrly Revenue Growth (yoy): 15.80%

Gross Profit (ttm): 24.29B

EBITDA (ttm): 8.64B

Net Income Avl to Common (ttm): 4.05B

Diluted EPS (ttm): 2.19

Qtrly Earnings Growth (yoy): -11.70%

Balance Sheet

Total Cash (mrq): 5.27B

Total Cash Per Share (mrq): 2.865

Total Debt (mrq): 27.54B

Total Debt/Equity (mrq): 0.839

Current Ratio (mrq): 1.128

Book Value Per Share (mrq): 17.82

Cash Flow Statement

Operating Cash Flow (ttm): 5.18B

Levered Free Cash Flow (ttm): 1.25B

Valuation Data For Return on Equity

Beta = .46

Risk Free Rate = .486

Avg. Market Risk = 11%

Re = Rf + B(Equity Risk Premium)

Re = .0486+.46(.11-.0486) = 7.68%

Valuation of Stock Price

Intrinsic Value based on Future Cash Flows

Conservative Growth rate

Normal Growth

Re= 7.68%

Owner earnings= $3.14B

Growth rate = 4%

Second Stage Growth rate = 2.5%

Estimated Intrinsic Value= $39.11

Valuation continued

Diminishing Growth

Using revenue growth of 14.3% from 2003-2004, and 6%

from 2004-2005, you could project that revenue growth

from 2005-2006 could be equal to:

6/14.3=.4196

.4196*6= 2.52% (new assumed growth rate)

Leaving all other variables the same

Estimated Intrinsic Value = $34.84

Valuation continued..

Impressive growth

By Viewing the table which displays sales in yen over the

9 months ended 12/31/2004, and then looking at the

sales in yen for the 9 months ended 12/31/2005 you get

the following numbers

2004 sales = 6300551

2005 sales =7074255

Growth rate= 7074255/6300551= 12.2%

Adjusted to 10%

Estimated Intrinsic Value = $62.50

Analysts Ratings finance.yahoo.com

RECOMMENDATION SUMMARY*

Mean Recommendation (this week): 1.3

Mean Recommendation (last week): 1.3

Change: 0

Industry Mean: N/A

Sector Mean: N/A

S&P 500 Mean: 2.46

Current

1 Month

Ago

3 Months

Ago

Strong Buy 2 2 2

Moderate Buy 1 1 1

Hold 0 0 0

Moderate Hold 0 0 0

Sell 0 0 0

Pros and Cons

Pros:

Fuel/ cost efficient products and technology

Extensive R&D programs

Superior Technology

Moving towards differentiated product lines

One of the few currently profiting companies in its industry

Objective Management Structure

Continuous increase in automotive sales in North America, particularly U.S.,

and in Europe as well.

Cons:

Fluctuation of Exchange rates, makes for inconsistent earnings

Japans Economy

Automotive industry very susceptible to interest rates

Toyota may be a better buy

Questions

?

You might also like

- The History of MoneyDocument29 pagesThe History of MoneyyannisxylasNo ratings yet

- Assignment: Littlefield Simulation - Game 2Document8 pagesAssignment: Littlefield Simulation - Game 2Sumit SinghNo ratings yet

- Nissan SwotDocument40 pagesNissan SwotAbhijit Kardekar0% (1)

- Brief Financial Report On Ford Versus ToyotaDocument8 pagesBrief Financial Report On Ford Versus ToyotaSayantani Nandy50% (2)

- LCD Loan PrimerDocument40 pagesLCD Loan PrimerMahesh Nagwan100% (2)

- Finance and AccountingDocument882 pagesFinance and Accountingabraham_simons67% (3)

- Lean-Mfg Basics r1Document54 pagesLean-Mfg Basics r1Agung CPNo ratings yet

- Global Auto IndustryDocument200 pagesGlobal Auto IndustryPRADITYO PUTRA PURNOMO ,100% (1)

- 02 Varun Nagar - Case HandoutDocument2 pages02 Varun Nagar - Case Handoutravi007kant100% (1)

- Payment Receipt: This Receipt Is Not Proof That Funds Have Reached The BeneficiaryDocument1 pagePayment Receipt: This Receipt Is Not Proof That Funds Have Reached The Beneficiarysunny tamrakar100% (2)

- Actrev2 - InvestmentsDocument19 pagesActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- Disciplined Trader Trade Journal (Shares)Document851 pagesDisciplined Trader Trade Journal (Shares)Nirmal SthaNo ratings yet

- Company Profile of ToyotaDocument3 pagesCompany Profile of ToyotaAri Purnama Dewi100% (1)

- Toyota Success RecipeDocument7 pagesToyota Success Recipeapi-3740973No ratings yet

- Honda Motor Company: Presented By: Zach Bodine March 9, 2006Document25 pagesHonda Motor Company: Presented By: Zach Bodine March 9, 2006Rohit KatyalNo ratings yet

- Honda Final PPT To ShowDocument20 pagesHonda Final PPT To ShowParul ChughNo ratings yet

- Arun Bassi Sukrit Gupta Vikalp Garg Ajit PalDocument20 pagesArun Bassi Sukrit Gupta Vikalp Garg Ajit PalHarini VengalaNo ratings yet

- Presented By:: Anmol Kalucha Aniket Choudhary Animesh Batra Ashmik Paul Ashish Chawla Anshul AggarwalDocument25 pagesPresented By:: Anmol Kalucha Aniket Choudhary Animesh Batra Ashmik Paul Ashish Chawla Anshul AggarwalAniket ChoudharyNo ratings yet

- Honda Final PPT To ShowDocument20 pagesHonda Final PPT To Showvikalpgarg71% (7)

- Strategic Management Presentation On VW FINALDocument32 pagesStrategic Management Presentation On VW FINALSoham SahaNo ratings yet

- Business Management - Toyota CaseDocument14 pagesBusiness Management - Toyota CaseBilgiMBA100% (1)

- HondaDocument20 pagesHondaVivek DhandeNo ratings yet

- Honda Financial Report 2008 Analysis With Ratio AnalysisDocument14 pagesHonda Financial Report 2008 Analysis With Ratio Analysisblackhat911100% (15)

- Honda MarketingDocument29 pagesHonda MarketingAnkit GuptaNo ratings yet

- HondaDocument14 pagesHondaPawan GuptaNo ratings yet

- Honda MotorsDocument4 pagesHonda MotorsjadezzNo ratings yet

- SWOT NissanDocument7 pagesSWOT NissanWq Quan100% (1)

- GM MyDocument68 pagesGM MyRonak BhatiaNo ratings yet

- Company Analysis: Bajaj Auto LimitedDocument11 pagesCompany Analysis: Bajaj Auto LimitedNitin BaranawalNo ratings yet

- 3c Tata MotorsDocument13 pages3c Tata MotorsManjunath BaraddiNo ratings yet

- Reflective Paper - Ayush Arora (MGB18GL059)Document11 pagesReflective Paper - Ayush Arora (MGB18GL059)Ayush AroraNo ratings yet

- Company Background: Key FactsDocument10 pagesCompany Background: Key FactsShubham ShimpiNo ratings yet

- Toyota MarketingDocument291 pagesToyota Marketing2mq55dkbm6No ratings yet

- BUY BUY BUY BUY: Toyota Motor CorpDocument5 pagesBUY BUY BUY BUY: Toyota Motor CorpBrenda WijayaNo ratings yet

- Toyota Motor Corporation: A Wright Investors' Service Research ReportDocument46 pagesToyota Motor Corporation: A Wright Investors' Service Research ReportImran Max SaleemNo ratings yet

- Honda Motor Co., LTD.: Company ProfileDocument11 pagesHonda Motor Co., LTD.: Company ProfileYeo Pei ShiNo ratings yet

- Global Auto Industry: Franklin Guo Dat Hong Rex Liu Reya LuDocument200 pagesGlobal Auto Industry: Franklin Guo Dat Hong Rex Liu Reya LuHARSHIT SINGHNo ratings yet

- Acorda, Keanna Micha Ella DDocument20 pagesAcorda, Keanna Micha Ella DLennox Llew HensleyNo ratings yet

- Global Auto Industry: Franklin Guo Dat Hong Rex Liu Reya LuDocument200 pagesGlobal Auto Industry: Franklin Guo Dat Hong Rex Liu Reya LuRafee HossainNo ratings yet

- Strategic ThinkingDocument22 pagesStrategic ThinkingMashkoor KhanNo ratings yet

- Honda FinalDocument18 pagesHonda FinalSaurabh GuptaNo ratings yet

- J.P. Morgan Auto Conference Dana IncorporatedDocument11 pagesJ.P. Morgan Auto Conference Dana IncorporatedAndy HuffNo ratings yet

- Industry Overview: Marketing Issues in Automobile IndustryDocument29 pagesIndustry Overview: Marketing Issues in Automobile IndustryAbid IqbalNo ratings yet

- Assignment 2 - HondaDocument8 pagesAssignment 2 - HondaMabu MabuNo ratings yet

- Swot AnalysisDocument13 pagesSwot AnalysisPurva Bhandari0% (1)

- Honda Motor CoDocument8 pagesHonda Motor Cowe are IndiansNo ratings yet

- Internship at Rosy Blue SecuritiesDocument12 pagesInternship at Rosy Blue SecuritiesKrish JoganiNo ratings yet

- Final Report Tata MotorsdoneDocument10 pagesFinal Report Tata Motorsdone2K20MC10 AdityaNo ratings yet

- Automobile Sales - September 2013: Car, CV Sales Stay Weak, But Improvement in Two-WheelersDocument3 pagesAutomobile Sales - September 2013: Car, CV Sales Stay Weak, But Improvement in Two-WheelersTariq HaqueNo ratings yet

- RBC Motor WeeklyDocument11 pagesRBC Motor WeeklyJean Paul BésNo ratings yet

- Question 5: Can The Brand Survive Next Decade? If Yes, Then What Is Their Sustainability Plan? AnswerDocument7 pagesQuestion 5: Can The Brand Survive Next Decade? If Yes, Then What Is Their Sustainability Plan? AnswershonnashiNo ratings yet

- The Indian Automobile Industry: Presented By-Aabir Ahmad Rohit Gupta Gagandeep SinghDocument22 pagesThe Indian Automobile Industry: Presented By-Aabir Ahmad Rohit Gupta Gagandeep SinghAabir AhmadNo ratings yet

- Report BMW PDFDocument23 pagesReport BMW PDFVMMNo ratings yet

- STMGT Toyota FINAAALLLLDocument10 pagesSTMGT Toyota FINAAALLLLRasika KambliNo ratings yet

- Nada Data 2010 f2Document21 pagesNada Data 2010 f2colinsox007No ratings yet

- NissanDocument31 pagesNissanRomilio CarpioNo ratings yet

- FordDocument27 pagesFordSara MujawarNo ratings yet

- Strategic Marketing Group Volkswagen By: Max Haustein, Moyo, Tatiana MonserratDocument15 pagesStrategic Marketing Group Volkswagen By: Max Haustein, Moyo, Tatiana MonserratAhlam KassemNo ratings yet

- Business Paper - 3 Mock - October 2022Document8 pagesBusiness Paper - 3 Mock - October 2022Rashedul HassanNo ratings yet

- DownloadDocument8 pagesDownloadKevin Dani JobiliusNo ratings yet

- Ford 'S Competitors AnalysisDocument19 pagesFord 'S Competitors Analysism 144702778% (9)

- Ignition Coils, Distributors, Leads & Associated Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandIgnition Coils, Distributors, Leads & Associated Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiper Motors, Wiper Blades & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandWiper Motors, Wiper Blades & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Batteries (Commercial Vehicle OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandBatteries (Commercial Vehicle OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Interior Fittings, Trim, Seats, Heating & Ventilation (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandInterior Fittings, Trim, Seats, Heating & Ventilation (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Shock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandShock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Invitation For Renewal: Bajaj Allianz General Insurance Company LTDDocument2 pagesInvitation For Renewal: Bajaj Allianz General Insurance Company LTDSulekha BhattacherjeeNo ratings yet

- Creating A World Without Poverty Yunus en 9413 PDFDocument7 pagesCreating A World Without Poverty Yunus en 9413 PDFASyaukiMahmudiNo ratings yet

- Advanced Corporate Finance Course OutlineDocument10 pagesAdvanced Corporate Finance Course OutlineGilbert ShonhiwaNo ratings yet

- Mercantile Law: Arranged and SequencedDocument31 pagesMercantile Law: Arranged and SequencedSGNo ratings yet

- 3 Financial Statement AnalysisDocument45 pages3 Financial Statement AnalysisOmar Faruk 2235292660No ratings yet

- Anasco, Act6 EcoDocument6 pagesAnasco, Act6 EcoDolph Allyn AñascoNo ratings yet

- ProblemsDocument3 pagesProblemsshreya chapagainNo ratings yet

- Annex A Form 101 Checklist of DocumentsDocument3 pagesAnnex A Form 101 Checklist of DocumentsAdrian joseph AdrianoNo ratings yet

- Introducing A Travel Agency in BangladeshDocument40 pagesIntroducing A Travel Agency in BangladeshZubairia KhanNo ratings yet

- Meucci 2011 - The PrayerDocument29 pagesMeucci 2011 - The PrayershuuchuuNo ratings yet

- Acc Account Name Trial Balance Debit CreditDocument6 pagesAcc Account Name Trial Balance Debit CreditNofi NurlailaNo ratings yet

- Cash Flow Template From Xlteq LimitedDocument12 pagesCash Flow Template From Xlteq LimitedmuhammadhideyosiNo ratings yet

- Kalbe Farma TBK Billingual 31 Des 2021 ReleasedDocument163 pagesKalbe Farma TBK Billingual 31 Des 2021 ReleasedNanda IshermawanNo ratings yet

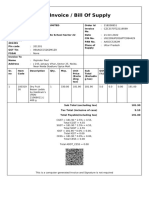

- Tax Invoice / Bill of SupplyDocument1 pageTax Invoice / Bill of SupplyCruise Films ProductionsNo ratings yet

- Nations TailDex Tail Risk IndexesDocument2 pagesNations TailDex Tail Risk IndexesEmanuele QuagliaNo ratings yet

- Fin 334-Corporate Bond Analysis 2014Document5 pagesFin 334-Corporate Bond Analysis 2014HelplineNo ratings yet

- 62287bos50449 Mod1 cp3Document51 pages62287bos50449 Mod1 cp3monicabhat96No ratings yet

- 6-7 Strategic CoorporateDocument50 pages6-7 Strategic CoorporateMoh SabilNo ratings yet

- Investment LawDocument12 pagesInvestment LawGauravKrishnaNo ratings yet

- Corporate Code of The PhilippinesDocument11 pagesCorporate Code of The PhilippinesDanJalbunaNo ratings yet

- DBFX Trading Station User GuideDocument28 pagesDBFX Trading Station User GuideSiddharth DurbhaNo ratings yet

- Exchange 2023 06 22Document1 pageExchange 2023 06 22Md Mintu MiahNo ratings yet

- REER & NeeRDocument19 pagesREER & NeeRhimanshu22109No ratings yet