Professional Documents

Culture Documents

18 Mergers and Acqiusition

Uploaded by

justingosocialOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

18 Mergers and Acqiusition

Uploaded by

justingosocialCopyright:

Available Formats

Mergers And Acquisitions

- 1

Mergers And Acquisitions

MERGERS

&

ACQUISITION

- 2

Mergers And Acquisitions

Contents

Chapters Page No.

Chapter 1. Introduction to Mergers and Acquisition. 2-5

Chapter 2. Purpose of merger and acquisition. 6-8

Chapter 3. Types of Mergers. -!"

Chapter 4. Ad#antages of mergers and ta$eo#ers. !!-!%

Chapter 5. Consideration of Merger and Ta$eo#er. !5-!

Chapter 6. &e#erse Merger. 2"-2%

Chapter 7. Procedure of Merger and Acquisition. 25-28

Chapter 8. '(y Mergers fai)*. 2-2

Chapter 10. Case +tudies.

GlaxoSmithlime the successful merger,

eutsche ! res"#er $a#% the merger that faile",

Sta#"Chart&Gri#"la's( )here Sta#"Chart ta%es o*er

Gri#"la's,

+ata&+etle'( the co#tro*ersial issue of success a#" failure.

,"-,8

- 3

Mergers And Acquisitions

Introduction to Mergers and

Acquisition

,e ha*e -ee# lear#i#g a-out the compa#ies comi#g together to from a#other compa#' a#"

compa#ies ta%i#g o*er the existi#g compa#ies to expa#" their -usi#ess.

,ith recessio# ta%i#g toll of ma#' .#"ia# -usi#esses a#" the feeli#g of i#securit' surgi#g o*er

our -usi#essme#, it is #ot surprisi#g )he# )e hear a-out the imme#se #um-ers of corporate

restructuri#gs ta%i#g place, especiall' i# the last couple of 'ears. Se*eral compa#ies ha*e -ee# ta%e#

o*er a#" se*eral ha*e u#"ergo#e i#ter#al restructuri#g, )hereas certai# compa#ies i# the same fiel" of

-usi#ess ha*e fou#" it -e#eficial to merge together i#to o#e compa#'.

.# this co#text, it )oul" -e esse#tial for us to u#"ersta#" )hat corporate restructuri#g a#"

mergers a#" ac/uisitio#s are all a-out.

0ll our "ail' #e)spapers are fille" )ith cases of mergers, ac/uisitio#s, spi#&offs, te#"er offers, 1

other forms of corporate restructuri#g. +hus importa#t issues -oth for -usi#ess "ecisio# a#" pu-lic

polic' formulatio# ha*e -ee# raise". 2o firm is regar"e" safe from a ta%eo*er possi-ilit'. 3# the more

positi*e si"e 4ergers 1 0c/uisitio#5s ma' -e critical for the health' expa#sio# a#" gro)th of the firm.

Successful e#tr' i#to #e) pro"uct a#" geographical mar%ets ma' re/uire 4ergers 1 0c/uisitio#5s at

some stage i# the firm6s "e*elopme#t. Successful competitio# i# i#ter#atio#al mar%ets ma' "epe#" o#

capa-ilities o-tai#e" i# a timel' a#" efficie#t fashio# through 4ergers 1 0c/uisitio#6s. 4a#' ha*e

argue" that mergers i#crease *alue a#" efficie#c' a#" mo*e resources to their highest a#" -est uses,

there-' i#creasi#g sharehol"er *alue. .

+o opt for a merger or #ot is a complex affair, especiall' i# terms of the tech#icalities i#*ol*e".

,e ha*e "iscusse" almost all factors that the ma#ageme#t ma' ha*e to loo% i#to -efore goi#g for

merger. Co#si"era-le amou#t of -rai#stormi#g )oul" -e re/uire" -' the ma#ageme#ts to reach a

co#clusio#. e.g. a "ue "ilige#ce report )oul" clearl' i"e#tif' the status of the compa#' i# respect of the

fi#a#cial positio# alo#g )ith the #et)orth a#" pe#"i#g legal matters a#" "etails a-out *arious co#ti#ge#t

lia-ilities. ecisio# has to -e ta%e# after ha*i#g "iscusse" the pros 1 co#s of the propose" merger 1 the

impact of the same o# the -usi#ess, a"mi#istrati*e costs -e#efits, a""itio# to sharehol"ers6 *alue, tax

- 4

Chapte

r

1

Mergers And Acquisitions

implicatio#s i#clu"i#g stamp "ut' a#" last -ut #ot the least also o# the emplo'ees of the +ra#sferor or

+ra#sferee Compa#'.

Merger-

4erger is "efi#e" as com-i#atio# of t)o or more compa#ies i#to a si#gle compa#' )here o#e

sur*i*es a#" the others lose their corporate existe#ce. +he sur*i*or ac/uires all the assets as )ell as

lia-ilities of the merge" compa#' or compa#ies. Ge#erall', the sur*i*i#g compa#' is the -u'er, )hich

retai#s its i"e#tit', a#" the exti#guishe" compa#' is the seller.

4erger is also "efi#e" as amalgamatio#. 4erger is the fusio# of t)o or more existi#g compa#ies.

0ll assets, lia-ilities a#" the stoc% of o#e compa#' sta#" tra#sferre" to tra#sferee compa#' i#

co#si"eratio# of pa'me#t i# the form of(

7/uit' shares i# the tra#sferee compa#',

e-e#tures i# the tra#sferee compa#',

Cash, or

0 mix of the a-o*e mo"es.

Acquisition-

0c/uisitio# i# ge#eral se#se is ac/uiri#g the o)#ership i# the propert'. .# the co#text of -usi#ess

com-i#atio#s, a# ac/uisitio# is the purchase -' o#e compa#' of a co#trolli#g i#terest i# the share capital

of a#other existi#g compa#'.

Methods of Acquisition:

0# ac/uisitio# ma' -e affecte" -'

8a9 agreeme#t )ith the perso#s hol"i#g ma:orit' i#terest i# the compa#' ma#ageme#t li%e mem-ers

of the -oar" or ma:or sharehol"ers comma#"i#g ma:orit' of *oti#g po)er;

8-9 purchase of shares i# ope# mar%et;

- 5

Mergers And Acquisitions

8c9 to ma%e ta%eo*er offer to the ge#eral -o"' of sharehol"ers;

8"9 purchase of #e) shares -' pri*ate treat';

8e9 0c/uisitio# of share capital through the follo)i#g forms of co#si"eratio#s *i<. mea#s of cash,

issua#ce of loa# capital, or i#sura#ce of share capital.

Ta$eo#er-

0 =ta%eo*er5 is ac/uisitio# a#" -oth the terms are use" i#tercha#gea-l'.

+a%eo*er "iffers from merger i# approach to -usi#ess com-i#atio#s i.e. the process of ta%eo*er,

tra#sactio# i#*ol*e" i# ta%eo*er, "etermi#atio# of share excha#ge or cash price a#" the fulfillme#t of

goals of com-i#atio# all are "iffere#t i# ta%eo*ers tha# i# mergers. >or example, process of ta%eo*er is

u#ilateral a#" the offeror compa#' "eci"es a-out the maximum price. +ime ta%e# i# completio# of

tra#sactio# is less i# ta%eo*er tha# i# mergers, top ma#ageme#t of the offeree compa#' -ei#g more co&

operati*e.

.e-merger or corporate sp)its or di#ision-

e&merger or split or "i*isio#s of a compa#' are the s'#o#'mous terms sig#if'i#g a mo*eme#t i#

the compa#'.

What will it take to succeed?

>u#"s are a# o-*ious re/uireme#t for )oul"&-e -u'ers. ?aisi#g them ma' #ot -e a pro-lem for

multi#atio#als a-le to tap resources at home, -ut for local compa#ies, fi#a#ce is li%el' to -e the si#gle

-iggest o-stacle to a# ac/uisitio#. >i#a#cial i#stitutio# i# some 0sia# mar%ets are -a##e" from lea"i#g

for ta%eo*ers, a#" "e-t mar%ets are small a#" illi/ui", "eterri#g i#*estors )ho fear that the' might #ot -e

a-le to sell their hol"i#gs at a later "ate. +he cre"it s/uee<es a#" the "epresse" state of ma#' 0sia#

e/uit' mar%ets ha*e o#l' ma"e a# alrea"' "ifficult situatio# )orse. >u#"s apart, a successful 4ergers 1

0c/uisitio# gro)th strateg' must -e supporte" -' three capa-ilities( "eep local #et)or%s, the a-ilities to

ma#age u#certai#t', a#" the s%ill to "isti#guish )orth)hile targets. Compa#ies that rush i# )ithout them

are li%el' to -e stum-le.

Assess target quality:

- 6

Mergers And Acquisitions

+o sa' that a compa#' shoul" -e )orth the price a -u'er pa's is to state the o-*ious. $ut

assessi#g compa#ies i# 0sia ca# -e fraught )ith pro-lems, a#" se*eral "eals ha*e go#e -a"l' )ro#g

-ecause -u'ers faile" to "ig "eepl' e#ough. +he attractio# of %#oc%"o)# price tag ma' tempt

compa#ies to s%ip crucial chec%s. Co#ceale" high "e-t le*els a#" "eferre" co#ti#ge#t lia-ilities ha*e

resulte" i# large "eals "estro'i#g *alue. $ut i# other cases, )here -u'ers ha*e u#"erta%e# "etaile" "ue

"ilige#ce, the' ha*e -ee# a-le to #egotiate prices as lo) as half of the i#itial figure.

ue "ilige#ce ca# -e "ifficult -ecause "isclosure practices are poor a#" compa#ies ofte# lac% the

i#formatio# -u'er #ee". 4oreo*er, most 0sia# co#glomerates still "o #ot prese#t co#soli"ate" fi#a#cial

stateme#ts, lea*i#g the possi-ilities that the sales a#" the profit figures might -e -loate" -' tra#sactio#s

-et)ee# affiliate" compa#ies. +he fi#a#cial recor"s that are a*aila-le are ofte# u#relia-le, )ith "iffere#t

pro:ectio#s ma"e -' "iffere#t "epartme#ts )ithi# the same compa#', a#" "iffere#t pro:ectio#s ma"e for

"iffere#t au"ie#ces. $a#%s a#" i#*estors, #aturall', are li%el' to -e sho)# optimistic forecasts.

- 7

Mergers And Acquisitions

Purpose of Mergers

and Acquisition

+he purpose for a# offeror compa#' for ac/uiri#g a#other compa#' shall -e reflecte" i# the

corporate o-:ecti*es. .t has to "eci"e the specific o-:ecti*es to -e achie*e" through ac/uisitio#. +he

-asic purpose of merger or -usi#ess com-i#atio# is to achie*e faster gro)th of the corporate -usi#ess.

>aster gro)th ma' -e ha" through pro"uct impro*eme#t a#" competiti*e positio#.

3ther possi-le purposes for ac/uisitio# are short liste" -elo)( &

/!0Procurement of supp)ies-

1. to safeguar" the source of supplies of ra) materials or i#terme"iar' pro"uct;

2. to o-tai# eco#omies of purchase i# the form of "iscou#t, sa*i#gs i# tra#sportatio# costs,

o*erhea" costs i# -u'i#g "epartme#t, etc.;

3. to share the -e#efits of suppliers eco#omies -' sta#"ar"i<i#g the materials.

/20&e#amping production faci)ities-

1. to achie*e eco#omies of scale -' amalgamati#g pro"uctio# facilities through more

i#te#si*e utili<atio# of pla#t a#" resources;

2. to sta#"ar"i<e pro"uct specificatio#s, impro*eme#t of /ualit' of pro"uct, expa#"i#g

3. mar%et a#" aimi#g at co#sumers satisfactio# through stre#gthe#i#g after sale

4. ser*ices;

5. to o-tai# impro*e" pro"uctio# tech#olog' a#" %#o)&ho) from the offeree compa#'

6. to re"uce cost, impro*e /ualit' a#" pro"uce competiti*e pro"ucts to retai# a#"

7. impro*e mar%et share.

/,0 Mar$et e1pansion and strategy-

1. to elimi#ate competitio# a#" protect existi#g mar%et;

2. to o-tai# a #e) mar%et outlets i# possessio# of the offeree;

- 8

Chapte

r

2

Mergers And Acquisitions

3. to o-tai# #e) pro"uct for "i*ersificatio# or su-stitutio# of existi#g pro"ucts a#" to e#ha#ce the

pro"uct ra#ge;

4. stre#gthe#i#g retai# outlets a#" sale the goo"s to ratio#ali<e "istri-utio#;

5. to re"uce a"*ertisi#g cost a#" impro*e pu-lic image of the offeree compa#';

6. strategic co#trol of pate#ts a#" cop'rights.

/%0 2inancia) strengt(-

1. to impro*e li/ui"it' a#" ha*e "irect access to cash resource;

2. to "ispose of surplus a#" out"ate" assets for cash out of com-i#e" e#terprise;

3. to e#ha#ce geari#g capacit', -orro) o# -etter stre#gth a#" the greater assets -ac%i#g;

4. to a*ail tax -e#efits;

5. to impro*e 7@S 87ar#i#g @er Share9.

/50 3enera) gains-

1. to impro*e its o)# image a#" attract superior ma#agerial tale#ts to ma#age its affairs;

2. to offer -etter satisfactio# to co#sumers or users of the pro"uct.

/60 45n de#e)opmenta) p)ans-

+he purpose of ac/uisitio# is -ac%e" -' the offeror compa#'5s o)# "e*elopme#tal pla#s.

0 compa#' thi#%s i# terms of ac/uiri#g the other compa#' o#l' )he# it has arri*e" at its o)#

"e*elopme#t pla# to expa#" its operatio# ha*i#g exami#e" its o)# i#ter#al stre#gth )here it

might #ot ha*e a#' pro-lem of taxatio#, accou#ti#g, *aluatio#, etc. -ut might feel resource

co#strai#ts )ith limitatio#s of fu#"s a#" lac% of s%ill ma#agerial perso##el5s. .t has to aim at

suita-le com-i#atio# )here it coul" ha*e opportu#ities to suppleme#t its fu#"s -' issua#ce of

securities, secure a""itio#al fi#a#cial facilities, elimi#ate competitio# a#" stre#gthe# its mar%et

positio#.

/60 +trategic purpose-

+he 0c/uirer Compa#' *ie) the merger to achie*e strategic o-:ecti*es through alter#ati*e t'pe

of com-i#atio#s )hich ma' -e hori<o#tal, *ertical, pro"uct expa#sio#, mar%et exte#sio#al or

other specifie" u#relate" o-:ecti*es "epe#"i#g upo# the corporate strategies. +hus, *arious t'pes

- 9

Mergers And Acquisitions

of com-i#atio#s "isti#ct )ith each other i# #ature are a"opte" to pursue this o-:ecti*e li%e

*ertical or hori<o#tal com-i#atio#.

/80 Corporate friend)iness-

0lthough it is rare -ut it is true that -usi#ess houses exhi-it "egrees of cooperati*e spirit "espite

competiti*e#ess i# pro*i"i#g rescues to each other from hostile ta%eo*ers a#" culti*ate situatio#s

of colla-oratio#s shari#g goo")ill of each other to achie*e performa#ce heights through -usi#ess

com-i#atio#s. +he com-i#i#g corporates aim at circular com-i#atio#s -' pursui#g this o-:ecti*e.

/0 .esired )e#e) of integration-

4ergers a#" ac/uisitio# are pursue" to o-tai# the "esire" le*el of i#tegratio# -et)ee# the t)o

com-i#i#g -usi#ess houses. Such i#tegratio# coul" -e operatio#al or fi#a#cial. +his gi*es -irth to

co#glomerate com-i#atio#s. +he purpose a#" the re/uireme#ts of the offeror compa#' go a lo#g

)a' i# selecti#g a suita-le part#er for merger or ac/uisitio# i# -usi#ess com-i#atio#s.

- 10

Mergers And Acquisitions

Types of ergers

4erger or ac/uisitio# "epe#"s upo# the purpose of the offeror compa#' it )a#ts to achie*e.

$ase" o# the offerors5 o-:ecti*es profile, com-i#atio#s coul" -e *ertical, hori<o#tal, circular a#"

co#glomeratic as precisel' "escri-e" -elo) )ith refere#ce to the purpose i# *ie) of the offeror

compa#'.

/A0 7ertica) com8ination-

0 compa#' )oul" li%e to ta%eo*er a#other compa#' or see% its merger )ith that compa#' to expa#"

espousi#g -ac%)ar" i#tegratio# to assimilate the resources of suppl' a#" for)ar" i#tegratio#

to)ar"s mar%et outlets. +he ac/uiri#g compa#' through merger of a#other u#it attempts o# re"uctio#

of i#*e#tories of ra) material a#" fi#ishe" goo"s, impleme#ts its pro"uctio# pla#s as per the

o-:ecti*es a#" eco#omi<es o# )or%i#g capital i#*estme#ts. .# other )or"s, i# *ertical com-i#atio#s,

the mergi#g u#"erta%i#g )oul" -e either a supplier or a -u'er usi#g its pro"uct as i#terme"iar'

material for fi#al pro"uctio#.

+he follo)i#g mai# -e#efits accrue from the *ertical com-i#atio# to the ac/uirer compa#' i.e.

819 it gai#s a stro#g positio# -ecause of imperfect mar%et of the i#terme"iar' pro"ucts, scarcit' of

resources a#" purchase" pro"ucts;

829 has co#trol o*er pro"ucts specificatio#s.

/90 :ori;onta) com8ination -

.t is a merger of t)o competi#g firms )hich are at the same stage of i#"ustrial process. +he

ac/uiri#g firm -elo#gs to the same i#"ustr' as the target compa#'. +he mail purpose of such mergers

is to o-tai# eco#omies of scale i# pro"uctio# -' elimi#ati#g "uplicatio# of facilities a#" the

operatio#s a#" -roa"e#i#g the pro"uct li#e, re"uctio# i# i#*estme#t i# )or%i#g capital, elimi#atio#

i# competitio# co#ce#tratio# i# pro"uct, re"uctio# i# a"*ertisi#g costs, i#crease i# mar%et segme#ts

a#" exercise -etter co#trol o# mar%et.

/C0 Circu)ar com8ination-

- 11

Chapte

r

3

Mergers And Acquisitions

Compa#ies pro"uci#g "isti#ct pro"ucts see% amalgamatio# to share commo# "istri-utio# a#"

research facilities to o-tai# eco#omies -' elimi#atio# of cost o# "uplicatio# a#" promoti#g mar%et

e#largeme#t. +he ac/uiri#g compa#' o-tai#s -e#efits i# the form of eco#omies of resource shari#g

a#" "i*ersificatio#.

/.0 Cong)omerate com8ination-

.t is amalgamatio# of t)o compa#ies e#gage" i# u#relate" i#"ustries li%e C4 a#" 4o"i .#"ustries.

+he -asic purpose of such amalgamatio#s remai#s utili<atio# of fi#a#cial resources a#" e#larges "e-t

capacit' through re&orga#i<i#g their fi#a#cial structure so as to ser*ice the sharehol"ers -' i#crease"

le*eragi#g a#" 7@S, lo)eri#g a*erage cost of capital a#" there-' raisi#g prese#t )orth of the

outsta#"i#g shares. 4erger e#ha#ces the o*erall sta-ilit' of the ac/uirer compa#' a#" creates

-ala#ce i# the compa#'5s total portfolio of "i*erse pro"ucts a#" pro"uctio# processes.

- 12

Mergers And Acquisitions

Ad!antages of ergers

and takeo!ers

4ergers a#" ta%eo*ers are perma#e#t form of com-i#atio#s )hich *est i# ma#ageme#t complete

co#trol a#" pro*i"e ce#trali<e" a"mi#istratio# )hich are #ot a*aila-le i# com-i#atio#s of hol"i#g

compa#' a#" its partl' o)#e" su-si"iar'. Sharehol"ers i# the selli#g compa#' gai# from the merger a#"

ta%eo*ers as the premium offere" to i#"uce accepta#ce of the merger or ta%eo*er offers much more price

tha# the -oo% *alue of shares. Sharehol"ers i# the -u'i#g compa#' gai# i# the lo#g ru# )ith the gro)th

of the compa#' #ot o#l' "ue to s'#erg' -ut also "ue to A-oots trappi#g ear#i#gsB.

Moti!ations for ergers and acquisitions

4ergers a#" ac/uisitio#s are cause" )ith the support of sharehol"ers, ma#ager5s a" promoters of

the com-i#g compa#ies. +he factors, )hich moti*ate the sharehol"ers a#" ma#agers to le#" support to

these com-i#atio#s a#" the resulta#t co#se/ue#ces the' ha*e to -ear, are -riefl' #ote" -elo) -ase" o#

the research )or% -' *arious scholars glo-all'.

/!0 2rom t(e standpoint of s(are(o)ders

.#*estme#t ma"e -' sharehol"ers i# the compa#ies su-:ect to merger shoul" e#ha#ce i# *alue.

+he sale of shares from o#e compa#'5s sharehol"ers to a#other a#" hol"i#g i#*estme#t i# shares shoul"

gi*e rise to greater *alues i.e. the opportu#it' gai#s i# alter#ati*e i#*estme#ts. Sharehol"ers ma' gai#

from merger i# "iffere#t )a's *i<. from the gai#s a#" achie*eme#ts of the compa#' i.e. through

8a9 reali<atio# of mo#opol' profits;

8-9 eco#omies of scales;

8c9 "i*ersificatio# of pro"uct li#e;

8"9 ac/uisitio# of huma# assets a#" other resources #ot a*aila-le other)ise;

8e9 -etter i#*estme#t opportu#it' i# com-i#atio#s.

- 13

Chapte

r

4

Mergers And Acquisitions

3#e or more features )oul" ge#erall' -e a*aila-le i# each merger )here sharehol"ers ma' ha*e

attractio# a#" fa*our merger.

/20 2rom t(e standpoint of managers

4a#agers are co#cer#e" )ith impro*i#g operatio#s of the compa#', ma#agi#g the affairs of the

compa#' effecti*el' for all rou#" gai#s a#" gro)th of the compa#' )hich )ill pro*i"e them -etter "eals

i# raisi#g their status, per%s a#" fri#ge -e#efits. 4ergers )here all these thi#gs are the guara#tee"

outcome get support from the ma#agers. 0t the same time, )here ma#agers ha*e fear of "isplaceme#t at

the ha#"s of #e) ma#ageme#t i# amalgamate" compa#' a#" also resulta#t "epreciatio# from the merger

the# support from them -ecomes "ifficult.

/,0 Promoter<s gains

4ergers "o offer to compa#' promoters the a"*a#tage of i#creasi#g the si<e of their compa#'

a#" the fi#a#cial structure a#" stre#gth. +he' ca# co#*ert a closel' hel" a#" pri*ate limite" compa#'

i#to a pu-lic compa#' )ithout co#tri-uti#g much )ealth a#" )ithout losi#g co#trol.

/%0 9enefits to genera) pu8)ic

.mpact of mergers o# ge#eral pu-lic coul" -e *ie)e" as aspect of -e#efits a#" costs to(

8a9 Co#sumer of the pro"uct or ser*ices;

8-9 ,or%ers of the compa#ies u#"er com-i#atio#;

8c9 Ge#eral pu-lic affecte" i# ge#eral ha*i#g #ot -ee# user or co#sumer or the )or%er i#

the compa#ies u#"er merger pla#.

- 14

Mergers And Acquisitions

/a0 Consumers

+he eco#omic gai#s reali<e" from mergers are passe" o# to co#sumers i# the form of

lo)er prices a#" -etter /ualit' of the pro"uct )hich "irectl' raise their sta#"ar" of li*i#g

a#" /ualit' of life. +he -ala#ce of -e#efits i# fa*our of co#sumers )ill "epe#" upo# the

fact )hether or #ot the mergers i#crease or "ecrease competiti*e eco#omic a#"

pro"ucti*e acti*it' )hich "irectl' affects the "egree of )elfare of the co#sumers through

cha#ges i# price le*el, /ualit' of pro"ucts, after sales ser*ice, etc.

/80 'or$ers community

+he merger or ac/uisitio# of a compa#' -' a co#glomerate or other ac/uiri#g compa#'

ma' ha*e the effect o# -oth the si"es of i#creasi#g the )elfare i# the form of purchasi#g

po)er a#" other miseries of life. +)o si"es of the impact as "iscusse" -' the researchers

a#" aca"emicia#s are( first)y= mergers )ith cash pa'me#t to sharehol"ers pro*i"e

opportu#ities for them to i#*est this mo#e' i# other compa#ies )hich )ill ge#erate

further emplo'me#t a#" gro)th to uplift of the eco#om' i# ge#eral. +econd)y= a#'

restrictio#s place" o# such mergers )ill "ecrease the gro)th a#" i#*estme#t acti*it' )ith

correspo#"i#g "ecrease i# emplo'me#t. $oth )or%ers a#" commu#ities )ill suffer o#

lesse#i#g :o- opportu#ities, pre*e#ti#g the "istri-utio# of -e#efits resulti#g from

"i*ersificatio# of pro"uctio# acti*it'.

/c0 3enera) pu8)ic

4ergers result i#to ce#trali<e" co#ce#tratio# of po)er. 7co#omic po)er is to -e

u#"erstoo" as the a-ilit' to co#trol prices a#" i#"ustries output as mo#opolists. Such

mo#opolists affect social a#" political e#*iro#me#t to tilt e*er'thi#g i# their fa*our to

mai#tai# their po)er a" expa#" their -usi#ess empire. +hese a"*a#ces result i#to

eco#omic exploitatio#. $ut i# a free eco#om' a mo#opolist "oes #ot sta' for a lo#ger

perio" as other compa#ies e#ter i#to the fiel" to reap the -e#efits of higher prices set i#

-' the mo#opolist. +his e#forces competitio# i# the mar%et as co#sumers are free to

su-stitute the alter#ati*e pro"ucts. +herefore, it is "ifficult to ge#erali<e that mergers

affect the )elfare of ge#eral pu-lic a"*ersel' or fa*ora-l'. 7*er' merger of t)o or more

compa#ies has to -e *ie)e" from "iffere#t a#gles i# the -usi#ess practices )hich protects

the i#terest of the sharehol"ers i# the mergi#g compa#' a#" also ser*es the #atio#al

- 15

Mergers And Acquisitions

purpose to a"" to the )elfare of the emplo'ees, co#sumers a#" "oes #ot create hi#"ra#ce

i# a"mi#istratio# of the Go*er#me#t polices.

- 16

Mergers And Acquisitions

Consideration of

Merger and Takeo!er

4ergers a#" ta%eo*ers are t)o "iffere#t approaches to -usi#ess com-i#atio#s. 4ergers are

pursue" u#"er the Compa#ies 0ct, 1C56 vide sectio#s 3C1D3C4 thereof or ma' -e e#*isage" u#"er the

pro*isio#s of .#come&tax 0ct, 1C61 or arra#ge" through $.>? u#"er the Sic% .#"ustrial Compa#ies 0ct,

1C85 )hereas, ta%eo*ers fall solel' u#"er the regulator' frame)or% of the S7$. ?egulatio#s, 1CC7.

Minority shareholders rights

S7$. regulatio#s "o #ot pro*i"e i#sight i# the e*e#t of mi#orit' sharehol"ers #ot agreei#g to the

ta%eo*er offer. Eo)e*er sectio# 3C5 of the Compa#ies 0ct, 1C56 pro*i"es for the ac/uisitio# of shares

of the sharehol"ers. 0ccor"i#g to sectio# 3C5 of the Compa#ies 0ct, if the offerer has ac/uire" at least

C0F i# *alue of those shares ma' gi*e #otice to the #o#&accepti#g sharehol"ers of the i#te#tio# of

-u'i#g their shares. +he C0F accepta#ce le*el shall #ot i#clu"e the share hel" -' the offerer or it5s

associates. +he proce"ure lai" "o)# i# this sectio# is -riefl' #ote" -elo).

1. .# or"er to -u' the shares of #o#&accepti#g sharehol"ers the offerer must ha*e reache" the C0F

accepta#ce le*el )ithi# 4 mo#ths of the "ate of the offer, a#" #otice must ha*e -ee# ser*e" o#

those sharehol"ers )ithi# 2 mo#ths of reachi#g the C0F le*el.

2. +he #otice to the #o#&accepti#g sharehol"ers must -e i# a prescri-e" ma##er. 0 cop' of a #otice

a#" a statutor' "eclaratio# -' the offerer 8or, if the offerer is a compa#', -' a "irector9 i# the

prescri-e" form co#firmi#g that the co#"itio#s for gi*i#g the #otice ha*e -ee# satisfie" must -e

se#t to the target.

3. 3#ce the #otice has -ee# gi*e#, the offerer is e#title" a#" -ou#" to ac/uire the outsta#"i#g

shares o# the terms of the offer.

- 17

Chapte

r

5

Mergers And Acquisitions

4. .f the terms of the offer gi*e the sharehol"ers a choice of co#si"eratio#, the #otice must gi*e

particulars of optio#s a*aila-le a#" i#form the sharehol"ers that he has six )ee%s from the "ate

of the #otice to i#"icate his choice of co#si"eratio# i# )riti#g.

5. 0t the e#" of the six )ee%s from the "ate of the #otice to the #o#&accepti#g sharehol"ers the

offerer must imme"iatel' se#" a cop' of #otice to the target a#" pa' or tra#sfer to the target the

co#si"eratio# for all the shares to )hich the #otice relates. Stoc% tra#sfer forms execute" o#

-ehalf of the #o#&accepti#g sharehol"ers -' a perso# appoi#te" -' the offerer must also -e se#t.

3#ce the compa#' has recei*e" stoc% tra#sfer forms it must register the offerer as the hol"er of

the shares.

6. +he co#si"eratio# mo#e', )hich is recei*e" -' the target, shoul" -e hel" o# trust for the perso#

e#title" to shares i# respect of )hich the sum )as recei*e".

7. 0lter#ati*el', if the offerer "oes #ot )ish to -u' the #o#&accepti#g sharehol"er5s shares, it must

still )ithi# o#e mo#th of compa#' reachi#g the C0F accepta#ce le*el gi*e such sharehol"ers

#otice i# the prescri-e" ma##er of the rights that are exercisa-le -' them to re/uire the offerer to

ac/uire their shares. +he #otice must state that the offer is still ope# for accepta#ce a#" specif' a

"ate after )hich the right ma' #ot -e exercise", )hich ma' #ot -e less tha# 3 mo#ths from the

e#" of the time )ithi# )hich the offer ca# -e accepte". .f the offerer fails to se#" such #otice it

8a#" it5s officers )ho are i# "efault9 are lia-le to a fi#e u#less it or the' too% all reaso#a-le steps

to secure complia#ce.

8. .f the sharehol"er exercises his rights to re/uire the offerer to purchase his shares the offerer is

e#title" a#" -ou#" to "o so o# the terms of the offer or o# such other terms as ma' -e agree". .f a

choice of co#si"eratio# )as origi#all' offere", the sharehol"er ma' i#"icate his choice )he#

re/uiri#g the offerer to ac/uire his shares. +he #otice gi*e# to sharehol"er )ill specif' the choice

of co#si"eratio# a#" )hich co#si"eratio# shoul" appl' i# "efault of a# electio#.

C. 3# applicatio# ma"e -' a# happ' sharehol"er )ithi# six )ee%s from the "ate o# )hich the

origi#al #otice )as gi*e#, the court ma' ma%e a# or"er pre*e#ti#g the offerer from ac/uiri#g the

shares or a# or"er specif'i#g terms of ac/uisitio# "ifferi#g from those of the offer or ma%e a#

or"er setti#g out the terms o# )hich the shares must -e ac/uire".

.# certai# circumsta#ces, )here the ta%eo*er offer has #ot -ee# accepte" -' the re/uire" C0F i#

*alue of the share to )hich offer relates the court ma', o# applicatio# of the offerer, ma%e a# or"er

- 18

Mergers And Acquisitions

authori<i#g it to gi*e #otice u#"er the Compa#ies 0ct, 1C85, sectio# 42C. .t )ill "o this if it is satisfie"

that(

a. the offerer has after reaso#a-le e#/uir' -ee# u#a-le to trace o#e or more sharehol"ers to )hom

the offer relates;

-. the shares )hich the offerer has ac/uire" or co#tracte" to ac/uire -' *irtue of accepta#ce of the

offerer, together )ith the shares hel" -' u#tracea-le sharehol"ers, amou#t to #ot less tha# C0F i#

*alue of the shares su-:ect to the offer; a#"

c. the co#si"eratio# offere" is fair a#" reaso#a-le.

+he court )ill #ot ma%e such a# or"er u#less it co#si"ers that it is :ust a#" e/uita-le to "o so,

ha*i#g regar", i# particular, to the #um-er of sharehol"er )ho has -ee# trace" )ho "i" accept the offer.

Alternati!e odes of acquisition

+he terms use" i# -usi#ess com-i#atio#s carr' ge#erall' s'#o#'mous co##otatio#s a#" ca# -e

use" i#tercha#gea-l'. 0ll the "iffere#t terms carr' o#e si#gle mea#i#g of AmergerB -ut each term ca##ot

-e gi*e# e/ual treatme#t i# the "iscussio# -ecause la) has create" a "i*i"i#g li#e -et)ee# =ta%e&o*er5

a#" ac/uisitio#s -' )a' of merger, amalgamatio# or reco#structio#. @articularl' the ta%eo*er

?egulatio#s for su-sta#tial ac/uisitio# of shares a#" ta%eo*ers %#o)# as S7$. 8Su-sta#tial 0c/uisitio#

of Shares a#" +a%eo*ers9 ?egulatio#s, 1CC7 *i"e sectio# 3 exclu"es a#' attempt of merger "o#e -' )a'

of a#' o#e or more of the follo)i#g mo"es(

8a9 -' allotme#t i# pursua#t of a# applicatio# ma"e -' the sharehol"ers for right issue a#" u#"er

a pu-lic issue;

8-9 prefere#tial allotme#t ma"e i# pursua#ce of a resolutio# passe" u#"er sectio# 818109 of the

Compa#ies 0ct, 1C56;

8c9 allotme#t to the u#"er)riters pursua#t to u#"er)riters agreeme#ts;

8"9 i#ter&se&tra#sfer of shares amo#gst group, compa#ies, relati*es, .#"ia# promoters a#" >oreig#

colla-orators )ho are sharehol"ersDpromoters;

- 19

Mergers And Acquisitions

8e9 ac/uisitio# of shares i# the or"i#ar' course of -usi#ess, -' registere" stoc% -ro%ers, pu-lic

fi#a#cial i#stitutio#s a#" -a#%s o# o)# accou#t or as ple"ges;

8f9 ac/uisitio# of shares -' )a' of tra#smissio# o# successio# or i#herita#ce;

8g9 ac/uisitio# of shares -' go*er#me#t compa#ies a#" statutor' corporatio#s;

8h9 tra#sfer of shares from state le*el fi#a#cial i#stitutio#s to co&promoters i# pursua#ce to

agreeme#ts -et)ee# them;

8i9 ac/uisitio# of shares i# pursua#ce to reha-ilitatio# schemes u#"er Sic% .#"ustrial Compa#ies

8Special @ro*isio#s9 0ct, 1C85 or schemes of arra#geme#ts, mergers, amalgamatio#, e&

merger, etc. u#"er the Compa#ies 0ct, 1C56 or a#' other la) or regulatio#, .#"ia# or >oreig#;

8:9 ac/uisitio# of shares of compa#' )hose shares are #ot liste" o# a#' stoc% excha#ge.

Eo)e*er, this exemptio# i# #ot a*aila-le if the sai" ac/uisitio# results i#to co#trol of a liste"

compa#';

8%9 such other cases as ma' -e exempte" from the applica-ilit' of Chapter ... of S7$.

regulatio#s -' S7$..

+he -asic logic -ehi#" su-sta#tial "isclosure of ta%eo*er of a compa#' through ac/uisitio# of

shares is that the commo# i#*estors a#" sharehol"ers shoul" -e ma"e a)are of the larger fi#a#cial sta%e

i# the compa#' of the perso# )ho is ac/uiri#g such compa#'5s shares. +he mai# o-:ecti*e of these

?egulatio#s is to pro*i"e greater tra#spare#c' i# the ac/uisitio# of shares a#" the ta%eo*ers of

compa#ies through a s'stem of "isclosure of i#formatio#.

"scrow account

+o e#sure that the ac/uirer shall pa' the sharehol"ers the agree" amou#t i# re"emptio# of his

promise to ac/uire their shares, it is a ma#"ator' re/uireme#t to ope# escro) accou#t a#" "eposit therei#

the re/uire" amou#t, )hich )ill ser*e as securit' for performa#ce of o-ligatio#.

+he 7scro) amou#t shall -e calculate" as per the ma##er lai" "o)# i# regulatio# 28829.

0ccor"i#gl'(

- 20

Mergers And Acquisitions

>or offers )hich are su-:ect to a mi#imum le*el of accepta#ce, a#" the ac/uirer "oes )a#t to

ac/uire a mi#imum of 20F, the# 50F of the co#si"eratio# pa'a-le u#"er the pu-lic offer i# cash shall

-e "eposite" i# the 7scro) accou#t.

Payent of consideration

Co#si"eratio# ma' -e pa'a-le i# cash or -' excha#ge of securities. ,here it is pa'a-le i# cash

the ac/uirer is re/uire" to pa' the amou#t of co#si"eratio# )ithi# 21 "a's from the "ate of closure of the

offer. >or this purpose he is re/uire" to ope# special accou#t )ith the -a#%ers to a# issue 8registere" )ith

S7$.9 a#" "eposit therei# C0F of the amou#t l'i#g i# the 7scro) 0ccou#t, if a#'. Ee shoul" ma%e the

e#tire amou#t "ue a#" pa'a-le to sharehol"ers as co#si"eratio#. Ee ca# tra#sfer the fu#"s from 7scro)

accou#t for such pa'me#t. ,here the co#si"eratio# is pa'a-le i# excha#ge of securities, the ac/uirer

shall e#sure that securities are actuall' issue" a#" "ispatche" to sharehol"ers i# terms of regulatio# 2C of

S7$. +a%eo*er ?egulatio#s.

- 21

Mergers And Acquisitions

#e!erse Merger

Ge#erall', a compa#' )ith the trac% recor" shoul" ha*e a less profit ear#i#g or loss ma%i#g -ut

*ia-le compa#' amalgamate" )ith it to ha*e -e#efits of eco#omies of scale of pro"uctio# a#" mar%eti#g

#et)or%, etc. 0s a co#se/ue#ce of this merger the profit ear#i#g compa#' sur*i*es a#" the loss ma%i#g

compa#' exti#guishes its existe#ce. $ut i# ma#' cases, the sic% compa#'5s sur*i*al -ecomes more

importa#t for ma#' strategic reaso#s a#" to co#ser*e commu#it' i#terest. +he la) pro*i"es

e#courageme#t through tax relief for the compa#ies that are profita-le -ut get merge" )ith the loss

ma%i#g compa#ies. .#fact this t'pe of merger is #ot a #ormal or a routi#e merger. .t is, therefore, calle"

as a &e#erse Merger.

+he allureme#t for such mergers is the tax sa*i#gs u#"er the .#come&tax 0ct, 1C61. Sectio# 720

of the 0ct e#sures the tax relief )hich -ecomes attracti*e for amalgamatio#s of sic% compa#' )ith a

health' a#" profita-le compa#' to ta%e the a"*a#tage of carr' for)ar" losses. +a%i#g a"*a#tage of the

pro*isio#s of sectio# 720 through merger or amalgamatio# is %#o)# as re*erse merger, )hich gi*es

sur*i*al to the sic% u#it -' mergi#g it )ith the health' u#it. +he health' u#it exti#cts loosi#g its #ame

a#" the sur*i*i#g sic% compa#' retai#s its #ame. Compa#ies to ta%e a"*a#tage of the sectio# follo) this

route -ut after a 'ear or so cha#ge their #ames to the o#e of the health' compa#' as )ere "o#e amo#gst

others -' Girlos%ar @#eumatics Ht". +he compa#' merge" )ith Girlos%ar +ractors Ht", a sic% u#it a#"

i#itiall' lost its #ame -ut after o#e 'ear it cha#ge" its #ame as )as prior to merger.

&e#erse Merger under Ta1 >a5s

Sectio# 720 of the .#come&tax 0ct, 1C61 is mea#t to facilitate re:u*e#atio# of sic% i#"ustrial

u#"erta%i#g -' mergi#g )ith healthier i#"ustrial compa#ies ha*i#g i#ce#ti*e i# the form of tax sa*i#gs

"esig#e" )ith the sole i#te#tio# to -e#efit the ge#eral pu-lic through co#ti#ue" pro"ucti*e acti*it',

i#crease" emplo'me#t a*e#ues a#" ge#eratio# of re*e#ue.

- 22

Chapte

r

6

Mergers And Acquisitions

/!0 9ac$ground

I#"er the existi#g pro*isio#s of the .#come&tax 0ct, so much of the -usi#ess loss of a 'ear as

ca##ot -e set off -' him agai#st the profits of the follo)i#g 'ear from a#' -usi#ess carrie" o# -' him. .f

the loss ca##ot -e so )holl' set off, the amou#t #ot so set off ca# -e carrie" for)ar" to the #ext

follo)i#g 'ear a#" so o#, up to a maximum of eight assessme#t 'ears imme"iatel' succee"i#g the

assessme#t 'ear for )hich the loss )as first compute". +he -e#efit of carr' for)ar" a#" set off of

-usi#ess loss is, ho)e*er, #ot a*aila-le u#less the -usi#ess i# )hich the loss )as origi#all' sustai#e" is

co#ti#ue" to -e carrie" o# -' the assessee. >urther, o#l' the assessee )ho i#curre" the loss -' his

pre"ecessor. Similarl', if a -usi#ess carrie" o# o#e assessee is ta%e# o*er -' a#other, the u#a-sor-e"

"epreciatio# allo)a#ce "ue to the pre"ecessor i# -usi#ess a#" set off agai#st his profits i# su-se/ue#t

'ears. .# *ie) of these pro*isio#s, the accumulate" -usi#ess loss a#" u#a-sor-e" "epreciatio# allo)a#ce

of a compa#' )hich merges )ith a#other compa#' u#"er a scheme of amalgamatio# ca##ot -e carrie"

for)ar" a#" set off -' the latter compa#' agai#st its profits.

+he *er' purpose of sectio# 720 is to re*i*e the -usi#ess of a# u#"erta%i#g, )hich is fi#a#ciall'

#o#&*ia-le a#" to -ri#g it -ac% to health. Sic%#ess amo#g i#"ustrial u#"erta%i#gs is a matter of gra*e

#atio#al co#cer#. 7xperie#ce has sho)# that ta%i#g o*er of such u#its -' Go*er#me#t is #ot al)a's the

most satisfactor' or the most eco#omical solutio#. +he more effecti*e course suggeste" )as to facilitate

the amalgamatio# of sic% i#"ustrial u#its )ith sou#" o#es -' pro*i"i#g i#ce#ti*es a#" remo*i#g

impe"ime#ts i# the )a' of such amalgamatio#. +o sa*e the Go*er#me#t from social costs i# terms of

loss of pro"uctio# a#" emplo'me#t a#" to relie*e the Go*er#me#t of the u#eco#omical -ur"e# of ta%i#g

o*er a#" ru##i#g sic% i#"ustrial u#its is o#e of the moti*ati#g factors i# i#tro"uci#g sectio# 720. +o

achie*e this o-:ecti*e so as to facilitate the merger of sic% i#"ustrial u#its )ith sou#" o#e, the ge#eral

rule of carr' for)ar" a#" set off of accumulate" losses a#" u#a-sor-e" "epreciatio# allo)a#ce of

amalgamati#g compa#' -' the amalgamate" compa#' )as statutoril' relate". $' a "eemi#g fictio#, the

accumulate" loss or the u#a-sor-e" "epreciatio# of the amalgamati#g is treate" to -e the loss or, as the

case ma' -e, allo)a#ce for "epreciatio# of the amalgamate" compa#' for the pre*ious 'ear i# )hich

amalgamatio# )as effecte".

+here are three statutor' co#"itio#s )hich are to -e fulfille" u#"er sectio# 720819 for the

-e#efits prescri-e" therei# to -e a*aila-le to the amalgamate" compa#', #amel' !

8i9 +he amalgamati#g compa#' )as, imme"iatel' -efore such amalgamatio#, fi#a#ciall' #o#&*ia-le

-' reaso# of its lia-ilities, losses a#" other rele*a#t factors;

8ii9 +he amalgamatio# is i# the pu-lic i#terest;

- 23

Mergers And Acquisitions

8iii9 Such other co#"itio#s as the Ce#tral Go*er#me#t ma' -' #otificatio# i# the 3fficial Ga<ette,

specif', to e#sure that the -e#efit u#"er this sectio# is restricte" to amalgamatio#, )hich )oul"

facilitate the reha-ilitatio# or re*i*al of the -usi#ess of amalgamati#g compa#'.

/20 &e#erse merger

0s it ca# -e #o) u#"erstoo", a re*erse merger is a metho" a"opte" to a*oi" the stri#ge#t

pro*isio#s of Sectio# 720 -ut still -e a-le to claim all the losses of the sic% u#it. >or "oi#g so, i# case of

a re*erse merger, i#stea" of a health' u#it ta%i#g o*er a sic% u#it, the sic% u#it ta%es o*erD amalgamates

)ith the health' u#it.

Eigh Court "iscusse" 3 tests for re*erse merger(

a. assets of tra#sferor compa#' -ei#g greater tha# tra#sferee compa#';

-. e/uit' capital to -e issue" -' the tra#sferee compa#' pursua#t to the ac/uisitio#

excee"i#g its origi#al issue" capital, a#"

c. the cha#ge of co#trol i# the tra#sferee compa#' clearl' i#"icate" that the prese#t

arra#geme#t )as a# arra#geme#t, )hich )as a t'pical illustratio# of ta%eo*er -' re*erse

-i".

Court hel" that prime facie the scheme of mergi#g a prosperous u#it )ith a sic% u#it coul" #ot -e

sai" to -e offe#"i#g the pro*isio#s of sectio# 720 of the .#come +ax 0ct, 1C61 si#ce the o-:ect

u#"erl'i#g this pro*isio# )as to facilitate the merger of sic% i#"ustrial u#it )ith a sou#" o#e.

/,0 +a)ient features of re#erse merger under section 62A

1. 0malgamatio# shoul" -e -et)ee# compa#ies a#" #o#e of them shoul" -e a firm of part#ers or

sole&proprietor. .# other )or"s, part#ership firm or sole&proprietar' co#cer#s ca##ot get the

-e#efit of tax relief u#"er sectio# 720 merger.

2. +he compa#ies e#teri#g i#to amalgamatio# shoul" -e e#gage" i# either i#"ustrial acti*it' or

shippi#g -usi#ess. .# other )or"s, the tax relief u#"er sectio# 720 )oul" #ot -e ma"e

a*aila-le to compa#ies e#gage" i# tra"i#g acti*ities or ser*ices.

3. 0fter amalgamatio# the Asic%B or Afi#a#ciall' u#*ia-le compa#'B shall sur*i*e a#" other

i#come ge#erati#g compa#' shall exti#ct. .# other )or"s esse#tial co#"itio# to -e fulfille" is

- 24

Mergers And Acquisitions

that the ac/uiri#g compa#' )ill -e a-le to re*i*e or reha-ilitate ha*i#g co#sume" the health'

compa#'.

4. 3#e of the merger part#er shoul" -e fi#a#ciall' u#*ia-le a#" ha*e accumulate" losses to

/ualif' for the merger a#" the other merger part#er shoul" -e profit ear#i#g so that tax relief to

the maximum exte#t coul" -e ha". .# other )or"s the compa#' )hich is fi#a#ciall' u#*ia-le

shoul" -e tech#icall' sou#" a#" feasi-le, commerciall' a#" eco#omicall' *ia-le -ut

fi#a#ciall' )ea% -ecause of fi#a#cial stri#ge#c' or lac% of fi#a#cial recourses or its lia-ilities

ha*e excee"e" its assets a#" is o# the -ri#% of i#sol*e#c'. +he seco#" re/uisite /ualificatio#

associate" )ith fi#a#cial u#a*aila-ilit' is the accumulatio# of losses for past fe) 'ears.

5. 0malgamatio# shoul" -e i# the pu-lic i#terest i.e. it shoul" #ot -e agai#st pu-lic polic', shoul"

#ot "efeat -asic te#ets of la), a#" must safeguar" the i#terest of emplo'ees, co#sumers,

cre"itors, customers a#" sharehol"ers apart from promoters of compa#' through the re*i*al of

the compa#'.

6. +he merger must result i#to follo)i#g -e#efit to the amalgamate" compa#' i.e. (a) carr'

for)ar" of accumulate" -usi#ess loses of the amalgamate" compa#'; (b) carr' for)ar" of

u#a-sor-e" "epreciatio# of the amalgamati#g compa#' a#" (c) accumulate" loss )oul" -e

allo)e" to -e carrie" for)ar" set of for eight su-se/ue#t 'ears.

7. 0ccumulate" loss shoul" arise from A@rofits a#" Gai#s from -usi#ess or professio#B a#" #ot

-e loss u#"er the hea" ACapital Gai#sB or ASpeculatio#B.

8. >or /ualif'i#g carr' for)ar" loss, the pro*isio#s of sectio# 72 shoul" ha*e #ot -ee#

co#tra*e#e".

C. Similarl' for carr' for)ar" of u#a-sor-e" "epreciatio# the co#"itio#s of sectio# 32 shoul" #ot

ha*e -ee# *iolate".

10. Specifie" authorit' has to -e satisfie" of the eligi-ilit' of the compa#' for the relief u#"er

sectio# 72 of the .#come +ax 0ct. .t is o#l' o# the recomme#"atio#s of the specifie" authorit'

that Ce#tral Go*er#me#t ma' allo) the relief.

- 25

Mergers And Acquisitions

11. +he compa#' shoul" ma%e a# applicatio# to a Aspecifie" authorit'B for re/uisite

recomme#"atio# of the case to the Ce#tral Go*er#me#t for gra#ti#g or allo)i#g the relief.

12. @roce"ure for merger or amalgamatio# to -e follo)e" i# such cases is same as i# a#' other

cases. Specifie" 0uthorit' ma%es recomme#"atio# after ta%i#g i#to co#si"eratio# the court5s

"irectio# o# scheme of amalgamatio#.

- 26

Mergers And Acquisitions

Procedure for

Takeo!er

and Acquisition

Pu$lic announceent%

+o ma%e a pu-lic a##ou#ceme#t a# ac/uirer shall follo) the follo)i#g proce"ure(

!. Appointment of merc(ant 8an$er-

+he ac/uirer shall appoi#t a mercha#t -a#%er registere" as categor' ! . )ith S7$. to a"*ise him

o# the ac/uisitio# a#" to ma%e a pu-lic a##ou#ceme#t of offer o# his -ehalf.

2. ?se of media for announcement-

@u-lic a##ou#ceme#t shall -e ma"e at least i# o#e #atio#al 7#glish "ail' o#e Ei#"i "ail' a#"

o#e regio#al la#guage "ail' #e)spaper of that place )here the shares of that compa#' are liste" a#"

tra"e".

,. Timings of announcement-

@u-lic a##ou#ceme#t shoul" -e ma"e )ithi# four "a's of fi#ali<atio# of #egotiatio#s or e#teri#g

i#to a#' agreeme#t or memora#"um of u#"ersta#"i#g to ac/uire the shares or the *oti#g rights.

- 27

Chapte

r

7

Mergers And Acquisitions

%. Contents of announcement-

@u-lic a##ou#ceme#t of offer is ma#"ator' as re/uire" u#"er the S7$. ?egulatio#s. +herefore,

it is re/uire" that it shoul" -e prepare" sho)i#g therei# the follo)i#g i#formatio#(

819 pai" up share capital of the target compa#', the #um-er of full' pai" up a#" partiall'

pai" up shares.

829 +otal #um-er a#" perce#tage of shares propose" to -e ac/uire" from pu-lic su-:ect

to mi#imum as specifie" i# the su-®ulatio# 819 of ?egulatio# 21 that is(

a9 +he pu-lic offer of mi#imum 20F of *oti#g capital of the compa#' to the

sharehol"ers;

-9 +he pu-lic offer -' a rai"er shall #ot -e less tha# 10F -ut more tha# 51F of

shares of *oti#g rights. 0""itio#al shares ca# -e ha" J 2F of *oti#g rights i# a#'

'ear.

839 +he mi#imum offer price for each full' pai" up or partl' pai" up share;

849 4o"e of pa'me#t of co#si"eratio#;

859 +he i"e#tit' of the ac/uirer a#" i# case the ac/uirer is a compa#', the i"e#tit' of the

promoters a#", or the perso#s ha*i#g co#trol o*er such compa#' a#" the group, if

a#', to )hich the compa#' -elo#g;

869 +he existi#g hol"i#g, if a#', of the ac/uirer i# the shares of the target compa#',

i#clu"i#g hol"i#g of perso#s acti#g i# co#cert )ith him;

879 Salie#t features of the agreeme#t, if a#', such as the "ate, the #ame of the seller, the

price at )hich the shares are -ei#g ac/uire", the ma##er of pa'me#t of the

co#si"eratio# a#" the #um-er a#" perce#tage of shares i# respect of )hich the

ac/uirer has e#tere" i#to the agreeme#t to ac/uirer the shares or the co#si"eratio#,

mo#etar' or other)ise, for the ac/uisitio# of co#trol o*er the target compa#', as the

case ma' -e;

- 28

Mergers And Acquisitions

889 +he highest a#" the a*erage pai" -' the ac/uirer or perso#s acti#g i# co#cert )ith

him for ac/uisitio#, if a#', of shares of the target compa#' ma"e -' him "uri#g the

t)el*e mo#th perio" prior to the "ate of the pu-lic a##ou#ceme#t;

8C9 3-:ects a#" purpose of the ac/uisitio# of the shares a#" the future pla#s of the

ac/uirer for the target compa#', i#clu"i#g "isclosers )hether the ac/uirer proposes to

"ispose of or other)ise e#cum-er a#' assets of the target compa#'(

@ro*i"e" that )here the future pla#s are set out, the pu-lic a##ou#ceme#t shall

also set out ho) the ac/uirers propose to impleme#t such future pla#s;

8109 +he =specifie" "ate5 as me#tio#e" i# regulatio# 1C;

8119 +he "ate -' )hich i#"i*i"ual letters of offer )oul" -e poste" to each of the

sharehol"ers;

8129 +he "ate of ope#i#g a#" closure of the offer a#" the ma##er i# )hich a#" the "ate -'

)hich the accepta#ce or re:ectio# of the offer )oul" -e commu#icate" to the share

hol"ers;

8139 +he "ate -' )hich the pa'me#t of co#si"eratio# )oul" -e ma"e for the shares i#

respect of )hich the offer has -ee# accepte";

8149 isclosure to the effect that firm arra#geme#t for fi#a#cial resources re/uire" to

impleme#t the offer is alrea"' i# place, i#clu"i#g the "etails regar"i#g the sources of

the fu#"s )hether "omestic i.e. from -a#%s, fi#a#cial i#stitutio#s, or other)ise or

foreig# i.e. from 2o#&resi"e#t .#"ia#s or other)ise;

8159 @ro*isio# for accepta#ce of the offer -' perso# )ho o)# the shares -ut are #ot the

registere" hol"ers of such shares;

8169 Statutor' appro*als re/uire" to o-tai#e" for the purpose of ac/uiri#g the shares u#"er

the Compa#ies 0ct, 1C56, the 4o#opolies a#" ?estricti*e +ra"e @ractices 0ct, 1C73,

a#"Dor a#' other applica-le la)s;

8179 0ppro*als of -a#%s or fi#a#cial i#stitutio#s re/uire", if a#';

- 29

Mergers And Acquisitions

8189 ,hether the offer is su-:ect to a mi#imum le*el of accepta#ces from the

sharehol"ers; a#"

81C9 Such other i#formatio# as is esse#tial fort the sharehol"ers to ma%e a# i#forme"

"esig# i# regar" to the offer.

- 30

Mergers And Acquisitions

Why Mergers fail?

Why Mergers &ail?

?e*e#ue "eser*es more atte#tio# i# mergers; i#"ee", a failure to focus o# this importa#t factor ma'

explai# )h' so ma#' mergers "o#5t pa' off. +oo ma#' compa#ies lose their re*e#ue mome#tum as the'

co#ce#trate o# cost s'#ergies or fail to focus o# post merger gro)th i# a s'stematic ma##er. Ket i# the

e#", halte" gro)th hurts the mar%et performa#ce of a compa#' far more tha# "oes a failure to #ail costs.

- 31

Chapte

r

8

Mergers And Acquisitions

Case 'tudies

CA+@ +T?.A !

GlaxoSmithGli#e @harmaceuticals Himite", .#"ia 8 Merger

Success 9.

4um-ai && Glaxo .#"ia Himite" a#" SmithGli#e $eecham @harmaceuticals 8.#"ia9 Himite" ha*e

legall' merge" to form GlaxoSmithKline harmaceuticals !imited i# .#"ia 8GSG). .t ma' -e recalle"

here that the glo-al merger of the t)o compa#ies came i#to effect i# ecem-er 2000.

Comme#ti#g o# the prospects of GSG i# .#"ia, Lice Chairma# a#" 4a#agi#g irector,

GlaxoSmithGli#e @harmaceuticals Himite", .#"ia, 4r. L +h'agara:a# sai", "#he t$o companies that

have merged to become GlaxoSmithKline in %ndia have a great heritage & a fact that gets reflected in

their products $ith strong brand equity'( Ee a""e", "#he t$o companies have a long history of

commitment to %ndia and en)oy a very good reputation $ith doctors* patients* regulatory authorities and

trade bodies' At GSK it $ould be our endeavor to leverage these strengths to further consolidate our

mar+et leadership'(

(la)o'ith*line+ India

+he merger i# .#"ia -ri#gs together t)o stro#g compa#ies to create a formi"a-le prese#ce i# the

"omestic mar%et )ith a mar%et share of a-out 7 per ce#t.

,ith this merger, GlaxoSmithGli#e has i#crease" its reach sig#ifica#tl' i# .#"ia. ,ith a fiel"

force of o*er 2,000 emplo'ees a#" more tha# 5,000 stoc%iest, the compa#'5s pro"ucts are a*aila-le

- 32

Chapte

r

9

Mergers And Acquisitions

across the cou#tr'. +he e#ha#ce" -as%et of pro"ucts of GlaxoSmithGli#e, .#"ia )ill help ser*e patie#ts

-etter -' stre#gthe#i#g the ha#"s of "octors -' offeri#g superior treatme#t a#" healthcare solutio#s.

(la)o'ith*line+ Worldwide

3)a1o+mit(B)ine p)c is the )orl"5s lea"i#g research&-ase" pharmaceutical a#" healthcare

compa#'. ,ith a# ?1 -u"get of o*er M2.3 -illio# 8?s.16, 130 crores9, GlaxoSmithGli#e has a

po)erful research a#" "e*elopme#t capa-ilit', e#compassi#g the applicatio# of ge#etics, ge#omics,

com-i#atorial chemistr' a#" other lea"i#g e"ge tech#ologies.

0 trul' glo-al orga#i<atio# )ith a )i"e geographic sprea", GlaxoSmithGli#e has its corporate

hea"/uarters i# the ,est Ho#"o#, IG. +he compa#' has o*er 100,000 emplo'ees a#" supplies its

pro"ucts to 140 mar%ets arou#" the )orl". .t has o#e of the largest sales a#" mar%eti#g operatio#s i# the

glo-al pharmaceutical i#"ustr'.

- 33

Mergers And Acquisitions

CA+@ +T?.A 2

eutsche ! res"#er $a#% 8 Merger ,ailure 9

+he merger that )as a##ou#ce" o# march 7, 2000 -et)ee# eutsche $a#% a#" res"#er $a#%,

Germa#'5s largest a#" the thir" largest -a#% respecti*el' )as co#si"ere" as Germa#'5s respo#se to

i#creasi#gl' tough competitio# mar%ets.

+he merger )as to create the most po)erful -a#%i#g group i# the )orl" )ith the -ala#ce sheet

total of #earl' 2.5 trillio# mar%s a#" a stoc% mar%et *alue arou#" 150 -illio# mar%s. +his )oul" put the

merge" -a#% for ahea" of the seco#" largest -a#%i#g group, I.S. -ase" citigroup, )ith a -ala#ce sheet

total amou#ti#g to 1.2 trillio# mar%s a#" also i# fro#t of the pla##e" Napa#ese -oo% mergers of

Sumitomo a#" Su%ura $a#% )ith 1.7 trillio# mar%s as the -ala#ce sheet total.

+he #e) -a#%i#g group i#te#"e" to spi# off its retail -a#%i#g )hich )as #ot ma%i#g much profit

i# -oth the -a#%s a#" costl', exte#si*e #et)or% of -a#% -ra#ches associate" )ith it.

+he merge" -a#% )as to retai# the #ame eutsche $a#% -ut a"opte" the res"#er $a#%5s gree#

corporate color i# its logo. +he future core -usi#ess li#es of the #e) merge" $a#% i#clu"e" i#*estme#t

$a#%i#g, asset ma#ageme#t, )here the #e) -a#%i#g group )as hope" to outsi"e the tra"itio#all'

"omi#a#t S)iss $a#%, Securit' a#" loa# -a#%i#g a#" fi#all' fi#a#ciall' corporate clie#ts ra#gi#g from

ma:or i#"ustrial corporatio# to the mi"&scale compa#ies.

,ith this %i#" of merger, the #e) -a#% )oul" ha*e reache" the #o.1 positio# of the IS a#"

create #e) "ime#sio#s of aggressi*e#ess i# the i#ter#atio#al mergers.

$ut -arel' 2 mo#ths after a##ou#ci#g their agreeme#t to form the largest -a#% i# the )orl", #egotiatio#s

for a merger -et)ee# eutsche a#" res"#er $a#% faile" o# 0pril 5, 2000.

+he mai# issue of the failure )as res"#er $a#%5s i#*estme#t arm, Glei#)ort $e#so#, )hich the

executi*e committee of the -a#% "i" #ot )a#t to reli#/uish u#"er a#' circumsta#ces.

.# the prelimi#ar' #egotiatio#s it ha" -ee# agree" that Glei#)ort $e#so# )oul" -e i#tegrate"

i#to the merge" -a#%. $ut from the outset these co#si"eratio#s e#cou#tere" resista#ce from the asset

ma#ageme#t "i*isio#, )hich )as eutsche $a#%5s i#*estme#t arm.

- 34

Mergers And Acquisitions

eutsche $a#%5s asset ma#ageme#t ha" o#l' i#tegrate" )ith Ho#"o#5s i#*estme#t group 4orga#

Gre#fell a#" the 0merica# $a#%er5s trust. +his "i*isio# alo#e co#tri-ute" o*er 60F of eutsche $a#%5s

profit. +he top people at the asset ma#ageme#t )ere #ot rea"' to u#"erta%e a #e) process of i#tegratio#

)ith Glei#)ort $e#so#. So there )as o#l' o#e optio# left )ith the res"#er $a#% i.e. to sell Glei#)ort

$e#so# completel'. Eo)e*er ,alter, the chairma# of the res"#er $a#% )as #ot prepare" for this. +his

le" to the )ith"ra)al of the res"#er $a#% from the merger #egotiatio#s.

.# eco#omic a#" political circles, the pla##e" merger )as cele-rate" as Germa#'5s a"*a#ce i#to

the premier league of the i#ter#atio#al fi#a#cial mar%ets. $ut the failure of the merger le" to the "isaster

of Germa#' as the fi#a#cial ce#ter.

- 35

Mergers And Acquisitions

CA+@ +T?.A ,

Sta#"ar" Chartere" Gri#"la'5s 8 Acquisition Success 9

.t has -ee# a hectic 'ear at Ho#"o#&-ase" Sta#"ar" Chartere" $a#%, goi#g -' its ac/uisitio#

spree across the 0sia&@acific regio#. 0t the helm of affairs, glo-all', is ?a#a +al)ar, group C73. +he

/ui#tesse#tial ge#eral, he %#e) )hat he )as up agai#st )he# he propou#"e" his 6emergi#g stro#ger6

strateg' & of gro)th through co#soli"atio# of emergi#g mar%ets & for the tur# of the 4ille##ium( loa"s of

scepticism. +he ce#tral issue( Sta# Chart5s 0ugust 2000 ac/uisitio# of 02O Gri#"la's $a#%, for P1.3

-illio#.

7*er'o#e %#o)s that ac/uisitio# is the eas' part, mergi#g operatio#s is #ot. 0#" rece#t histor' has

sho)# that -a#%i#g mergers a#" ac/uisitio#s 847?G7?S 1 0CQI.S.+.325s9, i# particular, are #ot as

simple to execute as u#if'i#g -ala#ce sheets. Ca# Sta# Chart5s propose" merger )ith 02O Gri#"la's -e

a#' "iffere#tR

+he 616 refers to the #e) e#tit', )hich )ill -e .#"ia6s 2o 1 foreig# -a#% o#ce the i#tegratio# is

complete". +his shoul" ta%e arou#" 18 mo#ths; till the#, 02O Gri#"la's )ill exist separatel' as

Sta#"ar" Chartere" Gri#"la's 8SCG9. +he 626 a#" 636 are Citi-a#% a#" Eo#g Go#g a#" Sha#ghai $a#%i#g

Corp 8ES$C9, .#"ia6s seco#" a#" thir" largest foreig# -a#%s, respecti*el'.

+hat ma%es the #e) e#tit' the )orl"6s -iggest 6emergi#g mar%ets6 -a#%. $' )a' of stre#gths, it

)ill ha*e treasur' operatio#s that )ill pro-a-l' go u#challe#ge" as the cou#tr'6s most sophisticate".

$est of all, it )ill -e a "'#amic -a#%. +ha#%s to pre&merger i#itiati*es ta%e# -' -oth -a#%s, it coul" per&

haps -oast of the cou#tr'6s fastest gro)i#g retail&-a#%i#g -usi#ess.

Sta#Chart is rate" highl' o# other parameters too. .t is curre#tl' targeti#g glo-al cost&sa*i#gs of

P108 millio# i# 2001, ha*i#g reporte" a profit&-efore&tax of P650 millio# i# the first half of 2000, up 31

per ce#t from the same perio" last 'ear. 2et re*e#ue i#crease" 6 per ce#t to P2 -illio# for the same

perio". Co#sumer -a#%i#g, a t'picall' lo)&profit -usi#ess )hich accou#te" for less tha# 40 per ce#t of

its glo-al operati#g profits till four 'ears ago, #o) -ri#gs i# 55 per ce#t of profits. So the compa#'6s

glo-al report car" loo%s fairl' goo".

- 36

Mergers And Acquisitions

Sta#Chart %#o)s it must#6t let its e#erg' "issipate. .t has -ee# gro)i#g at a claime" a##ual rate of

25 per ce#t i# the last t)o 'ears, )ell o*er the i#"ustr' a*erage of -elo) 10 per ce#t. $ut mai#tai#i#g

this pace )o#6t pro*e eas', )ith Citi-a#% a#" ES$C :ust )aiti#g to s#ip at it. +he 02O Gri#"la's

ac/uisitio# ha" happe#e" :ust -efore that, though the process starte" i# earl' 1CCC, at Sta# Chart5s

hea"/uarters i# Ho#"o#. 0t first, it )as :ust tal% of a strategic tie&up )ith 02O Gri#"la's, )hich ha" the

same colo#ial $ritish a#tece"e#ts.

$ut this pla# )as a-a#"o#e" )he# it -ecame e*i"e#t that all "ecisio#&ma%i#g )oul" *acillate

-et)ee# 4el-our#e a#" Ho#"o#, )here the t)o are hea"/uartere". $' ecem-er, 02O ha" expresse" a

)illi#g#ess to sell out, a#" Sta#Chart i#itiate" the "ue&"ilige#ce procee"i#gs. .t )as#6t u#til 4arch that a

fe) se#ior .#"ia# -a#% executi*es )ere let i#to the secret. 2o), it6s time to get goi#g. 0 #e) *ehicle,

#a*igators i# place, e#gi#es re**i#g a#" map charte", the roa" ahea" is challe#gi#g a#" full of promise.

+o steer clear of trou-le is the o#l' cautio# a"*ise" -' i#"ustr' a#al'sts, as the t)o -a#%s i#tegrate their

-usi#esses. Sceptics "o#6t see ho) Sta#Chart ca# reall' -e greater tha# the sum of its parts.

+he aggressio#, though, is #ot as ra) as it sou#"s. $ehi#" it all is a strateg' that e*er'o#e at

Sta#Chart seems to -e i# s'#chro#' )ith. 0#" -ehi#" that strateg' is +al)ar, *er' much the origi#ator of

the oft&repeate" phrase uttere" -' e*er' executi*e & Sgetti#g the right footpri#tS. +he other %e' )or"s

that te#" to fi#" their )a' i#to e*er' "iscussio# are 6focus6 a#" 6gro)th6.

Sta#Chart .#"ia6s #et #o#&performi#g loa#s, as a perce#tage of #et total a"*a#ces, is reporte" at

:ust 2 per ce#t for 1CCC&2000. .# terms of capital a"e/uac' too, the -a#%s are "oi#g fi#e. Sta#Chart has

a capital -ase of C.5 per ce#t of its ris%&)eighte" assets, )hile SCG has 10.C per ce#t. So, )ith or

)ithout a safet' #et pro*i"e" -' the glo-al group, the .#"ia# operatio#s are o# firm grou#".

- 37

Mergers And Acquisitions

CA+@ +T?.A %

+0+0 ! +7+H7K 8 -ontroversial %ssue over Success And

,ailure 9.

+he +ata group )as i#fusi#g a fresh 30 millio# pou#"s i#to +ata tea that ha" -ee# use" to -u' a#

85.7F sta%e i# the IG&-ase" +etle' last 'ear. 0lrea"' high o# a hea"' -re) of a fresh -u' a#" caffei#e,

most misse" )hat Grish#a Gumar6s stateme#t mea#t.

+ata +ea5s much h'pe" ac/uisitio# of +etle', o#e of the )orl"5s -iggest tea -ra#"s, is#5t

procee"i#g accor"i#g to the pla#. 15 mo#ths ago, the Gol%ata -ase" ?s C13 crore +ata +ea5s -u'out of

the pri*atel' hel" +he +etle' Group for ?s 1843 crore ha" stu##e" corporate )atchers a#" i#*estme#t

-a#%ers ali%e. .t )as a coupT 0# .#"ia# compa#' ha" use" a le*erage" -u'out to s#ag o#e of the

$ritai#5s -iggest e*er -ra#"s. .t )as -' far, the -iggest e*er le*erage" -u'out -' a# .#"ia# compa#'.

+ata +ea "i"#5t pa' cash upfro#t. .#stea", it i#*este" 70 millio# pou#"s as e/uit' capital to set up

+ata +ea. .t -orro)e" 235 millio# to -u' the +etle' sta%e. +he pla# )as that +etle'5s cash flo)s )oul"

-e i#sulate" from the "e-t -ur"e#.

,he# +ata +ea too% the -ig gam-le to -u' +etle', its i#te#t )as *er' clear. +he compa#' ha"

esta-lishe" a firm foothol" i# the "omestic mar%et a#" ha" a co#trolli#g positio# i# gro)i#g tea. Goi#g

glo-al loo%e" li%e the o-*ious thi#g to "o. ,ith +etle', the seco#" largest -ra#" after Hipto# i# its -ag,

+ata +ea loo%e" rea"' to set the +hames o# fire.

?ight from the start, +etle' )as #e*er a eas' -u'. .# 1CC6, 0llie" omec/, the li/uor a#" retail

co#glomerate, ha" put +etle' o# the -loc%. 7*e# the# +ata +ea, #estle, I#ile*er a#" Sara lee ha" put i#

-i"s, all u#"er 200 millio# pou#"s. 0llie" )a#te" to cash o# the ta-le. +ata +ea "i"#5t ha*e e#ough of its

o)#. +he others -i"s also "i" #ot go through. 7*e#tuall', +etle' group together )ith a co#sortium of

fi#a#cial i#*estors li%e @ru"e#tial a#" Schro"ers, -ought the e#tire e/uit' sta%e for 1C0 millio# pou#"s

i# all cash "eal. +)o 'ears later, +etle' )e#t for a# .@3, hopi#g to raise 350&400 millio# pou#"s. $ut the

.@3 #e*er too% place. Soo# after)ar"s, the i#*estors -ega# loo%i#g for exit optio#s. +etle' )as o#ce

agai# o# the -loc%.

- 38

Mergers And Acquisitions

.t )as u#til >e- 2000 that the "ue "ilige#ce )as complete". $' this time, the +ata6s )ere rea"'

)ith their offer. +he' )oul" pa' 271 millio# pou#"s to -u' the e#tire +etle' e/uit' a#" the fu#"s )oul"

go to)ar"s first pa'i#g off +etle'5s 106 millio# "e-t. +he -ala#ce )oul" go the o)#ers.

+he offer price "i" #ot i#clu"e rights to +etle' coffee -usi#ess, )hich )as sol" to the IS&-ase"

?o)la#" Coffee ?oasters a#" 4other @ar%er5s +ea a#" Coffee i# >e- 2000 for 55 millio# pou#"s.

>or +etle' #e) o)#ers, too, the pro-lems )ere o#l' :ust -egi##i#g. +he "eal hi#ge" o# +etle'5s

a-ilit', o*er a#" a-o*e co*eri#g its o)# "e-ts, to ser*ice the loa#s +ata +ea ha" ta%e# for the ac/uisitio#.

+hat5s )here realit' -ites.

Co#si"er the facts. ,he# +ata +ea ac/uire" +etle' through +ata +ea, it su#% i# 70 millio# pou#"s

as e/uit' a#" -orro)e" 235 millio# pou#"s fro ma co#sortium to fi#a#ce the "eal. .mplicit i# the H$3

)as that +etle'5s future cash flo)s )oul" fu#" the S@L5s i#terest a#" pri#cipal repa'me#t re/uireme#ts.

0t a# a*erage i#terest rate of 11.5F, +etle' #ee"e" to ge#erate 22 millio# pou#"s i# i#terest alo#e o# a

loa# o 1C0 millio# pou#"s. 0"" to this the i#terest o# the high cost *e#"or loa# #otes of 30 millio#

pou#"sUit )or%e" out to -e 4.5 millio# a#" the charges o# the )or%i#g capital portio#, amou#ti#g to 2

millio# pou#"s per a##um. 0ll this )or%s out to a-out 28 millio# pou#"s i# i#terest alo#e per 'ear.

0t the same time, it also has to pa' -ac% the pri#cipal of 110 millio# pou#"s o*er a #ice perio"

through half 'earl' i#stallme#ts. +his )or%s out to 12 millio# pou#"s per 'ear. .f 'ou )ere to assume

that "epreciatio# a#" restructuri#g charges )ere pegge" at last 'ear5s le*els, the -ill tots up to 48 millio#

pou#"s a 'ear. .# >K 1CCC, the +etle'5s cash flo)s )ere 2C millio# pou#"s.

Some of the pro-lems coul" ha*e -ee# o-*iate" if +etle'5s cash flo)s ha" i#crease" -' 40 F i#

>K 2001 o*er the pre*ious 'ear. +hat )a', the compa#' )oul" ha*e co*ere" -oth its o)# commitme#ts

as )ell as of the +ata6s. $ut the situatio# )orse#e". 4a:or IG retailers clampe" "o)# o# grocer' prices

last 'ear. +hat su-sta#tiall' re"uce" +etle'5s prici#g flexi-ilit'.

$esi"es, the IG tea mar%ets ha*e -ee# u#"er pressure for some time #o). 0ccor"i#g to the IG

go*er#me#t5s #atio#al foo" sur*e', there has -ee# a su-sta#tial fall i# the co#sumptio# of mai#stream

teas& tea&-ag -lac% teas "ru#% )ith mil% a#" sugar. 0lso the tea "ri#%i#g populatio# i# IG has come

"o)# from 77.1F to 68.3F i# 1CCC. 3# the other ha#", #atural :uices a#" coffee ha*e co#siste#tl'

i#crease" their mar%et share.

- 39

Mergers And Acquisitions

So, )he# it )as co#fro#te" -' +etle'5s sli"i#g performa#ce, )hat optio#s "i" +ata +ea ha*eR 3#

its o)#, it coul" #ot "o much. +he last 'ear has -ee# o#e of the )orst 'ears for the .#"ia# tea i#"ustr'

a#" +ata +ea has also -ee# affecte". +he "rop i# tea prices a#" a proliferatio# of smaller -ra#"s i# the

orga#i<e" segme#t ha*e ta%e# toll o# +ata +ea5s performa#ce. .# >K 2001, +ata +ea5s #et profit fell -'

1C.5CF from ?s 124.63 crore to ?s 100.21 crore. .#come from operatio#s "ecli#e" -' 8.72F.

$ut letti#g +etle' si#% u#"er the )eight of the i#terest -ur"e# )oul" ha*e -ee# a# u#thi#%a-le

optio#, gi*e# the prestige attache" to the "eal.

+hus from the a-o*e case )e i#fer that +ata ha" to shell out a lot of mo#e' to co*er all the "e-ts

of +etle' )hich )as fou#" #ot )orth' e#ough -' the ge#eral pu-lic.

,ut Tata still calls it to $e a success whereas in reality it is a failure.

- 40

Mergers And Acquisitions

NOTES

Ta8)e 5- Acquisitions in t(e Ce5 +eries Industries.

.#

"u

str

'

0c/uirerD$i""er +arget ate 4oti*e

Ad#er

tising

Agenc

y

,@@ Group plc 7/uus Nu#e 1CC6 7#tr' i# .#"ia# mar%et

4cCa##&7ric%so#

,orl")i"e

4cGa## 7ri%so# .#"ia 4arch 1CC8 $u'out :oi#t *e#ture part#er

,@@ Group plc Ei#"usta# +hompso#

0ssociates

Nu#e 1CC8 $u'out :oi#t *e#ture part#er

$ates ,orl")i""e $ates Cario# Na# 2000 $u'out :oi#t *e#ture part#er

Tra#e

)

Agenc

y

Carlso# ,ago#lit .#" +ra*els 0ugust 1CCC 7#tr' i# .#"ia# mar%et

Guo#i,

S)it<erla#"

Sita +ra*els Na# 2000 7#tr' i# .#"ia# mar%et

Guo#i +ra*el S3+C 4a' 1CC7 .#crease sta%e

9usin

ess

+er#ic

es

Nar"i#e >lemmi#g Gar*' Co#sulta#ts 0pril 1CC6 7#tr' i# .#"ia# mar%et

Coopers a#"

Ha'-ra#"

S$ $illimoria Nu#e 1CC6 7#tr' i# .#"ia# mar%et

7r#st a#" Kou#g S? $atli-oi Na# 1CC7 $u'out :oi#t *e#ture part#er

,atso# ,'att ,'att .#"ia 4arch 1CC8 $u'out :oi#t *e#ture part#er

Pu8)i

s(ing

4acmilla# IG 4acmilla# .#"ia 4a' 1CC7 .#crease sta%e

4cGra) Eill +ata 4cGra) Eill 0pril 1CC6 $u'out :oi#t *e#ture part#er

@ol'gram

.#ter#atio#al

Eol"i#g $*

@ol'gram .#"ia Nu#e 1CCC $u'out :oi#t *e#ture part#er

+oft5

are

$ari#g .#"ia

.#*estme#ts,

4auritius

$>H Soft)are Nu#e 1CC8 7#tr' i# .#"ia# mar%et

$ari#g @ri*ate

7/uit' @art#ers

8.#"ia9

S'#erg' Hog&.# S'stems 0pril 1CCC 7#tr' i# .#"ia# mar%et

4arte% Eol"i#gs

.#corporatio#

4asco# Glo-al Ht". Nul' 1CCC 7#tr' i# .#"ia# mar%et

.$4 .$4 Glo-al Ser*ices Sept 1CCC $u'out :oi#t *e#ture part#er

.$4 +ata .$4 Sept 1CCC $u'out :oi#t *e#ture part#er

- 41

Mergers And Acquisitions

NOTES

+a-le 1( Share of 4 a#" 05s i# >.

Inf)o5s in India.

Kear >. .#flo)s

8P millio#9

4 a#" 0 >u#"s

8P millio#9

Share of 4 a#" 0

>u#"s i# .#flo)s

8@erce#t9

1CC7 3200 1300 40.6

1CC8 2C00 1000 34.5

1CCC

8Na#&4ar9 1400 500 35.7

+otal 7100 2800 3C.4

Source: Economic Times December 23,1998 and June 21,1999

Ta8)e 2- MC@ &e)ated M and A<s in India.

Kear 4ergers 0c/uisitio#s +otal

1CC3&C4 4 C 13

1CC4&C5 & 7 7

1CC5&C6 & 12 12

1CC6&C7 2 46 48

1CC7&C8 4 61 65

1CC8&CC 2 30 32

1CCC&2000

8up to Na# 20009 5 74 7C

+otal 17 23C 256

Source: Kumar based on RIS-ICDRC Database

Ta8)e ,- Consideration in#o)#ed in +e)ect

MC@ &e)ated Acquisition.

+otal

Co#si"eratio#

8?s. 4illio#9

@erce#t

Share

0ll "eals 8879 8744C 100.00

+op 10 "eals 50371 66.75

+op 20 "eals 6CCC 80.04

$ottom 20 "eals 773 00.7C

Source: Kumar based on RIS-ICDRC Database

- 42

Mergers And Acquisitions

Ta8)e %- A#erage si;e of Acquisition

.ea)s

+'pes of

0c/uirer

2um-er 0mou#t

8?s. 4illio#9

0*erage per "eal

8?s. 4illio#9

7xisti#g 427

affiliates 1C 13,661 718

>oreig#

corporatio#s 36 37,360 1,038

>oreig# pare#ts

of existi#g

affiliates 32 36,420 1,138

0ll cases 87 87,440 1,005

Source: Kumar based on RIS-ICDRC Database

- 43

Mergers And Acquisitions

NOTES

- 44

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fine Scale Modeler 2024-01-02Document76 pagesFine Scale Modeler 2024-01-02Khaled BouchouarebNo ratings yet

- Intersciencebv - Case Analysis FinalDocument15 pagesIntersciencebv - Case Analysis Finalashwinikrss100% (1)

- Chapter 16 - Advertising, Sales Promotion & Public RelationsDocument16 pagesChapter 16 - Advertising, Sales Promotion & Public RelationsMohammed BIen ManambaNo ratings yet

- Mapping The Influence of Influencer Marketing: A Bibliometric AnalysisDocument25 pagesMapping The Influence of Influencer Marketing: A Bibliometric AnalysisDr. POONAM KAUSHALNo ratings yet

- A One Starch Products LimitedDocument7 pagesA One Starch Products LimitedChendra teja kNo ratings yet

- Food Processing Ingredients - Dubai - United Arab Emirates - TC2023-0004Document11 pagesFood Processing Ingredients - Dubai - United Arab Emirates - TC2023-0004Ang SHNo ratings yet

- Procurement Manager Interview QuestionsDocument2 pagesProcurement Manager Interview QuestionsSHK_1234No ratings yet

- X Press Transportation Business Plan PDFDocument8 pagesX Press Transportation Business Plan PDFStephen Francis100% (3)

- Latihan Soal Job Application LetterDocument5 pagesLatihan Soal Job Application Letteredi budiardiNo ratings yet

- Imc Po Co MappingDocument5 pagesImc Po Co MappingLingaboopathi ThangarajNo ratings yet

- SPACE Analysis - Strategic Position and Action Evaluation MatrixDocument5 pagesSPACE Analysis - Strategic Position and Action Evaluation MatrixSándor SzatmáriNo ratings yet

- Blood For SaleDocument2 pagesBlood For SaleJesse Amfra NagaNo ratings yet

- BUS 421 Winter 2022 SD1 Course OutlineDocument9 pagesBUS 421 Winter 2022 SD1 Course OutlineRithik KhannaNo ratings yet

- Example Full Report Group AssignmentDocument36 pagesExample Full Report Group AssignmentRuzaini AhmadNo ratings yet

- Local SEO Done Right Cheat SheetDocument4 pagesLocal SEO Done Right Cheat SheetTumblr_user100% (4)

- Managerial Application of AnalyticsDocument4 pagesManagerial Application of AnalyticsshailajaNo ratings yet

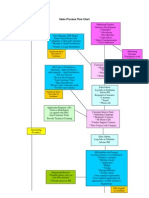

- Sales Process Flow ChartDocument3 pagesSales Process Flow Chartlakshmi0304No ratings yet

- Artificial Intelligence and Customer ExperienceDocument10 pagesArtificial Intelligence and Customer ExperienceDiyo LoryNo ratings yet

- The 6 Annual Data Report: B2B MarketingDocument13 pagesThe 6 Annual Data Report: B2B MarketingSean TanNo ratings yet

- Bata Business PlanDocument46 pagesBata Business PlanShafi MD Abdullah HishNo ratings yet

- WCM Finance Demo ProjectDocument69 pagesWCM Finance Demo ProjectRavi ShankarNo ratings yet

- Cohorts and Retention Playbook 3Document12 pagesCohorts and Retention Playbook 3Kratvesh PandeyNo ratings yet

- Indiamart Intermesh Limited - Project ReportDocument93 pagesIndiamart Intermesh Limited - Project Reportdhavalshukla77% (13)

- Introduction To MarketingDocument20 pagesIntroduction To MarketingChanda KumariNo ratings yet

- The Impact of Instagram Influencers On Purchase Attention.: Dr. Sami Al SmadiDocument12 pagesThe Impact of Instagram Influencers On Purchase Attention.: Dr. Sami Al Smadi2h rxNo ratings yet

- Market IntermediariesDocument35 pagesMarket IntermediariesmbadaroNo ratings yet

- Hmed HAH Urrani: B H / S E - BDocument4 pagesHmed HAH Urrani: B H / S E - Bfaiza minhasNo ratings yet

- Rubrics EvaluationDocument4 pagesRubrics EvaluationMuhammad Aiman Md NorNo ratings yet

- Studying The Brand Equity of GNRC Hospitals Among The People of Guwahati and Developing Communication Strategy For The Rejuvenation of The Brand GNRCDocument16 pagesStudying The Brand Equity of GNRC Hospitals Among The People of Guwahati and Developing Communication Strategy For The Rejuvenation of The Brand GNRCBinny DholaniNo ratings yet

- Rosenbloom Revised CH 11Document46 pagesRosenbloom Revised CH 11inflibnet inflibnetNo ratings yet