Professional Documents

Culture Documents

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mizuho Corporate Bank

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

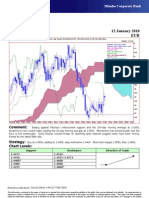

Technical Analysis 20 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Weekly

09Sep08 - 28Jul10

Pr

1.5

1.48

1.46

1.44

1.42

1.4

1.38

1.36

1.34

EUR=EBS , Last Quote, Candle

24Jan10 1.4375 1.4415 1.4166 1.4205 1.32

EUR= , Bid, Tenkan Sen 9

24Jan10 1.4655

EUR= , Bid, Kijun Sen 26 1.3

24Jan10 1.4575

EUR= , Bid, Senkou Span(a) 52

18Jul10 1.4615 1.28

EUR= , Bid, Senkou Span(b) 52

18Jul10 1.3800

EUR= , Bid, Chikou Span 26 1.26

02Aug09 1.4205

1.24

Oct08 Nov Dec Jan09 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan10 Feb Mar Apr May Jun Jul

Comment: Taking many by surprise as the Euro drops below December’s low to the lowest price since August

last year. Rather messy but we shall continue to see how prices react around long term Fibonacci retracement levels.

Note also how the weekly Ichimoku ‘cloud’ dips dramatically over the coming fortnight but then recovers equally

quickly and moves decidedly higher from April 2010.

Strategy: Stand aside if possibly. If not, attempt small longs at 1.4200; stop below 1.4100. Short term target

1.4300, then 1.4400.

Chart Levels:

Support Resistance Direction of Trade

1.4166 1.4215

1.4120 1.4260

1.4045 1.4295

1.4000** 1.4311

1.3900 1.4415

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocument1 pageAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337No ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- MyFXForecastsforMONDAY August2ndDocument2 pagesMyFXForecastsforMONDAY August2ndapi-26441337No ratings yet

- My LATESTFXForecastsfor MAY13Document2 pagesMy LATESTFXForecastsfor MAY13api-26441337No ratings yet

- My FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term ViewDocument3 pagesMy FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term Viewapi-26441337No ratings yet

- MyFXForecastsforWEDNESDAY August18thDocument2 pagesMyFXForecastsforWEDNESDAY August18thapi-26441337No ratings yet

- EUR USDUPDATEApril23Document2 pagesEUR USDUPDATEApril23api-26441337No ratings yet

- MEC321P Thermal Engineering Practice Expt-4: Vapour Compression Refrigeration SystemDocument5 pagesMEC321P Thermal Engineering Practice Expt-4: Vapour Compression Refrigeration Systemm sriNo ratings yet

- TV Glorietta DysonDocument1 pageTV Glorietta DysonJean Lindley JosonNo ratings yet

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Document7 pagesBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraNo ratings yet

- My Latest FXForecastsfor JULY5Document2 pagesMy Latest FXForecastsfor JULY5api-26441337No ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- 12Document1 page12Mohamed Khaled Elsayed GadNo ratings yet

- Locales P.2 PDFDocument1 pageLocales P.2 PDFGarcia Miguel Francisco AlbertoNo ratings yet

- Cuarto TV Asc Byl Despensa Cocina: Nivel 1Document1 pageCuarto TV Asc Byl Despensa Cocina: Nivel 1DAPAMINo ratings yet

- S.No Item Description Bar Description Bar Dia in MM Cut Length (M) Total Length (M) WT/M (KG) Total WT (KG) Shape No. of BarsDocument6 pagesS.No Item Description Bar Description Bar Dia in MM Cut Length (M) Total Length (M) WT/M (KG) Total WT (KG) Shape No. of BarsshailendraNo ratings yet

- Plano Arquitectónico Casa 1 PlantaDocument1 pagePlano Arquitectónico Casa 1 PlantaKaren BustosNo ratings yet

- Model de Parter Și SuprafețeDocument1 pageModel de Parter Și SuprafețeI am DavidNo ratings yet

- My LATESTFXForecastsfor MAY19Document2 pagesMy LATESTFXForecastsfor MAY19api-26441337No ratings yet

- Boutilier SDocument24 pagesBoutilier Sahmed009920006685No ratings yet

- Esquema Prueba Viga Vpt-1aDocument1 pageEsquema Prueba Viga Vpt-1aVictor HerreraNo ratings yet

- Chart P H R134a PDFDocument1 pageChart P H R134a PDFDianNo ratings yet

- Plan Parter Scara 1:100: Apartament 4Document1 pagePlan Parter Scara 1:100: Apartament 4Victor RîndunicaNo ratings yet

- Cartobase 9-14-2-2Document1 pageCartobase 9-14-2-2RicardoNo ratings yet

- Arquitectonico PaDocument1 pageArquitectonico PaPedro MárquezNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- Netflix Case AnalysisDocument2 pagesNetflix Case AnalysisShubham SoganiNo ratings yet

- BrandZ 2015 LATAM Top50 ReportDocument83 pagesBrandZ 2015 LATAM Top50 ReportmperdomoqNo ratings yet

- Increasing Model Dairy Sales Through Effective DistributionDocument91 pagesIncreasing Model Dairy Sales Through Effective DistributionVenkatesh GuntiNo ratings yet

- Tugas Komputer AkuntansiDocument4 pagesTugas Komputer AkuntansiDwi RanggaNo ratings yet

- Andrea Rubio Online ResumeDocument2 pagesAndrea Rubio Online Resumeapi-235925145No ratings yet

- Concession Agreement TrainingDocument6 pagesConcession Agreement TrainingShaheen RahmanNo ratings yet

- Lakme - Consumer BehaviourDocument9 pagesLakme - Consumer BehaviourPromila KadyanNo ratings yet

- Investment Appraisal - William ParrotDocument7 pagesInvestment Appraisal - William ParrotAcheampong AnthonyNo ratings yet

- Financial Authorisations OverviewDocument1,707 pagesFinancial Authorisations OverviewbathinisridharNo ratings yet

- Boost Customer Satisfaction and Retention with Proven StrategiesDocument30 pagesBoost Customer Satisfaction and Retention with Proven StrategiesPragxNo ratings yet

- Präsentation Leadership & Intercultural ManagementDocument18 pagesPräsentation Leadership & Intercultural ManagementbellaNo ratings yet

- Business Continuity Planning at The Bank of JapanDocument11 pagesBusiness Continuity Planning at The Bank of Japanblue_l1No ratings yet

- Brand Shadowing StrategyDocument20 pagesBrand Shadowing StrategyCharlotte CramerNo ratings yet

- Barton, D 2012 Business Skills 7 - Cross Cultural CommunicationDocument4 pagesBarton, D 2012 Business Skills 7 - Cross Cultural Communicationnickw43No ratings yet

- Urban Tourism Development For Bandung City, Indonesia: A Preliminary StudyDocument14 pagesUrban Tourism Development For Bandung City, Indonesia: A Preliminary StudyEnhaiipreneur Sekolah Tinggi Pariwisata NHI BandungNo ratings yet

- Cfas ReviewerDocument10 pagesCfas ReviewershaylieeeNo ratings yet

- IgyGeorge PDFDocument324 pagesIgyGeorge PDFMOHAMED SABITHNo ratings yet

- Accounting Information Systems 2nd Edition Richardson Test BankDocument35 pagesAccounting Information Systems 2nd Edition Richardson Test Banknubilegoggler.i8cm100% (13)

- Development of Aspirational Districts0 3Document30 pagesDevelopment of Aspirational Districts0 3himanshuNo ratings yet

- Week 8 Product ProfilingDocument29 pagesWeek 8 Product ProfilingLucy siiNo ratings yet

- Chemical Quality Assurance 1.0 PDFDocument167 pagesChemical Quality Assurance 1.0 PDFEasy ways2017No ratings yet

- Program Specs - Industrial EngineeringDocument108 pagesProgram Specs - Industrial EngineeringRabab ElkomyNo ratings yet

- Discontinued Operations Acctg. Test BankDocument12 pagesDiscontinued Operations Acctg. Test BankDalrymple CasballedoNo ratings yet

- Preparing A JCR .......Document7 pagesPreparing A JCR .......Challa RamanamurtyNo ratings yet

- Winding Up and Dissolution of Business and Non-Business Organization in Nigeria: Principles and ProceduresDocument18 pagesWinding Up and Dissolution of Business and Non-Business Organization in Nigeria: Principles and ProceduresAkin Olawale Oluwadayisi86% (14)

- Company Registration Status As On 10.12.2019Document1 pageCompany Registration Status As On 10.12.2019Vishav JindalNo ratings yet

- TQL Final PaperDocument14 pagesTQL Final Paperapi-264782078No ratings yet

- Kanban Project Management EbookDocument63 pagesKanban Project Management EbookVasanth Raja100% (2)

- Mcconnel vs. Ca 1 Scra 722 (1961)Document5 pagesMcconnel vs. Ca 1 Scra 722 (1961)Anonymous aDY1FFGNo ratings yet