Professional Documents

Culture Documents

Zircon Subductor L2 Example 2015

Zircon Subductor L2 Example 2015

Uploaded by

2c_adminCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zircon Subductor L2 Example 2015

Zircon Subductor L2 Example 2015

Uploaded by

2c_adminCopyright:

Available Formats

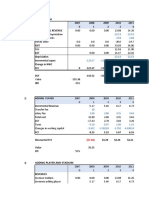

YEAR

Forecast Revs

Present value

Fixed Costs

Present value

NPV

1

2.50

2

2.50

3

2.50

4

2.50

5

2.50

6

2.50

7

2.50

8

2.50

0.70

0.70

0.70

0.70

0.70

0.70

0.70

0.70

13.837

4.347

-2.510

11.68

6.63

9.44

14.9

7.60

19.22

6.10

20.90

4.86

20.85

3.86

19.7

3.03

18.0

2.35

15.95

CASH FLOW

PV

1.80

13.977

INV

NPV

12.00

1.977

ABANDONMNT

OPTION VALUE

4.487

1.35

11.31

4.86

14.41

3.03

14.91

1.80

12.58

3.86

9.78

2.35

11.43

1.35

10.18

3.03

6.63

2.35

8.40

1.80

9.02

1.35

8.92

0.98

8.60

0.67

8.57

4.86

6.63

3.03

11.18

1.80

10.95

0.98

9.54

6.10

11.8

3.86

15.23

2.35

13.90

7.60

6.63

1.80

6.63

1.35

7.48

0.98

7.64

0.67

7.74

0.42

8.15

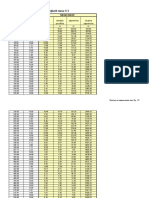

0.98

6.63

0.67

6.98

0.42

7.35

0.22

7.74

0.42

6.63

0.22

6.98

0.05

0.05

7.35

6.63

-0.08

6.98

-0.20

6.63

CAPEX

10.00

12

2.5

0.00%

9.00%

0.7

INVEST =

C1 =

growth =

R=

FC =

RF = 6.00%

Std. Dev. = 20.0%

up = 1.221403

down = 0.819

prob = 0.382

1 - prob = 0.618

Salvage t = 0

10

Dpn factor =

5%

PV Yr-8 salvage 4.162382

SALVAGE VALUE (years 1-8)

9.50

9.03

8.57

8.15

7.74

7.35

6.98

6.63

You might also like

- Solution - North Village Capital Private EquityDocument9 pagesSolution - North Village Capital Private Equitykeerthana100% (1)

- Financial Ratio Analysis - BMDocument18 pagesFinancial Ratio Analysis - BMKrishnamoorthy VijayalakshmiNo ratings yet

- Rango Salarial Valor Sueldo Mínimo Valor Sueldo Máximo Intervalo de PuntosDocument3 pagesRango Salarial Valor Sueldo Mínimo Valor Sueldo Máximo Intervalo de Puntoscaro15_pandaNo ratings yet

- FM 1-1Document25 pagesFM 1-1Utkarsh BalamwarNo ratings yet

- 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Total Selama 18 TahunDocument3 pages2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Total Selama 18 Tahunchristal panjaitanNo ratings yet

- Laporan Promkes TR II ButonDocument64 pagesLaporan Promkes TR II ButonLisna SunnyNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 10, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 10, 2012)Manila Standard TodayNo ratings yet

- Free Zone CompaniesDocument1 pageFree Zone CompaniesUmer ArshadNo ratings yet

- 01 Linea de Conduccion y DistribucionDocument9 pages01 Linea de Conduccion y DistribucionMichel Rosales RodriguezNo ratings yet

- BPP RegistrationDocument62 pagesBPP RegistrationNasir MustaphaNo ratings yet

- 4 Selangor PDFDocument14 pages4 Selangor PDFJoo LimNo ratings yet

- Agustus 2019Document94 pagesAgustus 2019jokoNo ratings yet

- Daily 04 July 2022Document4 pagesDaily 04 July 2022Asan ClanNo ratings yet

- Alc CNTDocument19 pagesAlc CNTTemNo ratings yet

- NO Kode Emiten HARGA SAHAM ROE (Bigger Better) DER (Less Better)Document17 pagesNO Kode Emiten HARGA SAHAM ROE (Bigger Better) DER (Less Better)Renggana Dimas Prayogi WiranataNo ratings yet

- QC Hema JANUARI 23Document9 pagesQC Hema JANUARI 23Maria Santi DewiNo ratings yet

- UAS HidrologiDocument4 pagesUAS HidrologinilayuniekaNo ratings yet

- EQCapitalGainsDetails 2Document2 pagesEQCapitalGainsDetails 2Varad MalpureNo ratings yet

- Tottenham Case PDF FreeDocument19 pagesTottenham Case PDF Freemaham nazirNo ratings yet

- Adding Player and StadiumDocument6 pagesAdding Player and StadiumPurwa ShakeelNo ratings yet

- Draft Survey in Use 2016 16.06.2016Document41 pagesDraft Survey in Use 2016 16.06.2016Veljko RadulovicNo ratings yet

- Aceros No. As (cm2) FC' (kgf/cm2) Fy (kgf/cm2) B (CM) Cuantia Min H (CM) Cuantia Max D (CM) Rec (CM) Fi Estribo M Refuerzo InfDocument13 pagesAceros No. As (cm2) FC' (kgf/cm2) Fy (kgf/cm2) B (CM) Cuantia Min H (CM) Cuantia Max D (CM) Rec (CM) Fi Estribo M Refuerzo InfAlejandro SaenzNo ratings yet

- Botanica CuricoDocument5 pagesBotanica CuricoJuan SchultzNo ratings yet

- Tabel 1. Tabel 2.: Rangkaian InvertingDocument4 pagesTabel 1. Tabel 2.: Rangkaian InvertingAdy NugrohoNo ratings yet

- Popular IndicatorsDocument14 pagesPopular IndicatorsMazlan NorinahNo ratings yet

- Draft Survey in Use 2015Document41 pagesDraft Survey in Use 2015Veljko RadulovicNo ratings yet

- Proyecto ElementosDocument328 pagesProyecto Elementosluis steven vergara rodriguezNo ratings yet

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerNo ratings yet

- Usna Yard Patrol Craft - Table of Offsets: Half-Breadths From Centerline (FT)Document1 pageUsna Yard Patrol Craft - Table of Offsets: Half-Breadths From Centerline (FT)Truong NguyenNo ratings yet

- Zero Traffic TrackerDocument7 pagesZero Traffic TrackerMark EmakhuNo ratings yet

- Tutorial Work BankingDocument12 pagesTutorial Work BankingJose Ortega CarrionNo ratings yet

- Forsum RuminasiaDocument3 pagesForsum Ruminasiashoby0210No ratings yet

- Almonte Excel1Document6 pagesAlmonte Excel1Cherry AnnNo ratings yet

- Attendance Sponsorship Broadcast Merchandise Other: Tottenham RevenuesDocument28 pagesAttendance Sponsorship Broadcast Merchandise Other: Tottenham RevenuesHzl ZlhNo ratings yet

- บันทึกผลการทดลอง ตอนที่ 1Document2 pagesบันทึกผลการทดลอง ตอนที่ 1kaanomNo ratings yet

- Present Value of An AnnuityDocument3 pagesPresent Value of An AnnuityMotivational QuotesNo ratings yet

- Stock Tracker 17.01Document4 pagesStock Tracker 17.01Inde Pendent LkNo ratings yet

- Group Name: Econ Lab Birds Subject: Econometrics Lab Year&Section: Bs Econ 3-1Document13 pagesGroup Name: Econ Lab Birds Subject: Econometrics Lab Year&Section: Bs Econ 3-1roannNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 20, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 20, 2012)Manila Standard TodayNo ratings yet

- T at FT Ultim V FT Ps FT Movil (3) FT Movil (4) FT PondeDocument5 pagesT at FT Ultim V FT Ps FT Movil (3) FT Movil (4) FT Pondejohn jairo fernandezNo ratings yet

- Excel TemplateDocument8 pagesExcel TemplateKaranveer Singh GahuniaNo ratings yet

- USD Period Installment Installment Breakdown From To USD Interst Payment Date A-B Payment To MulsDocument4 pagesUSD Period Installment Installment Breakdown From To USD Interst Payment Date A-B Payment To MulsCA Jitender PratapNo ratings yet

- Lbo SumDocument5 pagesLbo SumprachiNo ratings yet

- Pricetof FCFSGXsharesDocument1 pagePricetof FCFSGXsharessgdividendsNo ratings yet

- ArunDocument6 pagesArunVV CommunicationsNo ratings yet

- Nominal Size Outside Diameter Wall Thickness Plain-End Weight Inch MM Inch MM LB/FT KG/MDocument8 pagesNominal Size Outside Diameter Wall Thickness Plain-End Weight Inch MM Inch MM LB/FT KG/Mgauhip007No ratings yet

- SRP ИскопDocument11 pagesSRP ИскопNella NelicaNo ratings yet

- Everest KantoDocument10 pagesEverest KantoAman RajNo ratings yet

- Pass Enger06 07Document5 pagesPass Enger06 07api-3804561No ratings yet

- Practica Funcion Pago, PagointDocument5 pagesPractica Funcion Pago, PagointEsverlin BorgesNo ratings yet

- POWER Point Hourly 20210101 20210430 014d7707N 017d3977W LSTDocument50 pagesPOWER Point Hourly 20210101 20210430 014d7707N 017d3977W LSTsouleymanejules9510No ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayNo ratings yet

- Catch Basin ManholeDocument40 pagesCatch Basin Manholekalven marquezNo ratings yet

- Pearson R XXXXDocument9 pagesPearson R XXXXRendon StephenNo ratings yet

- Hasil To Simak Ui Brilliant - IpaDocument7 pagesHasil To Simak Ui Brilliant - Ipaarifresh057093No ratings yet

- Formato Pma Datos Chac - SHDocument5 pagesFormato Pma Datos Chac - SHErvin PumaNo ratings yet

- Sweet Beginnings Company Cash Budget For The Year 2016Document15 pagesSweet Beginnings Company Cash Budget For The Year 2016Jonalyn Lodor100% (4)

- Chapter Iv - Data Analysis and Interpretation: Property #1Document12 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- Conexión Soldada Cargada Excentricamente en Su Plano: Segmento PosicionDocument1 pageConexión Soldada Cargada Excentricamente en Su Plano: Segmento PosicionDario Quintanilla HuaytaNo ratings yet

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019From EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019No ratings yet