Professional Documents

Culture Documents

Renuka Industries: Ratio Actual 2006 Actual 2004 Actual 2005 Industry Average 2006

Uploaded by

Altaf Ur RehmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Renuka Industries: Ratio Actual 2006 Actual 2004 Actual 2005 Industry Average 2006

Uploaded by

Altaf Ur RehmanCopyright:

Available Formats

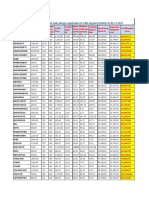

RENUKA INDUSTRIES

Ratio

Current Ratio

Quick Ratio

Inventory turnover

Average collection period

Total asset turnover

Debt ratio

Times interest earned ratio

Actual

2004

Actual

2005

1.7

1.8

2.5

=1531181/616000

0.9

1.35

=(25000+805556)/616000

1.2

5.2

5.29

=3704000/700625

10.2

50.7 days

55.8 days

57.1

=360/(5075000/805556)

46 days

1.5

1.5

1.62

=5075000/3125000

2.00

45.8%

54.3%

57.0%

=1781250/3125000

24.5%

Actual 2006

Industry

Average 2006

1.5

2.2

1.9

1.65

=153000/93000

2.50

27.5%

28%

27.0%

=1371000/5075000

26.0%

Net profit margin

1.1%

1.0%

0.7%

=36000/5075000

1.2%

Return on total assets

1.7%

1.5%

1.2%

=36000/3125000

2.4%

Return on common equity

3.1%

3.3%

2.7%

=(36000-0)/1343750

3.2%

Price/earnings ratio

33.5

38.7

34.5

=11.38/0.33

43.4%

Market / book ratio

1.1

0.85

=11.38/((1343750-0)/100000)

1.20

Gross profit margin

Analyze the firm's current financial position from both cross-sectional and a

time-series viewpoint. Break your analysis in to evaluations of the firm's (a)

Liquidity, (b) activity, (c) debt, (d) profitability and (e) market.

Summarize the firm's overall financial position on the basis of your findings

in part b.

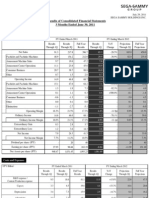

IBC

Ratio

19X1

19X2

Liquidity:

Net working capital

=115852-79150

36702

=116540-84100

32440

Current Ratio

=115852/79150

1.46

=116540/84100

1.39

=(10900+5877+32975)/79150

0.63

=(12500+7425+30950)/84100

0.60

=1025125/32975

31.09

=1075400/30950

34.75

=360/31.09

11.58

=360/34.75

10.36

=690300/58950

11.71

=725700/56320

12.89

=360/11.71

30.74

=360/12.89

27.93

=11.58+30.74

42.32

=10.36+27.93

38.29

=1025125/652952

1.57

=1075400/668240

1.61

Debt ratio

=79150/652952

0.12

=84100/668240

0.13

Debt / Equity ratio

=79150/302752

0.26

=84100/326240

0.26

=40100/17375

2.31

=46750/14620

3.20

=(1025125+350-690300)/1025125

32.7%

=(1075400+1200-725700)/1075400

32.6%

=12525/1025125

1.22%

=12705/1075400

1.18%

=12525/652952

1.92%

=12705/668240

1.90%

=(12525-0)/302752

4.14%

=(12705-0)/326240

3.89%

Quick Ratio

Activity

Account Receivable Turnover

Average collection period

Inventory turnover

Average age of Inventory - days

Operating cycle

Total Asset Turnover

Leverage

Times interest earned ratio

Profitability

Gross profit margin

Net profit margin

Return on total assets

Return on common equity

Market Value

Earnings per share

=(12525-0)/17100

0.73

=(12705-0)/17100

0.74

Price/Earnings ratio

=9.10/.732

12.43

=9.50/.743

12.79

Book Value per share

=(302752-0)/17100

17.70

=(326240-0)/17100

19.08

Dividend yield

=.365/9.10

0.04

=.3947/9.50

0.04

Dividend payout

=.365/.732

0.50

=.3947/.743

0.53

=6250/17100

0.37

=6750/17100

0.39

Dividend per share

MARTIN MANUFACTURING COMPANY

Industry Avg

Actual

2005

Current Ratio

1.8

1.84

Quick Ratio

0.7

0.78

Inventory turnover

2.5

2.59

37.5 days

36.5 days

65%

67%

3.8

38%

40%

3.50%

3.60%

4%

4%

9.50%

8%

1.1

1.2

Ratio

Average collection period

Debt ratio

Times interest earned ratio

Gross profit margin

Net profit margin

Return on total assets

Return on common equity

Market / book ratio

UFACTURING COMPANY

Analyze the firm's current financial posi

time-series viewpoint. Break your analy

Liquidity, (b) activity, (c) debt, (d) profit

Actual 2006

=72000/69000

1.04

=(500+1000+25000)/69000

0.38

=106,000/45500

2.33

=360/(160000/25000)

56.25

=69000/150000

46%

=17000/6100

2.79

=54000/160000

34%

=6540/160000

4.1%

=6540/150000

4.4%

=(6540-0)/(22950+31500+26550)

8.1%

=25/((22950+31500+26550-0)/3000)

0.93

Summarize the firm's overall financial p

in part b.

firm's current financial position from both cross-sectional and a

viewpoint. Break your analysis in to evaluations of the firm's (a)

) activity, (c) debt, (d) profitability and (e) market.

the firm's overall financial position on the basis of your findings

You might also like

- Organic Low Case Base Case High Case RevenueDocument48 pagesOrganic Low Case Base Case High Case Revenuesubburam007No ratings yet

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNo ratings yet

- Management of Monetary Resource of GSK: Course: Faculty: Group NameDocument27 pagesManagement of Monetary Resource of GSK: Course: Faculty: Group Nameborn2growNo ratings yet

- Aurora TextileDocument16 pagesAurora TextileMuhammad Zakky AlifNo ratings yet

- Income Statement For StartupsDocument3 pagesIncome Statement For StartupsBiki BhaiNo ratings yet

- Care Home - Management AccountsDocument9 pagesCare Home - Management AccountscoolmanzNo ratings yet

- Income StatementDocument3 pagesIncome StatementBiki BhaiNo ratings yet

- Financial Performance: 10 Year RecordDocument1 pageFinancial Performance: 10 Year RecordnitishNo ratings yet

- Lacrifresh PF Launch Plan - W5Document23 pagesLacrifresh PF Launch Plan - W5zeeshanNo ratings yet

- Midterm Exam R45D Coke. Co. TemplateDocument20 pagesMidterm Exam R45D Coke. Co. TemplateAchmad BaehakiNo ratings yet

- Ghazi Fabrics: Ratio Analysis of Last Five YearsDocument6 pagesGhazi Fabrics: Ratio Analysis of Last Five YearsASIF RAFIQUE BHATTINo ratings yet

- Growth Rates (%) % To Net Sales % To Net SalesDocument21 pagesGrowth Rates (%) % To Net Sales % To Net Salesavinashtiwari201745No ratings yet

- Investor - PPT June 14Document12 pagesInvestor - PPT June 14ChiragSinghalNo ratings yet

- Business Plan FinalDocument31 pagesBusiness Plan FinalBishnu Ram GhimireNo ratings yet

- Current Ratio Acid Test / Quick Ratio Cash To Current Liabilities Cash Flow From Operations To Sales Time Time Time %Document23 pagesCurrent Ratio Acid Test / Quick Ratio Cash To Current Liabilities Cash Flow From Operations To Sales Time Time Time %Shahid KhanNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- Project Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav KaushalDocument19 pagesProject Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav Kaushalmanisha sonawaneNo ratings yet

- Naztech - 27.01.2021 - IrrDocument81 pagesNaztech - 27.01.2021 - IrrRashan Jida ReshanNo ratings yet

- Group 2 EconomicDocument14 pagesGroup 2 EconomicCourage ChigerweNo ratings yet

- Vertical Analysis FS Shell PHDocument5 pagesVertical Analysis FS Shell PHArjeune Victoria BulaonNo ratings yet

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Otun's WorkDocument4 pagesOtun's WorkoluwapelumiotunNo ratings yet

- My Work BookDocument8 pagesMy Work BookNana Quarmi Agyim100% (1)

- Andhra Petrochemicals LTD.: Profitability RatioDocument13 pagesAndhra Petrochemicals LTD.: Profitability RatioDäzzlîñg HärîshNo ratings yet

- Akansh Arora FM AssignmentDocument17 pagesAkansh Arora FM AssignmentAKANSH ARORANo ratings yet

- 04 Theory of Production and Cost FinalDocument21 pages04 Theory of Production and Cost FinalNeushinth HettiarachchiNo ratings yet

- Financial Report - ShyamDocument14 pagesFinancial Report - ShyamYaswanth MaripiNo ratings yet

- Financial Model TemplateDocument13 pagesFinancial Model Templatedina cholidin0% (1)

- Financial Ratio Analysis of PSO and SPL (Shell) ........ TAHIR SAMIDocument35 pagesFinancial Ratio Analysis of PSO and SPL (Shell) ........ TAHIR SAMISAM100% (1)

- Ratio Analysis of AKBL, BOP and SCBPLDocument41 pagesRatio Analysis of AKBL, BOP and SCBPLtalalahmedgtmlNo ratings yet

- Toyworld LevelDocument12 pagesToyworld LevelNikhil DarakNo ratings yet

- Details of Daily Margin Applicable For F&O Segment (F&O) For 02.11.2015Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 02.11.2015Rahul NaharNo ratings yet

- New Heritage Doll Company Financial AnalysisDocument42 pagesNew Heritage Doll Company Financial AnalysisRupesh Sharma100% (6)

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodNo ratings yet

- UT Distribution HistoryDocument1 pageUT Distribution HistoryhaninadiaNo ratings yet

- Financial Decision Making: AssignmentDocument19 pagesFinancial Decision Making: AssignmentMutasem AmrNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Healthcare@Home Valuation Real Options NPV DraftDocument2 pagesHealthcare@Home Valuation Real Options NPV Draftma50702No ratings yet

- Residential MortgagesDocument14 pagesResidential MortgagesLee TeukNo ratings yet

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains SolutionUSD 654No ratings yet

- Amtek Ratios 1Document18 pagesAmtek Ratios 1Dr Sakshi SharmaNo ratings yet

- Homeritz Corporation BerhadDocument12 pagesHomeritz Corporation BerhadAfiq KhidhirNo ratings yet

- Koefisien Discounting (DF), Compounding (CF) Dan Anuity Factor (Af)Document30 pagesKoefisien Discounting (DF), Compounding (CF) Dan Anuity Factor (Af)Weedya NastitiNo ratings yet

- Analisis Lap KeuDocument10 pagesAnalisis Lap KeuAna BaenaNo ratings yet

- CHIEDZA MARIME Financial Management ExamDocument16 pagesCHIEDZA MARIME Financial Management Examchiedza MarimeNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- Financial Ratios v3Document18 pagesFinancial Ratios v3Amichai GravesNo ratings yet

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1No ratings yet

- HanssonDocument11 pagesHanssonJust Some EditsNo ratings yet

- Latihan Soal Financial RatiosDocument6 pagesLatihan Soal Financial RatiosInanda ErvitaNo ratings yet

- FM09-CH 27Document6 pagesFM09-CH 27Kritika SwaminathanNo ratings yet

- Financials at A GlanceDocument2 pagesFinancials at A GlanceAmol MahajanNo ratings yet

- Hosoku e FinalDocument6 pagesHosoku e FinalSaberSama620No ratings yet

- Project AppraisalDocument6 pagesProject AppraisalThabiso AstroNo ratings yet

- Analisis NumerikDocument4 pagesAnalisis NumerikKevinn ARNo ratings yet

- Star River Electronics Ltd.Document10 pagesStar River Electronics Ltd.jack stauberNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Following the Trend: Diversified Managed Futures TradingFrom EverandFollowing the Trend: Diversified Managed Futures TradingRating: 3.5 out of 5 stars3.5/5 (2)

- Deputy Assistant DirectorDocument5 pagesDeputy Assistant DirectorDanish RazaNo ratings yet

- Tariff ComparisonDocument2 pagesTariff ComparisonAltaf Ur RehmanNo ratings yet

- The Drugs Act, 1976Document32 pagesThe Drugs Act, 1976Dr-Usman KhanNo ratings yet

- Adc Invoice 400Document2 pagesAdc Invoice 400Altaf Ur RehmanNo ratings yet

- LC Presentation QICTDocument22 pagesLC Presentation QICTAltaf Ur RehmanNo ratings yet

- Application Form Instructions To Candidates - Latest (After Adv. No. 4) 153rd Approved 30.4.2015Document8 pagesApplication Form Instructions To Candidates - Latest (After Adv. No. 4) 153rd Approved 30.4.2015knight_riderrNo ratings yet

- SAMI Pharmaceuticals Supplier DirectoryDocument113 pagesSAMI Pharmaceuticals Supplier DirectoryAltaf Ur RehmanNo ratings yet

- Syllabus PDFDocument150 pagesSyllabus PDFAsma SethiNo ratings yet

- Custom RulesdsdsDocument279 pagesCustom RulesdsdsAltaf Ur RehmanNo ratings yet

- 2) Ana DiscussionDocument3 pages2) Ana DiscussionAltaf Ur RehmanNo ratings yet

- CE-2016 Public NoticeDocument1 pageCE-2016 Public NoticeKenneth MillerNo ratings yet

- Advt No 7-2015Document3 pagesAdvt No 7-2015Waqas TayyabNo ratings yet

- Experiment # 04: ObjectDocument8 pagesExperiment # 04: ObjectAltaf Ur RehmanNo ratings yet

- Import Policy Order 2013 PakistanDocument132 pagesImport Policy Order 2013 PakistanSher Zaman BhuttoNo ratings yet

- SCM in PharmaDocument20 pagesSCM in PharmaAbhiNo ratings yet

- 1) ChromatographyDocument8 pages1) ChromatographyAltaf Ur RehmanNo ratings yet

- Enquiry ListDocument12 pagesEnquiry ListAltaf Ur RehmanNo ratings yet

- Bill of Entry Bill of Export Baggage Declaration Transshipment PermitDocument2 pagesBill of Entry Bill of Export Baggage Declaration Transshipment PermitAltaf Ur RehmanNo ratings yet

- Assignment of DesizingDocument8 pagesAssignment of DesizingAltaf Ur RehmanNo ratings yet

- Import Docs Guide: Commercial, B/L, COO, Packing, GD FormsDocument8 pagesImport Docs Guide: Commercial, B/L, COO, Packing, GD FormsAltaf Ur RehmanNo ratings yet

- EXPERIMENT#2 (A) : Analtical Techniques COURSE#605Document4 pagesEXPERIMENT#2 (A) : Analtical Techniques COURSE#605Altaf Ur RehmanNo ratings yet

- Bill of Entry Bill of Export Baggage Declaration Transshipment PermitDocument2 pagesBill of Entry Bill of Export Baggage Declaration Transshipment PermitAltaf Ur RehmanNo ratings yet

- 06 Introduction To Oceanography. TomczakDocument123 pages06 Introduction To Oceanography. TomczakmishazujevNo ratings yet

- CE-2016 Public NoticeDocument1 pageCE-2016 Public NoticeKenneth MillerNo ratings yet

- LC Presentation QICTDocument22 pagesLC Presentation QICTAltaf Ur RehmanNo ratings yet

- Salient Feature CustomsDocument3 pagesSalient Feature CustomsAarif ShahNo ratings yet

- Syllabus PDFDocument150 pagesSyllabus PDFAsma SethiNo ratings yet

- Weboc 1Document30 pagesWeboc 1Altaf Ur RehmanNo ratings yet

- 1) Sales Contract 1) Sales Contract Importer or Buyer Importer or BuyerDocument5 pages1) Sales Contract 1) Sales Contract Importer or Buyer Importer or BuyerAltaf Ur RehmanNo ratings yet

- Advt No 7-2015Document3 pagesAdvt No 7-2015Waqas TayyabNo ratings yet