Professional Documents

Culture Documents

Analisis Lap Keu

Uploaded by

Ana BaenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analisis Lap Keu

Uploaded by

Ana BaenaCopyright:

Available Formats

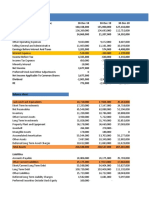

Reguler (dalam Rupiah

Accounts

2008 2009 2010

Summary of Balace Sheet

Receivables 993,923,000 1,345,255,000 1,567,538,000

Inventories 1,284,659,000 1,340,036,000 1,574,060,000

Current Assets 3,103,295,000 3,598,793,000 3,748,130,000

Fixed Assets 2,559,875,000 3,035,915,000 4,148,778,000

Other Assets 58,596,000 55,058,000 50,377,000

Total Assets 6,504,736,000 7,484,990,000 8,701,262,000

Current Liabilities 3,091,111,000 3,454,869,000 4,402,940,000

Longterm Liabilities 306,804,000 321,546,000 249,469,000

Total Liabilities 3,397,915,000 3,776,415,000 4,652,409,000

Authorized 7,630,000 7,630,000 7,630,000

Paid-up Capital 76,300,000 76,300,000 76,300,000

Par Value 10 10 10

Paid-up Capital Shares 7,630,000 7,630,000 7,630,000

Retained Earnings 2,928,012,000 3,530,519,000 3,873,119,000

Total Equity 3,100,312,000 3,702,819,000 4,045,419,000

Minority Interest 6,509,000 5,756,000 3,434,000

Summary of Income Statement

Total Sales 15,577,811,000 18,246,872,000 19,690,239,000

Cost of Good Sold 7,946,674,000 9,200,878,000 9,485,274,000

Gross Profit 7,631,137,000 9,045,994,000 10,204,965,000

Operating Profit 3,431,098,000 4,214,891,000 4,542,625,000

Other Income 17,307,000 33,699,000 -3982000

Earning Before Tax 3,448,405,000 4,248,590,000 4,538,643,000

Tax 1,036,643,000 1,205,236,000 1,153,995,000

Net Income 2,407,231,000 3,044,107,000 3,386,970,000

Indeks (%)

2008 2009 2010

100% 135% 117%

100% 104% 117% 2,278,582,000 2,685,291,000 3,141,598,000

100% 116% 104%

100% 119% 137%

100% 94% 91%

100% 115% 116%

100% 112% 127%

100% 105% 78%

100% 111% 123%

100% 100% 100%

100% 100% 100%

100% 100% 100%

100% 100% 100%

100% 121% 110%

100% 119% 109%

100% 88% 60%

100% 117% 108%

100% 116% 103%

100% 119% 113%

100% 123% 108%

100% 195% -12%

100% 123% 107%

100% 116% 96%

100% 126% 111%

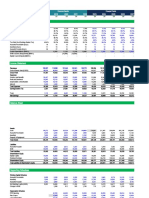

Reguler (dalam Rupiah

Accounts

2008 2009 2010

Summary of Balace Sheet

Receivables 993,923,000 1,345,255,000 1,567,538,000

Inventories 1,284,659,000 1,340,036,000 1,574,060,000

Current Assets 3,103,295,000 3,598,793,000 3,748,130,000

Fixed Assets 2,559,875,000 3,035,915,000 4,148,778,000

Other Assets 58,596,000 55,058,000 50,377,000

Total Assets 6,504,736,000 7,484,990,000 8,701,262,000

Current Liabilities 3,091,111,000 3,454,869,000 4,402,940,000

Longterm Liabilities 306,804,000 321,546,000 249,469,000

Total Liabilities 3,397,915,000 3,776,415,000 4,652,409,000

Authorized 7,630,000 7,630,000 7,630,000

Paid-up Capital 76,300,000 76,300,000 76,300,000

Par Value 10 10 10

Paid-up Capital Shares 7,630,000 7,630,000 7,630,000

Retained Earnings 2,928,012,000 3,530,519,000 3,873,119,000

Total Equity 3,100,312,000 3,702,819,000 4,045,419,000

Minority Interest 6,509,000 5,756,000 3,434,000

Summary of Income Statement

Total Sales 15,577,811,000 18,246,872,000 19,690,239,000

Cost of Good Sold 7,946,674,000 9,200,878,000 9,485,274,000

Gross Profit 7,631,137,000 9,045,994,000 10,204,965,000

Operating Profit 3,431,098,000 4,214,891,000 4,542,625,000

Other Income 17,307,000 33,699,000 -3982000

Earning Before Tax 3,448,405,000 4,248,590,000 4,538,643,000

Tax 1,036,643,000 1,205,236,000 1,153,995,000

Net Income 2,407,231,000 3,044,107,000 3,386,970,000

Analisis Commonsize (%)

2008 2009 2010

15.28% 17.97% 18.02%

19.75% 17.90% 18.09%

47.71% 48.08% 43.08%

39.35% 40.56% 47.68%

0.90% 0.74% 0.58%

100.00% 100.00% 100.00% 8,783,318,000 10,170,281,000 11,842,860,000

47.52% 46.16% 50.60%

4.72% 4.30% 2.87%

52.24% 50.45% 53.47%

0.12% 0.10% 0.09%

1.17% 1.02% 0.88%

0.00% 0.00% 0.00%

0.12% 0.10% 0.09%

45.01% 47.17% 44.51%

47.66% 49.47% 46.49%

0.10% 0.08% 0.04%

100.00% 100.00% 100.00%

51.01% 50.42% 48.17%

48.99% 49.58% 51.83%

22.03% 23.10% 23.07%

0.11% 0.18% -0.02%

22.14% 23.28% 23.05%

6.65% 6.61% 5.86%

15.45% 16.68% 17.20%

Reguler (dalam Rupiah Kenaikan/Penur

Accounts

2009 2010 unan

Receivables 1,345,255,000 1,567,538,000 222,283,000

Total Assets 7,484,990,000 8,701,262,000 1,216,272,000

Total Liabilities 3,776,415,000 4,652,409,000 875,994,000

Total Sales 18,246,872,000 19,690,239,000 1,443,367,000

Cost of Good Sold 9,200,878,000 9,485,274,000 284,396,000

Operating Profit 4,214,891,000 4,542,625,000 327,734,000

Net Income 3,044,107,000 3,386,970,000 342,863,000

Prosentase

(%)

16.52%

16.25%

23.20%

7.91%

3.09%

7.78%

11.26%

Reguler (dalam Rupiah

Accounts Kenaikan/Penurunan

2008 2009

Receivables 993,923,000 1,345,255,000 351,332,000

Total Assets 6,504,736,000 7,484,990,000 980,254,000

Total Liabilities 3,397,915,000 3,776,415,000 378,500,000

Total Sales 15,577,811,000 18,246,872,000 2,669,061,000

Cost of Good Sold 7,946,674,000 9,200,878,000 1,254,204,000

Operating Profit 3,431,098,000 4,214,891,000 783,793,000

Net Income 2,407,231,000 3,044,107,000 636,876,000

Prosentase(

%)

35.35%

15.07%

11.14%

17.13%

15.78%

22.84%

26.46%

Analisis Likuiditas Analisis Solvabilitas Analisis Profitabilitas

Tahun

Rasio Lancar Rasio Cepat Rasio Utang DER ROA ROE

2008 73.71% 32.15% 38.69% 109.60% 37.01% 77.64%

2009 77.72% 38.94% 37.13% 101.99% 40.67% 82.21%

2010 71.35% 35.60% 39.28% 115.00% 38.93% 83.72%

utang 3,397,915,000 3,776,415,000 ###

aktiva 8,783,318,000 ### ### ### ###

### ###

asset 6,504,736,000 7,484,990,000 ###

net income 2,407,231,000 3,044,107,000 ###

modal 3,100,312,000 3,702,819,000 ###

Al 2,278,582,000 2,685,291,000 ###

UL 3,091,111,000 3,454,869,000 ###

Persediaan 1,284,659,000 1,340,036,000 ###

993,923,000 1,345,255,000 ###

###

###

You might also like

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Latihan Soal Financial RatiosDocument6 pagesLatihan Soal Financial RatiosInanda ErvitaNo ratings yet

- Analisa SahamDocument10 pagesAnalisa SahamGede AriantaNo ratings yet

- Shree Cement DCF ValuationDocument71 pagesShree Cement DCF ValuationPrabhdeep DadyalNo ratings yet

- Baru Baru - PT X - Study Case 5Document98 pagesBaru Baru - PT X - Study Case 5Kojiro FuumaNo ratings yet

- FurnitureDocument2 pagesFurnitureTrân VõNo ratings yet

- Analisis de AmazonDocument6 pagesAnalisis de AmazonFrancisco MuñozNo ratings yet

- Less: Depreciation (CAPEX $ 6000,000) / 10 YearsDocument15 pagesLess: Depreciation (CAPEX $ 6000,000) / 10 YearsC D BNo ratings yet

- Kota Fibres, Ltd. (FIX)Document10 pagesKota Fibres, Ltd. (FIX)Aldo MadonaNo ratings yet

- Standalone Kitchen Model WorkingDocument3 pagesStandalone Kitchen Model WorkingSujith psNo ratings yet

- Vertical AnalysisDocument3 pagesVertical AnalysisJayvee CaguimbalNo ratings yet

- 2.0 Mba 670 GMDocument6 pages2.0 Mba 670 GMLauren LoshNo ratings yet

- DR Reddy Lab 5 Year DataDocument4 pagesDR Reddy Lab 5 Year Datashishir5087No ratings yet

- Excel TopgloveDocument21 pagesExcel Topglovearil azharNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- Tesla ForecastDocument6 pagesTesla ForecastDanikaLiNo ratings yet

- Burton Sensors SheetDocument128 pagesBurton Sensors Sheetchirag shah17% (6)

- Ratio Analysis: Investor Liquidity RatiosDocument11 pagesRatio Analysis: Investor Liquidity RatiosjayRNo ratings yet

- Financial Analysis ModelDocument5 pagesFinancial Analysis ModelShanaya JainNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- All Number in Thousands)Document7 pagesAll Number in Thousands)Lauren LoshNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain AdnanNo ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Spinning Project FeasibilityDocument19 pagesSpinning Project FeasibilityMaira ShahidNo ratings yet

- DCF 3 CompletedDocument3 pagesDCF 3 CompletedPragathi T NNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Profit & Loss Statement: O' Lites GymDocument8 pagesProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446No ratings yet

- Income Statement (All Nos. in Thousands)Document12 pagesIncome Statement (All Nos. in Thousands)Alok ChowdhuryNo ratings yet

- Gildan Model BearDocument57 pagesGildan Model BearNaman PriyadarshiNo ratings yet

- Ten Year Financial Summary PDFDocument2 pagesTen Year Financial Summary PDFTushar GoelNo ratings yet

- External Funds Need-Spring 2020Document8 pagesExternal Funds Need-Spring 2020sabihaNo ratings yet

- Beximco Pharmaceuticals LimitedDocument4 pagesBeximco Pharmaceuticals Limitedsamia0akter-228864No ratings yet

- DCF Model - Blank: Strictly ConfidentialDocument5 pagesDCF Model - Blank: Strictly ConfidentialaeqlehczeNo ratings yet

- INR (Crores) 2020A 2021A 2022E 2023E 2024E 2025EDocument5 pagesINR (Crores) 2020A 2021A 2022E 2023E 2024E 2025EJatin MittalNo ratings yet

- Millat Tractors - Final (Sheraz)Document20 pagesMillat Tractors - Final (Sheraz)Adeel SajidNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- APO Cement Corp. HolcimDocument46 pagesAPO Cement Corp. HolcimKate DaizNo ratings yet

- DCF Valuation Pre Merger Southern Union CompanyDocument20 pagesDCF Valuation Pre Merger Southern Union CompanyIvan AlimirzoevNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- ABB Power Systems & Automation CompanyDocument13 pagesABB Power Systems & Automation CompanyMohamed SamehNo ratings yet

- Analysis of Financial Statements - VICO Foods CorporationDocument19 pagesAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNo ratings yet

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDocument19 pagesKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNo ratings yet

- Hasbro Single FEC Outlet FS - 5 YearsDocument7 pagesHasbro Single FEC Outlet FS - 5 YearsC D BNo ratings yet

- ExecutivesummaryDocument4 pagesExecutivesummaryMayurNo ratings yet

- Ratio AnalysisDocument35 pagesRatio AnalysisMd. Sakib HossainNo ratings yet

- Financial Ratio AnalysisDocument6 pagesFinancial Ratio AnalysisSatishNo ratings yet

- Horizontal Vertical AnalysisDocument4 pagesHorizontal Vertical AnalysisAhmedNo ratings yet

- Business - Valuation - Modeling - Assessment FileDocument6 pagesBusiness - Valuation - Modeling - Assessment FileGowtham VananNo ratings yet

- NYSF Walmart Templatev2Document49 pagesNYSF Walmart Templatev2Avinash Ganesan100% (1)

- The Analyst Exchange 374407768.xlsx, Income Statement1 Of: On - LineDocument49 pagesThe Analyst Exchange 374407768.xlsx, Income Statement1 Of: On - LinePratik ChavhanNo ratings yet

- Projection and Valuation Example - SolutionDocument13 pagesProjection and Valuation Example - SolutionPrince Akonor AsareNo ratings yet

- Appendices Financial RatiosDocument3 pagesAppendices Financial RatiosCristopherson PerezNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialEsani DeNo ratings yet

- BMP Bav Report FinalDocument93 pagesBMP Bav Report FinalThu ThuNo ratings yet

- BMP Bav ReportDocument79 pagesBMP Bav ReportThu ThuNo ratings yet

- Exhibit 2 Amazon Financials, 2006-2017 (Millions USD) : Fiscal Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017Document1 pageExhibit 2 Amazon Financials, 2006-2017 (Millions USD) : Fiscal Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017AviralNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- CNXX JV 2012 Verkort 5CDocument77 pagesCNXX JV 2012 Verkort 5CgalihNo ratings yet

- Balance SheetDocument1 pageBalance SheetKian EganNo ratings yet

- Chapter 8 Types of Major AccountsDocument39 pagesChapter 8 Types of Major AccountsJc LocsinNo ratings yet

- Chap 2 Trial Balance STDocument30 pagesChap 2 Trial Balance STKim NganNo ratings yet

- Analisis Risiko AlkDocument21 pagesAnalisis Risiko AlkAnanda LukmanNo ratings yet

- Chapter-1 Accounting For Partnership Firms - Fundamentals - Questions - Edit PDFDocument17 pagesChapter-1 Accounting For Partnership Firms - Fundamentals - Questions - Edit PDFAlok Kumar MaheshwariNo ratings yet

- Income Statement FormatDocument2 pagesIncome Statement FormatShruti MohanNo ratings yet

- Horngren 9th Edition Solutions Ch1Document83 pagesHorngren 9th Edition Solutions Ch1AmyNo ratings yet

- Frecy Catadman Delivery Service (Journal)Document2 pagesFrecy Catadman Delivery Service (Journal)Charlotte AdoptanteNo ratings yet

- TOPIC 4 (2) International Financial Reporting Standards (IFRS) V AaoifiDocument36 pagesTOPIC 4 (2) International Financial Reporting Standards (IFRS) V AaoifikkNo ratings yet

- Revision Q&ADocument5 pagesRevision Q&ADylan Rabin PereiraNo ratings yet

- TRIAL Coffee Shop Financial Model Excel Template v1.4.122020Document88 pagesTRIAL Coffee Shop Financial Model Excel Template v1.4.122020fvfvfsNo ratings yet

- Toy World - ExhibitsDocument9 pagesToy World - Exhibitsakhilkrishnan007No ratings yet

- De Thi Tieng Anh Chuyen Nganh Ke Toan ThongDocument7 pagesDe Thi Tieng Anh Chuyen Nganh Ke Toan ThongHân Lê Thị NgọcNo ratings yet

- ANT Tax Comp FY22 Mar 22 13.04.22Document377 pagesANT Tax Comp FY22 Mar 22 13.04.22Aries BautistaNo ratings yet

- Mahindra and Mahindra Limited - 24Document12 pagesMahindra and Mahindra Limited - 24SourabhNo ratings yet

- Reviewer For AccountingDocument8 pagesReviewer For AccountingAnnie RapanutNo ratings yet

- Accounting Review Week 2Document13 pagesAccounting Review Week 2Janine IgdalinoNo ratings yet

- Module 2 Statement of Comprehensive IncomeDocument8 pagesModule 2 Statement of Comprehensive IncomeStella MarieNo ratings yet

- Financial Accounting 19 PDF FreeDocument6 pagesFinancial Accounting 19 PDF FreeLyka Kristine Jane PacardoNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- As Notes 2020-2021 Updated 17-4-2021 (On)Document135 pagesAs Notes 2020-2021 Updated 17-4-2021 (On)Desi TVNo ratings yet

- TuriDocument3 pagesTuriDedy SuyetnoNo ratings yet

- Adjusting Quiz 6Document5 pagesAdjusting Quiz 6Jyasmine Aura V. AgustinNo ratings yet

- C5 Corporate Liquidation and Organization Problem 3 and 5Document13 pagesC5 Corporate Liquidation and Organization Problem 3 and 5skilled legilimenceNo ratings yet

- Businessfinance12 q3 Mod4 Working-CapitalDocument23 pagesBusinessfinance12 q3 Mod4 Working-CapitalAsset Dy86% (14)

- 4 Home Office Agency Handout SolutionDocument15 pages4 Home Office Agency Handout SolutionRyan CornistaNo ratings yet

- Analysis of Advanced Information July 2023 v4Document18 pagesAnalysis of Advanced Information July 2023 v4Jack LeitchNo ratings yet