Professional Documents

Culture Documents

Acct 2020 Budget

Acct 2020 Budget

Uploaded by

api-271665570Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acct 2020 Budget

Acct 2020 Budget

Uploaded by

api-271665570Copyright:

Available Formats

Introduction to Management Accounting

Solutions Manual

Problems: Set A

P9-59A Comprehensive budgeting problem (Learning Objectives 2 & 3)

Requirements

1. Prepare a schedule of cash collections for January, February, and March, and for the quarter

in total.

2. Prepare a production budget.

3. Prepare a direct materials budget.

4. Prepare a cash payments budget for the direct material purchases from Requirement 3.

5. Prepare a cash payments budget for conversion costs.

6. Prepare a cash payments budget for operating expenses.

7. Prepare a combined cash budget.

8. Calculate the budgeted manufacturing cost per unit.

9. Prepare a budgeted income statement for the quarter ending March 31.

Solution:

Given

Sales Budget

December

Unit sales

January

7,000

Unit selling price

Total sales Revenue

8,000

10 $

70,000

10

80,000

Req. 1

Cash Collections (30% Current Month)

Credit Collections (70% Last Month)

Total Cash Collections

Cash Collections

January

$24,000

$49,000

$73,000

February

$27,600

$56,000

$83,600

Production Budget

January

8,000

February

9,200

Req. 2

Unit Sales

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Plus: Desired Ending Inventory

Total Needed

Less Beginning Inventory

Number of Products to Produce

Solutions Manual

2,300

10,300

2,000

8,300

2,475

11,675

2,300

9,375

Req. 3

Direct Materials Budget

January

February

Units to be produced (from Prod Budget)

8,300

9,375

Multiply by Quantity of DM per Unit(lbs)

2

2

Quantity of DM needed for Production

16,600

18,750

Plus: Desired end Inventory of DM

1,875

1,970

Total: Quantity needed (lbs)

18,475

20,720

Less: Beginning Inventory of DM

1,660

1,875

Quantity to Purchas (lbs)

16,815

18,845

2

Multiply by: Cost per Pound

2

Total Cost of DM Purchases

$33,630

$37,690

Units to be produced (from Prod Budget)

Multiply by Quantity of DM per Unit(lbs)

Quantity of DM needed for Production

Plus: Desired end Inventory of DM

Total: Quantity needed (lbs)

Less: Beginning Inventory of DM

April

9,700

2

19,400

1,700

21,100

2,110

May

8,500

2

17,000

0

17,000

1,700

Req. 4

Schedule of Expected Cash DisbursementsMaterial Purchases

January

February

December Purchases

$42,400

January Purchases

$6,726.0

$26,904.0

February Purchases

$7,538.0

March Purchases

Total Disbursements

$49,126

$34,442

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

Solutions Manual

Req. 5

Schedule of Expected Cash DisbursementsConversion Costs

January

February

Rent (fixed)

$5,000

$5,000

Other MOH (fixes)

$3,000

$3,000

Variable Conversion Costs (DL + MOH)

$9,960

$11,250

Total Disbursements

$17,960

$19,250

Req. 6

Schedule of Expected Cash Disbursements -- Operating Expenses

January

February

Variable Operating Expenses

$8,000

$9,200

Fixed Operating Expenses

$1,000

$1,000

Total Disbursements

$9,000

$10,200

Req. 7

Cash Balance, beginning

Add Cash Collections (req. 1)

Total Cash Available

Less Cash Disbursements:

For Materials (req. 4)

For Conversion Costs (req. 5)

For Operating Expenses (req. 6)

For Equipment

For Taxes

Total Disbursements

Excess (deficiency) of Cash

Financing:

Borrowings

Repayments

Interest

Total Financing

Cash Balance, Ending

Total interest

Combined Cash Budget

January

February

$4,500

$4,414

73,000

83,600

77,500

88,014

49,126

17,960

9,000

5,000

81,086

-3,586

34,442

19,250

10,200

12,000

10,000

85,892

2,122

8,000

2,000

8,000

$4,414

2,000

$4,122

$280

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

Req. 8

Budgeted Manufacturing Cost per Unit

Direct Materials: 2 lbs. each * $2 per lb

$4.00

Conversion Costs: $1.20 each unit

$1.20

Fixed MOH: $0.80 per unit

$0.80

Cost of manufacturing each unit

$6.00

Req. 9

Silverman Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales

Cost of Goods Sold ($6.00 * units sold)

Gross Profit

Operating Expenses

Depreciation Expenses

Operating Income

Less: Interest Expense

Less: Provision for Income Tax @ 30%

Net Income

271,000

(162,600)

108,400

28,100

4,800

75,500

(180)

22,596

52,724

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

(60 min.) P 9-59A

ves 2 & 3)

March, and for the quarter

from Requirement 3.

udget

February

9,200

March

April

9,900

May

9,700

8,500

10 $

10 $

10

10

92,000 $

99,000 $

97,000

85,000

March

$29,700

$64,400

$94,100

Quarter

$81,300

$169,400

$250,700

March

9,900

Quarter

27,100

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

2,425

12,325

2,475

9,850

2,425

34,300

2,000

32,300

March

9,850

2

19,700

1,880

21,580

1,970

19,610

2

Quarter

32,300

2

64,600

1,880

66,480

1,970

55,270

2

$39,220

$110,540

aterial Purchases

March

$30,152.0

$7,844.0

$37,996

Solutions Manual

Quarter

$42,400

$33,630

$37,690

$7,844

$121,564

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

onversion Costs

March

$5,000

$3,000

$11,820

$19,820

Quarter

$15,000

$9,000

$33,030

$57,030

erating Expenses

March

$9,900

$1,000

$10,900

Quarter

$27,100

$1,000

$28,100

March

$4,122

94,100

98,222

Quarter

$4,500

250,700

255,200

37,996

19,820

10,900

16,000

84,716

13,506

121,564

57,030

30,100

33,000

10,000

251,694

3,506

-9,000

-180

-9,180

$4,326

10,000

-9,000

-180

820

$4,326

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

10

You might also like

- ISB ITPM Assignment 7.2 Manasa VLSDocument3 pagesISB ITPM Assignment 7.2 Manasa VLSmanu vls92No ratings yet

- Financial Planning Tools and ConceptsDocument30 pagesFinancial Planning Tools and ConceptsEarl Concepcion89% (9)

- Essay Part 1Document56 pagesEssay Part 1Sachin KumarNo ratings yet

- Finance Case StudyDocument18 pagesFinance Case StudyMuntasir Ahmmed100% (1)

- Budget ProjectDocument18 pagesBudget Projectapi-318385102No ratings yet

- Work Breakdown Literature ReviewDocument13 pagesWork Breakdown Literature Reviewjulie100% (1)

- Executive Summary Business PlanDocument30 pagesExecutive Summary Business PlanSiddiq Ahmed91% (11)

- Master Budget Case: Turabi LTDDocument4 pagesMaster Budget Case: Turabi LTDFarwa SamreenNo ratings yet

- 2.1.6.validate Scope TemplatesDocument2 pages2.1.6.validate Scope TemplatesAssad AssadNo ratings yet

- Running Head: Chapter 13 ExercisesDocument7 pagesRunning Head: Chapter 13 ExercisesluluNo ratings yet

- Alternate Demonstration Problem MerchandisingDocument5 pagesAlternate Demonstration Problem MerchandisingmoNo ratings yet

- Project Proposal: Implementation of 5S at ACKE Production DepartmentDocument10 pagesProject Proposal: Implementation of 5S at ACKE Production DepartmentMuhammad HassanNo ratings yet

- Financial Policy and Procedure Manual Template: How To Complete This TemplateDocument23 pagesFinancial Policy and Procedure Manual Template: How To Complete This TemplatecizarNo ratings yet

- Budget TemplateDocument3 pagesBudget TemplateDaisyNo ratings yet

- GRESC Model Contract PDFDocument27 pagesGRESC Model Contract PDFAnaflor L. CandelariaNo ratings yet

- AFAR8720 - Government Accounting Manual PDFDocument8 pagesAFAR8720 - Government Accounting Manual PDFSid Tuazon100% (2)

- Osds Position and Competency ProfileDocument45 pagesOsds Position and Competency ProfileAnnaliza Garcia Esperanza100% (1)

- Acct 2020 Excel Budget Problem Student TemplateDocument12 pagesAcct 2020 Excel Budget Problem Student Templateapi-249190933No ratings yet

- Managerial Economics ReportDocument9 pagesManagerial Economics ReportArun Kumar SatapathyNo ratings yet

- Project Management - Financial AnalysisDocument37 pagesProject Management - Financial AnalysisArti RaghuwanshiNo ratings yet

- Project 1 Sukyung KimDocument14 pagesProject 1 Sukyung Kimapi-3418701680% (1)

- Plants Tissue Culture Lab Project ThattaDocument25 pagesPlants Tissue Culture Lab Project Thattarizwan mahmoodNo ratings yet

- Bit - Financial StatementsDocument10 pagesBit - Financial StatementsAldrin ZolinaNo ratings yet

- Excel Budget Template: Project Start Date Scroll To Week #Document5 pagesExcel Budget Template: Project Start Date Scroll To Week #rajeev kaushalNo ratings yet

- TEM Reporting DashboardDocument21 pagesTEM Reporting DashboardLawrence BrownNo ratings yet

- Project Presentation ON: Paper Rock PicturesDocument18 pagesProject Presentation ON: Paper Rock PicturesMunish PathaniaNo ratings yet

- Inter Company Process v6 SYDocument65 pagesInter Company Process v6 SYrikizalkarnain88No ratings yet

- Format of Financial Statements Under The Revised Schedule VIDocument97 pagesFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyNo ratings yet

- RL.1.1 Perfect Order Fullfilment - SuppliersDocument7 pagesRL.1.1 Perfect Order Fullfilment - SuppliersIsmael Guamani MenaNo ratings yet

- Annual ReportDocument193 pagesAnnual ReportShafali R ChandranNo ratings yet

- Mixed Use JK PDFDocument9 pagesMixed Use JK PDFAnkit ChaudhariNo ratings yet

- Project Cost ManagementDocument30 pagesProject Cost ManagementBUKENYA BEEE-2026No ratings yet

- 3 Jays Case StudyDocument22 pages3 Jays Case Studyapi-603875776No ratings yet

- Numbers Sheet Name Numbers Table NameDocument5 pagesNumbers Sheet Name Numbers Table NamePrem KumarNo ratings yet

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- Cost Estimate: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesDocument2 pagesCost Estimate: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesRanda S JowaNo ratings yet

- Project Controls Manager in New York City Metro Resume Duncan ForsythDocument6 pagesProject Controls Manager in New York City Metro Resume Duncan ForsythDuncan ForsythNo ratings yet

- Waterproofing Admixture Market PDFDocument8 pagesWaterproofing Admixture Market PDFsanthosh kumar t mNo ratings yet

- Excel Budget ProjectDocument6 pagesExcel Budget Projectapi-314303195No ratings yet

- Activity Definition and Sequencing WorksheetDocument1 pageActivity Definition and Sequencing WorksheetgorxxNo ratings yet

- UCEM Blank Report TemplateDocument10 pagesUCEM Blank Report Templatebaarum100% (1)

- Excel Financial Functions IDocument18 pagesExcel Financial Functions IElie YabroudiNo ratings yet

- Capacity PlanningDocument17 pagesCapacity PlanningfuriousTaherNo ratings yet

- Business Case SpreadsheetDocument78 pagesBusiness Case SpreadsheetRaju ShresthaNo ratings yet

- Line Items: Optimistic Averagepessimistic WebsiteDocument8 pagesLine Items: Optimistic Averagepessimistic Websiteeng_waleed2008No ratings yet

- Form CapexDocument1 pageForm CapexsatriawanNo ratings yet

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- 5 Year Financial PlanDocument26 pages5 Year Financial PlanNaimul KaderNo ratings yet

- Small Business Profit and Loss StatementDocument1 pageSmall Business Profit and Loss Statementcv.tapinsejahteramandiri21No ratings yet

- ITPM Project Charter Template v1.0Document3 pagesITPM Project Charter Template v1.0maneka bandaraNo ratings yet

- Fixed Asset and Depreciation Schedule: Instructions: InputsDocument6 pagesFixed Asset and Depreciation Schedule: Instructions: InputsLawrence Maretlwa100% (1)

- Former Governor. Bangladesh Bank Professor. School of Business BRAC UniversityDocument45 pagesFormer Governor. Bangladesh Bank Professor. School of Business BRAC UniversityHashmi SutariyaNo ratings yet

- Class Exercise On Linear Programming PDFDocument3 pagesClass Exercise On Linear Programming PDFKaran KakkarNo ratings yet

- Business Case Financial Analysis TemplateDocument22 pagesBusiness Case Financial Analysis TemplateOliviaNo ratings yet

- BA 353/ ACCY 353 - Information Systems Analysis and Design Spring 2007 Group Project Systems DevelopmentDocument6 pagesBA 353/ ACCY 353 - Information Systems Analysis and Design Spring 2007 Group Project Systems DevelopmentDeve CroosNo ratings yet

- Overhead Analysis: - Understand How To Analyse Overheads - How To Reduce Overhead ExpensesDocument21 pagesOverhead Analysis: - Understand How To Analyse Overheads - How To Reduce Overhead Expensesmohamed.mahrous1397No ratings yet

- Project Cost ManagementDocument5 pagesProject Cost ManagementMALAK LOKA MALAK LOKA100% (1)

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Apr 2007Document59 pagesUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Apr 2007MarcyNo ratings yet

- Case Case:: Colorscope, Colorscope, Inc. IncDocument4 pagesCase Case:: Colorscope, Colorscope, Inc. IncBalvinder SinghNo ratings yet

- Chapter # 2 Basic Investment Appraisal Techniques Class Lecture NotesDocument15 pagesChapter # 2 Basic Investment Appraisal Techniques Class Lecture NotesAzeezNo ratings yet

- Management Accounting SampleDocument25 pagesManagement Accounting SampleEdward Baffoe100% (1)

- Base Case Financial ModelDocument4 pagesBase Case Financial ModelAbdul KhaderNo ratings yet

- Product Variety IntroDocument63 pagesProduct Variety IntroPratik BhagatNo ratings yet

- Rolling Forecast TemplateDocument4 pagesRolling Forecast TemplatebenaikodonNo ratings yet

- Grow Your Wealth - 095904Document23 pagesGrow Your Wealth - 095904Amenye IssahNo ratings yet

- 06 Chapter 1Document12 pages06 Chapter 1Mukesh ManwaniNo ratings yet

- Director of Finance and Administration TFF JOB DESCRIPTIONDocument2 pagesDirector of Finance and Administration TFF JOB DESCRIPTIONJackson M AudifaceNo ratings yet

- Individual Project: SPT01 - Lecture 3Document38 pagesIndividual Project: SPT01 - Lecture 3Pamboy HkNo ratings yet

- Clinical Field Experience A-InterviewDocument5 pagesClinical Field Experience A-Interviewapi-548611213No ratings yet

- When Should The Government Intervene in The Economy?: 1. Market FailureDocument4 pagesWhen Should The Government Intervene in The Economy?: 1. Market FailurenishmaNo ratings yet

- Performance Informed Budgeting by DBM Asec. Gil Montalbo PDFDocument47 pagesPerformance Informed Budgeting by DBM Asec. Gil Montalbo PDFMoanaNo ratings yet

- Budgetary ControlDocument18 pagesBudgetary ControlTeena VarmaNo ratings yet

- Budget Planning or Preparation Process: SAP FM BCS Business BlueprintDocument22 pagesBudget Planning or Preparation Process: SAP FM BCS Business BlueprintÖmerFarukTekinNo ratings yet

- Flexible Budgets, Direct-Cost Variances, and Management ControlDocument30 pagesFlexible Budgets, Direct-Cost Variances, and Management ControlMatthewYueNo ratings yet

- Managerial Accounting ch10 QuizDocument7 pagesManagerial Accounting ch10 Quizariel4869No ratings yet

- SAS SyllabusDocument12 pagesSAS SyllabusEr. VinodNo ratings yet

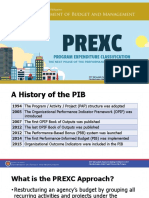

- Program Expenditure Classification PREXCDocument34 pagesProgram Expenditure Classification PREXCMark Lester MundoNo ratings yet

- NURS FPX 6216 Assessment 4 Preparing and Managing A Capital BudgetDocument5 pagesNURS FPX 6216 Assessment 4 Preparing and Managing A Capital BudgetCarolyn HarkerNo ratings yet

- Budget Process PUNJABDocument82 pagesBudget Process PUNJABMudassar Nawaz50% (2)

- 2017 06 30 TSIP Tracker SMK Draft SG3Document14 pages2017 06 30 TSIP Tracker SMK Draft SG3Chiko AmirNo ratings yet

- 4-Planning Tools & TechniquesDocument17 pages4-Planning Tools & TechniquesretNo ratings yet

- Tilahun BogaleDocument95 pagesTilahun Bogaleguadie workuNo ratings yet

- Sales Budget: Problem No. 1Document3 pagesSales Budget: Problem No. 1mugdha_567100% (4)

- EPM Key Design Decisions - Design PhaseDocument7 pagesEPM Key Design Decisions - Design PhaseVishwanath GNo ratings yet

- Part A: Strategic Overview of Ajumako Enyan Essiam District AssemblyDocument50 pagesPart A: Strategic Overview of Ajumako Enyan Essiam District AssemblyValentine AyiviNo ratings yet

- O Cases or Intro Ducci On LPDocument6 pagesO Cases or Intro Ducci On LPHumberto ZamoraNo ratings yet

- Techniques of Cash ManagementDocument18 pagesTechniques of Cash ManagementKrishna Chandran PallippuramNo ratings yet