Professional Documents

Culture Documents

Chapter 06

Uploaded by

GGCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 06

Uploaded by

GGCopyright:

Available Formats

125

Support Department Cost Allocation

CHAPTER 6

Support Department Cost Allocation

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

2.

3.

4.

Describe the difference between support departments and producing departments.

Explain five reasons why support costs may be assigned to producing departments.

Calculate charging rates, and distinguish between single and dual charging rates.

Allocate support center costs to producing departments using the direct method, the

sequential method, and the reciprocal method.

5. Calculate departmental overhead rates.

C H A P T E R S U M M A RY

This chapter first differentiates support departments from producing departments. The costs of

support departments are common to all producing departments and must be allocated to them to

satisfy many important objectives. Given that the causal factors can differ for fixed and variable

costs, a dual rate charging method is preferred to allocate the variable and fixed costs separately.

Three methods are introduced to recognize various degrees of support department interaction

considered. While the direct method allocates support department costs only to the producing

departments, the sequential method and the reciprocal method allocate support service costs

among some (or all) interacting support departments before allocating costs to the producing

departments. Upon allocating all support department costs to producing departments, an

overhead rate can be computed for each producing department in order to determine the

products unit cost.

CHAPTER REVIEW

I.

An Overview of Cost Allocation

Learning Objective #1

Cost allocation is required to assign common resource costs to cost objects or common

costs. Common costs occur when the same resource is used in the output of two or more

services or products.

Allocation is a means of dividing a pool of costs and assigning it to various subunits. Thus,

allocation does not affect the amount of total costs.

A.

Cost allocation procedures include the following steps:

1. Departmentalize the firm and classify each department as a support department or

a producing department.

126

Chapter6

There are two types of departments (cost objects):

a. Producing departments are directly responsible for creating the products and

services sold to customers.

Examples:Assembly, Finishing

b. Support departments provide essential support services for producing

departments.

Examples:Maintenance, Human Resources, cafeteria

Review textbook Exhibit 6-1, which gives examples of producing and

support departments for a manufacturing firm and a service firm.

2. Trace all overhead costs to a support or producing department.

The costs that are directly associated with the individual departments will be traced

to one, and only one, department.

3. Allocate support department costs to producing departments.

The support department costs are part of the total product costs and must be

assigned to the products through cost allocation from support departments to

producing departments.

4. Calculate predetermined overhead rates for producing departments.

5. Allocate overhead costs to the units of individual product through the

predetermined overhead rates.

Summary of support department cost allocation:

Support department cost assignment is a two-stage process:

Allocation of support department costs to producing departments.

Assignment of these allocated costs to individual products using departmental

overhead rates.

Support department costs cannot be allocated directly to units produced because:

Products do not pass through the support departments.

Support departments exist to support manufacturing activities within the

producing departments.

B.

Types of Allocation Bases

1. The use of causal factors (activity drivers) is best for allocation of support

department costs.

Causal factors are variables or activities within a producing department that

provoke the incurrence of support costs. Thus, using causal factors will result in

more accurate product costs and more control of the consumption of services.

2. The use of a proxy is an alternative when an easily measured causal factor cannot

be found.

The choice of a good proxy to guide allocation depends on the firms objectives for

allocation.

127

Support Department Cost Allocation

Review textbook Exhibit 6-3, which gives examples

of possible activity drivers for allocating support department costs.

II.

Objectives of Allocation

A.

Learning Objective #2

The Institute of Management Accountants (IMA) has identified the following major objectives of support department cost allocation.

1. To obtain a mutually agreeable price.

Accurate cost allocation helps a firm create meaningful and competitive bids.

2. To compute product-line profitability.

Reliable product cost information helps a firm ensure that all products are profitable.

3. To predict the economic effects of planning and control.

Accurate cost allocation helps a firm assess the profitability of various support

services and determine the appropriate mix of support services offered by the firm.

4. To value inventory.

All manufacturing costs, direct and indirect, must be assigned to the products

produced to meet GAAP requirements.

5. To motivate managers.

Allocation of support department costs:

Helps each producing department select the appropriate level of support

service consumption.

Encourages support department managers to be more sensitive to the needs

of the producing departments.

B.

The guidelines for determining the best allocation method are as follows:

1. Cause and effectCausal factors should be used to guide the allocations.

2. Benefits received Cost should be allocated based on the perceived benefits.

3. Fairness or equity (especially in government contracts)Cost allocation for a

government contract should be similar to that for a nongovernment contract.

4. Ability to bearThe more profitable the department, the larger the allocation,

regardless of whether or not there is any relationship or usage. This is the least

desirable guideline because it provides no motivational benefits.

5. Cost-benefitThe cost of implementing an allocation scheme should result in

some benefit.

III.

Allocating One Departments Costs to Another Department

Learning Objective #3

Support department costs are allocated through the use of a charging rate. Considerations

that go into determining an appropriate charging rate include (1) the choice of a single or a

dual rate and (2) the use of budgeted versus actual support department costs.

A.

A Single Charging Rate

128

Chapter6

1. Both fixed and variable costs are combined into a single rate. The amount of

service cost allocated is solely a function of usage/volume.

2. The use of a single rate treats the fixed cost as if it were variable. It ignores the differential impact of changes in usage on costs. Fixed costs do not vary with the

level of services.

B.

Dual Charging Rates

Two separate rates, one for fixed cost and one for variable cost, are used to avoid the

treatment of fixed costs as variable. The variable rate is used in conjunction with the

fixed amount allocated to determine the total charge.

1. Developing a Fixed Rate

Fixed service costs can be considered capacity costs because when the support

department was established, its delivery capacity was designed to serve the

long-term needs of the producing departments.

Support department fixed costs can be allocated using a three-step procedure:

a. Determination of budgeted fixed support service costs.

b. Computation of the allocation ratio:

Allocation ratio =

Producing department capacity

Total capacity

c. Allocation:

Allocation = Allocation ratio Budgeted fixed support service costs

2. Developing a Variable Rate

Need to identify the appropriate cost driver.

The benefits of dual charging rates include the following:

Fixed costs are allocated to producing departments according to their original needs

of support capacity.

Variable costs are allocated to producing departments based on their usage of the

support department service.

C.

Budgeted versus Actual Usage

1. Use the budgeted usage as the allocation base when fixed costs are involved.

2. Allocation of budgeted support service costs is better than allocation of actual

support service costs because allocating actual costs passes on the efficiencies or

inefficiencies of the service department, something that the manager of the

producing department cannot control.

3. Support department cost allocation for product costing is calculated as follows:

Cost allocated based on dual rate method =

(Total budgeted fixed cost Allocation ratio)

+ (Budgeted unit variable cost Budgeted activity level)

4. Support department cost allocation for performance evaluation is calculated as

follows:

Cost allocated based on dual rate method =

(Total budgeted fixed cost Allocation ratio)

+ (Budgeted unit variable cost Actual activity level)

D.

Fixed versus Variable Bases:A Note of Caution

129

Support Department Cost Allocation

1. Use the normal or practical capacity to allocate fixed support department costs

as long as the capacity demands from the producing departments remain at the

level originally anticipated.

2. Note that allocation of fixed costs based on actual usage will allow the actions of

one department to affect the amount of cost allocated to another department.

Review textbook Exhibit 6-4, which shows the use of budgeted usage for product costing.

Review textbook Exhibit 6-5, which illustrates the

use of actual usage for performance evaluation.

Note that the difference between the results of single-rate and dual-rate cost allocation

derives from different activity levels used for allocating variable cost for different purposes.

IV.

Choosing a Support Department Cost Allocation Method

Learning Objective #4

Many companies have multiple support departments, and they frequently interact. These

interactions among support departments need to be considered to produce accurate cost

assignments.

Three methods can be used to allocate support department costs: the direct, sequential,

and reciprocal methods. In determining which support department cost allocation method to

use, companies must:

Determine the extent of support department interaction.

Weigh the costs and benefits associated with each method.

A.

Direct Method of Allocation

When support department costs are allocated only to the producing departments, the

direct method of allocation is being used. This is the most simple and straightforward

of the three allocation methods. Under this method,

No support department costs are allocated to any other support department.

All interactions between the support departments are ignored.

Review textbook Exhibit 6-6, which illustrates the direct method of allocation.

Review textbook Exhibit 6-8, which provides a numeric example of direct allocation.

B.

Sequential Method of Allocation

The sequential (or step) method of allocation recognizes that interactions among support departments do occur.

1. Cost allocations are performed in a step-down fashion.

a. The costs of the support department rendering the greatest service are allocated

first.

b. Once a support departments costs have been allocated, no costs are

allocated back to it.

130

Chapter6

c. The costs allocated from a support department are its direct costs plus any costs

it receives in allocations from other support departments.

2. Sequential allocation may be more accurate than the direct method because it

recognizes some interactions among the support departments.

Its disadvantage, however, is that it does not recognize all of the interactions

between support departments.

Review textbook Exhibit 6-9, which illustrates the sequential method of allocation.

Review textbook Exhibit 6-10, which provides a numeric example of sequential allocation.

C.

Reciprocal Method of Allocation

In the reciprocal method of allocation, all of the interactions between support

departments are recognized by its reciprocity on cost allocation.

1. The total cost of a support department is the sum of its direct costs plus the

proportion of service received from other support departments. The total cost

reflects interactions among the support departments.

Total cost = Direct costs + Allocated costs

2. A series of simultaneous linear equations must be constructed and solved to

perform reciprocal cost allocation.

Review textbook Exhibit 6-11, which illustrates the reciprocal method of

allocation and the proportion of support output consumed by all users.

Review textbook Exhibit 6-12, which provides a numeric example of reciprocal allocation.

D.

Comparison of the Three Methods

1. The advantages of better allocation must outweigh the increased cost of using a

more theoretically preferred method.

2. Rapid changes in technology make allocation unnecessary. For example, there is

no need for support department cost allocation in the JIT environment because the

manufacturing cells (i.e., producing departments) are performing many support

functions.

V.

Departmental Overhead Rates and Product Costing

Learning Objective #5

Upon allocating all support department costs to producing departments, an overhead rate

can be computed for each producing department to assign costs to products.

Departmental overhead rates =

Direct overhead costs of producing department + Allocated costs of support department

Budgeted activity base of producing department

The accuracy of the product costs depends primarily on the accuracy of the assignment

of the overhead costs because material and labor are directly traceable to products.

Great care should be used in identifying and using causal factors for both stages of

overhead assignment. This, in turn, depends upon

Support Department Cost Allocation

131

the strength of correlation among the factors used to allocate support costs to the

department and

the strength of correlation among the factors used to allocate the producing

departments overhead costs to the products.

132

Chapter6

KEY TERMS TEST

From the list that follows, select the term that best completes each statement and write it in the

space provided.

causal factors

common cost

direct method

producing department

reciprocal method

sequential (or step) method

support department

1. The method that allocates service costs to producing departments without considering interactions that may exist among the support departments is the __________________

_____________.

2. _______________________ is the cost of a resource used in the output of two or more ser vices or products.

3. The method that allocates service costs to user departments giving partial consideration to

interactions among the support departments is the _______________________________.

4. The method that simultaneously allocates service costs to all user departments is the

_______________________________.

5. _________________________ are variables or activities within a producing department that

provoke the incurrence of support costs.

6. The ____________________________________ is responsible for producing the products

or services that are sold to customers.

7. The ____________________________________ provides essential support to producing

departments.

M U LTI P L E - C H O I C E Q U I Z

Complete each of the following statements by circling the letter of the best answer.

1. Which of the following departments would be classified as a support department?

a. Fabricating

b. Assembly

c. Engineering

d. Finishing

e. Grinding

2. Which of the following departments would be classified as a producing department?

a. Engineering

b. Machining

c. Final Inspection

d. Maintenance

e. Scheduling

Support Department Cost Allocation

133

3. Which of the following best describes the two-stage allocation process?

a. Costs are first traced to support departments, then costs are allocated to units.

b. Costs are first allocated to producing departments, then costs are traced to

support departments.

c. Costs are first allocated to support departments, then costs are allocated to products.

d. Costs are first allocated to producing departments, then costs are allocated to products.

e. Costs are first allocated to products, then costs are allocated to services.

4. Which of the following statements regarding allocation bases is correct?

a. Causal factors will introduce inaccuracies in the product costs; they should never be used.

b. Support departments will never have good proxies, thus a causal factor must be used.

c. Support departments will never have causal factors, thus a proxy must be used.

d. If possible, a good proxy should be used as the allocation base.

e. If possible, causal factors should be used as the allocation base.

5. Which of the following is not an objective of allocation, as identified by the IMA?

a. To provide an estimate of cost drivers.

b. To obtain a mutually agreeable price.

c. To compute product-line profitability.

d. To predict the economic effects of planning and control.

e. All of the above are objectives of allocation.

6. Which of the following statements regarding the allocation of support department costs

is correct?

a. A single charging rate will provide producing department managers with an accurate

assessment of fixed and variable costs.

b. A dual charging rate leads the producing department managers to treat all costs as

variable.

c. The ability to bear is the best guideline to follow in choosing an allocation method.

d. A dual charging rate leads the producing department managers to treat all costs as fixed.

e. A dual charging rate will provide producing department managers with an accurate

assessment of fixed and variable costs.

7. When a dual charging rate is used to allocate fixed costs, which of the following should be

used to measure the capacity?

a. normal activity of the support department

b. normal activity of the producing department

c. peak activity of the support department

d. actual activity of the producing department

e. actual activity of the support department

134

Chapter6

8. Which of the following is not a reason for using the budgeted support department costs in

preparing the allocation rates?

a. Only budgeted support department costs can be broken down into fixed and variable costs.

b. Since the support department allocation is preliminary to determining the overhead rate

at the beginning of the period, actual costs are not yet known.

c. Since support department allocations are used for performance evaluation, the budget is

used to enable comparisons with actual results.

d. Producing department managers have no control over the support department spending;

the efficiencies or inefficiencies should not be passed on to the producing department.

e. All of the above are reasons for using budgeted support department costs rather than

actual costs.

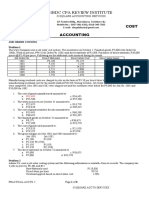

Use the following information for Questions 9 and 10:

ABC Company has two support departments (Power and Maintenance) and two producing

departments (Assembly and Finishing). The direct allocation method is used to assign support

department costs to the producing departments. The causal factor for the power costs is kilowatt

hours; the causal factor for the maintenance costs is repair hours. Assume the following

information:

Direct costs.....................

Kilowatt hours..................

Repair hours....................

Power

Maintenance

Assembly

Finishing

$100,000

$150,000

10,000

$75,000

90,000

2,500

$50,000

100,000

2,000

500

9. What would be the Power Department allocation to the Assembly Department?

a. $45,000

b. $47,368

c. $50,000

d. $54,474

e. $82,895

10. What would be the Maintenance Department allocation to the Finishing Department?

a. $20,000

b. $22,222

c. $60,000

d. $66,667

e. $71,111

Use the following information for Questions 11 and 12:

Triad Company has two support departments (Janitorial and Payroll) and two producing

departments (Assembly and Finishing). The sequential allocation method is used to assign

support department costs to the producing departments. Payroll costs are allocated first. A proxy

for janitorial services is square footage; a proxy for payroll is number of employees. Assume the

following information:

Direct costs.....................

Square feet.....................

Janitorial

Payroll

Assembly

Finishing

$250,000

$275,000

500

3,500

1,500

135

Support Department Cost Allocation

Number of employees.....

125

100

11. What would be the Payroll Department allocation to the Assembly Department?

a. $144,433

b. $149,457

c. $152,778

d. $172,639

e. none of the above

12. What would be the Janitorial Department allocation to the Finishing Department?

a. $68,182

b. $69,812

c. $75,000

d. $76,793

e. none of the above

Use the following information for Questions 13 and 14:

M&P Tool has three service departments that support the production area. Outlined below is the

estimated overhead by department for the upcoming year:

Estimated Overhead

Service Departments:

Receiving.................

Repair......................

Tool..........................

Production Departments:

Assembly.................

Bolting.....................

$25,000

35,000

10,000

Number of Employees

2

2

1

25

12

The Repair Department supports the greatest number of departments, followed by the Tool

Department. Overhead cost is allocated to departments based on the number of employees.

13. Using the direct method of allocation, how much of the Repair Departments overhead will

be allocated to the Tool Department?

a. $0

b. $875

c. $7,000

d. $11,667

e. $14,000

14. Using the sequential method of allocation, what would be the allocation from the Repair

Department to the Tool Department?

a. $0

b. $875

c. $7,000

d. $11,667

e. $14,000

136

Chapter6

PRACTICE TEST

EXERCISE 1

Classify each of the following departments in a factory as a producing department or a support

department by placing a check mark in the appropriate column.

Producing Department

1. Fabricating

2. Accounting

3. Machining

4. Finishing

5. Rework

6. Cafeteria

7. Maintenance

8. Grinding

9. Heat treat

10. Cutting

11. Materials storeroom

12. Purchasing

13. Assembly

14. Engineering

15. Welding

Support Department

137

Support Department Cost Allocation

EXERCISE 2

Apex Corporation has decided to revise the allocation approach for its Financial Analysis Department. The new approach is to develop a charging rate based on the number of special

reports requested. Each of the reports takes roughly the same resources, time, and supplies, so

the number of reports is an adequate proxy of the activity of the department. Fixed costs for the

department total $10,000 per month; variable costs are $15 per report. The estimated activity

for the various departments has been forecasted to be as follows:

Department

Scheduling....................................

Accounting....................................

Finance.........................................

Data Processing...........................

Engineering...................................

Legal.............................................

Estimated Reports

5

25

20

15

25

10

After the new allocation system had been in place for six months, the following average

monthly activity was observed:

Department

Scheduling....................................

Accounting....................................

Finance.........................................

Data Processing...........................

Engineering...................................

Legal.............................................

Actual Reports

10

25

45

15

30

25

Required:

1. Calculate a single charging rate, on a per report basis, to be charged to the departments.

Based on the departments actual number of reports, how much would be charged to each

department using the single charging rate?

138

Chapter6

EXERCISE 2(Continued)

2. Calculate a dual charging rate. Based on the departments actual number of reports, how much

would be charged to each department using the dual charging rate?

3. Which departments would prefer the single charging rate? Why? Which would prefer the

dual charging rate, and why?

Support Department Cost Allocation

139

EXERCISE 3

Triad Companys legal department serves as an internal patent consulting service. The department

has fixed salaries of $30,000 per month. Patent searches cost $50 per hour of connect time with

the on-line databases. All other costs of the department are fixed, totaling $15,000 per month.

The two research laboratories of Triad, Memphis and Columbus, are currently the only users of the

service. Normal usage has averaged 175 hours of connect time for the Memphis lab and 225

hours for the Columbus lab.

Required:

1. Determine the amount of legal service costs that should be assigned to each lab using a single

charging rate.

2. Determine the amount of legal service costs that should be assigned to each lab using a dual

charging rate.

3. During October, the Legal Department had fixed costs totaling $48,000 and actual connect time

costs of $23,400. The Memphis lab used 180 hours of connect time; Columbus used 270

hours. Determine the amount of costs that should be assigned to each lab. (Hint:Use good

principles of performance evaluation.)

140

Chapter6

EXERCISE 4

QRS Company has two support departments (Administration and Janitorial) and three producing

departments (Fabricating, Assembly, and Finishing). Costs and activities are as follows:

Direct costs.......................

Number of employees.......

Square feet.......................

Direct labor hours..............

Administration

Janitorial

Fabricating

Assembly

Finishing

$50,000

$30,000

10

$40,000

30

10,000

5,000

$50,000

40

28,000

6,000

$25,000

20

15,000

2,000

2,000

Administrative services are allocated based on the number of employees; janitorial services are

allocated based on square footage. Overhead rates for the three producing departments are based

on direct labor hours.

Required:

Determine the overhead application rates for the producing departments using each of the three

allocation methods:

1. Direct allocation method for the support departments

Support Department Cost Allocation

EXERCISE 4(Continued)

2. Sequential allocation method for the support departments

3. Reciprocal allocation method for the support departments

141

142

EXERCISE 4(Continued)

Use this space to continue your answer.

Chapter6

143

Support Department Cost Allocation

C A N YOU ? C H E C K L I S T

Can you describe the difference between a producing department and a support department?

Can you explain why the distinction is important?

Can you describe the steps to take to allocate support department costs?

Can you explain the various objectives of allocating support department costs? In other

words, why are support costs allocated?

Can you explain the difference between a single charging rate and a dual charging rate? Can

you explain when actual usage or budgeted usage should be used? Can you explain why the

method used may affect the producing department managers view of the cost behavior?

Can you allocate support department costs using the direct method? The sequential method?

The reciprocal method? Can you explain how each method treats the interactions among

support departments?

ANSWERS

KEY TERMS TEST

1.

2.

3.

4.

direct method

Common cost

sequential (or step) method

reciprocal method

5. Causal factors

6. producing department

7. support department

MULTIPLE-CHOICE QUIZ

1.

2.

3.

4.

5.

6.

7.

8.

c

b

d

c

a

e

b

a

9.

10.

11.

12.

b

d

b

d

13. a

14. b

$100,000 90,000 / (90,000 + 100,000) = $47,368

$150,000 2,000 / (2,000 + 2,500) = $66,667

$275,000 125 / (5 + 125 + 100) = $149,457

$250,000 + ($275,000 5) / (5 + 125 + 100) 1,500 / (3,500 + 1,500) =

$255,978 1,500 / 5,000 = $76,793

The direct method does not allocate support departments cost to other support

departments.

The Repair Department performs allocation first. Thus, the Tool Department will

receive cost allocation of ($35,000 1/40) = $875.

144

Chapter6

PRACTICE TEST

EXERCISE 1

Producing Department

1. Fabricating

Support Department

2. Accounting

3. Machining

4. Finishing

5. Rework

6. Cafeteria

7. Maintenance

8. Grinding

9. Heat treat

10. Cutting

11. Materials storeroom

12. Purchasing

13. Assembly

14. Engineering

15. Welding

EXERCISE 2(Apex Corporation)

1. Single charging rate = ($10,000 / 100) + $15 = $115

Department

Scheduling..............................

Accounting.............................

Finance...................................

Data Processing.....................

Engineering............................

Legal ......................................

Reports

10

25

45

15

30

25

Rate

$115

115

115

115

115

115

Total

$1,150

2,875

5,175

1,725

3,450

2,875

$17,250

2. Dual charging rate:Variable rate = $15; Fixed charge as follows:

Department

Scheduling..............................

Accounting.............................

Finance...................................

Data Processing.....................

Engineering............................

Legal ......................................

Reports

5

25

20

15

25

10

Department

Scheduling..............................

Accounting.............................

Finance...................................

Data Processing.....................

Engineering............................

Legal ......................................

Reports

10

25

45

15

30

25

Capacity Fixed Cost

Percent

Allocated

5

$ 500

25

2,500

20

2,000

15

1,500

25

2,500

10

1,000

100

$10,000

V/OH

Rate

$15

15

15

15

15

15

V/OH

Costs

$ 150

375

675

225

450

375

$2,250

Fixed Cost

Allocated

$ 500

2,500

2,000

1,500

2,500

1,000

$10,000

Total

$ 650

2,875

2,675

1,725

2,950

1,375

$12,250

145

Support Department Cost Allocation

3. The only time a department will prefer a single charging rate is when the actual usage is less than the expected

usage. When actual usage equals expected usage, a single charging rate will equal a dual charging rate. If actual

usage is greater than expected, the department will be charged a larger amount due to fixed costs.

EXERCISE 3(Triad Company)

1. Single charging rate = [($30,000 + $15,000) / (175 + 225)] + $50

Single charging rate = ($45,000 / 400) + $50 = $162.50

Overhead cost allocated to Memphis: 175 hours $162.50 = $28,437.50

Overhead cost allocated to Columbus: 225 hours $162.50 = $36,562.50

2. Dual charging rate:Variable charge = $50 hour

Memphis

175 hours = 43.75% of total hours

Fixed cost:

$45,000 0.4375 = $19,687.50

Overhead cost allocated: $19,687.50 fixed + ($50 175 hours) = $28,437.50

Columbus

225 hours = 56.25% of total hours

Fixed cost:

$45,000 0.5625 = $25,312.50

Overhead cost allocated: $25,312.50 fixed + ($50 225 hours) = $36,562.50

3. Memphis:

Columbus:

$19,687.50 + ($50 180 hours) = $19,687.50 + $9,000 = $28,687.50

$25,312.50 + ($50 270 hours) = 25,312.50 + 13,500 = 38,812.50

$45,000.00 + $22,500 = $67,500.00

Good principles of performance evaluation will use the budgeted rates for the allocation rather than the actual

rates. The inefficiencies in the Legal Department ($3,000 over-budget fixed costs and $900 over-budget variable

costs) are not allocated to the users.

EXERCISE 4(QRS Company)

1. Direct Method

No. of employees..............................

Service percentage......................

Fabricating

30

33.33%

Assembly

40

44.44%

Finishing

20

22.22%

Total

90

100.00%

Square feet.......................................

Service percentage......................

10,000

18.87%

28,000

52.83%

15,000

28.30%

53,000

100.00%

Administrative cost allocation*.........

Janitorial cost allocation**................

Direct overhead cost.........................

Total overhead cost..........................

Divided by direct labor hours...........

Departmental OH rate per DLH........

**Departmental employee % $50,000

**Departmental square feet % $30,000

$16,666.67

5,660.38

40,000.00

$62,327.05

5,000

$12.47

$22,222.22

15,849.06

50,000.00

$88,071.28

6,000

$14.68

$11,111.11

8,490.57

25,000.00

$44,601.68

2,000

$22.30

$50,000.00

30,000.00

146

Chapter6

2. Sequential Method

As indicated in the service proportion table, the Administration Department provides the highest percentage of

service to other service departments. Thus, the administrative costs will be allocated first, then followed by the

Janitorial Department cost allocation.

Service Proportion Table

Admin.

No. of employees..................................

Service percentage..........................

Square feet...........................................

Service percentage..........................

Janitorial Fabricating

10

30

10.00%

30.00%

Assembly

40

40.00%

Finishing

20

20.00%

Total

100

100.00%

10,000

18.18%

28,000

50.91%

15,000

27.27%

55,000

100.00%

2,000

3.64%

Sequential Cost Allocation

Admin.

Direct overhead cost............................. $ 50,000)

First step:Allocate admin. costs ......... $(50,000)

Janitorial

$30,000)

$5,000)

Fabricating

$40,000

$15,000

Assembly

$50,000

$20,000

10,000

18.87%

28,000

52.83%

Second step:Allocate janitorial costs

Determine allocation percentages:

Square feet..................................

Allocation percentage.................

Janitorial cost allocation..................

Total overhead costs.............................

Divided by direct labor hours................

Departmental OH rate per DLH............

$0)

Finishing

$25,000

$10,000

Total

15,000

28.30%

$(35,000)

$6,604

$18,491

$9,906

$0)

$61,604

5,000

$ 12.32

$88,491

6,000

$ 14.75

$44,906

2,000

$ 22.45

53,000

100.00%

$35,000

3. Reciprocal Method

Service Proportion Table

Admin.

No. of employees..................................

Service percentage..........................

Square feet...........................................

Service percentage..........................

Janitorial

10

10.00%

Fabricating

30

30.00%

Assembly

40

40.00%

Finishing

20

20.00%

Total

100

100.00%

10,000

18.18%

28,000

50.91%

15,000

27.27%

55,000

100.00%

2,000

3.64%

Simultaneous equations can be created based on the service proportion table above.

A = $50,000 +.0364J

J = $30,000 + 0.1A

where A = Administration Department total costs

J = Janitorial Department total costs

A = $50,000 + .0364 ($30,000 + 0.1A)

A = $50,000 + $1,092 + 0.00364A

J = $30,000 + (0.1 $51,279)

0.99636A = $51,092

J = $30,000 + $5,128

A = $51,279

J = $35,128

Reciprocal Cost Allocation

Direct overhead cost.............................

Administrative cost allocation..............

Janitorial cost allocation.......................

Total overhead costs.............................

Direct labor hours.................................

Departmental overhead rate.................

Admin.

$50,000.00)

(51,279.00)

1,277.38 )

$

0)

Janitorial

$30,000.00)

5,127.90)

(35,128.00)

$

0)

Fabricating

$40,000.00

15,383.70

6,386.91

$61,770.61

5,000

$12.35

Assembly

$50,000.00

20,511.60

17,883.35

$88,394.95

6,000

$14.73

Finishing

$25,000.00

10,255.80

9,580.36

$44,836.16

2,000

$22.42

You might also like

- EXAMDocument41 pagesEXAMJoebet Balbin BonifacioNo ratings yet

- 12Document2 pages12Carlo ParasNo ratings yet

- SpoilageDocument17 pagesSpoilageBhawin DondaNo ratings yet

- Job Costing: 1. Whether Actual or Estimated Costs Are UsedDocument16 pagesJob Costing: 1. Whether Actual or Estimated Costs Are UsedalemayehuNo ratings yet

- 555Document3 pages555Carlo ParasNo ratings yet

- 06 Process Cost Accounting Additional ProceduresDocument28 pages06 Process Cost Accounting Additional ProceduresRey Joyce Abuel100% (1)

- X04 Cost Volume Profit RelationshipsDocument39 pagesX04 Cost Volume Profit Relationshipschiji chzzzmeowNo ratings yet

- Midterms 201 NotesDocument6 pagesMidterms 201 NotesLyn AbudaNo ratings yet

- Cost Quizzer6Document6 pagesCost Quizzer6LumingNo ratings yet

- Name: - Section: - Schedule: - Class Number: - DateDocument13 pagesName: - Section: - Schedule: - Class Number: - Datechristine_pineda_2No ratings yet

- BACOSTMX Module 2 Self-ReviewerDocument7 pagesBACOSTMX Module 2 Self-ReviewerlcNo ratings yet

- Financial Accounting Questions and Solutions Chapter 3Document7 pagesFinancial Accounting Questions and Solutions Chapter 3bazil360No ratings yet

- BUKU - Blocher Et Al-Cost Management - A Strategic Emphasis, 5th Edition (2009) - 127-179 PDFDocument53 pagesBUKU - Blocher Et Al-Cost Management - A Strategic Emphasis, 5th Edition (2009) - 127-179 PDFelis100% (1)

- 09 X07 C ResponsibilityDocument8 pages09 X07 C ResponsibilityJune KooNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingRoselyn LumbaoNo ratings yet

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- Backflush Costing/Activity Based CostingDocument14 pagesBackflush Costing/Activity Based CostingEilen Joyce BisnarNo ratings yet

- Bacostmx-3tay2021-Finals Quiz 1Document6 pagesBacostmx-3tay2021-Finals Quiz 1Marjorie NepomucenoNo ratings yet

- Quiz-3 Cost2 BSA4Document6 pagesQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- JakeDocument5 pagesJakeEvan JordanNo ratings yet

- 18 x12 ABC ADocument12 pages18 x12 ABC AKM MacatangayNo ratings yet

- p2 Guerrero Ch15Document27 pagesp2 Guerrero Ch15Michael Brian TorresNo ratings yet

- Bsa 2202 SCM PrelimDocument17 pagesBsa 2202 SCM PrelimKezia SantosidadNo ratings yet

- AssignmentDocument6 pagesAssignmentIrishNo ratings yet

- Assignment 3: Spoilage in Weighted Average and FIFO Cost Flow MethodDocument3 pagesAssignment 3: Spoilage in Weighted Average and FIFO Cost Flow MethodKelvin CulajaráNo ratings yet

- 25 Profit-Performance Measurements & Intracompany Transfer PricingDocument13 pages25 Profit-Performance Measurements & Intracompany Transfer PricingLaurenz Simon ManaliliNo ratings yet

- Week 7 HWMDocument8 pagesWeek 7 HWMJarongchai Keng HaemaprasertsukNo ratings yet

- Chapter 7 - Accounting For Joint and by ProductsDocument8 pagesChapter 7 - Accounting For Joint and by ProductsJoey LazarteNo ratings yet

- Variable Costing - Cost Accounting QuizDocument2 pagesVariable Costing - Cost Accounting QuizRizza Mae RodriguezNo ratings yet

- Accounting For Joint Products/By-Products: Multiple ChoiceDocument10 pagesAccounting For Joint Products/By-Products: Multiple ChoiceAldrin CabangbangNo ratings yet

- 04 - Relevant CostingDocument5 pages04 - Relevant CostingVince De Guzman100% (2)

- Midterm Reviewer Cost AccountingDocument14 pagesMidterm Reviewer Cost AccountingPrecious AnneNo ratings yet

- 1Bdc Cpa Review Institute: Cost AccountingDocument8 pages1Bdc Cpa Review Institute: Cost AccountingJason BautistaNo ratings yet

- ACC102 Chapter8newDocument26 pagesACC102 Chapter8newAbdul RaheemNo ratings yet

- FARAP 4404 Property Plant EquipmentDocument11 pagesFARAP 4404 Property Plant EquipmentJohn Ray RonaNo ratings yet

- 6Document5 pages6TroisNo ratings yet

- Lecture-8.2 Job Order Costing (Theory With Problem)Document13 pagesLecture-8.2 Job Order Costing (Theory With Problem)Nazmul-Hassan Sumon100% (2)

- WHAT Is Evaporation Loss? WHO Determines or Estimates Evaporation Loss? HOW To Account Evaporation Loss?Document13 pagesWHAT Is Evaporation Loss? WHO Determines or Estimates Evaporation Loss? HOW To Account Evaporation Loss?Lyan Agustin IIINo ratings yet

- Acctg201 QuizDocument4 pagesAcctg201 QuizJehny AbelgasNo ratings yet

- Cost Mock Compre With AnsDocument15 pagesCost Mock Compre With Anssky dela cruzNo ratings yet

- MS 3405 Variable and Absorption CostingDocument5 pagesMS 3405 Variable and Absorption CostingMonica GarciaNo ratings yet

- Chapter 8 - Standard CostingDocument8 pagesChapter 8 - Standard CostingJoey LazarteNo ratings yet

- ms1 q3Document5 pagesms1 q3KrisshiaLynnSanchezNo ratings yet

- Accounting For Production Losses in A Job Order Costing SystemDocument7 pagesAccounting For Production Losses in A Job Order Costing Systemfirestorm riveraNo ratings yet

- Job Order Costing-Problems 1 and 2Document2 pagesJob Order Costing-Problems 1 and 2Charlé0% (2)

- Saint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Document4 pagesSaint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Esheikell ChenNo ratings yet

- FQ1Document4 pagesFQ1Maviel Suaverdez100% (1)

- Microsoft Word - FAR02 - Accounting For Debt InvestmentsDocument4 pagesMicrosoft Word - FAR02 - Accounting For Debt InvestmentsDisguised owl0% (1)

- Responsibility Accounting: Acctg 205: Management ScienceDocument34 pagesResponsibility Accounting: Acctg 205: Management ScienceEliseNo ratings yet

- 6 Variable Full Costing Ue Caloocan May 2023Document8 pages6 Variable Full Costing Ue Caloocan May 2023Trisha Marie LeeNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- CH 4Document10 pagesCH 4Abrha Giday0% (1)

- Mas 9403 Standard Costs and Variance AnalysisDocument21 pagesMas 9403 Standard Costs and Variance AnalysisBanna SplitNo ratings yet

- Latihan Soal AEB Chapter 6Document18 pagesLatihan Soal AEB Chapter 6Arlita RahmaNo ratings yet

- Learning Objectives: 1. An Overview of Cost AllocationDocument7 pagesLearning Objectives: 1. An Overview of Cost AllocationLorena TudorascuNo ratings yet

- Cost Allocation: Chapter ThreeDocument48 pagesCost Allocation: Chapter ThreesolomonaauNo ratings yet

- Support Department, Common Cost, and Revenue Allocations: Learning ObjectivesDocument14 pagesSupport Department, Common Cost, and Revenue Allocations: Learning ObjectivesKelvin John RamosNo ratings yet

- C.A-I Chapter-6Document14 pagesC.A-I Chapter-6Tariku KolchaNo ratings yet

- Ebook Cornerstones of Cost Accounting Canadian 1St Edition Hansen Solutions Manual Full Chapter PDFDocument32 pagesEbook Cornerstones of Cost Accounting Canadian 1St Edition Hansen Solutions Manual Full Chapter PDFriaozgas3023100% (11)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Past Questions of IGC1 & IGC2 (NEBOSH International General Certificate)Document23 pagesPast Questions of IGC1 & IGC2 (NEBOSH International General Certificate)Mudassar Hassan100% (1)

- Nebosh Internal General Certificate NotesDocument48 pagesNebosh Internal General Certificate NotesMudassar Hassan100% (1)

- Van Horne McqsDocument10 pagesVan Horne McqsMudassar Hassan100% (1)

- CHAPTER 12 Activity-Based CostingDocument23 pagesCHAPTER 12 Activity-Based CostingMudassar Hassan0% (1)

- Process Cost Accounting Additional Procedures: Accounting For Joint Products and By-ProductsDocument23 pagesProcess Cost Accounting Additional Procedures: Accounting For Joint Products and By-ProductsMudassar HassanNo ratings yet

- CHAPTER 7 Joint Product and By-Product CostingDocument21 pagesCHAPTER 7 Joint Product and By-Product CostingMudassar Hassan100% (1)

- Chapter 08Document18 pagesChapter 08hana_kimi_91No ratings yet

- CHAPTER 4 Product and Service Costing: Overhead Application and Job-Order SystemDocument28 pagesCHAPTER 4 Product and Service Costing: Overhead Application and Job-Order SystemMudassar Hassan100% (1)

- CHAPTER 5 Product and Service Costing: A Process Systems ApproachDocument30 pagesCHAPTER 5 Product and Service Costing: A Process Systems ApproachMudassar HassanNo ratings yet

- CHAPTER 3 Activity Cost BehaviorDocument28 pagesCHAPTER 3 Activity Cost BehaviorMudassar Hassan100% (1)

- CHAPTER 2 Basic Cost Management ConceptsDocument23 pagesCHAPTER 2 Basic Cost Management ConceptsMudassar Hassan100% (1)

- Resistance To Change TQMDocument11 pagesResistance To Change TQMAlex RiveraNo ratings yet

- Mechanistic-Empirical Pavement Design GuideDocument3 pagesMechanistic-Empirical Pavement Design Guidelelu8210No ratings yet

- Karpagam College of EngineeringDocument6 pagesKarpagam College of EngineeringSuresh VpNo ratings yet

- Challenges To FreedomDocument11 pagesChallenges To Freedomgerlie orqueNo ratings yet

- Blessings in DisguiseDocument238 pagesBlessings in DisguiseAJ HassanNo ratings yet

- Proposit Gen MathDocument9 pagesProposit Gen MathAngelika AndresNo ratings yet

- 8102 Lifespan ProjectDocument8 pages8102 Lifespan Projectapi-346419959No ratings yet

- Chapter 1 Introduction To Emergency Medical CareDocument19 pagesChapter 1 Introduction To Emergency Medical Carejmmos207064100% (1)

- Week1 - Introduction To Business Process ManagementDocument29 pagesWeek1 - Introduction To Business Process ManagementRamsky Baddongon PadigNo ratings yet

- CDP MCQs - Child Development & Pedagogy (CDP) MCQ Questions With AnswerDocument4 pagesCDP MCQs - Child Development & Pedagogy (CDP) MCQ Questions With AnswerPallav JainNo ratings yet

- Elena Alina Popa: Key StrengthsDocument3 pagesElena Alina Popa: Key StrengthsElena Alina PopaNo ratings yet

- SuperPad2 Flytouch3 Tim Rom TipsDocument4 pagesSuperPad2 Flytouch3 Tim Rom TipspatelpiyushbNo ratings yet

- Becoming A Rhetor - Adora CurryDocument3 pagesBecoming A Rhetor - Adora CurryAdora CurryNo ratings yet

- Self Measures For Self-Esteem STATE SELF-ESTEEMDocument4 pagesSelf Measures For Self-Esteem STATE SELF-ESTEEMAlina100% (1)

- Chemistry 102 Experiment 8 ColorimetryDocument7 pagesChemistry 102 Experiment 8 ColorimetryDaniel MedeirosNo ratings yet

- Structural Robustness of Steel Framed BuildingsDocument0 pagesStructural Robustness of Steel Framed BuildingsCristina VlaicuNo ratings yet

- Accessing I/O DevicesDocument33 pagesAccessing I/O DevicesKishore SKNo ratings yet

- Eju Maths Samp PaperDocument29 pagesEju Maths Samp PapersravanarajNo ratings yet

- A New Four-Scroll Chaotic System With A Self-Excited Attractor and Circuit ImplementationDocument5 pagesA New Four-Scroll Chaotic System With A Self-Excited Attractor and Circuit ImplementationMada Sanjaya WsNo ratings yet

- Vessel Nozzle PDFDocument30 pagesVessel Nozzle PDFEugenia LorenzaNo ratings yet

- Accu MAX3000Document2 pagesAccu MAX3000ynod70No ratings yet

- National AnthemsDocument6 pagesNational AnthemszhannurazimbaiNo ratings yet

- IU BIM Execution Plan TemplateDocument12 pagesIU BIM Execution Plan TemplateAyman KandeelNo ratings yet

- CA Cooling TowerDocument19 pagesCA Cooling TowerKeshia WiseNo ratings yet

- ENFSIDocument8 pagesENFSIkmrdNo ratings yet

- Chapter 1 A CULINARY HISTORYDocument10 pagesChapter 1 A CULINARY HISTORYMrinalini KrishnanNo ratings yet

- TR 4015Document62 pagesTR 4015Matias AndréNo ratings yet

- Thesis Report FormatDocument21 pagesThesis Report Formatsebsibe birhanuNo ratings yet

- An Overview On Co-Operative Societies in BangladeshDocument11 pagesAn Overview On Co-Operative Societies in BangladeshAlexander DeckerNo ratings yet

- (Intelligent Systems, Control and Automation_ Science and Engineering 72) B. S. Goh, W. J. Leong, K. L. Teo (Auth.), Honglei Xu, Xiangyu Wang (Eds.)-Optimization and Control Methods in Industrial EngiDocument300 pages(Intelligent Systems, Control and Automation_ Science and Engineering 72) B. S. Goh, W. J. Leong, K. L. Teo (Auth.), Honglei Xu, Xiangyu Wang (Eds.)-Optimization and Control Methods in Industrial EngiVu Duc TruongNo ratings yet