Professional Documents

Culture Documents

20 Ways To Increase Profit

Uploaded by

John HayesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

20 Ways To Increase Profit

Uploaded by

John HayesCopyright:

Available Formats

20

WAYS TO INCREASE

YOUR PROFIT THIS YEAR

1. MAKE USE OF LOSSES!

You may be able to carry forward any losses from previous years against future profits, or set them against other income for

immediate tax relief. Make sure your accountant reviews and advises on the most tax efficient treatment for your business.

2. CLAIM THE CORRECT MOTOR & SUBSISTENCE

When it comes to motor expenses, lots of people simply claim the specific amount of mileage they have used. However, it is often

useful to note that Revenue will accept payment of mileage and subsistence rates based upon civil servant rates. These rates can

be quite beneficial to Directors and employees. Remember though that proper records and control systems must be in pace to

substantiate claims.

3. DONT PAY VAT TOO EARLY

Ensure your Accountant has registered your business to return VAT on the cash receipts basis. This means you only pay VAT

to Revenue when you have received payment from your customers. The crucial benefit here is that you can also reclaim VAT on

purchase invoices paid and unpaid for the relevant VAT period, easing your cashflow somewhat.

4. CHECK YOUR STAFFS TAX CREDITS

As well as checking your own tax credits you should also ensuring your staff members tax credits are correct. You do not want

the surprise of having to pay a large refund of tax to a staff member in Month 4 and then wait a number of months to receive the

refund from Revenue.

5. PUT PENSION SCHEMES IN PLACE FOR YOUR EMPLOYEES

Operating a company pension scheme can have significant tax savings for your business. Employers can save10.75% employer

PRSI on payments made into a company pension scheme on behalf of staff members.

6. DONT MISS OUT ON CAPITAL ALLOWANCES

Depreciation of assets is not tax deductible, however capital allowances is a form of tax deprecation that can reduce your taxable

profits. Ensure you keep accurate records of all assets bought and sold to guarantee your accountant can calculate accurate

capital allowances.

7. TRAVEL PASSES/BIKE TO WORK SCHEMES

It can be beneficial for both you and the employee to implement these schemes, saving you 10.75% Er PRSI on the cost of the

travel pass or cost of the bicycle.

8. DONT FORGET TO RECLAIM VAT ON DIESEL

If you reimburse employees who use their own vehicles for legitimate business travel to clients premises, you are entitled to reclaim the VAT on diesel relating to this expense. VAT on unleaded petrol cannot be reclaimed.

9. OTHER ASSETS

Normally you receive a tax deduction over 8 years when purchasing certain assets, however an accelerated tax deduction (100%

in the year of purchase) is available for certain energy-efficient machinery/technology purchases, for example computer-based

systems, designed primarily to monitor and control building energy use or Efficient Heat Conservation and Recovery Equipment.

This green allowance scheme relates to assets purchased before 31 December 2014. Be sure you talk to your accountant to

attain a more definitive list of assets and ensure you are claiming all that you can.

7 Fairview Strand, Fairview, Dublin 3

Tel: 1890 987 609

www.taxassist.ie

10. CLAIM CORPORATION TAX RELIEF

If you set up your company in the past number of years and you employ a number of staff, you might be entitled to claim the corporation tax relief, based on the amount of ER PRSI your company pays. If you havent generated a profit the relief can be carried

forward indefinitely.

11. MOVE FROM A SOLE TRADER TO A LIMITED COMPANY

It may be time for you to consider moving to a limited company structure to save tax. It is important to consider the commercial

and tax issues before deciding to do so. A key area to examine is if the company has significant spare cash available each year

and if you are starting to pay tax at the top rate of 41%. If so, it may be advantageous to incorporate.

12. PAY INTO A PENSION SCHEME

Setting up a company pension scheme for directors can save tax as the company can contribute generous amounts over and

above the directors own personal tax relievable limits. A portion of the pension can be drawn tax free upon retirement.

13. CONSIDER EMPLOYING YOUR SPOUSE/CIVIL PARTNER

Employing a spouse in your company may allow you to claim the maximum standard rate tax band and pay more tax at 20%

rather than 41%.

14. CLAIMING RETIREMENT RELIEF

When deciding to retire or exit a company, selling your shares may be exempt from tax as a result of CGT retirement relief. If you

are planning on selling your shares and are aged 55 or over, relief of 500,000 up to 3,000,000 may be available, depending on a

couple of factors, such as your age or who you are selling the business to.

OWN A PROPERTY?

15. TAKE ADVANTAGE OF THE HOME RENOVATION INCENTIVE

The home renovation incentive is now available to landlords for investment properties. Essentially, it allows for an income tax credit

at 13.5% of qualifying expenditure on repair, renovation or improvement works carried out on a main home or rental property by

qualifying contractors.

16. RENT A ROOM IN YOUR HOUSE

You can earn up to 12,000 tax free by renting a room to an unconnected person, in your principal residence.

17. MAKE SURE YOU CLAIM FOR MORTGAGE PROTECTION POLICIES

One area that is commonly omitted when preparing rental accounts is the inclusion of mortgage protection policies. Payment of

mortgage protection policies aimed at covering the full amount left outstanding on a persons mortgage should they die, should be

deducted when calculating rental profits.

PASSING ON WEALTH TO THE NEXT GENERATION

18. SMALL GIFT EXEMPTION

You can gift up to 3,000 per year to each child without attracting gift tax. Therefore a parent can plan in advance by gifting

3,000, to each child, for a number of years tax free before transferring other assets to reduce the overall value of assets/estates

gifted/inherited.

19. TRANSFERS BETWEEN SPOUSES

There is no Gift/Inheritance tax on transfers of assets between spouses.

20. BE SURE NOT TO PAY CGT AND CAT ON THE SAME TRANSACTION/EVENT

Where for example an investment property is transferred from father to son (CGT is payable by the father on transfer, CAT is

payable by the son on the gift), the CAT payable by the son can be reduced by the amount of CGT payable by thefather. The sons

CAT bill can also be reduced by the stamp duty paid on the gift of an asset.

You might also like

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- Tax Planning, Evasion, AvoidanceDocument16 pagesTax Planning, Evasion, AvoidanceDr. Nathan WafNo ratings yet

- 10 TAX Tips: For Small Business OwnersDocument14 pages10 TAX Tips: For Small Business OwnersnnauthooNo ratings yet

- How To Save Tax in Private Limited CompanyDocument3 pagesHow To Save Tax in Private Limited Companytaxqoof1No ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Advantages and DesadvantagesDocument9 pagesAdvantages and DesadvantagesJohanna BibartNo ratings yet

- Preface: What Is The Tax Planning ?Document29 pagesPreface: What Is The Tax Planning ?SpUnky RohitNo ratings yet

- Ifp 29 Tax PlanningDocument5 pagesIfp 29 Tax Planningsachin_chawlaNo ratings yet

- Tax by Shivin VargheseDocument5 pagesTax by Shivin VargheseManu VargheseNo ratings yet

- LGS #04Document12 pagesLGS #04M DNo ratings yet

- 10taxtipstrades CompressedDocument14 pages10taxtipstrades CompressednnauthooNo ratings yet

- Guidance For Claiming ExpensesDocument5 pagesGuidance For Claiming Expensesrekha_angurajNo ratings yet

- Preface: What Is The Tax Planning ?Document29 pagesPreface: What Is The Tax Planning ?su_pathriaNo ratings yet

- Corporate TaxDocument29 pagesCorporate Taxsu_pathriaNo ratings yet

- Incorporation Now Later or NeverDocument2 pagesIncorporation Now Later or NeverCoreyFerrierNo ratings yet

- Taxation of Fringe BenefitsDocument5 pagesTaxation of Fringe BenefitsTawanda Tatenda HerbertNo ratings yet

- 06 07 Tax Planning With Limited Liability ParDocument1 page06 07 Tax Planning With Limited Liability Parmax_ashiNo ratings yet

- 10 TAX Tips: For Real Estate ProfessionalsDocument14 pages10 TAX Tips: For Real Estate ProfessionalsnnauthooNo ratings yet

- Thinking of Working For Yourself?Document17 pagesThinking of Working For Yourself?StaceyNo ratings yet

- Pathways - IPPDocument1 pagePathways - IPParsenic210No ratings yet

- Individual 2012 Tax ChecklistDocument11 pagesIndividual 2012 Tax Checklistganguly147147No ratings yet

- LGS #03Document13 pagesLGS #03M DNo ratings yet

- 100+ Ways To Reduce Expenses and Increase ProfitsDocument9 pages100+ Ways To Reduce Expenses and Increase ProfitsSapient Business Solutions, Inc.No ratings yet

- Tax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLDocument7 pagesTax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLmansiNo ratings yet

- 9 Little Known Strategies ThatDocument4 pages9 Little Known Strategies ThatCaptBB250% (2)

- 25 Questions On DCF ValuationDocument4 pages25 Questions On DCF ValuationZain Ul AbidinNo ratings yet

- Business Tax DeductionsDocument4 pagesBusiness Tax DeductionsGab VillahermosaNo ratings yet

- The Tool For BusinessDocument2 pagesThe Tool For BusinessHarryNo ratings yet

- Year-End Tax Guide 2015/16Document10 pagesYear-End Tax Guide 2015/16api-311814387No ratings yet

- Chapter 01Document39 pagesChapter 01Almira Alic TurcinovicNo ratings yet

- Choice of Accounting SystemDocument4 pagesChoice of Accounting SystemAnkush At Shiv ShaktiNo ratings yet

- Tax Exemption Rules in The PhilippinesDocument1 pageTax Exemption Rules in The PhilippinesEllen Glae DaquipilNo ratings yet

- How Banks Use Financial Ratios To Measure Your PerformanceDocument4 pagesHow Banks Use Financial Ratios To Measure Your PerformanceEmelyNo ratings yet

- Advanced Financial ch1Document13 pagesAdvanced Financial ch1bikilahussenNo ratings yet

- Tax Management With Reference To Capital StructureDocument2 pagesTax Management With Reference To Capital StructureDr Linda Mary Simon100% (1)

- How To Calculate Your Taxable Profits: Helpsheet 222Document14 pagesHow To Calculate Your Taxable Profits: Helpsheet 222subtle69No ratings yet

- Accounting For Income TaxDocument2 pagesAccounting For Income TaxlouvelleNo ratings yet

- A-Z Business Costs Expenses Limited CompanyDocument18 pagesA-Z Business Costs Expenses Limited Companyxon.taylorNo ratings yet

- Save Tax 2015Document18 pagesSave Tax 2015MrChwet AumNo ratings yet

- How To Save TaxDocument5 pagesHow To Save Taxvinoddeswal057No ratings yet

- 10 Steps To YearDocument4 pages10 Steps To YearSumit KathuriaNo ratings yet

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Why You're A Shareholder: Read This Article OnlineDocument10 pagesWhy You're A Shareholder: Read This Article OnlineAdeNo ratings yet

- ATX-SD21 AnsDocument13 pagesATX-SD21 AnsKAM JIA LINGNo ratings yet

- IRD Rental Properties Ir264Document41 pagesIRD Rental Properties Ir264Roger DaltryNo ratings yet

- 2009 R-3 Class Notes PDFDocument5 pages2009 R-3 Class Notes PDFAgayatak Sa ManenNo ratings yet

- How To Save ITDocument7 pagesHow To Save ITFaizal RakhangiNo ratings yet

- Important - Read This FirstDocument10 pagesImportant - Read This Firstwilson garzonNo ratings yet

- Cut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesFrom EverandCut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesNo ratings yet

- Final Freelancers Handbook 2010-11 v2Document53 pagesFinal Freelancers Handbook 2010-11 v2bogatunNo ratings yet

- Principles of Taxation For Business and Investment Planning 20th Edition Jones Test Bank 1Document7 pagesPrinciples of Taxation For Business and Investment Planning 20th Edition Jones Test Bank 1ambermcbrideokdcjfmgbx100% (27)

- Accounting and Tax Differences in The Philippines: Assurance Partner, PWC Philippines 23 Mar 2018Document5 pagesAccounting and Tax Differences in The Philippines: Assurance Partner, PWC Philippines 23 Mar 2018james luzonNo ratings yet

- RSM 324 Notes 5Document65 pagesRSM 324 Notes 5xsnoweyxNo ratings yet

- Advance Taxation Chp. 5Document6 pagesAdvance Taxation Chp. 5Rohan ThakkarNo ratings yet

- Divers and Diving Supervisors Revenue Expences Under CISDocument5 pagesDivers and Diving Supervisors Revenue Expences Under CISCailean FraserNo ratings yet

- 9 Little Known Strategies That Could Legally Save You Thousands in TaxesDocument6 pages9 Little Known Strategies That Could Legally Save You Thousands in Taxesstupid1112No ratings yet

- Portarlington Parish Newsletter July 16th 2023 - Fifteenth Sunday in o TDocument2 pagesPortarlington Parish Newsletter July 16th 2023 - Fifteenth Sunday in o TJohn HayesNo ratings yet

- Threshold We Are Gen Rent 2023Document56 pagesThreshold We Are Gen Rent 2023John HayesNo ratings yet

- September 3rd - Twenty Second Sunday in O.T. - Parish Newsletter PDFDocument2 pagesSeptember 3rd - Twenty Second Sunday in O.T. - Parish Newsletter PDFJohn HayesNo ratings yet

- December 3rd Parish Newsletter 2023Document2 pagesDecember 3rd Parish Newsletter 2023John HayesNo ratings yet

- Portarlington Parish Newsletter August 27th - Twenty First Sunday in O.T PDFDocument2 pagesPortarlington Parish Newsletter August 27th - Twenty First Sunday in O.T PDFJohn HayesNo ratings yet

- Portarlington Parish Newsletter MAY 21st 2023 - Ascension of The LordDocument2 pagesPortarlington Parish Newsletter MAY 21st 2023 - Ascension of The LordJohn HayesNo ratings yet

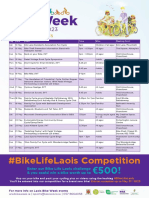

- LCC Bike Week A4 GENERAL Events List 2023Document1 pageLCC Bike Week A4 GENERAL Events List 2023John HayesNo ratings yet

- April 16th - Divine Mercy Sunday Second Sunday Easter 2023 - Parish NewsletterDocument2 pagesApril 16th - Divine Mercy Sunday Second Sunday Easter 2023 - Parish NewsletterJohn HayesNo ratings yet

- Portarlington Parish Newsletter APRIL 30th 2023 - Fourth Sunday of EasterDocument2 pagesPortarlington Parish Newsletter APRIL 30th 2023 - Fourth Sunday of EasterJohn HayesNo ratings yet

- Portarlington Parish Newsletter MAY 14TH 2023 - Sixth Sunday of EasterDocument2 pagesPortarlington Parish Newsletter MAY 14TH 2023 - Sixth Sunday of EasterJohn HayesNo ratings yet

- Signed Results Sheet For Portlaoise LEADocument2 pagesSigned Results Sheet For Portlaoise LEAJohn HayesNo ratings yet

- April 2nd - Palm Sunday 2023 - Portarlington Parish NewsletterDocument2 pagesApril 2nd - Palm Sunday 2023 - Portarlington Parish NewsletterJohn HayesNo ratings yet

- APRIL 23rd 2023 - Third Sunday of Easter - Parish Newsletter PDFDocument2 pagesAPRIL 23rd 2023 - Third Sunday of Easter - Parish Newsletter PDFJohn HayesNo ratings yet

- Portarlington Parish Newsletter February 19thDocument2 pagesPortarlington Parish Newsletter February 19thJohn HayesNo ratings yet

- Portarlington Parish February 12th Parish NewsletterDocument2 pagesPortarlington Parish February 12th Parish NewsletterJohn HayesNo ratings yet

- National Cultivate Week 2023Document1 pageNational Cultivate Week 2023John HayesNo ratings yet

- Kolbe School UpdateDocument2 pagesKolbe School UpdateJohn HayesNo ratings yet

- Portarlington Parish January 22nd NewsletterDocument2 pagesPortarlington Parish January 22nd NewsletterJohn HayesNo ratings yet

- March 12th 3rd Sunday of Lent 2023 Parish NewsletterDocument2 pagesMarch 12th 3rd Sunday of Lent 2023 Parish NewsletterJohn HayesNo ratings yet

- March 19th - 4th Sunday of Lent 2023 Parish Newsletter PDFDocument2 pagesMarch 19th - 4th Sunday of Lent 2023 Parish Newsletter PDFJohn HayesNo ratings yet

- March 5th 2nd Sunday of Lent 2023 Parish Newsletter PDFDocument2 pagesMarch 5th 2nd Sunday of Lent 2023 Parish Newsletter PDFJohn HayesNo ratings yet

- Portarlington Parish Newsletter January 29th NewsletterDocument2 pagesPortarlington Parish Newsletter January 29th NewsletterJohn HayesNo ratings yet

- Portarlington Parish Newsletter January 15th PDFDocument2 pagesPortarlington Parish Newsletter January 15th PDFJohn HayesNo ratings yet

- Portarlington Parish Newsletter Parish NewsletterDocument2 pagesPortarlington Parish Newsletter Parish NewsletterJohn HayesNo ratings yet

- Portarlington Parish Newsletter January 8thDocument2 pagesPortarlington Parish Newsletter January 8thJohn HayesNo ratings yet

- February 26th 1st Sunday of Lent 2023 Parish Newsletter PDFDocument2 pagesFebruary 26th 1st Sunday of Lent 2023 Parish Newsletter PDFJohn HayesNo ratings yet

- Portarlington Parish Newsletter December 18th 2022 - Fourth Sunday of Advent Newsletter PDFDocument2 pagesPortarlington Parish Newsletter December 18th 2022 - Fourth Sunday of Advent Newsletter PDFJohn HayesNo ratings yet

- Map of Property Clara CO. Offaly 2022Document1 pageMap of Property Clara CO. Offaly 2022John HayesNo ratings yet

- Portarlington Parish Newsletter December 25th 2022Document2 pagesPortarlington Parish Newsletter December 25th 2022John HayesNo ratings yet

- Laois GAA Handball Review of The Year 2022Document16 pagesLaois GAA Handball Review of The Year 2022John HayesNo ratings yet

- Tax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byDocument28 pagesTax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byahsanukkakarNo ratings yet

- Adr Cases SubmitDocument139 pagesAdr Cases Submit15870080No ratings yet

- DSDDocument5 pagesDSDFrancisco Javier Paz RiosNo ratings yet

- Hetzner 2021-02-04 R0012764148Document1 pageHetzner 2021-02-04 R0012764148Ольга СувороваNo ratings yet

- Toilet Cleaners, Floor Cleaners, Toilet Cleaners Liquids, Call BellDocument4 pagesToilet Cleaners, Floor Cleaners, Toilet Cleaners Liquids, Call BellNachiket KolapkarNo ratings yet

- Final Preboard Tax PDFDocument16 pagesFinal Preboard Tax PDFElla AlmazanNo ratings yet

- Customs Act 1962 AB NawalDocument10 pagesCustoms Act 1962 AB NawalShatrughna SamalNo ratings yet

- 08 - Invoice - Xiamen 20-21 - PGNDocument6 pages08 - Invoice - Xiamen 20-21 - PGNSoyabSuriyaNo ratings yet

- Germany SpainDocument18 pagesGermany SpainsriramNo ratings yet

- Point of Sale SystemDocument7 pagesPoint of Sale SystemMarla Angela M. JavierNo ratings yet

- 2nd File AmazonDocument36 pages2nd File AmazonPoovaidasanNo ratings yet

- Cir Vs SeagateDocument5 pagesCir Vs SeagateRenz Amon0% (1)

- Is GST Really A One NationDocument3 pagesIs GST Really A One NationJagadish SahuNo ratings yet

- National Treatment ObligationDocument17 pagesNational Treatment Obligationpoppy peterNo ratings yet

- CIR v. SVI TechnologiesDocument23 pagesCIR v. SVI Technologiesaudreydql5No ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BArun SasidharanNo ratings yet

- Jharkhand Draft Industrial Policy 2010Document22 pagesJharkhand Draft Industrial Policy 2010IndustrialpropertyinNo ratings yet

- HTTP WWW - Redeemer.com - Au Enrolments Fees 2010 School FeesDocument4 pagesHTTP WWW - Redeemer.com - Au Enrolments Fees 2010 School FeesonefelaNo ratings yet

- S C-Test Bank-Income TaxationDocument135 pagesS C-Test Bank-Income TaxationRoselie Barbin47% (19)

- Chapter 1 of Introduction With Margin 1111-1-2Document33 pagesChapter 1 of Introduction With Margin 1111-1-2YogiNo ratings yet

- VMDM Portal Fields FinalDocument57 pagesVMDM Portal Fields FinalRaghav SinghNo ratings yet

- Multan Electric Power Company: Detection BillDocument1 pageMultan Electric Power Company: Detection BillMubashar NazirNo ratings yet

- Bakery Business PlanDocument19 pagesBakery Business PlanSulabayo100% (3)

- Tax Invoice: Total Amount Paid Out (A - D + E) 80.19Document9 pagesTax Invoice: Total Amount Paid Out (A - D + E) 80.19Shieda Airis CollectionNo ratings yet

- WCT - How To Compute Works Contract Tax - WCT in Uttar Pradesh - U. PDocument9 pagesWCT - How To Compute Works Contract Tax - WCT in Uttar Pradesh - U. POm ChoudhryNo ratings yet

- Vat On Sales of Goods or PropertiesDocument10 pagesVat On Sales of Goods or Propertiesgoerginamarquez100% (1)

- Final Ramdeo Peer Mandir Road - Final ... 02.09.09Document297 pagesFinal Ramdeo Peer Mandir Road - Final ... 02.09.09Hemant GaikwadNo ratings yet

- Basics of Financial Management ExercisesDocument20 pagesBasics of Financial Management ExercisesWessel TraasNo ratings yet

- 47 Excel FormulasDocument140 pages47 Excel FormulascodytlseNo ratings yet