Professional Documents

Culture Documents

Q&A4

Uploaded by

cb2patelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q&A4

Uploaded by

cb2patelCopyright:

Available Formats

Q&A Chapter 4

Q.1 What is Key Information Memorandum

1.

2.

3.

4.

Q.2

is

is

is

is

an abridged version of the Offer Document and is provided with application form

a document that provides historical information about the fund

issued only by Private Sector mutual funds

a document that contains key disclosures which are not found in the Offer Document

One of the following is NOT required to be disclosed in the offer document. Which one?

1.

2.

3.

4.

Q.3

Details of Sponsor/Trustees

Investors rights and services

Performance of the other Mutual Funds

Description of the scheme and investment objective

The key information of memorandum of a mutual fund is available.

1.

2.

3.

4.

Q.4

Q.5

It

It

It

It

At the AMCs office

At the offices of authorized gents

At the branches of all banks

(1) And (2) only

The application form for investing in a mutual fund is normally found in....

1.

2.

3.

4.

The key information memorandum

With SEBI

Leading national newspapers

The funds financial statements

Offer Documents is updated every

1.

2.

3.

4.

Every 2 years.

Every year

Varies from scheme to scheme

Never updated

Q.6

A Charitable Trust wants to invest in Mutual Funds. What would you do?

1.

2.

3.

4.

Q.7

Accept the application from with the cheque

Refuse to accept the application

Refer to the Offer document of the scheme to confirm that a charitable trust is allowed to invest

Accept the application form, without the cheque, and forward it for final acceptance by the fund /

AMC

Regular tracking of mutual funds performance can be done by

1.

2.

3.

4.

Q.8

Newspapers, business periodicals, annual half-yearly and quarterly reports of the funds

Key information memorandum

The funds offer document

None of these.

The ideal source of information on investment plans and investor services offered by

the fund is...

1.

2.

3.

4.

Offer document

Advertisements about the scheme

Financial journals

The schemes annual report

The investor cannot plead ignorance of the procedures while investing in a mutual

fund because

1.

2.

3.

Mutual fund is a risky investment

The law does not permit the investor to sue the trust

While applying the investors signs an agreement stating they have read and understood the

terms and conditions

An investor is expected to be careful while investing

Mutual fund is based upon trust

Q.9

4.

5.

Q.10

As per SEBI guidelines, a due diligence certificate is not

1.

Signed by a Compliance Officer of the mutual fund

2.

A certificate that all legal formalities of a scheme are completed

3.

Attached to Annual report

4.

A part of offer document

Q.11

An offer document contains an AMCs investor grievances history for the past

1.

1 fiscal year

2.

2 fiscal year

3.

3 fiscal year

4.

Six months

Q.12

Along with the application, it is mandatory to distribute

1.

Offer document

2.

Key information memorandum

3.

Prospectus

4.

Q.13

None of the above

An offer document contains the summary of expenses history of all schemes for the

past

1.

1 fiscal year

2.

2 fiscal year

3.

3 fiscal year

4.

Q.14

Six months

Procedure for redemption or repurchase need not

1.

Be described in the offer document

2.

Include how redemption or repurchase price of units would be determined

3.

Include names of centers where redemption can be effected

4.

Indicate the redemption or repurchase price as at the end of the current fiscal year

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- NBME 22 OfflineDocument200 pagesNBME 22 OfflineGautham Kanagala86% (14)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Comparing Food with Comparative AdjectivesDocument4 pagesComparing Food with Comparative AdjectivesLuisito GonzalezNo ratings yet

- Healthy Voice: by Dan VascDocument22 pagesHealthy Voice: by Dan VascscoutjohnyNo ratings yet

- Intro To GymnasticsDocument69 pagesIntro To GymnasticsMichaela Celerio50% (2)

- IPru Saving Suraksha LeafletDocument4 pagesIPru Saving Suraksha Leafletcb2patelNo ratings yet

- ICICI Pru GIFT Long-term Income Plans with 110% ROPDocument4 pagesICICI Pru GIFT Long-term Income Plans with 110% ROPcb2patelNo ratings yet

- Mutual Fund: Concept, Organisation Structure, Advantages and TypesDocument10 pagesMutual Fund: Concept, Organisation Structure, Advantages and TypesvmktptNo ratings yet

- Application For Agency Tata Mutual FundDocument1 pageApplication For Agency Tata Mutual Fundcb2patelNo ratings yet

- Answer The Following QuestionsDocument23 pagesAnswer The Following QuestionsnirajdjainNo ratings yet

- Q&A4Document2 pagesQ&A4cb2patelNo ratings yet

- Practice Questions For AMFI TestDocument28 pagesPractice Questions For AMFI Testcb2patelNo ratings yet

- Q&A4Document2 pagesQ&A4cb2patelNo ratings yet

- SamDocument20 pagesSamcb2patelNo ratings yet

- Mutual Fund: Concept, Organisation Structure, Advantages and TypesDocument10 pagesMutual Fund: Concept, Organisation Structure, Advantages and TypesvmktptNo ratings yet

- Q&A AmfiDocument3 pagesQ&A Amficb2patelNo ratings yet

- Mutual Fund NISM Question BankDocument12 pagesMutual Fund NISM Question Bankcb2patel100% (1)

- SamDocument20 pagesSamcb2patelNo ratings yet

- Mutual Fund: Concept, Organisation Structure, Advantages and TypesDocument10 pagesMutual Fund: Concept, Organisation Structure, Advantages and TypesvmktptNo ratings yet

- SamDocument20 pagesSamcb2patelNo ratings yet

- SamDocument20 pagesSamcb2patelNo ratings yet

- 14 - Amfi Study MaterialDocument39 pages14 - Amfi Study MaterialNanda KumarNo ratings yet

- AMFI MembersDocument3 pagesAMFI Memberscb2patelNo ratings yet

- QuestionnairesDocument181 pagesQuestionnairesanon-280595100% (3)

- Trainer Note AMFIDocument7 pagesTrainer Note AMFINeeraj KumarNo ratings yet

- Draft Promotion LetterDocument1 pageDraft Promotion Lettercb2patelNo ratings yet

- Compabloc Heat Exchangers Cut Downtime at Nynäs RefineryDocument2 pagesCompabloc Heat Exchangers Cut Downtime at Nynäs RefinerylaythNo ratings yet

- 2.factory Price - Alarm Accessories-Complete 20150325Document15 pages2.factory Price - Alarm Accessories-Complete 20150325FREE BUSINESS INTELLIGENCENo ratings yet

- Menu Baru Kopi GandapoeraDocument7 pagesMenu Baru Kopi GandapoeraAlwan AhpNo ratings yet

- By Kerri Rivera, Kimberly Mcdaniel and Daniel Bender: Healing The Symptoms Known As Autism Second EditionDocument24 pagesBy Kerri Rivera, Kimberly Mcdaniel and Daniel Bender: Healing The Symptoms Known As Autism Second EditionMarilen De Leon EbradaNo ratings yet

- Ghana Off-Grid Solar Farm & Water System DevelopmentDocument1 pageGhana Off-Grid Solar Farm & Water System DevelopmentDaniel NguyenNo ratings yet

- Barlow 2Document56 pagesBarlow 2Lupu Adrian NicuNo ratings yet

- Development Team: Analytical Chemistry PolarographyDocument18 pagesDevelopment Team: Analytical Chemistry PolarographyKanchanNo ratings yet

- ODN102001 ATN Products Hardware Introduction ISSUE 1.00Document43 pagesODN102001 ATN Products Hardware Introduction ISSUE 1.00Jonathan Eduardo Tapias BeltranNo ratings yet

- SEN Code of Practice 2001Document148 pagesSEN Code of Practice 2001Matt GrantNo ratings yet

- REBA Employee Assessment Worksheet: A. Neck, Trunk and Leg AnalysisDocument1 pageREBA Employee Assessment Worksheet: A. Neck, Trunk and Leg AnalysisAgni JayantiNo ratings yet

- Water For Injections BP: What Is in This Leaflet?Document2 pagesWater For Injections BP: What Is in This Leaflet?Mohamed OmerNo ratings yet

- Pharmaceutical Microbiology - B.pharmDocument383 pagesPharmaceutical Microbiology - B.pharmkeyurNo ratings yet

- Ishrae 365 2009 PDFDocument16 pagesIshrae 365 2009 PDFZeeshan HasanNo ratings yet

- Experiment 1 Marble Race Virtual Science Lab Chem 2Document4 pagesExperiment 1 Marble Race Virtual Science Lab Chem 2Oribe, Narciso A.100% (1)

- Kristeva On Melanie Klein's "Oresteia"Document6 pagesKristeva On Melanie Klein's "Oresteia"danthetoasterNo ratings yet

- GAD Accomplishment ReportDocument1 pageGAD Accomplishment ReportRenante Naga100% (6)

- Old Fashioned Southern Tea CakesDocument2 pagesOld Fashioned Southern Tea CakesDB ScottNo ratings yet

- University of Health Sciences Lahore: Affiliated Private Sector Medical/Dental Colleges' Application FormDocument5 pagesUniversity of Health Sciences Lahore: Affiliated Private Sector Medical/Dental Colleges' Application FormkhnNo ratings yet

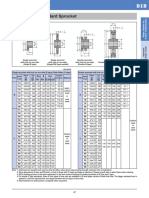

- Sprocket Asa 180Document1 pageSprocket Asa 180jhampolrosalesNo ratings yet

- D754te3 VMDocument37 pagesD754te3 VMGurpreet SinghNo ratings yet

- Qualifications of Public Health NurseDocument2 pagesQualifications of Public Health Nursekaitlein_mdNo ratings yet

- Top 50 Most Delicious Taco Reci - Julie HatfieldDocument267 pagesTop 50 Most Delicious Taco Reci - Julie HatfieldMazhar Aslam100% (2)

- Fingertip Injuries Diagnosis, Management and ReconstructionDocument197 pagesFingertip Injuries Diagnosis, Management and Reconstructionokida192No ratings yet

- C612Document5 pagesC612dinhtung2210100% (1)

- Deliver VALUE and RENEWABLE FUTUREDocument30 pagesDeliver VALUE and RENEWABLE FUTUREAlexandru SuciuNo ratings yet

- Physics Investigatory Project Class 12Document12 pagesPhysics Investigatory Project Class 12shivanginirai7No ratings yet