Professional Documents

Culture Documents

Industry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During The

Industry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During The

Uploaded by

vinay8464Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Industry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During The

Industry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During The

Uploaded by

vinay8464Copyright:

Available Formats

STEEL INDUSTRY

CHAPTER 1

INTRODUCTION

It is common today to talk about "the iron and steel industry" as if it were a single entity, but

historically they were separate products. The steel industry is often considered to be an

indicator of economic progress, because of the critical role played by steel in infrastructural

and overall economic development

Steel Industry is becoming more and more competitive with every passing day. During the

period 1960s to late 1980s, the steel market used to be dominated by OECD (Organization for

Economic Cooperation and Development) countries. But with the fast emergence of

developing countries like China, India and South Korea in this sector has led to slipping

market share of OECD countries. The balance of trade line is also tilting towards these

countries.

INDUSTRY PROFILE

India is the fifth largest producer of steel in the world. India’s Steel Industry has grown by

leaps and bounds, especially in recent times with Indian firms buying steel companies

overseas. The scope for steel industry is huge and industry estimates indicate that the industry

will continue to grow reasonably in the coming years with huge demands for stainless steel in

the construction of new airports and metro rail projects. The government is planning a

massive enhancement of the steel production capacity of India with the modernization of the

existing steel plants.

Domestic Scenario

The Indian steel industry have entered into a new development stage from 2005-06, riding

high on the resurgent economy and rising demand for steel. Rapid rise in production has

resulted in India becoming the 5th largest producer of steel.

The scope for steel industry is huge and industry estimates indicate that the industry will

continue to grow reasonably in the coming years with huge demands for stainless steel in the

construction of new airports and metro rail projects. The government is planning a massive

Dept Of M.B.A, JNNCE, Shimoga Page 1

STEEL INDUSTRY

enhancement of the steel production capacity of India with the modernization of the existing

steel plants.

It has been estimated by certain major investment houses, such as Credit Suisse that, India’s

steel consumption will continue to grow at nearly 16% rate annually, till 2012, fuelled by

demand for construction projects worth US$ 1 trillion. The scope for raising the total

consumption of steel is huge, given that per capita steel consumption is only 40 kg –

compared to 150 kg across the world and 250 kg in China.

The National Steel Policy has envisaged steel production to reach 110 million tonnes by

2019-20. However, based on the assessment of the current ongoing projects, both in

greenfield and brownfield, Ministry of Steel has projected that the steel capacity in the county

is likely to be 124.06 million tonnes by 2011-12. Further, based on the status of MOUs signed

by the private producers with the various State Governments, it is expected that India’s steel

capacity would be nearly 293 million tonne by 2020.

Growth Potential of India’s Steel Industry

India has traditionally been one of the major producers of steel in the world. Till the 1990s

the steel industry of India was regulated and controlled by government policies. After the

economic reforms of the early 1990s, the Indian steel industry has evolved significantly to

conform to global standards.

India has set a vision to be an economically developed nation by 2020. The steel industry is

expected to play a major role in India's economic development in the coming years. The steel

industry of India has a very high growth potential and is expected to register significant

growth in the coming decades. India is expected to emerge as a strong force in the global steel

market in coming years.

Steel Producers

Broadly there are two types of producers in India viz. integrated producers and secondary

producers. Integrated steel producers have traditionally integrated steel units have captive

plants for iron ore and coke, which are main inputs to these units. Currently there are three

main integrated producers of steel namely Steel Authority of India Limited (SAIL), Tata Iron

Dept Of M.B.A, JNNCE, Shimoga Page 2

STEEL INDUSTRY

and Steel Co Ltd (TISCO) and Rashtriya Ispat Nigam Ltd (RINL). SAIL dominates amongst

the three owing to its large steel production capacity plant size.

Secondary producers use steel scrap or sponge iron/direct reduced iron (DRI) or hot

briquetted iron (HBI). It comprises mainly of Electric Arc Furnace (EAF) and Induction

Furnace (IF) units, apart from other manufacturing units like the independent hot and cold

rolling units, rerolling units, galvanizing and tin plating units, sponge iron producers, pig iron

producers, etc. Secondary producers include Essar Steel Ltd., Ispat Industries Ltd., and JSW

Steel Ltd. There are 120 sponge iron producers; 650 mini blast furnaces, electric arc furnaces,

induction furnaces and energy optimizing furnaces; and 1,200 re-rollers in India.

The integrated producers constitute most of the mild steel production in India. Their main

products include flat steel products such as Hot Rolled, Cold Rolled and Galvanised steel.

They also produce long and special steel in small quantities. On the other, secondary

producers largely produce long steel products. Re-rollers are the units that come under

secondary producers’ category, and produce small quantity of steel like long and flat

products. These units either procure their inputs from the market or through their backward

integrated plants. They use sponge iron, pig iron or combination to produce finished steel or

ingots .

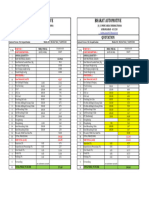

Global steel production:

Dept Of M.B.A, JNNCE, Shimoga Page 3

STEEL INDUSTRY

Industry-Statistics

Government targets to increase the production capacity from 56 million tones annually to 124

MT in the first phase which will come to an end by 2011 - 12. Currently with a production of

56 million tones India accounts for over 7% of the total steel produced globally, while it

accounts to about 5% of global steel consumption. The steel sector in India grew by 5.3% in

May 2009. Globally India is the only country to post a positive overall growth in the

production of crude steel at 1.01% for the period of January - March in 2009.

The liberalization of industrial policy and other initiatives taken by the Government have

given a definite impetus for entry, participation and growth of the private sector in the steel

industry. While the existing units are being modernized/expanded, a large number of

new/greenfield steel plants have also come up in different parts of the country based on

modern, cost effective, state of-the-art technologies.

Investments in Indian steel industry.

Even if we look into the type of investments that have happened after recession in India we

get very impressive an bullish outlook on the sector.

According to the Investment Commission of India investments of over US$ 30 billion

in steel are in the pipeline over the next 5 years.

Very recently Tata Steel has raised US$ 500 for its expansion of Jamshedpur plant

and overseas mining projects.

Many Steel companies have committed US$ 122.50 million for setting up sponge iron

units in Koppal and Bellary in Karnataka.

Even SAIL have declared that they will invest US$ 724.12 million to set up a 4-

million tonne per annum steel mill at its Bhilai Steel Plant.

Uttam Galva Steel plans a capital expenditure of US$ 62.8 million-US$ 104.6 million

over the next two years for setting up of a 60 MW power plant. The power plant will

help reduce its production costs.

Dept Of M.B.A, JNNCE, Shimoga Page 4

STEEL INDUSTRY

Imports of Steel

Steel is freely importable as per the extant policy.

Last five years import of Finished (Carbon) Steel is given below:-

Year Qty. (In Million Tonnes)

2004-2005 2.109

2005-2006 3.850

2006-2007 4.436

2007-2008 6.581

2008-2009 5.149

Exports

About 50% of the steel produced in India is exported. India's export of steel during April -

December 2008 was 64.4 MT as against 9.7 MT in December 2007. In February 2009, steel

export increased by 17% to 12.6 MT from 10.8 MT in the same month last year. More than

50% of steel from India is exported to China. The Government's decision to reduce export

duty on iron ore lumps from 15% to 5% has given a major boost to the export of steel.

Fortune of steel prices in 2010.

Steel prices are set to go up from January 2010 due to increase in raw material costs,

like iron ore and metal scrap.

Led by demand from China, prices of iron ore—the key raw material for pig iron—

has gone up sharply over the past two months to $106 per tonne from almost $81-$82

per tonne.

Coking coal prices have also gone up to $165-$170 per tonne from $128 per tonne as

China imported more coking coal this year.

If we look into the distribution of iron ore inventories we find:

According to a report by industry consultancy, this week, iron ore inventories at

China's major ports rose by 830,000 tonnes to end at 66.75 million tonnes,

While stockpiles of ore originating from Brazil increased by 180,000 tonnes to 19.1

million tonnes, and Indian ore rose by 830,000 tonnes at 13.18 million tonnes.

Australian ore inventories fell by 480,000 tonnes to end at 21.95 million tonnes by the

end of the week.

Dept Of M.B.A, JNNCE, Shimoga Page 5

STEEL INDUSTRY

Chinese iron ore prices remained steady, the average price of imported iron ore

increased by 2.3%. Iron ore prices are 25.8% higher than December 2008.

Sector structure/Market size

The steel industry in India has been moving from strength to strength and according to the

Annual Report 2009-10 by the Ministry of Steel, India has emerged as the fifth largest

producer of steel in the world and is likely to become the second largest producer of crude

steel by 2015-16.

Recently, Steel Minister, Mr Virbhadra Singh said that India will become the world's second-

largest steel producer by 2012, more than doubling its capacity to 124 million tonnes (MT) as

part of the push being given to assist overall infrastructure development.

Short Range Outlook:

In 2011, it is forecast that world steel demand will grow by 5.3% to reach a historical high of

1,306 mmt. The resilience of the emerging economies, especially China, has been the critical

factor enabling the earlier than expected recovery of world steel demand.

India’s steel demand maintained stable growth during the crisis and is expected to grow by

13.7% in 2011 respectively, after 7.7% in 2009. In 2011, India’s apparent steel use will reach

71.6 mmt.

Dept Of M.B.A, JNNCE, Shimoga Page 6

STEEL INDUSTRY

EVOLUTION

At the time of independence, India had a small Iron and Steel industry with production of

about a Million tonnes (mt). In due course, the government was mainly focusing on

developing basic steel industry, where crude steel constituted a major part of the total steel

production. Many public sector units were established and thus public sector had a dominant

share in the steel production till early 1990s. Mostly private players were in downstream

production, which was mainly producing finished steel using crude steel products. Capacity

ceiling measures were introduced.

Basically, the steel industry was developing under a controlled regime, which established

more public sector steel companies in various segments. Till early 1990s, when economic

liberalization reforms were introduced, the steel industry continued to be under the control of

Indian Government, regulation were constituted such as large plant capacities were reserved

only for public sector under capacity control measures; price regulation; for additional

capacity creation producers had to take license from the government; foreign investment was

restricted; and there were restrictions on imports as well as exports.

But after liberalization many reforms and regulation were changed which brought the new era

for development in steel industry. Some of the major developments were:

1. Large plant capacities that were reserved for public sector were removed;

2. Export restrictions were eliminated.

3. Import tariffs were reduced from 100 percent to 5 percent;

4. Decontrol of domestic steel prices;

5. Foreign investment was encouraged, and the steel industry was part of the high

priority industries for foreign investments and implying automatic approval for

foreign equity participation up to 100 percent; and

6. System of freight ceiling was introduced in place of freight equalization scheme.

Due to this, the domestic steel industry has since then, become market oriented and integrated

with the global steel industry. This has helped private players to expand their operations and

bring in new cost effective technologies to improve competitiveness not only in the domestic

but also in the global market.

Dept Of M.B.A, JNNCE, Shimoga Page 7

STEEL INDUSTRY

Key Events

1907*: Tata Iron and Steel Company set up.

1913: Production of steel begins in India.

1918: The Indian Iron & Steel Co. set up by Burn & Co. to compete with Tata Iron

and Steel Co.

1923*: Mysore Iron and Steel Company set up

1939*: Steel Corporation of Bengal set up

1948: A new Industrial Policy Statement states that new ventures in the iron and steel

industry are to be undertaken only by the central government.

1954: Hindustan Steel is created to oversee the Rourkela plant.

1959: Hindustan Steel is responsible for two more plants in Bhilai and Durgapur.

1964: Bokaro Steel Ltd. is created.

1973: The Steel Authority of India Ltd. (SAIL) is created as a holding company to

oversee most of India's iron and steel production.

1989: SAIL acquired Vivesvata Iron and Steel Ltd.

1993: India sets plans in motion to partially privatize SAIL.

*- new company set up

Dept Of M.B.A, JNNCE, Shimoga Page 8

STEEL INDUSTRY

MERGERS AND ACQUISITIONS:

On the consolidation front, the steel industry was focused on Mittal’s bid to gain control over

Arcelor. As of July 2006, it appears that Mittal has won its takeover effect for Arcelor, after a

protracted wooing. Mittal’s victory in the battle for global steel industry control is giving the

steel industry a new direction. The world’s number one and two producers have combined

and this will go a long way to push consolidation. The now combined Arcelor- Mittal would

produce more 10 percent of the world output, close to 100 million tons of steel. This would

give an increased pricing power for producers and suppliers, and decrease the fragmentation.

We expect more M&A transactions to occur, with large players buying up the smaller players.

Currently it appears to be that Arcelor laid its weapons, which were out before to defend itself

from being acquired by Mittal, though Mittal has proven itself to be an earnest and hard-to-

shake-off suitor.

Arcelor-Mittal have become the largest steelmaker in the world by turnover as well as by

volume. In early 2006, Arcelor had contacted the Russian steel maker Severstal for a rival

merger, in order to fend off Mittal’s hostile takeover bid, but it was unsuccessful in doing so.

Alexey Mordashov, the owner of Severstal, reacted to the hostile takeover by marching back

to Moscow, to wait and strike when the time is right. After the takeover, Mordashov stated:

“Severstal is reviewing all its options”. This indicated that Severstal might fight Mittal, but no

resistance was seen. Mordashov was planning to collaborate with Roman Abramovich (a

wealthy Russian billionaire with diverse business interests) to raise his offer for Arcelor but

decided to go back and conduct his business at Severstal. A possible candidate for

Mordashov’s future takeover bid would be Corus of UK. It can be envisaged that in the

medium term that there will be a handful of companies that will control about 1/3 of the

global steel production

Dept Of M.B.A, JNNCE, Shimoga Page 9

STEEL INDUSTRY

CHAPTER 2

GOVERNMENT POLICY AND REGULATIONS

The Government has also approved the National Steel Policy (NSP) in November 2005. The

long-term goal of the NSP is for India to have a modern and efficient steel industry of world

standards. The focus of the policy would therefore be to achieve global competitiveness not

only in terms of cost, quality and product-mix but also in terms of global benchmarks of

efficiency and productivity.

The policy targets to increase steel production at a compounded annual growth rate of 7.3%

to 110 mt by 2019-2020. It projects domestic consumption to grow at annual growth rate of

6.9% to 90 mt during this period. The policy envisages the share of exports to increase to

25% from present share of 11%.

The government would also encourage investments in creation of an additional modern iron

ore mining and beneficiation capacity of 200 mt. under this policy Recent increase in

infrastructure spending is also expected to have a positive impact on the steel demand. Major

investments planned in infrastructure sector are, national highway network, major ports, and

airports. The Government also proposes to undertake measures to promote usage of steel in

bridges, crash barriers, flyovers and building construction. 100% FDI is allowed under the

automatic route for metallurgy and processing of all metals.

Government Initiative

As per the Press Information Bureau, during 2009, the government took a number of fiscal

and administrative steps to contain steel prices. Central value added tax (CENVAT) on steel

items was reduced from 14 per cent to 10 per cent with effect from February 2009.

Moreover, in the Union Budget 2010-11, the government has allocated US$ 37.4 billion to

the infrastructure sector and has increased the allocation for road transport by 13 per cent to

US$ 4.3 billion which will further promote the steel industry.

Exchange rate used:

1 USD = 46.36 INR (as on February 2010)

1 USD = 44.42 INR (as on April 2010)

Dept Of M.B.A, JNNCE, Shimoga Page 10

STEEL INDUSTRY

CHAPTER 3

Top ten companies

Tata Steel Ltd

SAIL

J S W Steel Ltd

Jindal Steel & Power Ltd

Ispat Industries Ltd

Welspun-Gujarat Stahl RohrenLtd

J S L Ltd

Bhushan Steel Ltd

Uttam Galva Steels Ltd

K E C International Ltd

Company

Dept Of M.B.A, JNNCE, Shimoga Page 11

STEEL INDUSTRY

TATA STEEL LTD

Tata Steel

Type Public (BSE: 500470)

Industry Steel

Founded 1907

Headquarters Mumbai, India

Area served Worldwide

Key people Ratan Tata (Chairman)

B Muthuraman (Vice Chairman)

HM Nerurkar(MD)

Products Hot and cold rolled coils and sheets

Wire and rods

Construction bars

Pipes

Structurals and forging quality steel

Employees 81,269 (2010)

Parent Tata Group

Website TataSteel.com

Company Profile

Formerly known as TISCO and Tata Iron and Steel Company Limited, is the world's

seventh largest steel company, with an annual crude steel capacity of 31 million tonnes. It is

the largest private sector steel company in India in terms of domestic production. Ranked

258th on Fortune Global 500, it is based in Jamshedpur, Jharkhand, India. It is part of Tata

Group of companies. Tata Steel is also India's second-largest and second-most profitable

Dept Of M.B.A, JNNCE, Shimoga Page 12

STEEL INDUSTRY

company in private sector with consolidated revenues of Rs 1,32,110 crore and net profit of

over Rs 12,350 crore during the year ended March 31, 2008

Its main plant is located in Jamshedpur, Jharkhand, with its recent acquisitions; the company

has become a multinational with operations in various countries. The Jamshedpur plant

contains the DCS supplied by Honeywell. The registered office of Tata Steel is in Mumbai.

The company was also recognized as the world's best steel producer by World Steel

Dynamics in 2005. The company is listed on Bombay Stock Exchange and National Stock

Exchange of India, and employs about 82,700 people (as of 2007).

Managing a global workforce and setting global benchmarks is primarily about managing

diversity. In a process of inclusive growth, every person contributes to the blueprint of the

future and is truly committed to the stated objectives. And one of the key requisites for

successful diversity management is a shared vision.

Tata Steel Today…

The Tata Steel Group has always believed that mutual benefit of countries, corporations and

communities is the most effective route to growth. Tata Steel has not limited its operations

and businesses within India but has built an imposing presence around the globe as well. With

the acquisition of Corus in 2007 leading to commencement of Tata Steel's European

operations, the Company today, is among the top ten steel producers in the world with an

existing annual crude steel production capacity of around 30 million tones per annum and

employee strength of above 80,000 across five continents. The Group recorded a turnover of

Rs.147, 329 Crores (US$ 28,962 million) in 2008 - 2009. The Company has always had

significant impact on the economic development in India and now seeks to strengthen its

position of pre-eminence in international domain by continuing to lead by example of

responsibility and trust.

Tata Steel’s overseas ventures and investments in global companies have helped the

Company create a manufacturing and marketing network in Europe, South East Asia and the

Pacific-rim countries. The Group’s South East Asian operations comprise Tata Steel

Dept Of M.B.A, JNNCE, Shimoga Page 13

STEEL INDUSTRY

Thailand, in which it has 67.1% equity and Nat Steel Holdings, which is one of the largest

steel producers in the Asia Pacific with presence across seven countries.

Given below is an outline of Tata Steel's operations in Europe and South East Asia.

Corus is Europe’s second largest steel producer. With main steelmaking operations in the UK

and the Netherlands, Corus supplies steel and related services to the construction, automotive,

packaging, mechanical engineering and other markets worldwide. Corus comprises three

operating Divisions, Strip Products, Long Products and Distribution & Building Systems and

has a global network of sales offices and service centers, employing around 37,000 people

worldwide. (www.corusgroup.com)

Headquartered in Bangkok, Tata Steel Thailand is a major steel producer in Thailand and is

the largest producer of long steel products with a manufacturing capacity of 1.7 mtpa.

(www.tatasteelthailand.com)

Vision and Mission

The long journey of Tata Steel has seen the Company re-define its performance parameters in

a number of ways to become the global steel industry benchmark for value creation and

corporate citizenship. It ensures a total commitment to its ethical business practices and a

people oriented vision.

Vision

We aspire to be the global steel industry benchmark for

Value Creation and Corporate Citizenship.

We make the difference through our:

People, by fostering team work, nurturing talent, enhancing leadership capability and

acting with pace, pride and passion.

Offer, by becoming the supplier of choice, delivering premium products and services,

and creating value for our customers.

Innovative approach, by developing leading edge solutions in technology, processes

and products.

Conduct, by providing a safe working place, respecting the environment, caring for

our communities and demonstrating high ethical standards.

Dept Of M.B.A, JNNCE, Shimoga Page 14

STEEL INDUSTRY

Mission

Consistent with the vision and values of the founder Jamsetji Tata, Tata Steel strives to

strengthen India’s industrial base through the effective utilization of staff and materials. The

means envisaged to achieve this are high technology and productivity, consistent with modern

management practices.

Tata Steel recognizes that while honesty and integrity are the essential ingredients of a strong

and stable enterprise, profitability provides the main spark for economic activity.

Overall, the Company seeks to scale the heights of excellence in all that it does in an

atmosphere free from fear, and thereby reaffirms its faith in democratic values.

Dept Of M.B.A, JNNCE, Shimoga Page 15

STEEL INDUSTRY

BHUSHAN STEEL LTD

Bhushan Steel

Type Private

Industry Steel

Headquarters India

Key people Brij Bhushan Singhal (Chairman)

Neeraj Singhal

(Managing Director)

Products Cold rolled, galvanised, Bhushan Galume, colour coated tiles,

drawn tubes, strips, wire rods, alloy billets, sponge iron

Revenue Rs. 4202 crore

Website www.bhushan-group.org

Bhushan Steel is the largest manufacturer of auto-grade steel in India and is spending Rs.

260 billion to expand its capacity to 12 million tonnes annually, from the present installed

capacity of around one million tonnes.

Having made a modest beginning in 1978, Mr. Vijay Kumar Dadu and Mr. Parveen Kumar

Dadu, the founders of Bhushan Steel Corporation have developed state of the art

manufacturing facilities for global tractor and auto industry.

With Mr. Vijay Kumar Dadu's dynamism, inspiring leadership and vision, Bhushan Steel

Corporation has grown into a giant in producing high quality tractor and auto parts. With

Dept Of M.B.A, JNNCE, Shimoga Page 16

STEEL INDUSTRY

persistent research and development on quality of the products manufactured for tractors and

Auto industry the best which has enabled the company to be accredited by ISO 9001 : 2008

certification by British Standards institution (U.K.).

Company has achieved impeccable reputation in terms of reliability, quality & delivery and

thus in last three decades Bhushan Steel Corporation has emerged as first choice supplier of

premier manufacturers of tractors such as OEMs (Original Equipment Manufacturers) such as

international Tractors Ltd. Hoshiarpur (Punjab), Indo Farm Industries Ltd. Baddi, (H.P.) and

auto part industries in india & abroad.

The company has installed latest and imported machines at our works to create state of art

manufacturing facility. Their products in Bax and Bax Gold Trademark have achieved a

phenomenal acceptance both in the domestic and global market.

Mission

“Our mission is to grow our company by providing innovative strong and high

performance products and solutions to meet our global customer needs.”

Vision

“The vision of evolving into a totally Integrated Steel Producer by committing to achieve the

highest standards of Quality through Cutting-Edge Technology

VISION

About Culture: “to make it a place where all the people can thrive living, learning

and working in a clean, safe and healthy environment.”

About Values: ”to corporate values as “the rules or guidelines by which a corporation

exhorts its members to behave consistently with its order, security and growth.”

About People: “See the good in people and try to develop those qualities” i.e

preparation and grooming of the next generation of the young thinkers.

Dept Of M.B.A, JNNCE, Shimoga Page 17

STEEL INDUSTRY

About Customers: “Sell good merchandise at reasonable price: treat our customer

like we would treat our friends and the business will take care of itself. Bhushan

steel’s endeavor is to attain the highest level of satisfaction.”

About Products: “we should always be the pioneers with our products- out front

leading the market.”

CHAPTER 4

SWOT ANALYSIS

Strengths

Availability of labour at low wage rates.

Availability of huge resources of raw materials.

Good brand image of Indian steel makers.

Weaknesses

Lack of infrastructure.

Skilled labour deficiency.

Insufficient logistics.

Capital investment is huge.

Opportunities

Export market penetration

Increasing demand.

Investments by the state governments in infrastructure

Threats

Cheap Imports

Technological change

Dept Of M.B.A, JNNCE, Shimoga Page 18

STEEL INDUSTRY

Price sensitivity and demand volatility

Threat from substitutes

Huge bottlenecks in foreign invested projects

CONCLUSION

During the 20th century, consumption of steel increased at an average annual rate of 3.3 per

cent. Steel consumption increases when economies are growing, as governments invest in

infrastructure and transport and build new factories and houses.

The changing needs coupled with high degrees of competition in B2C segment make

innovation and differentiation a necessity. Now there is nothing like generic steel and generic

varieties that are manufactured by everyone. The raw materials are the same but the output is

not the same with every manufacturer.

Steel was considered a commodity but that perception is changing gradually. Uniqueness of

brands is being communicated to customers through the inherent attributes of the products

and the value added to them, to the society through the manufacturing processes and the

channel partners through the design of the channel. Hence, there is a conscious effort from

manufacturers, especially primary players with integrated steel plants, to brand not just

products but also their channels.

Dept Of M.B.A, JNNCE, Shimoga Page 19

You might also like

- GP 06-31 - Cathodic Protection CP Design For Onshore and OffsDocument42 pagesGP 06-31 - Cathodic Protection CP Design For Onshore and OffsTeymur Regenmaister100% (5)

- Final Project Proposal For Steel IndustryDocument17 pagesFinal Project Proposal For Steel Industryamitbhu201050% (2)

- MaxDocument205 pagesMaxKanpicha ChanngamNo ratings yet

- Precision Turned Products World Summary: Market Values & Financials by CountryFrom EverandPrecision Turned Products World Summary: Market Values & Financials by CountryNo ratings yet

- Steel Has An Oligopoly Market IDocument6 pagesSteel Has An Oligopoly Market Iarchana783No ratings yet

- Airstroke AirmountDocument112 pagesAirstroke Airmountvinay8464No ratings yet

- Detroit Type of AutomationDocument73 pagesDetroit Type of Automationvinay846458% (12)

- Essar Steel Finance ReportDocument53 pagesEssar Steel Finance ReportJigar PatelNo ratings yet

- Sail ProjectDocument69 pagesSail ProjectBhoomika SrivastavaNo ratings yet

- Bhushan Power & Steel LimitedDocument64 pagesBhushan Power & Steel LimitedSyaape100% (1)

- Group Assignment FS Mgt300Document3 pagesGroup Assignment FS Mgt300Yuzwan AlliNo ratings yet

- HDFC BankDocument16 pagesHDFC Bankpeketisantosh3011No ratings yet

- Summary Scandal: Know/index - HTMLDocument3 pagesSummary Scandal: Know/index - HTMLHendrikNo ratings yet

- F1020090210 Proshenjit BiswasDocument7 pagesF1020090210 Proshenjit Biswasakhi biswasNo ratings yet

- A. Company 1. ProfileDocument11 pagesA. Company 1. ProfilePortia FajardoNo ratings yet

- Basic CA StarbucksDocument36 pagesBasic CA StarbucksJason Guo100% (1)

- Cost Accounting Practices in BD PDFDocument57 pagesCost Accounting Practices in BD PDFSadman Ar RahmanNo ratings yet

- Starbucks CaseDocument13 pagesStarbucks CasepriyankaNo ratings yet

- 28 Mar 2022 17240314384746326AnnexurePFRDocument93 pages28 Mar 2022 17240314384746326AnnexurePFRyadawsandeepkumar395No ratings yet

- Survey of Chemical IndustryDocument9 pagesSurvey of Chemical Industrymanu1920% (1)

- Latest Technop123Document14 pagesLatest Technop123Francis AjeroNo ratings yet

- Pakistan Steel Mills Annual Report From Superior UniversityDocument8 pagesPakistan Steel Mills Annual Report From Superior UniversityShahbaz Ahmad100% (1)

- Edi GarmentDocument18 pagesEdi GarmentPrabal Kumar MajumdarNo ratings yet

- Development of Steel Industry of PakistanDocument19 pagesDevelopment of Steel Industry of PakistanAlexander RaoNo ratings yet

- General Banking System On First Security Islami Bank LTDDocument49 pagesGeneral Banking System On First Security Islami Bank LTDJohnathan RiceNo ratings yet

- Pakistan Textile Industry Facing New ChallengesDocument11 pagesPakistan Textile Industry Facing New ChallengesAliasif666No ratings yet

- Steel Plant Report FinalDocument54 pagesSteel Plant Report Finalkranthi chaitanyaNo ratings yet

- Marketing Strategy of D'damasDocument14 pagesMarketing Strategy of D'damasJyoti YadavNo ratings yet

- The Following Actions Occurred at Fort Myers Sheet Metal CoDocument2 pagesThe Following Actions Occurred at Fort Myers Sheet Metal CoAmit PandeyNo ratings yet

- Financial Analysis - JSW and JSL PDFDocument13 pagesFinancial Analysis - JSW and JSL PDFAnirban KarNo ratings yet

- Strategy Review - Tata SteelDocument20 pagesStrategy Review - Tata SteelKen SekharNo ratings yet

- Paper Sector BDDocument6 pagesPaper Sector BDFarin KaziNo ratings yet

- MKT 501 - Group 3 - Mini Assignment - Holistic Marketing - ACI LimitedDocument8 pagesMKT 501 - Group 3 - Mini Assignment - Holistic Marketing - ACI LimitedMd. Rafsan Jany (223052005)No ratings yet

- CHEMICAL INDUSTRY PresentationDocument18 pagesCHEMICAL INDUSTRY PresentationPrashant MirguleNo ratings yet

- PepsiCo Industry AnalysisDocument2 pagesPepsiCo Industry AnalysisVishwasNo ratings yet

- Fuwang and RAK Ceramics Ratio Analysis - Term Paper (2015-2019)Document28 pagesFuwang and RAK Ceramics Ratio Analysis - Term Paper (2015-2019)Md. Safatul BariNo ratings yet

- ShivprbhuDocument58 pagesShivprbhuShiv Prabhu AntinNo ratings yet

- For Master TilesDocument3 pagesFor Master Tilesumairashiq87No ratings yet

- Stern School of Business ChemturaDocument32 pagesStern School of Business Chemturaaskvishnu7112No ratings yet

- Wollo Smart Bus Transportation ServicesDocument28 pagesWollo Smart Bus Transportation Servicesbruk tadesseNo ratings yet

- Animal FeedDocument27 pagesAnimal FeedYem Ane100% (1)

- Lean Manufacturing in Apparel IndustryDocument27 pagesLean Manufacturing in Apparel IndustryILLANGOVAN SIVANANDAMNo ratings yet

- Summary/ Conclusions Summary of Starbucks Differentiation and GrowthDocument3 pagesSummary/ Conclusions Summary of Starbucks Differentiation and Growthcoke2juiceNo ratings yet

- Nokia FinalDocument22 pagesNokia FinalAyaz AliNo ratings yet

- StarbucksDocument18 pagesStarbucksapi-558164203No ratings yet

- Should Starbucks Open in IndiaDocument74 pagesShould Starbucks Open in IndiaRahul MadhavanNo ratings yet

- SWOT AnalysisDocument1 pageSWOT AnalysisMohammad Rysul IslamNo ratings yet

- Chapter 3 (Complete Proposal)Document30 pagesChapter 3 (Complete Proposal)KhairulAzwanizamNo ratings yet

- National Bank FOR Agriculture & Rural DevelopmentDocument21 pagesNational Bank FOR Agriculture & Rural Developmentshaikhnazneen100No ratings yet

- Sample Marketing Research ReportDocument124 pagesSample Marketing Research ReportSonakshi BehlNo ratings yet

- Business Plan On Textile LimitedDocument20 pagesBusiness Plan On Textile Limitedmilan5844No ratings yet

- Project Report AmitDocument53 pagesProject Report AmitShashi GoswamiNo ratings yet

- Project Profile On Leather Shoes PDFDocument5 pagesProject Profile On Leather Shoes PDFFaraz JiNo ratings yet

- Organization BehaviorDocument20 pagesOrganization Behaviorjeewanipd100% (1)

- 487 Assignment 2 Group2 Rev.1Document32 pages487 Assignment 2 Group2 Rev.1Phan Thao Nguyen (FGW CT)No ratings yet

- 1.1 Background of The Problem Task UndertakenDocument47 pages1.1 Background of The Problem Task UndertakenraahoulNo ratings yet

- Water Stress in Shinile Zone, Somali RegionDocument33 pagesWater Stress in Shinile Zone, Somali RegionAzaria Berhe100% (2)

- Business PlanDocument46 pagesBusiness PlanAbidNo ratings yet

- Internship ReportDocument10 pagesInternship ReportSidra KhanNo ratings yet

- F & BDocument89 pagesF & BSumit Pratap100% (1)

- International Marketing Plan For The Export of "Shirohana Flowers" To GermanyDocument113 pagesInternational Marketing Plan For The Export of "Shirohana Flowers" To Germanyken mainaNo ratings yet

- Iron and Steel Industry in IndiaDocument16 pagesIron and Steel Industry in IndiaAnonymous gQyrTUHX38100% (1)

- CCI Iron and Steel Industry in IndiaDocument16 pagesCCI Iron and Steel Industry in IndiaShubham KhattriNo ratings yet

- SABJANDocument1 pageSABJANvinay8464No ratings yet

- Salma Resume 2.10.18Document2 pagesSalma Resume 2.10.18vinay8464No ratings yet

- QAP1005ADocument13 pagesQAP1005Avinay8464No ratings yet

- Lecture 5Document3 pagesLecture 5vinay8464No ratings yet

- Mtech VTU IAR Question PapersDocument16 pagesMtech VTU IAR Question Papersvinay8464No ratings yet

- Recruitment Policy1 178Document7 pagesRecruitment Policy1 178vinay8464No ratings yet

- CADDocument21 pagesCADajit1130No ratings yet

- INTRODUCTION 2 Cad CamDocument12 pagesINTRODUCTION 2 Cad CamPrashant MeshramNo ratings yet

- Industry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During TheDocument19 pagesIndustry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During Thevinay8464No ratings yet

- NutsDocument60 pagesNutsDharmesh patelNo ratings yet

- Manual Break Glass Call Point: InternationalDocument2 pagesManual Break Glass Call Point: InternationalDauXuan Huynh100% (1)

- AISI 430 Ferritic Stainless Steel MicrostuctureDocument7 pagesAISI 430 Ferritic Stainless Steel MicrostuctureAid Farhan MaarofNo ratings yet

- When To Use A Spectacle Blind FlangeDocument6 pagesWhen To Use A Spectacle Blind FlangeYaneYangNo ratings yet

- Production Engineer Interview Questions and Answers 1594Document11 pagesProduction Engineer Interview Questions and Answers 1594Rahul RawatNo ratings yet

- The F638 SE/S2 Is An Extreme Heavy Duty Slurry Control Valve, With An Extended Body Style and Replaceable Body SleeveDocument11 pagesThe F638 SE/S2 Is An Extreme Heavy Duty Slurry Control Valve, With An Extended Body Style and Replaceable Body SleeveCapacitacion TodocatNo ratings yet

- Insulated Cables EEDocument36 pagesInsulated Cables EEgoyal.167009No ratings yet

- Shortcut To A WPSDocument18 pagesShortcut To A WPSCepi Sindang Kamulan100% (1)

- Laton Ms58 - CuZn39Pb3 - Original FusiblesDocument4 pagesLaton Ms58 - CuZn39Pb3 - Original FusiblesLuis CeronNo ratings yet

- 6-52-0043 Rev 4Document7 pages6-52-0043 Rev 4SujithkumarNo ratings yet

- Micro Switch™ Limit Switches Line Guide: FeaturesDocument6 pagesMicro Switch™ Limit Switches Line Guide: FeaturesAndika SNo ratings yet

- Project Cost ListDocument8 pagesProject Cost Listkumar.rajeshNo ratings yet

- Technical SpecificationsDocument9 pagesTechnical SpecificationsirshadhussawainsNo ratings yet

- Standard Specification For Metallic-Coated Steel Wire Strand PDFDocument5 pagesStandard Specification For Metallic-Coated Steel Wire Strand PDFsjeniferq100% (1)

- SteelDocument6 pagesSteelJ LorbelNo ratings yet

- Cu-ETP: C11000 Industrial RolledDocument4 pagesCu-ETP: C11000 Industrial Rolledsrsivaraman81No ratings yet

- 3.3 Joint Design For Welding and BrazingDocument21 pages3.3 Joint Design For Welding and Brazingyayus irmansyahNo ratings yet

- Gate, Globe and Check Valves (Amendments/Supplements To Iso 15761)Document13 pagesGate, Globe and Check Valves (Amendments/Supplements To Iso 15761)rajeshNo ratings yet

- Summer Training ReportDocument48 pagesSummer Training ReportBalveer MeenaNo ratings yet

- Tunnel and Metro VentilationDocument16 pagesTunnel and Metro VentilationIrinaNo ratings yet

- 2 Information Series Stainless Steel and Corrosion MaterialDocument8 pages2 Information Series Stainless Steel and Corrosion Materialgangzhu liangNo ratings yet

- Design:: Steel Structures Applied To Facade Containment SolutionsDocument112 pagesDesign:: Steel Structures Applied To Facade Containment SolutionsLuísNo ratings yet

- Types of Lathe ChucksDocument6 pagesTypes of Lathe ChucksSEENU VASANNo ratings yet

- Propeller Shaft Dubble BallDocument1 pagePropeller Shaft Dubble BallcontactNo ratings yet

- 6.0 - Motorized Volume Control DamperDocument5 pages6.0 - Motorized Volume Control DamperFloizel Anne Cruz - VictorinoNo ratings yet

- Application of Hydrometallurgy in Gold, Zinc & Copper ExtractionDocument11 pagesApplication of Hydrometallurgy in Gold, Zinc & Copper ExtractionVaibhavNo ratings yet

- Valvoline Tectyl Rust Preventive 506Document2 pagesValvoline Tectyl Rust Preventive 506HDSC ChemicalsNo ratings yet

- I. Read The Dialogue and Answer The Questions BelowDocument3 pagesI. Read The Dialogue and Answer The Questions BelowM.alwaly syariefNo ratings yet

- 19PT2-23 MA AssignmentDocument19 pages19PT2-23 MA AssignmentHardeep SinghNo ratings yet