Professional Documents

Culture Documents

0ff28practice Questions

Uploaded by

Divya Vishwanadh0 ratings0% found this document useful (0 votes)

12 views1 pageThe document provides a practice question to calculate the cost of equity for XYZ Ltd. based on its earnings per share, dividend payout ratio, growth rate, current market price per share, and floatation cost. The solution shows the calculations to find the current dividend, next year's dividend, deduct the floatation cost from the market price, and use the dividend growth model to determine the cost of equity is 21.15%.

Original Description:

Original Title

0ff28Practice Questions

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a practice question to calculate the cost of equity for XYZ Ltd. based on its earnings per share, dividend payout ratio, growth rate, current market price per share, and floatation cost. The solution shows the calculations to find the current dividend, next year's dividend, deduct the floatation cost from the market price, and use the dividend growth model to determine the cost of equity is 21.15%.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 page0ff28practice Questions

Uploaded by

Divya VishwanadhThe document provides a practice question to calculate the cost of equity for XYZ Ltd. based on its earnings per share, dividend payout ratio, growth rate, current market price per share, and floatation cost. The solution shows the calculations to find the current dividend, next year's dividend, deduct the floatation cost from the market price, and use the dividend growth model to determine the cost of equity is 21.15%.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

Practice Questions

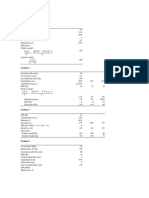

1. Calculate the cost of equity for XYZ Ltd.

• EPS for the current year is Rs.20

• Dividend payout ratio is 50%

• Growth rate is 5%.

• Current Market price per share is Rs.70

• Floatation cost is Rs.5 per share.

Solution:

Current Dividend = 50% * 20= 10

Dividend next year= 10(1+ .05) =10.5

DIV1

ke = +g

P0

P= 70-5= 65 as the flotation cost has to be deducted from the market price.

Cost of equity capital= (10.5/ 65) + .05= .2115= 21.15%

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- 2022 - Chapter02 To 05 - ValueDrivers - UpdatedDocument38 pages2022 - Chapter02 To 05 - ValueDrivers - UpdatedElias MacherNo ratings yet

- Lec8.Cost of CapitalDocument52 pagesLec8.Cost of Capitalvivek patelNo ratings yet

- fM-Cost of CapitalDocument46 pagesfM-Cost of CapitalParamjit Sharma100% (8)

- Solution - Problems and Solutions Chap 8Document8 pagesSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- Capital StructureDocument41 pagesCapital Structure/jncjdncjdnNo ratings yet

- Lecture 3 - Calculating Cost of Capital PDFDocument26 pagesLecture 3 - Calculating Cost of Capital PDFNav MatharuNo ratings yet

- FTP ExercisesDocument34 pagesFTP ExercisesRummanBinAhsanNo ratings yet

- Valuation of Shares: Abhinav RajvermaDocument35 pagesValuation of Shares: Abhinav RajvermaADITI AgarwalNo ratings yet

- 5 Most Important Solution - Security Valuation-DIVIDENDDocument4 pages5 Most Important Solution - Security Valuation-DIVIDENDram reddyNo ratings yet

- 8-Security-Valuation 2Document29 pages8-Security-Valuation 2saadullah98.sk.skNo ratings yet

- 2nd ArticleDocument145 pages2nd ArticleFatima NaeemNo ratings yet

- Projected FinancialsDocument1 pageProjected FinancialsUsman EhsanNo ratings yet

- Lecture15 PDFDocument24 pagesLecture15 PDFkate ngNo ratings yet

- Financial Management Economics For Finance 2023 1671444579Document26 pagesFinancial Management Economics For Finance 2023 1671444579RADHIKANo ratings yet

- Fmi S14Document66 pagesFmi S14Arpit JainNo ratings yet

- Lecture 17Document37 pagesLecture 17irshan amirNo ratings yet

- EBIT EPS AnalysisDocument29 pagesEBIT EPS Analysisshalini swarajNo ratings yet

- Conceptual Assignment I (30 Marks) : Working Capital Management (Session 1,2,3) (20 M) (Submission in Excel Only)Document15 pagesConceptual Assignment I (30 Marks) : Working Capital Management (Session 1,2,3) (20 M) (Submission in Excel Only)Sanjay MehrotraNo ratings yet

- Exercise 8 - Dividend DecisionDocument11 pagesExercise 8 - Dividend DecisionAditi ThakorNo ratings yet

- Math Fundamentals: For Capital MarketDocument25 pagesMath Fundamentals: For Capital MarketMehak GoyalNo ratings yet

- Practice - Cost of CapDocument6 pagesPractice - Cost of CapShruti AshokNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalShubham PariharNo ratings yet

- Financing DecisionsDocument27 pagesFinancing DecisionsBisma KhalidNo ratings yet

- Incremental After Tax Operating Cash Flow Each Year For The Life of The ProjectDocument1 pageIncremental After Tax Operating Cash Flow Each Year For The Life of The ProjectCarlos AlphonceNo ratings yet

- Dividend Policy Analysis and Comparison of Two CompaniesDocument13 pagesDividend Policy Analysis and Comparison of Two Companiessunny patwaNo ratings yet

- COC Solved SumsDocument5 pagesCOC Solved SumsRashi MehtaNo ratings yet

- Investments FINA-3720 Ligang Zhong: Lectures 12 & 13 (Chapter 18) Equity Evaluation ModelsDocument46 pagesInvestments FINA-3720 Ligang Zhong: Lectures 12 & 13 (Chapter 18) Equity Evaluation ModelsroBinNo ratings yet

- December 20 FTFM PracticeDocument54 pagesDecember 20 FTFM PracticerajanikanthNo ratings yet

- Cost of CapitalDocument21 pagesCost of Capitalmansi dhimanNo ratings yet

- Capital Budgeting and LeasingDocument22 pagesCapital Budgeting and LeasingDeekshaNo ratings yet

- FM09-CH 17Document5 pagesFM09-CH 17Mukul KadyanNo ratings yet

- 543L7 2 (Wacc 2)Document9 pages543L7 2 (Wacc 2)Äyušheë TŸagïNo ratings yet

- Synopsis - 10-Valuation of SharesDocument5 pagesSynopsis - 10-Valuation of SharesleyaketjnuNo ratings yet

- CS23Document17 pagesCS234xeroaccNo ratings yet

- Cost of CapitalDocument19 pagesCost of CapitalChintan KeniaNo ratings yet

- Cost of Capital - IDocument17 pagesCost of Capital - Ipallavi_42No ratings yet

- FLIP Finance and Banking Practice Test 2Document13 pagesFLIP Finance and Banking Practice Test 2Sukhdeep Singh AashtNo ratings yet

- PvtdiscrateDocument4 pagesPvtdiscrateapi-3763138No ratings yet

- Investment Criteria ExDocument14 pagesInvestment Criteria ExMon ThuNo ratings yet

- Financial Management Unit - 3Document22 pagesFinancial Management Unit - 3nallspalanikNo ratings yet

- Ankush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileDocument8 pagesAnkush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileAnkush GuptaNo ratings yet

- Weighted Average Cost of CapitalDocument20 pagesWeighted Average Cost of Capitalf20221444No ratings yet

- Book1Document8 pagesBook1dhrivsitlani29No ratings yet

- Capital Structure Determination Capital Structure DeterminationDocument41 pagesCapital Structure Determination Capital Structure DeterminationLEM tvNo ratings yet

- Capital StructureDocument37 pagesCapital StructurecleophacerevivalNo ratings yet

- WSP Paper LBO - VFDocument11 pagesWSP Paper LBO - VFjason.sevin02No ratings yet

- 2019 Exam - Moed A - Computer Science - (Solution)Document11 pages2019 Exam - Moed A - Computer Science - (Solution)adoNo ratings yet

- Lecture 7 - Stock Valuation Using Discounted Free Cash Flow and MultiplesDocument58 pagesLecture 7 - Stock Valuation Using Discounted Free Cash Flow and Multipleschenzhi fanNo ratings yet

- Cost of Capital: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A Ugc Net/JrfDocument10 pagesCost of Capital: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A Ugc Net/JrframNo ratings yet

- 05. LBO Model and Venture Capital Scenario AnalysisDocument73 pages05. LBO Model and Venture Capital Scenario Analysisharshit.dwivedi320No ratings yet

- Capital Structure DeterminationDocument41 pagesCapital Structure Determinationlinda zyongweNo ratings yet

- Capital Budgeting Practice Question With Solution (EXAM)Document10 pagesCapital Budgeting Practice Question With Solution (EXAM)imfondofNo ratings yet

- Chapter 17: Dividend Policy Problem 1: DPS K RBDocument4 pagesChapter 17: Dividend Policy Problem 1: DPS K RBMukul KadyanNo ratings yet

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDocument11 pagesManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaNo ratings yet

- Cost Of Capital BreakdownDocument37 pagesCost Of Capital BreakdownCrocsNo ratings yet

- Valuing Common Stocks with Discounted Cash FlowDocument8 pagesValuing Common Stocks with Discounted Cash FlowMadhuram SharmaNo ratings yet

- Abnormal Earnings GrowthDocument35 pagesAbnormal Earnings Growthshounak_chakravartyNo ratings yet

- CH 6Document30 pagesCH 6eng.hfk06No ratings yet

- Report On Tax Saving SchemesDocument16 pagesReport On Tax Saving SchemesDivya Vishwanadh100% (1)

- Financial Services: Course Code: BBF 503 Credit Units: 04 Course ObjectiveDocument3 pagesFinancial Services: Course Code: BBF 503 Credit Units: 04 Course ObjectiveDivya VishwanadhNo ratings yet

- The Secret CheckDocument1 pageThe Secret CheckDivya VishwanadhNo ratings yet

- (174062311) YLP-Self Assessment Form-2Document3 pages(174062311) YLP-Self Assessment Form-2Divya VishwanadhNo ratings yet

- 5 C 3 Ab ASEANDocument3 pages5 C 3 Ab ASEANDivya VishwanadhNo ratings yet

- Comprehensive Project Report: Indian Sugar IndustryDocument54 pagesComprehensive Project Report: Indian Sugar IndustryDivya VishwanadhNo ratings yet

- 79 FC 1 DerivativesDocument5 pages79 FC 1 DerivativesDivya VishwanadhNo ratings yet

- FinanceDocument86 pagesFinanceDivya VishwanadhNo ratings yet

- Indian ArmyDocument13 pagesIndian ArmyDivya VishwanadhNo ratings yet

- Business RiskDocument1 pageBusiness RiskDivya VishwanadhNo ratings yet

- Financial Analysis of Companies of The Pharmaceutical IndustryDocument12 pagesFinancial Analysis of Companies of The Pharmaceutical IndustryDivya VishwanadhNo ratings yet

- Amity School of Business:, 4 Semester Financial Management 2Document40 pagesAmity School of Business:, 4 Semester Financial Management 2Divya VishwanadhNo ratings yet

- Critical Incident Technique ReviewDocument23 pagesCritical Incident Technique ReviewDivya VishwanadhNo ratings yet