Professional Documents

Culture Documents

Risk MGMT

Uploaded by

mishori2008Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk MGMT

Uploaded by

mishori2008Copyright:

Available Formats

If u want to download this project then call me at 03458014643 or send me a text

National University of Modern Languages

Sector H-9 ISLAMABAD

Department of Management Science

Frm Project

SUBMITTED TO: Sir Zubair ahmed

SUBMITTED BY: Adeel Azher

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

“Banking is an art of striking a balance between Risk and Revenue.’’

What is RISK ?

It is the potential that events expected or unexpected, may have an

adverse effect on a financial institution’s capital or earnings.

Risk is inherent in all business and financial activities.

The greater the RISK associated with an activity the greater potential to

generate a high return.

Banks do take RISKS – The biggest RISK is not taking A RISK.

Definition of Risk Management

Risk Management is the process of identifying, measuring, monitoring

and controlling risks

Where Risks should be Identified

Institution-wide

Business lines

Products

Transactions

Banking Risk

Taking risks can almost be said to be the business of bank management. A

bank that is run on the principle of avoiding all risks or as many of them as

possible, will be a stagnant institution, and will not adequately serves the

legitimate credit needs of its society. On the other hand a bank that takes

excessive risks or credit is more likely, takes them without recognizing their

extent or their existence will surely run into difficulty.

Serving the Needs of Depositor Borrowers and Banks

Commercial Bank lending/Investment involves three parties :

1. The suppliers of funds (The depositor)

2. The users of funds (The borrowers)

3. A financial intermediary (Bank) s

Supplier Bank Borrower

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

Financial Aspect of the

HBL:

“An index that relates two accounting numbers and is obtained by dividing one

number by other”

Ratio Analysis is an important and age-old technique of financial

analysis. It simplifies the comprehension of financial statements. Ratios tell the

whole story of changes in the financial condition of business. It provides data fro

inter firm comparison. Ratios highlight the factors associated with successful

and unsuccessful firm. They also reveal strong firms and weak firms, over-

valued and under valued firms. It helps in Planning and forecasting. Ratios can

assist management, in its basic functions of forecasting, planning, co-ordination,

control and communication. Ratio analysis also makes possible comparison of

the performance of different divisions of the firm. The ratios are helpful in

decision about their efficiency of otherwise in the past and likely performance in

future. Ratios also help in Investment decisions in the investors and lending

decisions in the case of bankers etc.

Following are the main types of ratios that I am going to calculate in this report

to compare and highlight the financial performance of Habib bank in 2008 with

2007.

Return on Equity Ratio

Return on Assets

Loan to Assets ratio

Net Profit Ratio

Loan to Deposit

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

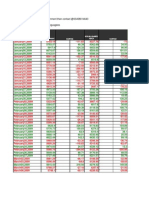

Return on Equity Ratio

2008 2007

Return on Equity Ratio

Net Profit after tax

15,614,020 10,084,037

Owner Equity

75,180,436 63,237,429

Return on equity

20.76 15.94

Interpretation:

The past two years data shows an improvement in the return on equity which is

a positive sign. The Bank should have to continue its policies. By observing

the audited account I found that this improvement is due to increase in the Net

profit which is good sign.

Return on Assets Ratio

2008 2007

Return on Assets

Net Profit after tax 15,614,020 10,084,037

Total Assets

757,928,389 691,991,521

Return on Assets

2.06 1.45

Interpretation:

Return on assets ratio shows an improving trend. This ratio shows that the both

the Net profit and Total Assets has improved in 2008 than 2007. But net profit

has increased more rapidly.

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

2008 2007

Loan to Assets ratio

Advances

456,355,507 382,172,734

Assets

757,928,389 691,991,521

Loan to Assets ratio 55.22

60.21

Loan to Assets ratio

Interpretation:

Loan to Asset Ratio is showing increasing trend in 2008. This is because

advances are increasing more rapidly than assets of the bank.

2008 2007

Net Profit Ratio

Net profit 15,614,020 10,084,037

Interest Income 43,970,884 33,250,937

Net profit ratio

35.50 30.32

Net Profit Ratio

Interpretation:

Net profit Ratio is giving upward trend. This trend is observed due to

increase in Net profit but on the other hand the expenses decreases

which shows an efficient management.

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

Loan to Deposit Ratio

Loan to Deposit 2008 2007

456,355,507 382,172,734

Advances

Deposits 597,090,545 531,298,127

Loan to deposit ratio 76.43 71.93

Interpretation:

Loans to deposit ratio show an increasing trend in 2008 as compare to 2007.

This trend is observed as the advances and deposits both are increasing but

advances are increasing more rapidly than deposits.

Net Intrest income

Net Intrest income = Net intrest income/earning asset

Net Intrest income / Margin 2008 2007

36,779,477 31,327,064

Net Intrest income

Earning asset 594,501,199 560,064,985

Loan to deposit ratio 0.0619 0.0560

Spread

Intrest income/eaning Asset - intrest expense/intest bearing liabilty

Net Intrest income / Margin 2008 2007

Intrest income/eaning Asset 2.9821 1.2197

0.00333 0.0297

intrest expense/intest bearing liab.

Spread 2.97877 1.1902

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

Overall Efficiency

Overall Efficiency= non intrest income/non intrest expense

Overall Efficiency 2008 2007

Non Intrest income 43,970,884 33,250,937

21,936,505 18,106,320

Non intrest expense

Overall Efficiency 2.0045 1.8364

Risk Faced by comercial banks in pakistan

Following are the risk which is faced by HBL

CREDIT RISK

MARKET RISK

INTEREST RISK

LIQUIDITY RISK

OPERATIONAL RISK

COUNTRY RISK

OWNERSIP / MANAGEMENT RISK

And i identify 3 major risk which hbl was facing now a days

CREDIT RISK

FINANCIAL RISK

OPERATIONAL RISK

Credit Risk

Credit risk is major category of risk of the bank.It occurs whenever

there is a possibility that is the customer cannot meet contractual

obligations to the bank in term of :

- The delivery of documents or commodities where the bank bear

the whole risk OR

- The payment of principal ,interest ,fees orcommissions.

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

Operational & financial risk

The best way to reach this objective is to understand the full risk

environment within which you operate...

External Internal

Environment Environment

Economic Expansion/ Financial Risk

Conditions Diversification

Asset

Culture Risk

Social/Legal

Trends Liability

Distribution Risk

Natural Catastrophes Risk Appetite

People Business Risk

Competition

Event

Processes Risk

Political/

Regulatory

Climate Technology Operational Risk

That is the internal and external environment in which hbl do their

opeartion external variable are related with the financial risk. It can effect

the asset and liability of the bank. And internal enviornment can effect the

operation of the bank

If u want to download this project then call me at 03458014643 or send me a text

If u want to download this project then call me at 03458014643 or send me a text

…and the complete set of strategies that are available to you...

Financial Operational

Strategies Strategies

Financial Risk Hiring/Training

Capital

Structure

Incentive Programs

Asset Risk

Asset

Allocation Internal Controls

Liability Risk

Products

Pricing

Technology

Business Risk

Product Mix Customer Service

Event Risk

Market Strategy

Operational Risk Securitisation

Distribution

That is the complete strategy for financial risk and operational

risk and be mitigated bay applying financial and operational strategyif we apply

the following strategy to the bank thenn these losses can be decrease to some

certain extend.

If u want to download this project then call me at 03458014643 or send me a text

You might also like

- Marijuana Grow Basics - Jorge CervantesDocument389 pagesMarijuana Grow Basics - Jorge CervantesHugo Herrera100% (1)

- LLoyd's Register Marine - Global Marine Safety TrendsDocument23 pagesLLoyd's Register Marine - Global Marine Safety Trendssuvabrata_das01100% (1)

- Rubric - Argumentative EssayDocument2 pagesRubric - Argumentative EssayBobNo ratings yet

- Implementing Beyond Budgeting: Unlocking the Performance PotentialFrom EverandImplementing Beyond Budgeting: Unlocking the Performance PotentialRating: 5 out of 5 stars5/5 (1)

- Return On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and ImplicationsDocument69 pagesReturn On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and Implicationsbauh100% (1)

- Global 6000 SystemsDocument157 pagesGlobal 6000 SystemsJosé Rezende100% (1)

- Financial Statements Analysis Case StudyDocument17 pagesFinancial Statements Analysis Case StudychrisNo ratings yet

- The Essential Controller: An Introduction to What Every Financial Manager Must KnowFrom EverandThe Essential Controller: An Introduction to What Every Financial Manager Must KnowNo ratings yet

- Case of Joneja Bright Steels: The Cash Discount DecisionDocument10 pagesCase of Joneja Bright Steels: The Cash Discount DecisionRHEANo ratings yet

- Indostar: BSE Limited National Stock Exchange of India LimitedDocument49 pagesIndostar: BSE Limited National Stock Exchange of India LimitedAjay BaligaNo ratings yet

- Anne Aylor Audit Planning MaterialityDocument14 pagesAnne Aylor Audit Planning MaterialityAlrac GarciaNo ratings yet

- ACCA Financial Management - Mock Exam 1 - 1000225 PDFDocument25 pagesACCA Financial Management - Mock Exam 1 - 1000225 PDFrash D100% (1)

- Name Email: Ganesh Bhushan Misra: A: Cash Flow From Operations Is The Section of A Company's Cash Flow Statement ThatDocument6 pagesName Email: Ganesh Bhushan Misra: A: Cash Flow From Operations Is The Section of A Company's Cash Flow Statement ThatGanesh Misra100% (1)

- Oracle Fusion Financials Book Set Home Page SummaryDocument274 pagesOracle Fusion Financials Book Set Home Page SummaryAbhishek Agrawal100% (1)

- Castel - From Dangerousness To RiskDocument10 pagesCastel - From Dangerousness To Riskregmatar100% (2)

- AC7114-2 Rev N Delta 1Document34 pagesAC7114-2 Rev N Delta 1Vijay YadavNo ratings yet

- Importance of liquidity for financial statement usersDocument15 pagesImportance of liquidity for financial statement usersSharmila Devi100% (1)

- Financial Accountin G& Analysis: Case Study Adept Chemical IncDocument15 pagesFinancial Accountin G& Analysis: Case Study Adept Chemical IncvatsalamNo ratings yet

- The Rich Hues of Purple Murex DyeDocument44 pagesThe Rich Hues of Purple Murex DyeYiğit KılıçNo ratings yet

- Group 7 Group AssignmentDocument16 pagesGroup 7 Group AssignmentAZLINDA MOHD NADZRINo ratings yet

- Riedijk - Architecture As A CraftDocument223 pagesRiedijk - Architecture As A CraftHannah WesselsNo ratings yet

- Consumer Behaviour Towards AppleDocument47 pagesConsumer Behaviour Towards AppleAdnan Yusufzai69% (62)

- Boosting Profitability Amidst New Challenges: 2015 Banking OutlookDocument24 pagesBoosting Profitability Amidst New Challenges: 2015 Banking OutlookIndarNo ratings yet

- Credit Risk Management at Bank AsiaDocument11 pagesCredit Risk Management at Bank AsiaAbdullah Al MahmudNo ratings yet

- Visiting Professor ProgramDocument34 pagesVisiting Professor ProgramUma Shankar VNo ratings yet

- BNL Stores Case Analysis: Declining Profitability and High Leverage Led to Falling Share PriceDocument19 pagesBNL Stores Case Analysis: Declining Profitability and High Leverage Led to Falling Share PriceAnshuman PandeyNo ratings yet

- BSBFIN601 Task 3 V0357Document5 pagesBSBFIN601 Task 3 V0357Catalina Devia CastiblancoNo ratings yet

- SecB_Group09Document26 pagesSecB_Group09Sayantika MondalNo ratings yet

- Answer 3Document10 pagesAnswer 3Hezekiah AtindaNo ratings yet

- Answer 1Document10 pagesAnswer 1Hezekiah AtindaNo ratings yet

- Ratio (1) FDocument4 pagesRatio (1) FKathryn Bianca Acance100% (1)

- Financial Analysis: Analysis of The Annual Report & AccountsDocument19 pagesFinancial Analysis: Analysis of The Annual Report & AccountsSrikar NamalaNo ratings yet

- Consolidated Profit and Loss Account For The Year Ended December 31, 2008Document16 pagesConsolidated Profit and Loss Account For The Year Ended December 31, 2008madihaijazNo ratings yet

- Asce PDFDocument19 pagesAsce PDFarooba hanifNo ratings yet

- AM Lecture 1Document15 pagesAM Lecture 1AliNo ratings yet

- Department of Education Republic of The PhilippinesDocument15 pagesDepartment of Education Republic of The PhilippinesWhyljyne Glasanay100% (2)

- Sample Thesis in Banking and FinanceDocument7 pagesSample Thesis in Banking and Financeannashawpittsburgh100% (2)

- Week 3Document19 pagesWeek 3DelaNo ratings yet

- Debt ManagementDocument5 pagesDebt Managementminhdoworking1811No ratings yet

- SSRN Id1105499Document69 pagesSSRN Id1105499rochdi.keffalaNo ratings yet

- Assignment of Risk Management of BankingDocument19 pagesAssignment of Risk Management of Bankingshruti_sood52No ratings yet

- Assignment 4 Group 4Document6 pagesAssignment 4 Group 4Kristina KittyNo ratings yet

- Financial Statement AnalysisDocument10 pagesFinancial Statement Analysiszayna faizaNo ratings yet

- Integer Holdings Corporation Q1 2023 Earnings Call Apr 27 2023Document34 pagesInteger Holdings Corporation Q1 2023 Earnings Call Apr 27 2023DanielNo ratings yet

- Roll of Bank in The EconomyDocument5 pagesRoll of Bank in The EconomyRaheel ZararNo ratings yet

- Terry AssDocument3 pagesTerry AssAli OuaidaNo ratings yet

- BNL Stores' Declining ProfitabilityDocument16 pagesBNL Stores' Declining ProfitabilityAMBWANI NAREN MAHESHNo ratings yet

- Performance Evaluation of Eastern Bank LTDDocument15 pagesPerformance Evaluation of Eastern Bank LTDMehedi HasanNo ratings yet

- Procredit Alb 2019Document62 pagesProcredit Alb 2019Thomas SzutsNo ratings yet

- NIM Genap 2. - in Equity Security Market There Are Two Kind of Analysis Namely Fundamental and TechnicalDocument3 pagesNIM Genap 2. - in Equity Security Market There Are Two Kind of Analysis Namely Fundamental and TechnicalyudaNo ratings yet

- Procredit Alb 2018Document64 pagesProcredit Alb 2018Thomas SzutsNo ratings yet

- SLM Unit 07 Mbf201Document17 pagesSLM Unit 07 Mbf201Pankaj Kumar100% (1)

- Procredit Alb 2020Document60 pagesProcredit Alb 2020Thomas SzutsNo ratings yet

- FSA Assignment III Group 4Document4 pagesFSA Assignment III Group 4Kristina Kitty100% (1)

- PNB AR 2007 With BH NamesDocument152 pagesPNB AR 2007 With BH NamesShingie0% (1)

- Management Accounting ProjectDocument15 pagesManagement Accounting Projecturvigarg079No ratings yet

- Impact of NPA on Profitability and Functioning of Commercial BanksDocument6 pagesImpact of NPA on Profitability and Functioning of Commercial Banksjatt_tinka_3760No ratings yet

- Accounts AssignmentDocument16 pagesAccounts AssignmentSimbarashe MugoniNo ratings yet

- HBL Markup ComparisonDocument12 pagesHBL Markup ComparisonNoor NaazNo ratings yet

- BISE: Jurnal Pendidikan Bisnis Dan EkonomiDocument5 pagesBISE: Jurnal Pendidikan Bisnis Dan Ekonomiyoseph2009No ratings yet

- BANK 311 SlidesDocument18 pagesBANK 311 SlidesMaha AlanjawiNo ratings yet

- Tutorial 7 FAT SolutionDocument13 pagesTutorial 7 FAT SolutionAhmad FarisNo ratings yet

- Thesis BankingDocument5 pagesThesis Bankingerinthompsonbatonrouge100% (2)

- BBA6053 - Accounting Ratio AnalysisDocument8 pagesBBA6053 - Accounting Ratio AnalysisBrute1989No ratings yet

- 03 IAG 1H23 Financial ResultsDocument6 pages03 IAG 1H23 Financial ResultsMarvin SwaminathanNo ratings yet

- Nov 2020 - Econ Tute2Document9 pagesNov 2020 - Econ Tute2Nivneth PeirisNo ratings yet

- Report On Financial Analysis of ICI Pakistan Limited 2008Document9 pagesReport On Financial Analysis of ICI Pakistan Limited 2008helperforeuNo ratings yet

- FAC1502 - Study Unit 3 - 2023Document11 pagesFAC1502 - Study Unit 3 - 2023Olwethu PhikeNo ratings yet

- Financial Performance Analysis of Southeast Bank Limited for Last 10 YearsDocument14 pagesFinancial Performance Analysis of Southeast Bank Limited for Last 10 YearsMasuma Binte SakhawatNo ratings yet

- National University of Modern Languages Department of Management Science Sector H-9 ISLAMABADDocument11 pagesNational University of Modern Languages Department of Management Science Sector H-9 ISLAMABADmishori2008No ratings yet

- JDWDocument50 pagesJDWmishori2008No ratings yet

- Adeel Azher If You Want To Download This Assignment Then Contact @03458014643Document54 pagesAdeel Azher If You Want To Download This Assignment Then Contact @03458014643mishori2008No ratings yet

- JDW - FinalDocument28 pagesJDW - Finalmishori2008No ratings yet

- Presentation 2Document58 pagesPresentation 2mishori2008No ratings yet

- AadeeDocument48 pagesAadeemishori2008No ratings yet

- BritanniaDocument25 pagesBritanniamishori200850% (2)

- Financial Statement Analysis Project On Sugar MillDocument19 pagesFinancial Statement Analysis Project On Sugar Millmishori2008100% (1)

- Bussiness PlanDocument21 pagesBussiness Planmishori2008100% (2)

- ICI Paints: Project OnDocument37 pagesICI Paints: Project Onmishori2008No ratings yet

- Motivation: Art of Living & SuccessDocument29 pagesMotivation: Art of Living & Successmishori2008No ratings yet

- uFONE 2Document29 pagesuFONE 2mishori2008No ratings yet

- Bussiness Letter by Adeel AzherDocument13 pagesBussiness Letter by Adeel Azhermishori2008No ratings yet

- Body Scan AnalysisDocument9 pagesBody Scan AnalysisAmaury CosmeNo ratings yet

- Assessing Eyes NCM 103 ChecklistDocument7 pagesAssessing Eyes NCM 103 ChecklistNicole NipasNo ratings yet

- Manju Philip CVDocument2 pagesManju Philip CVManju PhilipNo ratings yet

- COT EnglishDocument4 pagesCOT EnglishTypie ZapNo ratings yet

- Keberhasilan Aklimatisasi Dan Pembesaran Bibit Kompot Anggrek Bulan (Phalaenopsis) Pada Beberapa Kombinasi Media TanamDocument6 pagesKeberhasilan Aklimatisasi Dan Pembesaran Bibit Kompot Anggrek Bulan (Phalaenopsis) Pada Beberapa Kombinasi Media TanamSihonoNo ratings yet

- Seminar #22 Vocabury For Speaking PracticeDocument7 pagesSeminar #22 Vocabury For Speaking PracticeOyun-erdene ErdenebilegNo ratings yet

- 9AKK101130D1664 OISxx Evolution PresentationDocument16 pages9AKK101130D1664 OISxx Evolution PresentationfxvNo ratings yet

- Learn Square Roots & Plot on Number LineDocument11 pagesLearn Square Roots & Plot on Number LineADAM CRISOLOGONo ratings yet

- A Systematic Scoping Review of Sustainable Tourism Indicators in Relation To The Sustainable Development GoalsDocument22 pagesA Systematic Scoping Review of Sustainable Tourism Indicators in Relation To The Sustainable Development GoalsNathy Slq AstudilloNo ratings yet

- Chapter 08Document18 pagesChapter 08soobraNo ratings yet

- Form 1 ADocument2 pagesForm 1 ARohit Jain100% (1)

- EG-45-105 Material Information Sheet (Textura) V2Document4 pagesEG-45-105 Material Information Sheet (Textura) V2GPRNo ratings yet

- DAT MAPEH 6 Final PDFDocument4 pagesDAT MAPEH 6 Final PDFMARLYN GAY EPANNo ratings yet

- Exam Ref AZ 305 Designing Microsoft Azure Infrastructure Sol 2023Document285 pagesExam Ref AZ 305 Designing Microsoft Azure Infrastructure Sol 2023maniNo ratings yet

- StsDocument10 pagesStsSamonte, KimNo ratings yet

- Eudragit ReviewDocument16 pagesEudragit ReviewlichenresearchNo ratings yet

- Universal Robina Co. & Bdo Unibank Inc.: Research PaperDocument25 pagesUniversal Robina Co. & Bdo Unibank Inc.: Research PaperSariephine Grace ArasNo ratings yet

- VARCDocument52 pagesVARCCharlie GoyalNo ratings yet

- 153C Final Exam Study Guide-2Document6 pages153C Final Exam Study Guide-2Soji AdimulaNo ratings yet

- Malaysia Year 2011 Calendar: Translate This PageDocument3 pagesMalaysia Year 2011 Calendar: Translate This PageStorgas FendiNo ratings yet