Professional Documents

Culture Documents

Amendments CA PCC IPCC For Nov 2010 Attempt 120810070403

Uploaded by

Manik MahajanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amendments CA PCC IPCC For Nov 2010 Attempt 120810070403

Uploaded by

Manik MahajanCopyright:

Available Formats

CA.

AJAY JAIN

Salary

Amendment of Income Tax Rules, 1962 Applicable for NOV 2010 Changes in limits for valuation of Car [refer page 38]

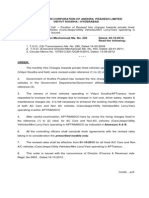

(13) Valuation of motor Car

Owned or hired by employer and used

owned by employee and used

exclusively for fully official purpose for

exclusively for private purpose

private

partly offical and partly personal

exclusively for partly

offical and

official purpose partly personal

Nil if specified use Nil taxable if Runn. & main- Actual and personal Specified Documents Chauffeur - Actual 1,800/1,600 2400pm actual maintained Wear & Tear 10%p.a. of exp. incurred by cost Or shall be hire charges taxable Runn. & main expenses by (Actual exp. is irrelevant) employer employee

Total Actual expenditure for office

Documents maintained

Less: 1,200

Less: 600.900 pm for chauffeur(if any) employer

Upto 1.6 ltrs cubic capacity Rs. 1,200 1,800p.m. shall be taxable

Upto 1.6 ltrs cubic capacity Rs. 400 , 600 p.m. shall be taxable However if actual expen. for official purpose

CA. AJAY JAIN

Salary is more than

the Exceeding 1.6 ltrs Exceeding 1.6 ltrs limits then actual Rs. 1,600 2,400p.m. Rs. 600 , 900p.m. expenditure can be shall be taxable shall be taxable deducted by maintaining Add Rs. 600 900 p.m. if chauffeur is also provided. specified documents (i) Specified documents (ii) If employee has been provided with more than one car, which are not used exclusively for official purposes then (a) value of one car shall be 1,200 or 1,600 Rs. 1,800 or 2,400 + Rs. 600 900p.m. for driver (if any) as the case may be and (b)the value of other cars shall be as if they are used exclusively for personal purposes.

CA.AJAY JAIIN

Salary Salary

Amendment of Income Tax Rules, 1962 Applicable for NOV 2010

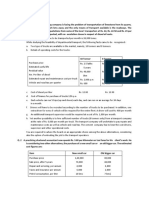

Changes in limits for valuation of Car [refer page 38] As per amended Rule 3, following changes have been madeLimits of Rs. 1,200 (upto 1.6 ltrs cc)/1,600 p.m.(exceeding 1.6 ltrs cc) in case Running & Maint. Expenses met by employer shall be substituted by Rs. 1,800/2,400 p.m.

(i)

Limits of Rs. 400 (upto 1.6 ltrs cc)/600 p.m.(exceeding 1.6 ltrs cc) in case Running & Maint. Expenses met by employee shall be substituted by Rs. 600/900 p.m.

(ii)

(iii) Limit of Rs. 600 in case chauffeur is also provided shall be substituted by 900 p.m.

You might also like

- Income Tax Car PerkDocument15 pagesIncome Tax Car PerkShubham DhimaanNo ratings yet

- It - Lesson 6Document25 pagesIt - Lesson 6Sugandha AgarwalNo ratings yet

- Ed Mech Too Ms No 225 DT 20 10 12Document4 pagesEd Mech Too Ms No 225 DT 20 10 12penusilaNo ratings yet

- Taxation of Motor Car PerquisiteDocument2 pagesTaxation of Motor Car PerquisiteHusain SulemaniNo ratings yet

- Notes - Capital AllowanceDocument8 pagesNotes - Capital AllowanceDIVA RTHININo ratings yet

- Motor CarDocument1 pageMotor CarDurgesh SrivastavaNo ratings yet

- Impact On IT For 2009-10Document7 pagesImpact On IT For 2009-10renjith11121No ratings yet

- 2023 24 SARS ElogbookDocument17 pages2023 24 SARS ElogbookSiphesihleNo ratings yet

- Appendix H Cost Analysis Example For A Typical Small Business Complying With The Proposed ATCM RequirementsDocument5 pagesAppendix H Cost Analysis Example For A Typical Small Business Complying With The Proposed ATCM RequirementsPat TejNo ratings yet

- Perk Valuation of Motor CarDocument18 pagesPerk Valuation of Motor CarcapkaggarwalNo ratings yet

- Appendix H Cost Analysis Example For A Typical Small Business Complying With The Proposed ATCM RequirementsDocument5 pagesAppendix H Cost Analysis Example For A Typical Small Business Complying With The Proposed ATCM RequirementsFatimah YahyaNo ratings yet

- 2011eLogbookV2Document16 pages2011eLogbookV2Gerhard GroblerNo ratings yet

- New Vehicle Registration ProceedureDocument3 pagesNew Vehicle Registration ProceedureParfact ENo ratings yet

- DCS CHT CWE&GE 6monthsDocument2 pagesDCS CHT CWE&GE 6monthsVijay Raj RajoraNo ratings yet

- 2016-17 SARS ELogbookDocument17 pages2016-17 SARS ELogbookMfundo DlaminiNo ratings yet

- Taxability of Motor Vehicle Under GST Ca Harshil ShethDocument12 pagesTaxability of Motor Vehicle Under GST Ca Harshil ShethPraful BoranaNo ratings yet

- Eligibility Calculator: House Rent Allowance 150,000 600,000 Oaar - 2 500,000Document12 pagesEligibility Calculator: House Rent Allowance 150,000 600,000 Oaar - 2 500,000Gokul ChidambaramNo ratings yet

- RajasthanDocument5 pagesRajasthanrahul srivastavaNo ratings yet

- Restructuring The Excise Taxation of Motor VehiclesDocument43 pagesRestructuring The Excise Taxation of Motor VehiclesFeruel PatalagsaNo ratings yet

- Vehicle PolicyDocument3 pagesVehicle Policyamanatbutt0% (1)

- 2010-10-01 Latest BSNL TA DA Rules BSNLDocument14 pages2010-10-01 Latest BSNL TA DA Rules BSNLgj657100% (1)

- Motor Vehicles (Amendment) Act 2019 - Key Features and PenaltiesDocument10 pagesMotor Vehicles (Amendment) Act 2019 - Key Features and Penaltiescaddcentre velacheryNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Ford Service Calculator EstimateDocument1 pageFord Service Calculator EstimateShreyas TamhanNo ratings yet

- Motor RulesDocument9 pagesMotor RulesDhruba BaruahNo ratings yet

- Quotation UAEDocument1 pageQuotation UAERabbit Tech HRNo ratings yet

- Bijutr@al-Kasid CoDocument2 pagesBijutr@al-Kasid CoSantosh SridharNo ratings yet

- Quotation of BMW 320d Luxury LineDocument2 pagesQuotation of BMW 320d Luxury Lineabhishek100% (1)

- Presentation For Income Tax ReturnDocument12 pagesPresentation For Income Tax ReturnmuhammadrizNo ratings yet

- Travelling Allowance Rules RBE 49 - 2013 - 23.05.2013Document11 pagesTravelling Allowance Rules RBE 49 - 2013 - 23.05.2013ukarthikbhelNo ratings yet

- Lecture 10-Ca IDocument69 pagesLecture 10-Ca I魔鬼No ratings yet

- Topic 6 Capital AllowanceDocument33 pagesTopic 6 Capital AllowanceBaby KhorNo ratings yet

- Operating Costing Test QuestionsDocument5 pagesOperating Costing Test Questionschandrakantchainani606No ratings yet

- Procedure For New Vehicle RegistrationDocument4 pagesProcedure For New Vehicle RegistrationWaseem ZafarNo ratings yet

- Quote - New - RateDocument3 pagesQuote - New - RateStaff-ISK Muhammad GhaziNo ratings yet

- Rahul Bhati Quatation jcb222222220Document3 pagesRahul Bhati Quatation jcb222222220SunilNo ratings yet

- Grade Scheme-I Scheme - II: Bajaj Electricals Limited MumbaiDocument5 pagesGrade Scheme-I Scheme - II: Bajaj Electricals Limited MumbaiamitpdabkeNo ratings yet

- 0126financial and Corporate ReportingDocument6 pages0126financial and Corporate ReportingSmag SmagNo ratings yet

- CA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesDocument17 pagesCA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesAyush ThÃkkarNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument33 pages© The Institute of Chartered Accountants of IndiaJayanth RamNo ratings yet

- Ng%Uh Áfë GâfÿDocument3 pagesNg%Uh Áfë GâfÿK SingaravelNo ratings yet

- Revised Car Scheme C1Document4 pagesRevised Car Scheme C1kapolaNo ratings yet

- Capital Allowance 2220Document58 pagesCapital Allowance 2220YanPing AngNo ratings yet

- KLZODocument15 pagesKLZOvivekin2019No ratings yet

- Tax Rates / Schedules: List of Fee SchdulesDocument4 pagesTax Rates / Schedules: List of Fee Schdulesnaeem9043No ratings yet

- DA RevisedDocument4 pagesDA RevisedArcGis TranscoNo ratings yet

- Income Tax - New RuleDocument13 pagesIncome Tax - New Ruleking_007No ratings yet

- Auto Repair ShopDocument9 pagesAuto Repair Shopsaurav0187No ratings yet

- Operating CostingDocument6 pagesOperating CostingAvilash Vishal MishraNo ratings yet

- Survey Fee 2013Document6 pagesSurvey Fee 2013abcNo ratings yet

- GuidelinesonAdanicarleasescheme 2018Document8 pagesGuidelinesonAdanicarleasescheme 2018Shubham GuptaNo ratings yet

- Service Costing QuestionDocument5 pagesService Costing Questionagnusswapna2003No ratings yet

- GO Memo 1320 2007Document3 pagesGO Memo 1320 2007SreenivasuluBejavada100% (2)

- Motor Vehicle Bill 2019Document8 pagesMotor Vehicle Bill 2019King Tushar AggarwalNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Critical Analysis of Motor Vehicles Amendment Act 2019Document23 pagesCritical Analysis of Motor Vehicles Amendment Act 2019KashishNo ratings yet

- Service CostingDocument6 pagesService Costingbinu100% (1)

- Instructions To Fill Up The Common Application Form For Clearances / Approvals / Services For Operation of An Industrial UnitDocument8 pagesInstructions To Fill Up The Common Application Form For Clearances / Approvals / Services For Operation of An Industrial UnitsuryanathNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet