Professional Documents

Culture Documents

Form 16

Form 16

Uploaded by

Nidhin MenonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16

Form 16

Uploaded by

Nidhin MenonCopyright:

Available Formats

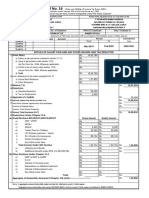

Form Compiled by www.finance.pushpi.com FORM NO.

16 [See rule 31(1)(a)] Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source on Salary Financial year Whether Original / Duplicate / Amended TAN of Deductor PAN of Deductee TDS Unique Transaction Number (UTN) as provided by Income Tax Department TDS Certificate number# If Amended give Previous TDS Certificate number Name of Deductor Name of Deductee Whether PAN uploaded was Gross Amount validated by Income TDS/TCS Amount Paid / Collected Tax Department? (Y/N)

Gross amount of TDS / TCS Total TDS amount where PAN was found valid by Income Tax Department* Details of Salary paid and any other income and tax deducted 1 Gross Salary (a) (b) (c) (d) Salary as per provisions contained in sec.17(1) Value of perquisites u/s 17(2) (as per Form No.12BB, wherever applicable) Rs Rs

Profits in lieu of salary under section 17(3)(as Rs per Form No.12BB, wherever applicable) Total Rs

Less: Allowance to the extent exempt u/s 10

Rs Rs Rs Rs Rs

3 4

Balance(1-2) Deductions : (a) (b) (c) Standard deduction Entertainment allowance Tax on employment Rs. Rs. Rs. Rs

5 6 7

Aggregate of 4(a) to (c) Income chargeable under the head 'salaries' (3-5) Add: Any other income reported by the employee

Rs Rs Rs Rs Rs Rs

8 9

Gross total income (6+7) Deductions under Chapter VIA Gross Amount (a) (b) (c) (d) Rs Rs Rs Rs Qualifying Amount Rs Rs Rs Rs Deductible Amount Rs Rs Rs Rs

Rs Rs Rs Rs

10 11 12

Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income

13

Rebate and relief under Chapter VIII I. Under section 88 (please specify) Gross Amount (a) (b) (c) (d) (e) Rs Rs Rs Rs Rs Qualifying Amount Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Tax rebate/ relief

(f) Total Rs [(a) to (e)] II (a) (b) III 14 15 16 17 Under section 88B Under section 88C

Under section 89 (attach details)

Aggregate of tax rebates and relief at 13 above [I(f) + II(a)+ II(b) + III] Tax payable (12-14) and surcharge thereon Less: Tax deducted at source Tax payable/refundable (15-16)

I _____________________________________, son/daughter of _________________________________ working in the capacity of ________________________________________ (designation) do hereby certify that a sum of Rs. ____________________________ [Rupees ____________________________________________ _____________________________________________________________________________ (in words)] has been deducted at source and paid to the credit of the Central Government. I further certify that the information given above is true and correct based on the books of accounts, documents and other available records. Place Date Designation Signature of person responsible for deduction of tax Full Name

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Chandrasekhar S. The Mathematical Theory of Black Holes PDFDocument667 pagesChandrasekhar S. The Mathematical Theory of Black Holes PDFBudhaditya Bhattacharjee94% (17)

- Form 16 ExcelDocument2 pagesForm 16 Excelapi-372756271% (7)

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- 502647F 2018Document2 pages502647F 2018Tilak RajNo ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Aggressive Model PortfolioDocument6 pagesAggressive Model PortfolioNirmaljyoti SharmaNo ratings yet

- Form 16Document6 pagesForm 16balaramappana2No ratings yet

- Form No 16Document2 pagesForm No 16saran2rasuNo ratings yet

- Form 16Document3 pagesForm 16ganesh_korgaonkarNo ratings yet

- Form 16Document3 pagesForm 16Apte SatishNo ratings yet

- Form No 16Document2 pagesForm No 16Anonymous 7KR8DpqNo ratings yet

- Form16 Applicable From 01.04Document3 pagesForm16 Applicable From 01.04Vishaal TalwarNo ratings yet

- Form No 16 - Ay0607Document4 pagesForm No 16 - Ay0607api-3705645100% (1)

- Tds 16 NDocument3 pagesTds 16 Nssanju_bhatNo ratings yet

- Form 16Document2 pagesForm 16Joyal JoseNo ratings yet

- Form No 16Document3 pagesForm No 16Deepak Kumar YadavNo ratings yet

- 38 - 16 & I6a (A.y.2009-10) With MarginalDocument4 pages38 - 16 & I6a (A.y.2009-10) With Marginalrajudutta11No ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Form16Rpt 169567-1Document3 pagesForm16Rpt 169567-1ishalshamnasNo ratings yet

- Abdul Naushad SiddiquiDocument2 pagesAbdul Naushad Siddiquiahad siddiquiNo ratings yet

- Certified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Document4 pagesCertified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Aravind ReddyNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- Name and Address of The Employer Name and Designation of The EmployeeDocument4 pagesName and Address of The Employer Name and Designation of The Employeeyogesh.b.lokhande9022No ratings yet

- Form 16Document6 pagesForm 16Pulkit Gupta100% (1)

- Form 16Document3 pagesForm 16api-247505461No ratings yet

- Digitally Signed by DINESH MOHAN: (Refer Annexure)Document3 pagesDigitally Signed by DINESH MOHAN: (Refer Annexure)Er Mayank UppalNo ratings yet

- SALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsDocument7 pagesSALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsShabeer UppotungalNo ratings yet

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Form 16aaDocument2 pagesForm 16aaJayNo ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- 317 Form16 (2005 06)Document6 pages317 Form16 (2005 06)sachin584No ratings yet

- Form 16 - 1617 PDFDocument3 pagesForm 16 - 1617 PDFAbhilashNo ratings yet

- Income Tax Calculation MemoDocument3 pagesIncome Tax Calculation Memoajeetpoly100% (3)

- ITDocument4 pagesITMahesh KumarNo ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Form16 2982Document3 pagesForm16 2982yogesh magarNo ratings yet

- Form PDF 375787380280821Document6 pagesForm PDF 375787380280821nthakur1410No ratings yet

- Form No 16Document5 pagesForm No 16Rabiul KhanNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Grade 6: Practice BookDocument34 pagesGrade 6: Practice BookMaryam ShakirNo ratings yet

- Quality Management Trainee - Robert Bosch D.O.O PDFDocument3 pagesQuality Management Trainee - Robert Bosch D.O.O PDFNemanja NikolicNo ratings yet

- What Is Plant Physiology BOTANYDocument12 pagesWhat Is Plant Physiology BOTANYfatima manzoorNo ratings yet

- Oralcomm11 q1 Mod3of7 Strategiestoovercomecommunicationbreakdown v2Document26 pagesOralcomm11 q1 Mod3of7 Strategiestoovercomecommunicationbreakdown v2LESLIE PACIFICARNo ratings yet

- WLT Does Routinely-The Conscientious Reviewing Of: World Literature Today: History andDocument32 pagesWLT Does Routinely-The Conscientious Reviewing Of: World Literature Today: History andStacy HardyNo ratings yet

- Christian Missionaries and Female Education in Bengal During East India Company's Rule: A Discourse Between Christianised Colonial Domination Versus Women EmancipationDocument11 pagesChristian Missionaries and Female Education in Bengal During East India Company's Rule: A Discourse Between Christianised Colonial Domination Versus Women EmancipationSanjay Samuel RaiNo ratings yet

- Ssith (Earth-616) - Marvel Database - Fandom Powered by WikiaDocument3 pagesSsith (Earth-616) - Marvel Database - Fandom Powered by Wikiajorge solieseNo ratings yet

- NPDDocument5 pagesNPDleo100% (2)

- POTA RegulationsDocument16 pagesPOTA RegulationsJonas S. MsigalaNo ratings yet

- Dwnload Full Introduction To Management Science 12th Edition Taylor Solutions Manual PDFDocument36 pagesDwnload Full Introduction To Management Science 12th Edition Taylor Solutions Manual PDFpavierdegust.3thj2k100% (13)

- Unity For Human BeingsDocument354 pagesUnity For Human BeingsChiragNo ratings yet

- Pressure WsDocument3 pagesPressure WsHi everyoneNo ratings yet

- Kaizen BudgetingDocument5 pagesKaizen BudgetingMonch Solstice Superales100% (2)

- PadedeDocument5 pagesPadedeEstri AmaliyaNo ratings yet

- Undertake Application of Building CodesDocument150 pagesUndertake Application of Building CodesT WNo ratings yet

- Unchained BarbarianDocument13 pagesUnchained Barbarian678ojyhiopNo ratings yet

- Teaching Speaking and Writing SkillsDocument34 pagesTeaching Speaking and Writing SkillsVen KeraNo ratings yet

- JR Mains (1) - Sec Division@feb-202Document16 pagesJR Mains (1) - Sec Division@feb-202TIRUMALA IIT AND MEDICAL ACADEMYNo ratings yet

- 127 - ASD-OPS-CHKLST-CAB-127 - OM-D Compliance Checklist - Training Personnel and Cabin CrewDocument46 pages127 - ASD-OPS-CHKLST-CAB-127 - OM-D Compliance Checklist - Training Personnel and Cabin CrewNabiL AliNo ratings yet

- Arba Minch Institute of Technology (Arba Minch University) : Import Management System For Agmas Medical Private CompanyDocument96 pagesArba Minch Institute of Technology (Arba Minch University) : Import Management System For Agmas Medical Private CompanyMussie DDKNo ratings yet

- Witches of The West For TalkDocument42 pagesWitches of The West For TalkChris CoreyNo ratings yet

- The Shadow Over DaleDocument10 pagesThe Shadow Over DalexnexusNo ratings yet

- l3 U1 FCDocument16 pagesl3 U1 FCAmy HopeNo ratings yet

- Factors Affecting The Level of Readiness and Effectiveness in Shifting To Alternative Learning Modalities Among Pangantucan District TeachersDocument22 pagesFactors Affecting The Level of Readiness and Effectiveness in Shifting To Alternative Learning Modalities Among Pangantucan District TeachersDesiree Aranggo MangueraNo ratings yet

- Audix tr40Document2 pagesAudix tr40wc9j7dy42xNo ratings yet

- Fluorescent and Colorimetric Sensors For Detection of Lead, Cadmium, and Mercury IonsDocument36 pagesFluorescent and Colorimetric Sensors For Detection of Lead, Cadmium, and Mercury IonskawtherahmedNo ratings yet

- KritikothariresumeDocument1 pageKritikothariresumeapi-435952629No ratings yet

- TB 2010 Lis SpecificationsDocument7 pagesTB 2010 Lis SpecificationsGustavo RivasNo ratings yet