Professional Documents

Culture Documents

Esiepfcalculator 2

Esiepfcalculator 2

Uploaded by

Atul KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Esiepfcalculator 2

Esiepfcalculator 2

Uploaded by

Atul KumarCopyright:

Available Formats

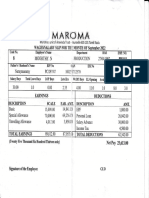

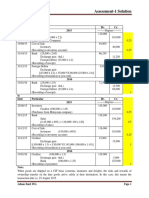

COMPANY NAME (2009-2010)

BRANCH NAME:

SALARY DETAILS FOR April '09

SL No.

BASIC

DESIGNATION

EMPLOYEE NAME

MR.A

MS.B

MR.C

MR.D

MR.E

TOTAL

5050.00

2450.00

4050.00

1700.00

1200.00

DA

2000.00

2000.00

3250.00

1800.00

1000.00

7050.00

4450.00

7300.00

3500.00

2200.00

14450.00 10050.00

24500.00

OTHER ALLOWANCES

ENTERTAIN

UNIFORM &

MENT

CONVEYAN

WASHING

ALLOWANC

CE

ALLOWANCE

E

BASIC SALARY

BASIC

1

2

3

4

5

ESI

NO

YES

NO

YES

YES

5000.00

1000.00

3500.00

1500.00

2000.00

1500.00

0.00 13000.00

2500.00

1000.00

3500.00

1000.00

1500.00

DEDUCTIONS

TOTAL

NET SALARY

DEDUCTIONS

HRA

EDUCATION MEDICAL

6500.00

3500.00

2000.00

1500.00

1500.00

3000.00

7000.00 11500.00

7500.00

1000.00

2500.00

500.00

2000.00

1500.00

SPECIAL GRAND TOTAL

5000.00

PF

ESI

1000.00

34550.00

6950.00

21300.00

8000.00

7700.00

780.00

534.00

780.00

420.00

264.00

0.00

122.00

0.00

140.00

135.00

6500.00 6000.00

78500.00

2778.00

397.00

1000.00

TDS

LIC

PT

LOAN/MEDI

150.00

75.00

75.00

75.00

75.00

0.00

0.00

0.00

930.00

731.00

855.00

635.00

474.00

33620.00

6219.00

20445.00

7365.00

7226.00

3625.00

74875.00

COMPANY NAME (2009-2010)

BRANCH :

PF LIST FOR APRIL '09

Sl No.

1

2

3

4

5

PF No.

EMPLOYEE NAME

MR.A

MS.B

MR.C

MR.D

MR.E

DETAILS

PF APPLICABLE EMPLOYER SHARE

SALARY

E.P.S

EPF

6,500.00

541.00

239.00

4,450.00

371.00

163.00

6,500.00

541.00

239.00

3,500.00

292.00

128.00

2,200.00

183.00

81.00

23,150.00

1,928.00

850.00

CALCULATIONS

PF CONTRI (STAFF)

2,778.00

EPS (8.33 % OF SALARY)

1,928.00

EPF(3.67% OF SALRY)

850.00

EPF ADMIN CHARGES (1.1% OF SALARY)

255.00

EDLI CHARGES(.05% OF SALARY)

12.00

EDLI ADMIN CHARGES( 0.01% OF SALARY)

2.00

TOTAL PAYABLE

5,825.00

TOTAL

780.00

534.00

780.00

420.00

264.00

2,778.00

COMPANY NAME (2009-2010)

BRANCH :

ESI LIST FOR APRIL '09

SL NO

1

2

3

4

5

ESI NO

EMPLOYEE NAME

MR.A

MS.B

MR.C

MR.D

MR.E

EMPLOYEE

ESI APPLICABLE

EMPLOYER

CONTRIBUTIO

SALARY

CONTRIBUTION

N

NOT APPLICABLE

0.00

0.00

6,950.00

122.00

331.00

NOT APPLICABLE

0.00

0.00

8,000.00

140.00

380.00

7,700.00

135.00

366.00

22650.00

DETAILS

SALARY (ESI APPLICABLE)

EMPLOYER CONTRIBUTION (4.75%)

EMPLOYEE'S CONTRIBUTION (1.75%)

NET ESI PAYABLE

CALCULATIONS

22,650.00

1,077.00

397.00

1,474.00

397.00

1077.00

TOTAL

0.00

453.00

0.00

520.00

501.00

1474.00

You might also like

- Internal Audit Checklist of Real EstateDocument41 pagesInternal Audit Checklist of Real Estatemaahi782% (45)

- Assignmet For Practice Session StudentsDocument5 pagesAssignmet For Practice Session StudentsYasir Ahmed Siddiqui0% (1)

- Payslip KPJ 12-20 PDFDocument1 pagePayslip KPJ 12-20 PDFraziqNo ratings yet

- Pay Slip NewDocument1 pagePay Slip NewSukadev Sahu0% (2)

- Adecco India Pvt. LTD.: Payslip For The Month of May 2019Document2 pagesAdecco India Pvt. LTD.: Payslip For The Month of May 2019Secret EarthNo ratings yet

- SKS Annual Report 2012 13Document120 pagesSKS Annual Report 2012 13maahi7No ratings yet

- Problem #3Document16 pagesProblem #3hehehehehloo42% (12)

- Lecture 4 - Profit PlanningDocument81 pagesLecture 4 - Profit PlanningDaphne PerezNo ratings yet

- PF & ESI Calculator in EXCELDocument7 pagesPF & ESI Calculator in EXCELmushtaqsaNo ratings yet

- Matarani Infrastructure PVT LTD.: Salary Structure EmployerDocument2 pagesMatarani Infrastructure PVT LTD.: Salary Structure EmployerDEEPAK KumarNo ratings yet

- 31 Dec 2023Document1 page31 Dec 2023dharmesh1967desaiNo ratings yet

- Img 20221107 0004Document1 pageImg 20221107 0004Sharfudeen KasimNo ratings yet

- 31 Aug 2023Document1 page31 Aug 2023Ashish MishraNo ratings yet

- MSBM Payrol August 1-15, 2019 (Individual)Document43 pagesMSBM Payrol August 1-15, 2019 (Individual)Lizanne GauranaNo ratings yet

- DecDocument1 pageDecapi-3712839100% (1)

- Book 1Document1 pageBook 1Che Osman Mat IsaNo ratings yet

- Salary Structure Need EditDocument1 pageSalary Structure Need EditPearl Gwenn TaboraNo ratings yet

- 0T7517 JULY 2017salary SlipDocument1 page0T7517 JULY 2017salary SlipmukeshkatarnavareNo ratings yet

- Employee Details Attendance Rat Es Earnings DeductionsDocument8 pagesEmployee Details Attendance Rat Es Earnings DeductionsVarun MalhotraNo ratings yet

- 04handout2 CostAcctgRecitationDocument3 pages04handout2 CostAcctgRecitationDummy GoogleNo ratings yet

- E Liwag 01312007 OLDDocument2 pagesE Liwag 01312007 OLDdaqs06No ratings yet

- Minwaly Trading & Consultancy PLC Rak Bakery Contrct Workers Payroll For The Month of Hidar 2009 E.CDocument2 pagesMinwaly Trading & Consultancy PLC Rak Bakery Contrct Workers Payroll For The Month of Hidar 2009 E.CABDELLA ALINo ratings yet

- Pay Slip For The Month of March-2017 A-100, Mayapuri Industrial Area Phase II, New Delhi, New Delhi - 110064 DelhiDocument1 pagePay Slip For The Month of March-2017 A-100, Mayapuri Industrial Area Phase II, New Delhi, New Delhi - 110064 DelhiChandra BhushanNo ratings yet

- Pelirene - Pay SlipDocument3 pagesPelirene - Pay SlipMaxwell MaxwellNo ratings yet

- Knmys2506174000 92252571 1690833348409 202308015148413686Document4 pagesKnmys2506174000 92252571 1690833348409 202308015148413686Darshan NayakNo ratings yet

- Monthly Budget: Company NameDocument2 pagesMonthly Budget: Company NameMalleshNo ratings yet

- Employee Id No. Name of Employee: TotalDocument15 pagesEmployee Id No. Name of Employee: TotalRoldan Arca PagaposNo ratings yet

- Budget Template With ChartsDocument3 pagesBudget Template With ChartsAhmedNo ratings yet

- P-Way PlanDocument10 pagesP-Way PlanAditya arya singhNo ratings yet

- Pay Slip For The Month of October-2017Document1 pagePay Slip For The Month of October-2017omkassNo ratings yet

- WEDDING R US WorksheetDocument2 pagesWEDDING R US WorksheetKaye VillaflorNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document7 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Chandan ChatterjeeNo ratings yet

- Hair and Nail Salon ExpensesDocument8 pagesHair and Nail Salon ExpensesTraining and DevelopmentNo ratings yet

- Simran International Export (India) Private Limited: A-3, Riico Industrial Area, Manpur Macheri, Jaipur (Rajasthan)Document8 pagesSimran International Export (India) Private Limited: A-3, Riico Industrial Area, Manpur Macheri, Jaipur (Rajasthan)Himanshu SainiNo ratings yet

- July 2017Document1 pageJuly 2017omkass100% (1)

- Payroll Summary Feb25-Mar10 2013Document27 pagesPayroll Summary Feb25-Mar10 2013Adriana CarinanNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document14 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)PocoNo ratings yet

- Onenlemla Imsong (02158) PDFDocument1 pageOnenlemla Imsong (02158) PDFMusican LightsNo ratings yet

- 2019 Revenue Expenses January February March April May June July August September October November DecemberDocument7 pages2019 Revenue Expenses January February March April May June July August September October November DecemberFiruza AfandiyevaNo ratings yet

- AnkushDocument31 pagesAnkushVikram KumarNo ratings yet

- YTD Payslip-2022-2023Document1 pageYTD Payslip-2022-2023rashi jaiswalNo ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 10:35:01Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 10:35:01Kumar VarunNo ratings yet

- June SalaryslipDocument1 pageJune SalaryslipParveen SainiNo ratings yet

- Gujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - SlipDocument1 pageGujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - Slipkeyur patelNo ratings yet

- Finaaaaaal HaysDocument3 pagesFinaaaaaal HaysFandinola BeverlyNo ratings yet

- Nov 2017Document1 pageNov 2017omkassNo ratings yet

- MykzhrpayslipDocument1 pageMykzhrpayslipRoziana RozieNo ratings yet

- Arnaez MBCPayroll CalculatorDocument12 pagesArnaez MBCPayroll Calculatoracctg2012No ratings yet

- For OT Rates Computation Only : TotalDocument21 pagesFor OT Rates Computation Only : TotalMark Angelo FernandezNo ratings yet

- Dec07 PDFDocument1 pageDec07 PDFomkassNo ratings yet

- A99td (Apr'08)Document5 pagesA99td (Apr'08)api-3722789No ratings yet

- Monthly Budget: Chicken StarDocument4 pagesMonthly Budget: Chicken StarFathy ManzanillaNo ratings yet

- BeneDocument2 pagesBeneRiza Mae Alce100% (1)

- Adjusting Trial BalanceDocument15 pagesAdjusting Trial BalancejepsyutNo ratings yet

- Perhitungan Volume Pekerjaan: Preservasi Rehabilitasi Mayor Jalan Sp. 3 Pos Batas Negara - Sei. Ular Dan SebatikDocument16 pagesPerhitungan Volume Pekerjaan: Preservasi Rehabilitasi Mayor Jalan Sp. 3 Pos Batas Negara - Sei. Ular Dan SebatikAL Dzikri MusrilNo ratings yet

- Model Fiche de PaieDocument221 pagesModel Fiche de PaieAlaedine BenguerraNo ratings yet

- Book 1Document4 pagesBook 1lpp_rajpatelNo ratings yet

- 30 Apr 2024Document1 page30 Apr 2024Sumeet MahapatraNo ratings yet

- Monthly Budget Test: Company NameDocument4 pagesMonthly Budget Test: Company NameveeraaaNo ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarNo ratings yet

- Adobe Acrobat DocumentDocument12 pagesAdobe Acrobat DocumentRei BurceNo ratings yet

- Monthly Budget: What Are My Top 5 Highest Actual Operating Expenses?Document4 pagesMonthly Budget: What Are My Top 5 Highest Actual Operating Expenses?hahal hoholNo ratings yet

- Grrjy0022564000 98949778 1702647707993 2023121569107994544Document2 pagesGrrjy0022564000 98949778 1702647707993 2023121569107994544itsmeswaroop9No ratings yet

- Payslip of Jun-23Document1 pagePayslip of Jun-23Amit chuadharyNo ratings yet

- Cma BrochureDocument16 pagesCma BrochureAskanaNo ratings yet

- Cashflow Forecasting TemplateDocument53 pagesCashflow Forecasting Templatemaahi7No ratings yet

- Notification No.09/2013 - Service TaxDocument2 pagesNotification No.09/2013 - Service Taxmaahi7No ratings yet

- Basix Ar 2011-12Document196 pagesBasix Ar 2011-12maahi7No ratings yet

- Non-Management Annual Performance ReviewDocument10 pagesNon-Management Annual Performance Reviewmaahi7No ratings yet

- Template-FinStatement Analysis v8 1Document14 pagesTemplate-FinStatement Analysis v8 1maahi7No ratings yet

- Water Conservation: The Water Wheel November/December 2008Document4 pagesWater Conservation: The Water Wheel November/December 2008maahi7No ratings yet

- FORM - 704 Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1 Audit and Certification (See Rule 65)Document55 pagesFORM - 704 Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1 Audit and Certification (See Rule 65)maahi7No ratings yet

- Module 7 - The Need For Adjusting Journal Entries, Part IDocument12 pagesModule 7 - The Need For Adjusting Journal Entries, Part INina AlexineNo ratings yet

- Chapter 3 Act310Document26 pagesChapter 3 Act310Shibly SadikNo ratings yet

- Assignment of Introduction To StatisticsDocument3 pagesAssignment of Introduction To StatisticsbashatigabuNo ratings yet

- Capital BudgetingDocument5 pagesCapital BudgetingstandalonembaNo ratings yet

- Tutorial Meeting 6Document5 pagesTutorial Meeting 6Ve DekNo ratings yet

- Mohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Document4 pagesMohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Md BilalNo ratings yet

- E5-4:E5-3 and Emma's AlternationsDocument4 pagesE5-4:E5-3 and Emma's AlternationsAman KailaniNo ratings yet

- The Project On Pragathi BankDocument85 pagesThe Project On Pragathi BankPrashanth PBNo ratings yet

- Accounting: Pearson EdexcelDocument16 pagesAccounting: Pearson EdexceljaberalislamNo ratings yet

- Management Information June-2012Document2 pagesManagement Information June-2012Laskar REAZNo ratings yet

- EM Notes Part 3Document4 pagesEM Notes Part 3Maisonette MichNo ratings yet

- Principles of Taxation Question Bank ICAPDocument118 pagesPrinciples of Taxation Question Bank ICAPMizanur Rahman Babla67% (3)

- Head & Sub-Head CocDocument11 pagesHead & Sub-Head CocNURULNAJIHANo ratings yet

- CAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015Document5 pagesCAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015Ali OptimisticNo ratings yet

- Final Accounts Illustration ProblemsDocument11 pagesFinal Accounts Illustration ProblemsSarath kumar CNo ratings yet

- Cash Flow Summary1Document6 pagesCash Flow Summary1Sunil SoniNo ratings yet

- Financial Reporting: TestbankDocument9 pagesFinancial Reporting: TestbankLaiba RazaNo ratings yet

- S20 TX SGP Sample AnswersDocument7 pagesS20 TX SGP Sample AnswersKAH MENG KAMNo ratings yet

- As Accounting Unit 1 RevisionDocument12 pagesAs Accounting Unit 1 RevisionAhmed NiazNo ratings yet

- Capital Budgeting & Revenue BudgetingDocument37 pagesCapital Budgeting & Revenue BudgetingArun KumarNo ratings yet

- Sample Midterm ExamDocument14 pagesSample Midterm ExamAnyone SomeoneNo ratings yet

- Unit 4 Profits and Gainsfrom Bus or ProfessionDocument11 pagesUnit 4 Profits and Gainsfrom Bus or ProfessionSahana SadanandNo ratings yet

- Activity Sheet in FABM2 Q1 W1 MELC1Document5 pagesActivity Sheet in FABM2 Q1 W1 MELC1Allyza Marielle P. AbreaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- 12 - 5 SCPA Action ItemsDocument95 pages12 - 5 SCPA Action ItemsCincinnatiEnquirerNo ratings yet

- Exercice Chap 1 - Acc Equation - STDocument19 pagesExercice Chap 1 - Acc Equation - STNguyen Thi Ngoc Diep (FUG CT)No ratings yet

- DAMASO, JONNETTE E. - Lucky Charm Mini MartDocument7 pagesDAMASO, JONNETTE E. - Lucky Charm Mini MartHeide PalmaNo ratings yet