Professional Documents

Culture Documents

Case Analysis of Ring Medicals

Case Analysis of Ring Medicals

Uploaded by

hellobharathOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Analysis of Ring Medicals

Case Analysis of Ring Medicals

Uploaded by

hellobharathCopyright:

Available Formats

Case Analysis of Ring Medicals

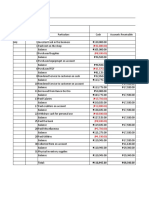

Major Issues An average of 2 to 3 units of HCS-100 a month was expected to be sold, yielding total revenues of approximately $150,000 per month at an average gross margin of nearly 50%, whereas till April 1988 only 5 systems had been sold versus a budgeted sales volume of over 30 and revenues totalled about 15% of the targeted annual amount of over $1.7 million Scanvest Ring had spent in excess of $700,000 on the HCS-100 effort and its CEO Helge Midttun and other board members were hesitant to invest further in a project that had so far shown lacklustre results There was disagreement about the most appropriate channels of distribution wherein three fairly distinct schools of thought prevailed Actionable Recommendations HCS-100 should be positioned as high end hospital internal communication system for large and medium size hospitals with clear message of the value delivered with ROI calculations HCS-100 should also be sold through the network of telecommunication distributors such as Introlink but with control on branding and pricing through agreements Analysis is support of Actionable Recommendations Target Market potential studies indicated nearly 7000 US hospitals spent over $1.4 billion on telecommunication equipment in 1987 Of all US hospitals, only 5% had an automated telephone answering system Under Ring Medicals current pricing scheme, the roughly 95% of unpenetrated medium and large hospitals represented a market of some $260 million Internal company estimates projected that at least half of these hospitals will be upgraded to offer an automated TAS service within the next five years US Hospital and Healthcare Market data o Present Number: 6,988 hospital sites in US o Size (6 99 beds): 3,239 small sites o Size (100 399 beds): 2,847 medium sites o Size ( over 400 beds): 902 large sites Market Potential: o % with automated Telephone Answering Systems: Less than 5% penetrated o % to be upgraded: 50%...

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ACI PRC-364.6-22: Concrete Removal in Repairs Involving Corroded Reinforcing Steel-TechnoteDocument3 pagesACI PRC-364.6-22: Concrete Removal in Repairs Involving Corroded Reinforcing Steel-TechnoteMoGHNo ratings yet

- Leopard Courier Services ProjectDocument17 pagesLeopard Courier Services ProjectStar Fish100% (2)

- Rights: Who, What, and Why?Document29 pagesRights: Who, What, and Why?hellobharathNo ratings yet

- Jupiter (In The Eight House) : AnalysisDocument9 pagesJupiter (In The Eight House) : AnalysishellobharathNo ratings yet

- Jupiter (In The Eight House) : AnalysisDocument9 pagesJupiter (In The Eight House) : AnalysishellobharathNo ratings yet

- Jupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-IXDocument1 pageJupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-IXhellobharathNo ratings yet

- Jupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-VIIIDocument1 pageJupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-VIIIhellobharathNo ratings yet

- Jupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-VIIDocument1 pageJupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-VIIhellobharathNo ratings yet

- Jupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-VIDocument1 pageJupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-VIhellobharathNo ratings yet

- Jupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-VDocument1 pageJupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-VhellobharathNo ratings yet

- Jupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-IVDocument1 pageJupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part? PART-IVhellobharathNo ratings yet

- Rahu: An Important PlanetDocument1 pageRahu: An Important PlanethellobharathNo ratings yet

- Jupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part?Document1 pageJupiter in The Eight House and Lagna Is Mesh. Whether Jupiter Is Responsible For Joint Pain? What Will Be Remedial Part?hellobharathNo ratings yet

- Chandra Rashi and Lagna RashiDocument2 pagesChandra Rashi and Lagna RashihellobharathNo ratings yet

- DM DL OH: $ Direct Materials $ Direct Labor $ Overhead Cost Flow DiagramDocument18 pagesDM DL OH: $ Direct Materials $ Direct Labor $ Overhead Cost Flow DiagramAbdulaziz AlzahraniNo ratings yet

- High PE Vs Low PEDocument11 pagesHigh PE Vs Low PEHema KhatwaniNo ratings yet

- BS Lecture 3.... Industrial ConcentrationDocument31 pagesBS Lecture 3.... Industrial ConcentrationAmin SonoghurNo ratings yet

- MI CH 5. Pricing Calculations PDFDocument2 pagesMI CH 5. Pricing Calculations PDFPonkoj Sarker TutulNo ratings yet

- Savings Goal Tracker: Saving TargetsDocument9 pagesSavings Goal Tracker: Saving TargetsLeo Marbeda FeigenbaumNo ratings yet

- DRSLPII W10 Bidding Forms - 20-MayDocument124 pagesDRSLPII W10 Bidding Forms - 20-MayEng Abdikarim WalhadNo ratings yet

- Appendix 1 Test Report of DWC PipeDocument2 pagesAppendix 1 Test Report of DWC Pipeprasun.tcelNo ratings yet

- What Is Production?: What You'll Learn To Do: Explain Production and The Production FunctionDocument3 pagesWhat Is Production?: What You'll Learn To Do: Explain Production and The Production FunctionCarla Mae F. DaduralNo ratings yet

- Compound Interest (H)Document5 pagesCompound Interest (H)Rudrakshi PillaiNo ratings yet

- RC Property Transfers 4-17 To 4-21Document1 pageRC Property Transfers 4-17 To 4-21Elizabeth WrightNo ratings yet

- Module 3 Quiz On Investment PropertiesDocument5 pagesModule 3 Quiz On Investment PropertiesLoven Boado100% (1)

- P01 Class:X. Sub:History. Chapter:05 The Age of Industrialization. Notes By: Wasim Sir Q No:01:explain The Following: A)Document12 pagesP01 Class:X. Sub:History. Chapter:05 The Age of Industrialization. Notes By: Wasim Sir Q No:01:explain The Following: A)Mohammad saheemNo ratings yet

- KEPL Drive Turbine - R1Document4 pagesKEPL Drive Turbine - R1aminardakaniNo ratings yet

- Metal Lath: Standard Specification ForDocument2 pagesMetal Lath: Standard Specification ForMohamed solimanNo ratings yet

- Sample Requistion For Jay Vijay LLP Godrej Site DATED 23 JAN 2024Document4 pagesSample Requistion For Jay Vijay LLP Godrej Site DATED 23 JAN 2024kiranmisale7No ratings yet

- Penguin Ice Cream Amigurumi Crochet PatternDocument9 pagesPenguin Ice Cream Amigurumi Crochet Patternflechedestructrice100% (2)

- 0901d196802cc518 MP5428 - TKBA 10 20 - TCM - 12 244914Document108 pages0901d196802cc518 MP5428 - TKBA 10 20 - TCM - 12 244914tomassagredoNo ratings yet

- Midterm-Exam Accounting Magno Test4-1Document21 pagesMidterm-Exam Accounting Magno Test4-1Castor, Cyril Nova T.No ratings yet

- Obstructed Views: Illinois' 102 County Online Transparency AuditDocument21 pagesObstructed Views: Illinois' 102 County Online Transparency AuditIllinois Policy100% (1)

- Revised Elleys Quarterly SchemeDocument8 pagesRevised Elleys Quarterly SchemePriyansh BachaniNo ratings yet

- SKAND Business and Management Paper 2 HL MarkschemeDocument3 pagesSKAND Business and Management Paper 2 HL MarkschemeSesión Plenaria Asamblea GeneralNo ratings yet

- Method of Statement - Drainage WorksDocument6 pagesMethod of Statement - Drainage Worksainamin77No ratings yet

- Letter ShowcauseDocument15 pagesLetter ShowcauseArifNo ratings yet

- Rubco Rubberised Coir Mattress Division (An Iso 9001:2008 Certified Company)Document1 pageRubco Rubberised Coir Mattress Division (An Iso 9001:2008 Certified Company)Thasreen sNo ratings yet

- Law of EquiDocument3 pagesLaw of EquiRahuldev MeherNo ratings yet

- State Wise Sales Analysis - GSNDocument15 pagesState Wise Sales Analysis - GSNPriyankaNo ratings yet

- CHT 4Document35 pagesCHT 4ferahNo ratings yet

- Pengaruh Risk Perception-Risk Tolerance-Overconfidence-dan Loss Aversion Terhadap Pengambilan Keputusan InvestasiDocument21 pagesPengaruh Risk Perception-Risk Tolerance-Overconfidence-dan Loss Aversion Terhadap Pengambilan Keputusan InvestasiAlvin ZhayyanNo ratings yet