Professional Documents

Culture Documents

Economic Survey

Economic Survey

Uploaded by

Mukesh MandalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Survey

Economic Survey

Uploaded by

Mukesh MandalCopyright:

Available Formats

Articles from General Knowledge Today

Economic Survey 2011-12: Quick Summary & Highlights

2012-03-16 10:03:03 GKToday

Economic Survey is an annual commentary on the state of the economy of India which is put together by Finance Ministry of India. It is a document which presents economic development during the course of the year. The draft of the survey is prepared by Department of Economic Affairs and cleared by Chief economic Advisor and the secretary Economic Affairs. The final version is vetted by Finance secretary and Finance Minister. Economic survey is presented every year shortly before presenting the Union Budget of Govt. of India. Economic Survey 2011-12 was presented by finance minister Pranab Mukherjee in Parliament on March 15, 2012. Here is a quick summary for all aspirants of all examinations. Important Figures: India's Economic Growth 6.9 per cent in the Fiscal 2011-12 7.6 percent (plus or minus 0.25 percent) in 2012-13 8.6 percent in 2013-14. Growth in Agriculture 2.5 % in Fiscal year 2011-12. Share of Agriculture, allied activities in GDP 13.9 % in FY 12 Production of food grains 250.42 million tones (FY 12) Food grains stocks 55.2 million tonnes Growth in Service Industry 9.4 %, in FY 12 (and its share in GDP stands at 59%). Industrial Growth To be 4-5% in FY 13 Central spending on social services 18.5% in FY 12 (It was 13.4% FY 07) Coverage of MGNREGA 5.49 Crore household (by 2011-12) Gross capital formation in Q3 of FY 12 as a ratio of GDP 30% (it was 32% in FY 11) Balance of Payments USD 32.8 Billion in first half of FY 12 (It was USD 29.6 Billion in FY 11) India's Forex Reserves USD 293 Billion, it was USD 305 Billion in March 2011 & USD 279 Billion in March 2010 Inflation Expected to moderate at 6.5-7% by March end Employment in Industry 21.9% in 2009-10 (in comparison to 16.2% in 1999-2000). Growth mainly due to construction sector. Growth in Basic goods and non-durables 6.1% Gross Capital Formation in industry 48.3% of overall GCF moderated in FY 11 Decline in Manufacturing GCF growth rate 7% in FY 11 Vs 42% in FY 10 Share of services in GDP 56.3% in FY 12 (it was 55.1% in FY 11) Share of Financial & non-financial services, IT, Telecom, Real Estate in Total FDI inflows

41.9 % (during April 2000-December 2011) Growth in trade, hotels and restaurants 11.2% Growth in FDI inflows in FY 12 (April-Dec) 36.8 % (stands at USD 9.3 billion) Growth in India's Exports (April 2011 - Jan 2012) 23.5% (stands at USD 242.8 Billion) Growth in India's Imports (April 2011 - Jan 2012) 29.4% (stands at USD 391.5 Billion) India's Largest Trading Partner United Arab Emirates (followed by China) Growth in India's Service Exports 17.1 & in H1 of FY 12 (It was 38.4 % @ USD 132.9 Billion in FY 11) Top performing Sectors in Export Petroleum and oil products, gems and jewellery, engineering, cotton fabrics, electronics, readymade garments, drugs Top performing Sectors in Import POL (petroleum, oil and lubricant), gold and silver. External Debt Stock USD 326 Billion Net capital flows USD 41.1 billion Share of Net Capital Flows in GDP 4.5% (in the H1 of FY 12) External commercial borrowing USD 10.6 billion (in H1 of FY 12) Trade Deficit as part of GDP More than 8% Current Account Deficit as part of GDP 3% (these two figures hint imbalance that is growing) Fall in Rupee against dollar 12.4 % (From 44.97 per USD in March 2011 to 51.34 per USD in January 2012) Total Investment in SEZ Rs. 2,49,630.80 crore (31 Dec. 2011) Number of Approved SEZ 583 (out of them 380 notified) Growth in Priority Sector Landing 19% Share of Computerised banks among all banks 96% Capital infused in public sector banks in 2012 Rs. 12,000 Crore Growth in bank credit extended by Scheduled Commercial Banks 17% Survey notes: Survey is optimistic about the fiscal consolidation and says that fiscal consolidation is likely to get back on track from 2012-13, when savings and capital formation will also begin to improve. High priority to Sustainable development and climate. Incorporates a new chapter this year. Global economic environment turns adverse since September 2011 due to Euro-zone crisis. Indian Economy slows down due to global as well as domestic factors. Recovery is slow , reason for slow recovery is decline in overall investment rate. Global economy seems to remain fragile. G-20 should make more efforts for global financial stability. India gets more closely integrated with the world economy India's foreign trade performance remained key driver of growth. Share of trade to GDP (of goods and services) in world tripled in 20 years (1990-2010). Inflation expected to moderate. Gap between WPI and CPI inflation narrows.

Consumption pattern main driver of food price inflation. Milk, eggs/meat/fish, gram & edible oils responsible. Monetary market remained orderly. RBI addressed the liquidity concerns of markets There are threats from asset price bubbles in real estate and stock markets Oild prices threat inflationary pressures. India has high level of food stocks , which shall help maintain overall price stability Industrial growth less than recent past and far below potential. Industrial sector expected to rebound during next financial year with inflation easing, moderation in commodities prices in international market and revival of manufacturing performance Contraction in production in the mining sector, particularly in coal and natural gas segments, improvement in electicity. Moderation in growth in other segments of IIP, Negative growth in capital goods and intermediates segment, Moderation in rate of growth of credit in infrastructure and manufacturing sectors. Services sector proves saviour during global crisis and hero of Economic Growth. It has slight moderation though, due to the steep fall in growth of public administration and defence services reflecting fiscal consolidation. India's Software service exports steady and face threat from Eurozone. Negative growth in Coal, Natural Gas, Fertilizers, handling of Export Cargo at airports and number of cell phone connections Low growth in steel. Credit growth to infrastructure sector turned negative There has been reduction in credit flow in power and telecom sectors. Foreign funding to remain sluggish. Equity and currency markets remained under pressure. Indian Banks have Robust fundamentals. Banking may become a risky business, thanks to global integration. Credit Disbursement to agro sector exceeded target by 19 %, 12.7 Million new farmers got farm credits. Self Help Group- bank linkage programme gets thumping success. Climate change, food security, water security, energy security and managing urbanization are main challenges. Recommendations: Inflation & Monetary Policy: Progressive deregulation of interest rates on savings accounts . Deregulation of interest rates on savings accounts to help raise financial savings and improve transmission of monetary policy. Domestic financial markets, especially corporate bond markets need deepening. There should be more efforts to attract dedicated infrastructure funds. There should be renewed focus on supply side measures essential for price stability There should be substantial Monetary policy challenge to rein-in inflation. There is a need to examine linkages between policy rate changes and inflation. There are threats from asset price bubbles in real estate and stock markets. To address them, RBI should further sharpen monetary policy. Recommendations: Agriculture Government should take measures for guiding farmers on fertilizers, insecticide, alternate cropping patterns, for price stability in food items. There should be regular imports of agriculture commodities in smaller quantities for price control. There should be special markets for special crops. Mandi Governance needs to be improved; interstate trade in agro commodities should be promoted. Perishable food items should be taken out of ambit of the APMC Act Survey thumbs up the FDI in multi brand retain , says it will fill infrastructure gap during harvest period Modern store facilities need to created for food grains. There should be adequate investment in R&D in Agriculture. Recommendations: Industry , Infrastructure & Exports Business sentiments should be boosted. There should be encouragement to investments and identify and wipe-out bottlenecks. Land acquisition and infrastructure issued should be dealt on priority basis.

Real estate ownership of dwellings and business services segment are worrisome segments. There should be further diversification of India's export basket. The procedural delays and red tape should be addresses to facilitate trade. Infrastructural bottlenecks need to be removed There is a need to attract large scale investment into infrastructure, looking at investment requirement at USD 1 trillion during Twelfth Plan. PPP has been a successful model, should be promoted in Infra segment. Sustainable levels of external debt should be maintained. Government should take innovative steps to bring corporate bond market at the centre stage. Government should promote the infrastructure financing and financing of unorganized micro/small business sectors. Recommendations: Climate Change Low carbon growth should be central element of 12th Five Year plan. India's per capita CO2 emissions much lower than those of developed countries, world needs more sensitivity from developed countries to carbon emissions.

You might also like

- Economic Analysis of India and Industry Analysis of Chemical IndustryDocument28 pagesEconomic Analysis of India and Industry Analysis of Chemical IndustrySharanyaNo ratings yet

- Proposed Report: Public FinancesDocument15 pagesProposed Report: Public FinancesChetan KhannaNo ratings yet

- Fundamental Analysis of TCSDocument15 pagesFundamental Analysis of TCSarupritNo ratings yet

- India Macro Presentation - Reliance Format Final 01Document27 pagesIndia Macro Presentation - Reliance Format Final 01nitesh chhutaniNo ratings yet

- Indian EconomyDocument12 pagesIndian Economyarchana_anuragiNo ratings yet

- Indian Economic Survey 2012Document10 pagesIndian Economic Survey 2012Krunal KeniaNo ratings yet

- Grant Thornton FICCI MSMEDocument76 pagesGrant Thornton FICCI MSMEIshan GuptaNo ratings yet

- State of EconomyDocument21 pagesState of EconomyHarsh KediaNo ratings yet

- KPMG Flash News Economic Survey 2010 11Document10 pagesKPMG Flash News Economic Survey 2010 11Neel GargNo ratings yet

- NagpalDocument21 pagesNagpalthakursahbNo ratings yet

- 2012 Budget PublicationDocument71 pages2012 Budget PublicationPushpa PatilNo ratings yet

- FMCG 1H10 IndustryDocument32 pagesFMCG 1H10 Industrycoolvik87No ratings yet

- Investment and Growth: 1.1 Contribution AnalysisDocument5 pagesInvestment and Growth: 1.1 Contribution AnalysisaoulakhNo ratings yet

- Slowdown of Global Economy Opportunity For India & ChinaDocument13 pagesSlowdown of Global Economy Opportunity For India & ChinaMitul Kirtania50% (2)

- Recent Development in Global Financial MarketDocument8 pagesRecent Development in Global Financial MarketBini MathewNo ratings yet

- Suyash Agarwal Research Report2023Document62 pagesSuyash Agarwal Research Report2023Lucky SrivastavaNo ratings yet

- Current Affairs 2012Document5 pagesCurrent Affairs 2012Indranil MandalNo ratings yet

- 2.1. Economic Analysis:: Boom Recovery Recession Depression Invest DisinvestDocument5 pages2.1. Economic Analysis:: Boom Recovery Recession Depression Invest DisinvestbatkiNo ratings yet

- MSMEs in IndiaDocument3 pagesMSMEs in IndianiyanmiloNo ratings yet

- Unit - 2 IBDocument6 pagesUnit - 2 IBAyush devdaNo ratings yet

- Getting To The Core: Budget AnalysisDocument37 pagesGetting To The Core: Budget AnalysisfaizanbhamlaNo ratings yet

- India Special Report - Assessing The Economic Impact of India's Real Estate Sector - CREDAI CBREDocument20 pagesIndia Special Report - Assessing The Economic Impact of India's Real Estate Sector - CREDAI CBRErealtywatch108No ratings yet

- Assignment On Fundamental Analysis of IdbiDocument11 pagesAssignment On Fundamental Analysis of IdbifiiimpactNo ratings yet

- Challenges and Coners of RbiDocument17 pagesChallenges and Coners of RbiParthiban RajendranNo ratings yet

- LenovoDocument84 pagesLenovoasifanis100% (1)

- GR Eco121Document20 pagesGR Eco121Nguyen Thi Nhung (K16HL)No ratings yet

- Economic Survey 2012Document20 pagesEconomic Survey 2012SandeepBoseNo ratings yet

- Performance ApppraidDocument81 pagesPerformance ApppraidManisha LatiyanNo ratings yet

- State of The Economy 2011Document8 pagesState of The Economy 2011agarwaldipeshNo ratings yet

- Summer Internship Report On LenovoDocument74 pagesSummer Internship Report On Lenovoshimpi244197100% (1)

- Bangladesh Quarterly Economic Update: September 2014From EverandBangladesh Quarterly Economic Update: September 2014No ratings yet

- Year GDPDocument9 pagesYear GDPishwaryaNo ratings yet

- India Union Budget 2013 PWC Analysis BookletDocument40 pagesIndia Union Budget 2013 PWC Analysis BookletsuchjazzNo ratings yet

- Ias Prelim 2011 Current Affairs Notes Economic Survey 2010 11Document13 pagesIas Prelim 2011 Current Affairs Notes Economic Survey 2010 11prashant_kaushal_2No ratings yet

- Bangladesh Quarterly Economic Update - March 2012Document28 pagesBangladesh Quarterly Economic Update - March 2012Asian Development BankNo ratings yet

- Interim Budget Speech of PchidambramDocument14 pagesInterim Budget Speech of PchidambramSankalp KumarNo ratings yet

- Indian EconomyDocument35 pagesIndian EconomyNeeraj ChadawarNo ratings yet

- Chapter 4 Policy ImperativesDocument8 pagesChapter 4 Policy ImperativesRituNo ratings yet

- Economy in The Last DecadeDocument42 pagesEconomy in The Last Decadedcs019No ratings yet

- Economic Slowdown and Macro Economic PoliciesDocument38 pagesEconomic Slowdown and Macro Economic PoliciesRachitaRattanNo ratings yet

- Sector-Wise Contribution of GDP of India: CIA FackbookDocument8 pagesSector-Wise Contribution of GDP of India: CIA FackbookPrakash VadavadagiNo ratings yet

- Indian Economy OverviewDocument3 pagesIndian Economy OverviewAkshar AminNo ratings yet

- GDP: Comparative Analysis: Submitted By: Jerin JoyDocument6 pagesGDP: Comparative Analysis: Submitted By: Jerin JoyJerin JoyNo ratings yet

- Kushal Jesrani 26 Research MethodologyDocument70 pagesKushal Jesrani 26 Research MethodologyKushal JesraniNo ratings yet

- India Market Report-2013Document15 pagesIndia Market Report-2013Chelladurai KrishnasamyNo ratings yet

- Fundamental Analysis of Airtel ReportDocument29 pagesFundamental Analysis of Airtel ReportKoushik G SaiNo ratings yet

- Helping You Spot Opportunities: Investment Update - August, 2013Document55 pagesHelping You Spot Opportunities: Investment Update - August, 2013akcool91No ratings yet

- Economic Growth of India and ChinaDocument4 pagesEconomic Growth of India and Chinaswatiram_622012No ratings yet

- Chapter 1: The Indian Economy: An OverviewDocument14 pagesChapter 1: The Indian Economy: An OverviewJaya NairNo ratings yet

- Fundamental AnalysisDocument8 pagesFundamental AnalysisJithin ManoharNo ratings yet

- Mets September 2010 Ver4Document44 pagesMets September 2010 Ver4bsa375No ratings yet

- Rakesh Mohan NotesDocument3 pagesRakesh Mohan Notesun3709579No ratings yet

- IndiaEconomicGrowth SDocument16 pagesIndiaEconomicGrowth SAmol SaxenaNo ratings yet

- Isc Economics Project 2Document15 pagesIsc Economics Project 2ashmit26007No ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

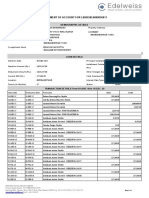

- 16 StatementofAccount LBHBSBL0000036011Document4 pages16 StatementofAccount LBHBSBL0000036011girija mohapatraNo ratings yet

- Genova Matter Opinion and OrderDocument6 pagesGenova Matter Opinion and OrderNewsdayNo ratings yet

- Tax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byDocument42 pagesTax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byahsanukkakarNo ratings yet

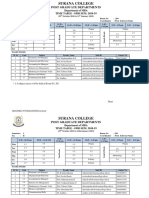

- Post Graduate Departments: Department of MBA Time Table - Odd Sem. 2018-19Document2 pagesPost Graduate Departments: Department of MBA Time Table - Odd Sem. 2018-19Divakar GowdaNo ratings yet

- Module 4-Operating, Financial, and Total LeverageDocument45 pagesModule 4-Operating, Financial, and Total LeverageAna ValenovaNo ratings yet

- Financial Reporting Standards CouncilDocument6 pagesFinancial Reporting Standards CouncilFrancis Jerome Cuarteros0% (1)

- Mutual Funds in IndiaDocument66 pagesMutual Funds in IndiaUtsav ThakkarNo ratings yet

- Contract Sounds and LightsDocument2 pagesContract Sounds and LightsHosting by Miss RuthNo ratings yet

- Pre Issue ManagementDocument19 pagesPre Issue Managementbs_sharathNo ratings yet

- Property, Plant and Equipment (IAS-16)Document2 pagesProperty, Plant and Equipment (IAS-16)Raneem BilalNo ratings yet

- Assignment FMDocument2 pagesAssignment FMKartik AhirNo ratings yet

- 10 Steps To Building A Winning Trading Plan PDFDocument8 pages10 Steps To Building A Winning Trading Plan PDFscreen1 record100% (1)

- Continental CarriersDocument10 pagesContinental Carriersnipun9143No ratings yet

- Money & BankingDocument46 pagesMoney & BankingAbdihakimNo ratings yet

- As Per Annexure Attached: MF DRF (Destatementization Request Form)Document3 pagesAs Per Annexure Attached: MF DRF (Destatementization Request Form)Mutual Fund JunctionNo ratings yet

- Dubai Islamic Bank January June 2021 SOCDocument26 pagesDubai Islamic Bank January June 2021 SOCAD ADNo ratings yet

- Full Download Test Bank For Auditing The Art and Science of Assurance Engagements Fourteenth Canadian Edition Plus Mylab Accounting With Pearson Etext Package 14th Edition PDF Full ChapterDocument36 pagesFull Download Test Bank For Auditing The Art and Science of Assurance Engagements Fourteenth Canadian Edition Plus Mylab Accounting With Pearson Etext Package 14th Edition PDF Full Chaptersiccaganoiddz6x100% (15)

- Acctng ProcessDocument4 pagesAcctng ProcessElaine YapNo ratings yet

- Numerology by MonthDocument8 pagesNumerology by Monthmaurice bertrandNo ratings yet

- 100 149 PDFDocument53 pages100 149 PDFSamuelNo ratings yet

- Investor PPPDocument43 pagesInvestor PPPGeraldNo ratings yet

- Energy Summit SampleDocument10 pagesEnergy Summit SampleVikramNo ratings yet

- CAIIB BRBL Marathon 1 PDF by ABDocument32 pagesCAIIB BRBL Marathon 1 PDF by ABAkshay SathianNo ratings yet

- Anatomy of A Stock PitchDocument15 pagesAnatomy of A Stock Pitchadm2143No ratings yet

- Partnership Accounts FormatDocument7 pagesPartnership Accounts FormatJamsheed Rasheed100% (1)

- Financial CIMA F3 CalculationsDocument23 pagesFinancial CIMA F3 CalculationsQasim DhillonNo ratings yet

- Report of The President B/A Keith D. Hill OCTOBER 2021Document29 pagesReport of The President B/A Keith D. Hill OCTOBER 2021Chicago Transit Justice CoalitionNo ratings yet

- Per Capita Income of BangladeshDocument5 pagesPer Capita Income of BangladeshRain StarNo ratings yet

- MERU SPORTS FIELDS BLANK BOQ FOR TENDER Main Works PDFDocument381 pagesMERU SPORTS FIELDS BLANK BOQ FOR TENDER Main Works PDFMADUHU KISUJA100% (1)

- BOLIVIA-BRAZIL GAS PIPELINE ReportDocument6 pagesBOLIVIA-BRAZIL GAS PIPELINE ReportnelsonmcamachoNo ratings yet