Professional Documents

Culture Documents

Grain Market Indicators

Uploaded by

r172214Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Grain Market Indicators

Uploaded by

r172214Copyright:

Available Formats

International Grains Council Conseil international des crales Consejo Internacional de Cereales GMI (08/09) 52 (24 June 2009)

IGC GRAIN MARKET INDICATORS

Week ending: Tuesday 23 June 2009

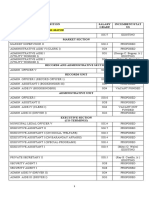

16 Jun 227 264 330 187d) 143 199 209 175d) 200d) 295d) 259 202 229d) 2,364

US: w heat futures - Jul

WHEAT

Export prices (fob, US$ per ton) Argentina (Up River) (New Crop) Australia ASW (Adelaide) Canada CWRS 13.5% (St. Law.) EU (UK) Feed grade EU (France) grade 1 a) EU (France) grade 1 EU (Germany) B quality Black Sea Feed Black Sea Milling US DNS 14% (PNW) US No 2 HRW 11.5% (Gulf) US No 2 SRW (ord) (Gulf) US No 2 SW (PNW) IGC Wheat Price Index b) Jan Jun Jun Jul Jul Jul Jul Jul Jul Jul Jul Jul Jul 23 Jun 225 264c) 324 183 140 196 207 150 180 294 251 203 227 2,302 year ago 433 204 318 324 503 365 276 398 3,359

c/b

750 700 650 600 550 500 10 11 12 15 16 17 18 19 22 23 CME KCBT MGE

c/b

CME (SRW) wheat futures

650 625 600 575 550 525 10 11 12 15 16 17 18 19 22 23 Jul Sep

a) Fob Rouen, euros/ton. b) As calculated by IGC for previous Friday. For composition, see Grain Market Report. c) 24 Jun quotation. d) Jun quotation.

Seasonal harvest pressure maintained a generally weak tone in world wheat markets in the past week, with expectations that global output would be the second highest on record. Futures in the US posted net declines, despite mixed results from the early stages of the winter wheat harvest. Combining advanced to 20% complete, compared with the five year average of 31%, with cutting in Kansas only 5% done compared with almost one-third normally. There were more reports of disease damage in SRW areas, while some disappointing protein levels were reported in HRW from Kansas. Slow harvesting had little impact on futures, with progress expected to accelerate amid much improved weather conditions. However the reports of quality problems continued to support export basis levels at the US Gulf, particularly SRW which traded at a premium to futures for the first time since mid-March. In Canada, widespread weekend rains brought some relief, but crops continue to significantly lag behind in development. Updated official estimates showed farmers planted slightly more spring wheat than expected, but less winter wheat and durum, with the all wheat area near unchanged from the year before, at 10.1m ha. However traders felt that the survey of farmers, which was conducted at the end of May, may not have taken account of recent adverse weather. In the EU, mostly favourable crop conditions and the early stages of harvest contributed to weaker prices. Values were also weighed by declines in the US and expectations for slow export demand due to good local harvests in North Africa and anticipated strong competition from Black Sea exports. Prices there were sharply lower as the new crop harvest commenced, with large old crop intervention stocks weighing on sentiment in Russia. Following recent quality problems with a shipment of Russian wheat, Egypt introduced new documentation and inspection requirements. Conditions in Argentina remained unfavourably dry and the Buenos Aires Grains Exchange further reduced its forecast of plantings to 2.96m ha, some 35% lower than the year before. Beneficial rains boosted prospects in Australia. Iraq bought 150,000 t milling wheat from Australia and 100,000 t from the US. Brazil was reported to have secured 50-100,000 t from Canada.

$ /t

US: w heat export prices

$ /t

300 275 250 225 200 175 10 11 12 15 16 17 18 19 22 23 SRW HRW

230 220 210 200 190

EU: w heat export prices

$ /t

340

Canada: w heat export price (CWB) CWRS 13.5% St. Law .

US $ 1 = Euro A ustralia $ Canada $ A rg. P eso

2 3 J un 0.71 4 1 .270 1 55 .1 3.784 2.01 5

16 J un 0.720 1 .249 1 31 .1 3.769 1 .946

330 320

10 11 12 15 16 17 18 19 22 23 France Germany

310 10 11 12 15 16 17 18 19 22 23

B razil Real

1 Canada Square, Canary Wharf, London E14 5AE Telephone 44 (0) 20 7513 1122, Fax 44 (0) 20 7513 0630, E-mail:igc-fac@igc.org.uk

IGC Grain Market Indicators - (GMI 08/09) 52

Page 2

c/b

MAIZE (CORN)

Export prices (fob, US$ per ton) US 3YC (Gulf) Argentina (Up River) Brazil (Paranagua) IGC Maize Price Index a) Jul Jul Jul 23 Jun 176 178 190 2,416 16 Jun 181 183 195 2,545 year ago 303 267 285 3,985

US: CME corn futures

455 430 405 380 10 11 12 15 16 17 18 19 22 23 Jul Sep

a) As calculated by IGC Secretariat for previous Friday. For index composition, see Grain Market Report.

US maize futures declined to a two-month low on Monday, pressured by favourable weather, weak technical features and some losses in outside markets. The market rebounded modestly yesterday, supported by a weaker US dollar and strong gains in soyabeans. Due to little fresh news, trading activity was often quiet, with many participants keenly awaiting USDAs Acreage and Grain Stocks reports on 30 June. On Friday, CME futures received some support from Informa Economics planted area forecast, which at 33.6m ha (34.8m), was 0.8m below USDAs projection. Weekly export sales data were also supportive, helping to limit overall losses on Thursday, with 2008/09 commitments 767,300 t higher, at 42.4m t (59.4m). New crop sales increased by 376,200 t. Maize crop condition ratings were unchanged from a week ago, at 70% good/excellent, up from last years 59%. Gulf premiums were moderately firmer but, with futures weaker, export prices were around $5 lower, at $176 fob. Exporters in Argentina reached an agreement with the government to buy up to 3m t of old crop maize in exchange for export permits for the same volume of new crop supplies. The Ag Secretariat reported that maize harvesting was 93% complete (90% year ago), with production expected to fall to 12.7m t (-38%) due to drought. Up River export prices were $5 lower, at around $178 fob. Domestic values in China were underpinned by slow farmer selling and tight nearby availabilities. The market continued to await news of maize sales from government stocks.

BARLEY

Export prices (fob, US$ per ton) EU (France) Feed (Rouen) Australia Feed (Adelaide) Black Sea Feed EU (France) Spring Malting Australia Malting Sloop (Adelaide) Canada Malting (St. Lawrence)

a) Jun quotation.

$ /t

EU: barley export prices

23 Jun Jul Jun Jul Jul Jun Jun 155 174 145 204 267

16 Jun 161a) 181 175a) 213a) 207 267

year ago 288 335 265 371 395

180 170 160 150 10 11 12 15 16 17 18 19 22 23 France Germany

Slow export demand pressured new crop barley prices in EU (France), quoted at $155. The market also had a weak tone in the Black Sea region with export prices placed at around $145 fob. In Australia, values declined by $7, to $174 fob (Adelaide). The official 2009 barley area forecast in Canada was reduced by 0.2m ha, to 3.6m (-6% year-on-year). US barley crop conditions were unchanged from last week, 80% rated good/excellent (74% year ago). In trade news, Israel is in the market today for 15,000 t feed barley.

OTHER GRAINS

Export prices (fob, US$ per ton) RYE EU (Germany) Feed SORGHUM US (Gulf) Argentina (Up River)

a) Jun quotation.

c/b

US: CME oats futures

23 Jun

16 Jun

year ago

280 260

Jun

240 220

Jul Jul

175 120

173a) 124a)

200

304 267

10 11 12 15 16 17 18 19 22 23 Jul Sep

Despite some occasional support from fund buying, nearby US oats futures declined by 5c/bu, to $2.08/bu ($143/t), pressured by weakness in other commodities. The crop was rated 56% good/excellent, slightly above last week, but below last years 66%. In Canada, 2009 area was officially forecast at 1.6m ha (-11% year-on-year), only marginally lower than the previous projection. In the US, sorghum was 87% planted (81% last year, 87% five-year ave.), with 57% rated good/excellent (50% last year). Export prices gained $2, to $175 fob (Gulf). Rye prices in Russia were nominally unchanged, at RUB3,250, with dollar export values down by $1, to $104, amid currency movements.

IGC Grain Market Indicators - (GMI 08/09) 52

Page 3

c/b

OILSEEDS

Export prices (fob, US$ per ton) SOYABEANS 2Y, US (Gulf) Argentina (Up River) Brazil (Paranagua) 23 Jun 16 Jun year ago

US: CME soyabean futures

1,275 1,225 1,175

Jul Jul Jul

461 442 449

467 450 445

579 544 561

1,125 1,075 10 11 12 15 16 17 18 19 22 23 Jul Aug

Nearby US CME soyabeans futures posted losses of around 2% in two-sided trade. Short covering and technical buying, together with better-than-expected weekly export sales and worries about tight supplies, initially underpinned a modest rally, with planting delays providing additional support to new-crop positions. However, gains were subsequently reversed by a bearish private plantings estimate, dollar gains, weaker outside markets and forecasts for improved crop weather, only partly recovered yesterday amid ideas that recent losses were overdone. Canadian canola futures were around 1% higher. Slow export demand weighed on market sentiment, but reports of a strong export line-up, slow farmer selling and crop concerns offered support. Statistics Canadas survey-based estimate of canola plantings was placed at 6.4m ha, some 0.3m higher than in its March intentions report, but still representing a decline of 2%, year-onyear. Elsewhere, EU (Euronext) rapeseed futures fell by 4%, to 295 (Aug). Malaysian palm oil futures ended lower, the nearby Jul contract down 5%, pressured mainly by concerns about slowing export demand and rising stocks.

RICE a)

Export prices (fob, US$ per ton) Thailand 100% Grade B Vietnam 5% Broken US No. 2, 4% India 25% Broken Pakistan 25% Broken Jun Jun Jun Jun Jun 23 Jun 577 400 531 365 16 Jun 573 395 537 372 year ago 790 813 785 700

c/cwt

US: CM E rough rice

1,300 1,275 1,250 1,225 1,200 10 11 12 15 16 17 18 19 22 23 Jul Sep

a) Provided, in part, by Jackson Son & Co (London) Ltd., other trader quotations and industry sources.

Concerns about tight supplies continued to support rice export prices in Thailand, as benchmark 100% B climbed by $4, to a three-month high of $577 fob, widening the premium over comparable grades at alternative origins. Export availabilities were significantly reduced by the governments late-May decision to delay indefinitely the sale of rice from state reserves. Although traders expect a fresh tender to be opened in August, exporters near-term worries have been compounded by the administrations expanded second-crop intervention scheme; the recently revised procurement target of 6m t is 2m higher than initially planned. In Vietnam, rice export prices were mixed, 5% broken offered slightly higher, at $400 fob, but still about $160 below equivalent quotations in Thailand. Trade sources indicated a strong pace of exports in June: shipments are expected to total 650,000 t, taking the cumulative 2009 total to 3.52m, up 36%, yearon-year. In trade news, Iraq bought 30,000 t long-grain supplies from Thailand, at $574 cif, with traders noting that negotiations were ongoing to take additional quantities from Vietnam/South America. In futures markets, nearby US CME rough rice ended near-unchanged in two-sided trade, with trading influenced by currency movements, developments in outside markets and crop concerns.

OCEAN FREIGHT RATES

US$ per ton (heavy grains) US Gulf to EU (B) (1) US Gulf to Japan (B) (1) (2) US Gulf to Korea, Rep (B) (1) Brazil to EU (A) (3)

1) Over 50,000 t. (2) Heavy grain. (3) 10-15,000 t.

Baltic Dry Index (BDI)

23 Jun 31.00 55.00 57.00 42.00

16 Jun 32.00 57.00 59.00 40.00

year ago 83.00 120.00 122.00 105.00

4,500 4,000 3,500 3,000 10 11 12 15 16 17 18 19 22 23

A slowdown in mineral demand, typical during the northern hemisphere summer months, pushed Capesize and Panamax rates lower. However, those in the Handysize sector mostly held steady, particularly in the south Atlantic and the Indian Ocean. The availability of large-tonnage vessels eased following a drop in enquiries for coal out of the US Gulf and the US east coast. Atlantic Panamax rates edged lower on limited transatlantic business and a build-up of tonnage. Grain business included a cargo from Brazil to China, for shipment in the first half of August, fixed at $49.00/t. Transatlantic roundtrips were quoted lower, at about $28,750 daily. In the timecharter sector, a one-year contract was settled at about $25,000 daily. Pacific rates were mostly steady, with roundtrips at around $22,700 daily. Capesize rates dipped on lower coal enquiries and excess tonnage, with the Baltic Exchanges average of four timecharter rates decreasing by 5.1%, to $83,257 daily. However, the major iron ore rate from Brazil to China was little changed at $45.35/t. Despite bearish sentiment in other market sectors, Atlantic Handysize rates were underpinned by shipments to SE Asia, particularly out of South America, which included a cargo at $25,000 daily. Shipments from the US Gulf included a fixture to Syria, also at about $25,000 daily, and a trip to Europe at $29,000 daily. In the Pacific, a cargo from Indias east coast to China was booked at a firm $21,000 daily. The Baltic Dry Index (BDI) fell by 1.9%, to 3,874.

The report is based on both official and trade sources. While every attempt is made to interpret information accurately, full reliability is not guaranteed. Comments and statistics are subject to regular revision. No part of this report may be reproduced without permission from, and attribution to, the International Grains Council. 2009

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nepalese Journal On Geo-Informatics Number 20Document108 pagesNepalese Journal On Geo-Informatics Number 20Tri Dev AcharyaNo ratings yet

- New Bio-Scientific Interpretations of The Eco-Economic Zootehnization of The Romanian Performing AgricultureDocument5 pagesNew Bio-Scientific Interpretations of The Eco-Economic Zootehnization of The Romanian Performing AgricultureCristi CîșlaruNo ratings yet

- Rural Marketing: M&M Tractors Vs TAFE TractorsDocument17 pagesRural Marketing: M&M Tractors Vs TAFE Tractorssiddharth_s91No ratings yet

- Maize Cultivation in Pakistan1Document8 pagesMaize Cultivation in Pakistan1Chudhary KhuShnoodNo ratings yet

- Action Plan For Gulayan Sa Paaralan 2022 2023Document3 pagesAction Plan For Gulayan Sa Paaralan 2022 2023Jef Vega86% (7)

- Microgreens, A Multimineral and Nutrient Rich FoodDocument6 pagesMicrogreens, A Multimineral and Nutrient Rich FoodLuna RuizNo ratings yet

- Borregro Ca: An Effective Soil Conditioner For Improved Crop GrowthDocument8 pagesBorregro Ca: An Effective Soil Conditioner For Improved Crop GrowthManuel ChireNo ratings yet

- Rijk Zwaan Convenience CatalogusDocument46 pagesRijk Zwaan Convenience CatalogusSteven MananguNo ratings yet

- Population ExplosionDocument52 pagesPopulation ExplosionusmansherdinNo ratings yet

- Recommendations For Layout, Design and Construction of Greenhouse StructuresDocument10 pagesRecommendations For Layout, Design and Construction of Greenhouse StructuresCgpscAspirantNo ratings yet

- Feasibility by AGROTECH CholistanDocument75 pagesFeasibility by AGROTECH CholistanfcspvtltdNo ratings yet

- Landscape Design Portfolio.Document27 pagesLandscape Design Portfolio.NIKHIL SOLANKINo ratings yet

- WaterFootprint Presentation GeneralDocument103 pagesWaterFootprint Presentation GeneralSaviNo ratings yet

- Assessment of Biomass Fuel Resource Potential and Utilization in Ethiopia: Sourcing Strategies For Renewable EnergiesDocument9 pagesAssessment of Biomass Fuel Resource Potential and Utilization in Ethiopia: Sourcing Strategies For Renewable EnergiesAddisu DagneNo ratings yet

- AGR662 Topic 12 & 13-Tobacco and KenafDocument36 pagesAGR662 Topic 12 & 13-Tobacco and KenafSiti RabiatulNo ratings yet

- Cengkeh (Syzygium Aromaticum)Document5 pagesCengkeh (Syzygium Aromaticum)Odi Gita Nasution PradanaNo ratings yet

- Soil SSCDocument11 pagesSoil SSCvkjha623477No ratings yet

- For Reference Only: Position Salary Grade Incumbent/Stat US I. Office of The Municipal MayorDocument19 pagesFor Reference Only: Position Salary Grade Incumbent/Stat US I. Office of The Municipal MayorAimee LopezNo ratings yet

- Aquaponics DesignDocument74 pagesAquaponics Designwilliam_pepito100% (8)

- Complete Report - Docx KSCST 41S - B - BE - 026 PDFDocument96 pagesComplete Report - Docx KSCST 41S - B - BE - 026 PDFShiva PrasadNo ratings yet

- ResearchDocument22 pagesResearchRANRIANo ratings yet

- Pre Assessment TestDocument5 pagesPre Assessment TestNichole Kyla EnriquezNo ratings yet

- Forest Resources in IndiaDocument4 pagesForest Resources in Indiaahemad_ali10No ratings yet

- Vermiculture ReportDocument22 pagesVermiculture ReportMd TauqeerNo ratings yet

- On GMO: A Research PaperDocument11 pagesOn GMO: A Research PaperTao DoNo ratings yet

- Influence of Lime ...Document7 pagesInfluence of Lime ...Luna EléctricaNo ratings yet

- 08 1 Karydas1Document14 pages08 1 Karydas1Lotfi Kazi-TaniNo ratings yet

- Orchard DesignDocument28 pagesOrchard DesignMarilou TagarinoNo ratings yet

- Economics of Vertical FarmingDocument21 pagesEconomics of Vertical FarmingKevin Anthony OndunaNo ratings yet

- MSP (2023-24)Document9 pagesMSP (2023-24)Pranav SurwaseNo ratings yet