Professional Documents

Culture Documents

Profitability Analysis: Warren D. Seider University of Pennsylvania Philadelphia, Pennsylvania Holger Nickisch Consultant

Uploaded by

Maryjean Almodiel InfornonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profitability Analysis: Warren D. Seider University of Pennsylvania Philadelphia, Pennsylvania Holger Nickisch Consultant

Uploaded by

Maryjean Almodiel InfornonCopyright:

Available Formats

PRODUCT and PROCESS DESIGN

LECTURE 07

Profitability Analysis

Warren D. Seider University of Pennsylvania Philadelphia, Pennsylvania Holger Nickisch Consultant

Approximate Measures of Economic Goodness

Total Production Cost

S-C

Usually

Return on Investment (ROI) =

Annual Earnings (Pretax or After - tax) C TCI

C TPI + C WC

Assume 330 days of operation 330/365 = 0.9041 = operating factor Project production First year 1/2 0.9 capacity Second year - 3/4 0.9 capacity Third year - 1.0 0.9 capacity Income Tax = 0.37 Pretax Earnings After-tax Earnings = Pretax Earnings Income Tax = 0.63 Pretax Earnings

For ROI

Profitability Analysis

Warren D. Seider, University of Pennsylvania

PRODUCT and PROCESS DESIGN

LECTURE 07

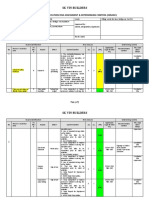

Cost Sheet Outline Table 17.1 (SSL, 2004)

Profitability Analysis

Cost Sheet Outline Table 17.1 (SSL, 2004) Contd.

Profitability Analysis

Warren D. Seider, University of Pennsylvania

PRODUCT and PROCESS DESIGN

LECTURE 07

Working Capital

CWC = cash reserves + inventory + accts. receivable - accts. payable

30 days of raw materials, utilities, operation, maintenance, . . . 7 days of liquid and solid products at sales price (gases are pipelined) 30 days of products at sales price 30 days of feedstocks

CTCI = CTPI + CWC

Profitability Analysis

Approximate Measures Table 17-4 (SSL, 2004) Time value of money ignored straight-line depreciation used

Profitability Analysis

Warren D. Seider, University of Pennsylvania

PRODUCT and PROCESS DESIGN

LECTURE 07

To obtain more accurate assessments of financial goodness, cash flows are computed for each year of the project. Plant Construction Annual cash flow = - f CTDC CWC - Cland Operation Pretax earnings = S CExcl. dep D Income Tax = 0.37 Pretax earnings

Use MACRS depreciation

After-tax earnings = Pretax earnings Income tax = 0.63(S CExcl. dep D) Ann. cash flow = After-tax earnings + D - f CTDC CWC Cland + = 0.63(S CExcl. Dep) + 0.37D - f CTDC CWC Cland + Profitability Analysis

7

Modified Accelerated Cost Recovery System MACRS Tax Basis Depreciation Table 17-4 (SSL, 2004)

Profitability Analysis

Warren D. Seider, University of Pennsylvania

PRODUCT and PROCESS DESIGN

LECTURE 07

Example 15 yr project life CTDC = $90MM, installed over three years (1997-1999) CWC = $40MM At 90% of capacity (3rd yr and later) S = $150MM/yr (1st yr = $75MM, 2nd yr = $113MM)

CExcl. Dep = $100MM/yr (1st yr = $55MM, 2nd yr = $78MM)

Profitability Analysis

Profitability Analysis

10

Warren D. Seider, University of Pennsylvania

PRODUCT and PROCESS DESIGN

LECTURE 07

Profitability Analysis

11

Profitability Analysis-1.1.xls by Holger Nickisch See Section 17.8 (SSL, 2004) Aligned with specifications and format of Chapters 16 and 17 in SSL, 2004. Extensive Visual BASIC (VBA) programming is used to reduce most common sources of error when setting up a complicated spreadsheet in EXCEL. Data is entered in dialog boxes and output is formatted on presentable pages. The user need not know VBA. Login dialog box enter user name - student password - engineer Start New Analysis or Load Existing Analysis Profitability Analysis

12

Warren D. Seider, University of Pennsylvania

PRODUCT and PROCESS DESIGN

LECTURE 07

Monochlorobenzene Separation Process

Profitability Analysis

13

From ASPEN PLUS simulation (file MCB.bkp): MCB product (S14) 5,572.1 lb/hr - $0.54/lb Feed stream (S01) 9,117.1 lb/hr - $0.30/lb Benzene by-product (S11) 3,132.7 lb/hr - $0.15/lb High pressure steam Cooling water Electricity Purchase Costs Absorber Distil. Column Heat Exchangers Flash & Storage Pumps 1365.5 lb/hr - $0.004/lb 129,270 lb/hr $0.000006/lb 9.6 kW - $0.04/kWhr Bare Module Factor 4.16 4.16 3.17 4.16 3.3

14

Purchase Cost $29,900 115,600 11,900 87,200 5,000

Profitability Analysis

Warren D. Seider, University of Pennsylvania

PRODUCT and PROCESS DESIGN

LECTURE 07

Working Capital Inventory MCB product Feed Accounts Receivable 4 days 2 days 30 days

Note: Defaults in spreadsheet are recommended in Chapters 16 and 17 (SSL, 2004) Solution is provided in Section 17.8 Student Assignment Exercise 17.21 Toluene hydrodealkylation process Profitability Analysis

15

Warren D. Seider, University of Pennsylvania

You might also like

- Iso 1328-1 - Cylindrical - GearsDocument58 pagesIso 1328-1 - Cylindrical - Gearsmauriciovendramin100% (2)

- Hirarc Bridge ConstructionDocument9 pagesHirarc Bridge ConstructionAdib Ikhwan100% (3)

- Colorscope CaseDocument11 pagesColorscope CaseJohn100% (1)

- Eva (C/SCSC) and Basics of Project ControlDocument60 pagesEva (C/SCSC) and Basics of Project ControleviroyerNo ratings yet

- Handbook of BudgetingFrom EverandHandbook of BudgetingWilliam R. LalliNo ratings yet

- Production and Cost FunctionDocument42 pagesProduction and Cost FunctionHealthEconomics_USaNNo ratings yet

- Advanced AutoCAD® 2017: Exercise WorkbookFrom EverandAdvanced AutoCAD® 2017: Exercise WorkbookRating: 1 out of 5 stars1/5 (1)

- Case Study Safety Instrumented Burner Management System Si BmsDocument16 pagesCase Study Safety Instrumented Burner Management System Si Bmsrayhantitho100% (1)

- 15.963 Management Accounting and Control: Mit OpencoursewareDocument11 pages15.963 Management Accounting and Control: Mit OpencoursewarePrachi TulsyanNo ratings yet

- 4 - EVN Project Monitoring & ControlDocument28 pages4 - EVN Project Monitoring & ControlYuvasri BalanNo ratings yet

- Insulator and Conductor Fittings For Overhead Power Lines - : Part 1: Performance and General RequirementsDocument26 pagesInsulator and Conductor Fittings For Overhead Power Lines - : Part 1: Performance and General RequirementsMohamed Ahmed Afifi100% (1)

- Statistical Thinking: Improving Business PerformanceFrom EverandStatistical Thinking: Improving Business PerformanceRating: 4 out of 5 stars4/5 (1)

- Kpi For Design TeamDocument23 pagesKpi For Design TeamGiap le Dinh100% (1)

- Earned Value Professional (EVP) Sample ExaminationDocument5 pagesEarned Value Professional (EVP) Sample ExaminationMohammad Shoaib Danish100% (1)

- Principles of Managerial Finance Chapter 10Document13 pagesPrinciples of Managerial Finance Chapter 10vireu100% (3)

- ch10 Project Monitoring & ControlDocument29 pagesch10 Project Monitoring & ControlLucky Luke100% (1)

- ColorscopeDocument11 pagesColorscopeabhishekbehal50120% (1)

- 13 Cost Benefit AnalysisDocument13 pages13 Cost Benefit AnalysisJimmy CaneNo ratings yet

- Data Center DesignDocument36 pagesData Center DesignKunjan Kashyap0% (1)

- Project MonitoringDocument24 pagesProject MonitoringhibonardoNo ratings yet

- Earned Value Project Management (Fourth Edition)From EverandEarned Value Project Management (Fourth Edition)Rating: 1 out of 5 stars1/5 (2)

- Materials Engineer Examination With Answers SET1 PDFDocument24 pagesMaterials Engineer Examination With Answers SET1 PDFArmie May Rico100% (1)

- Using The ADMIRALTY Vector Chart Service With The JRC ECDIS - JAN-7201/9201Document29 pagesUsing The ADMIRALTY Vector Chart Service With The JRC ECDIS - JAN-7201/9201Harman Sandhu100% (1)

- VI. Capital Budgeting Under Certainty: Professors Simon Pak and John ZdanowiczDocument56 pagesVI. Capital Budgeting Under Certainty: Professors Simon Pak and John ZdanowiczSonal Power UnlimitdNo ratings yet

- Hyperion Planning Start and Stop ProceduresDocument9 pagesHyperion Planning Start and Stop ProceduresCaio Leonardo LimaNo ratings yet

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Chapter 5 Project Monitoring and ControlDocument30 pagesChapter 5 Project Monitoring and ControlYonas YGNo ratings yet

- W38B New Bolts For Charge Air CoolerDocument3 pagesW38B New Bolts For Charge Air CoolerD.PoljachihinNo ratings yet

- Project Monitoring & ControlDocument29 pagesProject Monitoring & Controlsammyscr0% (1)

- 5 DCN - Design Change NoticeDocument10 pages5 DCN - Design Change NoticeZoebairNo ratings yet

- Integrated Cost and Schedule Control in Project ManagementFrom EverandIntegrated Cost and Schedule Control in Project ManagementRating: 2 out of 5 stars2/5 (1)

- CR 13045 PIER R00 Calculation ReportDocument11 pagesCR 13045 PIER R00 Calculation Reportmusiomi2005No ratings yet

- Waterway Continuous Problem WCPDocument17 pagesWaterway Continuous Problem WCPAboi Boboi50% (4)

- Depreciation CH 10Document40 pagesDepreciation CH 10احمد عمر حديدNo ratings yet

- Keeping Projects Under Control Project Control: Planning and Control The Control LoopDocument8 pagesKeeping Projects Under Control Project Control: Planning and Control The Control LoopAmit GandhiNo ratings yet

- Earned Value ManagementsDocument43 pagesEarned Value Managementsadityavicky1No ratings yet

- Design of 6 Sigma in MatlabDocument18 pagesDesign of 6 Sigma in MatlabrealpaladinNo ratings yet

- Cash Flows and Other Topics in Capital Budgeting Chap 10Document25 pagesCash Flows and Other Topics in Capital Budgeting Chap 10Allison EvangelistaNo ratings yet

- EV A Gentle Introduction To Earned Value Management SystemDocument33 pagesEV A Gentle Introduction To Earned Value Management Systema_sarfarazNo ratings yet

- Product Development Processes: Prof. Olivier de WeckDocument43 pagesProduct Development Processes: Prof. Olivier de Wecksamknight2009No ratings yet

- Present Value, Discounted Cash Flow. Engineering Economy: ObjectiveDocument6 pagesPresent Value, Discounted Cash Flow. Engineering Economy: ObjectiveColin HoffmanNo ratings yet

- Software Quality Assurance: Estimating Duration and CostDocument34 pagesSoftware Quality Assurance: Estimating Duration and Costpamalandi1No ratings yet

- Case Studies in Engineering Economics For Electrical Engineering StudentsDocument6 pagesCase Studies in Engineering Economics For Electrical Engineering Studentsryan macutoNo ratings yet

- Asignment Chapter 10Document6 pagesAsignment Chapter 10Thi Khanh Linh PhamNo ratings yet

- Chapter 2 - Project SelectionDocument24 pagesChapter 2 - Project SelectionHuyền TrangNo ratings yet

- Payroll Remittance Six Sigma Case StudyDocument2 pagesPayroll Remittance Six Sigma Case StudySteven BonacorsiNo ratings yet

- Project Monitoring and ControlDocument29 pagesProject Monitoring and ControlNivi SenthilNo ratings yet

- EvmDocument26 pagesEvmKaran DoshiNo ratings yet

- Prelim DataDocument10 pagesPrelim DatajerrenjgNo ratings yet

- Personal Assignment 4 Session 8Document8 pagesPersonal Assignment 4 Session 8Windi ArmandaNo ratings yet

- Lab Manual # 12: Title: C++ Nested StructuresDocument7 pagesLab Manual # 12: Title: C++ Nested StructuresUsama SagharNo ratings yet

- 11W-Ch 10&11 Capital Budget Basics & CF Estimation-2011-12-SkraćenoDocument38 pages11W-Ch 10&11 Capital Budget Basics & CF Estimation-2011-12-SkraćenoRachel PalosNo ratings yet

- Engineering Econs - Project AnalysisDocument15 pagesEngineering Econs - Project AnalysisClarence AG YueNo ratings yet

- Breakeven AnalysisDocument17 pagesBreakeven AnalysisRama KrishnanNo ratings yet

- Capital BudgetingDocument66 pagesCapital BudgetingAli KhanNo ratings yet

- Chapter 13 Capital BudgetingDocument60 pagesChapter 13 Capital BudgetinggelskNo ratings yet

- MGMT Sample ExamDocument9 pagesMGMT Sample ExamKenny RodriguezNo ratings yet

- Prepared BY: ـهمعـط دمحـم ـهيـناـد Dr: نسحلا نيساي: Student - NoDocument36 pagesPrepared BY: ـهمعـط دمحـم ـهيـناـد Dr: نسحلا نيساي: Student - NoSTNo ratings yet

- Chapter 8 - Capital Budgeting Analysis - NPV and Other MethodsDocument71 pagesChapter 8 - Capital Budgeting Analysis - NPV and Other MethodsMadhav Chowdary TumpatiNo ratings yet

- 15 Pengendalian Biaya 2Document15 pages15 Pengendalian Biaya 2FuadNo ratings yet

- Ch03 - Project ManagementDocument30 pagesCh03 - Project ManagementKajek FirstNo ratings yet

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRhonita Dea AndariniNo ratings yet

- Service Systems Management and Engineering: Creating Strategic Differentiation and Operational ExcellenceFrom EverandService Systems Management and Engineering: Creating Strategic Differentiation and Operational ExcellenceNo ratings yet

- Assignment 2 2022 UseDocument2 pagesAssignment 2 2022 UseDICKSON SIMUTAMINo ratings yet

- Technology of Machine ToolsDocument22 pagesTechnology of Machine Toolsaqsa_munirNo ratings yet

- Audiobahn Awes EternalDocument17 pagesAudiobahn Awes EternalSalvador González SánchezNo ratings yet

- TallyDocument4 pagesTallyHarini AivarnaduNo ratings yet

- Focus On Cycling: Copenhagen Guidelines For The Design of Road ProjectsDocument13 pagesFocus On Cycling: Copenhagen Guidelines For The Design of Road ProjectsNadia Agni SheillaNo ratings yet

- Evolution-L Tech DataDocument12 pagesEvolution-L Tech DataDaniel SanguinéNo ratings yet

- Presentación Planos Lopilato Buble Municipalidad de BurnabyDocument8 pagesPresentación Planos Lopilato Buble Municipalidad de BurnabyManuelaNo ratings yet

- It Lecture 1Document42 pagesIt Lecture 1Georges Abou HaydarNo ratings yet

- Lecture 02: The Waterfall Model: Course Leader(s) : Ms - Sahana.P.ShankarDocument11 pagesLecture 02: The Waterfall Model: Course Leader(s) : Ms - Sahana.P.ShankarPritam DasNo ratings yet

- What-Is-A-Watershed-Webquest StudentworksheetDocument5 pagesWhat-Is-A-Watershed-Webquest Studentworksheetapi-264283755No ratings yet

- Diesel Injection System Naturally AspiratedDocument346 pagesDiesel Injection System Naturally AspiratedGreg Hanna100% (1)

- Assuming That All The Elements of Epicyclic Gear Train Are Moving atDocument15 pagesAssuming That All The Elements of Epicyclic Gear Train Are Moving atMuhammad FarhalNo ratings yet

- Aryabhatta International School, Barnala: Time: 2 Hours Class: 5thDocument2 pagesAryabhatta International School, Barnala: Time: 2 Hours Class: 5tharunNo ratings yet

- Series B ROOTS Meters Repair ProceduresDocument28 pagesSeries B ROOTS Meters Repair ProceduresVeronicaNo ratings yet

- Getting Started With Oracle APEX 4 On Oracle Database 11g Express EditionDocument7 pagesGetting Started With Oracle APEX 4 On Oracle Database 11g Express EditionbobysiswantoNo ratings yet

- John Moffat - Quantum Measurements, Non Locality, and The Arrow of TimeDocument8 pagesJohn Moffat - Quantum Measurements, Non Locality, and The Arrow of Timedelenda3No ratings yet

- Technical ResumeDocument6 pagesTechnical Resumelildee64No ratings yet

- PWD Tinuvin 326Document2 pagesPWD Tinuvin 326sriNo ratings yet

- TDS (Specialties) SolcutDocument1 pageTDS (Specialties) SolcutD Wahyu BawonoNo ratings yet

- SSPC Guia 10Document8 pagesSSPC Guia 10Rony RuizNo ratings yet

- Scrollable and Non-Scrollable CursorsDocument12 pagesScrollable and Non-Scrollable CursorsHotPriyu OnlyforgalsNo ratings yet

- What Is Difference Between Upper and Lower Yield PointDocument4 pagesWhat Is Difference Between Upper and Lower Yield PointكنوزخطابNo ratings yet