Professional Documents

Culture Documents

Thesun 2009-06-22 Page14 Measat Targetsrm355m Revenue Next Four Years

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-06-22 Page14 Measat Targetsrm355m Revenue Next Four Years

Uploaded by

Impulsive collectorCopyright:

Available Formats

14 theSun | MONDAY JUNE 22 2009

business

Measat targets RM355m

revenue next four years

MOSCOW: Measat Satellite which has spent RM1.6 billion to provide more channels to its million MEASAT-3a. Satellites

Systems Sdn Bhd is targeting to in the last four to five years, was customers while expanded serv- have a 15-year life mission.

reap a higher revenue of US$100 looking to launch joint venture ices would be available for clients “In our industry, we can’t be a

million (RM355 million) annually satellites with partners who could such as Telekom Malaysia, Maxis small player because of the huge

in the next three to four years, up bring in capital and in the process and Celcom. capital investments. We need to

from US$60 million last year with “spread our risks.” “They will have the ability to be a big player but the good thing

the launch of MEASAT-3 and MEASAT-3 launched in 2006 provide more communication is that MEASAT-3 and MEASAT-

MEASAT-3a satellites. and MEASAT-3a which was services to more customers,” he 3a have a very strong customer

Its chief operating officer Paul J launched today at 5.30am Ma- said. base.”

Brown-Kenyon said the company laysian time from the Baikonur Brown-Kenyon said the “Beyond MEASAT, we are

also has revenue of US$600 mil- Cosmodrome “will expand the US$165 million MEASAT-3a looking always to grow the busi-

lion which would be raked in business,” he told journalists here would be operational possibly by ness.

from contracts ranging from three, on Saturday. end-July or even earlier and then “We are looking at Africa as

five and 15 years. This means that MEASAT’s sis- would start serving customers. a region and we are at the mo-

He also said that the company ter company Astro would be able “Two satellites give us an ment discussing with a number

enormous amount of peace of of partners about doing joint

mind as we would be able to ex- venture satellites in that part of

pand our capacity and deal with the region.”

redundancy issues associated He said Measat was mulling

with old satellites,” he said. joint venture satellites as the

He said MEASAT-3 was strong customer base, which

close to full capacity in terms means the capacity in the two

of take while Astro had already MEASAT satellites would be used

booked half of the transponders up quickly.

on MEASAT-3a which means “We have access to 17 orbital

new services, new channels and slots throughout the world and

increased content. each allowing a satellite to be

Asked when Measat could launched into a new region,” said

recoup its earnings for the new Brown-Kenyon.

satellite, he said that investments “We are in a growth phase

and costs in the satellite business and we have very successfully

would dilute earnings in the next built up a strong Malaysian base

12 to 18 months. and growing regionally in India,

“But after that, revenue goes Indonesia, with good broadcast

up.” customers such as British

In terms of payback, he said Broadcasting Corporation (BBC),

that it would take about six to National Geographic and History

seven years to pay for the US$165 Channel.” — Bernama

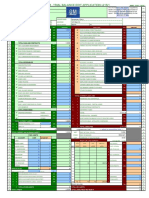

KL market summary

JUNE 19, 2009

INDICES CHANGE

FBMEMAS 7098.53 36.37

COMPOSITE 1059.50 5.09

INDUSTRIAL 2354.05 25.82

CONSUMER PROD 318.32 -0.36

INDUSTRIAL PROD 84.75 0.77

CONSTRUCTION 200.36 -0.78

TRADING SERVICES 140.29 0.93

FINANCE 8493.70 82.25

PROPERTIES 707.46 -17.14

PLANTATION 5328.63 4.40

MINING 275.60 0.00

FBMSHA 7325.65 24.10

FBM2BRD 4814.15 6.99

TECHNOLOGY 14.22 -0.23

Honda

TURNOVER VALUE

sticks to

1.353bil RM1.522bil

its guns

pg 16

Prices expected to trade

sideways this week

SHARE prices on Bursa Malaysia are likely

to trade sideways this week as investors

remain uncertain over the state of the

economy, dealers said.

MIMB Investment Bank’s senior analyst

Rosnani Rasul said the market is in for a

bumpy ride this week on traders’ pessimis-

tic view that recovery is likely to be slow.

“The market reacts to whatever news

there are, and there will be good news and

bad news along the way,” she said.

However, Rosnani said it would be good

if the market could correct itself further,

down to the 1,000-point level.

“The economic indicators now are still

not good. So the market should go for

further correction before it can gain the

momentum to rally,” she said.

Rosnani expects the immediate support

to be at 1,040 and lower support at 1,000

with the immediate resistance at 1,075 and

lower resistance at 1,100 this week.

On a Friday-to-Friday basis, the KLCI

closed the week 29.46 points lower at

1,059.5 compared to the previous week’s

closing of 1,090.15. — Bernama

You might also like

- Thesun 2009-08-13 Page16 Maxis Likely To Relist in Its Entirety Says Ecm LibraDocument1 pageThesun 2009-08-13 Page16 Maxis Likely To Relist in Its Entirety Says Ecm LibraImpulsive collectorNo ratings yet

- TheSun 2009-03-20 Page14 Celcom Eyes 120pct Broadband Subscriber GrowthDocument1 pageTheSun 2009-03-20 Page14 Celcom Eyes 120pct Broadband Subscriber GrowthImpulsive collector100% (2)

- ThebattleforC BandDocument4 pagesThebattleforC BandMitesh VardhanNo ratings yet

- Thesun 2009-07-09 Page16 B-Land Raises rm190m From Btoto PlacementDocument1 pageThesun 2009-07-09 Page16 B-Land Raises rm190m From Btoto PlacementImpulsive collectorNo ratings yet

- TheSun 2009-09-04 Page11 Epf q2 Investment Income Is Rm4.8bDocument1 pageTheSun 2009-09-04 Page11 Epf q2 Investment Income Is Rm4.8bImpulsive collectorNo ratings yet

- Thesun 2009-06-17 Page14 Malaysia Set To Register Positive Growth in q4Document1 pageThesun 2009-06-17 Page14 Malaysia Set To Register Positive Growth in q4Impulsive collectorNo ratings yet

- TheSun 2008-11-24 Page18 Commercial Radio Rides The High WavesDocument1 pageTheSun 2008-11-24 Page18 Commercial Radio Rides The High WavesImpulsive collectorNo ratings yet

- Fss Operators: Benchmarks & Performance ReviewDocument7 pagesFss Operators: Benchmarks & Performance ReviewhasanmuskaanNo ratings yet

- TheSun 2009-09-10 Page14 Btotos q1 Pre-Tax Profit Up 8.8pctDocument1 pageTheSun 2009-09-10 Page14 Btotos q1 Pre-Tax Profit Up 8.8pctImpulsive collectorNo ratings yet

- Herald Sun 20230607Document1 pageHerald Sun 20230607Promo RichieNo ratings yet

- Guerster 22 ADocument15 pagesGuerster 22 Astephane alestraNo ratings yet

- VSAT Marketbrief 2019Document8 pagesVSAT Marketbrief 2019martie poNo ratings yet

- Thesun 2009-07-20 Page14 Tax Returns Growth Still Positive Says Irb ChiefDocument1 pageThesun 2009-07-20 Page14 Tax Returns Growth Still Positive Says Irb ChiefImpulsive collectorNo ratings yet

- Cox CommunicationsDocument29 pagesCox CommunicationsCat100% (5)

- RHB Equity - 4 May 2010 (Construction, Semiconductor, Kencana, Daibochi, Hunza Technical: Proton)Document4 pagesRHB Equity - 4 May 2010 (Construction, Semiconductor, Kencana, Daibochi, Hunza Technical: Proton)Rhb InvestNo ratings yet

- Thesun 2009-07-06 Page14 Too Costly For Govt To Take Over Toll Roads AnalystsDocument1 pageThesun 2009-07-06 Page14 Too Costly For Govt To Take Over Toll Roads AnalystsImpulsive collectorNo ratings yet

- Thesun 2009-02-11 Page15 Scomi To Earn rm120m From Monorail O&mDocument1 pageThesun 2009-02-11 Page15 Scomi To Earn rm120m From Monorail O&mImpulsive collectorNo ratings yet

- Satellite Life Extension: Servicing Satellites in Space: Orbital ATK To Test MEV in 2018Document4 pagesSatellite Life Extension: Servicing Satellites in Space: Orbital ATK To Test MEV in 2018neerajhNo ratings yet

- Starkville Dispatch Eedition 7-29-20Document16 pagesStarkville Dispatch Eedition 7-29-20The DispatchNo ratings yet

- 3G WaveDocument1 page3G WavePooja Kulkarni NazareNo ratings yet

- RHB Equity 360° (Kencana Technical: Maybank) - 20/04/2010Document3 pagesRHB Equity 360° (Kencana Technical: Maybank) - 20/04/2010Rhb InvestNo ratings yet

- Maxis Market ShareDocument4 pagesMaxis Market Sharenur atiq0% (1)

- Asncorp-Investment Summary-Final-08142018 - 2 PDFDocument38 pagesAsncorp-Investment Summary-Final-08142018 - 2 PDFNick Hamasholdin AhmadNo ratings yet

- Case Write-Up On Komatsu KomtraxDocument1 pageCase Write-Up On Komatsu KomtraxSAMRIDHINo ratings yet

- The Edge 07 December 2023Document27 pagesThe Edge 07 December 2023flpflpNo ratings yet

- Morning: TNB To Invest RM90 Bil For Grid in Next Six Years, Says CEODocument24 pagesMorning: TNB To Invest RM90 Bil For Grid in Next Six Years, Says CEOQuint WongNo ratings yet

- Maxis PI Response 1Document16 pagesMaxis PI Response 1Sarah AriffNo ratings yet

- Thesun 2009-04-02 Page12 WCT Eyes Rm1bil Projects in Msia MideastDocument1 pageThesun 2009-04-02 Page12 WCT Eyes Rm1bil Projects in Msia MideastImpulsive collectorNo ratings yet

- Aishah Seacable NEWDocument1 pageAishah Seacable NEWAishah MustaphaNo ratings yet

- Malaysia AirlinesDocument5 pagesMalaysia AirlinesLeonard LowNo ratings yet

- RHB Equity 360° (KFC, SP Setia Technical: WTK) - 30/03/2010Document3 pagesRHB Equity 360° (KFC, SP Setia Technical: WTK) - 30/03/2010Rhb InvestNo ratings yet

- CBM Asia Upstream Sept 25 2009 - PG - 49 - 2Document1 pageCBM Asia Upstream Sept 25 2009 - PG - 49 - 2Marthen TangkeNo ratings yet

- Nora-Sakari Case StudyDocument7 pagesNora-Sakari Case StudyHafiz AliNo ratings yet

- Asia Pacific Credit Trends 2014: Telcos Look To The Cloud in Search of GrowthDocument5 pagesAsia Pacific Credit Trends 2014: Telcos Look To The Cloud in Search of Growthapi-239404108No ratings yet

- AT5Document8 pagesAT5Uday KiranNo ratings yet

- Good News and Bad News On 2014 Inmarsat Pricing: "Ready For The Internet"Document44 pagesGood News and Bad News On 2014 Inmarsat Pricing: "Ready For The Internet"AndreyNo ratings yet

- TheSun 2008-11-19 Page06 Bus Fares To Go Up Despite Fuel Price DropDocument1 pageTheSun 2008-11-19 Page06 Bus Fares To Go Up Despite Fuel Price DropImpulsive collectorNo ratings yet

- Business Plan: The Experience of Malaysia Airlines Name: Hamad Abdul-Hakim Alsharksi 022141031 AE555 EPMDocument49 pagesBusiness Plan: The Experience of Malaysia Airlines Name: Hamad Abdul-Hakim Alsharksi 022141031 AE555 EPMAlsharksi AviationNo ratings yet

- VcdyahDocument42 pagesVcdyahYahya AlrowniNo ratings yet

- 309 The Recipe For Mobile Broadband ProfitabilityDocument5 pages309 The Recipe For Mobile Broadband Profitabilityedwood00No ratings yet

- Evans1996 PDFDocument8 pagesEvans1996 PDFBebe WellykiliNo ratings yet

- Index - 2021-01-12T120550.813 PDFDocument1 pageIndex - 2021-01-12T120550.813 PDFAkshay BahetyNo ratings yet

- TheSun 2009-11-03 Page14 Mahb To Take New Istanbul Airport To Greater HeightsDocument1 pageTheSun 2009-11-03 Page14 Mahb To Take New Istanbul Airport To Greater HeightsImpulsive collectorNo ratings yet

- INSATDocument7 pagesINSATVarun KaushalNo ratings yet

- BIMBSec - Oil Gas News Flash 20120709Document3 pagesBIMBSec - Oil Gas News Flash 20120709Bimb SecNo ratings yet

- Banking & Financials - Writing On The WallDocument42 pagesBanking & Financials - Writing On The WallUnplugged12No ratings yet

- Inmarsat and Astrium Agree GX MOU: "Improved Crew Welfare"Document36 pagesInmarsat and Astrium Agree GX MOU: "Improved Crew Welfare"AndreyNo ratings yet

- Project Report of MTSDocument53 pagesProject Report of MTSjagdish92100% (2)

- 20151124-Rail Update Middle EastDocument19 pages20151124-Rail Update Middle EastHemant ChauhanNo ratings yet

- ZDA Spotlight - May 2009Document4 pagesZDA Spotlight - May 2009Chola Mukanga100% (3)

- Ciptadana Sekuritas Media Sector - Potential Collaboration On OTT ContentsDocument3 pagesCiptadana Sekuritas Media Sector - Potential Collaboration On OTT Contentsbudi handokoNo ratings yet

- Power Essays 2020: FeaturingDocument56 pagesPower Essays 2020: FeaturingPaul GeorgeNo ratings yet

- Sirena 3 Procurement ManagementDocument7 pagesSirena 3 Procurement ManagementPhilip CorsanoNo ratings yet

- 5G in ASEAN Reigniting Growth in Enterprise and Consumer MarketsDocument33 pages5G in ASEAN Reigniting Growth in Enterprise and Consumer MarketsphuockhNo ratings yet

- KcicDocument22 pagesKcicRaymond Pakur100% (2)

- Thesun 2009-04-21 Page16 PNB Offers 5Document1 pageThesun 2009-04-21 Page16 PNB Offers 5Impulsive collectorNo ratings yet

- Ude Desh Ka Aam Naagrik: Significance Key FeaturesDocument1 pageUde Desh Ka Aam Naagrik: Significance Key FeaturesRajat KalyaniaNo ratings yet

- Women DevelopmentDocument15 pagesWomen DevelopmentSukanya RayNo ratings yet

- CAREC Energy Strategy 2030: Common Borders. Common Solutions. Common Energy Future.From EverandCAREC Energy Strategy 2030: Common Borders. Common Solutions. Common Energy Future.No ratings yet

- KPMG CEO StudyDocument32 pagesKPMG CEO StudyImpulsive collectorNo ratings yet

- Emotional or Transactional Engagement CIPD 2012Document36 pagesEmotional or Transactional Engagement CIPD 2012Impulsive collectorNo ratings yet

- HayGroup Job Measurement: An IntroductionDocument17 pagesHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Islamic Financial Services Act 2013Document177 pagesIslamic Financial Services Act 2013Impulsive collectorNo ratings yet

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDocument5 pagesIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Global Added Value of Flexible BenefitsDocument4 pagesGlobal Added Value of Flexible BenefitsImpulsive collectorNo ratings yet

- HayGroup Rewarding Malaysia July 2010Document8 pagesHayGroup Rewarding Malaysia July 2010Impulsive collectorNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Stanford Business Magazine 2013 AutumnDocument68 pagesStanford Business Magazine 2013 AutumnImpulsive collectorNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Flexible Working Good Business - How Small Firms Are Doing ItDocument20 pagesFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- HBR - HR Joins The Analytics RevolutionDocument12 pagesHBR - HR Joins The Analytics RevolutionImpulsive collectorNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- 2012 Metrics and Analytics - Patterns of Use and ValueDocument19 pages2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorNo ratings yet

- IBM - Using Workforce Analytics To Drive Business ResultsDocument24 pagesIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TalentoDocument28 pagesTalentogeopicNo ratings yet

- Capacity Management in Service FirmsDocument10 pagesCapacity Management in Service FirmsJussie BatistilNo ratings yet

- Neo-Liberal Theory and Practice For Eastern Europe - Peter GowanDocument58 pagesNeo-Liberal Theory and Practice For Eastern Europe - Peter GowanpeterVoterNo ratings yet

- HKKJR LJDKJ: Central Public Works DepartmentDocument40 pagesHKKJR LJDKJ: Central Public Works DepartmentGautam DuttaNo ratings yet

- Invitation To Bid: Dvertisement ArticularsDocument2 pagesInvitation To Bid: Dvertisement ArticularsBDO3 3J SolutionsNo ratings yet

- Presentation - Sacli 2018Document10 pagesPresentation - Sacli 2018Marius OosthuizenNo ratings yet

- Guide To Buying A Wooden SunglassesDocument2 pagesGuide To Buying A Wooden SunglassesBrendan LuoNo ratings yet

- Business Economics PPT Chap 1Document18 pagesBusiness Economics PPT Chap 1david sughapriyaNo ratings yet

- Wilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Document2 pagesWilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Alvin Ryan KipliNo ratings yet

- Evaluasi Penerapan Perlakuan Akuntansi Psak 24 Pada PT Gudang Garam TBKDocument9 pagesEvaluasi Penerapan Perlakuan Akuntansi Psak 24 Pada PT Gudang Garam TBKphoechoexNo ratings yet

- Types of Economic SystemsDocument14 pagesTypes of Economic Systemsshaheen47No ratings yet

- GM OEM Financials Dgi9ja-2Document1 pageGM OEM Financials Dgi9ja-2Dananjaya GokhaleNo ratings yet

- Thurstone Interest Test by Marie ReyDocument9 pagesThurstone Interest Test by Marie Reymarie annNo ratings yet

- Human Resources-WPS Office PDFDocument14 pagesHuman Resources-WPS Office PDFArun KarthikNo ratings yet

- Money, Banking and Finance Je Rey Rogers Hummel Warren C. GibsonDocument291 pagesMoney, Banking and Finance Je Rey Rogers Hummel Warren C. GibsonrickloriNo ratings yet

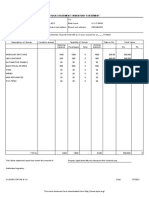

- Stock Statement Format For Bank LoanDocument1 pageStock Statement Format For Bank Loanpsycho Neha40% (5)

- Policy Brief - Food Insecurity in AfghanistanDocument3 pagesPolicy Brief - Food Insecurity in AfghanistanAPPROCenterNo ratings yet

- EVALUATION OF BANK OF MAHARASTRA-DevanshuDocument7 pagesEVALUATION OF BANK OF MAHARASTRA-DevanshuDevanshu sharma100% (2)

- WWW - Referat.ro England5093366fDocument13 pagesWWW - Referat.ro England5093366fJoanne LeeNo ratings yet

- Job Order Costing Seatwork - 2Document2 pagesJob Order Costing Seatwork - 2Akira Marantal ValdezNo ratings yet

- TAC0002 Bank Statements SelfEmployed ReportDocument78 pagesTAC0002 Bank Statements SelfEmployed ReportViren GalaNo ratings yet

- Container Industry Value ChainDocument14 pagesContainer Industry Value ChainRasmus ArentsenNo ratings yet

- La Part 3 PDFDocument23 pagesLa Part 3 PDFShubhaNo ratings yet

- M&A Module 1Document56 pagesM&A Module 1avinashj8100% (1)

- B2B Marketing - MRFDocument13 pagesB2B Marketing - MRFMohit JainNo ratings yet

- Collection of Pitch Decks From Venture Capital Funded StartupsDocument22 pagesCollection of Pitch Decks From Venture Capital Funded StartupsAlan Petzold50% (2)

- Finec 2Document11 pagesFinec 2nurulnatasha sinclairaquariusNo ratings yet

- Resolution On Road and Brgy Hall Financial AssistanceDocument6 pagesResolution On Road and Brgy Hall Financial AssistanceEvelyn Agustin Blones100% (2)

- Business Economics - Neil Harris - Summary Chapter 3Document2 pagesBusiness Economics - Neil Harris - Summary Chapter 3Nabila HuwaidaNo ratings yet

- Chap 013Document141 pagesChap 013theluckless77750% (2)

- Indian Economic Development: DAV Fertilizer Public School, BabralaDocument96 pagesIndian Economic Development: DAV Fertilizer Public School, Babralakavin sNo ratings yet