Professional Documents

Culture Documents

New Units Started Finished Units: FIFO Cost Flow Model Matches This Physical Flow Model

Uploaded by

ssregens82Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Units Started Finished Units: FIFO Cost Flow Model Matches This Physical Flow Model

Uploaded by

ssregens82Copyright:

Available Formats

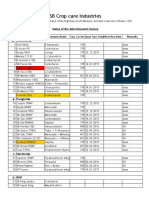

AMIS 525 Process Costing

Chapter 17 Equivalent Units

Process Physical Units Flow Model:

new units started finished units

new units started

finished units

new units started

finished units

FIFO cost flow model matches this physical flow model.

The Process Cost Allocation Dilemma The Dranik Manufacturing Company begins operation at the start of January. In the first month the company starts work on 1,000 units of its product. At the end of the month, 500 units have been completed and 500 units are still in process with an estimated degree of completion of 30 percent. Cost incurred for the month was $5,200. What is the cost transferred to the finished goods account and and the cost which remains in the work in process account at the end of the period?

1/9/2014

Solution: Incorrect FG WIP $5,200 / 1,000 = $5.20 per unit 500 * $5.20 = 500 * $5.20 = $2,600 $2,600 $5,200

Correct Equivalent Whole Units: 500 * 1.00 = 500 * .30 = Total 500 150 650

$5,200 / 650 = $8.00 per equivalent whole unit FG WIP 500 * $8.00 = 150 * $8.00 = $4,000 $1,200 $5,200

1/9/2014

Extended Example: In the second period (February) of operations, the Dranik Manufacturing Company started an additional 1,000 units and completed an additional 1,300 units. Cost incurred during the period was $10,000. The ending inventory was 50% completed. What is the cost transferred to the finished goods account and and the cost which remains in the work in process account at the end of the period?

Solution:

start of period

during the period

end of period

Beginning 500

Started STEP 1 1,000 Physical Completed Ending Units 800 200 1,500 Analysis

1,300 Completed

Q % @ START % ADDED % @ END E. U. @ Start E. U. Added E. U. @ End

B 500 30% 70% 100% 150 350 500

S&F 800 0% 100% 100% 0 800 800

E T STEP 2 200 1,500 Equivalent

Units

0% 50% 50%

Calculation

0 150 OLD 100 1,250 NEW 100 1,400 TOTAL

1/9/2014

COST OLD $1,200 NEW $10,000 TOTAL $11,200 $11,200 / 1,400 = $1,200 / 150 = $10,000 / 1,250 = $8.00 WA $8.00 FIFO $8.00 FIFO

STEP 3

Cost Per Equivalent Whole Unit

Solution: FG

150 * $8.00 = 350 * $8.00 = 800 * $8.00 = 100 * $8.00 =

$1,200 $2,800 $6,400 $800 $11,200

STEP 4 $4,000 $6,400 $10,400 $800 $11,200 $10,400 $800 $11,200 B S&F OUT E

Cost Allocation

WIP

or

FG WIP

1300 * $8.00 = 100 * $8.00 =

OUT E

1/9/2014

Extended Example: At the start of March, the WIP was 200 units 50% completed at a per equivalent unit cost of $8.00. In the third period (March) of operations, the Dranik Manufacturing Company started an additional 1,150 units. Cost incurred per equivalent unit of work during the period was $7.50. The ending inventory of 250 units was 60% completed. What is the cost transferred to the finished goods account and the cost which remains in the work in process account at the end of the period?

Solution:

start of period

during the period

end of period

Beginning 200

Started STEP 1 1,150 Physical Completed Ending Units 900 250 1,350 Analysis

1,100 Completed

B Q % @ START % ADDED % @ END E. U. @ Start E. U. Added E. U. @ End 200 50% 50% 100% 100 100 200

S&F 900 0% 100% 100% 0 900 900

E 250 0% 60% 60% 0 150 150

T 1350

STEP 2

Equivalent Units Calculation

100 OLD 1150 NEW 1250 TOTAL

1/9/2014

COST OLD NEW TOTAL

$800 $8,625 $9,425 new cost / 1,150 = $7.50 new cost = $8,625 $9,425 / 1,250 = FIFO

STEP 3

Cost Per Equivalent Whole Unit

$7.54 WA

Solution: FG

WIP

WA 100 * 100 * 900 * 1100 150 * 1250

STEP 4 $7.54 = $7.54 = $7.54 = $7.54 = $754 $754 $6,786 $8,294 $1,131 $9,425

Cost

$1,508 $6,786 $8,294 $1,131 $9,425 $8,294 $1,131 $9,425

B S&F OUT E Total OUT E

Allocation

or

FG WIP

1100 * $7.54 = 150 * $7.54 = 1250

Solution: FG

WIP

1/9/2014

FIFO 100 * 100 * 900 * 1100 150 * 1250

STEP 4 $8.00 = $7.50 = $7.50 = $7.50 = $800 $750 $6,750 $8,300 $1,125 $9,425

Cost

$1,550 $6,750 $8,300 $1,125 $9,425

B S&F OUT E Total

Allocation

You might also like

- Proces CostingDocument14 pagesProces CostingKenDedesNo ratings yet

- Bab 6 Process CostingDocument23 pagesBab 6 Process CostingVibbula Iswaradewi Anindyasari0% (1)

- Analisis Biaya: Semester Gasal TA 2016 - 2017 Process CostingDocument48 pagesAnalisis Biaya: Semester Gasal TA 2016 - 2017 Process CostingMaulana HasanNo ratings yet

- 6 Alvaro, Fernel Jean C. AE212-1742 TTHS 3-5PM ExercisesDocument7 pages6 Alvaro, Fernel Jean C. AE212-1742 TTHS 3-5PM ExercisesNhel Alvaro100% (1)

- Process CostingDocument44 pagesProcess CostingMayla Lei Pablo100% (2)

- Ae 211 Module 6 - Exercise 6-5 To 6-9Document7 pagesAe 211 Module 6 - Exercise 6-5 To 6-9Nhel AlvaroNo ratings yet

- Bab 6 Proces CostingDocument14 pagesBab 6 Proces CostingFransiskusSinaga100% (1)

- Kinney8e PPT Ch06Document43 pagesKinney8e PPT Ch06Christian GoNo ratings yet

- Bài tập nhóm số 6 - nhóm 4Document11 pagesBài tập nhóm số 6 - nhóm 4Lúa PhạmNo ratings yet

- Process Costing Problems 1Document9 pagesProcess Costing Problems 1RoMaNo ratings yet

- MBA 504 Ch3 SolutionsDocument22 pagesMBA 504 Ch3 SolutionsMohit Kumar GuptaNo ratings yet

- p2 - Guerrero Ch14Document46 pagesp2 - Guerrero Ch14JerichoPedragosa50% (18)

- Chapter 6 Practice QuestionsDocument9 pagesChapter 6 Practice QuestionsAbdul Wajid Nazeer CheemaNo ratings yet

- Process Costing (Power Point and Sample Problem)Document80 pagesProcess Costing (Power Point and Sample Problem)kraviusNo ratings yet

- Chapter 6 PRODUCT AND SERVICE COSTINGDocument40 pagesChapter 6 PRODUCT AND SERVICE COSTINGsalsa azzahraNo ratings yet

- Sesi 9 Process CostDocument76 pagesSesi 9 Process CostAnggrainiNo ratings yet

- Cost Accounting Quiz 2 PDFDocument10 pagesCost Accounting Quiz 2 PDFangel hello-helloNo ratings yet

- Acctg201 QuizDocument4 pagesAcctg201 QuizJehny AbelgasNo ratings yet

- Process Cost System: University of Santo Tomas Ust - Alfredo M. Velayo College of Accountancy SECOND TERM AY 2019-2020Document17 pagesProcess Cost System: University of Santo Tomas Ust - Alfredo M. Velayo College of Accountancy SECOND TERM AY 2019-2020allNo ratings yet

- Process Costing (W)Document9 pagesProcess Costing (W)Muhammad NaeemNo ratings yet

- Process Costing EU WAM and FIFODocument42 pagesProcess Costing EU WAM and FIFOBoi NonoNo ratings yet

- CH 06 Process CostingDocument67 pagesCH 06 Process CostingShannon Bánañas100% (2)

- Process Costing-WIPDocument3 pagesProcess Costing-WIPSigei LeonardNo ratings yet

- Process Cost System: Part I. Lecture and IllustrationDocument22 pagesProcess Cost System: Part I. Lecture and IllustrationMildred Angela DingalNo ratings yet

- Week 05 - Topics 09 & 10 - Process Costing - ElearnDocument30 pagesWeek 05 - Topics 09 & 10 - Process Costing - ElearnSwastik AgarwalNo ratings yet

- Process Costing - FIFODocument5 pagesProcess Costing - FIFODerick FigueroaNo ratings yet

- Process Costing ProblemsDocument9 pagesProcess Costing ProblemsAries Bautista67% (3)

- Assignment For Chapter 4 Job Order Costing: AnswersDocument7 pagesAssignment For Chapter 4 Job Order Costing: AnswersMitch Tokong MinglanaNo ratings yet

- Paper Quiz Session 1,2-CHAPTER 4-17 - With SolutionsDocument6 pagesPaper Quiz Session 1,2-CHAPTER 4-17 - With Solutionscome bidoNo ratings yet

- Process Costing: Kristin RosalinaDocument42 pagesProcess Costing: Kristin RosalinaKristin SoedjonoNo ratings yet

- Systems Design: Process Costing System Cost AllocationDocument70 pagesSystems Design: Process Costing System Cost AllocationPrincess Jay NacorNo ratings yet

- Multiple Choice QuestionsDocument7 pagesMultiple Choice QuestionsMitch Tokong MinglanaNo ratings yet

- P7-6 Hadenville Tool Campany Fabricating Department Cost of Production Report For AprilDocument6 pagesP7-6 Hadenville Tool Campany Fabricating Department Cost of Production Report For AprilrevnobitaNo ratings yet

- Lecture 11 Process Costing - 2ndDocument35 pagesLecture 11 Process Costing - 2ndMahyy AdelNo ratings yet

- Process CostingDocument68 pagesProcess Costingrandhawa_skaur100% (1)

- Problem No. 1 Average Method Equivalent Production Inputs: Materials Conversion CostDocument4 pagesProblem No. 1 Average Method Equivalent Production Inputs: Materials Conversion CostJune Maylyn MarzoNo ratings yet

- Process CostingDocument6 pagesProcess CostingLara CelestialNo ratings yet

- Week 2 - BUS 5431 - HomeworkDocument4 pagesWeek 2 - BUS 5431 - HomeworkSue Ming Fei100% (1)

- Normal and Abnormal SpoilageDocument6 pagesNormal and Abnormal SpoilageJanina CabatinganNo ratings yet

- Managerial AccountingDocument11 pagesManagerial Accountingmiljane perdizoNo ratings yet

- Flow of Cost Cost To Be Accounted For: (Complementary of The Normal ProcessDocument2 pagesFlow of Cost Cost To Be Accounted For: (Complementary of The Normal ProcessPol BernardinoNo ratings yet

- D. All of The Above Are True.: AMIS 3300 Pop Quiz - Chapter 17Document5 pagesD. All of The Above Are True.: AMIS 3300 Pop Quiz - Chapter 17DIGNA HERNANDEZNo ratings yet

- Process and Job Order Costing - EditedDocument6 pagesProcess and Job Order Costing - EditedJasper Andrew AdjaraniNo ratings yet

- Process Costing CompleteDocument84 pagesProcess Costing CompleteGian Carlo RamonesNo ratings yet

- 10.ACCT112 Process Costing-LMS-Seminar SlidesDocument58 pages10.ACCT112 Process Costing-LMS-Seminar SlidesKelvin Lim Wei LiangNo ratings yet

- Acc312 Platt Spr07 Exam1 Solution PostedDocument13 pagesAcc312 Platt Spr07 Exam1 Solution Posted03322080738No ratings yet

- CHAPTER FOUR Process CostingDocument10 pagesCHAPTER FOUR Process Costingzewdie100% (1)

- Multiple Choices - TheoreticalDocument8 pagesMultiple Choices - TheoreticalIsabelle AmbataliNo ratings yet

- Accounting Problems and SolutionsDocument3 pagesAccounting Problems and SolutionsKavitha Ragupathy100% (1)

- Chap.14 Guerrero Process CostingQuestionsDocument22 pagesChap.14 Guerrero Process CostingQuestionshoneylove uNo ratings yet

- Solution For Case B: Materials Labor & OverheadDocument3 pagesSolution For Case B: Materials Labor & OverheadNicole Allyson AguantaNo ratings yet

- 121 Mt2 Process Cost KeyDocument2 pages121 Mt2 Process Cost KeyMichelle LeeNo ratings yet

- Excel In 7 Days : Master Excel Features & Formulas. Become A Pro From Scratch In Just 7 Days With Step-By-Step Instructions, Clear Illustrations, And Practical ExamplesFrom EverandExcel In 7 Days : Master Excel Features & Formulas. Become A Pro From Scratch In Just 7 Days With Step-By-Step Instructions, Clear Illustrations, And Practical ExamplesNo ratings yet

- Quick EXCEL Tips & Tricks With Video Tutorials: Learn Excel Shortcuts with Exercise FilesFrom EverandQuick EXCEL Tips & Tricks With Video Tutorials: Learn Excel Shortcuts with Exercise FilesNo ratings yet

- Practical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsFrom EverandPractical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsNo ratings yet

- 101 Most Popular Excel Formulas: 101 Excel Series, #1From Everand101 Most Popular Excel Formulas: 101 Excel Series, #1Rating: 4 out of 5 stars4/5 (4)

- Building Multi-Tier Web Applications in Virtual EnvironmentsDocument30 pagesBuilding Multi-Tier Web Applications in Virtual Environmentsssregens82No ratings yet

- Lussier 3 Ech 05Document50 pagesLussier 3 Ech 05ssregens82No ratings yet

- Judicial Power of Supreme CourtDocument2 pagesJudicial Power of Supreme Courtssregens82No ratings yet

- Risk and Rates of Return: Learning ObjectivesDocument36 pagesRisk and Rates of Return: Learning Objectivesssregens82No ratings yet

- CHP 3Document2 pagesCHP 3ssregens82No ratings yet

- EOQ CalculatorDocument35 pagesEOQ Calculatorssregens82No ratings yet

- Orchestro State Inventory Management 2015Document8 pagesOrchestro State Inventory Management 2015ssregens82No ratings yet

- AgencyDocument21 pagesAgencyssregens82No ratings yet

- Supplier General QualificationsDocument3 pagesSupplier General Qualificationsssregens82No ratings yet

- Wuest15e ch01Document41 pagesWuest15e ch01ssregens82No ratings yet

- Administrative AgenciesDocument19 pagesAdministrative Agenciesssregens82No ratings yet

- Transportation and Logistics OptimizationDocument18 pagesTransportation and Logistics Optimizationssregens82No ratings yet

- Static Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing InstructionsDocument17 pagesStatic Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing Instructionsssregens82No ratings yet

- Chapter 1 BowersoxDocument38 pagesChapter 1 Bowersoxssregens82100% (1)

- Vcost DemoDocument2 pagesVcost Demossregens82No ratings yet

- Week 8 AssignmentDocument5 pagesWeek 8 Assignmentssregens82100% (2)

- Chap 001Document15 pagesChap 001ssregens82No ratings yet

- Final Team Case Presentation TemplateDocument3 pagesFinal Team Case Presentation Templatessregens82No ratings yet

- TP Calculator Class DemoDocument1 pageTP Calculator Class Demossregens82No ratings yet

- Problems, Problem Spaces and Search: Dr. Suthikshn KumarDocument47 pagesProblems, Problem Spaces and Search: Dr. Suthikshn Kumarssregens82No ratings yet

- AMIS 525 Pop Quiz - Chapters 22 and 23Document5 pagesAMIS 525 Pop Quiz - Chapters 22 and 23ssregens82No ratings yet

- V Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )Document1 pageV Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )ssregens82No ratings yet

- Wa BehaviorDocument1 pageWa Behaviorssregens82No ratings yet

- TPRICEDocument1 pageTPRICEssregens82No ratings yet

- Time Value PracticeDocument1 pageTime Value Practicessregens82No ratings yet

- TAX Incremental or TotalDocument1 pageTAX Incremental or Totalssregens82No ratings yet

- TP Calculator Class DemoDocument1 pageTP Calculator Class Demossregens82No ratings yet

- TP DemoDocument1 pageTP Demossregens82No ratings yet

- Regular Flow Irregular Flow Irregular Flow DepreciationDocument1 pageRegular Flow Irregular Flow Irregular Flow Depreciationssregens82No ratings yet

- Target Income Review ProblemDocument1 pageTarget Income Review Problemssregens82No ratings yet

- H.mohamed Ibrahim Hussain A Study On Technology Updatiing and Its Impact Towards Employee Performance in Orcade Health Care PVT LTD ErodeDocument108 pagesH.mohamed Ibrahim Hussain A Study On Technology Updatiing and Its Impact Towards Employee Performance in Orcade Health Care PVT LTD ErodeeswariNo ratings yet

- NJEX 7300G: Pole MountedDocument130 pagesNJEX 7300G: Pole MountedJorge Luis MartinezNo ratings yet

- 6 RVFS - SWBL Ojt Evaluation FormDocument3 pages6 RVFS - SWBL Ojt Evaluation FormRoy SumugatNo ratings yet

- Southern California International Gateway Final Environmental Impact ReportDocument40 pagesSouthern California International Gateway Final Environmental Impact ReportLong Beach PostNo ratings yet

- Adsorption ExperimentDocument5 pagesAdsorption ExperimentNauman KhalidNo ratings yet

- WFM 5101 Watershed Hydrology: Shammi HaqueDocument18 pagesWFM 5101 Watershed Hydrology: Shammi HaquejahirNo ratings yet

- Ebook Stackoverflow For ItextDocument336 pagesEbook Stackoverflow For ItextAnonymous cZTeTlkag9No ratings yet

- Mini Project A-9-1Document12 pagesMini Project A-9-1santhoshrao19No ratings yet

- You're reading a free preview. Pages 4 to 68 are not shown in this preview. Leer la versión completa You're Reading a Free Preview Page 4 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 5 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 6 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 7 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 8 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 9 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 10 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 11 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 12 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 13 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 14 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 15 is notDocument9 pagesYou're reading a free preview. Pages 4 to 68 are not shown in this preview. Leer la versión completa You're Reading a Free Preview Page 4 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 5 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 6 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 7 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 8 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 9 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 10 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 11 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 12 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 13 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 14 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 15 is notFernando ToretoNo ratings yet

- ITCNASIA23 - Visitor GuideDocument24 pagesITCNASIA23 - Visitor Guideibrahim shabbirNo ratings yet

- 04 Membrane Structure NotesDocument22 pages04 Membrane Structure NotesWesley ChinNo ratings yet

- Studies - Number and Algebra P1Document45 pagesStudies - Number and Algebra P1nathan.kimNo ratings yet

- Evolution of Campus Switching: Marketing Presentation Marketing PresentationDocument35 pagesEvolution of Campus Switching: Marketing Presentation Marketing PresentationRosal Mark JovenNo ratings yet

- 2 Calculation ProblemsDocument4 pages2 Calculation ProblemsFathia IbrahimNo ratings yet

- Model No. TH-65JX850M/MF Chassis. 9K56T: LED TelevisionDocument53 pagesModel No. TH-65JX850M/MF Chassis. 9K56T: LED TelevisionRavi ChandranNo ratings yet

- Teal Motor Co. Vs CFIDocument6 pagesTeal Motor Co. Vs CFIJL A H-DimaculanganNo ratings yet

- Voice Over Script For Pilot TestingDocument2 pagesVoice Over Script For Pilot TestingRichelle Anne Tecson ApitanNo ratings yet

- Under Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisDocument13 pagesUnder Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisMahmud RahmanNo ratings yet

- Combining Wavelet and Kalman Filters For Financial Time Series PredictionDocument17 pagesCombining Wavelet and Kalman Filters For Financial Time Series PredictionLuis OliveiraNo ratings yet

- IELTS Material Writing 1Document112 pagesIELTS Material Writing 1Lê hoàng anhNo ratings yet

- Products ListDocument11 pagesProducts ListPorag AhmedNo ratings yet

- Chapter 10 OutlineDocument3 pagesChapter 10 OutlineFerrari75% (4)

- Alufix Slab Formwork Tim PDFDocument18 pagesAlufix Slab Formwork Tim PDFMae FalcunitinNo ratings yet

- Deloitte - Introduction To TS&A - CloudDocument2 pagesDeloitte - Introduction To TS&A - Cloudsatyam100% (1)

- Newcastle University Dissertation FormatDocument6 pagesNewcastle University Dissertation FormatWriteMyEnglishPaperForMeSterlingHeights100% (1)

- Manual TV Hyundai HYLED3239iNTMDocument40 pagesManual TV Hyundai HYLED3239iNTMReinaldo TorresNo ratings yet

- Jar Doc 06 Jjarus Sora Executive SummaryDocument3 pagesJar Doc 06 Jjarus Sora Executive Summaryprasenjitdey786No ratings yet

- Molde Soldadura TADocument1 pageMolde Soldadura TAMarcos Ivan Ramirez AvenaNo ratings yet

- TRAVEL POLICY CARLO URRIZA OLIVAR Standard Insurance Co. Inc - Travel Protect - Print CertificateDocument4 pagesTRAVEL POLICY CARLO URRIZA OLIVAR Standard Insurance Co. Inc - Travel Protect - Print CertificateCarlo OlivarNo ratings yet

- 5000-5020 en PDFDocument10 pages5000-5020 en PDFRodrigo SandovalNo ratings yet