Professional Documents

Culture Documents

2014 February Metrolist Local Market Updates

Uploaded by

Bill HopkinsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 February Metrolist Local Market Updates

Uploaded by

Bill HopkinsCopyright:

Available Formats

Local Market Updates

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

City

Agate Arvada Aurora Bailey Bennett Bow Mar Brighton Broomfield Byers Castle Pines North Castle Rock Centennial Cherry Hills Village Columbine Valley Commerce City Conifer Dacono Deckers Deer Trail Denver Edgewater Elbert Elizabeth Englewood Evergreen Federal Heights Firestone Fort Lupton Foxfield Franktown Frederick Glendale Golden 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34

February 2014

Greenwood Village Henderson Highlands Ranch Idaho Springs Indian Hills Keenesburg Kiowa Kittredge Lafayette Lakewood Larkspur Littleton Lone Tree Longmont Louisville Louviers Morrison Northglenn Parker Sedalia Sheridan Simla Strasburg Superior Thornton Twin Lakes Watkins Westminster Wheat Ridge 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63

All data from Metrolist. Metrolist is a registered trademark of Metrolist, Inc. 2013 Metrolist, Inc. All rights reserved.

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 66.7%

-Change in Sold Listings

-Change in Median Sold Price**

Agate

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 6 2 3 0 0 0 0 0 2014 2 0 1 0 0 0 0 0 +/ - 66.7% - 100.0% - 66.7% ------

Year to Date (YTD)

2013 -4 7 1 1 $78,000 $78,000 89.7% 2014 -0 1 0 0 0 0 0 +/ -- 100.0% - 85.7% - 100.0% -100.0% - 100.0% - 100.0% - 100.0%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

3

2013

2014

Year to Date (YTD)

7

2013

2014

1 1 0

- 66.7% New Listings

1 0

- 100.0% Sold Listings

0

- 85.7% New Listings

-Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 40%

All MLS Agate

b a

+ 30%

+ 20%

+ 10%

0%

- 10%

- 20% 1-2008

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

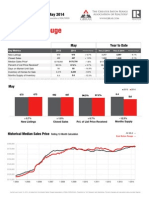

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 6.3%

+ 15.6%

Change in Sold Listings

+ 8.2%

Change in Median Sold Price**

Arvada

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 152 191 159 122 57 $229,150 $249,649 98.4% 2014 163 219 169 141 41 $248,000 $286,084 98.5% +/ + 7.2% + 14.7% + 6.3% + 15.6% -28.1% + 8.2% + 14.6% + 0.1%

Year to Date (YTD)

2013 -362 332 236 63 $232,000 $257,052 98.5% 2014 -406 330 250 39 $255,950 $281,511 98.9% +/ -+ 12.2% - 0.6% + 5.9% -38.1% + 10.3% + 9.5% + 0.4%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

159 169 122

2013

2014

Year to Date (YTD)

332 330 236

2013

2014

141

250

+ 6.3% New Listings

+ 15.6% Sold Listings

- 0.6% New Listings

+ 5.9% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Arvada

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

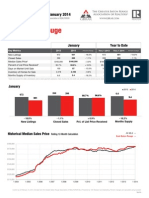

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 12.0%

- 12.2%

Change in Sold Listings

+ 14.3%

Change in Median Sold Price**

Aurora

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 411 535 541 444 65 $175,000 $192,538 99.7% 2014 534 654 476 390 44 $200,000 $213,970 98.7% +/ + 29.9% + 22.2% - 12.0% - 12.2% -32.3% + 14.3% + 11.1% - 1.0%

Year to Date (YTD)

2013 -1,035 1,036 823 63 $168,400 $187,985 99.5% 2014 -1,298 976 747 47 $192,900 $207,964 98.9% +/ -+ 25.4% - 5.8% - 9.2% -25.4% + 14.5% + 10.6% - 0.6%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

541 476 444

2013

2014

Year to Date (YTD)

1,036 976 823

2013

2014

390

747

- 12.0% New Listings

- 12.2% Sold Listings

- 5.8% New Listings

- 9.2% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% - 25% 1-2008

All MLS Aurora

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 13.3%

- 16.7%

Change in Sold Listings

- 0.7%

Change in Median Sold Price**

Bailey

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 66 24 15 12 88 $142,000 $167,994 99.1% 2014 52 20 17 10 56 $141,000 $186,090 99.2% +/ - 21.2% - 16.7% + 13.3% - 16.7% -36.4% - 0.7% + 10.8% + 0.1%

Year to Date (YTD)

2013 -46 39 32 127 $170,750 $193,893 96.1% 2014 -47 39 34 93 $174,975 $189,172 95.8% +/ -+ 2.2% 0.0% + 6.3% -26.8% + 2.5% - 2.4% - 0.3%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

17 15 12

2013

2014

Year to Date (YTD)

39 39 32

2013

2014

34

10

+ 13.3% New Listings

- 16.7% Sold Listings

0.0% New Listings

+ 6.3% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 30%

All MLS Bailey

b a

+ 20%

+ 10%

0%

- 10%

- 20%

- 30% 1-2008

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 28.6%

+ 66.7%

Change in Sold Listings

+ 27.7%

Change in Median Sold Price**

Bennett

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 14 10 7 3 8 $148,000 $128,167 102.8% 2014 36 8 9 5 81 $189,000 $251,200 96.9% +/ + 157.1% - 20.0% + 28.6% + 66.7% + 912.5% + 27.7% + 96.0% - 5.7%

Year to Date (YTD)

2013 -16 16 9 53 $179,900 $206,250 99.5% 2014 -16 20 6 71 $159,500 $231,000 97.4% +/ -0.0% + 25.0% - 33.3% + 34.0% - 11.3% + 12.0% - 2.1%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

9 7

2013

2014

Year to Date (YTD)

20 16

2013

2014

5 3 9 6

+ 28.6% New Listings

+ 66.7% Sold Listings

+ 25.0% New Listings

- 33.3% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 80% + 60% + 40% + 20% 0% - 20% - 40% - 60% 1-2008

All MLS Bennett

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 100.0%

- 100.0%

Change in Sold Listings

- 100.0%

Change in Median Sold Price**

Bow Mar

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 3 1 1 2 126 $737,500 $737,500 91.7% 2014 5 1 2 0 0 0 0 0 +/ + 66.7% 0.0% + 100.0% - 100.0% -100.0% - 100.0% - 100.0% - 100.0%

Year to Date (YTD)

2013 -2 1 2 126 $737,500 $737,500 91.7% 2014 -1 3 1 472 $2,755,000 $2,755,000 91.8% +/ -- 50.0% + 200.0% - 50.0% + 274.6% + 273.6% + 273.6% + 0.1%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

2 2

2013

2014

Year to Date (YTD)

3 2

2013

2014

1 1 0

+ 100.0% New Listings - 100.0% Sold Listings + 200.0% New Listings - 50.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 60% + 50% + 40% + 30% + 20% + 10% 0% - 10% - 20% - 30% - 40% 1-2008

All MLS Bow Mar

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 24.2%

- 3.8%

Change in Sold Listings

+ 5.3%

Change in Median Sold Price**

Brighton

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 134 80 99 53 93 $225,000 $261,413 98.6% 2014 122 88 75 51 69 $237,000 $264,227 98.7% +/ - 9.0% + 10.0% - 24.2% - 3.8% -25.8% + 5.3% + 1.1% + 0.1%

Year to Date (YTD)

2013 -154 167 117 90 $217,500 $242,853 98.1% 2014 -159 128 107 78 $247,500 $274,087 98.5% +/ -+ 3.2% - 23.4% - 8.5% -13.3% + 13.8% + 12.9% + 0.4%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

99 75 53

2013

2014

Year to Date (YTD)

167 128 117

2013

2014

107

51

- 24.2% New Listings

- 3.8% Sold Listings

- 23.4% New Listings

- 8.5% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Brighton

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 6.6%

+ 9.4%

Change in Sold Listings

+ 6.4%

Change in Median Sold Price**

Broomfield

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 89 80 76 53 55 $260,000 $288,584 97.9% 2014 103 92 71 58 54 $276,593 $347,163 99.4% +/ + 15.7% + 15.0% - 6.6% + 9.4% -1.8% + 6.4% + 20.3% + 1.5%

Year to Date (YTD)

2013 -157 152 113 56 $265,000 $311,277 98.4% 2014 -171 151 106 56 $295,500 $365,368 99.4% +/ -+ 8.9% - 0.7% - 6.2% 0.0% + 11.5% + 17.4% + 1.0%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

76 71 53

2013

2014

Year to Date (YTD)

152 151 113

2013

2014

58

106

- 6.6% New Listings

+ 9.4% Sold Listings

- 0.7% New Listings

- 6.2% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 30% + 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Broomfield

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 200.0%

- 50.0%

Change in Sold Listings

- 25.0%

Change in Median Sold Price**

Byers

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 5 6 1 2 93 $206,648 $206,648 96.6% 2014 14 4 3 1 39 $155,000 $155,000 103.3% +/ + 180.0% - 33.3% + 200.0% - 50.0% -58.1% - 25.0% - 25.0% + 6.9%

Year to Date (YTD)

2013 -10 6 5 59 $178,295 $190,111 97.0% 2014 -5 6 1 39 $155,000 $155,000 103.3% +/ -- 50.0% 0.0% - 80.0% -33.9% - 13.1% - 18.5% + 6.5%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

3 2 1

2013

2014

Year to Date (YTD)

6 6 5

2013

2014

1 1

+ 200.0% New Listings

- 50.0% Sold Listings

0.0% New Listings

- 80.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 100% + 80% + 60% + 40% + 20% 0% - 20% - 40% 1-2008

All MLS Byers

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Castle Pines North

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

-Change in New Listings

-Change in Sold Listings

-Change in Median Sold Price**

February

2013 0 0 0 0 0 0 0 0 2014 0 0 0 0 0 0 0 0 +/ ---------

Year to Date (YTD)

2013 -0 0 0 0 0 0 0 2014 -0 0 0 0 0 0 0 +/ ---------

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

2013

2014

Year to Date (YTD)

2013

2014

-New Listings

-Sold Listings

-New Listings

-Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Castle Pines North

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 12.2%

- 16.2%

Change in Sold Listings

+ 5.0%

Change in Median Sold Price**

Castle Rock

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 241 161 164 117 81 $295,000 $377,015 98.6% 2014 368 166 184 98 56 $309,750 $367,866 98.2% +/ + 52.7% + 3.1% + 12.2% - 16.2% -30.9% + 5.0% - 2.4% - 0.4%

Year to Date (YTD)

2013 -308 311 204 87 $314,300 $390,799 98.4% 2014 -301 359 187 58 $308,000 $368,193 98.3% +/ -- 2.3% + 15.4% - 8.3% -33.3% - 2.0% - 5.8% - 0.1%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

184 164 117

2013

2014

Year to Date (YTD)

359 311

2013

2014

98

204

187

+ 12.2% New Listings

- 16.2% Sold Listings

+ 15.4% New Listings

- 8.3% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Castle Rock

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 10.7%

- 24.8%

Change in Sold Listings

+ 5.4%

Change in Median Sold Price**

Centennial

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 103 182 177 133 49 $275,000 $297,400 98.8% 2014 147 155 158 100 36 $289,950 $301,076 98.6% +/ + 42.7% - 14.8% - 10.7% - 24.8% -26.5% + 5.4% + 1.2% - 0.2%

Year to Date (YTD)

2013 -344 334 231 59 $264,900 $298,627 98.6% 2014 -295 266 203 38 $283,000 $305,079 98.5% +/ -- 14.2% - 20.4% - 12.1% -35.6% + 6.8% + 2.2% - 0.1%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

177 158 133

2013

2014

Year to Date (YTD)

334 266 231

2013

2014

100

203

- 10.7% New Listings

- 24.8% Sold Listings

- 20.4% New Listings

- 12.1% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Centennial

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Cherry Hills Village

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

- 70.0%

Change in New Listings

0.0%

Change in Sold Listings

+ 37.2%

Change in Median Sold Price**

February

2013 36 11 20 3 272 $1,450,000 $1,568,333 94.3% 2014 43 13 6 3 58 $1,990,000 $2,290,040 89.4% +/ + 19.4% + 18.2% - 70.0% 0.0% -78.7% + 37.2% + 46.0% - 5.2%

Year to Date (YTD)

2013 -18 39 10 119 $1,350,000 $1,348,050 96.1% 2014 -14 15 9 93 $1,632,300 $2,120,824 91.0% +/ -- 22.2% - 61.5% - 10.0% -21.8% + 20.9% + 57.3% - 5.3%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

20

2013

2014

Year to Date (YTD)

39

2013

2014

15 6 3

- 70.0% New Listings

10 3

- 61.5% New Listings

0.0% Sold Listings

- 10.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 60% + 50% + 40% + 30% + 20% + 10% 0% - 10% - 20% - 30% - 40% - 50% 1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013

All MLS Cherry Hills Village

b a

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 100.0%

- 100.0%

Change in Sold Listings

- 100.0%

Change in Median Sold Price**

Columbine Valley

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 5 4 6 1 242 $1,489,000 $1,489,000 93.1% 2014 5 0 0 0 0 0 0 0 +/ 0.0% - 100.0% - 100.0% - 100.0% -100.0% - 100.0% - 100.0% - 100.0%

Year to Date (YTD)

2013 -6 6 3 111 $1,100,000 $969,667 93.4% 2014 -1 0 1 108 $531,000 $531,000 98.3% +/ -- 83.3% - 100.0% - 66.7% -2.7% - 51.7% - 45.2% + 5.2%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

6

2013

2014

Year to Date (YTD)

6

2013

2014

3 1 0

- 100.0% New Listings

1 0 0

- 100.0% New Listings - 66.7% Sold Listings

- 100.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 100% + 80% + 60% + 40% + 20% 0% - 20% - 40% 1-2008

All MLS Columbine Valley

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 5.8%

+ 76.3%

Change in Sold Listings

+ 34.7%

Change in Median Sold Price**

Commerce City

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 68 78 69 38 52 $170,000 $180,774 99.7% 2014 93 86 65 67 38 $229,000 $216,256 100.5% +/ + 36.8% + 10.3% - 5.8% + 76.3% -26.9% + 34.7% + 19.6% + 0.8%

Year to Date (YTD)

2013 -156 159 93 62 $194,500 $184,939 100.3% 2014 -167 139 119 45 $224,500 $213,414 99.8% +/ -+ 7.1% - 12.6% + 28.0% -27.4% + 15.4% + 15.4% - 0.5%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

69 65

2013

2014

Year to Date (YTD)

159 139

2013

2014

67

119 38 93

- 5.8% New Listings

+ 76.3% Sold Listings

- 12.6% New Listings

+ 28.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 30% + 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Commerce City

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 6.7%

+ 11.1%

Change in Sold Listings

+ 36.1%

Change in Median Sold Price**

Conifer

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 44 23 15 9 94 $263,000 $267,506 94.8% 2014 35 15 14 10 100 $358,000 $468,700 97.8% +/ - 20.5% - 34.8% - 6.7% + 11.1% + 6.4% + 36.1% + 75.2% + 3.2%

Year to Date (YTD)

2013 -40 32 14 94 $266,125 $274,646 94.0% 2014 -28 28 21 93 $368,000 $461,960 96.6% +/ -- 30.0% - 12.5% + 50.0% -1.1% + 38.3% + 68.2% + 2.8%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

15 14 9

2013

2014

Year to Date (YTD)

32 28

2013

2014

10 14

21

- 6.7% New Listings

+ 11.1% Sold Listings

- 12.5% New Listings

+ 50.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Conifer

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 200.0%

- 50.0%

Change in Sold Listings

+ 321.5%

Change in Median Sold Price**

Dacono

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 3 5 2 2 54 $112,450 $112,450 89.3% 2014 8 7 6 1 98 $474,000 $474,000 96.9% +/ + 166.7% + 40.0% + 200.0% - 50.0% + 81.5% + 321.5% + 321.5% + 8.5%

Year to Date (YTD)

2013 -8 7 2 54 $112,450 $112,450 89.3% 2014 -11 10 7 34 $155,000 $185,636 107.4% +/ -+ 37.5% + 42.9% + 250.0% -37.0% + 37.8% + 65.1% + 20.3%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

6

2013

2014

Year to Date (YTD)

10 7

2013

2014

2 1 2

+ 200.0% New Listings

- 50.0% Sold Listings

+ 42.9% New Listings

+ 250.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 250% + 200% + 150% + 100% + 50% 0% - 50% - 100% 1-2008

All MLS Dacono

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

--

-Change in Sold Listings

-Change in Median Sold Price**

Deckers

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 0 0 0 0 0 0 0 0 2014 1 0 0 0 0 0 0 0 +/ ---------

Year to Date (YTD)

2013 -0 0 0 0 0 0 0 2014 -0 0 0 0 0 0 0 +/ ---------

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

2013

2014

Year to Date (YTD)

2013

2014

-New Listings

-Sold Listings

-New Listings

-Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Deckers

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 100.0%

- 100.0%

Change in Sold Listings

- 100.0%

Change in Median Sold Price**

Deer Trail

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 5 1 1 1 162 $65,000 $65,000 92.9% 2014 8 1 2 0 0 0 0 0 +/ + 60.0% 0.0% + 100.0% - 100.0% -100.0% - 100.0% - 100.0% - 100.0%

Year to Date (YTD)

2013 -3 3 2 132 $81,500 $81,500 98.0% 2014 -3 4 1 39 $314,000 $314,000 99.7% +/ -0.0% + 33.3% - 50.0% -70.5% + 285.3% + 285.3% + 1.7%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

2

2013

2014

Year to Date (YTD)

4 3

2013

2014

2 1 0

+ 100.0% New Listings

- 100.0% Sold Listings

+ 33.3% New Listings

- 50.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 450% + 400% + 350% + 300% + 250% + 200% + 150% + 100% + 50% 0% - 50% - 100% 1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013

All MLS Deer Trail

b a

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 6.7%

+ 1.8%

Change in Sold Listings

+ 7.9%

Change in Median Sold Price**

Denver

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 970 1,096 1,124 758 63 $245,500 $295,282 99.0% 2014 1,409 1,282 1,049 772 53 $265,000 $318,010 98.6% +/ + 45.3% + 17.0% - 6.7% + 1.8% -15.9% + 7.9% + 7.7% - 0.4%

Year to Date (YTD)

2013 -2,050 2,141 1,428 65 $234,500 $292,225 98.6% 2014 -2,464 2,180 1,453 51 $255,000 $319,102 98.3% +/ -+ 20.2% + 1.8% + 1.8% -21.5% + 8.7% + 9.2% - 0.3%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

1,124 1,049 758

2013

2014

Year to Date (YTD)

2,141 2,180 1 428 1,428

2013

2014

772

1 453 1,453

- 6.7% New Listings

+ 1.8% Sold Listings

+ 1.8% New Listings

+ 1.8% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 40% + 30% + 20% + 10% 0% - 10% - 20% - 30% - 40% 1-2008

All MLS Denver

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 50.0%

- 42.9%

Change in Sold Listings

- 9.8%

Change in Median Sold Price**

Edgewater

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 3 3 2 7 42 $241,000 $236,343 100.5% 2014 1 5 3 4 52 $217,500 $225,625 100.2% +/ - 66.7% + 66.7% + 50.0% - 42.9% + 23.8% - 9.8% - 4.5% - 0.3%

Year to Date (YTD)

2013 -11 11 11 33 $241,000 $236,895 98.7% 2014 -10 7 10 33 $199,750 $206,950 99.8% +/ -- 9.1% - 36.4% - 9.1% 0.0% - 17.1% - 12.6% + 1.1%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

7

2013

2014

Year to Date (YTD)

11 11

2013

2014

10

4 3 2

+ 50.0% New Listings

- 42.9% Sold Listings

- 36.4% New Listings

- 9.1% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 30% + 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Edgewater

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 66.7%

- 50.0%

Change in Sold Listings

+ 34.2%

Change in Median Sold Price**

Elbert

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 14 3 3 2 250 $214,500 $214,500 94.0% 2014 24 1 5 1 76 $287,900 $287,900 97.8% +/ + 71.4% - 66.7% + 66.7% - 50.0% -69.6% + 34.2% + 34.2% + 4.0%

Year to Date (YTD)

2013 -5 7 5 164 $340,000 $353,580 96.6% 2014 -3 8 3 103 $250,000 $217,633 93.3% +/ -- 40.0% + 14.3% - 40.0% -37.2% - 26.5% - 38.4% - 3.4%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

5

2013

2014

Year to Date (YTD)

8 7 5

2013

2014

3 2 1

+ 66.7% New Listings

- 50.0% Sold Listings

+ 14.3% New Listings

- 40.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 120% + 100% + 80% + 60% + 40% + 20% 0% - 20% - 40% 1-2008

All MLS Elbert

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 12.5%

- 39.3%

Change in Sold Listings

- 18.5%

Change in Median Sold Price**

Elizabeth

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 44 28 24 28 84 $367,500 $326,645 98.0% 2014 55 34 21 17 67 $299,500 $323,073 98.7% +/ + 25.0% + 21.4% - 12.5% - 39.3% -20.2% - 18.5% - 1.1% + 0.7%

Year to Date (YTD)

2013 -53 52 40 85 $341,250 $335,264 98.3% 2014 -55 44 26 67 $308,750 $331,740 98.6% +/ -+ 3.8% - 15.4% - 35.0% -21.2% - 9.5% - 1.1% + 0.3%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

28 24 21

2013

2014

Year to Date (YTD)

52 44 40

2013

2014

17 26

- 12.5% New Listings

- 39.3% Sold Listings

- 15.4% New Listings

- 35.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Elizabeth

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 26.9%

+ 42.9%

Change in Sold Listings

+ 11.7%

Change in Median Sold Price**

Englewood

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 53 93 78 49 48 $224,900 $253,814 98.0% 2014 109 118 99 70 36 $251,236 $297,971 97.6% +/ + 105.7% + 26.9% + 26.9% + 42.9% -25.0% + 11.7% + 17.4% - 0.4%

Year to Date (YTD)

2013 -168 166 98 52 $216,826 $241,092 98.6% 2014 -210 191 126 41 $259,500 $324,423 98.1% +/ -+ 25.0% + 15.1% + 28.6% -21.2% + 19.7% + 34.6% - 0.5%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

99 78 49

2013

2014

Year to Date (YTD)

191

2013

2014

70

166 126 98

+ 26.9% New Listings

+ 42.9% Sold Listings

+ 15.1% New Listings

+ 28.6% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Englewood

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 23.8%

- 16.7%

Change in Sold Listings

+ 26.6%

Change in Median Sold Price**

Evergreen

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 151 41 63 30 113 $347,500 $372,087 96.4% 2014 155 55 48 25 63 $440,000 $452,878 96.3% +/ + 2.6% + 34.1% - 23.8% - 16.7% -44.2% + 26.6% + 21.7% - 0.1%

Year to Date (YTD)

2013 -96 117 55 116 $351,000 $381,462 96.2% 2014 -107 99 54 90 $362,500 $421,471 96.7% +/ -+ 11.5% - 15.4% - 1.8% -22.4% + 3.3% + 10.5% + 0.5%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

63 48 30

2013

2014

Year to Date (YTD)

117 99 55

2013

2014

25

54

- 23.8% New Listings

- 16.7% Sold Listings

- 15.4% New Listings

- 1.8% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% - 25% 1-2008

All MLS Evergreen

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 25.0%

- 50.0%

Change in Sold Listings

- 13.8%

Change in Median Sold Price**

Federal Heights

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 2 5 4 2 108 $171,750 $171,750 96.4% 2014 3 3 3 1 4 $148,000 $148,000 105.8% +/ + 50.0% - 40.0% - 25.0% - 50.0% -96.3% - 13.8% - 13.8% + 9.8%

Year to Date (YTD)

2013 -8 6 6 69 $148,750 $141,417 96.9% 2014 -3 4 6 11 $150,000 $160,417 102.6% +/ -- 62.5% - 33.3% 0.0% -84.1% + 0.8% + 13.4% + 5.9%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

4 3

2013

2014

Year to Date (YTD)

6 4 6

2013

2014

2 1

- 25.0% New Listings

- 50.0% Sold Listings

- 33.3% New Listings

0.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 80% + 60% + 40% + 20% 0% - 20% - 40% - 60% 1-2008

All MLS Federal Heights

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 26.7%

+ 42.9%

Change in Sold Listings

+ 16.3%

Change in Median Sold Price**

Firestone

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 18 12 15 7 63 $240,000 $237,571 99.2% 2014 11 8 11 10 74 $279,000 $269,364 100.3% +/ - 38.9% - 33.3% - 26.7% + 42.9% + 17.5% + 16.3% + 13.4% + 1.1%

Year to Date (YTD)

2013 -20 24 13 48 $236,000 $223,654 99.1% 2014 -19 16 23 72 $275,000 $256,439 99.3% +/ -- 5.0% - 33.3% + 76.9% + 50.0% + 16.5% + 14.7% + 0.2%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

15 11 7

2013

2014

Year to Date (YTD)

24

2013

2014

23 16 13

10

- 26.7% New Listings

+ 42.9% Sold Listings

- 33.3% New Listings

+ 76.9% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Firestone

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 60.0%

+ 100.0%

Change in Sold Listings

+ 74.4%

Change in Median Sold Price**

Fort Lupton

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 21 7 5 2 23 $119,250 $119,250 93.5% 2014 24 3 8 4 97 $208,000 $211,750 96.3% +/ + 14.3% - 57.1% + 60.0% + 100.0% + 321.7% + 74.4% + 77.6% + 3.0%

Year to Date (YTD)

2013 -12 9 5 43 $140,000 $140,900 95.7% 2014 -12 10 12 78 $173,250 $218,325 98.2% +/ -0.0% + 11.1% + 140.0% + 81.4% + 23.8% + 55.0% + 2.6%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

8

2013

2014

Year to Date (YTD)

10

2013

2014

12 9

5 4 5 2

+ 60.0% New Listings

+ 100.0% Sold Listings

+ 11.1% New Listings

+ 140.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 60% + 50% + 40% + 30% + 20% + 10% 0% - 10% - 20% - 30% 1-2008

All MLS Fort Lupton

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

--

- 100.0%

Change in Sold Listings

- 100.0%

Change in Median Sold Price**

Foxfield

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 0 1 0 1 81 $417,000 $417,000 101.7% 2014 2 2 1 0 0 0 0 0 +/ -+ 100.0% -- 100.0% -100.0% - 100.0% - 100.0% - 100.0%

Year to Date (YTD)

2013 -2 0 1 81 $417,000 $417,000 101.7% 2014 -2 2 0 0 0 0 0 +/ -0.0% -- 100.0% -100.0% - 100.0% - 100.0% - 100.0%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

1 1

2013

2014

Year to Date (YTD)

2

2013

2014

0

-New Listings

0

- 100.0% Sold Listings

0

-New Listings

0

- 100.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 200%

All MLS Foxfield

b a

+ 150%

+ 100%

+ 50%

0%

- 50%

- 100% 1-2008

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 33.3%

+ 25.0%

Change in Sold Listings

+ 33.8%

Change in Median Sold Price**

Franktown

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 22 1 6 4 185 $422,500 $545,500 94.2% 2014 30 6 8 5 98 $565,500 $555,680 97.8% +/ + 36.4% + 500.0% + 33.3% + 25.0% -47.0% + 33.8% + 1.9% + 3.8%

Year to Date (YTD)

2013 -11 14 7 126 $445,000 $534,429 95.1% 2014 -15 15 10 87 $513,750 $533,270 97.7% +/ -+ 36.4% + 7.1% + 42.9% -31.0% + 15.4% - 0.2% + 2.7%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

8 6

2013

2014

Year to Date (YTD)

14 15

2013

2014

5 4 7

10

+ 33.3% New Listings

+ 25.0% Sold Listings

+ 7.1% New Listings

+ 42.9% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 40% + 30% + 20% + 10% 0% - 10% - 20% - 30% - 40% 1-2008

All MLS Franktown

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 8.7%

- 18.2%

Change in Sold Listings

+ 10.4%

Change in Median Sold Price**

Frederick

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 31 16 23 11 132 $220,000 $232,670 98.6% 2014 26 11 21 9 64 $242,900 $239,861 99.5% +/ - 16.1% - 31.3% - 8.7% - 18.2% -51.5% + 10.4% + 3.1% + 0.9%

Year to Date (YTD)

2013 -34 36 18 111 $205,000 $219,253 98.0% 2014 -25 31 15 63 $242,900 $257,760 98.8% +/ -- 26.5% - 13.9% - 16.7% -43.2% + 18.5% + 17.6% + 0.8%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

23 21

2013

2014

Year to Date (YTD)

36 31

2013

2014

11

18 9

15

- 8.7% New Listings

- 18.2% Sold Listings

- 13.9% New Listings

- 16.7% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Frederick

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 100.0%

0.0%

Change in Sold Listings

+ 0.4%

Change in Median Sold Price**

Glendale

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 2 0 1 1 3 $127,000 $127,000 99.6% 2014 0 1 0 1 30 $127,500 $127,500 98.2% +/ - 100.0% -- 100.0% 0.0% + 900.0% + 0.4% + 0.4% - 1.4%

Year to Date (YTD)

2013 -1 3 1 3 $127,000 $127,000 99.6% 2014 -1 1 1 30 $127,500 $127,500 98.2% +/ -0.0% - 66.7% 0.0% + 900.0% + 0.4% + 0.4% - 1.4%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

1 1

2013

2014

Year to Date (YTD)

3

2013

2014

1 0

- 100.0% New Listings 0.0% Sold Listings - 66.7% New Listings

0.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 60% + 50% + 40% + 30% + 20% + 10% 0% - 10% - 20% 1-2008

All MLS Glendale

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 26.0%

- 4.1%

Change in Sold Listings

- 2.2%

Change in Median Sold Price**

Golden

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 124 66 73 49 123 $358,000 $401,115 98.5% 2014 105 72 54 47 54 $350,000 $390,080 98.6% +/ - 15.3% + 9.1% - 26.0% - 4.1% -56.1% - 2.2% - 2.8% + 0.1%

Year to Date (YTD)

2013 -132 144 87 107 $390,000 $413,156 98.4% 2014 -122 111 92 53 $330,000 $361,756 97.8% +/ -- 7.6% - 22.9% + 5.7% -50.5% - 15.4% - 12.4% - 0.6%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

73 54 49

2013

2014

Year to Date (YTD)

144 111

2013

2014

47

87

92

- 26.0% New Listings

- 4.1% Sold Listings

- 22.9% New Listings

+ 5.7% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Golden

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Greenwood Village

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

- 17.1%

Change in New Listings

- 9.1%

Change in Sold Listings

- 9.8%

Change in Median Sold Price**

February

2013 58 22 35 11 141 $569,000 $702,455 96.9% 2014 55 16 29 10 45 $513,500 $663,070 95.3% +/ - 5.2% - 27.3% - 17.1% - 9.1% -68.1% - 9.8% - 5.6% - 1.7%

Year to Date (YTD)

2013 -38 53 20 124 $587,500 $712,750 96.9% 2014 -36 43 17 61 $747,500 $761,213 96.6% +/ -- 5.3% - 18.9% - 15.0% -50.8% + 27.2% + 6.8% - 0.3%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

35 29

2013

2014

Year to Date (YTD)

53 43

2013

2014

11

10

20

17

- 17.1% New Listings

- 9.1% Sold Listings

- 18.9% New Listings

- 15.0% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 70% + 60% + 50% + 40% + 30% + 20% + 10% 0% - 10% - 20% - 30% 1-2008

All MLS Greenwood Village

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 220.0%

+ 60.0%

Change in Sold Listings

+ 4.0%

Change in Median Sold Price**

Henderson

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 6 7 5 5 26 $222,000 $214,580 99.4% 2014 19 19 16 8 27 $230,950 $224,594 100.0% +/ + 216.7% + 171.4% + 220.0% + 60.0% + 3.8% + 4.0% + 4.7% + 0.6%

Year to Date (YTD)

2013 -13 11 6 23 $232,000 $221,317 100.5% 2014 -32 35 11 32 $242,400 $265,096 99.4% +/ -+ 146.2% + 218.2% + 83.3% + 39.1% + 4.5% + 19.8% - 1.1%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

16

2013

2014

Year to Date (YTD)

35

2013

2014

8 5 5 11 6 11

+ 220.0% New Listings

+ 60.0% Sold Listings

+ 218.2% New Listings

+ 83.3% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 35% + 30% + 25% + 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013

All MLS Henderson

b a

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 8.8%

- 21.0%

Change in Sold Listings

+ 12.0%

Change in Median Sold Price**

Highlands Ranch

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 79 212 182 124 53 $296,750 $336,385 98.4% 2014 142 173 166 98 31 $332,500 $359,269 98.7% +/ + 79.7% - 18.4% - 8.8% - 21.0% -41.5% + 12.0% + 6.8% + 0.3%

Year to Date (YTD)

2013 -370 328 230 56 $307,700 $355,627 98.1% 2014 -328 313 189 32 $340,000 $366,452 98.5% +/ -- 11.4% - 4.6% - 17.8% -42.9% + 10.5% + 3.0% + 0.4%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

182 166 124

2013

2014

Year to Date (YTD)

328 313 230

2013

2014

98

189

- 8.8% New Listings

- 21.0% Sold Listings

- 4.6% New Listings

- 17.8% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 20% + 15% + 10% + 5% 0% - 5% - 10% - 15% - 20% 1-2008

All MLS Highlands Ranch

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

+ 25.0%

+ 75.0%

Change in Sold Listings

+ 35.4%

Change in Median Sold Price**

Idaho Springs

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 19 8 4 4 95 $158,756 $148,867 97.6% 2014 26 4 5 7 79 $215,000 $199,464 97.8% +/ + 36.8% - 50.0% + 25.0% + 75.0% -16.8% + 35.4% + 34.0% + 0.2%

Year to Date (YTD)

2013 -12 6 7 95 $160,000 $143,638 95.2% 2014 -15 13 12 75 $155,500 $173,021 97.0% +/ -+ 25.0% + 116.7% + 71.4% -21.1% - 2.8% + 20.5% + 1.9%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

2013

2014

Year to Date (YTD)

13

2013

2014

7 5 4 4 6

12

+ 25.0% New Listings

+ 75.0% Sold Listings

+ 116.7% New Listings

+ 71.4% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 200%

All MLS Idaho Springs

b a

+ 150%

+ 100%

+ 50%

0%

- 50% 1-2008

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 33.3%

-Change in Sold Listings

-Change in Median Sold Price**

Indian Hills

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 5 0 3 0 0 0 0 0 2014 9 0 2 0 0 0 0 0 +/ + 80.0% -- 33.3% ------

Year to Date (YTD)

2013 -1 4 2 198 $148,500 $148,500 99.4% 2014 -2 2 3 94 $485,000 $425,905 97.3% +/ -+ 100.0% - 50.0% + 50.0% -52.5% + 226.6% + 186.8% - 2.1%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

3 2

2013

2014

Year to Date (YTD)

4

2013

2014

3 2 2

0

- 33.3% New Listings

0

- 50.0% New Listings + 50.0% Sold Listings

-Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 100% + 80% + 60% + 40% + 20% 0% - 20% - 40% 1-2008

All MLS Indian Hills

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 50.0%

+ 100.0%

Change in Sold Listings

- 2.6%

Change in Median Sold Price**

Keenesburg

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 19 1 8 1 325 $133,000 $133,000 96.4% 2014 29 4 4 2 162 $129,500 $129,500 96.2% +/ + 52.6% + 300.0% - 50.0% + 100.0% -50.2% - 2.6% - 2.6% - 0.2%

Year to Date (YTD)

2013 -3 12 3 124 $133,000 $122,000 98.3% 2014 -6 8 5 80 $188,000 $162,180 97.9% +/ -+ 100.0% - 33.3% + 66.7% -35.5% + 41.4% + 32.9% - 0.4%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

8

2013

2014

Year to Date (YTD)

12 8

2013

2014

4 5 2 1

- 50.0% New Listings + 100.0% Sold Listings - 33.3% New Listings + 66.7% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 250%

All MLS Keenesburg

b a

+ 200%

+ 150%

+ 100%

+ 50%

0%

- 50% 1-2008

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing. Due to differences in statistical methodologies, methodologies figures may vary from other market reports provided by Metrolist. Metrolist

Local Market Update February 2014

A RESEARCH TOOL PROVIDED BY METROLIST SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

- 20.0%

- 100.0%

Change in Sold Listings

- 100.0%

Change in Median Sold Price**

Kiowa

Active Listings Under Contract Listings New Listings Sold Listings Total Days on Market Median Sold Price* Average Sold Price* Percent of Sold Price to List Price*

Change in New Listings

February

2013 9 4 5 2 104 $267,400 $267,400 97.3% 2014 14 3 4 0 0 0 0 0 +/ + 55.6% - 25.0% - 20.0% - 100.0% -100.0% - 100.0% - 100.0% - 100.0%

Year to Date (YTD)

2013 -11 9 6 120 $198,900 $211,800 95.7% 2014 -5 7 1 87 $429,000 $429,000 100.0% +/ -- 54.5% - 22.2% - 83.3% -27.5% + 115.7% + 102.5% + 4.5%

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

February

5 4

2013

2014

Year to Date (YTD)

9 7 6

2013

2014

2 1 0

- 20.0% New Listings - 100.0% Sold Listings - 22.2% New Listings - 83.3% Sold Listings

Change in Median Sold Price from Prior Year (6-Month Average)

+ 60% + 50% + 40% + 30% + 20% + 10% 0% - 10% - 20% - 30% 1-2008

All MLS Kiowa

b a

7-2008

1-2009

7-2009

1-2010

7-2010

1-2011

7-2011

1-2012

7-2012

1-2013

7-2013

1-2014