Professional Documents

Culture Documents

Long-Term Market Equilibrium Modeling For Generation Expansion Planning

Uploaded by

Italo ChiarellaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Long-Term Market Equilibrium Modeling For Generation Expansion Planning

Uploaded by

Italo ChiarellaCopyright:

Available Formats

Long-term Market Equilibrium Modeling for

Generation Expansion Planning

Efraim Centeno, Javier Reneses, Ral Garca, Juan Jos Snchez

Abstract--This paper introduces a methodology to

assist generation companies to deal with planning

decisions in a competitive framework. It is based on a

two-stage representation of market equilibrium. A first

level computes an approximate continuous Cournot

equilibrium for the entire model horizon. The second one

discretises this solution separately for each year. Some

aspects of its practical implantation are discussed.

KeywordsElectricity Competition, Electricity

Generation, Market Models, Power Generation Planning

and Operation, Nash-Cournot Equilibrium.

*

I. INTRODUCTION

Deregulation of electricity generation has been

accomplished in a significant group of countries all

over the world and it is a general trend in a large

number of them. This liberalisation of electrical

business implies decentralisation of strategic decisions;

in this new context, generation companies must carry

out generation expansion. These kind of decisions are

difficult to face in the new framework because of the

high level of risk involved on them. Besides, defined

market rules have shown to be insufficient to ensure

energy supply in some cases, like the Californian one.

Because of these contingencies, incentives for building

new plants are usually in continuous discussion and

redefinition.

Mathematical methods to assess and assist

generation planning in the new framework are now

under development. Operation models have

experimented a great development in the last few years

and they have been renewed both from a theoretical

and applied point of view (see [1] and [2]). The modus

operandi of this kind of new models is to incorporate

technical characteristics of power generation systems

within well state economic representation of the

market. A preliminary work in this direction with a

clearly stated theoretical basis is [3].

When it comes to medium- (about one year) and

long-term (several years), market equilibrium

representation arises as an efficient and informative

technique for electrical market analysis. Nevertheless,

the shape of cost functions of electrical generation is

complicated and may lead to difficult-to-manage

formulations when represented with detail.

Consequently, attention must also be paid not only to

This work was partially supported by Endesa.

All the authors are with Universidad Pontificia Comillas (Instituto de

Investigacin Tecnolgica), c/ Alberto Aguilera, 23. 28015 Madrid.

SPAIN (e-mail: Efraim.Centeno@iit.upco.es).

market equilibrium formulation but also to the model

resolution method. Efficient methods have been

proposed to solve this market representation based on

dynamic games theory [4], complementary problem

(including Stackelberg quantity leader approach) [5]

and equivalent quadratic optimisation problem [6]. The

later provides some useful features that will allow the

extension presented in this paper. In addition to

Cournot or Stackelberg equilibrium approaches,

expansion of some systems may be strongly

conditioned by the agents blockage to possible new

competitors entry.

This paper pursues a double aim. First, it proposes a

Nash-Cournot market equilibrium definition to

establish a forecasting of long-term system expansion.

This leads to the formulation of a large problem

difficult to solve due to the size of the possible set of

solutions. Second, an algorithm to find and

approximate solution to this problem is suggested. It is

based in the traditional concepts of static [7] and

dynamic generation planning [8] and actualises

centralised expansion concepts for the new situation. In

this context, the concepts dynamic and static have a

different meaning than in game theory and should not

be confused. This focusing allows the development of

useful tools for GenCos involved in expansion

decisions.

Complexity of the addressed problem makes hard

to take into account the uncertainty of the problem. It

mainly appears in variables as fuel prices, demand, unit

availability, hydro inflows and strategic behaviour of

competitors. Nevertheless, all this elements can be

analysed using this deterministic model via scenario

analysis. These scenarios should at least represent

realistic situations of overexpansion and

underexpansion in the system.

The model considers only the energy product.

Capacity payments have not been directly included, but

they could be represented as production cost

reductions. Long-term fuel contracts and

environmental constraints to emissions have also been

disregarded, but could be easily included in the model.

The site location and other factors related to

transmission network involved in expansion decisions

are not included either. These additional details are

commonly analysed subsequently and by means of

different models, after a size for expansion has been

decided.

Discounted net value is commonly accepted as the

variable to be maximized in the long-term as a

0-7803-7967-5/03/$17.00 2003 IEEE

Paper accepted for presentation at 2003 IEEE Bologna Power Tech Conference, June 23th-26th, Bologna, Italy

measurement of firms value. Some simplifications

have been used to define a long-term benefit function

for each firm intending to approximate in an easy way

this value. It includes energy pool revenues, production

and expansion cost as well as assets residual value.

Taxes, as well as tax saving due to depreciation, have

not been included. If a straight line depreciation is

assumed along plants life span, its impact over new

plant building actualised cost can be neglected in order

to compute market equilibrium.

In section 2, a dynamic planning equilibrium model

is presented to represent long-term market evolution,

leading to a difficult-to-solve problem formulation.

Section 3 introduces a simplified version of the

previous problem that allows obtaining an approximate

solution. The method to improve this approximate

solution using a heuristic searching method is proposed

in section 4. The previously described methods suggest

an algorithm detailed in section 5. The paper is

completed with a study case and conclusions extracted

from the numerical results.

II. DYNAMIC PLANNING EQUILIBRIUM MODEL

Under some weak assumptions, an electricity

market can be represented in the mid-term by means of

Cournot-market model [9], including technical

characteristics [6]. This market representation is also

commonly accepted as suitable for the long-term

scope. The scheme proposed in this paper is based on

Cournot equilibrium, however, it could be applied to

alternative market modeling methodologies preserving

the overall structure.

The scope of the model is considered to be

extended to a number of years (y=1,2,Y) including an

additional one, Y+1, for a residual value computation.

Each year is divided into several load levels

(l=1,2,L). In this model, every firm (e=1,2,...E)

participates in the market by generating a certain

quantity for each year and each load level P

eyl

, which

each company chooses for the maximisation of profit.

Each firm is the owner of a number of generation

groups g, so:

eyl gyl

g e

P P

=

(1)

Besides, the demand is modelled as a decreasing

function of the price . As in many other market

studies, the function is considered to be afine, being

0

its slope, and D

0

its intercept.

0 0

.

yl yl yl yl

D D = (2)

The variables for the generation and the demand are

linked through the power balance equation:

1

E

yl eyl

e

D P

=

=

(3)

The total output of each group is limited by the

maximum capacity of one group multiplied by the

number of similar built groups x

gy

. This value must be

considered as a decision variable only for those groups

that are candidates to be built or to increase their output

capacity. For the other groups it takes the value 1, and

it is a constant. New plants are supposed to start

working at the beginning of each year:

gyl

gyl gy

P x P (4)

In addition, the number of installed groups must be

increasing. If demand increases every year, this

constraint is likely to be non-active.

, 1 gy g y

x x

+

(5)

The discounted benefit B

e

obtained by a firm,

assuming remuneration at the marginal price, is:

( ) ( )

, 1

1 1

1 .

e e Y

Y L

y

e yl eyl eyl ey

y l

B B

d P C E

+

= =

= +

(

+ +

(

(6)

The cost function for the firm includes production

costs C

eyl

and also expansion cost E

ey

in case of any

new plant is installed. A discount rate (1+d

e

)

-1

is

applied for each year; d

e

can be interpreted as the firm

WACC (weighted average capital cost). B

e,Y+1

represents the so-called residual benefit of the firm.

Note that, unlike traditional expansion models, system

reliability is not included as an objective for generation

companies.

Residual benefit B

e,Y+1

is computed under the

common assumption of uniform growing g

e

for each

firm, starting from last year in model scope for every

following years. If firm activities are considered as

unlimited in time, this expression has a finite value

whether g

e

<d

e

.

( )

( )

, 1

1

1 1

1

y Y

Y e e

e Y Y

y Y

e e e

B g g

B B

d d g

+

= +

+ | | +

= =

|

+

\ .

(7)

This representation implies two decision levels.

First, installed capacity is decided for every year.

Second, power output is decided for each load level.

The first decision involves a set of discrete variables

x

gy

, while the second one is represented by a set of

continuous variables P

eyl

. Solution of the model is

defined as a discrete Nash-Cournot equilibrium for the

first level and as a continuous Nash-Cournot

equilibrium for the second.

*

( ) ( )

e gy e gy gy

B x B x e y x g e >

( )

* *

, 0

e

eyl gy

eyl

B

P x

P

(8)

In this formulation of this two-level equilibrium,

x

*

gy

and P

*

eyl

represent the equilibrium point.

After expansion decisions are taken, it is immediate

to compute Cournot equilibrium and obtain the value

of power output for every year and load level. Thus,

the second equation does not create any computational

problem. Unfortunately, in a real expansion study, a

huge number of possibilities should be evaluated to

find values that satisfy the first expression. The next

section proposes a methodology to obtain approximate

solutions.

III. RELAXED DYNAMIC EQUILIBRIUM MODEL

This section makes use and extends the operation

model presented in [6]. Consider again the problem

described by equations (6). An approximate solution

for this problem can be obtained by considering x

gy

as

continuous variables. This is equivalent to accept that

firms can build a portion of a group. Under this

assumption, the cost function can be defined as

continuous and convex, and the existence of the

equilibrium is guaranteed. Now, the problem consists

of a single stage equilibrium, considering power output

in each year and level as the decision variable. Thus:

0 , ,

e

eyl

B

e y l

P

(9)

That leads to:

( )

0

,

0 , ,

eyl eyl gy eyl ey

yl

yl eyl eyl

C P x P E

e y l

P P

=

(10)

This equation states that at the equilibrium point,

marginal revenue is equal to marginal cost, including

operation and expansion cost.

It can be proved that the previous equilibrium

problem is equivalent to the following optimisation

problem:

( )

, 1

,

1 1 1

1

eyl yl

Y L E

y

eyl yl e Y

P D

y l e

mn d C U B

+

= = =

( + +

s.t.

1

:

E

yl eyl yl

e

D P

=

=

eyl gyl

g e

P P

g

gyl gy

P x P

, 1 gy g y

x x

+

(11)

Where

eyl

C denotes a term called effective cost

function and U

yl

is the utility function for the

demand. g P is the maximum output power of group g.

( ) ( )

2

0

, ,

2

eyl

eyl eyl gy ey eyl eyl gy

yl

P

C P x E C P x

= + +

(12)

( ) ( )

2

0

0

0

1

2

yl

D

yl

yl yl yl yl yl

yl

D

U D D dD D D

| |

= =

|

|

\ .

(13)

Under the hypothesis of continuity and convexity in

cost functions, it can be proved that the first and second

order conditions are equivalent to those of the Cournot

equilibrium problem. Note that the dual variable of the

demand constraint is the marginal price of the system.

Moreover, additional technical constraints may be

added to the optimisation problem.

The solution of this problem provides useful

information about trends that may be followed by the

firms planning, including an approximation of

capacity value in the studied horizon. However, in

many cases, fractional expansion values cannot be

accepted.

IV. STATIC PLANNING EQUILIBRIUM MODEL

In order to find an exact solution for the first stage

of the problem, a static planning equilibrium model is

proposed. This model is similar to the dynamic one (8),

but it is only computed for one year of the horizon.

Benefit function is slightly modified: expansion costs

for the year are computed dividing total expansion cost

among the expected life span of the plant s and

including a capital cost coefficient q computed under

the assumption of equal payments along life span.

*

( ) ( )

ey g ey g g

B x B x e x g e >

( )

* *

, 0

ey

el g

el

B

P x

P

(14)

1

.

L

ey

ey yl eyl eyl

l

E

B P C q

s

=

| |

=

|

\ .

(15)

This problem can be established for every single

year. The number of plants in the previous years is

considered as independent decisions and the effect of

present expansion decision on subsequent years is not

considered. Under these assumptions, the size of the

problem is dramatically reduced and can be solved by

enumeration without relaxing the expansion variable.

However, as every year is solved separately, this may

not lead to an overall equilibrium. Other problem than

may arise is that the solution obtained with this method

may not satisfy equation (5), nevertheless under the

hypothesis of sustained increasing demand, this will

not happen.

V. PROPOSED ALGORITHM

The two previous algorithms do not obtain a

satisfactory solution for the expansion problem. The

relaxed dynamic obtains non-integer values for

expansion, while the static one finds a different

solution for each year without guarantying an overall

equilibrium, and probably with incoherence with

previous or following years.

These two algorithms can be combined to obtain an

approximation of the overall solution that satisfies

every constraint. The combined algorithm consists of

four steps for each year of the horizon. For the sake of

simplicity a similar size of new groups has been

assumed in the description.

Starting from first year, and moving forward:

1. Solve the relaxed dynamic problem. Compute and

discretise the number of accumulate groups to be built

until each year by each company. It will be considered

as a central value to search x

*

yg

.

( )

int 1

ye gy

g e

w x

(

= +

(16)

2. Compute the total accumulate number of groups

to be built in the system in one year as:

1

E

y ye

e

z w

=

=

(17)

This value will be used as an estimate value for x

*

y

(total accumulate new groups by year).

3. Enumerate for each year all the possible integer

values of x

yg

that satisfy:

ye gy ye

g e

w k x w k

(18)

0

gy

x

(19)

*

, 1

1 1

E E

g y gy

e g e e g e

x x

= =

(20)

Equation (18) means that we consider as possible

solutions those which lead to build a total number of

new groups each year, close to the total suggested by

the relaxed algorithm. In this equation, k establishes

how close this solution has to be. It should be an

integer small value to be chosen using heuristic criteria

based on experience.

Next equation (19), determines that values of x must be

positives. And finally, equation (20) fixes a lower

bound for system total number of built groups for each

year. This lower bound is the number of groups built

on previous year (zero for the first year).

4. Solve the static equilibrium for every value

enumerated in the previous step and determine Nash

equilibrium by inspection of the benefit matrix. In case

that equilibrium is not found, it should be fixed using

heuristic criteria. (See case study).

The algorithm can be easily extended if different

size of new groups must be considered. Instead of

using number of groups as reference and bound values,

accumulate power by year and company, and total

accumulate system power by year should be

considered.

Nevertheless, this is an unnecessary extension in

many systems, where only a single technology (as

combined cycle gas turbines, for example) is

considered for expansion. Anyhow, in order to reduce

computation time, candidate technologies should be

restricted to a maximum of two.

A simple example with two GenCos (E=2) for a

scope of five years (Y=5) is shown to illustrate the

methodology. Only one technology is considered as

candidate to be built.

TABLE I

SOLUTION FOR RELAXED DYNAMIC PROBLEM (STEP 1)

Year 1 2 3 4 5

GenCo 1 1,22 1,59 1,89 2,32 2,42

GenCo 2

0,53 0,97 1,39 1,81 2,16

TABLE II

ACCUMULATED GROUPS BY COMPANY AND YEAR (STEP 2)

Year 1 2 3 4 5

GenCo 1 2 2 2 3 3

GenCo 2

1 1 2 2 3

Total

3 3 4 5 6

TABLE III

MINIMIMUM/MAXIMUM VALUE FOR NUMBER OF ACCUMULATED

GROUPS BY YEAR (STEP 3)

Year 1 2 3 4 5

GenCo 1 0/4 0/4 0/4 1/5 1/5

GenCo 2

-1/3 -1/3 0/4 1/4 1/5

Consider that the second year is under study and

only one group has been decided to be built in the first

year, by company 1. A value of k=2 has been used for

this example. As shown in TABLE I, TABLE II and TABLE III,

company 1 should built more than 0 and about 4 new

units, whereas company 2 should built more than 0 (the

value 1 is not possible) and about 3. As one unit was

built in the first year and the maximum accumulate

built units for this second year is 3, about 2 new units

should be built in. This reduces the possibilities to be

evaluated in step 4 to the following: (0,0), (0,1), (0,2),

(1,1) and (2,0).

VI. CASE STUDY

A. Case Description

The case study represents a hypothetical large-scale

electric power system. The scope is split into 10 years,

two subperiods for each year (working days and

weekends) and three load levels for each subperiod

(peak, off-peak-1 and off-peak-2). So, there are sixty

load levels. See TABLE IV.

There are five utilities (U1 to U5) in the market

with different sizes. The installed generation capacity

for each of them is detailed in TABLE V. Only utilities

U1, U2 and U3 are considered to be interested on

expand their capacity. The main characteristics of

thermal and hydro units by utility are shown,

respectively, in TABLE VI and TABLE VII. No expansion is

considered for hydro units.

TABLE VIII shows power demand for zero price in

first year. A sustained increase of 3% each year is

considered. Demand slope is 165 MW/(/MWh) for

every level. A single technology for expansion is

considered. Expansion cost is 500 k/MW. Groups for

expansion have a maximum power of 400 MW and a

variable cost of 2.3 /MWh. Discount rate is d = 5%,

growing rate g = 0, span life s = 20 years, and from the

previous values q = 1.605.

TABLE IV

DAILY LEVEL DURATION (HOURS)

TABLE V

UTILITIES INSTALLED GENERATION CAPACITY (MW)

TABLE VI

CAPACITY (MW) AND NUMBER (IN PARENTHESES) OF THERMAL

GROUPS BY UTILITY RANGED BY COST

/MWh

U1 U2 U3 U4 U5

Up to 5 4600 (5) 400 (1) 1000 (1) 300 (1) 0 (0)

5 to 10 0 (0) 100 (1) 1000 (1) 0 (0) 0 (0)

10 to 15 2800 (8) 1300 (3) 1500 (5) 600 (2) 0 (0)

15 to 20 1100 (6) 500 (3) 2800 (11) 1800 (4) 0 (0)

20 to 25 700 (28) 1000 (2) 2700 (9) 0 (0) 0 (0)

Over 25 500 (3) 0 (0) 800 (3) 1000 (3) 0 (0)

TABLE VII

HYDRO GROUPS CHARACTERISTICS BY UTILITY

Utility U1 U2 U3 U4 U5

Number of groups 2 13 6 0 4

Total capacity (MW) 700 9700 2300 0 900

Total inflows (MW) 1400 1940 4600 0 3600

Max. energy (GWh) 600 15700 2300 0 400

Min. energy (GWh) 0 0 0 0 0

Initial res. level (GWh) 360 9420 1380 0 240

TABLE VIII

POWER DEMAND OF YEAR 1 FOR = 0 (MW)

B. Results

TABLE IX shows results for relaxed dynamic

equilibrium. Utility 2 is not interested on expanding its

capacity because it has a number of hydro groups and

its new groups would be scheduled for production few

hours a year, preventing them from investment costs

recovery. For the sake of simplicity it will not be

considered in the next steps. TABLE X contains the

results obtained using the proposed algorithm.

Higher values than those estimated by relaxed

equilibrium model are obtained. These discrepancies

between both methods may be firstly originated by the

definition of expansion cost in static and dynamic

approaches. Alternative definition of this yearly

expansion cost could lead to more similar results.

Secondly, the use of a short horizon for the study (ten

years) in comparison with groups life span (twenty

years) may be also producing this underestimation.

Finally, more specific for this case, are analysed below.

TABLE IX

RELAXED DYNAMIC EQUILIBRIUM RESULTS (NUMBER OF GROUPS)

Year 1 2 3 4 5 6 7 8 9 10

U1 0 1.13 2.26 3.69 4.92 6.14 7.05 8.06 9.33 10.65

U2 0 0 0 0 0 0 0 0 0 0

U3 2.05 3.22 4.26 5.26 6.43 7.58 8.63 9.58 10.41 11.61

z 3 6 8 10 12 15 17 19 21 23

TABLE X

PROPOSED ALGORITHM RESULTS (NUMBER OF GROUPS)

Year 1 2 3 4 5 6 7 8 9 10

U1 2 3 4 8 10 11 11 14 14 18

U2 - - - - - - - - - -

U3 4 4 8 9 11 12 16 19 19 20

Total 6 7 12 17 21 23 24 33 33 38

The results for first year are shown in TABLE XI.

Maximum values for utility 1 in each row is shown in

bold type. Maximum values for utility 3 are similarly

highlighted in each column. Building two new groups

for utility 1 and four groups for utility 2 is the only

option marked as maximum for both utilities and

consequently it is the solution for Nash equilibrium.

Note that the result (2,2) could be almost considered as

an equilibrium point, with a low difference with the

previous. This solution is closer to the one proposed by

the relaxed algorithm. This small difference shows that

the algorithm is very sensitive to modelling of system

and to precision in computation of results.

TABLE XI

UTILITIES 1 AND 3 BENEFIT FOR YEAR 1 FOR DIFFERENT NUMBER OF

ACCUMULATED NEW GROUPS (M)

U1

U3

0 1 2 3 4 5 6

5078.8 5077.3 5086.1 5082.2 5074.7 5075.3 5070.2

0 4958.7 4949.0 4900.7 4885.0 4869.8 4844.4 4827.3

5041.0 5039.6 5057.9 5054.0 5051.5 5044.1 5036.6

1

4971.7 4961.6 4908.3 4895.0 4877.4 4853.8 4836.6

5017.8 5015.6 5020.8 5011.0 5002.3 5001.9 4997.0

2 4974.5 4964.4 4919.3 4903.4 4894.3 4867.7 4849.1

4984.3 4987.5 4999.0 4997.4 4990.6 4986.9 4973.7

3 4983.0 4962.2 4920.2 4901.7 4891.2 4864.6 4851.6

4970.8 4971.5 4980.1 4978.2 4974.3 4974.2 4966.2

4 4981.1 4956.8 4920.2 4901.8 4885.7 4858.7 4845.5

4965.6 4971.5 4975.0 4969.7 4962.4 4952.2 4942.0

5 4973.8 4946.8 4912.5 4895.7 4881.3 4856.2 4846.7

4929.0 4938.6 4938.7 4936.2 4933.4 4932.0 4921.9

6 4982.4 4938.3 4917.1 4898.7 4878.8 4853.7 4844.3

Situation is more complicated in year 2 (see TABLE

XII). There is not a point of equilibrium, but there are

four states that establish a 2x2 region of equilibrium. If

decision of U1 is to install 3 groups, then U3 finds its

maximum installing 5 groups, these decision leads U1

to add a group to reach a maximum. In this situation

U3 prefers to reduce one group to maximize benefit.

For this decision of U3, the best option for U1 is to

build up 3 groups, that was the starting point. The

values (3,4) has been chosen heuristically as

equilibrium point first because the increment that U3

would obtain changing its decision is lower than the

other three changes that appear in the previously

described dynamic. Besides, the difference is

negligible.

TABLE XII

UTILITIES 1 AND 3 BENEFIT FOR YEAR 2 FOR DIFFERENT NUMBER OF

ACCUMULATED NEW GROUPS (M)

U1

U3

2 3 4 5 6 7 8

5467.1 5485.3 5484.5 5481.8 5483.4 5476.9 5461.3

4 5507.9 5453.1 5434.0 5416.2 5387.5 5369.0 5360.6

5459.1 5466.7 5467.4 5461.5 5463.6 5459.3 5449.0

5

5502.9 5453.5 5428.9 5417.1 5386.7 5366.7 5356.9

5450.3 5465.2 5467.5 5458.7 5460.7 5446.0 5433.3

6

5493.1 5444.2 5419.0 5408.4 5378.1 5362.9 5354.1

5426.6 5425.9 5423.2 5417.2 5417.9 5412.8 5402.3

7 5485.5 5446.5 5427.5 5415.0 5386.3 5367.3 5357.4

5415.1 5416.9 5413.9 5407.9 5408.5 5403.4 5393.0

8 5474.8 5438.4 5419.4 5406.9 5378.1 5359.2 5349.2

5407.7 5415.6 5414.0 5407.9 5408.6 5395.7 5380.1

9 5462.7 5425.8 5406.1 5393.4 5364.8 5349.4 5341.8

5400.6 5401.0 5394.2 5386.3 5375.7 5365.5 5354.7

10 5449.4 5419.9 5402.7 5379.6 5359.8 5349.4 5339.1

Year 3, presented in TABLE XIII, raises a different

situation. Two different Nash equilibriums are founded

(7,5) and (4,8). None of these two equilibriums is

dominant with respect to the other. Additionally both

of them have the same total groups value, so the value

of z

y

, cannot used as reference value. An additional

heuristic criteria is required. The later point has been

choosen, because it distributes differences with

continuous equilibrium results for each firm (w

ey

) more

equally.

TABLE XIII

UTILITIES 1 AND 3 BENEFIT FOR YEAR 3 FOR DIFFERENT NUMBER OF

ACCUMULATED NEW GROUPS (M)

U1

U3

3 4 5 6 7 8 9

5971.6 5995.2 5999.5 6001.7 6004.1 5997.5 5984.8

4

5851.5 5815.0 5801.6 5787.6 5773.3 5754.9 5746.0

5928.6 5965.5 5964.9 5966.2 5967.6 5965.0 5955.3

5 5882.4 5836.7 5818.3 5800.9 5785.7 5763.3 5752.9

5921.2 5954.7 5954.4 5952.6 5949.3 5945.1 5934.9

6

5878.3 5834.8 5816.0 5801.3 5780.7 5761.1 5751.3

5914.9 5947.8 5947.0 5948.2 5949.3 5944.9 5933.6

7 5875.2 5831.9 5813.2 5795.7 5770.6 5751.2 5741.2

5906.3 5919.6 5912.1 5902.9 5905.7 5901.5 5891.2

8

5873.9 5839.0 5822.6 5808.7 5776.5 5756.1 5746.2

5883.8 5905.8 5900.4 5893.3 5896.1 5891.9 5881.6

9

5848.4 5832.0 5816.2 5800.7 5768.6 5748.2 5738.3

5876.3 5898.0 5894.6 5891.1 5893.9 5889.8 5878.1

10 5882.9 5820.2 5805.8 5788.5 5756.3 5735.9 5725.9

There is another interesting result for this year. The

point (4,5) is a local equilibrium. A unilateral change

of one group for U1 or U3 causes a benefit decrease.

This point is close the value obtained with continuous

algorithm (2.26,4.26). This kind of situations may also

explain discrepancies between both algorithms, as the

continuous one is based in a local definition of

equilibrium.

Results for year 4 are detailed in TABLE XIV. In this

case a 4x2 equilibrium region appears, similar to the

one presented for year 2. Equilibrium point is selected

with the same criterion used before.

TABLE XIV

UTILITIES 1 AND 3 BENEFIT FOR YEAR 4 FOR DIFFERENT NUMBER OF

ACCUMULATED NEW GROUPS (M)

U1

U3

4 5 6 7 8 9 10

6403.5 6422.9 6425.6 6426.4 6439.3 6439.1 6431.3

8

6503.1 6466.8 6441.9 6424.6 6394.5 6380.8 6373.6

6402.2 6411.1 6405.0 6398.7 6410.0 6409.5 6401.2

9

6494.6 6465.2 6442.1 6428.9 6401.6 6387.7 6380.9

6361.6 6383.7 6387.6 6384.7 6395.3 6394.9 6386.7

10 6506.9 6459.1 6434.2 6396.1 6396.2 6382.3 6375.5

6351.8 6373.7 6377.3 6374.4 6385.0 6384.7 6376.4

11 6499.2 6451.3 6426.3 6412.0 6388.3 6374.5 6367.6

6351.8 6368.4 6372.2 6366.5 6369.5 6366.0 6353.8

12 6485.8 6443.3 6418.1 6406.9 6390.0 6378.6 6371.8

6332.7 6344.6 6352.0 6350.9 6357.8 6357.4 6343.0

13 6492.2 6454.1 6434.7 6408.2 6386.7 6370.9 6361.7

6327.3 6336.5 6343.8 6345.4 6352.1 6346.0 6336.1

14 6482.3 6447.3 6418.0 6398.3 6376.6 6360.8 6349.2

Finally, TABLE XV presents results for year 9. In this

case there is a single equilibrium at the corner of the

table, and both firms decide not to expand their

capacity.

TABLE XV

UTILITIES 1 AND 3 BENEFIT FOR YEAR 9 FOR DIFFERENT NUMBER OF

ACCUMULATED NEW GROUPS (M)

U1

U3

14 15 16 17 18 19 20

9239.6 9223.5 9236.1 9199.7 9149.1 9178.8 9158.7

19 9029.2 9021.4 8983.4 9003.1 9210.7 9078.2 9069.0

9231.2 9235.2 9389.1 9517.9 9250.5 9132.8 9021.0

20 9016.9 9003.3 8857.4 8835.1 8866.2 8985.2 8968.5

9230.6 9227.9 9080.5 9049.2 9185.2 9187.0 9183.2

21 9000.8 8998.3 9090.7 8967.3 9142.3 8991.7 8955.3

9230.8 9227.3 8985.4 9490.6 9162.1 9133.6 9124.9

22 8984.5 8946.6 8992.8 8958.2 8918.0 8904.4 9048.2

9231.2 9227.9 9224.7 9294.1 9120.6 9116.4 9180.0

23 8968.7 9034.6 8952.5 8803.9 9050.6 9141.2 8997.0

9231.2 9249.4 9176.3 9139.2 9202.6 9392.2 9145.1

24 8952.6 8923.8 8954.7 9328.3 8897.6 8693.7 8852.6

9231.2 9227.1 9040.3 9195.6 9210.5 9166.0 9170.5

25 8936.7 8967.4 9020.8 8813.6 8702.6 8891.3 8995.8

The rest of the years present similar behaviours to

some of the presented ones.

From previous results, the value of parameter k, can

be established for future computations. Heuristic search

need large values of parameter k for the reason that

relaxed equilibrium underestimates discrete ones.

TABLE XVI shows minimum required value for each year

as a result of the extensive exploration performed for

the study case.

TABLE XVI

MINIMUM REQUIRED VALUE FOR SEARCHING PARAMETER K

Year 1 2 3 4 5 6 7 8 9 10

k 2 1 3 4 5 4 7 9 8 8

VII. CONCLUSIONS

A methodology that allows the computation of

capacity expansion in a competitive framework has

been presented. The market equilibrium has been

represented using a two-stage model. One level is

based on a continuous Cournot equilibrium and

computes a market equilibrium approximation for the

entire model horizon. A second level discretises this

solution separately for each year.

Results obtained show remarkable differences

between the results obtained using both methods. The

definition of expansion cost in static and dynamic

approaches, the use of short horizons in comparison

with groups life span and the existence of local and

multiple equilibriums are the origin of this

dissimilarities. Nevertheless the approximate method

arises as a useful aid to define equilibrium in an

approximate way.

VIII. ACKNOWLEDGEMENT

The authors gratefully acknowledge the

contributions of Andrs Daz Casado for his work on

the original version of this document.

IX. REFERENCES

[1] B. F. Hobbs. "LCP Models of Nash-Cournot Competition in

Bilateral and POOLCO-Based Power Markets". Proceedings

of IEEE Winter power Meeting, New York, 1999.

[2] C. J. Day, B. F. Hobbs. Oligopolistic competition in power

networks: a conjectured supply function approach, IEEE

Trans. Power System 2002, vol 17, pp 597-607.

[3] N. M. von der Fehr. Capacity Investment and Long-Run

Efficiency in Market-Based Electricity Industries.

Competition in the Electricity Supply Industriy, DH&F

Publishing, Copenhagen, 1995.

[4] P. Murto. Models of Capacity Investment in Deregulated

Electricity Markets. PhD Thesis. Helsinki University of

Technology. Department of Engineering Physics and

Mathematics. Systems Analysis Laboratory, 2000.

[5] M. Ventosa, R. Denis, C. Redondo. Expansion Planning in

Electriciy Markets. Two different Approaches. Proceeding of

14th PSCC, Sevilla, 24-28 June 2002.

[6] J. Reneses, E. Centeno and J. Barquin, "Computation and

Decomposition of Marginal Costs for a GENCO in a

Constrained Competitive Cournot Equilibrium, in Proc 1999

IEEE International Conference on Electric Power Engineering

Power Tech. Budapest.

[7] A. Ramos. I.J. Perez-Arriaga, J. Bogas, "A Nonlinear

Programming Approach to Optimal Static Generation

Expansion Planning", IEEE Trans. Power System 1989, vol 4,

pp 1140-1146.

[8] B. G. Gorenstin, N. M. Campondonico, J. P. Costa and M. V.

F. Pereira "Power System Expansion Planning under

Uncertainty". IEEE Trans. Power System 1993, vol 8, pp 29-

36.

[9] A. F. Saughety. Cournot Oligopoly, Cambridge University

Press, 1988.

X. BIOGRAPHIES

Efraim Centeno obtained a Degree in

Industrial Engineering (1991) and a PhD in

Industrial Engineering (1998) at the

Universidad Pontificia de Comillas, Madrid. He

belongs to the research staff at the Instituto de

Investigacin Tecnolgica . His areas of interest

include planning and development of electric

energy systems.

Javier Reneses obtained a Degree in Electric

Industrial Engineering at the Universidad

Pontificia de Comillas, Madrid in 1996. At

present, he is Researcher at the Instituto de

Investigacin Tecnolgica. His areas of interest

include operation, simulation models and

planning of electric energy systems and risk

management strategies in electricity markets.

Rul Garca obtained a Degree in Industrial

Engineering (2001) at the Universidad de

Valladolid. At present, he is Researcher at the

Instituto de Investigacin Tecnolgica. His

areas of interest include planning and

development of electric energy systems.

Juan Jos Snchez obtained a Degree in

Industrial Engineering (2002) at the

Universidad Pontificia de Comillas, Madrid. At

present, he is Researcher at the Instituto de

Investigacin Tecnolgica. His areas of interest

include planning and development of electric

energy systems.

You might also like

- Generation Expansion Planning Strategies On Power System: A ReviewDocument4 pagesGeneration Expansion Planning Strategies On Power System: A Reviewrudreshsj86No ratings yet

- Quota Modeling in Hydrothermal Systems: M. M. Belsnes, A. Haugstad and B. Mo, SINTEF Energy Research, P. Markussen, ElsamDocument6 pagesQuota Modeling in Hydrothermal Systems: M. M. Belsnes, A. Haugstad and B. Mo, SINTEF Energy Research, P. Markussen, ElsamItalo ChiarellaNo ratings yet

- A Simulation Tool For Short Term Electricity MarketsDocument6 pagesA Simulation Tool For Short Term Electricity MarketsMani GandanNo ratings yet

- BE Strategic BiddingDocument9 pagesBE Strategic Biddingkaren dejoNo ratings yet

- New Efficiency Theory With Applicatio... (Z-Library)Document183 pagesNew Efficiency Theory With Applicatio... (Z-Library)Alberto Julian LaraNo ratings yet

- Pensar !!!Document6 pagesPensar !!!Jamerson RamosNo ratings yet

- Optimal Penetration Approach: Annex "A"Document20 pagesOptimal Penetration Approach: Annex "A"api-25914216No ratings yet

- Coredp 2001 52Document30 pagesCoredp 2001 52tarcisioNo ratings yet

- A Linear Programming Approach To Solving Stochastic Dynamic ProgramsDocument39 pagesA Linear Programming Approach To Solving Stochastic Dynamic ProgramskcvaraNo ratings yet

- A Game-Theoretic Model For Generation Expansion Planning: Problem Formulation and Numerical ComparisonsDocument7 pagesA Game-Theoretic Model For Generation Expansion Planning: Problem Formulation and Numerical ComparisonsMuhammad BahrulNo ratings yet

- Simulating DSM Impact in The New Liberalized Electricity MarketDocument8 pagesSimulating DSM Impact in The New Liberalized Electricity MarketDoankhoa DoanNo ratings yet

- Long Horizon Versus Short Horizon Planning in Dynamic Optimization Problems With Incomplete InformationDocument39 pagesLong Horizon Versus Short Horizon Planning in Dynamic Optimization Problems With Incomplete InformationrerereNo ratings yet

- BE Nash EquilibriaDocument10 pagesBE Nash Equilibriakaren dejoNo ratings yet

- New Market Power Driven Multistage Trans-Mission Expansion Strategy in Power MarketsDocument8 pagesNew Market Power Driven Multistage Trans-Mission Expansion Strategy in Power MarketssunitharajababuNo ratings yet

- 411 1713 2 PB Expansion PDFDocument15 pages411 1713 2 PB Expansion PDFkaren dejoNo ratings yet

- MILP Unit Commitment FormulationDocument8 pagesMILP Unit Commitment FormulationAhmed AsimNo ratings yet

- Optimized Clusters For Disaggregated Electricity Load ForecastingDocument20 pagesOptimized Clusters For Disaggregated Electricity Load ForecastingKalthoum ZaoualiNo ratings yet

- Kun SCH 2008Document15 pagesKun SCH 2008Oscar CordobaNo ratings yet

- WASP-IV Summary PDFDocument14 pagesWASP-IV Summary PDFSuson DhitalNo ratings yet

- Notes On Some Common Misconceptions in Input-Output Impact MethodologyDocument27 pagesNotes On Some Common Misconceptions in Input-Output Impact MethodologyLilian IordacheNo ratings yet

- Evaluating The Performance of Nearest Neighbour Algorithms When Forecasting US Industry ReturnsDocument20 pagesEvaluating The Performance of Nearest Neighbour Algorithms When Forecasting US Industry ReturnsOotam SeewoogoolamNo ratings yet

- A Computable General Equilibrium Modeling Platform For The Azorean Economy: A Simple Approach With International TradeDocument24 pagesA Computable General Equilibrium Modeling Platform For The Azorean Economy: A Simple Approach With International TradeFrancisco SilvaNo ratings yet

- Electricity Market Modeling Trends: Mariano Ventosa, ! Alvaro Ba !ıllo, Andr!es Ramos, Michel RivierDocument17 pagesElectricity Market Modeling Trends: Mariano Ventosa, ! Alvaro Ba !ıllo, Andr!es Ramos, Michel RivierSuad SalijuNo ratings yet

- Flexible Transmission Network Planning Considering The Impacts of Distributed GenerationDocument32 pagesFlexible Transmission Network Planning Considering The Impacts of Distributed GenerationhunghtdNo ratings yet

- Electric Power Systems Research: SciencedirectDocument12 pagesElectric Power Systems Research: Sciencedirectoctober87No ratings yet

- Macroeconomics Fourteenth Canadian Edition Canadian 14th Edition Ragan Solutions ManualDocument11 pagesMacroeconomics Fourteenth Canadian Edition Canadian 14th Edition Ragan Solutions Manualadelaideoanhnqr1v100% (21)

- Simulated Annealing For Complex Portfolio Selection ProblemsDocument26 pagesSimulated Annealing For Complex Portfolio Selection Problemsveeken77No ratings yet

- CombinedDocument27 pagesCombinedjerc1324No ratings yet

- 1 s2.0 S0306261922002057 MainDocument14 pages1 s2.0 S0306261922002057 MainluisNo ratings yet

- Optimal Response of An Oligopolistic Generating Company To A Competitive Pool-Based Electric Power MarketDocument7 pagesOptimal Response of An Oligopolistic Generating Company To A Competitive Pool-Based Electric Power MarketwilliamnuevoNo ratings yet

- 1 s2.0 S2211467X22000955 MainDocument13 pages1 s2.0 S2211467X22000955 Mainjun luNo ratings yet

- The Integration of Activity Based Costing and Enterprise Modeling For Reengineering PurposesDocument12 pagesThe Integration of Activity Based Costing and Enterprise Modeling For Reengineering PurposesLivia MarsaNo ratings yet

- Firm Size and Productivity. Evidence From The Electricity Distribution Industry in BrazilDocument8 pagesFirm Size and Productivity. Evidence From The Electricity Distribution Industry in BrazilGeorge NunesNo ratings yet

- Application of Fuzzy Logic To Priced-Based Unit Commitment Under Price UncertaintyDocument5 pagesApplication of Fuzzy Logic To Priced-Based Unit Commitment Under Price UncertaintyHafeez AnsariNo ratings yet

- The Measurement of Productive Efficiency and Productivity ChangeDocument4 pagesThe Measurement of Productive Efficiency and Productivity ChangeHa M ZaNo ratings yet

- Omega: Marius Häntsch, Arnd HuchzermeierDocument17 pagesOmega: Marius Häntsch, Arnd HuchzermeierPilar RiveraNo ratings yet

- An Insight Into Bio-Inspired and Evolutionary Algorithms For Global Optimization Review Analysis and Lessons Learnt Over A Decadeof CompetitionsDocument28 pagesAn Insight Into Bio-Inspired and Evolutionary Algorithms For Global Optimization Review Analysis and Lessons Learnt Over A Decadeof CompetitionsAmreen KhanNo ratings yet

- CGE Classroom ExcelDocument39 pagesCGE Classroom ExcelPaf Veterans-FamiliesNo ratings yet

- Introduction to Dynamic Macroeconomic General Equilibrium ModelsFrom EverandIntroduction to Dynamic Macroeconomic General Equilibrium ModelsNo ratings yet

- A Profit-Based Maintenance Scheduling of Thermal Power Units in Electricity MarketDocument9 pagesA Profit-Based Maintenance Scheduling of Thermal Power Units in Electricity Marketraul_bsuNo ratings yet

- Production FunctionDocument8 pagesProduction FunctionutsmNo ratings yet

- An Integrated Model For An Industrial Production Distribution ProblemDocument11 pagesAn Integrated Model For An Industrial Production Distribution ProblemalexNo ratings yet

- Modelling Product Development Productivity With System DynamicsDocument9 pagesModelling Product Development Productivity With System DynamicsRavishanker BaligaNo ratings yet

- Managerial Economics (8522) LEVEL: MBA (3 Years) Assignment No. 1Document26 pagesManagerial Economics (8522) LEVEL: MBA (3 Years) Assignment No. 1saniaNo ratings yet

- Energies: Analysis of Photovoltaic Self-Consumption SystemsDocument18 pagesEnergies: Analysis of Photovoltaic Self-Consumption SystemskalokosNo ratings yet

- Business Confidence & Depression PreventionDocument8 pagesBusiness Confidence & Depression PreventionShriram DusaneNo ratings yet

- Laffont, J.J. Tirole, J. A Theory of Incentives in Procurement and Regulation. Cap. 1.1-1.3 y 1.5Document19 pagesLaffont, J.J. Tirole, J. A Theory of Incentives in Procurement and Regulation. Cap. 1.1-1.3 y 1.5Flor MartinezNo ratings yet

- MB0048 - Operation ResearchDocument15 pagesMB0048 - Operation ResearchMeha SharmaNo ratings yet

- Karda Kos 2014Document9 pagesKarda Kos 2014Shimpy RalhanNo ratings yet

- Summary of Production TheoryDocument6 pagesSummary of Production TheoryAndreas Audi KemalNo ratings yet

- Waste Management Multi-Objective Optimiza-Tion For Greenhouse Gases Emissions ControlDocument11 pagesWaste Management Multi-Objective Optimiza-Tion For Greenhouse Gases Emissions ControlMario WhoeverNo ratings yet

- A Study On The Dynamic Mechanism For Allocating Emission Permits Under Endogenous GrowthDocument10 pagesA Study On The Dynamic Mechanism For Allocating Emission Permits Under Endogenous Growthliuyiaustin0710No ratings yet

- Chapter 03Document78 pagesChapter 03orfeas11No ratings yet

- Sticky Information Models in Dynare: Dynare Working Papers SeriesDocument18 pagesSticky Information Models in Dynare: Dynare Working Papers SeriesLaur LaurNo ratings yet

- Capturing Electricity Market Dynamics in Strategic Market Participation Using Neural Network Constrained OptimizationDocument14 pagesCapturing Electricity Market Dynamics in Strategic Market Participation Using Neural Network Constrained OptimizationYULIANTONo ratings yet

- Aggregate Planning in Manufacturing Company - Linear Programming ApproachDocument8 pagesAggregate Planning in Manufacturing Company - Linear Programming ApproachMawar NooviaNo ratings yet

- Course Notes For EE394V Restructured Electricity Markets: Locational Marginal PricingDocument62 pagesCourse Notes For EE394V Restructured Electricity Markets: Locational Marginal PricingLTE002No ratings yet

- College of Engineering: Optimal Economic Load Dispatch Using Novel Bat AlgorithmDocument23 pagesCollege of Engineering: Optimal Economic Load Dispatch Using Novel Bat AlgorithmJean-nette BarlisanNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewKIBIWOT jobNo ratings yet

- A Fast and Efficient Method For Frequency Deviation Measurement Based On Genetic Algorithms Using A FPGA ApproachDocument6 pagesA Fast and Efficient Method For Frequency Deviation Measurement Based On Genetic Algorithms Using A FPGA ApproachItalo ChiarellaNo ratings yet

- 0 AE549 BEd 01Document6 pages0 AE549 BEd 01Italo ChiarellaNo ratings yet

- Observation of Frequency Oscillation in Western Japan 60Hz Power System Based On Multiple Synchronized Phasor MeasurementsDocument6 pagesObservation of Frequency Oscillation in Western Japan 60Hz Power System Based On Multiple Synchronized Phasor MeasurementsItalo ChiarellaNo ratings yet

- 0 FF349 BEd 01Document6 pages0 FF349 BEd 01Italo ChiarellaNo ratings yet

- A Fast Electric Load Forecasting UsingDocument6 pagesA Fast Electric Load Forecasting UsingItalo ChiarellaNo ratings yet

- Synchronous MachineDocument10 pagesSynchronous MachineItalo ChiarellaNo ratings yet

- Yi Ming 2003Document7 pagesYi Ming 2003Italo ChiarellaNo ratings yet

- A Uniform Line Model For Non-Uniform Single-Phase Lines With Frequency Dependent Electrical ParametersDocument6 pagesA Uniform Line Model For Non-Uniform Single-Phase Lines With Frequency Dependent Electrical ParametersItalo ChiarellaNo ratings yet

- Simulation of The Impact of Wind Power On The Transient Fault BehaviorDocument10 pagesSimulation of The Impact of Wind Power On The Transient Fault Behaviormanigopal123No ratings yet

- Street Light by Using ZigbeeDocument5 pagesStreet Light by Using ZigbeeRohit Khodke100% (1)

- 141020131617446117500Document8 pages141020131617446117500Italo ChiarellaNo ratings yet

- 5 A58243 FD 01Document8 pages5 A58243 FD 01Italo ChiarellaNo ratings yet

- Abdel Akher2014Document6 pagesAbdel Akher2014Italo ChiarellaNo ratings yet

- Applications of Optical Current and Voltage Sensors in High-Voltage SystemsDocument4 pagesApplications of Optical Current and Voltage Sensors in High-Voltage SystemsItalo ChiarellaNo ratings yet

- Direct Load Control As A Market-Based Program in Deregulated Power IndustriesDocument4 pagesDirect Load Control As A Market-Based Program in Deregulated Power IndustriesItalo ChiarellaNo ratings yet

- Operating Stationary Fuel Cells On Power System and Micro-GridsDocument6 pagesOperating Stationary Fuel Cells On Power System and Micro-GridsItalo ChiarellaNo ratings yet

- Replicating Interruptible Supply Contracts For Security Constrained Transmission ManagementDocument7 pagesReplicating Interruptible Supply Contracts For Security Constrained Transmission ManagementItalo ChiarellaNo ratings yet

- CD2 B2 C3 CD 01Document4 pagesCD2 B2 C3 CD 01Italo ChiarellaNo ratings yet

- CA3 C2 C3 CD 01Document7 pagesCA3 C2 C3 CD 01Italo ChiarellaNo ratings yet

- Analysing Negative Skewness of Spot Returns in The Australian Electricity MarketDocument7 pagesAnalysing Negative Skewness of Spot Returns in The Australian Electricity MarketItalo ChiarellaNo ratings yet

- A6 E733 C1 D 01Document7 pagesA6 E733 C1 D 01Italo ChiarellaNo ratings yet

- An Efficient Multi-Objective Meta-Heuristic Method For Distribution Network Expansion PlanningDocument6 pagesAn Efficient Multi-Objective Meta-Heuristic Method For Distribution Network Expansion PlanningItalo ChiarellaNo ratings yet

- Stochastic Assessment of Unbalanced Voltage Dips in Large Transmission SystemsDocument8 pagesStochastic Assessment of Unbalanced Voltage Dips in Large Transmission SystemsItalo ChiarellaNo ratings yet

- Technological Evolution of MV Equipment and Structure NetworkDocument5 pagesTechnological Evolution of MV Equipment and Structure NetworkItalo ChiarellaNo ratings yet

- ACEE3 D87 D 01Document6 pagesACEE3 D87 D 01Italo ChiarellaNo ratings yet

- A Dynamic SecurityDocument8 pagesA Dynamic SecurityItalo ChiarellaNo ratings yet

- CD9 C2 C3 CD 01Document8 pagesCD9 C2 C3 CD 01Italo ChiarellaNo ratings yet

- Power System Stability Improvement by Energy Storage Type STATCOMDocument7 pagesPower System Stability Improvement by Energy Storage Type STATCOMItalo ChiarellaNo ratings yet

- An Integrated Machine Learning Model For Day-Ahead Electricity Price ForecastingDocument7 pagesAn Integrated Machine Learning Model For Day-Ahead Electricity Price ForecastingItalo ChiarellaNo ratings yet

- CCB82C3Cd01 PDFDocument4 pagesCCB82C3Cd01 PDFItalo ChiarellaNo ratings yet

- MGN815: Business Models: Ajay ChandelDocument38 pagesMGN815: Business Models: Ajay ChandelSam RehmanNo ratings yet

- Capacitor Trip Device CTD-4Document2 pagesCapacitor Trip Device CTD-4DAS1300No ratings yet

- Chapter 17 Study Guide: VideoDocument7 pagesChapter 17 Study Guide: VideoMruffy DaysNo ratings yet

- Splash25 Winner InstructionsDocument8 pagesSplash25 Winner InstructionsRamkrishna PaulNo ratings yet

- A Database For Handwritten Text Recognition ResearchDocument5 pagesA Database For Handwritten Text Recognition Researchtweety492No ratings yet

- Practice Paper Pre Board Xii Biology 2023-24-1Document6 pagesPractice Paper Pre Board Xii Biology 2023-24-1salamnaseema14No ratings yet

- Proposal For A Working Procedure To Accurately Exchange Existing and New Calculated Protection Settings Between A TSO and Consulting CompaniesDocument9 pagesProposal For A Working Procedure To Accurately Exchange Existing and New Calculated Protection Settings Between A TSO and Consulting CompaniesanonymNo ratings yet

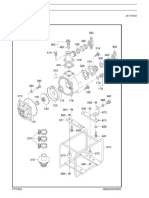

- Workshop Manual: 3LD 450 3LD 510 3LD 450/S 3LD 510/S 4LD 640 4LD 705 4LD 820Document33 pagesWorkshop Manual: 3LD 450 3LD 510 3LD 450/S 3LD 510/S 4LD 640 4LD 705 4LD 820Ilie Viorel75% (4)

- Topic - Temperature SensorDocument9 pagesTopic - Temperature SensorSaloni ChaudharyNo ratings yet

- RL78 L1B UsermanualDocument1,062 pagesRL78 L1B UsermanualHANUMANTHA RAO GORAKANo ratings yet

- DGKCC Internship ReportDocument17 pagesDGKCC Internship ReportMuhammad AtharNo ratings yet

- What Role Does Imagination Play in Producing Knowledge About The WorldDocument1 pageWhat Role Does Imagination Play in Producing Knowledge About The WorldNathanael Samuel KuruvillaNo ratings yet

- Benefits and Drawbacks of Thermal Pre-Hydrolysis For Operational Performance of Wastewater Treatment PlantsDocument7 pagesBenefits and Drawbacks of Thermal Pre-Hydrolysis For Operational Performance of Wastewater Treatment PlantsmartafhNo ratings yet

- Inglês - Advérbios - Adverbs.Document18 pagesInglês - Advérbios - Adverbs.KhyashiNo ratings yet

- Viking 062293Document8 pagesViking 062293Lukman ZakariyahNo ratings yet

- New Horizon Public School, Airoli: Grade X: English: Poem: The Ball Poem (FF)Document42 pagesNew Horizon Public School, Airoli: Grade X: English: Poem: The Ball Poem (FF)stan.isgod99No ratings yet

- Contemp Module 56Document5 pagesContemp Module 56crisanta pizonNo ratings yet

- R917007195 Comando 8RDocument50 pagesR917007195 Comando 8RRodrigues de OliveiraNo ratings yet

- Electron LayoutDocument14 pagesElectron LayoutSaswat MohantyNo ratings yet

- Elad Shapira - Shall We Play A Game - Lessons Learned While Playing CoreWars8086Document61 pagesElad Shapira - Shall We Play A Game - Lessons Learned While Playing CoreWars8086james wrightNo ratings yet

- The Uv Environment Production System Best Practice OperationDocument2 pagesThe Uv Environment Production System Best Practice OperationFarzad ValizadehNo ratings yet

- PTD30600301 4202 PDFDocument3 pagesPTD30600301 4202 PDFwoulkanNo ratings yet

- The Future Mixed TensesDocument4 pagesThe Future Mixed TensesChernykh Vitaliy100% (1)

- ActivityDocument2 pagesActivityShaira May SalvadorNo ratings yet

- Sullivan's Interpersonal TheoryDocument27 pagesSullivan's Interpersonal TheoryJezalen GonestoNo ratings yet

- Dial 1298 For Ambulance - HSBCDocument22 pagesDial 1298 For Ambulance - HSBCDial1298forAmbulanceNo ratings yet

- Centric WhitepaperDocument25 pagesCentric WhitepaperFadhil ArsadNo ratings yet

- University Grading System - VTUDocument3 pagesUniversity Grading System - VTUmithilesh8144No ratings yet

- TDS-11SH Top Drive D392004689-MKT-001 Rev. 01Document2 pagesTDS-11SH Top Drive D392004689-MKT-001 Rev. 01Israel Medina100% (2)

- Time-Temperature Charge Function of A High Dynamic Thermal Heat Storage With Phase Change MaterialDocument15 pagesTime-Temperature Charge Function of A High Dynamic Thermal Heat Storage With Phase Change Materialgassoumi walidNo ratings yet