Professional Documents

Culture Documents

Chapter 20 - Answer

Chapter 20 - Answer

Uploaded by

sweetwinkle09Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 20 - Answer

Chapter 20 - Answer

Uploaded by

sweetwinkle09Copyright:

Available Formats

MANAGEMENT ACCOUNTING (VOLUME II) - Solutions Manual

CHAPTER 20

CAPITAL BUDGETING DECISIONS

I.

Questions

1. A capital investment involves a current commitment of funds with the

expectation of generating a satisfactory return on these funds over a

relatively extended period of time in the future.

2. Cost of capital is the weighted minimum desired average rate that a

company must pay for long-term capital while discounted rate of return is

the maximum rate of interest that could be paid for the capital employed

over the life of an investment without loss on the project.

3. The basic principles in capital budgeting are:

1. Capital investment models are focused on the future cash inflows and

outflows - rather than on net income.

2. Investment proposals should be evaluated according to their

differential effects on the companys cash flows as a whole.

3. Financing costs associated with the project are excluded in the

analysis of incremental cash flows in order to avoid the doublecounting of the cost of money.

4. The concept of the time value of money recognizes that a peso of

present return is worth more than a peso of future return.

5. Choose the investments that will maximize the total net present value

of the projects subject to the capital availability constraint.

4. The major classifications as to purpose are:

1. Replacement projects

- those involving replacements of worn-out assets to avoid

disruption of normal operations, or to improve efficiency.

2. Product or process improvement

- projects that aim to produce additional revenue or to realize cost

savings.

3. Expansion

- projects that enhance long-term returns due to increased profitable

volume.

5. Greater amounts of capital may be used in projects whose combined

returns will exceed any alternate combination of total investment.

20-1

Chapter 20 Capital Budgeting Decisions

6. No. This implies that any equity funds are cost free and this is a

dangerous position because it ignores the opportunity cost or alternative

earnings that could be had from the fund.

7. Yes, if there are alternative earnings foregone by stockholders.

II. Matching Type

1.

2.

3.

4.

5.

A

C

F

B

I

6.

7.

8.

9.

10.

H

D

G

J

E

III. Problems

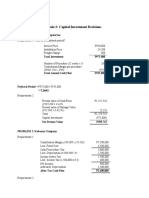

Problem 1 (Equipment Replacement Sensitivity Analysis)

Requirement 1

Total Present Value

A.

B.

New Situation:

Recurring cash operating costs (P26,500 x 2.69)

Cost of new equipment

Disposal value of old equipment now

Present value of net cash outflows

Present Situation:

Recurring cash operating costs (P45,000 x 2.69)

Disposal value of old equipment four years hence

(P2,600 x 0.516)

Present value of net cash inflows

Difference in favor of replacement

P 71,285

44,000

(5,000)

P110,285

P121,050

(1,342)

P119,708

P 9,423

Requirement 2

Payback period for the new equipment

Requirement 3

Let X = annual cash savings

Let O = net present value

20-2

P44,000 P5,000

P18,500

2.1 years

Capital Budgeting Decisions Chapter 20

X (2.69) + P5,000 - P44,000 - P1,342 = O

2.69X = P40,342

X = P14,997

If the annual cash savings decrease from P18,850 to P14,997 or by P3,503,

the point of indifference will be reached.

Another alternative way to get the same answer would be to divide the net

present value of P9,423 by 2.690.

Problem 2

Annual cash expenses of the manual bookkeeping

machine system, P9,800 x 12

Annual cash expenses of computerized data processing

Annual cash savings before taxes

Annual cash savings (a)

Depreciation

Inflow before tax

Income tax (50%) (b)

Cash inflow after tax (a - b)

Year 1

Year 2

Year 3

Year 3 Salvage

Year 3 Tax loss

Year 1

P64,000

20,000

P44,000

22,000

P42,000

Year 2

P64,000

16,000

P48,000

24,000

P40,000

Year 3

P64,000

12,800

P51,200

25,600

P38,400

After Tax

Cash Inflows

P42,000

40,000

38,400

20,000

15,600*

PV Factor

x 0.909

x 0.826

x 0.750

x 0.750

x 0.750

PV

P 38,178

33,040

28,800

15,000

11,700

P126,718

100,000

P 26,718

Investment (I)

Net present value (NPV)

_________________

*

P117,600

53,600

P 64,000

The P15,600 tax benefit of the loss on the disposal of the computer at the end of

year 3 is computed as follows:

Estimated salvage value

Estimated book value:

Historical cost

Accumulated depreciation

Estimated loss

20-3

P 20,000

P100,000

48,800

51,200

P(31,200)

Chapter 20 Capital Budgeting Decisions

Tax rate

Tax effect of estimated loss

50%

P(15,600)

Since the net present value is positive, the computer should be purchased

replacing the manual bookkeeping system.

Problem 3

Requirement 1

(a) Purchase price of new equipment

Disposal of existing equipment:

Selling price

Book value

Loss on disposal

Tax rate

Tax benefit of loss on disposal

Required investment (I)

P(300,000)

P

0

60,000

P60,000

0.4

(b) Increased cash flows resulting from

change in contribution margin:

Using new equipment [18,000 (P20 - P7)] *

Using existing equipment [11,000 (P20 - P9)]

Increased cash flows

Less: Taxes (0.40 x P113,000)

Increased cash flows after taxes

Depreciation tax shield:

Depreciation on new equipment

(P300,000 5)

P60,000

Depreciation on existing equipment

(P60,000 5)

12,000

Increased depreciation charge P48,000

Tax rate

0.40

Depreciation tax shield

Recurring annual cash flows

_________________

*

24,000

P(276,000)

P234,000

121,000

113,000

45,200

P 67,800

19,200

P 87,000

The new equipment is capable of producing 20,000 units, but ETC Products

can sell only 18,000 units annually.

The sales manager made several errors in his calculations of required

investment and annual cash flows. The errors are as follows:

Required investment:

20-4

Capital Budgeting Decisions Chapter 20

-

The cost of the market research study (P44,000) is a sunk cost because it

was incurred last year and will not change regardless of whether the

investment is made or not.

The loss on the disposal of the existing equipment does not result in an

actual cash cost as shown by the sales manager. The loss on disposal

results in a reduction of taxes, which reduces the cost of the new

equipment.

Annual cash flows:

- The sales manager considered only the depreciation on the new equipment

rather than just the additional depreciation which would result from the

acquisition of the new equipment.

- The sales manager also failed to consider that the depreciation is a noncash

expenditure which provides a tax shield.

- The sales managers use of the discount rate (i.e., cost of capital) was

incorrect. The discount rate should be used to reduce the value of future

cash flows to their current equivalent at time period zero.

Requirement 2

Present value of future cash flows (P87,000 x 3.36)

Required investment (I)

Net present value

P292,320

276,000

P 16,320

Problem 4

Requirement 1: P(507,000)

Requirement 2: P(466,200)

Requirement 3: P(23,400)

IV. Multiple Choice Questions

1.

2.

3.

4.

5.

6.

7.

8.

D

C

B

B

A

C

D

B

11.

12.

13.

14.

15.

16.

17.

18.

D

D

D

C

C

D

D

B

21.

22.

23.

24.

25.

26.

27.

28.

20-5

C

B

C

D

C

C

D

B

31.

32.

33.

34.

35.

36.

37.

38.

D

C

C

D

D

B

B

B

Chapter 20 Capital Budgeting Decisions

9. B

10. A

19. A

20. A

29. D

30. A

20-6

39. D

40. B

You might also like

- 05 Procedure For Addressing Risk and OpportunityDocument4 pages05 Procedure For Addressing Risk and OpportunityQualtic Certifications100% (5)

- Ebook Startup 101 How Experts Drive Success PDFDocument12 pagesEbook Startup 101 How Experts Drive Success PDFGoce KuzmanovskiNo ratings yet

- Risk Based Approach To ValidationDocument6 pagesRisk Based Approach To ValidationAlex CristiNo ratings yet

- Articles of Corporation FINALDocument11 pagesArticles of Corporation FINALMichelle Ann Domagtoy100% (1)

- How To Use and Apply Human Capital Metrics in Your Company-Palgrave Macmillan UK (2015)Document195 pagesHow To Use and Apply Human Capital Metrics in Your Company-Palgrave Macmillan UK (2015)Bona Christanto SiahaanNo ratings yet

- Volatility Exchange-Traded Notes - Curse or CureDocument25 pagesVolatility Exchange-Traded Notes - Curse or CurelastkraftwagenfahrerNo ratings yet

- Final Quiz All TopicsDocument2 pagesFinal Quiz All TopicsNikki GarciaNo ratings yet

- MS 1806 Inventory ModelDocument5 pagesMS 1806 Inventory ModelMariane MananganNo ratings yet

- Job Order Costing Spoilage Defective - StudentDocument4 pagesJob Order Costing Spoilage Defective - StudentVince Christian PadernalNo ratings yet

- Capital Budgeting Lecture UpdatedDocument5 pagesCapital Budgeting Lecture UpdatedMark Gelo WinchesterNo ratings yet

- Fabm2 June 4Document2 pagesFabm2 June 4Glaiza Dalayoan FloresNo ratings yet

- Assignment 3 Prepare A Cash Budget KarununganDocument3 pagesAssignment 3 Prepare A Cash Budget KarununganRenzo KarununganNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Financial Controller 1 Quiz 5 QuestionsDocument1 pageFinancial Controller 1 Quiz 5 QuestionsWen Capuno0% (2)

- ReviewerDocument6 pagesReviewerSamuel FerolinoNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- PFS: Financial Aspect - Investment CostsDocument11 pagesPFS: Financial Aspect - Investment CostsSheena Cadiz FortinNo ratings yet

- SCMDocument4 pagesSCMMixx MineNo ratings yet

- Assignment 4 - CVPDocument12 pagesAssignment 4 - CVPAlyssa BasilioNo ratings yet

- Korarai 18181881Document4 pagesKorarai 18181881KyraraNo ratings yet

- Working Capital Management Quick NotesDocument9 pagesWorking Capital Management Quick NotesAlliah Mae ArbastoNo ratings yet

- Reviewer Mas5Document26 pagesReviewer Mas5Joyce Anne MananquilNo ratings yet

- Chapter Six Control &AISDocument6 pagesChapter Six Control &AISAmbelu AberaNo ratings yet

- Non Routine Decisions AnswerDocument9 pagesNon Routine Decisions AnswerCindy CrausNo ratings yet

- ms1 q3Document5 pagesms1 q3KrisshiaLynnSanchezNo ratings yet

- Requirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100Document1 pageRequirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100KHAkadsbdhsgNo ratings yet

- 2nd Week - The Master Budget ExercisesDocument5 pages2nd Week - The Master Budget ExercisesLuigi Enderez BalucanNo ratings yet

- (Resa2017) Mas-A (Management Accounting)Document4 pages(Resa2017) Mas-A (Management Accounting)Adam SmithNo ratings yet

- Drill#1Document5 pagesDrill#1Leslie BustanteNo ratings yet

- Financial Management - Part 1 For PrintingDocument13 pagesFinancial Management - Part 1 For PrintingKimberly Pilapil MaragañasNo ratings yet

- Quiz-3 Cost2 BSA4Document6 pagesQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- Auditing Theory and Principles Thanks GuysDocument51 pagesAuditing Theory and Principles Thanks GuysrenoNo ratings yet

- Cost of Goods Manufactured & SoldDocument17 pagesCost of Goods Manufactured & SoldMichael Brian TorresNo ratings yet

- MA CUP PracticeDocument9 pagesMA CUP PracticeFlor Danielle Querubin100% (1)

- BUSE 3 - Practice ProblemDocument8 pagesBUSE 3 - Practice ProblemPang SiulienNo ratings yet

- Lockbox SystemDocument7 pagesLockbox SystemYosua ManurungNo ratings yet

- Edoc - Pub Problems Solving Masdocx PDFDocument6 pagesEdoc - Pub Problems Solving Masdocx PDFReznakNo ratings yet

- Quiz 6 A6Document25 pagesQuiz 6 A6Lara FloresNo ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- Desired Income (Step Costs)Document2 pagesDesired Income (Step Costs)Ann louNo ratings yet

- Pinnacle in House CPA Review Tuition Fee UpdatedDocument1 pagePinnacle in House CPA Review Tuition Fee UpdatedRaRa SantiagoNo ratings yet

- PPL CupDocument9 pagesPPL CupErrol John P. SahagunNo ratings yet

- Acmas 2137 Final SADocument5 pagesAcmas 2137 Final SAkakaoNo ratings yet

- Year 1Document17 pagesYear 1lov3m3No ratings yet

- Group 5 Problem 7 2Document6 pagesGroup 5 Problem 7 2Shieryl BagaanNo ratings yet

- Cortez Practice Set JanuaryDocument5 pagesCortez Practice Set JanuaryChristian LapidNo ratings yet

- Acctba3 - Comprehensive ReviewerDocument10 pagesAcctba3 - Comprehensive ReviewerDarwyn MendozaNo ratings yet

- C-12 Multiple ChoicesDocument14 pagesC-12 Multiple ChoicesKashif Ishrat AzharNo ratings yet

- MS03-03 - Activity-Based-Costing-Reviewees-EncryptedDocument9 pagesMS03-03 - Activity-Based-Costing-Reviewees-EncryptedKaren MagsayoNo ratings yet

- Je Homework GovaccDocument6 pagesJe Homework GovaccEizzel SamsonNo ratings yet

- Management Science Chapter 11Document42 pagesManagement Science Chapter 11Myuran SivarajahNo ratings yet

- Problem 1 #1.: Statement of AffairsDocument7 pagesProblem 1 #1.: Statement of AffairsAlizah BucotNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- MAS Review CVP and Variable CostingDocument7 pagesMAS Review CVP and Variable CostingAizzy ManioNo ratings yet

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- Ch7 Variable Absoorption Extra ExcersisesDocument7 pagesCh7 Variable Absoorption Extra ExcersisesSarah Al MuallaNo ratings yet

- Chapter 2 Standard Costs and Operating Performance Measures Problem DiscussionDocument12 pagesChapter 2 Standard Costs and Operating Performance Measures Problem DiscussionSteffany RoqueNo ratings yet

- Activity 1 - Demetillo, Emnace, NepomucenoDocument3 pagesActivity 1 - Demetillo, Emnace, NepomucenoCheveem Grace EmnaceNo ratings yet

- Cost of Capital: By: Judy Ann G. Silva, MBADocument21 pagesCost of Capital: By: Judy Ann G. Silva, MBAAnastasha GreyNo ratings yet

- USJR QB 2018 MASElims SBDocument8 pagesUSJR QB 2018 MASElims SBSarah BalisacanNo ratings yet

- Chap 4 MNGT Acctng PDFDocument4 pagesChap 4 MNGT Acctng PDFRose Ann YaboraNo ratings yet

- Chapter 13Document5 pagesChapter 13Kirsten FernandoNo ratings yet

- Acctg 7 - Problem 3&4Document5 pagesAcctg 7 - Problem 3&4Nyster Ann RebenitoNo ratings yet

- Problem 3 & 4 - Acctg 7Document6 pagesProblem 3 & 4 - Acctg 7Nyster Ann RebenitoNo ratings yet

- MODULE 8 Capital BudgetingDocument16 pagesMODULE 8 Capital BudgetingKatrina Peralta FabianNo ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- MADERAZO, Dheine Louise - Quiz 2 - Capital Investment DecisionsDocument2 pagesMADERAZO, Dheine Louise - Quiz 2 - Capital Investment DecisionsDheine MaderazoNo ratings yet

- TYBMS SEM V MOCK Strategic HRMDocument3 pagesTYBMS SEM V MOCK Strategic HRMketan karmoreNo ratings yet

- Dhea Novi Wahyuni: 06/2019 To 09/2019 PT Bank Pembangunan Daerah Jawa Barat Dan Banten TBK, Kabupaten SukabumiDocument1 pageDhea Novi Wahyuni: 06/2019 To 09/2019 PT Bank Pembangunan Daerah Jawa Barat Dan Banten TBK, Kabupaten SukabumiWasis WicaksonoNo ratings yet

- Terms and ConditionsDocument14 pagesTerms and ConditionssoumanaNo ratings yet

- HR Analytics: Challenges and Prospects of Indian It Sector: Maria AfzalDocument12 pagesHR Analytics: Challenges and Prospects of Indian It Sector: Maria AfzalShwetha GyNo ratings yet

- Key TermsDocument3 pagesKey TermsJaeson SisonNo ratings yet

- ControldeLectura2021 B - Iso25030Document7 pagesControldeLectura2021 B - Iso25030Oliver Bravo M.No ratings yet

- Master Budget and Profit Planning Report BADocument13 pagesMaster Budget and Profit Planning Report BAGerwin GolingayNo ratings yet

- Blackbook BataDocument10 pagesBlackbook BataJoel WaghchoureNo ratings yet

- RFPBelgaum FruitDocument47 pagesRFPBelgaum FruitAnam enterprisesNo ratings yet

- Auditing Theory 3rd ExaminationDocument12 pagesAuditing Theory 3rd ExaminationKathleenNo ratings yet

- 2 The Emerging Global EnvironmentDocument63 pages2 The Emerging Global EnvironmentVÂN LÊ NGUYỄN NHƯỢCNo ratings yet

- Skate N' Surf Began OperationsDocument5 pagesSkate N' Surf Began Operationslaale dijaanNo ratings yet

- Panoro Announces US$ 140 Million Precious Metals Streaming Financing With Silver WheatonDocument4 pagesPanoro Announces US$ 140 Million Precious Metals Streaming Financing With Silver WheatonMiguel Ampudia BellingNo ratings yet

- 200MT Brinks - 11-10-1Document4 pages200MT Brinks - 11-10-1Jose Manuel Quiroz MarinNo ratings yet

- Freelance EmpploymentDocument3 pagesFreelance EmpploymentLilian GîncuNo ratings yet

- Marketing Answer 1 Part 2Document4 pagesMarketing Answer 1 Part 2Meenakshi sundhi100% (1)

- SAP Basis Infrastructure Audit Program ExcerptDocument9 pagesSAP Basis Infrastructure Audit Program Excerptmurikah.wNo ratings yet

- Price Edward Island Preserve CompanyDocument18 pagesPrice Edward Island Preserve CompanyMurad Ahmed NiaziNo ratings yet

- Hitachi Managed Cloud Operations ChecklistDocument3 pagesHitachi Managed Cloud Operations ChecklistRalph LobatoNo ratings yet

- Coastal ShippingDocument4 pagesCoastal ShippingS SUDHARSANNo ratings yet

- Process CostingDocument39 pagesProcess CostingnathanNo ratings yet

- Market Research and Analysis - HyundaiDocument46 pagesMarket Research and Analysis - HyundaiMithesh Phadtare75% (4)

- Soal Sertifikasi SAP GabunganDocument88 pagesSoal Sertifikasi SAP Gabunganshifwa fawanisNo ratings yet