Professional Documents

Culture Documents

Time Value On Excel (Using The Function (FX) Wizard)

Time Value On Excel (Using The Function (FX) Wizard)

Uploaded by

oluomo1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time Value On Excel (Using The Function (FX) Wizard)

Time Value On Excel (Using The Function (FX) Wizard)

Uploaded by

oluomo1Copyright:

Available Formats

Time Value on Excel (Using the Function (fx) Wizard)

note: click on the cell next to the question mark to see the formula.

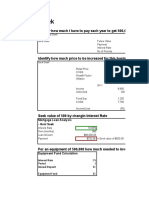

Future Value:

If I deposit $100 in an account earning 10% per year, how much will my

deposit be worth after 5 years?

PV

I

n

FV?

(100.00)

10.00%

5

$161.05

What if we had the same problem but interest is compounded monthly?

PV

I

n

FV?

(100.00)

0.83%

60

$164.53

***Note: Change the values of any variable other than that being solved for to view changes***

Time Value on Excel (Using the Function (fx) Wizard)

note: click on the cell next to the question mark to see the formula.

Present Value:

How much would I need to deposit today in an account earning 10% per year

in order to accumulate $10,000 after 5 years?

FV

I

n

PV?

$(10,000.00)

10.00%

5

$6,209.21

What if my interest was compounded monthly?

FV

I

n

PV?

$(10,000.00)

0.83%

60

$6,077.89

***Note: Change the values of any variable other than that being solved for to view changes***

Time Value on Excel (Using the Function (fx) Wizard)

note: click on the cell next to the question mark to see the formula.

Future Value of an Annuity:

How much would I have in my retirement account if I deposited $2000 each

year for 35 years and I earned 10% on my savings? What about $4,000?

PMT

I

n

FVA?

(2,000.00)

10.00%

35

$542,048.74

PMT

I

n

FVA?

(4,000.00)

10.00%

35

$1,084,097.47

Instead, what if I made monthly deposits of $166.67? How about monthly deposits of $333.33?

PMT

I

n

FVA?

(75,000.00)

0.63%

60

$5,439,532.90

PMT

I

n

FVA?

***Note: Change the values of any variable other than that being solved for to view changes***

(75,000.00)

0.41%

60

$5,095,082.21

Time Value on Excel (Using the Function (fx) Wizard)

note: click on the cell next to the question mark to see the formula.

Future Value of an Annuity Due:

How much would I have in my retirement account if I deposited $2000 at the beginning of each

year for 35 years and I earned 10% on my savings? What about $4,000?

PMT

I

n

FVA?

FVAD?

(2,000.00)

10.00%

35

$542,048.74

$596,253.61

PMT

I

n

FVA?

FVAD?

(4,000.00)

10.00%

35

$1,084,097.47

$1,192,507.22

Instead, what if I made beginning of the month deposits of $166.67? How about monthly deposits of $333.33?

PMT

I

n

FVA?

FVAD?

(75,000.00)

0.63%

60

$5,439,532.90

$5,473,529.98

PMT

I

n

FVA?

FVAD?

***Note: Change the values of any variable other than that being solved for to view changes***

(333.33)

0.83%

420

$1,238,851.38

$1,249,089.82

posits of $333.33?

Time Value on Excel (Using the Function (fx) Wizard)

note: click on the cell next to the question mark to see the formula.

Present Value of an Annuity:

How much could I afford to borrow for a home if I can make monthly payments of $12,000

per year for 30 years at 8%? What about monthly payment of $1,000?

PMT

I

n

PVA?

12,000.00

8.00%

30

($135,093.40)

PMT

I

n

PVA?

1,000.00

0.67%

360

($136,283.49)

What if I wanted to know what my montlhy payments would be a $20,000 car loan over

five years at 8%?

PV

I

n

PVA?

$ 500,000.00

2.08%

24

($26,685.76)

***Note: Change the values of any variable other than that being solved for to view changes***

Time Value on Excel (Using the Function (fx) Wizard)

note: click on the cell next to the question mark to see the formula.

Present Value of an Annuity:

How much could I afford to borrow for a home if I can make annual payments of $12,000

per year for 30 years at 8%? What about monthly payment of $1,000?

PMT

I

n

PVA?

PVAD?

12,000.00

8.00%

30

($135,093.40)

($145,900.87)

PMT

I

n

PVA?

PVAD?

1,000.00

0.67%

360

($136,283.49)

($137,192.05)

What if I wanted to know what my montlhy payments would be a $20,000 car loan over

five years at 8%?

PV

I

n

PVA?

PVAD?

20,000.00

0.67%

60

($405.53)

($402.84)

***Note: Change the values of any variable other than that being solved for to view changes***

You might also like

- Robert Reid Lady M Confections SubmissionDocument13 pagesRobert Reid Lady M Confections SubmissionSam Nderitu100% (1)

- Bilal Hyder I170743 20-SEPDocument10 pagesBilal Hyder I170743 20-SEPUbaid0% (1)

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Chapter 6Document28 pagesChapter 6Faisal Siddiqui0% (1)

- Core Chapter 09 Excel Master 4th Edition StudentDocument77 pagesCore Chapter 09 Excel Master 4th Edition StudentShaunak ChitnisNo ratings yet

- Lincoln SportDocument8 pagesLincoln SportArtiar AnjaniNo ratings yet

- Fabozzi CH 03 Measuring Yield HW AnswersDocument5 pagesFabozzi CH 03 Measuring Yield HW AnswershardiNo ratings yet

- W10 Excel Model Cash Flow, Net Cost, and Capital BudgetingDocument5 pagesW10 Excel Model Cash Flow, Net Cost, and Capital BudgetingJuan0% (1)

- Assingment FullDocument12 pagesAssingment FullAzman Scx100% (1)

- Time Value On Excel (Using The Financial Function (FX) Wizard) Clink Links BelowDocument8 pagesTime Value On Excel (Using The Financial Function (FX) Wizard) Clink Links BelowClarizza Joyce HervasNo ratings yet

- AnujDocument227 pagesAnujAshish GoyalNo ratings yet

- Interest Rate (Pa) : 0.08 Compound Periods: 4 Number of Years: 5Document5 pagesInterest Rate (Pa) : 0.08 Compound Periods: 4 Number of Years: 5SGNo ratings yet

- Time Value On Excel (Using The Financial Function (FX) Wizard) Clink Links BelowDocument8 pagesTime Value On Excel (Using The Financial Function (FX) Wizard) Clink Links BelowPawan KumarNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- S16 - Scenario Manager - NPVDocument9 pagesS16 - Scenario Manager - NPVSRISHTI ARORANo ratings yet

- S16 - Scenario Manager - NPV - ClassDocument11 pagesS16 - Scenario Manager - NPV - ClassABHAY VEER SINGHNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Net Present Value Year Cash Flow D Rate Year Cash FlowDocument12 pagesNet Present Value Year Cash Flow D Rate Year Cash FlowPragati AgarwalNo ratings yet

- Case Study - Caribbean Internet CaféDocument7 pagesCase Study - Caribbean Internet CaféANo ratings yet

- Project Analysis (NPV)Document20 pagesProject Analysis (NPV)EW1587100% (1)

- Real Estate Excel Functions TutorialDocument14 pagesReal Estate Excel Functions Tutorialajohnson79100% (2)

- Based On Accounting Profit: Reak-VEN NalysisDocument5 pagesBased On Accounting Profit: Reak-VEN NalysisgiangphtNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument36 pagesRisk Analysis, Real Options, and Capital BudgetingBussines LearnNo ratings yet

- Free Cash Flow $ 378,400.00 $ 416,240.00Document2 pagesFree Cash Flow $ 378,400.00 $ 416,240.00Raca DesuNo ratings yet

- SensIt Guide 145 PDFDocument17 pagesSensIt Guide 145 PDFheda kaleniaNo ratings yet

- Ginny's Restaurant Case StudyDocument5 pagesGinny's Restaurant Case StudyМенчеВучковаNo ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- Write Your Name and Roll Number BelowDocument8 pagesWrite Your Name and Roll Number BelowPrince Waqas AliNo ratings yet

- Sharukh Khan Capital Budgeting ModellingDocument4 pagesSharukh Khan Capital Budgeting ModellingOktariadie RamadhianNo ratings yet

- Model Oventa Multi Nive LDocument5 pagesModel Oventa Multi Nive LMayte SánchezNo ratings yet

- Solutions Chapter 8Document6 pagesSolutions Chapter 8Carmella DismayaNo ratings yet

- Tutorial Solution EvaluationDocument9 pagesTutorial Solution EvaluationbillNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Present Value Rate-Of-Return (Ror) Examples One Equation, One Unknown Variable 1.61051 FV PV Ror PV FV Ror T M 1 2 3 4 5Document7 pagesPresent Value Rate-Of-Return (Ror) Examples One Equation, One Unknown Variable 1.61051 FV PV Ror PV FV Ror T M 1 2 3 4 5Sagar GogiaNo ratings yet

- Cash+flow+estimation (14-1759)Document9 pagesCash+flow+estimation (14-1759)M shahjamal QureshiNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Soal BaruDocument14 pagesSoal BaruDella Lina50% (2)

- Taller 3Document22 pagesTaller 3CRISTIAN CAMILO MORALES SOLISNo ratings yet

- Spreadsheet Problem: FV ChartDocument6 pagesSpreadsheet Problem: FV Chartbader munirNo ratings yet

- Excel Loan - Investment Project Start FileDocument4 pagesExcel Loan - Investment Project Start FileJoel LindsayNo ratings yet

- What If ChecklistDocument11 pagesWhat If Checklistmohsanmajeed100% (1)

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Document7 pagesPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanNo ratings yet

- Sensitivity Analysis Using SensitDocument17 pagesSensitivity Analysis Using SensitMessy CoolNo ratings yet

- Profit Analysis Worksheet: ProductionDocument18 pagesProfit Analysis Worksheet: ProductionhariveerNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- Cash FlowDocument1 pageCash Flowuch sereyleapNo ratings yet

- CH 3 AssignmntDocument78 pagesCH 3 Assignmnthu mirzaNo ratings yet

- Cell Name Original Value Final ValueDocument4 pagesCell Name Original Value Final ValueBharaniNo ratings yet

- NP EX19 9b JinruiDong 2Document10 pagesNP EX19 9b JinruiDong 2Ike DongNo ratings yet

- Chapter 13 - Risk Analysis and Project Evaluating: Financial Management TaskDocument11 pagesChapter 13 - Risk Analysis and Project Evaluating: Financial Management TaskFaradibaNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- Time For Job Electrician 1 Alone Electrician 2 Alone Electrician 3 Alone Percentage of Job FinishedDocument5 pagesTime For Job Electrician 1 Alone Electrician 2 Alone Electrician 3 Alone Percentage of Job FinishedAmit deyNo ratings yet

- Product Development ModelsDocument17 pagesProduct Development ModelsKUNAL PATELNo ratings yet

- ActivitiesDocument4 pagesActivitiesUnknowingly AnonymousNo ratings yet

- FlexibleDocument1 pageFlexibleShubhangiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesFrom EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesRating: 5 out of 5 stars5/5 (1)

- Cloud Computing - Opportunities & ThreatsDocument6 pagesCloud Computing - Opportunities & ThreatsVikas AcharyaNo ratings yet

- Beginner Guide To Financial PlanningDocument114 pagesBeginner Guide To Financial PlanningVikas AcharyaNo ratings yet

- Excel Function Dictionary PDFDocument207 pagesExcel Function Dictionary PDFSantosh AthaniNo ratings yet

- Marketing Advertising Punch LinesDocument4 pagesMarketing Advertising Punch LinesVikas AcharyaNo ratings yet

- Microsoft Excel Sheet For Managing Personal Information OrganiserDocument49 pagesMicrosoft Excel Sheet For Managing Personal Information OrganiserVikas Acharya100% (1)

- Microsoft Excel Sheet For Calculating EMI (Equated Monthly Installment) (TYPE 1)Document31 pagesMicrosoft Excel Sheet For Calculating EMI (Equated Monthly Installment) (TYPE 1)Vikas Acharya100% (1)

- Age Calculator (Years, Month & Day Together)Document2 pagesAge Calculator (Years, Month & Day Together)Vikas AcharyaNo ratings yet

- Microsoft Excel Sheet For Calculating Various Financial Formula by Jack KarnesDocument42 pagesMicrosoft Excel Sheet For Calculating Various Financial Formula by Jack KarnesVikas AcharyaNo ratings yet

- Microsoft Excel Sheet For Calculating (Money) Inflation, Projected InflationDocument10 pagesMicrosoft Excel Sheet For Calculating (Money) Inflation, Projected InflationVikas AcharyaNo ratings yet

- TvmextraDocument8 pagesTvmextragl620054545No ratings yet

- CUHKMCDocument19 pagesCUHKMCLam Chun YuNo ratings yet

- Second Quarter: General MathematicsDocument22 pagesSecond Quarter: General MathematicsJester Guballa de LeonNo ratings yet

- Notes Chapter 5 FARDocument6 pagesNotes Chapter 5 FARcpacfa100% (10)

- Chapter 4 (Time Value of Money)Document38 pagesChapter 4 (Time Value of Money)arasoNo ratings yet

- Jamuna Bank Internship ReportDocument76 pagesJamuna Bank Internship ReportCool AhsanNo ratings yet

- Jun18l1qme-C02 QaDocument5 pagesJun18l1qme-C02 QajuanNo ratings yet

- Fundamentals of Corporate Finance, SlideDocument250 pagesFundamentals of Corporate Finance, SlideYIN SOKHENG100% (4)

- General Mathematics 11: Week 1 - Modified AssessmentDocument7 pagesGeneral Mathematics 11: Week 1 - Modified AssessmentKelsy Edrei HechanovaNo ratings yet

- Present Value and Future Value of Ordinary Annuity and Annuity Due Example Sums by Vihaan Vadnere SYBA-B Roll No.2376Document10 pagesPresent Value and Future Value of Ordinary Annuity and Annuity Due Example Sums by Vihaan Vadnere SYBA-B Roll No.2376Vihaan VadnereNo ratings yet

- BUDGET OF WORK - Grade 11Document2 pagesBUDGET OF WORK - Grade 11alma.callonNo ratings yet

- Section 1.9.1 Annuity-ImmediateDocument15 pagesSection 1.9.1 Annuity-ImmediateMary Dianneil MandinNo ratings yet

- Income For Life - Walter Updegrave July 2002Document7 pagesIncome For Life - Walter Updegrave July 20024cinvestorNo ratings yet

- ENGRING ECON With PASION KeyDocument14 pagesENGRING ECON With PASION KeyLevi CloverioNo ratings yet

- Tvom PDFDocument16 pagesTvom PDFgoyal_khushbu88No ratings yet

- Interest Rate QNDocument4 pagesInterest Rate QNDeogratias MsigalaNo ratings yet

- Accounting & Finance For Bankers Module A: Presentation BY Cma Sunil Kumar MohanDocument205 pagesAccounting & Finance For Bankers Module A: Presentation BY Cma Sunil Kumar MohanAkanksha MNo ratings yet

- Math of InvestmentDocument3 pagesMath of InvestmentRaymond RamirezNo ratings yet

- HAM Methodology - August2020Document11 pagesHAM Methodology - August2020Yash AgarwalNo ratings yet

- Comparative Study of Lic and Icici Pension PlanDocument67 pagesComparative Study of Lic and Icici Pension PlanNitesh Singh100% (2)

- Module 7-8-AnnuityDocument19 pagesModule 7-8-AnnuityI am AngelllNo ratings yet

- Ch3 Time Value of MoneyDocument60 pagesCh3 Time Value of MoneyNiazi MustafaNo ratings yet

- M Finance 3rd Edition Cornett Test Bank 1Document202 pagesM Finance 3rd Edition Cornett Test Bank 1andrew100% (44)

- Sol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionDocument13 pagesSol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Leases Set CDocument12 pagesLeases Set CbessmasanqueNo ratings yet

- Annuity Calculator: Withdrawal PlanDocument2 pagesAnnuity Calculator: Withdrawal PlanAjay SinghNo ratings yet

- Assignment - Current Liabilities - Notes PayableDocument24 pagesAssignment - Current Liabilities - Notes PayableBEA CATANEONo ratings yet

- Basic Long-Term Financial ConceptsDocument40 pagesBasic Long-Term Financial ConceptsBr. Ivan Karlo Umali FSCNo ratings yet