Professional Documents

Culture Documents

The Forrester Wave Enterprise Social Listening Platforms Q1 2016reprint

Uploaded by

vaglohrdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Forrester Wave Enterprise Social Listening Platforms Q1 2016reprint

Uploaded by

vaglohrdCopyright:

Available Formats

For B2C Marketing Professionals

The Forrester Wave: Enterprise Social Listening

Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

by Samantha Ngo and Mary Pilecki

March 2, 2016

Why Read This Report

Key Takeaways

In our 30-criteria evaluation of enterprise social

listening platform providers, we identified the 12

most significant ones Brandwatch, Cision,

Clarabridge, Crimson Hexagon, NetBase,

Networked Insights, Oracle, Prime Research,

Salesforce, Sprinklr, Synthesio, and Sysomos

and researched, analyzed, and scored them. This

report shows how each provider measures up

and helps B2C marketing professionals make the

right choice.

Synthesio, NetBase, Sprinklr, And Brandwatch

Lead The Pack

Forresters research uncovered a market in which

Synthesio, NetBase, Sprinklr, and Brandwatch

lead the pack. Crimson Hexagon, Clarabridge,

Networked Insights, Salesforce, and Cision offer

competitive options. Prime Research, Oracle, and

Sysomos lag behind.

B2C Marketing Pros Are Looking For

Engagement, Measurement, And Analytics

The social listening market is growing because

more B2C marketers see social intelligence as

a way to get closer to their customers. Social

listening has moved well beyond just looking for

buzz, and now informs marketing content and

product innovation, as well as measures brand

health.

Analytics And Integration Features Are Key

Differentiators

As social intelligence technology matures, more

platforms will offer improved analytics tools and

better integration with business data to help drive

business objectives. Vendors that can provide tools

that help clients better understand the preferences

of their customers and measure the outcomes of

actions resulting from insights will win.

forrester.com

For B2C Marketing Professionals

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

by Samantha Ngo and Mary Pilecki

with Carlton A. Doty, Clement Teo, Nick Hayes, and Emily Miller

March 2, 2016

Table Of Contents

2 Social Listening Platforms Now Inform The

Entire Enterprise

Clients Look To Social Listening Platforms To

Fill In The Gaps

Vendors Advance Their Analytics And

Integration Capabilities To Keep Pace

4 Enterprise Social Listening Platforms

Evaluation Overview

Evaluated Vendors And Inclusion Criteria

6 Vendor Profiles

Notes & Resources

Forrester conducted product evaluations in

November 2015 and interviewed 12 vendors and

36 customer references.

Related Research Documents

Drive Toward Social Intelligence Maturity

The Forrester Wave: Asia Pacific Enterprise

Listening Platforms, Q1 2016

The Forrester Wave: Social Relationship

Platforms, Q2 2015

Predictions 2016: Social Gets Reinforcements

Leaders

Strong Performers

Understand The Enterprise Listening Platform

Landscape

Contenders

12 Supplemental Material

Forrester Research, Inc., 60 Acorn Park Drive, Cambridge, MA 02140 USA

+1 617-613-6000 | Fax: +1 617-613-5000 | forrester.com

2016 Forrester Research, Inc. Opinions reflect judgment at the time and are subject to change. Forrester,

Technographics, Forrester Wave, RoleView, TechRadar, and Total Economic Impact are trademarks of Forrester

Research, Inc. All other trademarks are the property of their respective companies. Unauthorized copying or

distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

Social Listening Platforms Now Inform The Entire Enterprise

As the landscape of social technology develops, social listening platforms prove their value beyond

simple brand monitoring by doubling down on analytics and surfacing insights that can be used across

the enterprise. Since our last evaluation of the space, B2C marketing professionals have increased

the sophistication of their social strategies, and thus the complexity of their use cases. Social listening

vendors have kept pace through product enhancements in some areas and consolidation in others.

Clients Look To Social Listening Platforms To Fill In The Gaps

Marketers no longer see social data collection as a critical challenge.1 With that out of the way, their

use cases for social listening have evolved beyond the basics of buzz and public relations crisis

management (see Figure 1). Now, marketers look for all forms of social insights to better understand

their customer and use social listening to:

Inform cross-channel campaigns. Social listening platforms can surface insights from social

data, whether its user-generated content or images of people using a product to help inspire

campaigns 26% of customer references in this Forrester Wave do just this and the need for

inspiration is apparent. In 2015, 38% of avid social marketers stated finding or creating content

was a top problem and 53% stated measuring the performance of their brand profiles was a top

challenge.2 Only 21% of US online adults believe that brands share interesting content on social

media websites and online social tools.3

Provide customer service. Customers expect to get service through social media channels. Over

the past two years, more than 37% of US online adults contacted a company on Twitter for

service growing from 22% in 2013.4 Brands are using social media as a customer service

channel not only to meet customer expectations, but also to reduce call center expenses. Of the

client references we surveyed in this study, 22% use social data for customer service.5

Measure brand health. One-third of customer references mention understanding customers or

brand monitoring and brand health tracking as part of their current initiatives for social listening.6

Brands use social to keep an ear to the ground for new content, understand trends, and develop

a relationship with their customers. Clients are looking to understand the why behind customer

behavior and turning to social means getting data straight from the source the customer.

Drive product innovation. Social data must be tied to business metrics that make sense to those

outside the digital or marketing teams. Emerging use cases, like using social insights for product

development help brands get buy-in across the organization. Seventeen percent of customer

references surveyed in this study use social data for product development.

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

FIGURE 1 Social Listening Platforms Help Solve Client Challenges

What are your current initiatives and goals for social listening?

Brand monitoring/brand health

36%

Measuring campaign success

36%

33%

Gain better understanding of customers

Customer service or customer care

22%

Inspiring content for campaigns

22%

Risk and crisis management

19%

Competitive analysis

19%

Product innovation

17%

Base: 36 social listening platform users

Source: Forresters Q4 2015 Global Enterprise Social Listening Platforms Customer Reference Phone/Online

Survey

Vendors Advance Their Analytics And Integration Capabilities To Keep Pace

As we see this technology mature, listening vendors are keeping pace by adding more features and

enhancing functionality. For instance, 10 of the 12 vendors in this Forrester Wave evaluation offer some

sort of customer engagement features. As these enhancements mature across the category, we predict

that social listening platforms will converge with social relationship platforms.7 But customers of social

listening platforms still struggle to measure the impact of social listening and validate social datas

usage across the organization.8 To support these endeavors, vendors must tie the social insights that

their platforms deliver to the real-world business objectives of their clients. Specifically, social listening

platforms must:

Integrate with other marketing and business tools. Social maturity involves tying social

metrics to business objectives.9 Social usage continues to grow, with over 70% of consumers

wanting to engage on social channels, but only 10% of marketers expanding or upgrading their

implementation of listening platforms.10 As one client told us, Ive measured impressions before

and when I presented it to my CFO at the end of the quarter, he shrugged. I dont want to be there

again.11 Marketers in search of a social platform should include in their critical selection criteria

the ease of integration with their existing CRM, customer analytics tools, or voice-of-the-customer

(VoC) tools.

Surface insights for action across the enterprise. Social listening tools enable you to parse

out influencers and audiences that matter most to cut through the noise, bubble up insights,

and take action across the enterprise. The success of Yoplaits removal of high fructose corn

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

syrup is just one example of a product team taking note of social insights.12 Firms can use social

listening platforms to test campaign results or find insights to inspire them. A major automotive

manufacturer leveraged social listening to find insights about consumers perceptions of electric

vehicles in Europe. Identifying five key barriers to purchase, the manufacturer used the barriers

as pillars for their messaging, getting their customers excited about electric cars and positioning

themselves as the market leader.13 Several vendors have dashboards that track predefined key

performance indicators (KPIs) like intent to buy to help surface the most valuable insights. Data

visualization features (like topic maps) have also become valuable tools.

Measure the intangible and inspire new ideas. Social listening platform vendors are beginning to

understand that theres much more to be done with sentiment than just tracking an overall positive

or negative tone for a specific product, campaign, or brand. Vendors are leveraging text analysis

methodologies overlaid with audience or topic analyses to find relationships between the two to

help clients better understand their customers. Before its new crime show aired, a television network

looked at the actress who played the main characters followers on Twitter and found that audience

had affinities for telenovelas, Telemundo, The Real Housewives series, and beauty trends not your

typical crime show watchers. Using this information to inform its marketing, the show delivered the

networks second-best A18-49 (Nielsen audience rating) result for a Thursday drama premiere in

nearly four years.14

Enterprise Social Listening Platforms Evaluation Overview

To assess the state of the enterprise customer listening market and see how the vendors stack up

against each other, Forrester evaluated the strengths and weaknesses of top enterprise social listening

vendors. After examining past research, user needs assessments, and vendor and expert interviews,

we developed a comprehensive set of evaluation criteria. We evaluated vendors against 30 criteria,

which we grouped into three high-level buckets:

Current offering. In this section, we assess how vendors compare in data coverage, how they

process data for accuracy and how they enable insights to action. We also looked at how social

listening vendors help support their clients social strategies and their current capabilities to

combine data to enable enterprise social listening.

Strategy. We evaluated each vendors vision and road map in the journey to enterprise customer

listening. Vision and future-looking enhancements that lead to faster insights to action were the

crux of this section.

Market presence. Lastly, we measured the vendors market based on the number of clients,

revenues, and growth rates.

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

Evaluated Vendors And Inclusion Criteria

Forrester included 12 vendors in the assessment: Brandwatch, Cision, Clarabridge, Crimson Hexagon,

NetBase, Networked Insights, Oracle, Prime Research, Salesforce, Sprinklr, Synthesio, and Sysomos.

Each of these vendors has (see Figure 2):

Revenue from social listening product. We evaluated vendors with more than $15 million in

revenue generated specifically from their social listening product. We see this revenue threshold as

an indicator of company stability and experience with client demands.

An enterprise orientation. Forresters client firms are mostly enterprise sized, which we define as

more than $1 billion dollars in revenue. Only vendors with more than 50 enterprise customers were

included, as these vendors have helped solve the problems Forresters clients are seeking to answer.

End-to-end technology for social listening. Forrester selected vendors that offer technology

that captures social data, presents it to users, and analyzes it to produce actionable insights. In

cases where vendors provide services to clients, they must use their own technology for all of

these functions.

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

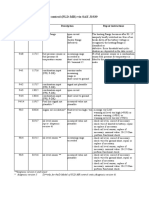

FIGURE 2 Evaluated Vendors: Product Information And Selection Criteria

Vendor

Product evaluated

Brandwatch

Brandwatch Analytics

Cision

Visible Intelligence (VI), V*IQ,

Cision Social Edition, & Cision PRE

Clarabridge

CX Engagor

Crimson Hexagon

Product version

evaluated

Date evaluated

15.2.0

Q4 2015

N/A

Q4 2015

Clarabridge 7

Q4 2015

The Crimson Hexagon Platform

N/A

Q4 2015

NetBase

NetBase, NetBase LIVE Pulse, & Audience 3D

N/A

Q4 2015

Networked Insights

Kairos

Q4 2015

Oracle

Oracle Social Relationship Management

(SRM) Platform

N/A

Q4 2015

Prime Research

Media Insight Suite

N/A

Q4 2015

Salesforce

Social Studio

N/A

Q4 2015

Sprinklr

Sprinklr Experience Cloud

9.2.1

Q4 2015

Synthesio

Synthesio

N/A

Q4 2015

Sysomos

Heartbeat & Map

1.14.2 Heartbeat &

1.14.2 Map

Q4 2015

Vendor selection criteria

The vendor must have revenues of at least $15 million generated specifically from their social listening

product.

The vendor must have at least 50 enterprise customers. Forrester defines enterprise sized customers as

firms with at least $1 billion in annual revenue.

The vendor must offer technology that captures social data, presents it to users, and analyzes it to

produce actionable insights. In cases where vendors provide services to clients, they must use their

own technology for all of these functions.

Vendor Profiles

This evaluation of the enterprise social listening market is intended to be a starting point only. We

encourage clients to view detailed product evaluations and adapt criteria weightings to fit their

individual needs through the Forrester Wave Excel-based vendor comparison tool (see Figure 3).

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

FIGURE 3 Forrester Wave: Enterprise Social Listening Platforms, Q1 16

Challengers Contenders

Strong

Strong

Performers

Leaders

Synthesio

Networked

Insights

Prime

Research

NetBase

Clarabridge

Crimson Hexagon

Cision

Oracle

Current

offering

Brandwatch

Sprinklr

Salesforce

Go to Forrester.com to

download the Forrester

Wave tool for more

detailed product

evaluations, feature

comparisons, and

customizable rankings.

Sysomos

Market presence

Weak

Weak

Strategy

Strong

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

Forresters

Weighting

Brandwatch

Cision

Clarabridge

Crimson Hexagon

NetBase

Networked Insights

Oracle

Prime Research

Salesforce

Sprinklr

Synthesio

Sysomos

FIGURE 3 Forrester Wave: Enterprise Social Listening Platforms, Q1 16 (Cont.)

CURRENT OFFERING

Data sources

Data processing

Dashboard functionality

Integration

Consulting, analysis, and

support services

Research reporting

50%

10%

20%

20%

20%

20%

4.17

4.80

3.70

4.25

4.00

5.00

3.51

3.40

3.75

3.60

4.00

3.00

3.64

4.05

3.65

4.50

4.00

3.00

3.44

3.85

3.95

2.80

2.00

5.00

4.10

3.20

4.90

3.00

4.00

5.00

3.68

3.75

4.20

3.30

2.00

5.00

2.96

3.35

2.10

3.50

3.00

3.00

3.63

3.50

3.95

3.95

1.00

5.00

3.43

3.75

3.20

4.05

3.00

3.00

4.17

4.20

4.25

4.50

5.00

3.00

4.46

5.00

4.25

4.05

4.00

5.00

2.50

1.50

2.45

3.30

2.00

3.00

10%

3.00 3.00 2.00 3.00 4.00 4.00 3.00 5.00 4.00 4.00 5.00 2.00

STRATEGY

Corporate strategy:

Enterprise customer

listening focus

Customer retention

Product road map

50%

50%

3.80 2.50 2.70 3.40 4.80 2.60 2.30 1.70 2.70 4.00 4.60 2.20

4.00 3.00 3.00 4.00 5.00 3.00 3.00 1.00 3.00 3.00 5.00 2.00

10%

40%

2.00 2.00 4.00 2.00 3.00 3.00 0.00 4.00 0.00 5.00 5.00 0.00

4.00 2.00 2.00 3.00 5.00 2.00 2.00 2.00 3.00 5.00 4.00 3.00

MARKET PRESENCE

Customers

Revenue

Customer growth rate

0%

70%

20%

10%

4.10

5.00

2.00

2.00

2.40

3.00

1.00

1.00

4.50

5.00

4.00

2.00

2.60

3.00

1.00

3.00

2.80

3.00

2.00

3.00

3.00

3.00

2.00

5.00

2.80

3.00

3.00

1.00

2.30

2.00

3.00

3.00

4.50

5.00

5.00

0.00

3.90

4.00

3.00

5.00

3.30

4.00

2.00

1.00

4.10

5.00

3.00

0.00

All scores are based on a scale of 0 (weak) to 5 (strong).

Leaders

Synthesio. Synthesios ability to align social listening data with a firms other business data

enables its clients to quickly mature their listening programs. This is achieved primarily through the

strong ecosystem of partnerships Synthesio has built with vendors, as well as an extensive API

that supports merging all forms of business data. Lauded for its account management, customer

references speak highly of Synthesios services one said, We selected Synthesio because we

had a gut feeling wed be a number one priority. We were right. Its strategic vision and road map

are focused on the potential of social listening and on metrics that tie to business results rather

than attempting to become an all-in-one solution. This vendor is also the only one that spoke

specifically of trying to help establish industry standards, an example being the Social Reputation

Score that helps marketers track and communicate social data more eloquently by giving them

a metric that correlates to Net Promoter Score (NPS).15 Overall, Synthesio offers a well-balanced

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

and useful listening product, but you wont find fluid workflows to engagement with this product.

Synthesio is sticking to its core as a pure player in the social listening space, and is best suited for

research and customer insights analysts.

NetBase. Since our 2014 evaluation, NetBase has shifted its business strategy to be fully

customer-centric. After moving its executive vice president of customer success and consulting

to head up the product team, NetBase improved its platform significantly with analytics

methodologies, enhanced reporting outputs, and better business integration partnerships and

features. With Audience 3D, clients get data on an audiences interest levels in specific topics in

a clean, useable way, and can even compare how often a custom audience is speaking about

a specific topic compared to the rest of the population. The platform has advanced entity-level

sentiment analysis that gives clients a deeper understanding of how consumers speak about their

products or brands including emotional and behavioral indicators. You pay for what you get with

NetBase comprehensive analytics its an option for those willing to dig deep in their pockets,

and customer references state that NetBase is a good partner, their leadership is in tune, and

the company is forward-thinking. NetBase has an improved user interface to support digital

marketers but is still strongly suited for research users.

Sprinklr. Customers appreciate Sprinklrs full social marketing suite, which allows them to manage

social experiences with customers. Focused on workflows for social data, the vendor provides a

rules-based engine that routes flagged posts to specific agents for more comprehensive social

customer care. Sprinklr has strong integrations with its other social tools, and with business

applications like Marketo for enterprise marketing, Salesforce for CRM, and Adobe SiteCatalyst

and Coremetrics for analytics. However, despite these integrations, its metrics havent evolved

beyond counting volume and hashtag mentions. Sprinklrs audience analysis is not as advanced

as others in this group. The vendor chooses to put efforts into becoming a better suite, rather than

a collection of best-in-class point solutions and its customer references said that the platform

is complex. This platform is best suited for those looking to combine all their social marketing

teams and associated functions.

Brandwatch. Brandwatch understands the need to clarify social listenings business value and

works to disseminate social insights across organizations in a cohesive and comprehensive

way. It exhibits a strong focus on data visualization with its Vizia product, supporting enterprise

social intelligence through easy-to-understand dashboards and an intuitive distribution process.

Customer references expressed Brandwatchs commitment to being a strategic partner, saying

it follows the social to dollars mantra. With its acquisition of PeerIndex in December 2014,

Brandwatch is improving audience analysis through a planned release of advanced audience

features in February 2016. The vendor is expanding out of Europe and North America to focus on

Latin America, but its international presence is still stunted by lack of regional support. Brandwatch

lags slightly behind other Leaders in text analysis methodologies, but the platform is well suited

for large enterprises with users who might have fewer technical people like insights analysts.

Brandwatch is strong in reporting and mobile outputs and has a growing number of financial

services clients due to its commitment to privacy and compliance.

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

Strong Performers

Crimson Hexagon. Customers commend Crimsons efforts to make the platform more userfriendly in recent years and for continually being a strategic partner. One customer reference states,

Its the partnership with them that allows us to mature the practice. Crimson is not just providing

a tool for us to use, but a tool to do better work. Crimsons topic analysis goes beyond keyword

queries and gives clients a broader perspective on what their customers are speaking about in

relation to their brand or original query. Crimson also offers solid audience analysis. However,

a customer reference recalled getting lost in too much detail when drilling down on topic or

audience data. Customer references also reported poor satisfaction in data security, spam filtering,

and workflow management. Crimsons road map further simplifies the platform in efforts to broaden

the user base to include more marketers, rather than just hardcore social analysts. This platform is

best suited for market analysis and research and for use by analysts in unregulated industries.

Clarabridge. Historically focused on text analytics for customer experience, Clarabridge uses

these methodologies to quantify and measure structured and unstructured data for customer

service. It can ingest other forms of business data and built out a comprehensive ecosystem with

other business tools, resulting in intuitive workflow features. The platform comes out-of-the-box

with industry-tuned sentiment templates and has advanced audience and topic analysis features.

Customer references say the tool is straightforward and that the vendor is deep in the art of

social media; however, there is room for the vendor to share client best practices and strengthen

business knowledge to become a strategic partner. While Clarabridge fits the requirements for a

social listening platform, many clients use it as a customer service platform. Its customer-centric

approach makes it a valuable tool for clients looking to use social listening to enhance customer

relationships, but not necessarily to find deep insights for product development, market research,

and more innovative use cases like propensity to buy and brand health.

Networked Insights. Networked Insights product, Kairos, helps clients understand their

opportunity audiences. Its mission is to help clients invest in the right media and create content

that resonates with the right people. Networked Insights text analysis methodologies and

sentiment analysis include entity-level analysis and extraction techniques that categorize the

posters intent or emotion. Its partnership with Twitter allows for deeper audience analysis as

well. Its dashboards are simple to read and have aesthetic appeal. However, customer references

state disappointment in its reporting and integration capabilities. Networked Insights road map

lists integration plans to business tools, but the lack of any current partnerships causes us to be

skeptical of this commitment. It currently takes the vendor two to four weeks to complete a custom

integration with business data if requested by a client. Networked Insights approach to social

listening is creative focused and the vendor is best suited for media and marketing teams.

Salesforce. Salesforce has overcome most of its major integration challenges with its Radian6,

Buddy Media, and ExactTarget acquisitions. Customer references are more satisfied with the

platform, stating the Salesforce team is very supportive and responsive. The workflows in

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

10

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

Salesforce Social Studio have been simplified, making the platform more user-friendly and

customer references stated the tool was widely adopted by large teams of 30 to 50 people.

Salesforce believes in the democratization of social data and is focused on tools and workflows to

distribute reports and importing and exporting data easily. But Salesforce still has a way to go with

its planned road map many vendors already offer the enhancements in Salesforces future, such

as Instagram hashtag listening, scheduled reporting, and audience demographics data. Buyers

shouldnt be surprised to hear Salesforce Social Studio is still a great fit for clients already using

other Salesforce tools such as its CRM system or service cloud.

Cision. Cision bought Visible Technologies in September 2014 in an effort to track and analyze

earned, owned, and paid media, and ultimately, to make it a communications tool. Its technical

capabilities are still strong, and its user management and workflow features are robust. However,

its topic analysis, privacy measures, and mobile outputs still have further to go to compete in this

market. Though customer references stated their love for their account managers (who also assist

with strategic decisions), they stated a desire for Cision to innovate faster and be more prompt with

questions or requests. Cision is best suited for customers looking for a communications or public

relations tool who want to look at a wide range of media for top trends and analysis.

Contenders

Prime Research. With a strong research and analytics background, Prime Research is a tool for

enterprises looking for a hands-off approach for their social listening tool. Prime Research has

an academic feel it covers the largest amount of media of any vendor in this evaluation and

manually scans offline print sources. Prime Research has advanced text analysis methodologies,

consulting and support, and data coverage; but it remains research-focused and lacks a clear

articulation of enterprise social listening that includes integration with CRM or business intelligence

(BI) tools through partnerships. With longer lead times for technical setup and limited self-service

capabilities, Prime is best for companies wanting to outsource deep social market research.

Oracle. Oracle tells the customer-first story, as evidenced by placing the social cloud in its

customer experience suite and purposefully separating it from the marketing cloud so it intrinsically

ties to sales and commerce. Oracles biggest differentiator is its dynamic link tracking, which is the

closest to social attribution weve seen. But its text analysis methodologies, sentiment analysis,

and influencer analysis lag, indicating a lack of transparency and innovation for data processing

methods. Regarding the user interface, a customer reference stated, It would be helpful if they

could figure out how to make sentiment more digestible in the tool. Theres no doubt that Oracle

has the know-how to drive data integration across an organization- and theres trust in the social

clouds integration with Eloqua, BlueKai, Responsys, etc. Over 80% of its social listening clients

use the full social suite including its tools for social engagement and social marketing. While

Oracle offers an open API to other systems, it is still inherently best suited out-of-the-box for clients

who have Oracle deeply imbedded in related areas of their organization.

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

11

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

Sysomos. Sysomos recent acquisitions put it in a tough spot for this evaluation, as it will take

some time to stitch together the workflows to immerse Expion and Gazemetrix into the Sysomos

ecosystem. Currently, for the Heartbeat, Map, GazeMetrix, and Expion products, Sysomos fails

to tell a coherent story about the overall product design and how it will be sold, packaged, and

priced. In its current state, customer references commend the vendor for being responsive to

problems and questions, and call it a simple tool to use, and commend its account managers and

customer service. Sysomos is building out a data science layer that will support a single dashboard

for monitoring, listening/research, and action; however, it failed to give us details at the time of

evaluation. Sysomos has all the right tools in place, but stumbles because it lacks a cohesive way

to sell its value proposition. As it stands, Sysomos is a good choice for research purposes and

customer insights analysts; and eventually, for customer care.

Engage With An Analyst

Gain greater confidence in your decisions by working with Forrester thought leaders to apply our

research to your specific business and technology initiatives.

Analyst Inquiry

Analyst Advisory

Ask a question related to our research; a

Forrester analyst will help you put it into

practice and take the next step. Schedule

a 30-minute phone session with the analyst

or opt for a response via email.

Put research into practice with in-depth

analysis of your specific business and

technology challenges. Engagements

include custom advisory calls, strategy

days, workshops, speeches, and webinars.

Learn more about inquiry, including tips for

getting the most out of your discussion.

Learn about interactive advisory sessions

and how we can support your initiatives.

Supplemental Material

Online Resource

The online version of Figure 3 is an Excel-based vendor comparison tool that provides detailed product

evaluations and customizable rankings.

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

12

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

Data Sources Used In This Forrester Wave

Forrester used a combination of 3 data sources to assess the strengths and weaknesses of each

solution. We evaluated the vendors participating in this Forrester Wave, in part, using materials that

they provided to us by November 20, 2016.

Vendor surveys. Forrester surveyed vendors on their capabilities as they relate to the evaluation

criteria. Once we analyzed the completed vendor surveys, we conducted vendor calls where

necessary to gather details of vendor qualifications.

Product demos. We asked vendors to conduct demonstrations of their products functionality. We

used findings from these product demos to validate details of each vendors product capabilities.

Customer reference calls. To validate product and vendor qualifications, Forrester also conducted

reference calls with 3 of each vendors current customers.

The Forrester Wave Methodology

We conduct primary research to develop a list of vendors that meet our criteria to be evaluated in this

market. From that initial pool of vendors, we then narrow our final list. We choose these vendors based

on: 1) product fit; 2) customer success; and 3) Forrester client demand. We eliminate vendors that have

limited customer references and products that dont fit the scope of our evaluation.

After examining past research, user need assessments, and vendor and expert interviews, we develop

the initial evaluation criteria. To evaluate the vendors and their products against our set of criteria,

we gather details of product qualifications through a combination of lab evaluations, questionnaires,

demos, and/or discussions with client references. We send evaluations to the vendors for their review,

and we adjust the evaluations to provide the most accurate view of vendor offerings and strategies.

We set default weightings to reflect our analysis of the needs of large user companies and/or

other scenarios as outlined in the Forrester Wave evaluation and then score the vendors based

on a clearly defined scale. We intend these default weightings to serve only as a starting point and

encourage readers to adapt the weightings to fit their individual needs through the Excel-based tool.

The final scores generate the graphical depiction of the market based on current offering, strategy, and

market presence. Forrester intends to update vendor evaluations regularly as product capabilities and

vendor strategies evolve. For more information on the methodology that every Forrester Wave follows,

go to http://www.forrester.com/marketing/policies/forrester-wave-methodology.html.

Integrity Policy

We conduct all our research, including Forrester Wave evaluations, in accordance with our Integrity

Policy. For more information, go to http://www.forrester.com/marketing/policies/integrity-policy.html.

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

13

For B2C Marketing Professionals

March 2, 2016

The Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

The 12 Providers That Matter Most And How They Stack Up

Endnotes

Thirty six customer references interviewed for the Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

evaluation answered the question, What are current challenges for your social listening program?

During the Social Relationship Platform Wave evaluation, Forrester surveyed 118 avid social marketers. Source:

Forresters Q1 2015 Global Social Relationship Platform Wave Online Survey.

Source: Forresters North American Consumer Technographics Online Benchmark Survey (Part 1), 2015.

3

4

Over the past two years, more than one-third of US online adults contacted a company on Twitter for service, and

this trend is growing. For more information, see the Build Customer Relationships With Social Customer Care

Forrester report.

Thirty six customer references interviewed for the Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

answered the question, What are your current initiatives for your social listening program? In an analysis of

responses, approximately 20% mentioned customer service.

Thirty six customer references interviewed for the Forrester Wave: Enterprise Social Listening Platforms, Q1 2016

answered the question, What are your current initiatives for your social listening program? In an analysis of

responses, 30% mentioned the listed initiatives as part of the goals for their program.

We see the convergence of social relationship platforms and social listening platforms on the horizon, as evidenced

by Sysomos acquisition of Expion, and the vendor capabilities we saw in this Forrester Wave evaluation. For more

information, see the Predictions 2016: Social Gets Reinforcements Forrester report.

Thirty six customer references interviewed for the Forrester Wave: Enterprise Social Listening Platforms, Q1

2016 answered the question, What are current challenges for your social listening program? 39% mentioned

understanding insights and making sense of the data. 32% talked about internal challenges.

According to our social maturity model, integrating social data with other business data is the highest level of maturity.

It isnt easy and you have to crawl, walk, and run before you fly. For more information, see the The Road Map To

Integrated Social Intelligence Forrester report.

In 2015, our Consumer Technographics Social Technographics framework found that 20% of US online adults (18+)

appreciate social interactions with a company, 25% expect social interactions, and 27% demand social interactions.

See the Social Technographics Defines Your Social Strategies And Tactics Forrester report and Forresters North

American Consumer Technographics Online Benchmark Survey (Part 1), 2015.

10

Our data also shows that 10% of marketing decision-makers companies in North America are expanding or

upgrading their listening platforms. Source: Forresters Global Business Technographics Marketing Survey, 2015.

Source: Inquiry with a Forrester analyst on February 10, 2016.

11

After a consumer posted about removing high fructose corn syrup from the Yoplait recipe, the company decided to

take action. It used this post and launched a campaign around social, showcasing its commitment to its customers.

Source: Sparked by a Post, Yoplait (http://www.yoplait.com/yoplait-in-action/great-minds-think-alike).

12

Source: Synthesios Great Big Book of Insights, Synthesio, February 5, 2014 (http://www.synthesio.com/resources/

synthesios-great-big-book-insights/).

13

Source: Interview with a Forrester client in November 2015.

14

Net Promoter and NPS are registered service marks, and Net Promoter Score is a service mark, of Bain & Company,

Satmetrix Systems, and Fred Reichheld.

15

2016 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law.

Citations@forrester.com or +1 866-367-7378

14

We work with business and technology leaders to develop

customer-obsessed strategies that drive growth.

Products and Services

Core research and tools

Data and analytics

Peer collaboration

Analyst engagement

Consulting

Events

Forresters research and insights are tailored to your role and

critical business initiatives.

Roles We Serve

Marketing & Strategy

Professionals

CMO

B2B Marketing

B2C Marketing

Customer Experience

Customer Insights

eBusiness & Channel

Strategy

Technology Management

Professionals

CIO

Application Development

& Delivery

Enterprise Architecture

Infrastructure & Operations

Security & Risk

Sourcing & Vendor

Management

Technology Industry

Professionals

Analyst Relations

Client support

For information on hard-copy or electronic reprints, please contact Client Support at

+1 866-367-7378, +1 617-613-5730, or clientsupport@forrester.com. We offer quantity

discounts and special pricing for academic and nonprofit institutions.

Forrester Research (Nasdaq: FORR) is one of the most influential research and advisory firms in the world. We work with

business and technology leaders to develop customer-obsessed strategies that drive growth. Through proprietary

research, data, custom consulting, exclusive executive peer groups, and events, the Forrester experience is about a

singular and powerful purpose: to challenge the thinking of our clients to help them lead change in their organizations.

122523

For more information, visit forrester.com.

You might also like

- Social Media Listening Tool A Comparative StudyDocument22 pagesSocial Media Listening Tool A Comparative StudysrilivesNo ratings yet

- Turning Insight Into Action:: The Journey To Social Media IntelligenceDocument9 pagesTurning Insight Into Action:: The Journey To Social Media IntelligenceJavier RomeroNo ratings yet

- The Forrester Wave Listening Platforms Q1Document12 pagesThe Forrester Wave Listening Platforms Q1Priya KoshyNo ratings yet

- Managing Big Data: What's Relevant?Document3 pagesManaging Big Data: What's Relevant?Warren Smith QC (Quantum Cryptanalyst)No ratings yet

- AI Analytics ML FutureDocument15 pagesAI Analytics ML FutureRaúl ArellanoNo ratings yet

- ANA Social Media MonitoringDocument14 pagesANA Social Media MonitoringDemand Metric100% (1)

- Consumer Awareness Towards E-MarketingDocument71 pagesConsumer Awareness Towards E-MarketingAbhay JainNo ratings yet

- Market Intelligence Report - Digital AnalyticsDocument40 pagesMarket Intelligence Report - Digital AnalyticsSebastian TugulanNo ratings yet

- Blume-Fintech RPRT - Aug 2020Document27 pagesBlume-Fintech RPRT - Aug 2020Rajesh DuttaNo ratings yet

- Rural CommunicationDocument14 pagesRural CommunicationGarima JainNo ratings yet

- Google Analytics WorkshopDocument37 pagesGoogle Analytics WorkshopAnkit AgarwalNo ratings yet

- Global-Software-Sector-Update-Spring-2020 Pagemill PartnersDocument25 pagesGlobal-Software-Sector-Update-Spring-2020 Pagemill Partnersdear14us1984No ratings yet

- Exploratory Research Design Secondary DataDocument16 pagesExploratory Research Design Secondary DataimadNo ratings yet

- A Project Report: A Study On Recommender Systems Employed by Indian E-Commerce CompaniesDocument64 pagesA Project Report: A Study On Recommender Systems Employed by Indian E-Commerce CompaniesUpdesh ChauhanNo ratings yet

- Digital Marketing Assignment PDFDocument23 pagesDigital Marketing Assignment PDFRaja Babu SharmaNo ratings yet

- Mintigo Why B2B Marketers Need Predictive MarketingDocument18 pagesMintigo Why B2B Marketers Need Predictive MarketingSSibani77No ratings yet

- Collective BargainingDocument10 pagesCollective BargainingMegha SahayNo ratings yet

- 83 Best ToolsDocument14 pages83 Best ToolsKhushboo JainNo ratings yet

- McKinsey Report Busted Five Myths About Retailer Media 1667897746Document7 pagesMcKinsey Report Busted Five Myths About Retailer Media 1667897746Rishikesh KumarNo ratings yet

- Analytics PPT For Traffic SourceDocument67 pagesAnalytics PPT For Traffic SourceAshok KumarNo ratings yet

- AADHAR The Digital Ecosystem Final P001 P561Document612 pagesAADHAR The Digital Ecosystem Final P001 P561Ashish RajadhyakshaNo ratings yet

- 2020 Tech Trends Report Interactive PDFDocument36 pages2020 Tech Trends Report Interactive PDFrwilson66No ratings yet

- Integrated Brand CommunicationDocument102 pagesIntegrated Brand CommunicationBui Phuoc ThienNo ratings yet

- EY Social Media Marketing India Trends Study 2014Document44 pagesEY Social Media Marketing India Trends Study 2014Ramachandra GanapathiNo ratings yet

- B2B Branding: Team MembersDocument11 pagesB2B Branding: Team MembersManjunathan MohanNo ratings yet

- Data Analytics Data Analytics in HigherDocument13 pagesData Analytics Data Analytics in HighermukherjeesNo ratings yet

- Sayali Patil, MMS A, Roll No 44 Amazon Case QuestionsDocument5 pagesSayali Patil, MMS A, Roll No 44 Amazon Case QuestionsSayali PatilNo ratings yet

- Marketing Research ProjectDocument28 pagesMarketing Research ProjectAshley WilliamsNo ratings yet

- Senior Growth Associate-MeeshoDocument2 pagesSenior Growth Associate-MeeshoDivyyaPandeyNo ratings yet

- Examples of Big Data in MarketingDocument6 pagesExamples of Big Data in MarketingDarshil RaveshiaNo ratings yet

- Retail MKT InnovationDocument23 pagesRetail MKT InnovationCarlaNo ratings yet

- The Impact of Engagement With Social Media Marketing On Brand AwarenessDocument8 pagesThe Impact of Engagement With Social Media Marketing On Brand Awarenessbsarangan88No ratings yet

- Omnichannel: The Path To ValueDocument7 pagesOmnichannel: The Path To ValueArun KsNo ratings yet

- A Study of Consumer Perception Towards MwalletsDocument5 pagesA Study of Consumer Perception Towards MwalletsPratik DasNo ratings yet

- PWC Global Fintech Report 17.3.17 FinalDocument20 pagesPWC Global Fintech Report 17.3.17 Finalindratetsu100% (2)

- Chapter 11 - Culture and ConsumersDocument58 pagesChapter 11 - Culture and ConsumersBeeChenNo ratings yet

- Transforming Marketing With Artificial Intelligence: July 2020Document14 pagesTransforming Marketing With Artificial Intelligence: July 2020Manel MarziNo ratings yet

- Social MediaDocument15 pagesSocial Mediasaoussen souidi100% (1)

- UnicommerceDocument31 pagesUnicommerceNitish krNo ratings yet

- Gartner Group Study MPSDocument13 pagesGartner Group Study MPSMarta Catarina ValenteNo ratings yet

- Himanshu Tandon Airtel AnalysisDocument12 pagesHimanshu Tandon Airtel AnalysisHimanshu Tandon100% (1)

- Iim Grp-1 Capstone ProjectDocument24 pagesIim Grp-1 Capstone ProjectAbhi SNo ratings yet

- A Study On Factors Affecting Online Streaming Service Choice Among MillennialsDocument10 pagesA Study On Factors Affecting Online Streaming Service Choice Among MillennialsRockstar100% (1)

- IT, ITES and AnalyticsDocument70 pagesIT, ITES and AnalyticsSrikant RaoNo ratings yet

- Data Analytics Case Studies From TatvicDocument24 pagesData Analytics Case Studies From TatvicNobodyNo ratings yet

- E - Marketing On Marriage BureauDocument7 pagesE - Marketing On Marriage BureauSakhawat HossainNo ratings yet

- Supply Chain Principles and ApplicationsDocument12 pagesSupply Chain Principles and ApplicationsRicky KristandaNo ratings yet

- Blankespoor, 2018Document8 pagesBlankespoor, 2018Arthur MesquitaNo ratings yet

- Marketing in The Moment PDFDocument14 pagesMarketing in The Moment PDFAmourad77No ratings yet

- Case 3 - Ather Energy Motivation and PersonalityDocument8 pagesCase 3 - Ather Energy Motivation and PersonalityARAVINDAN A 2127011No ratings yet

- Botify - The SEO Challenge TodayDocument22 pagesBotify - The SEO Challenge TodayTrue NorthNo ratings yet

- LNK SG ThoughtLeadership Digital v04.01Document51 pagesLNK SG ThoughtLeadership Digital v04.01Anustup Nayak100% (2)

- Mistral - Ai Strategic MemoDocument7 pagesMistral - Ai Strategic MemoVaibhav PritwaniNo ratings yet

- Consumer BehaviorDocument19 pagesConsumer BehaviorSandeep Ghatuary100% (1)

- Jain Drip IrrigationDocument26 pagesJain Drip IrrigationAbrar AhmedNo ratings yet

- IIM C-Capstone Solution - April 30 EDITEDDocument17 pagesIIM C-Capstone Solution - April 30 EDITEDRamapriyaNo ratings yet

- Winzo Onboarding OverviewDocument5 pagesWinzo Onboarding Overviewsaheb167No ratings yet

- Social Media Intelligence Article For KalaariDocument3 pagesSocial Media Intelligence Article For KalaarirahulNo ratings yet

- Marketing Analytics: 7 Easy Steps to Master Marketing Metrics, Data Analysis, Consumer Insights & Forecasting ModelingFrom EverandMarketing Analytics: 7 Easy Steps to Master Marketing Metrics, Data Analysis, Consumer Insights & Forecasting ModelingNo ratings yet

- Social Media ROI Benchmark Report PDFDocument35 pagesSocial Media ROI Benchmark Report PDFDemand MetricNo ratings yet

- Bill of Lading - Terms and ConditionsDocument13 pagesBill of Lading - Terms and ConditionsDuDu SmileNo ratings yet

- Talkitout PDF FinalDocument194 pagesTalkitout PDF FinalDuDu SmileNo ratings yet

- Covering Letter of Offer Exercises DoneDocument9 pagesCovering Letter of Offer Exercises DoneDuDu SmileNo ratings yet

- A Forever Kind of Guy - Barbara Meyers - Chapter OneDocument7 pagesA Forever Kind of Guy - Barbara Meyers - Chapter OneDuDu SmileNo ratings yet

- Two Wheels TractorsDocument6 pagesTwo Wheels Tractorscuauhtemoc negreteNo ratings yet

- F-T Multi-Cartridge Filter - 231201 - 192843Document1 pageF-T Multi-Cartridge Filter - 231201 - 192843isaidce50No ratings yet

- Forensics of GM - Daewoo Joint VentureDocument18 pagesForensics of GM - Daewoo Joint VentureSumit S NairNo ratings yet

- The CLAVIS Hand Held Belt Tension Meter (Type 4)Document31 pagesThe CLAVIS Hand Held Belt Tension Meter (Type 4)Willy AndretyNo ratings yet

- Catalog Robot Zyj800bDocument74 pagesCatalog Robot Zyj800b96phamminhNo ratings yet

- Transmisiones, Diferenciales, LlantasDocument19 pagesTransmisiones, Diferenciales, LlantasJesús AraizaNo ratings yet

- 9 EPT20-15ET Operation Manual 2019-08-13 - 20190905 - 094817Document44 pages9 EPT20-15ET Operation Manual 2019-08-13 - 20190905 - 094817Lacatusu MirceaNo ratings yet

- Form-162-Scissor Lift Daily Inspection ChecklistDocument1 pageForm-162-Scissor Lift Daily Inspection Checklistshamroz khan100% (1)

- Palad: Wrong Answer SummaryDocument15 pagesPalad: Wrong Answer SummaryАртём Савалюк100% (1)

- Jadual Pembahagian Penilaian Berterusan ScribdDocument7 pagesJadual Pembahagian Penilaian Berterusan ScribdZAKEY ABDULNo ratings yet

- Volvo XC70 Wiring Manual 2003-2007Document328 pagesVolvo XC70 Wiring Manual 2003-2007NecsaszNorbert100% (1)

- FahrschuleDocument23 pagesFahrschuleVipin SekarNo ratings yet

- MaK M20C Presentation 32106Document9 pagesMaK M20C Presentation 32106Aurelijus UrbonasNo ratings yet

- A Project Report ON Vector Control Approach For Switched Reluctance Motor To Mitigate Acoustic NoiseDocument12 pagesA Project Report ON Vector Control Approach For Switched Reluctance Motor To Mitigate Acoustic NoiseKalyan Reddy AnuguNo ratings yet

- Electric Tractor Prototype For Zero - Emission AgricultureDocument39 pagesElectric Tractor Prototype For Zero - Emission AgricultureAkshay SharmaNo ratings yet

- Cost-Effective Fleet and Security Management SolutionDocument4 pagesCost-Effective Fleet and Security Management SolutionBROCHIERNo ratings yet

- Fault Codes (PLD-MR) Via SAE J1939 - 1.2Document17 pagesFault Codes (PLD-MR) Via SAE J1939 - 1.2Patrick ByronNo ratings yet

- Auris 2010 Press Kit Eng 748635Document35 pagesAuris 2010 Press Kit Eng 748635Valentin BencheciNo ratings yet

- Improved Energy Efficiency of Air Cooled ChillersDocument4 pagesImproved Energy Efficiency of Air Cooled ChillersKhozema GoodluckNo ratings yet

- Electrolux Outdoor Products: PNC Type/Prefix/nd Model BrandDocument6 pagesElectrolux Outdoor Products: PNC Type/Prefix/nd Model BrandNicolau FerreiraNo ratings yet

- DX235LCR-5: Crawler ExcavatorsDocument24 pagesDX235LCR-5: Crawler ExcavatorsJuan carlosNo ratings yet

- S4E500AM0301 - Fisa TehnicaDocument12 pagesS4E500AM0301 - Fisa TehnicaMario UrsuNo ratings yet

- Mechanical Dept IndentDocument27 pagesMechanical Dept IndentPankaj PandeyNo ratings yet

- Career Aspiration:: Rahul Naik +91-8970748632Document2 pagesCareer Aspiration:: Rahul Naik +91-8970748632Akhil RoutNo ratings yet

- 3MA1 Wiring Diagram en PDFDocument1 page3MA1 Wiring Diagram en PDFenduras_WRNo ratings yet

- Mechanical Engineering Department: PPT On Automobile EngineeringDocument147 pagesMechanical Engineering Department: PPT On Automobile EngineeringMuhammad Hamza TahirNo ratings yet

- Agra Based SME Email MobileDocument89 pagesAgra Based SME Email MobileNaveenJain0% (1)

- SM - VOLVO G970 MOTOR GRADER Service RepairDocument9 pagesSM - VOLVO G970 MOTOR GRADER Service RepairKai FebNo ratings yet

- 800N.m (81.5kg.m) /1400rpm 218g/kW.h (160g/PS.h) : Mechanical System Fuel SystemDocument2 pages800N.m (81.5kg.m) /1400rpm 218g/kW.h (160g/PS.h) : Mechanical System Fuel SystemJose MuñizNo ratings yet

- Shock Absorber CatalogueDocument151 pagesShock Absorber CatalogueMiguelangel Contreras SanchezNo ratings yet