Professional Documents

Culture Documents

RR 16-2011 PDF

Uploaded by

Anonymous KvztB3Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RR 16-2011 PDF

Uploaded by

Anonymous KvztB3Copyright:

Available Formats

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

October 27, 2011

REVENUE REGULATIONS NO. 16-2011

SUBJECT: Increasing the Amount of Threshold Amounts for Sale of Residential Lot, Sale

of House and Lot, Lease of Residential Unit and Sale or Lease of Goods or

Properties or Performance of Services covered by Section 109 (P), (Q) and (V)

of the Tax Code of 1997, as amended, thereby Amending Certain Provisions

of Revenue Regulations No. 16 -2005, as amended Otherwise Known as

Consolidated VAT Regulations of 2005.

TO : All Internal Revenue Officers, Employees and Others Concerned

--------------------------------------------------------------------------------------------------------------------------

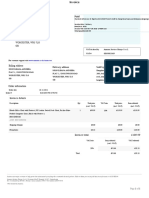

Section 1. BACKGROUND. Sections 109(P), (Q) and (V) of the Tax Code of 1997, as

amended provides that the amounts stated therein shall be adjusted to their present values

using the Consumer Price Index as published by the National Statistics Office (NSO).

Using the following formula / information:

Value (Current Year) = CPI (Current year)

Value Base Year CPI (Base Year)

Value 2010 = CPI 2010

Value 2005 CPI 2005

Where: CPI = Consumer Price Index

CPI 2010 = 166.1

CPI 2005 = 129.8

the adjusted threshold amounts, rounded off to the nearest hundred are as follows:

Section Amount in Pesos Adjusted threshold

(2005) amounts

Section 109 (P) 1,500,000 1,919,500.00

Section 109 (P) 2,500,000 3,199,200.00

Section 109 (Q) 10,000 12,800.00

Section 109 (V) 1,500,000 1,919,500.00

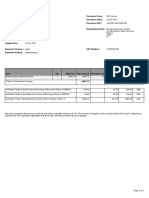

Section 2. SALE OF REAL PROPERTIES. - Pertinent portions of Section 4.106-3 of

Revenue Regulations No. 16-2005, as amended is hereby further amended to read as

follows:

"Section 4.106-3 Sale of Real Properties. Sale of real properties held

primarily for sale to customers or held for lease in the ordinary course of

trade or business of the seller shall be subject to VAT.

Sale of residential lot with gross selling price exceeding P1,919,500.00,

residential house and lot or other residential dwellings with gross selling

price exceeding P3,199,200.00, where the instrument of sale (whether the

instrument is nominated as a deed of absolute sale, deed of conditional sale

or otherwise) is executed on or after Nov. 1, 2005, shall be subject to ten

percent (10%) output VAT, and starting Feb. 1, 2006, to twelve percent (12%)

output VAT .

xxx xxx xxx"

Section 3. VAT EXEMPT TRANSACTIONS. - Sections 4.109.-1 (B)(1) (e)(1), (p)(4), (q)

and (v) of Revenue Regulations No. 16-2005, as amended, is hereby further amended to

read as follows:

"(e) Services subject to percentage tax under Title V of the Tax Code, as

enumerated below:

(1) Sale or lease of goods or properties or the performance of

services of non-VAT-registered persons, other than the transactions

mentioned in paragraphs (A) to (U) of Sec. 109(1) of the Tax Code, the

gross annual sales and/or receipts of which does not exceed the

amount of One Million Nine Hundred Nineteen Thousand Five

Hundred Pesos (P1,919,500.00); Provided, That every three (3) years

thereafter, the amount herein stated shall be adjusted to its present

value using the Consumer Price Index, as published by the National

Statistics Office (NSO) (Sec. 116 of the Tax Code); Provided, further,

that such adjustment shall be published through revenue

regulations to be issued not later than March 31 of each year;

xxx xxx xxx

(p) The following sales of real properties are exempt from VAT, namely:

(4) Sale of residential lot valued at One Million Nine Hundred

Nineteen Thousand Five Hundred Pesos (P1,919,500.00) and below,

or house & lot and other residential dwellings valued at Three Million

One Hundred Ninety-Nine Thousand Two Hundred Pesos

(P3,199,200.00) and below where the instrument of

sale/transfer/disposition was executed on or after July 1, 2005;

Provided, That every three (3) years thereafter, the amounts stated

herein shall be adjusted to its present value using the Consumer

Price Index, as published by the National Statistics Office (NSO);

Provided, further, that such adjustment shall be published through

revenue regulations to be issued not later than March 31 of each

year;

If two or more adjacent residential lots are sold or disposed in favor

of one buyer, for the purpose of utilizing the lots as one residential

lot, the sale shall be exempt from VAT only if the aggregate value of

the lots do not exceed P1,919,500.00. Adjacent residential lots,

although covered by separate titles and/or separate tax declarations,

when sold or disposed to one and the same buyer, whether covered

by one or separate Deed of Conveyance, shall be presumed as a sale

of one residential lot.

(q) Lease of residential units with a monthly rental per unit not exceeding

Twelve Thousand Eight Hundred Pesos (P12,800.00), regardless of the

amount of aggregate rentals received by the lessor during the year;

Provided, every three (3) years thereafter, the amount shall be adjusted to

its present value using the Consumer Price Index, as published by the NSO;

Provided, further, that such adjustment shall be published through revenue

regulations to be issued not later than March 31 of each year;

The foregoing notwithstanding, lease of residential units where the monthly

rental per unit exceeds Twelve Thousand Eight Hundred Pesos (P12,800.00)

but the aggregate of such rentals of the lessor during the year do not exceed

One Million Nine Hundred Nineteen Thousand Five Hundred Pesos

(P1,919,500.00) shall likewise be exempt from VAT, however, the same shall

be subjected to three percent (3%) percentage tax.

In cases where a lessor has several residential units for lease, some are

leased out for a monthly rental per unit of not exceeding P12,800.00 while

others are leased out for more than P12,800.00 per unit, his tax liability will

be as follows:

1. The gross receipts from rentals not exceeding P12,800.00 per

month per unit shall be exempt from VAT regardless of the aggregate

annual gross receipts.

2. The gross receipts from rentals exceeding P12,800.00 per

month per unit shall be subject to VAT if the aggregate annual gross

receipts from said units only (not including the gross receipts from

units leased for not more than P12,800.00) exceeds P1,919,500.00.

Otherwise, the gross receipts will be subject to the 3% tax imposed

under Section 116 of the Tax Code.

The term 'residential units' shall refer to apartments and houses & lots used

for residential purposes, and buildings or parts or units thereof used solely as

dwelling places (e.g., dormitories, rooms and bed spaces) except motels,

motel rooms, hotels, hotel rooms, lodging houses, inns and pension houses.

The term 'unit' shall mean an apartment unit in the case of apartments,

house in the case of residential houses; per person in the case of dormitories,

boarding houses and bed spaces; and per room in case of rooms for rent.

xxx xxx xxx

(v) Sale or lease of goods or properties or the performance of services

other than the transactions mentioned in the preceding paragraphs, the

gross annual sales and/or receipts do not exceed the amount of One Million

Nine Hundred Nineteen Thousand Five Hundred Pesos (P1,919,500.00);

Provided, every three (3) years thereafter, the amount shall be adjusted to

its present value using the Consumer Price Index, as published by the NSO;

Provided, further, that such adjustment shall be published through revenue

regulations to be issued not later than March 31 of each year;

For purposes of the threshold of P1,919,500.00, the husband and the wife

shall be considered separate taxpayers. However, the aggregation rule for

each taxpayer shall apply. For instance, if a professional, aside from the

practice of his profession, also derives revenue from other lines of business

which are otherwise subject to VAT, the same shall be combined for

purposes of determining whether the threshold has been exceeded. Thus,

the VAT-exempt sales shall not be included in determining the threshold.

xxx xxx xxx"

Section 4. REPEALING CLAUSE. - All existing rules and regulations and other

issuances or parts thereof which are inconsistent with the provisions of these Regulations

are hereby modified, amended or revoked accordingly.

Section 5. EFFECTIVITY. - These Regulations shall take effect starting January 1,

2012.

(Original Signed)

CESAR V. PURISIMA

Secretary of Finance

Recommending Approval:

(Original Signed)

KIM S. JACINTO -HENARES

Commissioner of Internal Revenue

You might also like

- Music Business Chapter 21 Record Distribution DealsDocument33 pagesMusic Business Chapter 21 Record Distribution Dealsupperhouse100% (1)

- EO 77, S. 2019 Travel Expenses (CDASIA) PDFDocument12 pagesEO 77, S. 2019 Travel Expenses (CDASIA) PDFATTY. R.A.L.C.No ratings yet

- Plants Abroad - How ToDocument6 pagesPlants Abroad - How ToLuc De Winter100% (3)

- Auto Repair Service Business PlanDocument14 pagesAuto Repair Service Business Plangauravmawar80% (5)

- Authority To Lease TemplateDocument1 pageAuthority To Lease TemplategiadamyloveNo ratings yet

- Deed of Absolute Sale of A Motor VehicleDocument2 pagesDeed of Absolute Sale of A Motor VehicleFroilan FerrerNo ratings yet

- Assignment On Public FinanceDocument21 pagesAssignment On Public Financepadum chetry100% (1)

- Drop Ileana Andreea Flat 1, 5 Droitwich Road Worcester, Wr3 7Lg GBDocument1 pageDrop Ileana Andreea Flat 1, 5 Droitwich Road Worcester, Wr3 7Lg GBIleana Andreea DropNo ratings yet

- Authority To Sell TemplateDocument1 pageAuthority To Sell TemplateMao WatanabeNo ratings yet

- Authority To SellDocument3 pagesAuthority To SellHERMIN ARCEONo ratings yet

- DAO 2 S. 1993 - IRR of RA 7394 (With Amendments From DAO 20-02, s.2010)Document21 pagesDAO 2 S. 1993 - IRR of RA 7394 (With Amendments From DAO 20-02, s.2010)ATTY. R.A.L.C.No ratings yet

- Authority To SellDocument3 pagesAuthority To SellRamon Chito Pudelanan100% (2)

- Broker Agent Agreement TemplateDocument1 pageBroker Agent Agreement Templatecandie marangaNo ratings yet

- Authority To Sell - TemplateDocument2 pagesAuthority To Sell - TemplateGar100% (1)

- 0001 Ucpl Sap Fico s4 Hana SyllabusDocument12 pages0001 Ucpl Sap Fico s4 Hana SyllabusUCPL Training100% (1)

- Philippine Market For CosmeticsDocument7 pagesPhilippine Market For Cosmeticsgcualteros100% (1)

- RDO No. 110 - General Santos City South Cotabato (All Muns)Document344 pagesRDO No. 110 - General Santos City South Cotabato (All Muns)Albert Degino50% (2)

- AUTHRITY TO SELL With OpDocument2 pagesAUTHRITY TO SELL With OpBen Deriquito100% (1)

- R-890 S. 2012Document8 pagesR-890 S. 2012mabzicleNo ratings yet

- Authority To Sell and Formal Client RegistrationDocument2 pagesAuthority To Sell and Formal Client RegistrationEuneun Bustamante100% (1)

- Authority To Sell Blank TemplateDocument2 pagesAuthority To Sell Blank TemplateSYGILNo ratings yet

- Lease ContractDocument3 pagesLease ContractSometimes good100% (1)

- Formal Offer To Sell Napindan Property Taguig City PhilippinesDocument3 pagesFormal Offer To Sell Napindan Property Taguig City PhilippinesJunel BatillerNo ratings yet

- Aff Transferro-Ree-1Document2 pagesAff Transferro-Ree-1Anonymous kJPBOi0HNo ratings yet

- Authority To SellDocument1 pageAuthority To SellJohn Sowp MacTavish100% (1)

- Affidavit of Loss OrcrDocument2 pagesAffidavit of Loss OrcrJ CNo ratings yet

- SLUP Application FormDocument1 pageSLUP Application FormMarijenLeañoNo ratings yet

- Bir ReliefDocument15 pagesBir ReliefHenry Mapa100% (1)

- Income TaxationDocument124 pagesIncome TaxationGWENN JYTSY BAFLORNo ratings yet

- Sworn Statement As To Maximum Selling PriceDocument1 pageSworn Statement As To Maximum Selling PriceFELSON CAPANGPANGANNo ratings yet

- 2021-11 Annex D REQUEST FORM DISLODGING - Res - 0Document1 page2021-11 Annex D REQUEST FORM DISLODGING - Res - 0NASSER DUGASANNo ratings yet

- Ra 10884Document4 pagesRa 10884Kevin BonaobraNo ratings yet

- Amended Guidelines Abot-Kamay Pabahay Program'Document30 pagesAmended Guidelines Abot-Kamay Pabahay Program'Ge-An Moiseah Salud AlmueteNo ratings yet

- VAT (In Patients)Document2 pagesVAT (In Patients)Anonymous XkzaifvdNo ratings yet

- AUTHORITY TO SELL With HOLD OVER CLAUSEDocument1 pageAUTHORITY TO SELL With HOLD OVER CLAUSEJohnNo ratings yet

- UNDERTAKING MeralcoDocument3 pagesUNDERTAKING MeralcoFaye100% (2)

- 801 Value Added TaxDocument4 pages801 Value Added TaxHarold Cedric Noleal OsorioNo ratings yet

- Authority To Sell ExtensionDocument1 pageAuthority To Sell ExtensionPaul BaesNo ratings yet

- CONTRACT TO SELL ExampleDocument3 pagesCONTRACT TO SELL ExampleJanine AranasNo ratings yet

- Exclusive Right To SellDocument1 pageExclusive Right To SellDonnaAntonucciNo ratings yet

- Contract To Sell Final 1Document4 pagesContract To Sell Final 1justineNo ratings yet

- HUDCC Resolution No. 1 Series of 2015Document3 pagesHUDCC Resolution No. 1 Series of 2015Daisy DucepecNo ratings yet

- Registration and DocumentationDocument6 pagesRegistration and DocumentationMichelle GozonNo ratings yet

- RDO No. 39 - South Quezon CityDocument376 pagesRDO No. 39 - South Quezon CityNotario PrivadoNo ratings yet

- RDO No. 103 - Butuan City, Agusan Del NorteDocument703 pagesRDO No. 103 - Butuan City, Agusan Del Nortelovenia mantilla0% (1)

- Sample Authority To SellDocument1 pageSample Authority To SellAtty. Rheneir Mora100% (2)

- Farmlot SubdivisionDocument5 pagesFarmlot SubdivisionJulius100% (1)

- Offer To Sell of Real Estate PropertyDocument1 pageOffer To Sell of Real Estate PropertyAilen Rose Puertas100% (1)

- RA 7160 Situs of The Tax - IRRDocument71 pagesRA 7160 Situs of The Tax - IRRErnie F. CanjaNo ratings yet

- BIR Ruling No. 242-18 (Gift Certs.)Document7 pagesBIR Ruling No. 242-18 (Gift Certs.)LizNo ratings yet

- Affidavit of No Improvement Sample PDFDocument1 pageAffidavit of No Improvement Sample PDFJena Mae YumulNo ratings yet

- Authority To SellDocument3 pagesAuthority To SellAlbert Caisip SampangNo ratings yet

- HDMF Circular No. 274 - Revised Guidelines On Pag-IBIG Fund MembershipDocument8 pagesHDMF Circular No. 274 - Revised Guidelines On Pag-IBIG Fund MembershipjoNo ratings yet

- Authority To Negotiate LeaseDocument1 pageAuthority To Negotiate LeasePaul BaesNo ratings yet

- Contract To Sell - UploadDocument4 pagesContract To Sell - UploadJustine CastanedaNo ratings yet

- Evat Law Leased of Real PropertyDocument5 pagesEvat Law Leased of Real Propertyenal92No ratings yet

- Regalian DoctrineDocument4 pagesRegalian DoctrineJacinto HyacinthNo ratings yet

- Authorization Letter: Assessor's Office of Cainta, RizalDocument1 pageAuthorization Letter: Assessor's Office of Cainta, RizalJason YangaNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- License To SellDocument24 pagesLicense To SellMay YellowNo ratings yet

- PRLD - SRS.002-B.00 - Sworn Registration Statement (Single)Document2 pagesPRLD - SRS.002-B.00 - Sworn Registration Statement (Single)KLASANTOS100% (1)

- Contract of LeaseDocument3 pagesContract of LeaseFeEdithOronicoNo ratings yet

- MOA Draft InternalDocument2 pagesMOA Draft InternalCarlo Ibrahim MaderazoNo ratings yet

- Authorization: DHSUD HOACD Form No. 2021-006Document1 pageAuthorization: DHSUD HOACD Form No. 2021-006Leo YatcoNo ratings yet

- Authority To Sell FORMDocument2 pagesAuthority To Sell FORMSuzi Garcia-RufinoNo ratings yet

- Revised MOA Paul Andrew Pilapil Lot 1181-BDocument3 pagesRevised MOA Paul Andrew Pilapil Lot 1181-BttunacaoNo ratings yet

- Application Form For Business Permit Office of The City Mayor Business Permit & Licensing DivisionDocument2 pagesApplication Form For Business Permit Office of The City Mayor Business Permit & Licensing Divisionvivian deocampoNo ratings yet

- Affidavit (Sample) : This Is A Sample. Please Prepare Pursuant To The Actual Situation of The CompanyDocument2 pagesAffidavit (Sample) : This Is A Sample. Please Prepare Pursuant To The Actual Situation of The CompanyAlmira SalsabilaNo ratings yet

- Affidavit-Socialized HousingDocument1 pageAffidavit-Socialized HousingAnskee TejamNo ratings yet

- (P3,300,000.00), Philippine Currency, Payable As FollowsDocument3 pages(P3,300,000.00), Philippine Currency, Payable As FollowsMPat EBarr0% (1)

- MC28 FormsDocument4 pagesMC28 FormsDeborah Micah PerezNo ratings yet

- SPA JOY BERRENGUER J. BAYACA Married To ROWEL F. BAYACADocument3 pagesSPA JOY BERRENGUER J. BAYACA Married To ROWEL F. BAYACAAnjo AlbaNo ratings yet

- Memorandum of Agreement: The HEIRS of - , NamelyDocument3 pagesMemorandum of Agreement: The HEIRS of - , NamelyBetsy Maria ZalsosNo ratings yet

- RR 3-2012 Threshold Amounts For Sale of Real PropertyDocument3 pagesRR 3-2012 Threshold Amounts For Sale of Real PropertyNick NañgitNo ratings yet

- DAO No. 18-07, s.2018 Annex C.4Document62 pagesDAO No. 18-07, s.2018 Annex C.4ATTY. R.A.L.C.No ratings yet

- 03 DAO 04 S. 2008 - Rules and Regulations On PS Issuance - IRRDocument7 pages03 DAO 04 S. 2008 - Rules and Regulations On PS Issuance - IRRATTY. R.A.L.C.No ratings yet

- Davao City EO 31 s.2020 LPCCDocument3 pagesDavao City EO 31 s.2020 LPCCATTY. R.A.L.C.No ratings yet

- DAO No. 18-07, s.2018 Annex C.5Document62 pagesDAO No. 18-07, s.2018 Annex C.5ATTY. R.A.L.C.No ratings yet

- DAO No. 18-07, s.2018 Revised Rules and Regulations Implementing Act No. 3883 (CDASIA)Document19 pagesDAO No. 18-07, s.2018 Revised Rules and Regulations Implementing Act No. 3883 (CDASIA)ATTY. R.A.L.C.No ratings yet

- Rirr 9184Document352 pagesRirr 9184mid paNo ratings yet

- DAO 2, s.1994 - Further Amending MO 32, s.1985Document10 pagesDAO 2, s.1994 - Further Amending MO 32, s.1985ATTY. R.A.L.C.No ratings yet

- 20161129LS' Opinion Re Sales PromotionDocument14 pages20161129LS' Opinion Re Sales PromotionATTY. R.A.L.C.No ratings yet

- DAO 8, s.2003 - Guidelines For The Mandatory Accreditation of Rebuilding Centers BDocument20 pagesDAO 8, s.2003 - Guidelines For The Mandatory Accreditation of Rebuilding Centers BATTY. R.A.L.C.No ratings yet

- DTI MC 20-31 - Amendment To The Supplemental Guidelines On The Concession On Residential Rents and Commercial RentsDocument2 pagesDTI MC 20-31 - Amendment To The Supplemental Guidelines On The Concession On Residential Rents and Commercial RentsATTY. R.A.L.C.No ratings yet

- DTI MC 20-37 - Guidelines On The Implementation of Minimum Health Protocols For Dine in Services by Restaurants and Fastfood EstablishmentsDocument6 pagesDTI MC 20-37 - Guidelines On The Implementation of Minimum Health Protocols For Dine in Services by Restaurants and Fastfood EstablishmentsATTY. R.A.L.C.No ratings yet

- DTI MC 20-19 - Grant of Grace Period To File Applications or Submit Reports and Moratorium On Monitoring and EnforcementDocument2 pagesDTI MC 20-19 - Grant of Grace Period To File Applications or Submit Reports and Moratorium On Monitoring and EnforcementATTY. R.A.L.C.No ratings yet

- Justice Bersamin Ponencia - Legal and Judicial EthicsDocument23 pagesJustice Bersamin Ponencia - Legal and Judicial EthicsATTY. R.A.L.C.No ratings yet

- DTI MC 20-18 - Guidelines On The Conduct of Remote Inspection and SamplingDocument4 pagesDTI MC 20-18 - Guidelines On The Conduct of Remote Inspection and SamplingATTY. R.A.L.C.No ratings yet

- Justice Bersamin Ponencia - Political LawDocument20 pagesJustice Bersamin Ponencia - Political LawATTY. R.A.L.C.No ratings yet

- 10 CIR v. Toledo Power CompanyDocument47 pages10 CIR v. Toledo Power Companyada mae santoniaNo ratings yet

- Document TypeDocument1 pageDocument TypeAdam ŽákNo ratings yet

- Case Study 14 IbsDocument9 pagesCase Study 14 Ibsnerises364No ratings yet

- Dr. Bawumia's Comments On The 2015 BudgetDocument19 pagesDr. Bawumia's Comments On The 2015 BudgetMahamudu Bawumia100% (2)

- 7th STD Social 3rd Term Book Back Questions With Answers in English PDFDocument32 pages7th STD Social 3rd Term Book Back Questions With Answers in English PDFAlvin ANo ratings yet

- HCL Singapore Pte Limited: Tax InvoiceDocument2 pagesHCL Singapore Pte Limited: Tax InvoiceNguyen AnhNo ratings yet

- Celent Intellect Qcbs Rbi Case StudyDocument24 pagesCelent Intellect Qcbs Rbi Case StudyJaswant SutharNo ratings yet

- Summary SoundCloud Premier G210110174 U865097 2021 06Document2 pagesSummary SoundCloud Premier G210110174 U865097 2021 06danNo ratings yet

- Tolentino v. Secretary of Finance, 235 SCRA 630Document212 pagesTolentino v. Secretary of Finance, 235 SCRA 630Zafra ChunNo ratings yet

- GEPCODocument1 pageGEPCOAbu EssaNo ratings yet

- 8262 Tender DocsDocument52 pages8262 Tender DocsAkash NitoneNo ratings yet

- CIR V Puregold 760 SCRA 96Document12 pagesCIR V Puregold 760 SCRA 96Karen Joy MasapolNo ratings yet

- Withholding VAT Guideline (2017-18)Document29 pagesWithholding VAT Guideline (2017-18)banglauserNo ratings yet

- GST - InterviewDocument13 pagesGST - Interviewjishnu surendranNo ratings yet

- TALLY-9.0-PDF - Book Full-1-188Document188 pagesTALLY-9.0-PDF - Book Full-1-188Beloved DhinaNo ratings yet

- Newsletter - Agustus I - Part IIIDocument11 pagesNewsletter - Agustus I - Part IIIDaisy Anita SusiloNo ratings yet

- Summer Trainning Report Dilasha 234567890Document72 pagesSummer Trainning Report Dilasha 234567890Sujeet HoodaNo ratings yet

- Chemexcil GST FAQsDocument230 pagesChemexcil GST FAQssrinivas100% (1)