Professional Documents

Culture Documents

Benny

Uploaded by

Hwee LingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benny

Uploaded by

Hwee LingCopyright:

Available Formats

Bennys Pizza Restaurant Ltd is looking at replacing an old European model oven which was

purchased four years ago for $25,000 with a new American model oven costing $58,000. The

cost of installing the new oven is $5000. The optimal replacement life of old model in terms of

output is five years, therefore the old European model is due to be replaced but it is still working,

although it has not any salvage value.

The optimal replacement life of new American - model in terms of output is projected for four

years.

Benny has just returned from a trip overseas where he was researching which ovens would best

suit the restaurants needs. This overseas research trip cost $6000. The company bought

additional space (one room) 5 years ago just next to the kitchen for $3000 in anticipation of

using it as a warehouse, but has since decided there is no further need for such space. The

restaurant was offered last week $3700 for selling the room. But if a new American oven is

installed, restaurant must built a new ventilation system in that room. Cost of ventilation are

included in the cost of installing (of $5000).

The new American oven will increase income by $40 000 in year 1 and this will increase by 50%

in year 2 and remain constant for years 3 and 4. The increased cost of using the new oven will

be $12 000 in year 1 and will increase by 25% in year 2 (as a result of greater usage and more

frequent servicing costs) and remain constant for years 3 and 4.

The salvage value of the new American oven is $10 000.

The deprecation rate for tax purposes is 20% straight line. The tax rate is 30% and the relevant

discount rate is 12%. It may be necessary for Bennys restaurant to borrow fund at 10 % to

purchase the machine because it has temporary cash flow problems.

Required:

I. Prepare a table of cash flows

II. Using this table determine using THREE (3) alternative project evaluation techniques

whether Benny should invest in the new American oven?

You might also like

- Strategic Finance Assignment CalculatorDocument6 pagesStrategic Finance Assignment CalculatorSOHAIL TARIQNo ratings yet

- Tax Problem 2020Document9 pagesTax Problem 2020Justine Ashley SavetNo ratings yet

- FM W11Document5 pagesFM W11Syifa AureliaNo ratings yet

- All But 7Document6 pagesAll But 7bestmoosena100% (2)

- Week 12 HomeworkDocument2 pagesWeek 12 HomeworkMichael Clark0% (1)

- Assignment I & IiDocument4 pagesAssignment I & IiMikoo TNo ratings yet

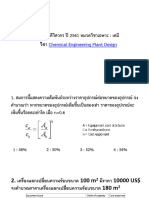

- ข้อสอบ กว Additional Problems Chapter 9 Rapid cost estimating method for stdDocument11 pagesข้อสอบ กว Additional Problems Chapter 9 Rapid cost estimating method for stdภูมิรพี ศรีโวทานัยNo ratings yet

- Two New Alternatives Have Come Up For Expanding Grandmother S CHDocument1 pageTwo New Alternatives Have Come Up For Expanding Grandmother S CHAmit Pandey0% (1)

- Jones IronworksDocument1 pageJones Ironworkssachinrst100% (1)

- ACC315 Cost Accounting Test Chapters 8, 10-12Document4 pagesACC315 Cost Accounting Test Chapters 8, 10-12Jamie N Clint BrendleNo ratings yet

- Additional Practice QuestionsDocument4 pagesAdditional Practice QuestionsLeejat Kumar PradhanNo ratings yet

- Addmath AngahDocument9 pagesAddmath AngahNurul SyafiraNo ratings yet

- Chapter 10 - Capital Budgeting - ProblemsDocument4 pagesChapter 10 - Capital Budgeting - Problemsbraydenfr05No ratings yet

- Bai Tap Chuong 4Document2 pagesBai Tap Chuong 4viettiennguyenNo ratings yet

- Operations Process Analysis, EOQ, Project Management & Coffee Shop OperationsDocument3 pagesOperations Process Analysis, EOQ, Project Management & Coffee Shop OperationsMindaou_Gu_3146No ratings yet

- Q - Shut Down ReplacementDocument1 pageQ - Shut Down ReplacementIrahq Yarte TorrejosNo ratings yet

- Revised Accounting 15Document26 pagesRevised Accounting 15Jennifer Garnette50% (2)

- S2023 Assignment 1 Chs 1 3 - For Release 481Document3 pagesS2023 Assignment 1 Chs 1 3 - For Release 481Isha ShuklaNo ratings yet

- Actecon # 6 PDFDocument1 pageActecon # 6 PDFDonna Claire AngusNo ratings yet

- CH #3 NumericalsDocument3 pagesCH #3 NumericalsMs Noor ul AinNo ratings yet

- Week 7 Homework Template - 13thDocument11 pagesWeek 7 Homework Template - 13thalgadilan0% (2)

- Ch01 Problems RevDocument4 pagesCh01 Problems RevHetty Mustika0% (3)

- Week 5 - Tutorial Questions-1Document4 pagesWeek 5 - Tutorial Questions-1Đan Thanh Nguyễn NgọcNo ratings yet

- Fall 2018 Microeconomics MITx MidTerm Exam QuestionsDocument16 pagesFall 2018 Microeconomics MITx MidTerm Exam QuestionsdguheliosNo ratings yet

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- Engineering Eco PDF FreeDocument26 pagesEngineering Eco PDF FreeMJ ArboledaNo ratings yet

- CHAPTER 6 ExercisesDocument15 pagesCHAPTER 6 ExercisesMoshir Aly100% (1)

- EngEcon Worded Problems PDFDocument62 pagesEngEcon Worded Problems PDFVirgil Caballero54% (13)

- Tio Ieoper2 Hw1Document1 pageTio Ieoper2 Hw1Hannah TioNo ratings yet

- Sunk CostDocument3 pagesSunk CostBrian BermudezNo ratings yet

- Engineering EcoDocument26 pagesEngineering EcoEric John Enriquez100% (2)

- Depreciation and Capital Investment CalculationsDocument3 pagesDepreciation and Capital Investment CalculationsRiya khungerNo ratings yet

- Assignment - Capital BudgetingDocument2 pagesAssignment - Capital BudgetingMuhammad Ali SamarNo ratings yet

- MB 2203 FINANCIAL MANAGEMENT TUTORIAL WEEK 11ADocument1 pageMB 2203 FINANCIAL MANAGEMENT TUTORIAL WEEK 11ASyifa AureliaNo ratings yet

- Ingenieria EconomicaDocument2 pagesIngenieria EconomicaXavier Pacheco PaulinoNo ratings yet

- EM3000 Tutorial Set 2 Break Even Analysis and Product Mix OptimizationDocument3 pagesEM3000 Tutorial Set 2 Break Even Analysis and Product Mix OptimizationSahanNo ratings yet

- Soal MicroeconomyDocument2 pagesSoal MicroeconomyDavid WijayaNo ratings yet

- Assignment IPE 481Document3 pagesAssignment IPE 481syd_xpNo ratings yet

- A 2Document4 pagesA 2sabaNo ratings yet

- Additional - Chapter 13Document12 pagesAdditional - Chapter 13Gega XachidENo ratings yet

- Home Assignment - 1Document2 pagesHome Assignment - 1Pankaj kumarNo ratings yet

- MAS Synchronous May 13 Part 2Document4 pagesMAS Synchronous May 13 Part 2Marielle GonzalvoNo ratings yet

- Math HomeworkDocument4 pagesMath HomeworkLuqman HakimiNo ratings yet

- Assignment 1 - Standard Costing and Capital Budgeting ExercisesDocument3 pagesAssignment 1 - Standard Costing and Capital Budgeting ExercisesBlessie Joy DalisayNo ratings yet

- ExercisesDocument5 pagesExercisesZandro Gagote0% (1)

- essay_BSDocument1 pageessay_BSthaindnds180468No ratings yet

- Lecture Ques-Sol.Document9 pagesLecture Ques-Sol.Rami RRKNo ratings yet

- Exercise QuestionsDocument8 pagesExercise QuestionsShahrukhNo ratings yet

- Answers Series 3 2015Document12 pagesAnswers Series 3 2015Penny Pun80% (5)

- Review QuestionsDocument3 pagesReview QuestionsJEZICAH MAE DE JESUSNo ratings yet

- Janet's Bakery Oven Replacement DecisionDocument8 pagesJanet's Bakery Oven Replacement DecisionDarya KoroviyNo ratings yet

- Long Problems Process Costing PDFDocument8 pagesLong Problems Process Costing PDFPatDabzNo ratings yet

- MNGRL AccDocument21 pagesMNGRL AcceiNo ratings yet

- Hayden Has A NoDocument1 pageHayden Has A NoWaqar Ahmad0% (1)

- CMADocument24 pagesCMAeiNo ratings yet

- Department of Management College of Business and Economics Mekelle University Mathematics For Management WorksheetDocument4 pagesDepartment of Management College of Business and Economics Mekelle University Mathematics For Management Worksheetoromafi tubeNo ratings yet

- E 3Document7 pagesE 3MianAsrarUlHaqNo ratings yet

- Lawton Enterprises Project AnalysisDocument11 pagesLawton Enterprises Project AnalysisM. Wasif ChauhdaryNo ratings yet

- Kitchen Remodeling with An Architect: Design Ideas to Modernize Your Kitchen -The Latest Trends +50 Pictures: HOME REMODELING, #1From EverandKitchen Remodeling with An Architect: Design Ideas to Modernize Your Kitchen -The Latest Trends +50 Pictures: HOME REMODELING, #1Rating: 5 out of 5 stars5/5 (1)

- The Kitchen Makeover: A Guide to Remodeling Your KitchenFrom EverandThe Kitchen Makeover: A Guide to Remodeling Your KitchenRating: 5 out of 5 stars5/5 (1)

- Activity Based Costing ExplanationDocument6 pagesActivity Based Costing ExplanationHwee LingNo ratings yet

- Free Sample Lecture NotesDocument42 pagesFree Sample Lecture NotesHwee LingNo ratings yet

- CB Course Outlines-BB 4322 CB-2017Document4 pagesCB Course Outlines-BB 4322 CB-2017Hwee LingNo ratings yet

- Report Deciding Where To Deliver Out BabyDocument2 pagesReport Deciding Where To Deliver Out BabyHwee LingNo ratings yet

- Report Deciding Where To Deliver Out BabyDocument2 pagesReport Deciding Where To Deliver Out BabyHwee LingNo ratings yet

- Chakras - (Easternbody) .PDF 33Document23 pagesChakras - (Easternbody) .PDF 33Hwee Ling100% (1)