Professional Documents

Culture Documents

Assignment - Capital Budgeting

Uploaded by

Muhammad Ali SamarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment - Capital Budgeting

Uploaded by

Muhammad Ali SamarCopyright:

Available Formats

Capital Budgeting Question for Practice:

1) Johnny’s Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $20,000 and

will be depreciated according to the 3-year Straight line method. It will be sold for scrap metal after 3

years for $5,000. The grill will have no effect on revenues but will save Johnny’s $10,000 in energy

expenses. The tax rate is 35 percent.

a. What are the operating cash flows in Years 1–3?

b. If the discount rate is 12 percent, should the grill be purchased?

2) Bottoms Up Diaper Service is considering the purchase of a new industrial washer. It can purchase the

washer for $6,000 and sell its old washer for $2,000. The new washer will last for 6 years and save

$1,500 a year in expenses. The opportunity cost of capital is 15 percent, and the firm’s tax rate is 40

percent.

a. If the firm uses straight-line depreciation to an assumed salvage value of zero over a 6-year life, what

are the cash flows of the project in Years 0–6? The new washer will in fact have zero salvage value after

6 years, and the old washer is fully depreciated.

b. What is project NPV?

3) Kinky Copies may buy a high-volume copier. The machine costs $100,000 and will be depreciated

straight-line over 5 years to a salvage value of $20,000. Kinky anticipates that the machine actually can

be sold in 5 years for $30,000. The machine will save $20,000 a year in labor costs but will require an

increase in working capital, mainly paper supplies, of $10,000. The firm’s marginal tax rate is 35 percent

and the discount rate is 8 percent. Should Kinky buy the machine?

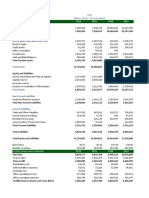

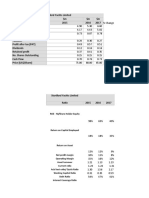

4) Mutually Exclusive Investments. Here are the cash flow forecasts for two mutually exclusive

projects:

a. Which project would you choose on NPV and IRR basisif the opportunity cost of capital is 2 percent?

b. Which would you choose if the opportunity cost of capital is 12 percent?

c. Why does your answer change?

5) Ilana Industries, Inc., needs a new lathe. It can buy a new high-speed lathe for $1 million. The

lathe will cost $35,000 to run, will save the firm $125,000 in labor costs, and will be useful for 10

years. Suppose that for tax purposes, the lathe will be depreciated on a straight-line basis over

its 10-year life to a salvage value of $100,000. The actual market value of the lathe at that time

also will be $100,000. The discount rate is 10 percent and the corporate tax rate is 35 percent.

What is the NPV of buying the new lathe?

6) PC shopping network may upgrade its modem pool. It last upgraded two years ago, when it

spent $115mn on equipment with an assumed life of 5 years and an assumed salvage value of

$15mn for tax purpose. The firm uses straight line depreciation. The old equipment can be sold

today for $80mn. A new modern pool can be installed today for $150mn. They will have a 3 year

life and will be depreciated to zero using straight line depreciation. The new equipment will

enable the firm to increase sales by $25mn per year and decrease operating cost by $10mn per

year. At the end of the three years, the new equipment will be worthless. Assume the firm’s tax

rate is 35% and the discount rate for the project of this sort is 10%. What is the NPV of the

replacement project?

You might also like

- Review of Capital Budgeting Lecture 2 QuestionsDocument2 pagesReview of Capital Budgeting Lecture 2 QuestionsSalman AhmedNo ratings yet

- Analyze Earth Mover, Spectrometer, and Machine Replacement ProjectsDocument2 pagesAnalyze Earth Mover, Spectrometer, and Machine Replacement ProjectsDanang0% (2)

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- BT Lựa Chọn Dự Án EDocument2 pagesBT Lựa Chọn Dự Án EstormspiritlcNo ratings yet

- Chapter 10 - Capital Budgeting - ProblemsDocument4 pagesChapter 10 - Capital Budgeting - Problemsbraydenfr05No ratings yet

- Should you purchase a $250k machineDocument1 pageShould you purchase a $250k machineelfi_bitzaNo ratings yet

- Practice Problems - Making Capital Investment DecisionsDocument2 pagesPractice Problems - Making Capital Investment DecisionsHello KittyNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- FIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingDocument3 pagesFIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingKelly KohNo ratings yet

- Chapter 2 - ProblemsDocument13 pagesChapter 2 - ProblemsTSARNo ratings yet

- Chapter 10 ProblemsDocument21 pagesChapter 10 ProblemsJane Hzel Lopez MilitarNo ratings yet

- Intial Interim FinDocument2 pagesIntial Interim FinYasir AamirNo ratings yet

- Cap BudgDocument5 pagesCap BudgShahrukhNo ratings yet

- Capital Budgeting NPV Analysis for Earth Mover ProjectDocument6 pagesCapital Budgeting NPV Analysis for Earth Mover ProjectMarcoBonaparte0% (1)

- Assigment 6 - Managerial Finance Capital BudgetingDocument5 pagesAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenNo ratings yet

- Replace Bottling Machine Investment AnalysisDocument11 pagesReplace Bottling Machine Investment AnalysisAli SajidNo ratings yet

- Prob SetDocument9 pagesProb SetVynz Higuit100% (1)

- PGPM FM I Glim Assignment 3 2014Document5 pagesPGPM FM I Glim Assignment 3 2014sexy_sam280% (1)

- SFM Practice QuestionsDocument13 pagesSFM Practice QuestionsAmmar Ahsan0% (1)

- Week 12 HomeworkDocument2 pagesWeek 12 HomeworkMichael Clark0% (1)

- Time Value of Money Course AssignmentDocument4 pagesTime Value of Money Course AssignmentSyed Osama Ali100% (1)

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Ps Capital Budgeting PDFDocument7 pagesPs Capital Budgeting PDFcloud9glider2022No ratings yet

- Tutorial 02 QuestionsDocument2 pagesTutorial 02 QuestionsAamir ShaikNo ratings yet

- Assignment 4Document2 pagesAssignment 4Cheung HarveyNo ratings yet

- HW1 NPVDocument4 pagesHW1 NPVLalit GuptaNo ratings yet

- Corporate Finance I: Home Assignment 2 Due by January 30Document2 pagesCorporate Finance I: Home Assignment 2 Due by January 30RahulNo ratings yet

- Analyzing Project Cash Flows and NPVDocument21 pagesAnalyzing Project Cash Flows and NPVAkash KumarNo ratings yet

- Homework - Cash Flow PrinciplesDocument2 pagesHomework - Cash Flow PrinciplesCristina Maria ConstantinescuNo ratings yet

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNo ratings yet

- NPV Analysis of Automated Dishwasher PurchaseDocument15 pagesNPV Analysis of Automated Dishwasher PurchaseTaz UddinNo ratings yet

- Capital Budgeting 2Document3 pagesCapital Budgeting 2mlexarNo ratings yet

- Study Set 5Document8 pagesStudy Set 5slnyzclrNo ratings yet

- Cash Flow Estimation Problem SetDocument6 pagesCash Flow Estimation Problem SetmehdiNo ratings yet

- Engineering Economy: Page 1 of 1Document1 pageEngineering Economy: Page 1 of 1Den CelestraNo ratings yet

- Capital Budgeting 2 Homework SS 22Document2 pagesCapital Budgeting 2 Homework SS 22buivunguyetminhNo ratings yet

- Cash Flows-Capbud PDFDocument2 pagesCash Flows-Capbud PDFErjohn PapaNo ratings yet

- Cash Flow Estimation Chapter 11Document4 pagesCash Flow Estimation Chapter 11Venus TumbagaNo ratings yet

- Lahore School of Economics Financial Management II Cash Flow Estimation and Risk Analysis - 2Document2 pagesLahore School of Economics Financial Management II Cash Flow Estimation and Risk Analysis - 2IIBRAHIM 245No ratings yet

- NPV Capital Budgeting GuideDocument8 pagesNPV Capital Budgeting GuideAnastasiaNo ratings yet

- Engineering Contract Payback and Capitalization CalculationsDocument2 pagesEngineering Contract Payback and Capitalization Calculationsnajib casanNo ratings yet

- Assignment 2Document2 pagesAssignment 2Parth ShahNo ratings yet

- Capital Budgeting Problems For Fin102Document2 pagesCapital Budgeting Problems For Fin102Marianne AgunoyNo ratings yet

- PGPBL assignment questions analysisDocument6 pagesPGPBL assignment questions analysiskarthikawarrierNo ratings yet

- DCF Group 5Document18 pagesDCF Group 5Ravi Kumar100% (1)

- PS01 MainDocument12 pagesPS01 MainSumanth KolliNo ratings yet

- Ie342 SS4Document8 pagesIe342 SS4slnyzclrNo ratings yet

- ABC Company machine replacement analysisDocument2 pagesABC Company machine replacement analysisAsad razaNo ratings yet

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- Engg Econ QuestionsDocument7 pagesEngg Econ QuestionsSherwin Dela CruzzNo ratings yet

- Engineering Economy: Solutions For Each Number Are Found After This PageDocument8 pagesEngineering Economy: Solutions For Each Number Are Found After This PageFranchezca WestermannNo ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- Eceecon Problem Set 2Document8 pagesEceecon Problem Set 2Jervin JamillaNo ratings yet

- Exercise 1 - TVM & Equivalence 2.0Document5 pagesExercise 1 - TVM & Equivalence 2.0Bayu PurnamaNo ratings yet

- MNGRL AccDocument21 pagesMNGRL AcceiNo ratings yet

- CF1 Homework 4Document2 pagesCF1 Homework 4Rudine Pak MulNo ratings yet

- Work Sheet On Chapter OneDocument3 pagesWork Sheet On Chapter Onerobel popNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Assignment 1 TVM, Bonds StockDocument2 pagesAssignment 1 TVM, Bonds StockMuhammad Ali SamarNo ratings yet

- Dettol Distribution ChannelDocument3 pagesDettol Distribution ChannelPratyush VanshrajNo ratings yet

- Stortford Yachts Limited ratio analysis reveals operational issuesDocument8 pagesStortford Yachts Limited ratio analysis reveals operational issuesMuhammad Ali SamarNo ratings yet

- Empathetic Problem SolversDocument2 pagesEmpathetic Problem SolversMuhammad Ali SamarNo ratings yet

- Brand Positioning by Sunil GuptaDocument2 pagesBrand Positioning by Sunil GuptaMuhammad Ali SamarNo ratings yet

- Should Kinky Copies Buy a High-Volume CopierDocument2 pagesShould Kinky Copies Buy a High-Volume CopierMuhammad Ali SamarNo ratings yet

- Empathetic Problem SolversDocument2 pagesEmpathetic Problem SolversMuhammad Ali SamarNo ratings yet

- Resolve consumer conflicts with targeted marketing strategiesDocument1 pageResolve consumer conflicts with targeted marketing strategiesMuhammad Ali SamarNo ratings yet

- Van H Wac CH 03 Class ProblemsDocument10 pagesVan H Wac CH 03 Class ProblemsMuhammad Ali SamarNo ratings yet

- AFN MINI CASE STUDY CLASS Excel SAMPLEDocument6 pagesAFN MINI CASE STUDY CLASS Excel SAMPLEMuhammad Ali SamarNo ratings yet

- Corporate Valuation ExampleDocument8 pagesCorporate Valuation ExampleMuhammad Ali SamarNo ratings yet

- AFN CH 12 Mini Case StudyDocument3 pagesAFN CH 12 Mini Case StudyMuhammad Ali SamarNo ratings yet

- Assignment 1 TVM, Bonds StockDocument2 pagesAssignment 1 TVM, Bonds StockMuhammad Ali SamarNo ratings yet

- Assignment - Capital BudgetingDocument2 pagesAssignment - Capital BudgetingMuhammad Ali SamarNo ratings yet

- AFN Forecasting - Practice QuestionsDocument1 pageAFN Forecasting - Practice QuestionsMuhammad Ali Samar100% (3)

- MTP May21 ADocument11 pagesMTP May21 Aomkar sawantNo ratings yet

- Final Acc Wid Adjustment PracticalDocument20 pagesFinal Acc Wid Adjustment PracticalMuskan LohariwalNo ratings yet

- CFIN AuditedDocument103 pagesCFIN AuditedDika DaniswaraNo ratings yet

- Quiz on Corporation Law Powers and Shareholder RightsDocument2 pagesQuiz on Corporation Law Powers and Shareholder RightsRSNo ratings yet

- IB Pitchbook Valuation AnalysisDocument3 pagesIB Pitchbook Valuation AnalysisSHIVAM SRIVASTAVANo ratings yet

- Dutch Bangla Bank 10720015Document11 pagesDutch Bangla Bank 10720015ABIDUZ ZAMANNo ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- Solved - Spring MID SEM Question Paper 2023Document9 pagesSolved - Spring MID SEM Question Paper 2023Arghadeep BiswasNo ratings yet

- QuizDocument5 pagesQuizQasim KhanNo ratings yet

- Fa4e SM Ch01Document21 pagesFa4e SM Ch01michaelkwok1100% (1)

- CPA 1 - Financial AccountingDocument8 pagesCPA 1 - Financial AccountingPurity muchobella100% (1)

- Cons 7820 PBM Reading TwoDocument14 pagesCons 7820 PBM Reading Twoრაქსშ საჰაNo ratings yet

- Fairchem Organics LimitedDocument16 pagesFairchem Organics Limitedsaipavan999No ratings yet

- Patient Capital - A Study On The Outperformance of Infrequent TradersDocument72 pagesPatient Capital - A Study On The Outperformance of Infrequent TradersCanadianValueNo ratings yet

- PFRSforSMEs PPTPart2-1542938815252Document7 pagesPFRSforSMEs PPTPart2-1542938815252Renz Angel M. RiveraNo ratings yet

- Financial Accounting: Volume 3 Summary ValixDocument10 pagesFinancial Accounting: Volume 3 Summary ValixPrincess KayNo ratings yet

- Capital Budgeting Technique: Md. Nehal AhmedDocument25 pagesCapital Budgeting Technique: Md. Nehal AhmedZ Anderson Rajin0% (1)

- 10065CBSE Guess Paper 2022-23Document8 pages10065CBSE Guess Paper 2022-23Dhriti KarnaniNo ratings yet

- CengageNOWv2 - Online Teaching and Learning Resource From Cengage Learning Week 2Document8 pagesCengageNOWv2 - Online Teaching and Learning Resource From Cengage Learning Week 2Swapan Kumar SahaNo ratings yet

- Comparative Financial Statements AnalysisDocument10 pagesComparative Financial Statements Analysisarushi sarafNo ratings yet

- Manufacturing Accounts PowerpointDocument12 pagesManufacturing Accounts PowerpointRaynardo KnightNo ratings yet

- Receivables HandoutsDocument5 pagesReceivables HandoutsClrk RoxassNo ratings yet

- Products and Services in MFBDocument24 pagesProducts and Services in MFBMichael TochukwuNo ratings yet

- Investment Banking Resume and CV Template PDFDocument2 pagesInvestment Banking Resume and CV Template PDFRuiPachecoNo ratings yet

- PT Indo Pixel Balance Sheet 2015Document1 pagePT Indo Pixel Balance Sheet 2015Hizba SabilillahNo ratings yet

- Rockboro Machine Tools Financial StrategyDocument10 pagesRockboro Machine Tools Financial StrategyPatcharanan SattayapongNo ratings yet

- Redemption of Preference SharesDocument19 pagesRedemption of Preference SharesAshura ShaibNo ratings yet

- Dayag Chapter 3Document45 pagesDayag Chapter 3Clifford Angel Matias90% (10)

- Nike - Case Study MeenalDocument9 pagesNike - Case Study MeenalAnchal ChokhaniNo ratings yet

- Draft Solutions Diploma in IFRS For SMEs Final Exam JD21Document84 pagesDraft Solutions Diploma in IFRS For SMEs Final Exam JD21Vuthy DaraNo ratings yet