Professional Documents

Culture Documents

Corporate Valuation Example

Uploaded by

Muhammad Ali Samar0 ratings0% found this document useful (0 votes)

8 views8 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views8 pagesCorporate Valuation Example

Uploaded by

Muhammad Ali SamarCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 8

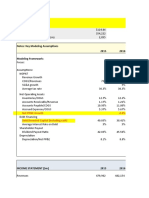

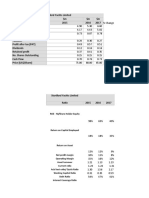

Calculation of FCF ($ Million)

Operating Current Asset (OCA)

Operating Current Liabilties (OCL)

Net operating Working Capital (NOWC)

Net Plant and Equipment

Net Operating Capital

Investment in Operation Capital

NOPAT

Free Cash Flow

PV of FCF

Sum of PV of FCF

Terminal Value / Continuing Value

PV of Terminal Value

Value of Opertion

Value of Non Operating Asset

Company's Value

Value of Common Equity

No of Shares Outstanding

Internic value or Equity Value per Share

1 2

Formula 2010 2011 2012

Total Current Asset - Marketable Sec. or Short-term Investments 272 320 352

Total Current Liabilities - Notes Payable or short term loans 60 70 77

NOWC = OCA -OCL 212 250 275

279 310 341

NOC= NOWC + Net Plant and Equiment 491 560 616

Investment in Operating Capital = Change in Net Operating Capital 69 56

EBIT * (1-tax rate) 44 51 33

FCF= NOPAT - Investment in Operating Capital 44 -18 -23

FCF/(1+WACC)^n 43.80 -16.24 -18.72

75.38

FCF * (1+g) / (Ke - g) or FCF Last Year * (1+g) / (WACC-g) 881.0

Terminal Value / (1+WACC)^n 526.61

Sum PV of FCF + Pv of Terminal Value 601.99

Marketable Secutries

Company Value = Value of Operations + Value of Non-Operating Assets

Value of Common Equity = Company Value – Debt – Preferred Equity

3 4 4

2013 2014 Terminal Value

370 388 g 5%

81 85 wacc 10.84%

289 303

358 376

647 679

31 32 Additional Investment in Operating Capital

77 81 Earning

46 49 51

34.07 32.46

49*(1+J3)/(J4-J3)

You might also like

- Kohler DCFDocument1 pageKohler DCFJennifer Langton100% (1)

- Lobj19 - 0000055 CR 1907 02 A PDFDocument28 pagesLobj19 - 0000055 CR 1907 02 A PDFqqqNo ratings yet

- Assignment 2. Estimating Adidas' Equity ValueDocument4 pagesAssignment 2. Estimating Adidas' Equity Valuefasihullah1995No ratings yet

- Walmart Valuation ModelDocument179 pagesWalmart Valuation ModelHiếu Nguyễn Minh HoàngNo ratings yet

- Answers: Operating Income Changes in Net Operating AssetsDocument6 pagesAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Principles of Corporate ValuationDocument14 pagesPrinciples of Corporate ValuationSubhrodeep DasNo ratings yet

- Finance For Non-Finance: Ratios AppleDocument12 pagesFinance For Non-Finance: Ratios AppleAvinash GanesanNo ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- 6886 Valuation 2Document25 pages6886 Valuation 2api-3699305100% (1)

- Ratio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosDocument10 pagesRatio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosKAVYA GUPTANo ratings yet

- FIN-573 - Lecture 2 - Jan 28 2021Document33 pagesFIN-573 - Lecture 2 - Jan 28 2021Abdul BaigNo ratings yet

- 60 HK Food Investment 1Q2011Document17 pages60 HK Food Investment 1Q2011Lye Shyong LingNo ratings yet

- Description Variable 2008: Financial Leverege (Nfo/cse)Document9 pagesDescription Variable 2008: Financial Leverege (Nfo/cse)Nizam Uddin MasudNo ratings yet

- Bergerac XLS ENGDocument12 pagesBergerac XLS ENGTelmo Barros0% (1)

- CPG Annual Report 2015Document56 pagesCPG Annual Report 2015Anonymous 2vtxh4No ratings yet

- AssignmentDocument6 pagesAssignmentAnkita KumariNo ratings yet

- Project 1 - FCF Intel Example - DirectionsDocument27 pagesProject 1 - FCF Intel Example - Directionsअनुशा प्रसादम्No ratings yet

- Anchor Compa CommonDocument14 pagesAnchor Compa CommonCY ParkNo ratings yet

- Condensed Consolidated Income StatementDocument26 pagesCondensed Consolidated Income StatementIhdaNo ratings yet

- 11.bergerac SystemsDocument12 pages11.bergerac SystemsAviralNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument36 pagesFinancial Statements, Cash Flow, and TaxesHussainNo ratings yet

- Chapter 8 Equity Valuation Assignment Chapter 8Document4 pagesChapter 8 Equity Valuation Assignment Chapter 8mehandiNo ratings yet

- Announcement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)Document25 pagesAnnouncement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)shiyeegohNo ratings yet

- ENX - URD2022 - Financial Statements and Auditors ReportDocument99 pagesENX - URD2022 - Financial Statements and Auditors ReportRaghunathNo ratings yet

- Quiz 1 Practice ProblemsDocument8 pagesQuiz 1 Practice ProblemsUmaid FaisalNo ratings yet

- Practice Exam - SolutionsDocument12 pagesPractice Exam - SolutionsSu Suan TanNo ratings yet

- Ratio Table - ACCT 3BDocument10 pagesRatio Table - ACCT 3BHoàng Minh ChuNo ratings yet

- Colgate ModelDocument19 pagesColgate ModelRajat Agarwal100% (1)

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- Financial PlanningDocument22 pagesFinancial Planningangshu002085% (13)

- LectureWeek5 ProfitabilityAnalysis-5Document75 pagesLectureWeek5 ProfitabilityAnalysis-5Thi Kim Ngan TranNo ratings yet

- QIB FS 30 June 2022 English SignedDocument26 pagesQIB FS 30 June 2022 English SignedMuhammad AbdullahNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument45 pagesFinancial Statements, Cash Flow, and TaxesFridolin Belnovando Abditomo PrakosoNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument44 pagesFinancial Statements, Cash Flow, and TaxesMahmoud Abdullah100% (1)

- Ch02 ShowDocument44 pagesCh02 ShowardiNo ratings yet

- Excel Advanced Excel For Finance EXERCISEDocument91 pagesExcel Advanced Excel For Finance EXERCISEhaz002No ratings yet

- Free Cash FlowDocument8 pagesFree Cash FlowSisila Agusti AnggrainiNo ratings yet

- FIN2704 Week 2 Zoom Lecture SlidesDocument21 pagesFIN2704 Week 2 Zoom Lecture SlidesZenyuiNo ratings yet

- Case 9Document11 pagesCase 9Nguyễn Thanh PhongNo ratings yet

- Module 4 - Analysis WorksheetDocument5 pagesModule 4 - Analysis WorksheetElizabethNo ratings yet

- TargetDocument8 pagesTargetGLORIA GUINDOS BRETONESNo ratings yet

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- In Millions of Euros, Except For Per Share DataDocument24 pagesIn Millions of Euros, Except For Per Share DataGrace StylesNo ratings yet

- Discounted Cash FlowDocument9 pagesDiscounted Cash FlowAditya JandialNo ratings yet

- BTVN Chap 03Document14 pagesBTVN Chap 03Nguyen Phuong Anh (K16HL)No ratings yet

- Cash Flow From Assets - Solution PDFDocument3 pagesCash Flow From Assets - Solution PDFSeptian Sugestyo PutroNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Norco Annual Report 2017Document107 pagesNorco Annual Report 2017Jigar Rameshbhai PatelNo ratings yet

- Q1FY22 KIP REIT Results (Bursa)Document17 pagesQ1FY22 KIP REIT Results (Bursa)seeme55runNo ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Assignment 7 SolutionsDocument10 pagesAssignment 7 SolutionsjoanNo ratings yet

- 2020 Annual Financial Report EDocument94 pages2020 Annual Financial Report EDejene GelanNo ratings yet

- ABC Cement FM (Final)Document24 pagesABC Cement FM (Final)Muhammad Ismail (Father Name:Abdul Rahman)No ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNo ratings yet

- IB396 Seminar-6-Slides ZZDocument17 pagesIB396 Seminar-6-Slides ZZmaxNo ratings yet

- ABS CBN CorporationDocument16 pagesABS CBN CorporationAlyssa BeatriceNo ratings yet

- Brand CoDocument7 pagesBrand CoCamila VillamilNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Ratio Case Study - Standfornd Yard Mon Sec Summer 2021Document8 pagesRatio Case Study - Standfornd Yard Mon Sec Summer 2021Muhammad Ali SamarNo ratings yet

- Assignment 1 TVM, Bonds StockDocument2 pagesAssignment 1 TVM, Bonds StockMuhammad Ali SamarNo ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Brand Positioning by Sunil GuptaDocument2 pagesBrand Positioning by Sunil GuptaMuhammad Ali SamarNo ratings yet

- 2008-04-13 155702 KinkyDocument2 pages2008-04-13 155702 KinkyMuhammad Ali SamarNo ratings yet

- ENT403 Road Safety Group Assignment 1Document2 pagesENT403 Road Safety Group Assignment 1Muhammad Ali SamarNo ratings yet

- Van H Wac CH 03 Class ProblemsDocument10 pagesVan H Wac CH 03 Class ProblemsMuhammad Ali SamarNo ratings yet

- Approach Avoidance Motivational ConflictDocument1 pageApproach Avoidance Motivational ConflictMuhammad Ali SamarNo ratings yet

- Assignment - Capital BudgetingDocument2 pagesAssignment - Capital BudgetingMuhammad Ali SamarNo ratings yet

- AFN MINI CASE STUDY CLASS Excel SAMPLEDocument6 pagesAFN MINI CASE STUDY CLASS Excel SAMPLEMuhammad Ali SamarNo ratings yet

- AFN CH 12 Mini Case StudyDocument3 pagesAFN CH 12 Mini Case StudyMuhammad Ali SamarNo ratings yet

- AFN Forecasting - Practice QuestionsDocument1 pageAFN Forecasting - Practice QuestionsMuhammad Ali Samar100% (3)