Professional Documents

Culture Documents

Accounting Cheat Sheet PDF

Accounting Cheat Sheet PDF

Uploaded by

SummerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Cheat Sheet PDF

Accounting Cheat Sheet PDF

Uploaded by

SummerCopyright:

Available Formats

Lesson 6,

Bond interest: Two year semiannual bond w/ par value of $500 and STUDY GUIDE through

Financial stmts

Lesson 4 | Inventory & Payables Primary advantage

a stated rate of 7% was priced to yield 8%. Lesson 1 | Accounting Concepts Inventory costing methods LIFO & FIFO is tax benefit

cont... Footnotes

-Calc the issue price, find the pres value of both lump-sum principle pymt of $500 Purpose of accounting: 1) Provide financial information

Auditors's report INCOME Current, higher acquisition Px Older, lower acquisition Px

and the interest stream of $35 per year. - Pres val of principle = $427 about 2) Reporting entities

Basic financial Mgmt's discussion

STMT

mtchd w/ curr, higher sales px matched w/ higher sales Px

BEGINNING INTEREST INTEREST ENDING - Pres val of interest stream = $64 statements (FOUR) to 3) Primary users

PERIOD BALANCE EXPENSE PAYMENT BALANCE - Issue price = $491 & analysis (MD&A) BALANCE

Inventory is valued using Inventory is valued using

1 $491.00 $19.75 $17.50 $493.25 Income Statement Capital market Sole proprietors

SHEET

older lower acquisition Px current (higher) acquisition Px

Record bond proceeds

2 $493.25 $19.75 $17.50 $495.50

1

Cash Revenues Product market Partnerships

3 $495.50 $19.75 $17.50 $497.75 -Expenses Government Corporations ACCT for Inventory BALANCE SHEET INCOME STATEMENT

491.00 Net Income

4 $497.75 $19.75 $17.50 $500.00 Internal users - execs LLC's ASSETS = LIABILITIES + EQUITY REVENUE - EXPENSES = NET INCOME

Bonds Payable Inventory -500

EFFECTIVE STATED 500.00 Stmt of Retained Earnings

RATE = 4%

Record first semi-annual interest payment

RATE = 3.5% Disc on Bonds Pyble

9.00

Beginning RE

+ Net Income 2

Ending Retained Earnings Balance Sheet 4

COGS Expense

Cash +1,000

-500 -500 =-500

Sales Revenue +1,000 +1,000 =1,000

Cash Disc on Bonds Pyble Interest Expense Stmt of Cash Flows --Assets-- --Liabilities & Equity-- Totals +500 +500 +1,000 -500 =500

17.50 bal 9.00 19.75 Cash A/P

3

Beginning Cash

2.25 Inventory LT Debt Lower of Cost or Market

Operating Activities

BALANCE SHEET INCOME STATEMENT PPE Equity Other inventory issues

ASSETS = LIABILITIES + EQUITY REVENUE - EXPENSES = NET INCOME MY SIDE Investing Activities

Financing Activities

Total Total

When future revenue-producing ability < purch Px

the inventory asset write down will reflect loss

Interest Expense -19.75 -19.75 =-19.75

Cash -17.50 Trial Balance Form

Net Change in Cash

Ending Cash 1Info

Relevance

capable of making

Lesson 5 | Fixed

& Intangible Assets

-Ensures inventory is not overvalued

-Accelerates future losses to current Inc Stmt

Bonds Payable +2.25 Debit Credit Property, Plant, Compare historical cost (balance sheet value)

Asset Amount Qualitative characteristics | primary qualities (TWO) a difference in a decision to Market Value. Report the lower of the two.

& Equip

Liability Amount -Predictive value -Market value is cost to replace inventory today

Issue 3000 shares of common stock for $15,000

Cash 15,000 Equity Amount 2InfoReliability

strives to faithfully represent the

-Predict outcomes of past,

present, & future events

1

Straight-Line Depreciation

Common stock 15,000 Revenue Amount -Confirming value Depreciation Expense = Asset Cost - Salvage Value

economic situation example Estimated Useful Life

Common Expense Amount -Feedback can be used

Cash -Completeness $10k asset has salvage of $1k, use life is 3 years

Assets = Liabilities + Equity Stock Dividends Amount -Includes all info necessary for user to understand to set expectations

+15,000 +15,000 15k 15k Totals Total DRs Total CRs -Materiality =(10000 - 1000)/3 = 3000 per year

-Neutrality

-Info cannot be manipulated; free from bias -Inclusion/omission would BALANCE SHEET ASSETS INCOME STATEMENT

Receive $2,000 for future services Unearned -Freedom from Error

influence judgement PP& E ACCUM. DEPR DEPR. EXPENSE

Cash 2,000 Assets = Liabilities + Equity Cash Revenue -Contains no errors/omissions Acquire PP&E +10,000

For info to be relevant, it

Unearned Revenue 2,000 +2,000 +2,000 2k 2k -Does not require perfect accuracy should have predictive or Year 1 depreciation -3,000 -3,000

confirming value, & be Year 2 depreciation -3,000 -3,000

Pay $250 for advertising Advertising Year 3 depreciation -3,000 -3,000

material for the

Advertising Expense 250 Assets = Liabilities + Equity Cash Expense Balances +10,000 -9,000 -9,000

Reliability, or faithful representation, is a reporting entity.

Cash 250 -250 -250 250 250

necessity for individuals who neither have

Increase on the

2 Double Declining Balance

Depreciation Expense = Net Book Value * 2

Do work and leave an invoice for $3,500 the time nor the expertise to evaluate

Accounts Service Revenues increase Equity Credit Side Estimated Useful Life

Assets = Liabilities + Equity the factual content of the information. OR

Accounts Receivable 3,500 Receivable Revenue Expenses decrease Equity Debit Side

+3,500 +3,500 3.5k 3.5k Determine by taking the straight-line rate of depreciation and

Service Revenue 3,500 DOUBLE-ENTRY ACCOUNTING

DETAILED EXAMPLES

Lesson 2 | Accounting Building Blocks double it. Example: Asset w/ 4-year life = straight-line rate 25%,

Pay $1,500 in dividends Recording transactions accounting equation Assets = Liabilities + Equity calc'd by 100%/4years. The straight-line rate doubled = 50%.

Asset w/ a 5-year life would = 20% straight-line * 2 = 40%.

Dividends 1,500 Assets = Liabilities + Equity Cash Dividends Adjusting entries D C D C D C Doubled rate is then multiplied by Net Book Value:

-1,500 -1,500 1.5k 1.5k Accrual Cash

Cash 1,500 Recognizes economic Recognizes economic

Depreciation Expense = Depreciation rate * Net Book Value

events in the period events when cash has Ignores revenue recognition & matching principles -DO NOT REDUCE! cost by = (Straight-line rate *2)

Serviced pre-paid client ($2k) Unearned SVC salvage value * (Cost - Accumulated Depreciation)

in which they occur been exchanged Not in conformity with GAAP

Unearned Revenue 2,000 Assets = Liabilities + Equity Revenue Revenue -STOP DEPRECIATING

-2,000 +2,000 2k 2k DETAILED EXAMPLES when salvage value is reached

Service Revenue 2,000

Lesson 3 | Revenue & Receivables Realized example BALANCE SHEET ASSETS INCOME STATEMENT

Equipment depreciation of $600 per month Depreciation Accum Revenue recognition recognized/recorded when BOTH Seller has received cash or will at

PP& E ACCUM. DEPR DEPR. EXPENSE

Depreciation Expense 600 Assets = Liabilities + Equity Expense Deprec Acquire PP&E +10,000

some point in the future (AR)

Accumulated Depreciation 600 -600 -600 600 600 Earned Year 1 depreciation -6,667 -6,667

Goods/services are delivered & related obligs *General Rule Year 2 depreciation -2,222 -2,222

Balance sheet: Reports a company's resources & claims against @ a given point in time. are complete Recognition @ time of sale provides Year 3 depreciation -111 -111

Income Stmt: Rev & Exp over period. Stmt of RE: Shows RE over period. Stmt of Cash Flows: use of $$ Seller has performed duties under terms of a uniform/reasonable test Balances +10,000 -9,000 -9,000

sales agreement- title has passed to buyer Recognition Principle: Revenue should be

HANDY FORMULAS

Net income = Revenue - Expenses R=revenue

E=expense

Assets = Liabilities + Equity w/o right of return or contingencies recorded when a resource has been earned

Natural Resources

Net Book Value = $1,000

Intangible Assets

Retained Earnings = Net Income - Dividends

Receivable = Asset

D C D C D C -As extracted the asset is depleted -Lack physical existence

A=asset

Net sales = Credit sales - Sales returns & allowances L=liability

Receivables and transferred to inventory -Not financial instruments

Net Book Value = Cost - Accumulated Depreciation SE=Stock-

hld eq Net realizable value D C -As sold the expense is Xferred to -Normally classified as long-term

ITEMS, STATEMENTS, & ACCOUNTS Amount the company expects to collect (GAAP Requirement) income statement as COGS Exp assets

IS=income statement | RE=retained earnings | BS=balance sheet Income Stmt Balance Sheet

EXAMPLES Allowance method | Bad Debt Expense (BDE) Estimate results in Percentage of sales method Lesson 6

ITEM STATEMENT ACCOUNT Percentage % of current credit Allowance does not

Recognize BDE in the period of sale by estimating doubtful accounts Bad Debt Expense Bad debt is estimated as a % of credit sales that

Retained Earnings BS, RE SE sales is matched with necessarily reflect the

of credit current sales revenue receivables that are -Record estimate in contra-asset acct "Allowance for Doubtful Accts" occured during the period

Equipment BS A sales as bad debt expense -Estimate results in balance of -Percent is based on historical trends

uncollectible Aging of AR method allowable account

Common Stock BS SE Estimate how much of the ending balance of AR is bad debt & company policies

Unearned Revenue BS L Aging of Bad debt expense is a Allowance for Bad

-Amount becomes ending balance of Allowance for Bad DebtBALANCE SHEET

-Bad Debt Expense is a "plug"

EXAMPLES

plug to force Debts is calculated INCOME STATEMENT Effective/stated rates

Sales IS R Accounts allowance for bad based on balance in -Based on the age of account making up ending bal of AR ASSETS = LIABILITIES + EQUITY REVENUE - EXPENSES = NET INCOME -Effective = market rate, or yield

Rent Expense IS E Receivable debt to the proper Accounts Receivable Allow. for Bad Debt -4,500 -Stated = Specified on the face of

balance the bond.

Inventory BS A Bad Debt Exp -4,500

You might also like

- Accounting Cheat SheetDocument7 pagesAccounting Cheat Sheetopty100% (16)

- Cheat Sheet Exam 1Document1 pageCheat Sheet Exam 1Shashi Gavini Keil100% (2)

- Becker CPA BEC Review CheatsheetDocument6 pagesBecker CPA BEC Review CheatsheetGabrielNo ratings yet

- Basic Everyday Journal EntriesDocument2 pagesBasic Everyday Journal EntriesMary73% (15)

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

- Inbm 110 - Accounts Study Sheet: Chapter 1 & 2Document5 pagesInbm 110 - Accounts Study Sheet: Chapter 1 & 2Laura TaiNo ratings yet

- Closing Journal EntriesDocument1 pageClosing Journal EntriesMary91% (11)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetZee Drake100% (6)

- Final Report InternshipDocument17 pagesFinal Report InternshipSAMARTH UPADHYAYANo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Cheat Sheet For AccountingDocument4 pagesCheat Sheet For AccountingshihuiNo ratings yet

- Cheat Sheet Final - FMVDocument3 pagesCheat Sheet Final - FMVhanifakih100% (2)

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

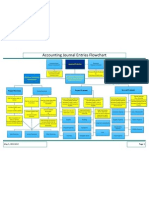

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetToby Arriaga100% (2)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CheatDocument1 pageCheatIshmo KueedNo ratings yet

- Accounting Cheat SheetDocument2 pagesAccounting Cheat Sheetanoushes1100% (2)

- ACCT 101 Cheat SheetDocument1 pageACCT 101 Cheat SheetAndrea NingNo ratings yet

- Cheat Sheet For Financial AccountingDocument1 pageCheat Sheet For Financial Accountingmikewu101No ratings yet

- Accounting NotesDocument66 pagesAccounting NotesShashank Gadia71% (17)

- Fin Cheat SheetDocument3 pagesFin Cheat SheetChristina RomanoNo ratings yet

- FAR NotesDocument163 pagesFAR NotesClaire Antonette Limpangog100% (2)

- Learn Your Accounting Basics - A Step by Step Approach: Junior High School and beginners, #1From EverandLearn Your Accounting Basics - A Step by Step Approach: Junior High School and beginners, #1Rating: 1.5 out of 5 stars1.5/5 (2)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat Sheetazulceleste0_0100% (1)

- BEC Notes Chapter 3Document6 pagesBEC Notes Chapter 3cpacfa90% (10)

- Kelly's Finance Cheat Sheet V6Document2 pagesKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- Account ClassificationDocument2 pagesAccount ClassificationMary96% (23)

- Book of Facts by Isaac AsimovDocument158 pagesBook of Facts by Isaac AsimovMD. Monzurul Karim ShanchayNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Accounting Cheat Sheet FinalsDocument5 pagesAccounting Cheat Sheet FinalsRahel Charikar100% (1)

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- ACC1002X Cheat Sheet 2Document1 pageACC1002X Cheat Sheet 2jieboNo ratings yet

- Accouting Finals Cheat SheetDocument1 pageAccouting Finals Cheat SheetpinkrocketNo ratings yet

- Financial Accounting: Tools For Business Decision-Making, Third Canadian EditionDocument6 pagesFinancial Accounting: Tools For Business Decision-Making, Third Canadian Editionapi-19743565100% (1)

- BEC CPA Formulas - November 2015 - Becker CPA ReviewDocument20 pagesBEC CPA Formulas - November 2015 - Becker CPA Reviewgavka100% (1)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetHectorNo ratings yet

- Accounting Cheat SheetDocument2 pagesAccounting Cheat SheetvgirotraNo ratings yet

- Class of AccountsDocument5 pagesClass of AccountssalynnaNo ratings yet

- Accounting GuideDocument153 pagesAccounting Guidebam04100% (1)

- Basics of AccountingDocument20 pagesBasics of AccountingvirtualNo ratings yet

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDocument3 pagesExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNo ratings yet

- Cheat Sheet - Financial STDocument2 pagesCheat Sheet - Financial STMohammad DaulehNo ratings yet

- Basic Accounting Concepts - GE AccountingDocument62 pagesBasic Accounting Concepts - GE AccountingTarun ChawlaNo ratings yet

- Cheat Sheet - AccountingDocument2 pagesCheat Sheet - AccountingJeffery KaoNo ratings yet

- Midterm Cheat SheetDocument4 pagesMidterm Cheat SheetvikasNo ratings yet

- The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackFrom EverandThe Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackRating: 1 out of 5 stars1/5 (1)

- BEC Notes Chapter 3Document13 pagesBEC Notes Chapter 3bobby100% (1)

- Financial Accounting Is The Process of Preparing Financial Statements For A BusinessDocument11 pagesFinancial Accounting Is The Process of Preparing Financial Statements For A Businesshemanth727100% (1)

- The Holy AL-Quran (Bengali Translation)Document701 pagesThe Holy AL-Quran (Bengali Translation)MD. Monzurul Karim ShanchayNo ratings yet

- Best Stories of The Quran-Part 3Document244 pagesBest Stories of The Quran-Part 3MD. Monzurul Karim Shanchay100% (1)

- News Writting and Editing-Sikandar FayezDocument190 pagesNews Writting and Editing-Sikandar FayezMD. Monzurul Karim ShanchayNo ratings yet

- The Treasures of Good DeedsDocument24 pagesThe Treasures of Good DeedsMD. Monzurul Karim Shanchay100% (1)

- Mirza Galib's PoetryDocument93 pagesMirza Galib's PoetryMD. Monzurul Karim ShanchayNo ratings yet

- Regular Irregularities-Hanif SanketDocument75 pagesRegular Irregularities-Hanif SanketMD. Monzurul Karim ShanchayNo ratings yet

- Entire Travel-Humayun AhmedDocument360 pagesEntire Travel-Humayun AhmedMD. Monzurul Karim Shanchay100% (1)

- Bengali Grammar by Jyotibhusan ChakiDocument309 pagesBengali Grammar by Jyotibhusan ChakiMD. Monzurul Karim Shanchay100% (2)

- Thinking and Writing From Word To Sentence To Paragraph To EssayDocument238 pagesThinking and Writing From Word To Sentence To Paragraph To EssayMD. Monzurul Karim Shanchay50% (2)

- Sustho Deho Prashanto MonDocument210 pagesSustho Deho Prashanto MonmamunngsNo ratings yet

- Kidney DiseasesDocument136 pagesKidney DiseasesMD. Monzurul Karim ShanchayNo ratings yet

- Bengali Grammar-Exam. PreparationDocument43 pagesBengali Grammar-Exam. PreparationMD. Monzurul Karim Shanchay100% (2)

- Learning The Holy AL-QuranDocument128 pagesLearning The Holy AL-QuranMD. Monzurul Karim ShanchayNo ratings yet

- ShortCut MathDocument299 pagesShortCut MathMD. Monzurul Karim Shanchay100% (3)

- Allah's Names and AttributesDocument256 pagesAllah's Names and AttributesMD. Monzurul Karim ShanchayNo ratings yet

- Advanced Learner's Functional EnglishDocument448 pagesAdvanced Learner's Functional EnglishMD. Monzurul Karim Shanchay88% (8)

- Kalimatus ShahadahDocument98 pagesKalimatus ShahadahMD. Monzurul Karim Shanchay100% (1)

- Women's Prayer PDFDocument98 pagesWomen's Prayer PDFMD. Monzurul Karim ShanchayNo ratings yet

- Market Structure-Perfect CompetitionDocument72 pagesMarket Structure-Perfect CompetitionUtsav AaryaNo ratings yet

- Answer Key Far Assessment Questionairre 1Document22 pagesAnswer Key Far Assessment Questionairre 1Johnfree VallinasNo ratings yet

- ZAFRA Hannah Mae S. Income Statement and Balance Sheet Ferna CompanyDocument2 pagesZAFRA Hannah Mae S. Income Statement and Balance Sheet Ferna CompanyAngeliePanerioGonzagaNo ratings yet

- Solution Manual For Advanced Accounting 13Th Edition Beams Anthony Bettinghaus Smith 0134472144 9780134472140 Full Chapter PDFDocument30 pagesSolution Manual For Advanced Accounting 13Th Edition Beams Anthony Bettinghaus Smith 0134472144 9780134472140 Full Chapter PDFrose.carvin242100% (11)

- Ratio Analysis: Ratio Analysis Is The Process of Establishing and Interpreting Various RatiosDocument26 pagesRatio Analysis: Ratio Analysis Is The Process of Establishing and Interpreting Various RatiosTarpan Mannan100% (2)

- E-Commerce UNIT-1Document12 pagesE-Commerce UNIT-1Bhavan YadavNo ratings yet

- Intenship Project Omkar Sir Final 2Document20 pagesIntenship Project Omkar Sir Final 2Saurabh KumbharNo ratings yet

- Credit Memo - MH3M300182Document1 pageCredit Memo - MH3M300182AltafNo ratings yet

- Assignment Kinetic Honda Case Study Consumer Buying JourneyDocument3 pagesAssignment Kinetic Honda Case Study Consumer Buying JourneyAnnu ChandraNo ratings yet

- Revenue RecognitionDocument8 pagesRevenue RecognitionSedrick ChiongNo ratings yet

- Hul Lime IimiDocument25 pagesHul Lime Iimirsriram84No ratings yet

- Lat TakeDocument8 pagesLat TakeCamila Gail GumbanNo ratings yet

- Strategic ManagementDocument56 pagesStrategic Managementobsinan dejene100% (3)

- The Merit Corporation IDocument2 pagesThe Merit Corporation IMOHIT MALVIYA PGP 2020 BatchNo ratings yet

- A Construction Company Entered Into A FixedDocument40 pagesA Construction Company Entered Into A FixedDiaиa Diaz50% (2)

- Organization Chart - Marketing 2017 (Rev 5)Document2 pagesOrganization Chart - Marketing 2017 (Rev 5)Nam CHNo ratings yet

- Mas MCQDocument13 pagesMas MCQIm In TroubleNo ratings yet

- Main Cirque Du Soleil FinalDocument4 pagesMain Cirque Du Soleil FinalFarhan HossainNo ratings yet

- Connor Med SystemsDocument5 pagesConnor Med SystemsAndrii DutchakNo ratings yet

- Sample Client: CLS Investments, LLC Is Independent of Your Advisor's Broker/dealer And/or Registered Investment AdvisorDocument15 pagesSample Client: CLS Investments, LLC Is Independent of Your Advisor's Broker/dealer And/or Registered Investment AdvisorLaskar PejuangNo ratings yet

- Wellhead Procurement StrategyDocument2 pagesWellhead Procurement StrategyYougchu LuanNo ratings yet

- A Study On Customer Satisfaction of FMCG in Pathanjali ProductsDocument13 pagesA Study On Customer Satisfaction of FMCG in Pathanjali ProductseswariNo ratings yet

- Test Bank For Advertising Imc Principles and Practice 10e by Moriarty 0133763536Document44 pagesTest Bank For Advertising Imc Principles and Practice 10e by Moriarty 0133763536JeremySotofmwa100% (43)

- Chapter 6 Test: InventoriesDocument129 pagesChapter 6 Test: InventoriesQueen Nikki MinajNo ratings yet

- A021221078 - Akuntansi Dasar Pekan 5Document2 pagesA021221078 - Akuntansi Dasar Pekan 5Nazwa AuliaNo ratings yet

- Absorption Vs Marginal CostingDocument24 pagesAbsorption Vs Marginal CostingPoint BlankNo ratings yet

- Quiz 1 SolutionsDocument5 pagesQuiz 1 Solutionsgovt2No ratings yet

- 5 - DepreciationDocument22 pages5 - Depreciationnhel estalloNo ratings yet

- Marketing Plan TemplateDocument9 pagesMarketing Plan TemplateAzeb SeidNo ratings yet