Professional Documents

Culture Documents

EC Member Bridging Requirements Factsheet

Uploaded by

wclonnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EC Member Bridging Requirements Factsheet

Uploaded by

wclonnCopyright:

Available Formats

Requirements for public

accounting registration

(licensure) post certification

Protection of the public and provincial regulatory requirements demand that all members registered

(licensed) to provide public accounting services meet the professions public accounting registration

standards. The education, examination and practical experience requirements for CPA candidates seeking

public accounting registration at the point of certification are defined in the CPA Harmonized Education

Policies, Common Final Examination guidance, and CPA Practical Experience Requirements.

Public accounting requirements are met at the point of certification as a CPA by those who successfully

complete the assurance pathway in education, examination and practical experience.

Members can also meet registration requirements post certification by meeting additional education,

evaluation and experience requirements. Some jurisdictions offer multiple pathways for post designation

public accounting registration. Contact your provincial/regional CPA body for requirement details.

Note: The post-certification requirements addressed in this document do not apply to legacy members who

were licensed to practice public accounting but have not done so for more than five years. Requirements for

returning to practice after an extended absence are under development and are expected to be released at

the end of 2016.

Eligibility for post certification public accounting registration

Note: Some jurisdictions offer different levels of public accounting registration. In jurisdictions with one level

of registration, the audit standard applies to both audit and review. Contact your provincial/regional CPA

body for more information.

Individuals can qualify for audit, review, and compilation registration post-certification if they are:

Members in good standing who met:

certification requirements in a non-assurance stream through the new CPA qualification process, or

certification requirements through legacy non-assurance streams and did not meet legacy public

accounting requirements post certification

CPA students/candidates who have completed:

all requirements (education, examination, and experience) for CPA membership through non-assurance

streams and are awaiting certification

the education and examination requirements through the assurance stream but not the experience

requirements. These students/candidates must complete the experience requirements for public

accounting within 30 months of certification, and all three components within five years. For

additional information, refer to the CPA Practical Experience Requirements - 2.2.4 Pre-approved

bridge to assurance.

Public Accounting REgistRAtion | cPA MEMbERs

Audit level registration

To qualify for audit level registration, eligible members and students/candidates should:

Successfully complete the nationally developed, regionally delivered Post Designation Public Accounting

(PDPA) Program, which includes both the PDPA Module and the PDPA Examination (see below for further

information)

Meet the practical experience requirements specific to public accounting applicable in their jurisdiction:

two years in public practice within a rolling five-year period

1250 assurance chargeable hours of which a minimum of 625 are audit of historical financial

information

depth in audit and assurance

experience must be completed in a pre-approved program that offers qualifying experience for audit

services

any additional requirements applicable in their jurisdiction

Review level registration

To qualify for review level registration (if available in your jurisdiction), eligible members and students/

candidates must:

Successfully complete the Post Designation Public Accounting (PDPA) Program which includes both the

PDPA Module and the PDPA Examination (see below for further information)

Meet the practical experience requirements for review applicable in their jurisdiction:

two years in public practice within a rolling five-year period

1250 assurance chargeable hours of which a minimum of 625 are providing assurance on historical

financial information

at least two competency sub-areas (both at level 2) from audit and assurance competency area (for

more information, refer to Appendix A in the CPA Practical Experience Requirements)

experience must be completed in a pre-approved program that offers qualifying experience for review

services

any additional requirements applicable in their jurisdiction

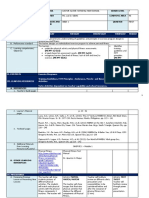

Post-certification requirements for audit and review registration

Qualification Additional education Additional examination Additional experience

Process requirements requirements requirements

CPA PDPA module PDPA examination Practical experience requirements

in their jurisdiction

Legacy CA None None Practical experience requirements

in their jurisdiction

Legacy CMA PDPA module PDPA examination Practical experience requirements

in their jurisdiction

Legacy CGA PDPA module PDPA examination Practical experience requirements

in their jurisdiction

Compilation level registration

To qualify for compilation level registration in jurisdictions offering different levels of public accounting

registration, eligible members must:

Successfully complete the CPA Professional Education Program (CPA PEP) Taxation elective, including

the examination (completion of the PDPA module or examination is not required.) Legacy CGA members

who completed the CGA Advanced Personal and Corporate Tax (TX2) elective module will not be

required to complete the CPA PEP Tax elective module.

Meet the practical experience requirements for compilation in their jurisdiction:

two years in public practice within a rolling five-year period

625 hours in compilation (hours spent on the audit or review of historical financial information are

accepted as compilation hours). For more information, refer to Appendix A in the CPA Practical

Experience Requirements.

additional experience in tax and advisory services

experience can be completed:

in either a pre-approved program that offers qualifying experience for compilation services or

through experience verification

in a CPA office registered with the province to provide compilation (or audit or review) services

OR under the mentorship of an individual acting in the capacity of suitably qualified engagement

quality control reviewer (EQCR) who reviews all statements prior to release to the client

any additional requirements applicable in their jurisdiction

Post-certification requirements for compilation registration

Designation Additional education Additional examination Additional experience

requirements requirements requirements

CPA CPA PEP Taxation elective CPA PEP Taxation elective Practical experience

module examination requirements for compilation

in their jurisdiction

Legacy CA None None Practical experience

requirements for compilation

in their jurisdiction

Legacy CMA CPA PEP Taxation elective CPA PEP Taxation elective Practical experience

module examination requirements for compilation

in their jurisdiction

Legacy CGA CPA PEP Taxation elective CPA PEP Taxation elective Practical experience

module + examination + requirements for compilation

in their jurisdiction

+Legacy CGA members who completed the CGA Advanced Personal and Corporate Tax (TX2) elective module will not be required to

complete the CPA PEP Tax elective module or examination.

CPA Post Designation Public Accounting (PDPA) Program

The PDPA Program has two purposes. First and foremost it protects the public interest by ensuring all members

offering Audit and/or Review services meet the professions competency standard related to assurance work.

Second, it provides CPAs with the option of qualifying for public accounting registration post-certification.

The PDPA Program comprises:

A mandatory PDPA education module that covers the technical knowledge required for public

accounting registration, including tax, assurance, financial reporting, finance, and strategy and

governance

A mandatory four-hour PDPA examination consisting of objective format questions testing the required

technical knowledge

The PDPA Program is available to members in good standing who have never met the qualifications for

registration to practice public accounting in their jurisdictions. This includes:

new CPAs who certified in a non-assurance stream

legacy CMA and CGA members who did not meet legacy public accounting requirements either on

certification or through a legacy post-certification program

members in jurisdictions offering compilation registration who are seeking audit or review registration

Legacy CA members are not required to complete the PDPA Program as the CA education program and

Uniform Final Evaluation met all public accounting education and examination requirements; legacy CA

members who met their experience requirements outside public practice must, however, meet the public

accounting practical experience requirements.

The PDPA Education Module

The PDPA Education Module is expected to be available of as May 2017. The PDPA module covers the

technical knowledge required for public accounting registration, including tax, assurance, financial reporting,

finance, and strategy and governance. It is a self-study module that consists of reading resources, practice

problems and multiple-choice questions covering the CPA Competency Map at the elective level. There are

no deadlines, submissions or face-to-face components (for example, workshops) to the module.

The PDPA Examination

The PDPA examination consists of objective format questions testing the required technical knowledge for

public accounting registration. See the PDPA examination blueprint for more information.

Members must complete the PDPA module to be eligible to write the PDPA examination.

Future PDPA education module and examination offerings will be planned to meet member demand and are

expected to be offered at least annually.

You might also like

- PPAT Contextual Factors ChartDocument3 pagesPPAT Contextual Factors ChartRachel Lea100% (2)

- How We Learn,' by Benedict Carey - The New York TimesDocument2 pagesHow We Learn,' by Benedict Carey - The New York Timeswclonn100% (1)

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- NPMA Certification HandbookDocument13 pagesNPMA Certification HandbookhendrigantingNo ratings yet

- RecipeForReading Research PDFDocument8 pagesRecipeForReading Research PDFJanet Carbonilla ArdalesNo ratings yet

- Diploma Human Resources Management and PracticesDocument11 pagesDiploma Human Resources Management and PracticesVuk'ethulini Lucky-Cadillac ThangoNo ratings yet

- FIADocument12 pagesFIAFahad Dehbar, ACCANo ratings yet

- Course 7 - ICT For Learning - Trainer GuideDocument36 pagesCourse 7 - ICT For Learning - Trainer GuideAraoye Abdulwaheed0% (1)

- Learning Agreement For Studies 15 DEFDocument4 pagesLearning Agreement For Studies 15 DEFGonzalo MoyaNo ratings yet

- EC Member Bridging Requirements FactsheetDocument4 pagesEC Member Bridging Requirements Factsheetbelle desacadaNo ratings yet

- How To Qualify For A Cpa LicenseDocument2 pagesHow To Qualify For A Cpa LicenseRushabh ChitaliaNo ratings yet

- G10473 EC - CPA PER For Public Accounting Candidates - ENDocument2 pagesG10473 EC - CPA PER For Public Accounting Candidates - ENStephenNo ratings yet

- CBPA Handbook-V7Document23 pagesCBPA Handbook-V7lilly carbonNo ratings yet

- OC-Diesel Mechanic PDFDocument5 pagesOC-Diesel Mechanic PDFMichael NcubeNo ratings yet

- Continuing Professional Education Policy: Requirements For Certification & Qualification ProgramsDocument11 pagesContinuing Professional Education Policy: Requirements For Certification & Qualification ProgramsHammadNo ratings yet

- PMI Agile Certi Ed Practitioner (PMI-ACP) Handbook - PDF RoomDocument55 pagesPMI Agile Certi Ed Practitioner (PMI-ACP) Handbook - PDF RoomĆetko OkiljevićNo ratings yet

- Sheridan To CPADocument1 pageSheridan To CPASammyNo ratings yet

- Module 00 About PMI-PBADocument71 pagesModule 00 About PMI-PBAzara afridiNo ratings yet

- Certified Associate in Project Management (CAPM) HandbookDocument41 pagesCertified Associate in Project Management (CAPM) HandbookAniruthan Ranganathan SingarajuNo ratings yet

- Saqa 50285Document14 pagesSaqa 50285Marius BuysNo ratings yet

- 11-23 Picpa AncDocument22 pages11-23 Picpa AncSHEENANo ratings yet

- Cpa Exam Digital BookletDocument20 pagesCpa Exam Digital BookletMaruf Hasan NirzhorNo ratings yet

- Rat & CapDocument3 pagesRat & CapchandraNo ratings yet

- Continuing Professional Education (CPE) : Payment Card Industry (PCI)Document10 pagesContinuing Professional Education (CPE) : Payment Card Industry (PCI)secua369No ratings yet

- Ers Jun14resultsDocument1 pageErs Jun14resultsyared1995203No ratings yet

- Rasci Tot Process NoteDocument11 pagesRasci Tot Process Notesudha mandloiNo ratings yet

- CTP Candidate HandbookDocument32 pagesCTP Candidate HandbookMujahid IjazNo ratings yet

- PMP HandbookDocument54 pagesPMP HandbookVaibhav ShelarNo ratings yet

- WWW Simandhareducation Com Blogs Us Cpa Exam in India Now Permanent Us Cpa Evolution 2024Document4 pagesWWW Simandhareducation Com Blogs Us Cpa Exam in India Now Permanent Us Cpa Evolution 2024srinu patroNo ratings yet

- 2024 CPA Exam Evolution EbookDocument22 pages2024 CPA Exam Evolution EbookAbd-Ullah Atef100% (2)

- Program Management Professional HandbookDocument43 pagesProgram Management Professional HandbookivanNo ratings yet

- AT.3401 - The Professional Practice of AccountancyDocument6 pagesAT.3401 - The Professional Practice of AccountancyMonica GarciaNo ratings yet

- Project Management Professional (PMP) HandbookDocument59 pagesProject Management Professional (PMP) HandbookAdoree RamosNo ratings yet

- QCTO - Truck DriverDocument6 pagesQCTO - Truck DriverMichael NcubeNo ratings yet

- Babe1-6 Accountancy ActDocument4 pagesBabe1-6 Accountancy ActJanelle Lyn MalapitanNo ratings yet

- Advanced Certification: Handbook & ApplicationDocument14 pagesAdvanced Certification: Handbook & ApplicationOnche AbrahamNo ratings yet

- PMP Handbook 2022Document31 pagesPMP Handbook 2022RobiNo ratings yet

- Experience CriteriaDocument2 pagesExperience CriteriachintanghadiyaliNo ratings yet

- CPA - FTC Global EducationDocument10 pagesCPA - FTC Global EducationMani ManandharNo ratings yet

- Certified Associate in Project Management (CAPM) HandbookDocument45 pagesCertified Associate in Project Management (CAPM) Handbookjohnnywalker2000No ratings yet

- Guidelines On Continuing Professional Development CPD For QS Rev2018Document12 pagesGuidelines On Continuing Professional Development CPD For QS Rev2018Nah Phei SzeNo ratings yet

- California Road Map For CPADocument2 pagesCalifornia Road Map For CPASnovia MohsinNo ratings yet

- Certified Management Accountant (CMA) Certification CoursesDocument4 pagesCertified Management Accountant (CMA) Certification CoursesHannah Denise BatallangNo ratings yet

- How To Book PCOE Pre-Audit Services Delivered by PSD Final1.1Document7 pagesHow To Book PCOE Pre-Audit Services Delivered by PSD Final1.1АртемКогутNo ratings yet

- CPA BrochureDocument12 pagesCPA Brochureanees.pathan2No ratings yet

- Project Management Professional HandbookDocument29 pagesProject Management Professional HandbookChetali RNo ratings yet

- 24 Setting Up A Public Accounting PracticeDocument71 pages24 Setting Up A Public Accounting Practicetrisha100% (1)

- PMI ACP HandbookDocument55 pagesPMI ACP HandbookPads BoyaNo ratings yet

- OC - Automotive Engine MechanicDocument5 pagesOC - Automotive Engine MechanicMichael NcubeNo ratings yet

- Capm HandbookDocument38 pagesCapm HandbookQaisarNo ratings yet

- Transport Brochure WEBDocument12 pagesTransport Brochure WEBnetatrainingNo ratings yet

- Updated PER Guidance16ppDocument16 pagesUpdated PER Guidance16ppTawandaNo ratings yet

- Cpa2b Spring 2021 IntheknowDocument1 pageCpa2b Spring 2021 Intheknowapi-309610507No ratings yet

- Credentialling ChecklistDocument2 pagesCredentialling Checklistedwin cNo ratings yet

- Certified Associate in Project Management (CAPM) HandbookDocument45 pagesCertified Associate in Project Management (CAPM) Handbookalkanfor2010No ratings yet

- PMI-RMP Handbook PDFDocument52 pagesPMI-RMP Handbook PDFBench LaxamanaNo ratings yet

- Risk Management Professional HandbookDocument39 pagesRisk Management Professional HandbookmgkvprNo ratings yet

- Chap. 3 Professional Practice of Accounting San BedaDocument23 pagesChap. 3 Professional Practice of Accounting San BedaXarina LudoviceNo ratings yet

- Pmi Acp IntroDocument21 pagesPmi Acp IntroBnn 9544No ratings yet

- CAP Short PresentationDocument12 pagesCAP Short PresentationHammad ZaidiNo ratings yet

- CAP Short PresentationDocument12 pagesCAP Short Presentationsalic2013No ratings yet

- Accreditation of Providers and Registration of QualificationsDocument1 pageAccreditation of Providers and Registration of QualificationsJaphta David MoeketsiNo ratings yet

- Accountancy ProfessionDocument4 pagesAccountancy ProfessionIya MercadejasNo ratings yet

- 1.3 Law On Accreditation of CPAs and Information On CPD (Formerly CPE)Document3 pages1.3 Law On Accreditation of CPAs and Information On CPD (Formerly CPE)MMCNo ratings yet

- Financing A Startup: Steve BayleDocument20 pagesFinancing A Startup: Steve BaylewclonnNo ratings yet

- Using Costing of Services To Improve Performance-Oriented Budgeting by Jim Mccrindell and Vijay JogDocument30 pagesUsing Costing of Services To Improve Performance-Oriented Budgeting by Jim Mccrindell and Vijay JogwclonnNo ratings yet

- PWC Cloud Computing and Revenue Recognition Whitepaper PDFDocument14 pagesPWC Cloud Computing and Revenue Recognition Whitepaper PDFwclonnNo ratings yet

- Comparison of A - B Testing Tools and Multivariate Testing Software - Conversion Rate ExpertsDocument4 pagesComparison of A - B Testing Tools and Multivariate Testing Software - Conversion Rate ExpertswclonnNo ratings yet

- Locals Question Why Toronto VC Managing B.CDocument3 pagesLocals Question Why Toronto VC Managing B.CwclonnNo ratings yet

- Structuring Venture Capital, Private Equity, and Entrepreneural Transactions (Review)Document3 pagesStructuring Venture Capital, Private Equity, and Entrepreneural Transactions (Review)wclonnNo ratings yet

- Separating Programming Sheep From Non-Programming GoatsDocument3 pagesSeparating Programming Sheep From Non-Programming GoatswclonnNo ratings yet

- From Accountant To Law - The Life and Career of Jack Levin, Senior Partner at Kirkland & Ellis - LawCrossingDocument4 pagesFrom Accountant To Law - The Life and Career of Jack Levin, Senior Partner at Kirkland & Ellis - LawCrossingwclonnNo ratings yet

- SRF Foundation Brief Profile 30-03-19Document6 pagesSRF Foundation Brief Profile 30-03-19AbishaNo ratings yet

- Rheans Final Research 123Document25 pagesRheans Final Research 123reyansranoco70% (30)

- Deemas ResumeDocument4 pagesDeemas Resumeapi-385327442No ratings yet

- Proposed 2023 2024 School CalendarDocument1 pageProposed 2023 2024 School CalendarStacey ThomasNo ratings yet

- Critical Literacy Lesson PlanDocument6 pagesCritical Literacy Lesson PlanAnonymous PS4gsTENo ratings yet

- Professional Identity in Education From The Perspective of The Dialogical Self Theory - CMonereoDocument50 pagesProfessional Identity in Education From The Perspective of The Dialogical Self Theory - CMonereoTamara Paola Caballero GuichardNo ratings yet

- Applications For The 2016 Academic Year Parallel ProgrammesDocument3 pagesApplications For The 2016 Academic Year Parallel ProgrammesBanda Ada ManNo ratings yet

- Eim1 07 WorksheetDocument1 pageEim1 07 WorksheetSolange CarrilloNo ratings yet

- Better India Better World - Narayanamurthy - ExcerptsDocument12 pagesBetter India Better World - Narayanamurthy - ExcerptsSruthy S. KhanNo ratings yet

- 16d85 16 - 2938 - Development of EducationDocument11 pages16d85 16 - 2938 - Development of Educationsunainarao201No ratings yet

- 11 Humss Discipline and Ideas in The Applied Social Sciences 3RD SummativeDocument4 pages11 Humss Discipline and Ideas in The Applied Social Sciences 3RD Summativemichelle garbinNo ratings yet

- Science 4 Q4 W3Document6 pagesScience 4 Q4 W3LARLEN MARIE T. ALVARADONo ratings yet

- Republic of The Philippines Department of Education Region XII Cotabato Division Aleosan East District Aleosan, CotabatoDocument4 pagesRepublic of The Philippines Department of Education Region XII Cotabato Division Aleosan East District Aleosan, CotabatofemjoannesNo ratings yet

- q1 Grade 7 Pe DLL Week 1Document10 pagesq1 Grade 7 Pe DLL Week 1Noel Adan Castillo100% (9)

- CO and PO, PSO Mapping With CO - C406K - OEC1711 - Leansixsigma - R2021Document1 pageCO and PO, PSO Mapping With CO - C406K - OEC1711 - Leansixsigma - R2021jvanandhNo ratings yet

- Resume 2016Document2 pagesResume 2016api-313149236No ratings yet

- SCP Educ101 1Document107 pagesSCP Educ101 1Vanessa TresvallesNo ratings yet

- 2 Admission Application Form 2020-21Document2 pages2 Admission Application Form 2020-21engr_saifNo ratings yet

- What Is The Relation Between Religion and EducationDocument3 pagesWhat Is The Relation Between Religion and EducationAllanNo ratings yet

- Guste LoDocument10 pagesGuste Loakalakoikaw3No ratings yet

- Listening 1Document28 pagesListening 1Shohnur ShokirovNo ratings yet

- Bedroom BedlamDocument3 pagesBedroom BedlamAnival LopezNo ratings yet

- Online Classes During Covid 19 PandemicDocument9 pagesOnline Classes During Covid 19 PandemicparvathiNo ratings yet

- Examen Selectividad INGLES Septiembre2015Document1 pageExamen Selectividad INGLES Septiembre2015lorenuchiNo ratings yet

- PSL I PSL II Early Childhood Education Lesson PlanDocument6 pagesPSL I PSL II Early Childhood Education Lesson Planapi-410335170No ratings yet

- INSET2023 3rd ReflectionJournalDocument1 pageINSET2023 3rd ReflectionJournalewan koNo ratings yet